Bitcoin’s $100K Breakout Incoming? Institutional Moves and 2026 Trends That Could Make or Break Your Portfolio

Are we really about to see Bitcoin punch through $100K… or is this the moment where retail gets lured in, chopped up, and sent back to “I’ll never buy crypto again” land?

I’m writing this today (January 5th, 2026) because the signals are getting louder. Not the influencer noise. The real signals: how big money behaves, how narratives are shifting, and how a lot of portfolios are quietly positioned for “up only” with zero plan for “what if not.”

If you’re holding BTC, shopping for altcoin upside, or wondering whether 2026 is actually the bull run people expected earlier… this is the checklist I personally want in front of me before I touch another buy button.

The pain right now: too much noise, not enough decision-making

Most people don’t lose because they “picked the wrong coin.” They lose because they make the right decision at the wrong time, for the wrong reason, with no risk rules.

Here’s what wrecks portfolios in this kind of market:

- Buying hype after the move already happened You see BTC rip 8–12% in a week, your feed turns into rocket emojis, and suddenly you’re buying the exact candle that institutions are selling into.Real example: in past cycles, the most painful entries often happened right after breakout headlines. One classic study, DALBAR’s investor behavior research, repeatedly shows that average investors underperform not because markets “hate them,” but because they chase performance and sell fear. Crypto just compresses that pain into faster timeframes.

- Confusing a viral narrative with a real trend A narrative is “everyone is talking about it.” A trend is “people are paying for it,” sticking around, and driving real usage. Crypto loves to reward the loud story early… then punish late buyers when the story stops printing numbers.

- Over-rotating into alts right before BTC dominance flips This one is sneaky. BTC chops, alts pump, you convince yourself “alt season is here,” then BTC wakes up and sucks liquidity back like a vacuum. The result: BTC is green, your alts are red, and you feel like you somehow lost money in a bull market.

- Having no risk rules when volatility spikes This is the silent killer. No max loss per position, no plan for a fast drawdown, no rules for when to cut size. You don’t need to be a professional trader to survive, but you do need professional habits.

And let’s be honest: crypto “education” online is often just entertainment dressed up as certainty. You get a confident voice, a clean chart, and a price target… but no discussion of what would invalidate the idea. That’s not analysis. That’s a hype machine.

Promise: I’ll help you read the 2026 market like a grown-up (without killing the excitement)

I’m not here to tell you “just DCA and ignore everything.” That’s not realistic when volatility can swing your net worth in a weekend.

What I am going to do is keep the focus on what actually matters in 2026:

- Institutional flows (how larger players accumulate, hedge, and rotate)

- Macro + liquidity (because crypto doesn’t pump in a vacuum)

- On-chain signals (when supply and demand actually show up in the data)

- Sector trends (the themes that attract capital… and the ones that quietly bleed you)

Then I’ll turn that into practical moves: how I’d size positions, what would make me lean bullish vs bearish, and how I’d answer the “BTC $100K?” question without guessing like it’s a coin flip.

The goal isn’t to be the loudest bull or the smartest bear.

It’s to build a portfolio that doesn’t fall apart when the chart stops being friendly.

Who this is for (and who it’s not)

This is for you if:

- You hold BTC and want a clean plan for a potential $100K test

- You buy alts but keep getting wrecked by timing and rotations

- You’ve lived through at least one cycle and you’re done with emotional trading

- You’re rebuilding and want a strategy that doesn’t require “perfect entries”

This is not for you if:

- You want “the next 1000x coin” with zero risk and zero drawdowns

- You think every red candle is “manipulation” and every green candle is “confirmed”

I’ll still talk about upside. I’m just going to attach reality to it—because that’s how you stay in the game long enough to catch the real winners.

Quick map of what we’re covering

Here’s the path from here (so you know exactly what you’re getting):

- What would actually push BTC through $100K (and what would block it)

- What institutions are doing differently this cycle (and why that matters for your entries and exits)

- 2026 trends that can boost—or wreck—your portfolio

- The “1000x coin” question, answered in a way that won’t get you rekt

- Is 2026 the bull run year? What I’m watching to confirm it

Now the real question: what would need to happen for Bitcoin to break $100K and actually hold it—and what are the signs that a “breakout” is just a trap with better marketing?

Next, I’m going to lay out a simple breakout checklist (not vibes), and it’ll make it painfully obvious whether this move is real… or just another liquidity game.

Bitcoin $100K: what has to happen (and what can go wrong)

Whenever BTC gets close to a big, clean number like $100,000, the market turns into a pressure cooker. Bulls start talking like it’s “inevitable.” Bears start calling every green candle a trap. And most people end up trading their emotions instead of the setup.

So here’s how I’m thinking about it right now: not as a prediction, but as a breakout checklist. If enough boxes get checked, the odds of a real move go up. If they don’t, I assume chop, fakeouts, and portfolio death-by-a-thousand-cuts.

Round numbers don’t matter because of math. They matter because humans place orders there.

Let’s talk about what actually pushes Bitcoin through $100K—and what usually breaks traders right before it happens.

A simple breakout checklist (so you’re not trading “vibes”)

- Real spot demand (not just leveraged futures pumping price)

- Supply staying tight (long-term holders not dumping into every pump)

- Liquidity conditions cooperating (risk-on that actually sticks)

- Clean market structure (reclaiming key zones and holding them)

- Leverage not overheating (open interest/funding not screaming “top”)

- Sentiment still skeptical (the most bullish moves often climb a wall of worry)

If you want a shortcut: the strongest $100K break is the one where people are still arguing it won’t happen.

Demand catalysts: what “real buying” looks like (and what’s fake)

To get through $100K and stay there, Bitcoin needs spot-driven demand. Not “price went up because funding was positive and everyone aped perps.” I mean the boring kind of buying that doesn’t care about the 5-minute chart.

Here are the demand signals I respect most:

- ETF-style flows and steady accumulation (where available), or similar “slow money” behavior: consistent buys on red days, not just green candles.Why it matters: Studies on market microstructure consistently show that persistent order flow moves price more reliably than bursty speculation. In plain English: slow, repeated buying beats hype.

- Treasury/strategic accumulation behavior: entities that buy and then basically forget they own it. They don’t sell because a 4H RSI is high.Real-world sample: When large entities add BTC, the buying often shows up as “price refuses to dip,” even when headlines are messy.

- Reduced liquid supply: fewer coins sitting on exchanges ready to be sold.What I look for: multi-week trends where exchange balances (tracked by on-chain analytics firms like Glassnode / CryptoQuant) drift down while price holds or rises. That combination is gasoline.

- Long-term holders behaving like long-term holders: not panicking into resistance.Quick reference point: Glassnode’s long-term holder metrics have historically been useful for spotting when “strong hands” are distributing versus holding steady. I don’t need perfection—I just want the general behavior aligned.

What fake demand looks like: price ripping while spot volume is thin, open interest explodes, funding flips aggressively positive, and every timeline turns into “this is guaranteed.” That’s not a breakout—often that’s a liquidation ladder waiting to happen.

Liquidity conditions: when risk-on sticks (and when it’s just a fakeout)

People love to pretend Bitcoin moves in a vacuum. It doesn’t. Liquidity is the tide that lifts (or sinks) everything—BTC included.

When I say “liquidity conditions,” I’m watching a few practical things:

- Stablecoin growth (a rough proxy for crypto-native buying power)Why it matters: More stablecoin supply and velocity can mean more ammo on the sidelines. If stablecoin supply is flat or contracting, rallies tend to feel fragile.

- Credit stress and macro surprisesIf markets start pricing in nasty surprises (sudden tightening, risk-off shocks), crypto can get sold just because it’s liquid and easy to sell.

- “Good news can’t pump it” vs “bad news can’t dump it”This is one of my favorite tells. In a real bull phase, bad headlines get absorbed. In a fakeout, good headlines get sold.

A lot of fakeouts happen when liquidity looks supportive for a week, then disappears the moment leverage gets crowded. That’s when you see the classic move: slow grind up, everyone flips bullish, then one hard flush that wipes out overconfident positioning.

Key market structure: the levels and leverage that decide everything

I’m not going to pretend one magic line on the chart controls the world—but market structure matters because it shapes behavior. If BTC is flirting with $100K, here’s what I’m watching mechanically:

- Reclaim zones: does price break above a major level and hold, or does it wick above and close back below?Sample behavior: A clean breakout usually retests the breakout zone and finds buyers quickly. A weak breakout spends too long hovering, giving sellers time to reload.

- Prior cycle levels as psychology magnetsOld highs and major bands tend to attract both profit-taking and breakout buying. That tug-of-war is exactly where traps form.

- Open interest and funding ratesIf price is rising and open interest is rising faster, I ask one question: “Is this spot-led, or leverage-led?”Simple rule: Breakouts driven mostly by leverage are easier to reverse because liquidations amplify downside the same way they amplified upside.

- “Leveraged froth” tellsWhen funding stays elevated and traders treat pullbacks as impossible, the market tends to manufacture a pullback anyway—just to punish certainty.

If you want a mental model: spot builds floors, leverage builds ceilings (until it gets flushed).

Sentiment traps: the moment “everyone is certain” is the moment I get defensive

One of the oldest lessons in markets is that the crowd is most confident right before volatility expands in the opposite direction.

What “dangerously confident” looks like in crypto:

- Every pullback is called “free money” without any invalidation level

- People increase leverage because “institutions won’t let it drop”

- Altcoin FOMO spikes before BTC has even confirmed the move

- Timelines turn into price targets instead of risk plans

There’s a reason behavioral finance research (from Kahneman/Tversky onward) keeps showing how humans overweight recent gains and underestimate risk after a winning streak. Crypto just compresses that psychology into a shorter time frame.

The institutional angle: why this cycle doesn’t feel like the last one

Retail tends to imagine “institutions” as one giant entity hitting the buy button at the top. In reality, they usually behave in a way that feels almost boring.

Here’s what I see institutions doing differently than the average trader:

- They scale in quietly, often using time-based execution (think: buying in chunks over weeks).Translation: they don’t chase candles the way crypto Twitter does.

- They use custodians, structured products, and hedgesThis part matters more than people admit. Hedging changes behavior: if you’re protected, you don’t panic-sell the first dip.

- They rotate like grown-ups: BTC → ETH → “safer beta” → then maybe smaller caps.If you’re wondering why your favorite microcap isn’t moving while BTC grinds up, this is often why.

- They care about liquidity and exitsAnd this should change how you pick alts. If a token can’t handle size without insane slippage, serious money won’t treat it as a core holding.

If you want to track this mentality shift in real time, I found these threads useful for framing what bigger players watch and how narratives are forming:

- https://x.com/Bankless/status/2000913803412955563

- https://x.com/stacy_muur/status/2004204009264239077

- https://x.com/0xPhilanthrop/status/2000287850680705260

- https://x.com/nicrypto/status/1996280154721784319

The 2026 trends that could make your year (or drain you slowly)

I don’t like trend-hunting by vibes. I like it by filters. Because in crypto, a trend can look huge on X while the actual product is a ghost town.

Here’s the framework I use to judge whether a “hot sector” is investable or just incentive-fueled noise:

- “Real users” vs “incentives only”Ask one brutal question: If rewards dropped 70% tomorrow, would anyone still use this?If the honest answer is “no,” you’re not looking at adoption—you’re looking at rented activity.

- Token value captureDoes the token actually capture value from usage (fees, burns, buybacks, real yield), or is it just a mascot for the protocol?Sample smell test: If the product has growing usage but the token has no clear link to that value, you’re basically buying a narrative.

- Regulation and listings riskSome sectors don’t fail because the tech is bad—they fail because they can’t get distribution (exchanges, onramps, compliant access).

- Infrastructure maturity (only where usage exists)I like infrastructure when it’s clearly pulled by demand, not pushed by token incentives.Things I’m willing to research in 2026 if usage is real: scaling layers, interoperability, data availability, restaking/AVS-style services, and security tooling.

One more thing: trends can still be profitable even if they’re “early.” But early doesn’t mean blind. Early just means your sizing and exit plan matter more than your conviction.

“Which coin will give 1000x?” — the honest answer (and the smarter way to hunt)

If you’ve been in crypto long enough, you’ve seen the cycle:

Someone asks for the next 1000x coin → influencers post a “top 10 gems” thread → price pumps → liquidity disappears → late buyers become bagholders.

So here’s my honest answer: nobody can promise a 1000x coin. Not me. Not your favorite account with a laser-eyed profile pic. And anyone who speaks in guarantees is selling something.

Also, a true 1000x outcome usually requires:

- Tiny starting market cap (which means brutal volatility)

- Survival through multiple shakeouts (most don’t make it)

- A real catalyst (product-market fit, major distribution, or a category shift)

- Time (people want 1000x in 3 weeks; markets don’t care)

The smarter approach isn’t “bet everything on one moonshot.” It’s building a lottery basket with rules so one winner can matter while losers don’t ruin you.

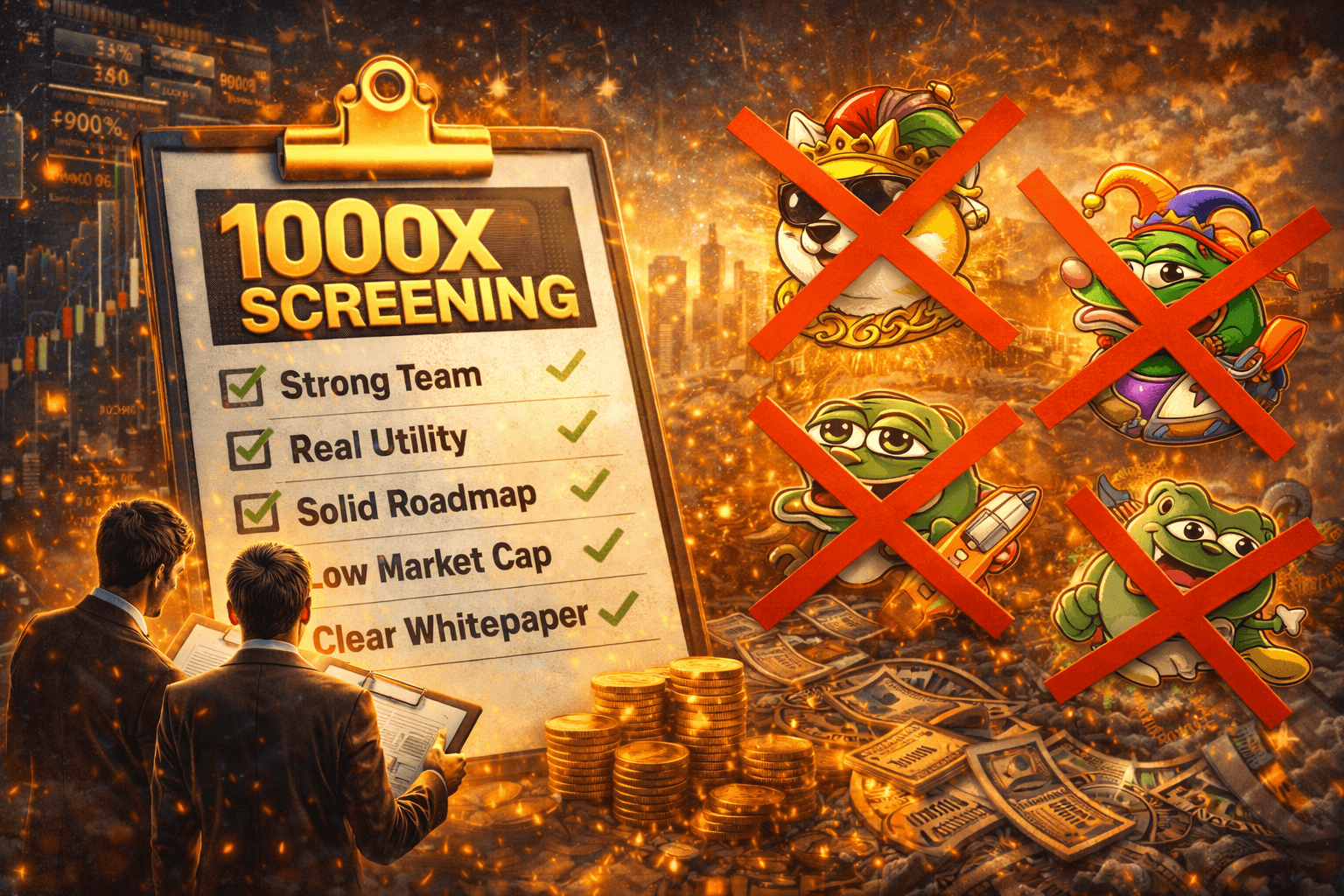

A practical 1000x screening checklist (so you stop buying random memes)

If I’m even considering a microcap, I want to know the following before I touch it:

- Liquidity Can I enter and exit without donating 10% to slippage? If not, it’s not an investment—it’s a trap disguised as a chart.

- Distribution and supply schedule I check for whale concentration, team wallets, unlocks, and emissions. Tokens don’t usually “randomly dump.” They dump when supply hits the market.

- Narrative + timing Is the market paying for this story right now, or is it an old meta that already had its run?

- Proof: dev activity, credible audits, real usage I want to see the basics: shipping, users, retention, partnerships that aren’t just a logo on a website.

- Exchange path How does this actually reach broader liquidity? If the only plan is “hope it trends,” that’s not a plan.

Here’s the uncomfortable truth: most microcaps fail quietly. The ones that win tend to have a clear reason to exist and a believable path to attention and liquidity.

“Will the bull run be in 2026?” — what would confirm it (and what would cancel it)

I don’t like arguing “bull vs bear” like it’s a sports team. I’d rather run a confirmation list and let price/liquidity tell me who’s right.

What would confirm a real bull phase:

- BTC making higher highs while leverage stays reasonable (no constant funding euphoria)

- Alt strength appearing after BTC strength (rotation, not desperation)

- Liquidity improving: stablecoin growth, healthier exchange flows, easier credit conditions

- Regulatory clarity (or at least fewer “surprise” hits that freeze risk appetite)

What would cancel it (or at least make me defensive):

- High-timeframe breakdowns after failed breakouts (classic bull trap behavior)

- Liquidity shocks that force selling across risk assets

- Forced selling events (big liquidations, major unwind events)

- Systemic exchange/custody stress (when trust becomes the headline)

If you’ve ever been through a real unwind, you know this: you don’t get a polite warning. You get a fast move, wide spreads, and timelines pretending they “called it.” That’s why the checklist matters.

Portfolio game plan: how I’d position without betting the farm

I’m not interested in a portfolio that only works if everything goes perfectly. I want something that can survive chop, survive fakeouts, and still participate if the breakout sticks.

Here’s a structure that’s simple enough to manage and hard enough to kill:

- Core: BTC (and possibly ETH) as the “survive anything” base This is the part I expect to hold through noise without constantly tinkering.

- Satellites: a few high-conviction themes Not 25 tokens. A few. The point is to be right with size, not “kind of right” with chaos.

- Spec basket: small caps with strict sizing + limit orders + take-profit ladders This is where people blow themselves up by sizing like it’s “core.” I treat it like speculation because that’s what it is.

- Dry powder: cash/stables for dips and volatility spikes This is the difference between buying opportunities and begging the chart to go back up.

Risk rules I’d set before the market gets exciting again

If you only take one thing from this section, take this: your risk rules need to exist before the adrenaline hits.

- Max loss per position (a hard number) If you can’t say, “If this drops X%, I’m out,” you don’t have a position—you have a hope.

- Take-profit plan (sell into strength) I like ladders. I like trimming on the way up. Because waiting for the perfect top is how people ride winners back down to breakeven.

- Avoid overexposure to one narrative AI, gaming, DeFi, whatever the meta is—when it unwinds, it unwinds together. Diversify by behavior, not just ticker symbols.

- Know when to do nothing This is the most underrated edge in crypto. If conditions are messy, sitting on your hands is a strategy.

Now here’s the real question: if BTC tags $100K and the market goes a little crazy (because it will), what exactly do you do that day—not in theory, but in actions, levels, and rules?

That’s what I’m going to lay out next—a concrete checklist you can copy, including how I handle both a clean breakout and the nastier scenario nobody wants to plan for.

My “make or break” checklist for your 2026 crypto portfolio (starting today)

If you only do one thing this week, make it this: write down your plan before the market forces you to make decisions at 2 a.m.

I’m giving you a checklist you can literally copy/paste into Notes and update as conditions change. The goal isn’t to be “right.” The goal is to stay solvent and sharp long enough to catch the real move—whether that’s a clean push through $100K or another brutal fakeout.

- BTC thesis (confirmation vs trap)

- Confirm $100K momentum when: BTC breaks $100K and holds it on daily closes, then retests that zone and buyers step in fast (no slow bleed back under). Bonus points if you see spot-led buying (price rising while perpetual funding stays reasonable).

- Warn of a trap when: BTC wicks above $100K and immediately snaps back below, especially if open interest jumps hard while spot volume doesn’t follow. That’s often “paper” leverage doing the work.

- My simple rule: I don’t treat $100K as “broken” until the market proves it can live above it for more than a headline cycle.

- Exposure limits (so one bad week doesn’t erase your year)

- Core (BTC/ETH): set a minimum you won’t touch unless your thesis breaks. For a lot of people, that’s 50–80% depending on risk tolerance.

- Alts (high liquidity only): cap this bucket so it can’t sink you. I like 15–40% max, and I keep it concentrated (a few themes, not 30 tokens).

- Microcaps: treat like lottery tickets, not rent money. I keep this at 0–5% and assume it can go to zero.

- Dry powder: yes, even in a bull-ish year. I keep 5–20% in stablecoins/cash equivalents because volatility is where good entries come from.

- Catalyst calendar (stop being surprised by predictable events)

- Macro days: CPI, Fed/ECB rate decisions, jobs reports. Crypto still reacts to liquidity expectations. Put the dates on your calendar.

- Crypto-native flow checks: ETF/ETP flow updates, major exchange netflows, stablecoin supply changes. If you’re not watching flows, you’re trading blind.

- Token unlocks: any position with a big unlock in the next 30–90 days needs an explicit plan. “I’ll just hold” is not a plan.

- Protocol releases: major mainnet upgrades, incentive program changes, big app launches. These are often “buy the rumor, sell the news” events.

- Regulatory deadlines/hearings: you don’t need to be a lawyer, but you do need to know when your sector might get punched in the face.

- Rebalance rules (what you do when you’re winning)

- Profit ladder: I pre-set trims at levels I know the crowd will fixate on (round numbers, prior ATH zones). Not because it’s magical—because liquidity clusters there.

- Rotation rule: if an alt pumps hard but BTC is still the market’s engine, I’m willing to rotate some gains back into BTC/ETH instead of “letting it ride” until it round-trips.

- Drawdown rule: if a position is down past my invalidation level, it’s gone. I don’t negotiate with charts.

One thing I’ve learned watching multiple cycles: people don’t blow up because they never made money. They blow up because they made money, got sloppy, and gave it back. This checklist is the “anti-sloppy” system.

Quick reference studies worth knowing: a lot of the evidence around “rules beat vibes” comes from traditional markets, but it maps well to crypto behavior. For example, Barber & Odean’s well-known research on retail trading showed active traders tend to underperform due to overtrading and bad timing (the classic “I can’t sit still” problem). Crypto amplifies that because it’s 24/7 and emotionally loud. (Trading Is Hazardous to Your Wealth)

If BTC clears $100K: what I’d do next (so I don’t fumble the move)

$100K is a magnet level. It’s also the kind of number that makes smart people do dumb things. If we get the breakout, here’s how I handle it so I don’t turn a win into a mess.

- I don’t ape the breakout candle When price rips through a round number, the worst entries are usually the ones that feel “obvious.” I’d rather:

- scale in with smaller buys over a few days, or

- wait for a retest of the breakout area (even if it means missing the exact top-tick entry).

Real example behavior: in prior cycles, BTC often broke a psychological level, ran a bit, then came back to “check” it. That retest is where you find out if it was hype or real demand.

- I trim underperforming high-beta alts into BTC strength This is counterintuitive, but it’s saved me repeatedly: if BTC is ripping and some of my “should be flying” alts are barely moving, I take that as a warning. I’ll rotate part of those positions back into BTC/ETH while liquidity is strong.When the market is excited, you get paid for being decisive. When the market is scared, you get trapped.

- I set take-profit targets before the crowd gets euphoric I like placing sells in advance at levels like:

- just below obvious round numbers (because everyone else targets the exact number),

- prior major highs (where sellers love to show up),

- and stretched moves where funding starts to creep up.

I’m not trying to sell the top. I’m trying to make sure I actually bank some wins while the market is offering them.

- I watch leverage like a hawk When a breakout is real, it can still get temporarily wrecked by leverage getting too crowded. If I see:

- funding rates heating up fast,

- open interest spiking without matching spot aggression,

- and “easy money” talk everywhere,

…I tighten risk. That can mean trimming, hedging, or just refusing to add risk until the market cools.

My rule: I’d rather be slightly late than perfectly timed and overleveraged.

If BTC fails near $100K: how I’d protect capital without panicking

A rejection near $100K doesn’t mean “bear market confirmed.” But it does mean the market just showed you where sellers are willing to swing. That’s valuable information—if you use it calmly.

- I reduce leverage exposure first Even if I’m bullish long-term, leverage is what turns a normal drawdown into a forced decision. If BTC can’t hold a key level, I cut leverage quickly. I can always re-enter.

- I rotate from fragile positions into liquidity In chop or rejection conditions, low-liquidity alts and microcaps can drop 30–60% in days because exits disappear. I’ll move some risk into BTC/ETH or stablecoins until the market shows its hand.

- I use invalidation levels and I actually respect them This is where most people lie to themselves. They say they have a stop, but when it hits, they “give it a little room,” then a little more, then suddenly it’s an “investment.”What I do instead:

- pick a level that invalidates the trade thesis (not just a random percentage),

- size the position so that if I’m wrong, the loss is annoying—not life-changing,

- and execute without drama.

- I protect dry powder like it’s a position Dry powder is not “money I’m failing to deploy.” It’s my right to buy the real dip when the market finally offers it. If BTC rejects $100K and the market gets shaky, I’m not trying to be fully invested just to feel productive.

One thing that helps emotionally: I remind myself that missing a move is not the same as losing money. Panic-buying into a failed breakout is how people turn a good year into a therapy session.

A plan that survives both outcomes

I’m not interested in confidence theater. I’m interested in repeatable decisions.

If BTC breaks and holds $100K, I want a plan that keeps me in the move without making me reckless.

If BTC rejects and chops everyone up, I want a plan that keeps my capital intact so I can take the next clean setup instead of revenge trading.

The whole point: build a portfolio that can handle a breakout and

If you want a simple action step: copy the checklist above, fill in your numbers (allocations, invalidation levels, profit targets), and put the next two macro dates plus any big unlocks on your calendar right now. Future-you will thank you when the chart starts moving fast.

Crypto Investment Disclosure: Investing in cryptocurrencies involves significant risks and is not suitable for all investors. Cryptocurrencies are highly volatile assets, and their prices can fluctuate dramatically in short periods, potentially resulting in substantial or total loss of invested capital. Unlike traditional investments, crypto assets are not insured by government agencies like the FDIC or SIPC, offering no protection against market losses, hacks, or exchange failures.Additional risks include: regulatory changes that could ban or restrict trading; security vulnerabilities leading to theft or scams; market manipulation and liquidity issues; technological failures in blockchain networks; and complex tax implications on gains or losses. Past performance is not indicative of future results, and external factors like economic shifts or geopolitical events can exacerbate volatility.This article is for informational purposes only and does not constitute financial, legal, or investment advice. Always conduct your own research (DYOR), consult qualified professionals, and only invest what you can afford to lose. We may hold positions in discussed assets, but all opinions are our own.