Vitalik’s Ethereum Bombshell: Quantum‑Proof Security, “Infinite” Scaling, and the Real Case for ETH at $50K in 2026

What if the next Ethereum “upgrade” isn’t just about cheaper fees… but about surviving a future where quantum computers can crack today’s crypto?

That’s the combo lighting up my feeds right now: quantum‑resistant security + scaling that feels almost limitless from a normal user’s point of view (because rollups do the heavy lifting). And if this story accelerates through 2026, you can see why some traders are whispering the spicy number again: $50K per ETH.

On Cryptolinks.com News, I’m going to keep this grounded: what’s being claimed, what’s real today, what still needs to ship, and what would need to happen for ETH to even have a realistic shot at that price.

Big idea: if Ethereum can look “future‑safe” (quantum) while feeling “boringly fast and cheap” (rollups), the confidence premium alone could change how the market values ETH.

The pain points people keep hitting with Ethereum (and why they still matter in 2026)

Ethereum has come a long way. Rollups are no longer a niche, and the ecosystem is packed with choices. But if you actually use it week to week, the same frustrations still pop up—especially when markets heat up.

Here’s what I see users and institutions complaining about most (and yes, these still matter in 2026):

- Fee spikes still happen when demand surges

Even if your “normal day” fees are fine on an L2, the moment there’s a meme-coin frenzy, NFT mint wave, or liquidation cascade, the whole user experience can feel like traffic hour. L2s help a lot, but the ecosystem still has moments where users say, “Why does this still feel hard?” - Bridging risk is not a theoretical risk

Bridges have historically been one of crypto’s biggest soft spots. A lot of people still remember the ugly headlines from previous cycles. For a sense of scale, Chainalysis has repeatedly highlighted that bridge exploits were responsible for billions in losses across 2021–2022, with bridges singled out as a major attack surface (Chainalysis: 2022 crypto hacks analysis).Even though the tech and practices have improved, the emotional memory is still there: “I don’t mind using an L2… I just don’t want my funds stuck or stolen in transit.” - Fragmented liquidity makes Ethereum feel like multiple mini‑internets

One DEX has the best price on one rollup, another has the best liquidity somewhere else, and your stablecoins might be split across networks. If you’ve ever tried to move size quickly, you know the pain: you can win on fees and still lose on slippage + routing complexity. - Confusing L2 choices (and trust assumptions) are still a UX tax

“Which rollup should I use?” sounds simple until you realize users are also choosing security models, upgrade keys, fraud proofs vs validity proofs, sequencer decentralization, exit paths, and governance risk. Most people don’t want a PhD in rollups—they just want the app to work. - Institutions still ask the same question: is Ethereum secure enough long‑term?

Not “secure enough today.” Long-term. The kind of long-term where boards, auditors, and custody providers ask uncomfortable questions like:

“What happens if quantum computing becomes practical against today’s signature schemes?”And to be clear: this isn’t pure sci‑fi. The math is known (Shor’s algorithm has been known for decades). The uncertainty is timelines and engineering. This is exactly why the U.S. government has been pushing a post‑quantum transition, and why NIST has been standardizing post‑quantum cryptography (NIST Post‑Quantum Cryptography project). - The market’s biggest question: does scaling actually increase ETH value?

This one is the elephant in the room. People can love cheaper fees and faster apps and still ask:

“If users live on L2, does ETH become less valuable… or more valuable?”Because here’s the tension: scaling can make the ecosystem explode in usage, but value capture doesn’t automatically flow where you want it to flow. Traders notice this. So do long-term holders.

So yeah—Ethereum is stronger than it was, but the same core friction points still shape whether normal users stick around and whether big money feels comfortable parking size here for years.

Promise: I’ll connect the tech changes to the price narrative (without the hype)

I’m not here to sell you a moon poster.

What I will do is translate the “bombshell” talk into practical checkpoints you can actually track:

- Quantum safety: what needs to be true for Ethereum accounts to be realistically safer against future quantum attacks (without turning wallets into a nightmare).

- “Infinite scaling”: what people really mean when they say this, and why it’s less about magic and more about rollups doing execution while Ethereum focuses on settlement and data.

- ETH value capture: what catalysts would need to show up for scaling to push demand for ETH itself (not just make random ecosystem tokens pump).

If you’ve ever read a “$ETH to $50K” thread and thought, “Okay, but… show me the steps”, that’s the angle I’m taking.

People Also Ask (what I’ll answer as we go)

These are the exact questions I keep seeing—so I’m going to answer them plainly as we move forward:

- Can quantum computers really break Ethereum, and when?

- Is Ethereum already quantum‑proof?

- What is Vitalik proposing (in simple terms)?

- What does “infinite scaling” even mean for Ethereum?

- Will rollups reduce fees permanently?

- How does scaling affect ETH price?

- Could ETH realistically hit $50K in 2026, and what would need to happen?

- What are the biggest risks that could kill the $50K thesis?

Next: if quantum risk is real enough that governments are standardizing post‑quantum crypto, what would a realistic “quantum‑proof Ethereum” transition look like—and how do you do it without breaking every wallet and contract people rely on?

The “quantum-proof Ethereum” storyline: what it means and what would change

If you strip away the hype, “quantum-proof Ethereum” really means one thing: upgrading Ethereum’s signature security so a future quantum computer can’t forge transactions.

Today, most crypto security is built around public-key cryptography that’s rock-solid against normal computers, but not designed for a world where Shor’s algorithm is practical at scale. In plain English: a sufficiently capable quantum computer could take a public key and reverse-engineer the private key for popular schemes.

On Ethereum, that matters because:

- EOAs (normal user wallets) rely on elliptic-curve signatures. Once your public key is revealed (which happens when you spend), a quantum attacker in the future could theoretically try to derive your private key.

- Validators rely on BLS signatures (different math, same general “Shor breaks it” problem).

- Smart contracts often hardcode assumptions like “this address is controlled by ECDSA signatures,” and entire ecosystems (multisigs, bridges, relayers) inherit that assumption.

So “quantum-proofing Ethereum” isn’t a single patch. It’s a migration of how accounts prove ownership, without making wallets unusable or making every transaction 10x bigger.

The real target isn’t “quantum-proof the chain.” The chain is just data. The target is: quantum-resistant ownership (accounts + validators) that doesn’t wreck UX, doesn’t blow up fees, and doesn’t break existing contracts.

What would actually change for users?

- You’d likely see new account types (think “quantum-safe accounts”) that can sign with post-quantum algorithms (like lattice-based schemes) or hybrid approaches.

- Wallets might offer a simple switch: “Upgrade to quantum-safe mode” (but under the hood it’s a new signature verifier + new key format + new recovery assumptions).

- Smart wallets (account abstraction style) become even more important, because they can swap signature validation logic without changing the “address identity” in the same brittle way.

And yes, standards matter here. The real world is already moving: NIST’s post-quantum cryptography process selected algorithms for standardization (the “grown-up” sign that PQC isn’t just sci-fi). Ethereum will want to align with that kind of work instead of inventing its own cryptography in a corner.

What a realistic quantum transition could look like (step-by-step)

If I were designing the rollout like a boring (but safe) engineer, I’d expect something like this:

1) Optional quantum-safe accounts first

- Early adopters opt into quantum-resistant signature verification.

- Institutions and custodians go first because they have the most to lose and the longest security horizon.

- We’ll probably see hybrid signing (classic + post-quantum) at first, because it reduces the “unknown unknowns” risk while the ecosystem hardens.

2) Wallet + infrastructure readiness (this is the real bottleneck)

- Hardware wallets need firmware support for new signature schemes (and memory constraints are real).

- Custody stacks need audits, key management updates, and clean recovery flows.

- Libraries + standards need to settle so every wallet doesn’t implement a slightly different “quantum-safe” format.

- Indexers, RPCs, explorers must understand new transaction formats/account types without mislabeling them as “weird contract activity.”

3) Migration incentives… and eventually deadlines

- The uncomfortable truth: if quantum risk becomes “real enough,” the chain can’t politely wait forever.

- A credible plan would likely include a long transition window plus escalating nudges:

- Warnings in wallets when you’re using legacy signatures.

- Defaults switching to quantum-safe for new wallets.

- Possible “legacy signature deprecation” timelines for certain high-risk account behaviors.

- The goal is simple: avoid a future where billions sit in old-style accounts because people forgot, lost access, or didn’t understand the risk.

One practical example: a “legacy” EOA that’s never spent from (public key not revealed yet) has a different risk profile than an account that signs constantly. A sensible migration plan would treat those differently, instead of screaming “everything is broken tomorrow.”

The big question: “Do we need quantum-proofing now, or later?”

This is where the conversation gets messy, because both sides have a point.

The “later” camp says: practical quantum computers that can break widely used signatures at scale aren’t here yet, and we shouldn’t rush cryptography changes that could introduce new bugs.

The “now” camp says: security planning has lead times measured in years, not weeks. Also, there’s a concept called harvest now, decrypt later (usually discussed around encryption): adversaries can collect data today and crack it later when tech improves.

For Ethereum specifically, the urgency isn’t just academic. The scarier scenario is a future moment where quantum capability arrives and attackers can:

- Target high-value accounts that have revealed public keys.

- Exploit transaction propagation windows (mempool/ordering dynamics) to race legitimate spends.

- Attack validator key material if the ecosystem hasn’t migrated.

So what counts as credible urgency versus marketing panic?

- Credible: concrete specs, audited implementations, wallet support roadmaps, and opt-in adoption that starts quietly.

- Hype: “Quantum will break ETH next month, buy this token” style fear-selling.

My personal filter is simple: show me the migration path. If the plan depends on everyone flipping a switch overnight, it’s not a plan.

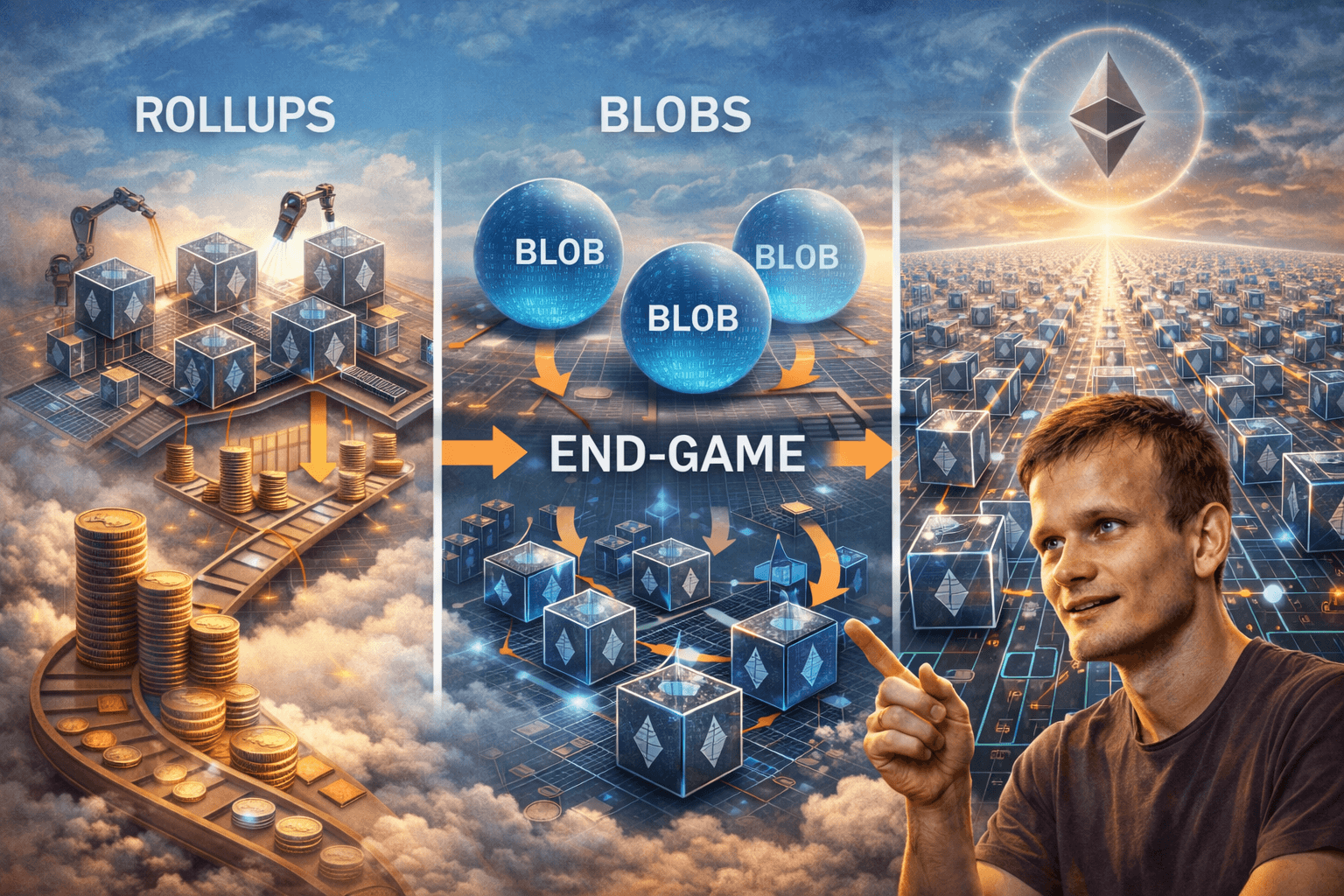

“Infinite scaling” explained like a normal human (rollups, blobs, and the end-game idea)

When people say Ethereum is heading toward “infinite scaling,” they usually mean this:

Ethereum L1 becomes the secure settlement + data availability layer, while rollups (L2s) do the execution.

That’s not a slogan—it’s already the shape of the network. The “infinite” part doesn’t mean unlimited computers. It means scaling becomes mostly constrained by:

- How much data Ethereum can publish for rollups (so users can verify the rollup state honestly).

- How efficiently rollups can compress transactions and produce proofs (ZK) or fraud windows (optimistic).

Blobs matter here because they’re basically Ethereum saying: “Here’s a cheaper, rollup-friendly lane for posting data.” If rollups can post more data at predictable costs, they can serve more users with lower fees.

And that’s why users experience it as “infinite”:

- More rollup capacity → more apps can run cheaply

- More competition between rollups → fees trend down on average

- Better UX → more normal people actually use on-chain apps without feeling robbed by gas

Real-world feel check: when mainnet fees spike, a basic action (swap, mint, claim) can get expensive fast. On many rollups, the same action often costs cents. That “gap” is what makes people believe the scaling story is finally turning into something you can feel, not just a roadmap diagram.

What needs to improve for scaling to feel seamless in 2026

Scaling isn’t only throughput. It’s the “whole experience.” These are the three friction points I keep seeing:

1) Cross-rollup UX that doesn’t feel like a trap

- Bridging still feels like choosing between slow/official vs fast/risky.

- Users want it to feel like moving money between checking accounts: clear, quick, and hard to screw up.

2) Shared liquidity + composability (less “walled garden” behavior)

- Ethereum’s magic used to be composability: protocols stacking like Lego in one place.

- On L2s, liquidity fragments. Apps end up “big on one rollup, empty on another.”

- The win condition is smoother liquidity sharing and better intent-based routing so users don’t care where execution happens.

3) Prover costs + decentralization

- ZK systems are powerful, but proving infrastructure can become centralized if only a few players can afford to run it.

- If proving/sequencing becomes too concentrated, you trade one bottleneck (L1 fees) for another (a small club controlling what gets included).

The uncomfortable truth: scaling can be bullish, but it doesn’t automatically pump ETH

I see people miss this constantly: scaling success and ETH price performance are related, but not identical.

If L2s capture most execution fees, then ETH value capture leans more heavily on:

- Data availability demand (blobs and whatever comes after): rollups paying Ethereum to publish data.

- Settlement demand: high-value apps willing to pay L1 for finality and dispute resolution.

- ETH as core collateral across DeFi, RWAs, and institutional on-chain finance.

- Security premium: the idea that Ethereum’s neutrality and battle-tested base layer is worth paying for.

- MEV dynamics and how value flows through the stack (this gets complicated fast, but it matters).

So scaling is “bullish” when it increases total economic activity so much that Ethereum’s base layer becomes more valuable as the anchor—despite cheaper user transactions happening off L1.

Why the $50K ETH narrative exists (and the checklist it must pass)

The $50K ETH idea survives because it’s a clean story people can repeat:

- Quantum-resistant direction → strengthens long-term security confidence

- Rollups + blobs → makes usage explode without L1 fee pain

- ETH remains the anchor asset → collateral + settlement + economic gravity

But a number like $50K implies a market cap that doesn’t happen on vibes. It needs catalysts, and it needs time. So I treat it like a checklist—not a chant.

The bull checklist for 2026 (what would have to happen)

- Quantum-resistance progress that’s real: credible specs, wallet support, and a migration path that doesn’t rely on miracles.

- Rollups keep growing without major trust failures: no long-lived censorship scandals, no governance meltdowns, no ugly surprises that scare normal users away.

- Demand drivers stay hot:

- Stablecoins expanding on Ethereum rails

- RWAs that actually settle meaningful size

- Consumer apps that don’t feel like crypto toys

- Institutional settlement that prefers Ethereum-grade security

- ETH staying central as collateral, not replaced by a dozen app-specific assets

- Supply/demand tailwinds: staking participation, burn dynamics during high activity, and enough macro liquidity to support a risk-on valuation regime.

The bear checklist (what could wreck the $50K idea fast)

- A major L2/bridge failure that freezes withdrawals, drains liquidity, or breaks user trust for months.

- Regulatory shocks that hit staking, stablecoins, or force harsh on-chain compliance in ways that break UX.

- A competing ecosystem wins “default chain” status for mainstream apps (where users never even think about Ethereum).

- Quantum-proofing stalls in standards fights, wallet incompatibility, or a migration plan that’s so messy people just ignore it.

Quick source list I’m referencing for context (threads)

- https://x.com/status/2010621884811845708

- https://x.com/status/2010638090075775100

- https://x.com/status/2010657882879205626

- https://x.com/status/2010249752823373962

- https://x.com/status/2010601998400266636

- https://x.com/status/2010624370901971193

- https://x.com/status/2010586930854174836

- https://x.com/status/2010638337783009416

- https://x.com/status/2010654039751737794

- https://x.com/status/2010546246428066132

- https://x.com/status/2010651131756904553

- https://x.com/status/2010598748985212947

- https://x.com/status/2010640210288333205

- https://x.com/status/2010627993014518008

- https://x.com/status/2010624676419236096

- https://x.com/status/2010386092294365549

- https://x.com/status/2010649153198772655

- https://x.com/status/2010433803433751014

- https://x.com/status/2010253778365055363

- https://x.com/status/2010358543644500369

- https://x.com/status/2010343442287911172

- https://x.com/status/2010401610476785791

- https://x.com/status/2009803286849708260

- https://x.com/status/2010629936936108263

- https://x.com/status/2010324481676394887

- https://x.com/status/2010048647652880419

- https://x.com/status/2009928202396074059

- https://x.com/status/2010060148472197609

- https://x.com/status/2010025113778040881

- https://x.com/status/2010044190470610976

I’m going to make the next section painfully practical: how I’d model the ETH upside without pretending I can see the future—what’s measurable month-to-month in 2026, what’s pure narrative, and which single metric would change my mind fastest. Want the simple model, or the “trackers I watch like a hawk” list first?

How I’d frame the “ETH to $50K in 2026” take: a simple model, not a moonshot chant

Whenever I see “$50K ETH” get posted like it’s a foregone conclusion, I instinctively reach for a calculator.

$50,000 per ETH with roughly ~120M ETH floating around (give or take, because supply does move) implies something like a $6 trillion network value. That’s not impossible in a global context… but it’s not a casual target either. It requires a real, sustained shift in usage, value capture, and market pricing all clicking at once.

So here’s the model I actually use when I think about this in 2026. It’s intentionally simple, because simple is trackable.

ETH to $50K isn’t one bet. It’s three bets running in parallel: usage growth, value capture, and risk-on pricing.

I put everything into three buckets:

- 1) Network usage growth — Are more people actually using Ethereum-powered rails (mostly via L2s) for real things: stablecoin transfers, trading, gaming, payments, RWAs, settlements?

- 2) Value capture — Of all that activity, how much flows back to ETH as the asset: staking demand, fees/burn, collateral usage, and the “you need ETH to operate” gravity?

- 3) Market pricing — Even if the tech is winning, is the macro tape friendly: liquidity, rates, ETF flows, and the overall appetite for risk assets?

What I like about this framing is that two of the three buckets are measurable in real time. Only the “market pricing” bucket stays partly vibes-driven.

Here’s what’s measurable right now in 2026:

- Usage growth is measurable: active addresses, stablecoin volume, app revenue, L2 throughput, fees paid (or saved), and developer activity.

- Value capture is measurable: ETH burned, blob fee markets, validator economics, staking inflows/outflows, ETH collateralization across DeFi, and how much settlement value touches L1.

And here’s what stays guesswork:

- Market pricing: how aggressive the next risk-on cycle gets, whether ETH ETFs keep attracting consistent net inflows, and what regulators decide to make easy or painful this year.

If you want a “sanity check” version of the $50K thesis, I see it like this:

- Base case: Ethereum keeps growing, but value capture is “okay,” macro is mixed → ETH does well, but $50K is a stretch.

- Bull case: L2 usage explodes and L1 becomes the undeniable data/settlement backbone, staking remains sticky, and a strong risk-on year adds fuel → $50K becomes a “not crazy” number people can model, not just chant.

- Bear case: big security mess (bridges/governance), or value capture disappoints, or macro turns risk-off → the ceiling comes down fast.

If you want one academic-ish anchor for why “security upgrades and future-proofing” matter to valuation: there’s a long history in finance of markets rewarding reduced tail risk (lower perceived probability of catastrophic loss) with better capital access and higher multiples. In crypto, “tail risk” is often protocol failure or custody compromise. That’s why progress on long-horizon threats (like quantum-resistant standards) can matter even before it’s “urgent urgent.”

And as a reminder: the NIST post-quantum cryptography standardization process (years in the making) is exactly the kind of slow, boring, credibility-building pipeline that markets tend to trust more than hype headlines. Ethereum aligning with that kind of standard-driven path is a signal I take seriously—even if timelines remain messy.

What to watch each month in 2026 (my practical tracker list)

I’m a big believer in monthly check-ins instead of constantly refreshing price candles. If ETH is really on a path toward a higher “ceiling,” the chain will tell you—quietly—before CT starts yelling about it.

Here’s my practical 2026 tracker list. These are the tabs I keep coming back to:

- L2 activity + fee trends

- Are L2s sustaining high throughput without users getting randomly wrecked by fee spikes?

- Is the average user actually paying less over time for common actions (swaps, transfers, minting, on-chain games)?

- Where I check: L2beat for adoption and risk notes, and app-specific dashboards (often on Dune) for real usage.

- Blob/data demand and L1 economics (this is the “does ETH capture value?” heartbeat)

- Are blobs consistently in demand, or are they sitting empty most of the time?

- Do we see a healthy fee market for data availability when L2 usage climbs?

- Where I check: blob-focused explorers/dashboards (for example Blobscan-style trackers), plus fee/burn dashboards like ultrasound.money to keep an eye on burn dynamics.

- Staking metrics

- Are validators increasing, flatlining, or slowly exiting?

- Is stake getting dangerously concentrated (a few operators gaining too much influence)?

- How big is liquid staking vs. native staking—does one dominate?

- Where I check: beaconcha.in and other validator dashboards for distribution and flows.

- Security headlines (I treat this like credit risk)

- Any major bridge incident, sequencer censorship scandal, governance takeover, or forced upgrade fiasco is a “stop and reassess” moment.

- Even if funds are recovered, the question is: does mainstream trust pause for months?

- Where I check: incident reports from teams, post-mortems, and reputable security researchers—not just CT threads.

- Quantum-proof progress (this is about credibility, not drama)

- Do we have clear standards language (what schemes, what assumptions, what timelines)?

- Do major wallets and custodians support the path in a user-friendly way?

- Do we see a real migration plan that normal users can follow without wrecking themselves?

- Green flag: the conversation looks like “boring engineering.” Red flag: it looks like “marketing war.”

If you want a really practical way to use this list: I’d rather see six straight months of steady improvement in these metrics than one explosive week of price action.

My personal take: bullish tech doesn’t mean automatic price — but it can change the ceiling

I’m optimistic about where Ethereum is heading, but I’m not going to pretend the market rewards effort on a perfect schedule.

Here’s the difference people miss:

- Scaling progress can increase usage without pumping ETH if the value capture is leaky or if the market is risk-off.

- Security credibility can raise the kind of long-term confidence that brings in slower, bigger money—especially when it’s paired with scaling that feels boring and reliable.

And that’s where the “ceiling” idea matters.

If Ethereum looks like it’s becoming:

- a dependable settlement layer,

- a data backbone for rollups,

- and a chain that takes long-term cryptographic risk seriously,

…then the range of plausible valuations expands. Not guaranteed. Not immediate. But expanded.

In plain English: even if ETH doesn’t hit $50K in 2026, the market might start pricing it like an asset that could reach numbers like that in a future cycle. That shift in perception is powerful.

So… is this really a bombshell?

To me, the “bombshell” isn’t one announcement or one tweet. It’s the combination of two slow, serious storylines turning into something the average user can feel:

- Quantum-proofing is a long game. It’s not about panic—it’s about making sure Ethereum still makes sense as a place to store serious value when the cryptography world changes.

- Scaling through rollups is already happening. The question for 2026 isn’t “can it scale?” as much as “can it feel seamless, safe, and boring?”

- Price depends on whether Ethereum captures enough value from that growth—while the macro environment stays supportive enough for big valuations to show up.

If you’re reading this on Jan 12, 2026, my advice is simple: don’t marry the $50K number. Marry the checklist. Track the metrics. Watch for real adoption, real value capture, and real security progress—not just narrative spikes.

Your turn: what’s the one thing you want me to break down next—quantum migration in plain English, rollup security risk, blob economics, cross-rollup UX, or the actual “$50K math” with scenarios? Send it my way and I’ll write a follow-up.

Quick note: this isn’t financial advice. It’s just my research and how I’m thinking about the Ethereum narrative as of Jan 12, 2026.