NFTfi Aggregators: Streamline Your NFT Trading Now

Have you ever felt like keeping up with your NFTs is a full-time job? Whether you’re trading, lending, or borrowing, managing it across multiple platforms can quickly become overwhelming. Here’s the truth: NFTs are amazing, but the chaos of juggling wallets, marketplaces, and high gas fees makes the whole experience frustrating—unless you know about NFTFi aggregators.

Imagine this: you’re on the hunt for the best deal for your NFT, but it’s hidden among dozens of platforms with different tools, interfaces, and even gas fees. Worst case? You’re spending hours browsing, switching tabs, and calculating fees manually, only to realize you might have missed better opportunities elsewhere. Sound familiar?

What’s making NFT trading difficult?

If you’ve dived into the NFT space, you’ve probably noticed it’s bursting with opportunities, but it’s also all over the place. Here are some reasons why trading and managing NFTs can feel like climbing a mountain:

- Managing multiple platforms: Each NFT marketplace or platform comes with its own account setup, wallet connection, and user interface. Keeping tabs on everything gets messy super fast.

- High gas fees: Every transaction eats into your profits with unpredictable Ethereum gas fees—it’s like paying a toll for every move you make.

- Fragmented deals: There’s no efficient way to find the best opportunities since each platform holds its own offers and they’re scattered across the web.

It’s no wonder that even the most seasoned NFT enthusiasts are frustrated trying to stay on top of their game. The good news? You’re not stuck with the chaos. There’s a better way to streamline everything and focus on making smarter moves.

Don’t worry, there’s a way out

This is where NFTFi aggregators step in to save the day. Think about it: how much simpler would your life be if everything you needed—lending opportunities, trading tools, borrowing options—could be found in one easy-to-use place? No more hopping between platforms, no more endless tabs, and no more missed deals. Sounds perfect, right?

In the next part, we’ll explore exactly how these aggregators work and how they can transform your NFT experience. Ready to see how this all ties together? Stay tuned.

What are NFTFi aggregators?

Managing NFTs can feel like herding cats, right? That’s where NFTFi aggregators swoop in to save the day. Imagine having every tool and service you need to trade, borrow, or lend NFTs packed into one convenient platform. It’s like having your all-time favorite food trucks lined up in a single spot—quick, efficient, and super satisfying.

How do they work?

The brilliance of NFTFi aggregators lies in their ability to centralize scattered data. Instead of hopping between different NFT marketplaces or juggling multiple tabs, these platforms merge everything you need into one sleek dashboard. Think of something like Google Flights—how it pulls together flights from various airlines to save you time and get you the best deals. Now, apply that genius to NFT trading.

For instance, if you’re lending your NFT for liquidity, an aggregator gives you real-time rates from various platforms like NFTfi.com. Or if you’re borrowing, it helps find the best interest rates without the endless comparing and calculating. The goal? Convenience and better outcomes.

Examples of key players

Now, let’s take a look at some big names in this space.

- NFTfi.com: This platform lets you unlock your NFTs’ liquidity with ease. Loan processes here are designed for simplicity while offering competitive rates.

- Blend by Blur: Blur’s Blend has been shaking things up in the borrowing space, with features like rolling loans that renew automatically. It’s flexible and designed for seasoned traders who want options.

Platforms like these aren’t just trendsetters—they’re revolutionizing how trading and finance unfold in the NFT world. It’s all about making life easier for users like us. According to The Block, the rise of these aggregators is already signaling a new wave of efficiency that could reshape NFT trading forever.

“The smarter the tools, the smarter the trader.”

What’s next?

Feeling curious about how you can maximize these tools? Wondering how they transform lending and borrowing for NFT enthusiasts? I’ve got you covered. Stick around, and you’ll see exactly how your prized NFTs can become financial powerhouses without losing ownership.

How does NFTFi lending and borrowing work?

Let’s face it—sometimes, we need quick cash, but selling our prized NFTs feels like saying goodbye to a favorite memory. The good news? NFTFi lending and borrowing let you tap into liquidity without letting go of your NFT treasures. Sounds like magic, right? Let me show you how it works.

Using NFTs as collateral

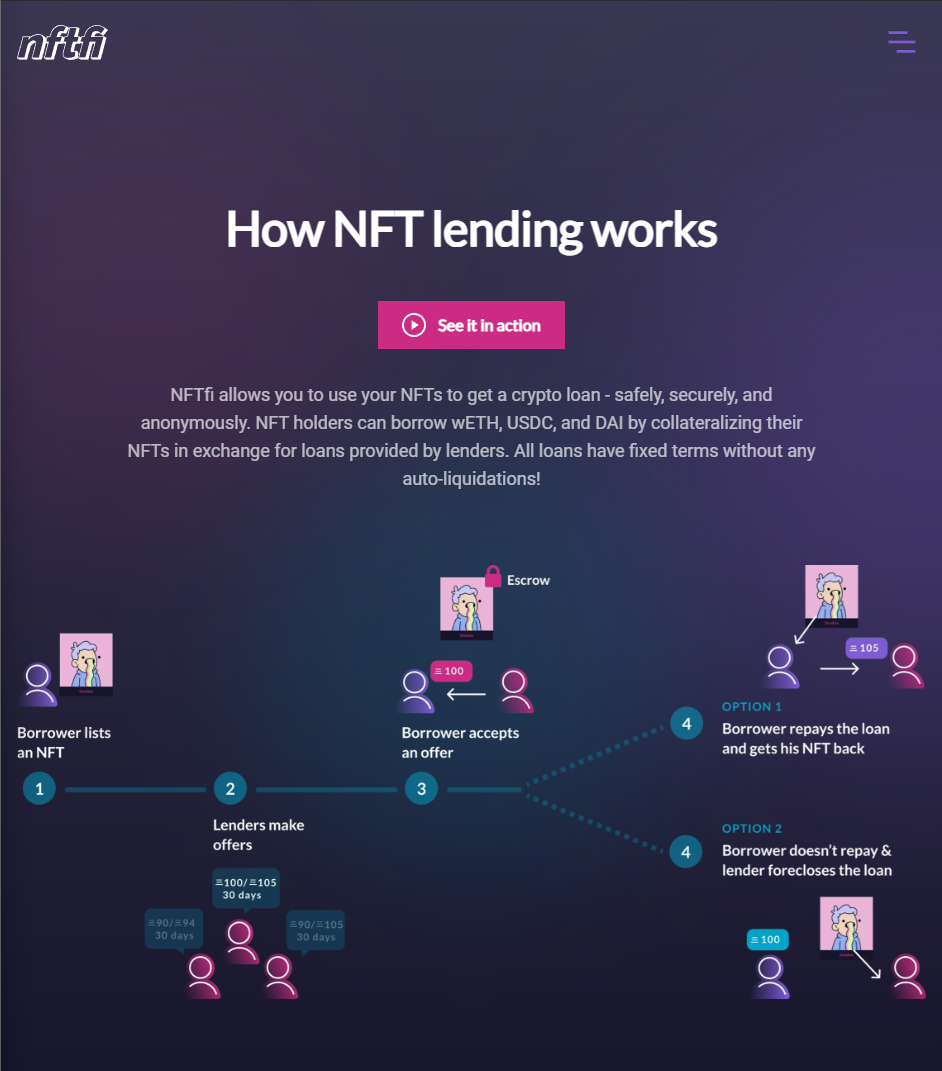

Here’s the deal: you can use your NFT as collateral to borrow crypto. For example, on platforms like NFTfi.com, you lock your NFT into a secured contract and get a loan in return. No need to sell. No goodbye hugs to your rare Bored Ape or those precious game character skins. Just simple, temporary borrowing.

For collectors, it’s like unlocking your NFT’s hidden potential while keeping ownership intact. Imagine having financial flexibility while your assets stay safe—it’s exactly the kind of win-win scenario people love.

Features of platforms like Zharta

Some platforms take this idea even further with cutting-edge technology. Take a platform like Zharta. They’ve integrated AI to make borrowing seamless and ultra-fast. The process appraises your NFT instantly to determine its value, so you’re not left waiting—or guessing.

If speed and precision are what drive your decisions, tools like this can be a game-changer. It’s about making the whole borrowing process feel smooth, intuitive, and reliable.

Risks to watch for

Now, before you get too excited, let’s talk risks. Borrowing money using NFTs doesn’t come without challenges. Here’s the kicker: if you fail to repay the loan, you lose your NFT. That’s right—your collateral essentially becomes the lender’s property.

This can hurt especially if market prices turn against you mid-loan. Imagine losing a valuable piece just because the market took a dip. It’s a reminder to borrow responsibly and keep a close eye on repayment terms.

“When it comes to NFT lending, the key isn’t just borrowing—it’s borrowing wisely.”

So, think before you leap. Are you prepared to put your digital treasure on the line?

Now that we’ve cracked open the world of NFT lending and borrowing, what about all the other features NFTFi aggregators bring to the table? If trading smarter or unlocking liquidity sounds like something you need, you’re going to want to keep reading. Let’s check out just how these platforms take your NFT game to the next level.

What other features do NFTFi aggregators offer?

When you think NFTFi aggregators are just about lending and borrowing, hold on—there’s so much more packed into these powerful platforms. They don’t just help you borrow funds or unlock liquidity; they also bring tools that completely change how you interact with NFTs. Let’s unpack the other features that make these aggregators game-changers in the NFT space.

Trading efficiency

Imagine scrolling through multiple NFT marketplaces, comparing prices, and checking availability. Frustrating, right? Aggregators streamline this entire process for you. They create a direct connection to listings across several platforms in real time, ensuring you always spot the best deals. No more jumping back and forth across tabs or second-guessing whether you’re overpaying. For instance, some aggregators even highlight underpriced NFTs to help you snag assets that are way below market value.

It’s like having a super-intelligent assistant constantly hunting for the best opportunities for you. Have you ever heard that saying, “Time is the most valuable currency”? This is especially true in NFT trading, where every second could mean missing—or securing—a once-in-a-lifetime deal.

Liquidity pools

Need quick liquidity without the headache of traditional selling terms? Say hello to liquidity pools. Some aggregators let you place your NFTs into shared pools, giving you instant liquidity options. Think of it this way: your NFTs don’t have to sit idle in your wallet anymore. By participating in these pools, not only can you unlock value, but you might also earn a steady yield.

For example, some platforms maintain “peer-to-protocol” liquidity pools, making the entire process faster and smoother. Essentially, while your Bored Ape lounges in the pool, you’re off putting those funds to work elsewhere. It’s freedom with your assets, redefined.

Portfolio management

Let’s be honest—keeping track of all your NFTs, trades, loans, and earnings can feel like a nightmare. Are you still juggling spreadsheets or scribbling random notes? If yes, it’s time to finally let that go.

NFTFi aggregators simplify portfolio management by pulling everything together into one dashboard. From tracking floor prices to monitoring loan expirations, it’s now ridiculously easy to stay informed. Imagine logging into a sleek interface where all your NFT data syncs automatically, making management effortless.

Platforms often offer customization options, too. Want to set alerts when an expensive NFT in your collection hits a certain value? Done. Need updates on your active loans? No problem. This feature, in particular, is a lifesaver for anyone looking to stay organized in the fast-moving world of NFTs.

“You can’t manage what you don’t measure.” This quote hits hard when you think about how vital it is to stay in control of your NFT investments.

From trading smarter to unlocking liquidity and managing your digital portfolio like a pro, the range of tools in these aggregators isn’t just helpful—it’s essential for NFT enthusiasts striving to level up. But, I know you’re wondering: why are NFT traders so hooked on these platforms? Trust me, the answer is just as exciting as what we’ve covered so far. Let’s take a look at why these tools have earned almost cult-like devotion in the next part.

Why Do NFT Traders Love Aggregators?

You know that feeling when everything just clicks? That’s exactly what NFT traders experience when they start using NFTFi aggregators. Trading NFTs can be chaotic—jumping between platforms, monitoring multiple wallets, and trying not to miss out on opportunities. Aggregators eliminate the chaos. Let me walk you through why these tools are a game-changer for NFT enthusiasts.

Time-Saving Benefits

Think about the hours spent switching tabs, comparing NFT prices, or finding the right lending rate. Every minute matters when the crypto market moves faster than a lightning bolt. NFTFi aggregators simplify this process by putting everything you need on one screen. No more unnecessary clicks; everything you’re hunting for is aggregated in one seamless spot.

For instance, if you’re looking for the best borrowing terms, a good aggregator will compare rates across platforms instantly. Imagine lending your NFT via NFTfi.com—you’ll likely find the deal almost effortlessly. Efficiency like this isn’t a luxury, it’s a necessity!

“Time is money” isn’t just a saying in NFTs; it’s practically law.

Optimized Outcomes

Ever wondered if you’re actually getting the best deal when you trade or lend an NFT? With all the different platforms out there, you might be leaving money on the table. NFTFi aggregators fix that.

These tools do more than save you time—they help you make smarter moves. They use algorithms to catch opportunities you might miss manually. Let’s say you want to borrow some crypto by staking your NFT as collateral. Instead of settling for whatever’s available, an aggregator scans multiple platforms to find you the best interest rates or most favorable terms. It’s not just trading; it’s trading with strategy.

Take Blend by Blur as another example. With its rolling loan functionality, you get flexible borrowing options built for the fast-paced NFT market. That’s the kind of advantage you don’t want to skip.

Why It Matters

In a world where seconds count, these benefits aren’t small perks. They’re game-changers. If you can save hours of time and end up with better terms or deals in the process, why wouldn’t you jump on board?

Feeling curious about where you can find the most trusted NFTFi aggregators to get started? Keep reading—I promise you won’t regret it.

The Top NFTFi Aggregators to Try Today

So, let’s talk about the real stars of the show—those platforms that are making NFT trading a breeze. If you’ve been dabbling in NFT finance, or even if you’re just NFT-curious, these aggregators deserve your attention. They’ve been turning heads, saving hours, and maximizing returns for traders everywhere. Wanna know what makes them tick? Let’s check them out.

NFTFi.com: The Pioneer

Think of NFTFi.com as the OG of NFT finance tools. It’s built for everyone—from the collector with one prized NFT to the hardcore trader moving piles of assets daily. With its clean interface (no clutter!) and powerful features for lending and borrowing, it’s the go-to for unlocking your NFTs’ value without selling them.

Fun fact: Since launching, NFTFi.com has helped users unlock over $200 million in NFT-backed loans. One quick look, and you’ll see why it’s a favorite. The efficiency and ease are unreal.

Zharta: AI-Powered Lending

If you’re into tech innovation, this one’s for you. Zharta is not just about loans—it’s about smart loans. It uses AI to appraise your NFT’s value in real-time, offering instant liquidity without breaking a sweat. Whether you’re holding onto a hot piece from a gaming metaverse or some unique 1-of-1 art, you’ll appreciate the speed.

“Automation is liberation.” — That’s not their exact tagline, but it might as well be.

What I love about Zharta is how precise it is. The AI evaluates everything, saving you from the guess and gamble game of figuring out collateral worth. Plus, no unnecessary delays. You get your funds faster than you can say “blockchain.”

Blend by Blur

Here’s a quote I read the other day: “Flexibility is key to survival.” That perfectly sums up Blend. It’s not just another aggregator—it’s rewriting the rulebook by offering rolling loans, keeping the lending process ridiculously flexible. You know that feeling when everything just clicks? That’s Blend for market-savvy users.

It’s particularly popular for traders aiming for short-term liquidity without locking themselves into rigid repayment schedules. Flexibility means freedom, and in the NFT world, freedom is everything.

Blend is part of the Blur ecosystem, which has been gaining traction with pro traders. So, if you’re serious about positioning your NFTs for the best deals—or simply curious—you might want to see what Blend is cooking up.

Who’s Your Favorite?

Now, imagine having all these powerhouse platforms at your fingertips. Which would you try first? Or, more importantly, how can you make sure you’re leveraging them fully without getting burned by risks? Up next, we’ll break down some challenges you absolutely need to watch out for. Stay tuned.

Challenges to Keep in Mind

Let’s be real—no tool out there is completely flawless, and NFTFi aggregators are no exception. While they’ve made NFT trading more accessible for thousands of collectors and traders, there are still a few hurdles to navigate. Let’s take an honest look at the risks and challenges you should consider before jumping in headfirst.

Gas Fees: The Unskippable Expense

You know that feeling when you’re about to buy something online, and then you see the “shipping cost” suddenly pop up? That’s kind of what gas fees are like in the NFT world. Even with the most polished NFTFi aggregator, Ethereum gas fees can hit you hard—especially if the platform isn’t leveraging a Layer 2 solution.

For instance, let’s say you find an amazing lending opportunity for your CryptoPunk. But suddenly, that gas fee bites into your profit margins, making the trade less lucrative. It’s frustrating! Always calculate gas costs before transacting, and keep an eye out for aggregators exploring cheaper options, like Optimism or Arbitrum.

Over-Collateralization Risks

Borrowing against NFTs sounds like a genius move… until it’s not. Here’s the thing with NFT-backed loans: these platforms often operate with over-collateralization. That means you might be required to lock in more NFT value than the amount you’re borrowing. Sounds harmless? Not always.

Imagine this: you lock up your cherished Mutant Ape NFT, pegged at 10 ETH in market value, for a loan worth 5 ETH. But what happens if the NFT market takes a sudden dive (which is not exactly unheard of)? The platform can liquidate your precious asset if you can’t repay swiftly. Ouch. So, while the opportunities are exciting, pay attention to market volatility and borrow smartly, not impulsively.

Trusting New Platforms

NFTFi is still relatively new, and while many platforms are doing fantastic work, some might not be as secure as they appear. Scams are real, and glitches in poorly-built systems can cost users their assets. Trust is priceless in this space, and not every shiny aggregator deserves it.

Here’s a quick tip: stick with platforms that have a proven track record, solid user reviews, and transparent operations. Do your homework. For example, NFTfi.com has established itself as a reliable option, but when you venture into newer platforms, read the fine print and tread carefully.

“If You Don’t Understand It, Don’t Risk It”

“The riskiest thing we can do is not take risks. But the uncalculated risks? Those are the ones that sting the most.” – Anonymous

In this ever-changing world of NFTs, there’s always the allure of quick gains, but don’t let that excitement blind you to the potential pitfalls. Taking unnecessary risks will cost you more than you think—especially in this volatile market.

Feeling like there’s a lot to consider? You’re not wrong. But don’t stress too much just yet. The next part will help you figure out whether NFTFi aggregators truly align with your style, goals, and needs.

How to Decide if NFTFi Aggregators Are for You

Let me ask you this: are you someone who builds a strategy before making a move, or do you just dive straight in? Knowing where you stand can help you figure out whether NFTFi aggregators fit your style. These tools are incredibly useful, but only if you see how they match your goals. Let’s break it down in a way that makes sense for both beginners and seasoned NFT pros.

Beginner or Seasoned NFT Collector?

If you’re a beginner in the NFT space, there’s no shame in admitting that things can quickly feel overwhelming. Think about it—juggling platforms, managing wallets, understanding contracts, and keeping track of market updates? It’s a lot. NFTFi aggregators are like the personal organizer you didn’t know you needed. They simplify the chaos by streamlining everything into one clean, easy-to-navigate interface. For someone just starting, this can mean the difference between missing out on opportunities or thriving in the NFT world.

Experienced traders, don’t think I forgot about you. If you’ve been in the game long enough, you know that timing and efficiency are everything. Aggregators don’t just save you time—they optimize your strategy. Imagine having all your favorite features in one place: lending platforms, liquidity pools, and curated offers from multiple marketplaces. Want the lowest borrowing rates or fastest liquidity options? These tools level up your trading game exponentially by giving you that edge.

Need for Liquidity or Optimization?

Here’s another question for you: is liquidity your priority? For someone who owns high-value NFTs but feels “asset-rich and cash-poor,” an aggregator brings enormous value. For example, platforms like NFTfi make it possible to unlock funds instantly using NFTs as collateral without parting ways with them permanently. Imagine needing quick liquidity for a crypto dip or another investment opportunity—aggregators let you make that happen efficiently.

Now, let’s say you’re not desperate for liquidity but want to make sure every move you make is optimized. Aggregators can act like your secret weapon here. They connect you to the best opportunities across various platforms—whether it’s scoring unbeatable lending rates or securing the best trading deals. As Anna Wang explains in her LinkedIn piece, a well-informed strategy in the NFTFi space can significantly improve returns. From managing high-valued assets with precision to unlocking quick liquidity, it seems these aggregators can cater to whatever need you may have.

So, what do you really need—simplicity, liquidity, or optimized investing? Perhaps a mix of all three? With aggregators ticking multiple boxes, the question isn’t so much whether they work. It’s about whether you’re ready to transform how you trade and manage NFTs.

The question now is: are these platforms enough to future-proof your investments against the evolving NFT market? Let me show you why the answer is an absolute yes—but first, let’s get to the final part and uncover what’s next.

Ready to simplify your NFT trading?

Let’s face it: trading, lending, or borrowing NFTs doesn’t have to feel like navigating a maze anymore. NFTFi aggregators are not just another fancy crypto novelty—they’re like having a personal assistant who keeps all your NFT tasks organized in one place. Are you ready to take the leap and make your NFT journey easier and more effective?

Where to start?

If you’re new to this, I get it—taking the first step can feel intimidating. Start with beginner-friendly platforms like NFTfi.com. It’s perfect for testing the waters and understanding how to borrow or lend safely. Want something slightly more advanced? Check out Blend by Blur; it’s been making waves thanks to its flexibility and innovative rolling loans.

If you’re a fan of learning through examples, industry leaders often highlight success stories where aggregators help traders save money, gain extra liquidity, or spot high-value opportunities. Even better, dive into what trusted voices like Anna Wang have shared on LinkedIn. It’s packed with valuable insights, especially if you want to explore how liquidity plays a key role in maximizing NFT potential.

The future is streamlined

We’re only scratching the surface of what NFTFi aggregators can do. As NFTs continue to grow in popularity, these tools are set to become the default for anyone serious about NFT trading. Think about it: why waste energy juggling multiple wallets, interfaces, and tools when you can have them all neatly organized in one place?

Imagine a future where managing your NFTs feels as effortless as scrolling through your favorite app. That’s where we’re headed—with fewer headaches and more opportunities to focus on making smarter trades and investments.

Closing thoughts

In this fast-moving world of crypto and NFTs, timing is everything. Tools like NFTFi aggregators offer the edge you need to stay ahead of the game. No more scattered tools or time wasted—just smarter, faster trading at your fingertips.

My advice? Don’t wait. Start small, experiment with platforms like NFTfi.com, and refine your strategy along the way. Whether you’re in it for the profits, the tech, or the sheer thrill of it all, there’s no better time to get started.

The NFT world isn’t slowing down. The question is—are you ready to simplify, optimize, and dominate your NFT journey? Let’s make it happen.