5 Things to Know Before Investing in Bitcoin

It is tempting to want to take some of your salary and savings and buy Bitcoin immediately. The price moves so quickly that it can be difficult to resist just buying-in and seeing what happens.

Before jumping in, there are certain things which will not only help with making the investment but also with how to secure it and manage it. We present five things that should be considered before making your first investment.

1. Securing Bitcoin is just as important as buying Bitcoin

Bitcoin is not only an investment of money. It should also be an investment of time. Time should be spent learning how to store your Bitcoin as well as buy it. The two key steps with making an initial Bitcoin investment are using a reliable exchange and securing it in a wallet.

In terms of an exchange, it is best to use a large exchange with a solid reputation. Coinbase, Kraken, and Bitstamp all rank highly in this regard. Once an account is set-up, users can transfer funds to the exchange and make their cryptocurrency purchase. It is strongly advised not to leave funds on an exchange as it both puts the exchange in control of the funds and exposes the user to the business risks of the exchange.

It is a much better option to choose a secure wallet to transfer the funds to. The highest standard of wallet in terms of security are hardware wallets. These need to be purchased online from the official seller. If users are not willing to invest in a hardware wallet, a desktop or mobile wallet with strong security can be considered, The key point to note with the security of the wallet is how the private key is stored. The private key should be in the control of the user and stored on their own device. Private keys that are stored on the wallet providers servers are insecure and there is the risk that the funds will be accessible to another party. It is also extremely important to never reveal the private key of a wallet to anyone as this will allow whoever has the private key to access the funds in the wallet.

2. There’s a lot of information and opinions floating around

Between Twitter, Reddit, and other social media, there is pretty much an opinion supporting any viewpoint in the cryptocurrency world. Communities such as these can be good sources of information but independent research should always be completed. There will never be a lack of people online who are claiming with certainty that a project will increase at least 100%.

Be careful not to get caught up in the hype of some of the opinions you come across. Many will be selling membership to paid groups. There is no such thing as easy or free money in investing. Good returns come at the cost of spending time doing researching investments.

3. Scams are everywhere

The cryptocurrency industry is still developing. This makes the industry ripe for scam projects and shady businesses. There have been numerous projects which have raised funds for a proposed project only to disappear with investors funds afterwards. Initial coin offerings (ICOs) are a fundraising mechanism whereby teams issue tokens in exchange for funds for a project they propose. While some investors have achieved good returns from investing in strong ICO projects such as Ethereum, there are many which are simply scams.

4. The price is going to swing

Prices in cryptocurrencies are still very volatile. It is not uncommon to see large swings in either direction take place within minutes. This can be scary for the first-time investor as they are concerned about entering at an unattractive price. One strategy to help prevent entering at an unattractive price is to apply dollar-cost averaging. The dollar cost averaging strategy is when a fixed amount is invested at regular intervals. Imagine you have $5000 to invest. Instead of investing the $5000 all at once, dollar cost averaging could be investing $500 at the end of every month for ten months. This helps prevent against buying at market highs.

5. It is still very early

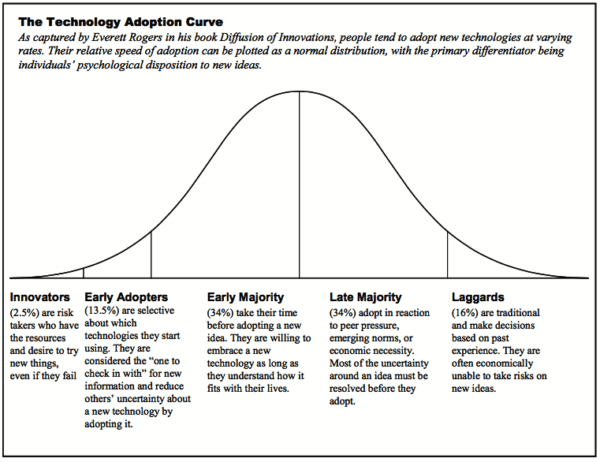

Technology Adoption Curve

Cryptocurrencies are best described as an emerging technology. It has been in existence for barely ten years. It has been declared dead over 300 times. While it is easy to get concerned about the daily price movements and what the latest development is, the fact is that it is still a very nascent technology and anybody involved at this stage is likely very early to the scene. If you try to think of at least 100 people you know, what percentage of these are in some way involved in cryptocurrency? The figure is likely to be less than 5% unless you are working in the industry.