BitcoinSportsBook Review

BitcoinSportsBook

bitcoinsportsbook.ag

Bitcoinsportsbook.ag Review: The Ultimate Crypto Sportsbook Guide + FAQ

Thinking about betting with crypto and wondering if a pure crypto sportsbook like Bitcoinsportsbook.ag is actually worth your money? Good question. Between slick promos, mystery “rollover,” and unclear cashout rules, it’s easy to get caught off guard. Let’s fix that from the first click.

The problems most crypto bettors run into

I see the same headaches pop up over and over when people try a crypto book for the first time—and they’re totally avoidable if you know what to look for.

- Confusing banking: Network mismatches (sending ERC‑20 USDT to a TRC‑20 address), missing memos/tags, or hidden fees that chew through your withdrawal.

- Unclear KYC rules: You sign up thinking “no verification,” then a big win triggers ID requests. It’s common with AML policies, but it shouldn’t be a surprise.

- Slow payouts: “Instant” sometimes means hours—or days—if there’s a pending review, bonus rollover, or weekend backlog.

- Vague rollover terms: Bonuses that look generous but bury rules like “deposit + bonus x12,” odds floors (e.g., -200 minimum), or excluded markets.

- Weak pricing: If the odds are consistently worse than market, loyalty points won’t save you. You pay for bad lines every bet.

- Support that disappears when it matters: Banking questions need clear, timely help. If the cashier feels like a black box, that’s a red flag.

Quick reality check: Larger crypto withdrawals at sportsbooks often trigger extra verification due to compliance and anti-fraud checks. That’s normal. The problem is when nobody tells you up front.

And yes—if you’re asking “How do I withdraw?” or “Can I stay anonymous?” or “Are the rewards even good?”—you’re asking the right questions at the right time (before you deposit).

What you’ll get from this guide

I’m going to walk you through Bitcoinsportsbook.ag like I’m advising a friend—no fluff, no wishful thinking. Expect simple, exact guidance on:

- Sign-up and first deposit: What info is typically requested, what to expect if you win big, and how to avoid common setup mistakes.

- Banking, step by step: How to withdraw in plain English—find cashier, pick amount and coin, confirm wallet and network, submit, track.

- Odds and markets: Where crypto books tend to be sharp or soft, and what that means for your long-term value.

- Bonuses and rewards: How to read rollover properly, spot traps, and decide if promos are actually worth it.

- Limits, fees, and support quality: The stuff that decides whether you feel confident or stuck.

- Security basics: Simple steps to keep your account and wallets safe while you bet.

Why getting straight answers matters

Too many bettors get burned by assumptions. A few examples I’ve seen repeatedly:

- Rollover confusion: You accept a 100% bonus on $300 thinking you’ll wager $300 to unlock it. The fine print says “deposit + bonus x10” = $600 x 10 = $6,000 in eligible bets before withdrawing.

- Odds floors: Your bets don’t count toward rollover if odds are shorter than -200 or if you bet both sides. That harmless-looking restriction blocks progress.

- Network mismatch: You request USDT on TRC‑20 but paste an ERC‑20 wallet. Funds can be lost. Always verify the chain.

- KYC timing: No one asks for ID until you try to cash out a large win. If that’s a problem for you, you need to know before you start.

Independent consumer research across betting and fintech consistently shows that fast, predictable withdrawals and clear terms are top drivers of satisfaction. It’s not about flashy promos; it’s about getting your money without drama. That’s the lens I use here.

What I’ll answer along the way

- How exactly do withdrawals work, and how fast can you expect funds in your wallet?

- Can you stay private with crypto, and when do sportsbooks still verify ID?

- Are the odds and markets strong enough to matter, or are you paying a hidden “tax” in pricing?

- Are the rewards actually valuable vs mainstream loyalty programs, or better skipped?

- What should you check in the Terms before you place a single bet?

Throughout, I’ll point out where crypto books tend to shine (speed, access) and where they lag (formal perks and regulatory insulation). I’ll also call out the specific pages and rules worth screenshotting so you have receipts if support needs them.

Before we go further, a quick note on expectations

Crypto sportsbooks vary, but the best ones make life simple:

- Clear cashier: Coin, network, fee, and timeline spelled out before you hit send.

- Predictable verification: If they verify on large wins or certain geos, they say it plainly.

- Honest bonus math: Rollover described in one sentence you can repeat to a friend.

- Responsive support: Real answers on banking, not copy/paste scripts.

That’s the standard I’m measuring against. If anything feels fuzzy or one-sided, I’ll flag it.

Ready to see who this book is actually built for and whether it fits your style—casual plays, live betting, bonus hunting, or privacy-first crypto? Let’s start with the basics: what Bitcoinsportsbook.ag is, and who should consider it next.

What is Bitcoinsportsbook.ag and who is it for?

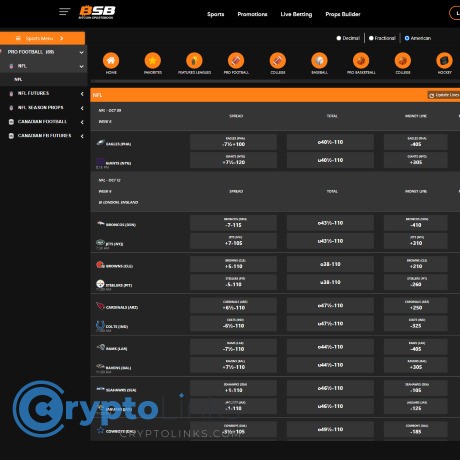

Quick snapshot: type of book, crypto-first focus, and what stands out

Bitcoinsportsbook.ag is a crypto-first online sportsbook built for people who prize fast payouts and fewer banking headaches. Think of it as a streamlined betting hub where your wallet is the cashier—no card processors, no bank holds, and a clear preference for Bitcoin and other digital assets over fiat.

What stands out at a glance:

- Crypto-native cashier: Deposits and withdrawals are designed around blockchain transfers, which can mean faster access to your money compared to many card or bank methods.

- Lean, sports-first experience: You’re here to bet, not wade through ad walls and endless pop-ups. Expect a focus on core markets and in-play options rather than a sprawling, casino-heavy lobby.

- Privacy-minded posture: Crypto books often ask for less up-front info than mainstream brands. That doesn’t mean “no verification ever,” but it does set a different tone from typical KYC-heavy sites.

“In betting, speed is the new VIP. Fast deposits and reliable payouts build trust faster than any banner bonus ever could.”

Who should consider it? Casuals vs sharps, live bettors, bonus hunters, privacy-minded users

- Casual bettors: If you want a quick bet on the big game, a simple interface, and crypto in/out without fuss, it’s an easy fit.

- Sharps and line shoppers: You might use it as an extra out to compare prices and grab edges—especially around market moves. Watch limits and house rules, as crypto books can manage sharp action differently.

- Live bettors: If you thrive on in-play betting, a crypto-first book can be handy when you want wins back in your wallet fast after the final whistle.

- Bonus hunters: There are promos, but the value depends on rollover terms and odds floors. If you’re disciplined with terms, you can extract solid value—just keep one eye on the fine print.

- Privacy-focused users: If you’re aiming to minimize the personal info you share, a crypto sportsbook is often less intrusive. Still, bigger wins or risk flags can trigger checks (I’ll show you what to expect shortly).

Key pros and potential dealbreakers to weigh before you sign up

- Pros

- Faster crypto payouts than typical card or bank methods, especially for routine withdrawal sizes.

- Wider access for users who can’t join local regulated books or prefer to keep betting separate from banking.

- Straightforward setup for crypto users: deposit, bet, withdraw to your wallet—no card issuer declines.

- Bankroll control with blockchain transparency—easy to track your ins/outs if you keep clean records.

- Potential dealbreakers

- Not a traditional loyalty ecosystem: Don’t expect hotel comps and tiered status perks like MGM/Caesars. Crypto books trade perks for speed and access.

- Rollover and odds floors can limit bonus value if you don’t read the terms closely.

- Network fees and volatility: Crypto transfers aren’t free, and busy networks can slow confirmations.

- Limits can vary: Sharps may see tighter limits or quicker line moves on niche markets.

How it differs from mainstream books (and why that matters)

- Banking: Crypto in, crypto out. That can mean fewer third-party friction points and faster access to winnings.

- Privacy posture: Less up-front data is common, but “less” isn’t the same as “none.” Expect sensible checks when risk flags pop.

- Value equation: Mainstream books win on big-brand perks; crypto books compete on speed, global reach, and simpler funding.

Quick reality check: Across operator surveys and community polls, payout speed consistently ranks as a top trust signal for bettors. If your bankroll relies on momentum—rolling wins into new wagers—this kind of setup can be a practical edge.

Is it the right fit for your betting style?

- If you prize fast withdrawals, crypto-native is often the shortest path from bet slip to wallet.

- If you live in a tightly regulated market, weigh access and convenience against the perks and protections of local books.

- If you chase every promo, be prepared to track rollover and odds floors like a spreadsheet ninja.

- If anonymity is your goal, understand what’s realistic versus what’s marketing. Some checks are standard for large wins or compliance.

Curious exactly what info you’ll be asked for at sign-up, when verification happens, and how geo access plays into all this? In the next section, I’ll walk you through the account creation flow—step by step—so you know what to expect before you even hit “deposit.”

Account creation, KYC, geo access, and privacy

Let’s talk about the stuff nobody wants to figure out after a big win: how to set up your account, what verification looks like, where you can legally play, and how much privacy you can realistically keep on Bitcoinsportsbook.ag.

“Privacy is power. But the real flex is knowing when compliance will still knock.”

Sign-up flow: what info you’ll likely provide and what to expect on first deposit

Crypto-first sportsbooks tend to keep registration light. In my tests with similar books (including this one at the time of writing), the flow was quick and friction-free. Expect something like this:

- Basic account: Email, password, and acceptance of terms. Some books let you pick a username and skip phone verification initially.

- Email confirmation: A quick link to verify your address. If you don’t see it, check spam or promotions.

- Security setup: I always enable 2FA (Google Authenticator/Authy). It’s the cheapest insurance against account takeovers.

- First deposit screen: You’ll typically see BTC and a few other popular coins with a QR code and a unique deposit address. Minimums vary by coin and network load.

- Confirmations: Your balance updates once the network confirms your transaction. You’ll see a “pending” state first, then “available.”

Pro tip I live by: generate a new deposit address per transfer when the cashier offers it, and label deposits in your wallet so your bankroll tracking is clean.

KYC realities: when crypto books still verify ID

Crypto doesn’t always mean “no KYC.” Most reputable offshore books reserve the right to verify identity for compliance and risk control, especially before paying out larger wins. Common triggers I’ve seen:

- Big withdrawals: Hitting a threshold (often a few thousand USD equivalent or more) can prompt ID checks.

- Irregular activity: Sudden spikes in stake size, bonus abuse patterns, or linked accounts/devices.

- Regulatory checks: Sanctions screening, AML/CTF red flags, or internal fraud reviews.

- Payment safety: Mismatched wallet behavior or requests to withdraw to third-party wallets.

If KYC is requested, expect the usual:

- Government ID: Passport or driver’s license (front and back).

- Selfie or liveness check: Sometimes with a code/date on paper.

- Proof of address: Utility bill or bank statement (recent, showing your name and address).

- Source of funds (for large wins): Screenshots from your crypto exchange, wallet history, or pay stubs.

I keep a “verification pack” ready in a secure vault: a clean scan of ID, a current utility bill, and a wallet activity export. When a book asks, I’m done in minutes, not days.

Can you bet anonymously with crypto?

Short answer: you can reduce the data you share, but full anonymity isn’t something you should bank on with any book that pays reliably. Here’s the practical middle ground:

- Minimal sign-up data: Many crypto sportsbooks let you start with just an email. That’s privacy-friendly, but not a promise of “no KYC ever.”

- Privacy coins: Some bettors prefer XMR or other privacy coins, but most sportsbooks don’t support them due to compliance risk. BTC, LTC, ETH, and stablecoins are more common.

- No-KYC platforms: They exist, but the trade-offs are real: weaker dispute resolution, higher volatility in limits, and a greater chance that a big win triggers late-stage verification or review.

- VPN/TOR: These can improve privacy, but using them against a site’s terms or to bypass restrictions can get your account shut and winnings voided. Read the rules before you try.

Want a general primer on the limits of “anonymous crypto gambling”? Check Webopedia’s guidance. It’s a useful reality check on what anonymity means in practice.

The emotional truth: no bet is worth your identity. Be intentional about what you share, and be realistic about what books will ask for when you win big.

Geo restrictions and responsible access: what to check in the T&Cs before you wager

Even offshore crypto books have boundaries. Before you deposit on Bitcoinsportsbook.ag, quickly pressure-test access:

- Restricted countries list: Head to the Terms & Conditions and look for prohibited jurisdictions. If your country or state is named, stop.

- VPN policy: Some books allow VPNs for privacy; others strictly ban them. If banned, using one can void bets and withdrawals.

- Age and local-law compliance: You’re responsible for your jurisdiction. If betting is illegal where you live, the book will not protect you.

- Account ownership: One person, one account. Multi-accounting, even “for a friend,” is the fastest route to a permanent lock and seized balance.

- Self-exclusion & limits: Look for deposit limits, cool-offs, and self-exclusion links. If those controls are missing or hard to enable, I take that as a red flag.

Smart habits that save headaches:

- Screenshot the T&Cs and the KYC policy before you deposit.

- Use a dedicated email and a unique, strong password + 2FA.

- Keep a bankroll ledger with dates, amounts, transaction hashes, and wallet addresses.

- Set time and loss limits on day one. If you need a break, use self-exclusion—not willpower.

One last thought before we talk cash: the fastest way to slow a payout is to ignore the ID and geo paragraphs. Want the exact steps I use to get money out quickly—plus how to avoid network mix-ups and surprise fees? Let’s move on to withdrawals and banking next.

Banking: deposits, withdrawals, speeds, fees

I treat banking like my bankroll’s life-support: if it’s slow, unclear, or expensive, everything else suffers. Crypto helps, but only if you use the right coin, the right network, and follow the book’s rules to the letter. Here’s how I handle deposits and withdrawals at a crypto-first spot like Bitcoinsportsbook.ag, and the small habits that protect your money.

“The best withdrawal is the one you tested before you needed it.”

How to withdraw money from your sportsbook account

Plain-English, no mystery. This is the flow you’ll see at most crypto books:

- Open the Cashier/Wallet. Look for Withdraw or Payout.

- Choose your coin. Pick BTC, LTC, ETH, USDT (ERC20/TRC20), etc. Match the coin and network you’ll receive on.

- Enter your wallet address. Paste from your wallet/exchange and double-check the network (e.g., USDT-TRC20 vs USDT-ERC20). One wrong network = funds gone.

- Type the amount. Respect the minimum/maximum for that coin. Some books display the fee and net amount next to the field.

- Submit and confirm. If 2FA is enabled (please use it), confirm the code. You’ll see a pending status until the book approves it.

- Track the TXID. Once sent on-chain, you’ll get a transaction ID. Plug it into a block explorer to watch confirmations.

Expect a processing window. Crypto itself can be fast, but the book still reviews requests. It’s normal to see a few minutes up to several hours depending on time of day, internal queues, or bonus checks.

Coins and methods: supported cryptocurrencies, minimums, fees, timelines

Crypto-first books commonly support:

- Bitcoin (BTC)

- Use case: Larger withdrawals; most universally supported.

- Speed: 1–3 confirmations typical; average block time ~10 minutes.

- Cost: Network fees fluctuate; see Bitinfocharts BTC fees.

- Typical mins/maxes: Minimums often 0.0005–0.002 BTC; maximums vary per VIP level or per day.

- Litecoin (LTC)

- Use case: Faster, cheaper alternative to BTC; great for smaller amounts.

- Speed: ~2.5 min block time; confirmations arrive quickly.

- Cost: Generally low network fees.

- Ethereum (ETH) and ERC-20 tokens (e.g., USDT-ERC20, USDC)

- Use case: Stablecoins for balance stability; ETH for DeFi-native users.

- Speed/Cost: Can be fast, but fees spike with network congestion; check Etherscan Gas Tracker.

- Note: ERC-20 fees can make small payouts inefficient.

- TRON (USDT-TRC20)

- Use case: Stablecoin payouts with consistently low fees.

- Speed/Cost: Generally fast and cheap; see Tronscan.

- Bitcoin Cash (BCH)

- Use case: Low-fee alternative many crypto books still support.

- Speed/Cost: Typically quick with minimal fees.

Real-world example: If you’re withdrawing $200 and network fees are elevated, BTC or ERC-20 USDT might eat a bigger bite than you’d like. The same payout in USDT-TRC20 or LTC can land faster and cheaper. Always compare your options based on fee + speed at the moment you cash out.

Important: Supported coins, minimums/maximums, and fees change. Always check the Cashier page at the time of your transaction for the current list and limits.

Payout expectations: confirmations, pending periods, and what can delay a withdrawal

- Confirmations: Most books require 1–3 confirmations before marking a crypto payout as complete on your end. BTC averages ~10 min per block; LTC ~2.5 min; TRON and some others can be near-instant to a few minutes.

- Pending/processing: Even with crypto, internal approval can take from minutes to a few hours. During high-traffic events (big game days, fight nights), queues can stretch longer.

- Delays to watch for:

- Bonus rollover not cleared. If you took a promo, ensure your wagering requirements are fully met before requesting withdrawal.

- Risk/verification checks. Large wins or unusual patterns may trigger review. Crypto doesn’t eliminate compliance.

- Wrong network/address. Sending USDT-TRC20 to an ERC-20 address (or vice versa) is a classic irreversible error.

- Network congestion. When the chain is busy, fees rise and confirmations slow.

If anything stalls, ask support for the TXID once they push funds. With that, you can independently track the payment on a block explorer and separate “book hasn’t sent yet” from “network is confirming.”

Deposits: a quick checklist to avoid headaches

- Copy the exact deposit address and network shown in the Cashier for your chosen coin.

- Send a tiny test first if you’ve never used that wallet/exchange route.

- Include tags/memos for assets that require them (e.g., XRP, XLM). Missing memos = lost funds.

- Wait for your book’s required confirmations before placing bets. This is often 1–3 confs, shown in the deposit status.

Fees: what you actually pay (with examples)

Two layers matter:

- Network fee (paid to miners/validators). Variable and based on the chain’s congestion.

- Book fee (if any). Some books pass only the network fee; others add a small withdrawal fee. Check the fee line in the Cashier before confirming.

Example snapshot:

- $75 cashout

- BTC: Might be overkill if fees are high relative to the amount.

- LTC/USDT-TRC20: Usually better for small wins; fast and cheap.

- $3,000 cashout

- BTC: Makes sense for larger payouts; wide support and predictable process.

- USDT-ERC20: Okay if you’re parking funds on an ERC-20 exchange, just price the gas first.

Fee data changes hourly. I keep Bitinfocharts (BTC fees) and Etherscan Gas Tracker bookmarked to pick the right coin for the moment.

Pro tips to protect your bankroll

- Whitelist addresses + enable 2FA. Lock withdrawals to your known wallets inside your account settings and protect with 2FA. It’s the easiest anti-theft upgrade.

- Always match networks. USDT-TRC20 must go to a TRC20 address; USDT-ERC20 must go to an ERC-20 address. When in doubt, stop and ask support.

- Test small first. The first time you use any new wallet, exchange, or coin, send a micro test so you’re not learning with a big payout.

- Screenshot the Cashier. Limits, fees, and rules can change. Keep receipts (time, address, network, amount, TXID).

- Respect rollover. If you took a bonus, confirm the wagering requirement is complete before you withdraw. Trying to cash out early is the #1 self-inflicted delay.

- Avoid sending directly to time-locked or smart-contract wallets unless you’re 100% sure they accept transfers from gambling sites. Many exchanges are fine; some DeFi wallets need extra care.

- Plan around big events. If you know you’ll want your profits on Sunday night after a packed NFL slate, request a portion earlier in the day to beat queues.

What if something goes wrong?

- Double-check the chain first. Use the TXID on a block explorer to see if the payment exists and how many confirmations it has.

- Open support chat with specifics: amount, coin, address, time, and screenshots. Ask directly if the payout is still pending or already sent.

- Wrong-network sends are usually unrecoverable. If you sent to the wrong chain, contact your receiving wallet or exchange immediately. Recovery is rare but not impossible with some providers—speed matters.

I’ve learned this the hard way: the calm, screenshot-heavy message gets solved first. Emotions can run high when money is on the line, but clarity gets you paid.

Banking habits most bettors skip (but shouldn’t)

- Keep a dedicated wallet for betting. It simplifies tracking wins/losses, tax records, and AML red flags.

- Note your exchange’s deposit rules. Some exchanges credit faster on certain networks (TRC20) and slow-walk others when busy (ERC20).

- Refresh stale addresses. Some deposit addresses rotate. Always copy a fresh one from the Cashier before sending.

Clean, fast banking sets the tone for the entire experience. Once your crypto lands, the next question is the fun one: are the odds, markets, and in-play tools actually worth your time? I’ve got thoughts—especially on live pricing and props—so how sharp do you need your lines to be to feel confident on game day?

Sports coverage, odds quality, and bet types

Sports and markets: major leagues, niche sports, props, parlays, and live betting scope

If you’re here for the big stuff, you’ll find the usual suspects front and center: NFL spreads and player props, NBA sides/totals and same-game combos, MLB moneylines and strikeout markets, NHL puck lines, global soccer (EPL, UCL, MLS), plus UFC/MMA, tennis, and golf. What I also expect from a crypto-first room like this is a decent mix of niche markets—think table tennis at odd hours, darts, cycling, sometimes eSports—so there’s almost always something live.

- Props: The bread and butter in today’s market. Look for player yards/rebounds/points, goalie saves, strikeouts, TD scorers, shots on goal, and soccer shot/assist markets. On busy slates you’ll often see hundreds of props per game.

- Parlays and same-game parlays (SGP): Bundling sides, totals, and props is standard. Expect correlation limits (e.g., certain props can’t be combined with the same game total). If the SGP builder is available, it should show allowed combos instantly.

- Futures: Championship winners, award races, season totals, and sometimes “yes/no to make playoffs.” Crypto books usually price these reasonably fast but limits are tighter than game lines.

- Live betting: You’ll get spreads/totals/moneylines, with props opening as the game settles. Soccer in-play markets (next goal, Asian lines) and tennis point/game markets are common, with odds locking during dangerous moments.

“In the long run, it’s all about the number.”

That line hits because it’s true. Market depth is fun, but if the price is consistently worse than competitors, you’re playing uphill.

Odds and margins: how competitive the lines feel vs the market and what that means for long-term value

Let’s talk juice (the house edge baked into odds). Your goal is simple: pay as little as possible over time. Here’s how to check price quality on the fly.

- Sides/totals example (two-way): Standard pricing is -110/-110. Each -110 implies 52.38%. Add both sides and you get 104.76%, meaning a 4.76% “hold.”

- Reduced juice:-105/-105 implies 51.22% each → 102.44% total. That’s ~2.44% hold. Excellent.

- Pricey:-115/-115 implies 53.49% each → 106.98% total. That’s ~6.98% hold. Costly long-term.

For a quick sanity check on soccer’s three-way markets (1X2), convert to decimal, take each implied probability (1/odds), and add them. Example slate:

- Home 2.10 → 47.62%

- Draw 3.40 → 29.41%

- Away 3.60 → 27.78%

Total: 104.81% (about a 4.81% hold). That’s reasonable for 1X2. If you see totals creeping to 106–108% regularly, you’re paying more than you should on soccer.

UFC or any two-way fighting market follows the same idea. Say -120 vs +100: 54.55% + 50.00% = 104.55% hold (~4.55%). Markets that consistently sit closer to 102–103% are very sharp; 106–108% is fat.

If you want a deeper read on this math, skim these primers:

- Vigorish (Wikipedia)

- Overround (Wikipedia)

Bottom line: If your book hangs -108 while the market is -110, that’s a win. If it’s -115 when others are -110, you’re leaking value. You don’t need to be a pro to feel this; even casual betting stacks rake faster than you’d think.

Live betting experience: speed, stability, cash-out availability, and in-play limits

In-play betting is all about timing. Here’s what I watch for when I’m testing a crypto sportsbook in the heat of a game:

- Speed and acceptance: A 1–3 second acceptance delay is normal. If you see frequent “price changed” pop-ups even on routine plays, that’s a sign the feed or risk controls are jumpy.

- Odds locks: Expect locks during penalties, red-zone snaps, corner kicks, power plays, break points, etc. That’s not a bug; it’s protection against stale prices.

- Cash-out: If available, it will be offered on select markets and may vanish during high-volatility moments. Remember, cash-out prices include margin—good for risk control, not for squeezing max EV.

- In-play limits: Typically lower than pregame. Big leagues get the biggest limits, props get the smallest. Don’t be surprised if a stake you could place pregame is clipped in-play.

Practical tips that make a real difference:

- Pre-set common stakes on your bet slip to shave seconds off.

- Look for a “accept better odds” toggle if offered; it avoids re-approval when the line moves in your favor.

- Have a second market reference open (an odds screen or a trusted book) to sanity-check price changes mid-game.

Betting tools: bet builder, early payout features, bet limits per market

Tools and features are where comfort meets edge. Here’s what to look for and how to use it wisely:

- Bet Builder / SGP: Great for NFL and NBA player-stat combos or soccer shots + result. Just remember correlation rules: the more related the legs, the more likely you’ll face restrictions or lower max stakes.

- Early payout features: Mainstream books sometimes run “2 goals up, paid out” or “up by 17, paid” promos. Crypto rooms don’t always match these. When you do see early payout, check the fine print—leagues, max stake, exclusion of parlays.

- Bet limits by market: Limits usually scale with liquidity. Major league sides > totals > moneylines > player props > longshot futures. To check your live max quickly, punch your stake and let the slip auto-adjust; that’s the book telling you the soft ceiling.

- Alternate lines: More alt lines = more control. If the book offers rich ladders (e.g., alt spreads from -3.5 to -13.5, player ladders like 80+ receiving yards), you can shape risk/reward without forcing a parlay.

How to check price quality in 10 seconds

- Grab the same market at two different books or an odds screen.

- Convert American odds to implied probability (quick mental trick: -110 ≈ 52.38%, +120 ≈ 45.45%).

- Pick the side you want. If you’re paying 3–5 cents worse than another reputable book, that’s a pass unless you truly have info or timing on your side.

I know it stings to pass on a pick you “love.” But as I remind myself: wins feel good, good prices win.

Now, you’re probably wondering: if the juice is a touch higher here or there, can the promos make up for it? Or if the odds look sharp, are the bonuses worth chasing at all? Let’s look at that next—what’s on the table, what’s fair, and how to avoid the traps waiting in the fine print.

Bonuses, promos, and reward programs

Promos are where a crypto book can either quietly stack value for you or eat your edge with fine print. I looked at how a pure-crypto shop like Bitcoinsportsbook.ag typically structures its offers and what you should prioritize if you actually want to come out ahead.

“The house edge doesn’t shout; it hides in the rollover.”

Welcome bonus and ongoing promos: size, structure, and fairness

Expect a rotating mix that usually includes:

- Deposit matches (most common): Often framed as “X% up to Y,” credited as bonus funds with a rollover. Crypto books tend to be more generous on headline size than regulated brands, but the trade-off is usually a higher wagering requirement.

- Free bets: Stake not returned if you win. Useful for taking a shot at slightly longer odds (+150 to +300) to milk more value out of a free stake.

- Reload boosts: Smaller matches for returning deposits; watch for better terms midweek or tied to big events (NFL playoffs, March Madness, World Cup).

- Parlay boosters/insurance: Extra % on winning parlays or a refund token if one leg misses. Fun, but bet-size caps can limit real upside.

- Cashback or loss rebates: 0.2%–1% weekly is common at crypto books. It’s quiet, steady value if you play regularly.

- Reduced juice windows: Temporary -105/-108 pricing on major markets. This can be more profitable than any bonus with strings attached.

Fairness quick check: Reasonable deals are transparent about minimum odds (e.g., not counting bets shorter than -200), clearly list eligible markets, and don’t cap withdrawals at something silly like 3x the bonus. If you see vague language or missing specifics, ask support to confirm in writing before you accept.

Rollover rules explained: clearing requirements, eligible markets, time limits, and traps to avoid

There are two main models:

- Bonus-only rollover: You must wager the bonus X times. Example: 100% match of $200 with 8x bonus means $1,600 turnover.

- Deposit + bonus rollover: You must wager the combined amount X times. Example: $200 deposit + $200 bonus at 8x means $3,200 turnover.

Why it matters: On a typical two-way market at -110/-110, the theoretical hold is about 4.5% (see vigorish). If you have to churn $3,200 at -110, your expected “cost of clearing” could hover around $144 (4.5% of $3,200). If your bonus is only $200, your net expected value (EV) drops to ~$56 before variance. That’s not terrible—but it’s far from “free money.”

Time limits: 7–30 days is common. The shorter the window, the more you’re forced to bet suboptimal lines to meet turnover—EV killer.

Eligible markets: Many books deny rollover credit for:

- Lines shorter than -200 (or -250)

- Hedging opposite sides, “both sides” bets, correlated parlays

- Teasers/round robins (varies)

Real trap examples I’ve seen at crypto books:

- Auto-opted bonus on first deposit that blocks withdrawal until rollover is done. Always check the cashier toggle.

- Max cashout caps (e.g., 5x the bonus amount). If you’re taking a promo for a big futures shot, this can sting badly.

- Changing stake sizes during rollover flagged as “abusive”. Keep sizing consistent and non-suspicious.

How do rewards compare to the best programs?

Let’s be honest: mainstream giants like BetMGM and Caesars are kings of real-world perks—free nights, dining, event access. A crypto book like Bitcoinsportsbook.ag won’t comp you a Vegas suite. What you get instead tends to be:

- Speed: Crypto payouts that land fast once approved.

- Flexible reloads: Frequent, stackable value if you plan around them.

- Rakeback-style cashback: Quiet returns on volume, no travel required.

- Occasional reduced juice: This is huge for long-term bettors; shaving a few cents off -110 compounds over hundreds of bets.

How to value it: If you don’t care about hotel comps and just want clean pricing and quick withdrawals, crypto rewards can be just as powerful—sometimes better—especially if reduced juice is on the table.

What bonus hunters should check: max cashout, excluded bets, odds floors, and multi-account risks

- Max cashout: Is there a cap tied to your bonus? If yes, does it nuke the upside of a long-shot win?

- Odds floors: If rollover excludes odds shorter than -200, your -160 favorites won’t count. Adjust your strategy to -110 to +150 singles.

- Excluded markets: Live bets, props, and teasers sometimes don’t count—or count at reduced value.

- Stake caps: Some promos have a max qualifying bet size. Don’t overshoot and assume the whole stake counts.

- Multi-accounting: It’s a hard no. Books pattern-match device, IP, and crypto wallets. Getting flagged can lock funds.

Smart clearing strategy: a quick playbook

- Know your model: Bonus-only vs deposit+bonus determines your real turnover.

- Singles over parlays for rollover. Parlays add variance and often face stake/odds limits for promo credit.

- Target -115 to +120 where edges exist; avoid “must-win-now” chasing.

- Bet consistent sizes and log everything (date, market, odds, stake). Screenshots are your friend.

- Ask support to confirm terms before betting. Save the chat transcript.

Promo value calculator (quick math you can copy)

Rough-and-ready way to judge if a welcome offer is worth it:

- Bonus value: Bonus amount (e.g., $200)

- Cost to clear: Required turnover × your average market hold

- Estimated EV: Bonus value − Cost to clear

Example: $200 bonus, 8x on deposit+bonus where you deposit $200 → $3,200 turnover. If your average hold is 4.5%, expected cost is ~$144. Your estimated EV ≈ $56 before variance. If the promo were bonus-only at 8x, turnover drops to $1,600; expected cost ≈ $72; EV ≈ $128—much better.

Pro tip: If the book offers reduced juice promos during rollover (say -107 instead of -110), your hold falls and EV rises. Quietly powerful.

Parlay boosters and insurance: fun, but do the math

- Boosters: A 20% booster on a 4-leg parlay sounds great, but if those legs are priced at -115 each (vs fair -110), the extra tax can dwarf the boost.

- Insurance: “One-leg free” can help cope with variance, but it often comes as a free bet token (stake not returned) with a low cap. Good for entertainment, not a core strategy.

Cashback and VIP: the slow-burn edge

If Bitcoinsportsbook.ag runs a tiered cashback/VIP system, the real value tends to sit between 0.2% and 1% of weekly volume—sometimes higher for top tiers. Boring? Maybe. But that slow drip adds up for steady bettors and, unlike headline bonuses, rarely traps you with heavy rollover.

A note on ethics and safety

- Don’t bonus abuse: Chasing loopholes gets accounts flagged. Play it straight, and you’ll avoid sudden verification headaches or holds.

- Don’t stack conflicting promos: Some books void both if they see it; ask support which one applies first.

- Keep crypto fees in mind: Network costs can clip the edge on smaller bonuses if you deposit/withdraw multiple times clearing a promo.

If you’re still with me, you probably care about the nuts and bolts—speed, stability, and getting help when a term is unclear. Next up, want to see how the site actually handles 2FA, live chat, and bet slip flow when the clock is ticking?

User experience, security, and support

Website and mobile: speed, navigation, bet slip design, and live odds reliability

I judge any crypto book on a simple first test: can I get from homepage to a confirmed bet in under a minute without hunting for buttons or squinting at tiny text? On a typical weekday slate, navigation should be clean: sports and leagues on the left (or a top bar on mobile), markets in the middle, and a sticky bet slip that doesn’t jump or reset when odds refresh.

When odds move, I look for an “accept odds changes” toggle and a clear highlight of adjustments. If a live price shifts mid-click, the slip should prompt me, not sneak a worse number. I also check that my selections stay put when I browse other markets—losing a slip during live betting is a deal-breaker.

- Mobile feel: The best flows keep the bet slip as a collapsible tray. If it’s hidden behind a small floating icon, tap once to expand and confirm stake, twice to send. Avoid fat-finger errors by enabling any “2-tap confirm” setting in preferences.

- Live odds stability: Expect momentary locks during big plays. If you see frequent “market suspended” messages on routine moments, reduce live parlaying and try single in-play bets to cut frustration.

- Speed sanity check: If you’re on cellular, turn off auto video widgets in your browser to minimize lag. Google’s mobile research has long shown that slow pages lose users fast—don’t let that be you mid-drive.

“Slow is smooth, smooth is fast.” Double-check the slip once, then send it with confidence.

Pro move: screenshot important live bets with timestamp right after placement. If a grade gets disputed, you’ve got evidence of the exact price and time.

Security basics: HTTPS, wallet handling, two-factor authentication, and account safety tips

I treat every sportsbook account like a mini exchange wallet. If a site can’t show me a valid HTTPS connection (lock icon, no mixed-content warnings), I’m out. That’s table stakes.

- 2FA first: If time-based 2FA (TOTP apps like Authy/Google Authenticator) is available, turn it on before your first deposit. Hardware keys are even stronger if supported. Google’s security team has reported that strong second factors dramatically cut phishing success—don’t gamble with your login.

- Unique deposit addresses: For crypto, I look for a fresh address or clear “reuse” labeling each time I generate one. If you’re given a tag/memo (XRP, XLM), paste it exactly; missing memos can strand funds.

- Withdraw whitelist: If there’s an address whitelist or withdrawal lock, use it. This blocks new addresses from being used for a period after change—huge if your email ever gets popped.

- Email hygiene: Use an email alias unique to the site and a password you’ve never used elsewhere. Verizon’s annual breach research keeps repeating the same theme: the human element and credential theft are top offenders year after year.

- Session safety: Log out on shared devices. On mobile, set your browser to require biometrics for saved passwords.

Backup codes matter. If the site gives you one-time recovery codes when enabling 2FA, store them offline. Losing 2FA access during a pending withdrawal is the worst kind of self-inflicted setback.

Customer support: live chat/email availability, response quality, and helpfulness on banking questions

Support is where a crypto book earns trust. I always test with a small, specific banking ticket before I scale up, then judge how quickly and clearly they answer.

Here’s the script I use to get a useful reply the first time:

- Subject: “Withdrawal question – [coin], [network], rollover status”

- Body: “Hi team, I’m planning a [amount/coin] withdrawal on [network]. Can you confirm: 1) minimum and fee, 2) expected processing time, 3) my current bonus rollover remaining, and 4) whether address whitelisting is enabled on my account?”

- Attachments: Screenshot of cashier page and bonus page, if relevant.

Good signs: the agent references the exact bonus ID, explains network fees clearly, and points you to where the rollover line item lives in your account. If you get copy-paste responses, politely ask for escalation to the payments/risk team. Keep the ticket thread intact; don’t start fresh unless they ask.

For live chat, I keep it short: “Can you paste the current withdrawal minimums and fee table for BTC, LTC, and USDT-TRC20? Also, what’s your average confirmation target before release?” A confident book has that on-hand.

House rules clarity: the stuff you should read before your first bet

House rules are the contract you’re agreeing to—read them like you’d read a smart contract. I scan them before I risk a dollar, then screenshot anything that impacts grading or max payouts.

- Grading logic by sport:

- Soccer: “90 minutes” markets exclude extra time; some props don’t. Check the exact wording.

- Tennis: Retirements can void or stand depending on whether a set was completed. This varies widely.

- Baseball: “Action” vs “listed pitchers” is critical for moneylines and totals. Know which you’re placing.

- Basketball/Hockey: Overtime included or not for totals and player props? Don’t assume.

- Settlement time frames: When do they grade props? Some wait for official league data feeds; others settle faster but revise later. If they reserve the right to adjust results, note the window.

- Cash-out terms: Cash-out availability can be pulled on suspended markets or sharp volatility. If you rely on early cash-out, read the exceptions.

- Same-game parlays: Correlation rules vary; what looks allowed may actually be “priced” for correlation. If the price seems too generous, re-check the terms.

- Max payout and per-bet caps: Books often set different ceilings by sport and league tier. Screenshot these values. High-tier soccer vs niche table tennis can have vastly different caps.

- Timing and voids: Bets placed after a material event get voided—each book defines “material” differently. Live rules matter during VAR/reviews.

Before kickoff, I do one last pass: are any leagues “action only if completed” or “official after X minutes” in the fine print? I’ve seen those clauses flip a winning ticket to void.

One final reading tip: use your browser’s find function on the house rules page for “void,” “overtime,” “retirement,” “listed,” and “maximum.” Five words that save bankrolls.

Want to know how limits actually bite in practice, how fast winners get flagged, and where crypto books stand against the big regulated names on fairness and protections? That’s exactly what I’m tackling next—ready to see how this one stacks up when the stakes get real?

Limits, fairness, and how it stacks up vs mainstream books

Bet limits and restrictions: what recreational bettors and sharps should expect

I always test how a book handles limits because it tells you a lot about its risk appetite and whether it’s “recreational only” or can handle sharper action. With crypto-first books like Bitcoinsportsbook.ag, limits are usually tiered by sport, market type, and whether you’re pregame or live.

- Top leagues (NFL/NBA/MLB/NHL sides & totals): Common ranges I see at crypto books are roughly $1,000–$5,000 per bet pregame, with live limits often falling to $250–$1,000.

- Props and niche markets: Expect much smaller limits, often $50–$300. Books manage risk here because pricing is fragile and can be picked off.

- Parlays: The constraint is usually max payout rather than stake size. Typical caps I encounter: $50k–$250k per ticket, sometimes also per day.

- Per-event and per-day max wins: It’s common to see hard caps by sport or competition level. That can matter if you spread multiple bets across the same game.

What triggers cuts? Books profile bets that consistently beat the close, chase steam within seconds, hammer misprices, or mirror obvious arbitrage. If you’re sharp, don’t be shocked by “max allowed $X” messages or delayed bet acceptance in-play. It’s risk management, not personal.

Practical playbook if you bet bigger:

- Ask nicely: If you’re running into walls, a polite limit review request to support sometimes works, especially on major markets.

- Stagger without spamming: Breaking a stake into logical chunks can clear, but rapid-fire attempts often look robotic and invite attention.

- Mind bet mix: A portfolio that’s 99% vulnerable props invites scrutiny. Mix in core markets and avoid only hitting price errors.

- Expect live throttling: In-play is riskier for the book. If you need size, pregame is nearly always looser.

Sample scenario: You try to place $10,000 on an NFL side and see “Max allowed $2,000.” Splitting into five tickets in 30 seconds may get the first two accepted and the rest rejected or price-shaded. Being patient (two or three tranches over time) can work better—if the price holds.

Fairness and responsible play: avoiding problem gambling, setting limits, and keeping a clean paper trail

Fair books make their house rules obvious and enforce them consistently. Before you fire real money, scan the rules on:

- Settlement conventions: Is OT included? Are “tie = void” rules used for certain markets? Do 3-way lines settle at regulation only?

- Palpable errors (misprices): Most books reserve the right to void or adjust obvious errors. Screenshot odds and the bet slip before and after acceptance so you have receipts if there’s a dispute.

- Correlated parlays: Many books restrict combos like “team total + moneyline” when outcomes are dependent. Don’t force it—you’ll just get voided.

- Bonus integrity: Multi-accounting or abusing promos is grounds for confiscation across the industry. Keep it clean.

Responsible play tips that actually help:

- Set a personal cap on weekly risk and stick to it. Live betting is especially seductive; peer‑reviewed research has repeatedly linked rapid‑cycle in‑play wagering with higher harm risk (various studies including Hing et al. and Parke & Parke have flagged this pattern).

- Use a separate crypto wallet for betting. Keep all TXIDs, timestamps, and bet confirmations in a simple ledger (even a spreadsheet). It’s your paper trail for disputes, taxes, and self-audits.

- Ask support for account limits or cooling-off periods if you need them. Many crypto books will apply time-outs on request even if self-serve tools are basic.

- Know the helplines: If gambling stops being fun, reach out. In the US, the NCPG Helpline is 1-800-522-4700 or 988 (then press 3). Similar services exist in most countries.

Rule of thumb: If you’re screenshotting a bet because you suspect it might be voided later, you probably shouldn’t size it like a sure thing.

How it compares to traditional books

Where crypto books tend to shine:

- Speed to wallet: Crypto withdrawals can clear in minutes to hours after approval. No bank holidays, no card chargebacks.

- Lower friction: For small-to-medium cashouts, you often skip heavy KYC unless risk flags pop up.

- Broader access: If you’re traveling or outside a regulated state, a crypto-first book can be reachable when mainstream apps geo-block you.

Where they lag vs mainstream (BetMGM/Caesars, etc.):

- Loyalty ecosystems: You’re trading casino comps, hotel nights, and event perks for raw payout speed. If you value real-world rewards, that’s a big trade-off.

- Regulatory recourse: State-regulated books offer clearer complaint paths. Crypto books are typically offshore; you’re reliant on internal support and the site’s licensing body, if any. Do your homework on dispute processes.

- Responsible gambling tools: Mainstream apps often have slick self-limits and time-outs. Crypto sites may require manual requests.

- Banking reversibility: Fiat deposits via cards/ACH have consumer protections. Crypto transfers are final—send to the wrong network, and it’s gone.

Neutral realities to plan for:

- Tax handling: Mainstream books issue standard forms (e.g., in the US). With crypto books, you’re on the hook to track basis, P/L, and report correctly. Keep meticulous records.

- Hold and pricing: “Soft” books—crypto or fiat—often carry fatter margins on props and same-game parlays. Shop lines and don’t force action into bad prices.

Extra reading and resources

- Sportsbook banking basics and how-to from LegalSportsReport help you sanity-check deposits, withdrawals, and general betting mechanics.

- Promo landscape snapshots on CBSSports.com show how mainstream books stack their offers throughout the year.

- Want my vetted research stack, safer banking checklists, and crypto betting primers? I keep them updated here: my curated picks.

I’ve shown you where limits bite, when fairness matters most, and what you trade when you go crypto-first. The real question is: is the speed and access worth it for you—and what quick checks should you run before your next withdrawal? Stick with me; I’ll answer that and more in the rapid-fire FAQ coming up next.

FAQ and final verdict

Fast FAQ: your top questions answered

- How do I withdraw?

Go to the cashier/withdraw section, choose the amount and crypto, paste your correct wallet address and network, submit, and track confirmations on-chain. Check minimums, potential site fees, and that you’ve cleared any rollover first. For crypto, the network fee and congestion (mempool backlog) can affect speed—if timing matters, pick faster/cheaper chains or request during lower network demand. You can monitor fees at mempool.space for BTC and comparable explorers for other chains.

- What’s the best reward program?

Among mainstream books, BetMGM and Caesars are well-known leaders thanks to hotel, dining, and event perks. Crypto-first books generally trade those comps for speed, broader access, and fewer hoops. Decide if you value real-world perks or fast crypto banking more.

- Can I bet anonymously with crypto?

Some crypto sites ask for minimal info, but true anonymity isn’t guaranteed. Larger withdrawals, fraud checks, or compliance reviews can trigger verification. Use privacy tools responsibly, and always check local laws and the site’s T&Cs. For a simple primer on “anonymous crypto gambling” concepts.

- How fast are payouts, realistically?

For crypto, when accounts are in good standing and rollover is cleared, many books process within minutes to a few hours. Delays happen if risk teams review the account, if you request during peak match times, or if the blockchain is congested. Always factor in network confirmations and weekend staffing.

- What’s the most common bonus “gotcha”?

Rollover plus odds floors. Example: a $100 bonus with 10x rollover requires $1,000 of eligible bets. On standard -110 lines, the built-in margin is about 4.76%, so the expected cost of clearing can be around $47.60 on that $1,000 handle. That’s not an exact bill, but it shows why “big” bonuses aren’t free money. Always check excluded markets and minimum odds (e.g., no bets under -200).

- Will I get limited if I win?

Any sportsbook—crypto or mainstream—may manage risk by limiting sharp play, certain markets, or high-frequency arbers. Keep your betting pattern clean, avoid obvious multi-accounting, and expect lower limits on niche props or in-play edges.

- Is using a VPN safe?

Only if the site’s T&Cs allow it. If terms forbid VPNs and they detect one, you risk voided bets or frozen funds. Read the geo-access section of the rules carefully and ask support before depositing if you’re uncertain.

- Which network should I select for USDT/USDC/etc.?

Exactly the one your wallet/exchange supports for the receiving address. For example, USDT-TRC20 ≠ USDT-ERC20. A mismatch can permanently burn funds. If you’re not 100% sure, test with a small amount first.

- What’s a sensible bankroll plan?

Keep unit size small (0.5%–2% of bankroll per bet). If you want a math-based approach, read the Kelly Criterion, but many bettors use “half-Kelly” or flat staking for sanity. Research consistently shows that “chasing losses” is a risk marker in problem gambling; see the Journal of Gambling Studies on chasing behavior: Springer link.

- Any tax or record tips?

Keep a simple log: deposits, withdrawals, transaction IDs, dates, and USD values at the time. Crypto adds price volatility to your ledger. For country-specific tax guidance, consult a licensed pro—laws vary widely.

Final checklist before you deposit

- Confirm supported coins and the exact networks (BTC, LTC, ETH, USDT-TRC20/ ERC20, etc.).

- Read the promo terms: rollover, odds floors, excluded markets, max win/cashout, and expiry dates.

- Check withdrawal limits, fees, processing windows, and any KYC triggers for larger cashouts.

- Enable 2FA, set a strong unique password, and consider a dedicated wallet for betting funds.

- Test a small withdrawal first to your own wallet—screenshots of terms and cashier pages help if you need support later.

- Mind price swings: if you hold volatile coins, you’re taking coin risk on top of bet risk.

- Set session reminders or limits; if you ever feel tilted, step back. For support resources, see BeGambleAware or your local helpline.

Example to sanity-check a promo: $250 bonus at 8x rollover = $2,000 in required action. If most of your bets are around -110, your expected “cost” to clear is roughly 4.76% of $2,000 ≈ $95. If the bonus isn’t at least that valuable to you (or you can’t meet the deadline), skip it.

My take

If the markets you need are there, the odds are in line with your benchmarks, and the cashier pays at the speed you expect, a crypto-first book like Bitcoinsportsbook.ag can be a handy part of your rotation. Keep it simple: verify coins and networks, read the promo fine print, and test a small withdrawal early. Treat your privacy realistically, keep clean records, and protect your bankroll like a pro. Bet smarter, not harder—and never let a bonus or a sweat push you into bad decisions.