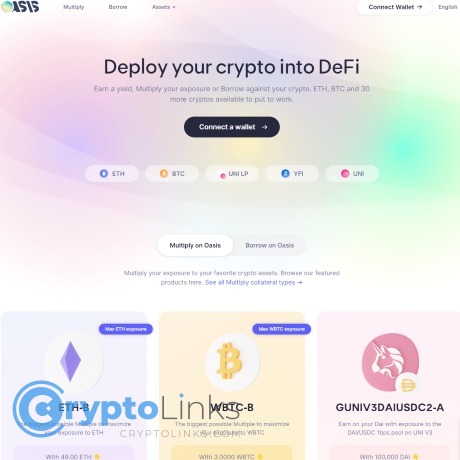

Oasis.app Review

Oasis.app

oasis.app

Oasis.app Review Guide: Is This Crypto Tool Worth Your Time?

Have you ever felt overwhelmed with managing your cryptocurrency assets or frustrated with platforms that seem overly complicated and out of sync with your needs?

If you've spent more than a few hours dealing with crypto, I'm sure you know exactly what I mean. Whether you're trying to smoothly handle crypto loans or effectively manage your digital currencies, finding a platform that feels intuitive and reliable can be extremely challenging.

I decided enough was enough—that’s why I took an in-depth look at oasis.app to see if it genuinely lives up to its promise of simplifying cryptocurrency management for everyday users.

In this no-nonsense, straightforward Oasis.app review guide, I'll uncover everything you truly need to know, including its standout features, strengths, weaknesses, security measures, and hidden fees. By the end, you'll clearly understand whether oasis.app deserves a place in your crypto toolkit, or if it's yet another flashy service you should skip.

Why Dealing with Crypto Can Be a Big Headache

Let's be real—crypto management isn’t always sunshine and Bitcoin-shaped rainbows. If you've ever:

- Struggled with complicated, cluttered interfaces

- Been unpleasantly surprised by sneaky hidden fees

- Doubted the security measures a platform claims to have

Then you absolutely know what I'm talking about. A 2022 study conducted by Business Wire revealed that up to 43% of crypto investors face these exact issues on crypto platforms—hidden fees, confusing interfaces, and unclear security protocols topping the list.

The frustrations are very real.

With so many crypto lending and asset management platforms popping up almost every month, it's never been more crucial to find one that truly works smoothly, securely, and transparently for everyday users.

Is Oasis.app a Solid Answer to Common Crypto User Issues?

You've probably wondered if there’s really a better option out there to make the whole crypto-related chaos easier. So have I! That’s precisely why I'm about to give you a totally honest evaluation of oasis.app. I'll thoroughly check if oasis.app successfully solves typical annoyances like usability headaches, unexpected fees, and security worries.

But first, let’s quickly clarify something important: who exactly will benefit most from checking out oasis.app?

Who Should Check out Oasis.app?

If you're an active cryptocurrency enthusiast who often deals with activities such as:

- Borrowing and lending crypto assets regularly

- Looking for clarity and transparency to avoid unexpected costs

- Seeking convenience paired with robust security features to give you peace of mind in your crypto management journey

Then oasis.app could be exactly the crypto service you've been looking for.

Curious if this platform lives up to expectations? Stick around—the details might surprise you!

Understanding Oasis.app: What Exactly Does It Offer?

We’ve all hit roadblocks when managing crypto—too complex interfaces, hidden fees, unclear security measures. But could Oasis.app really simplify all this chaos? Before getting too excited or simply closing this tab, first let's clearly unpack exactly what Oasis.app brings to the table.

Put simply, Oasis.app positions itself as a seamless gateway to decentralized finance (DeFi)—allowing you to easily manage, borrow, and optimize your crypto holdings without the headaches. Think of it like your personal DeFi assistant: no frills or complicated jargon, just straightforward management of your crypto assets.

Oasis.app Basics: How It Really Works

The heart of Oasis.app is providing a clear and effortless connection between you and DeFi lending markets like MakerDAO. Here's a quick snapshot of how it typically works for users:

- Collateralized Vaults: Users can deposit crypto holdings as collateral to create "vaults" which allow minting stablecoins (primarily DAI).

- Asset Management in One Place: Easily track and manage active collateral positions, loans, and interest within a single intuitive dashboard. No more clicking fifty different menus or tabs.

- Repayment Flexibility: Quickly repay debts or withdraw collateral anytime, with transparent loan information and manageable repayment options clearly outlined.

"Simplicity boils down to two steps: Identify the essential. Eliminate the rest." — Leo Babauta.

And that's exactly what Oasis.app aims to accomplish—granting access to DeFi's great advantages without overwhelming you with unnecessary complexities. The platform appeals directly to both crypto veterans tired of dealing with complicated protocols, and newcomers cautious of steep learning curves.

Notable Features Making Oasis.app Stand Out

What differentiates Oasis.app in a crowded marketplace brimming with similar DeFi solutions?

- User-Friendly Dashboard: Simple visuals clearly show you your collateral positions, loans, & asset statistics at a glance. It feels intuitive even for first-time users. No Ph.D. in blockchain required!

- Collateralized Loans with MakerDAO: Securely borrow DAI stablecoin against approved crypto collateral without relinquishing full ownership of your assets.

- Competitive Stability Fees & Transparency: Fees and interest rates are prominently displayed. No guesswork, hidden charges, or surprises.

- All-In-One DeFi Toolset: Access multiple DeFi features effortlessly, including leveraged positions, liquidation management, and refinancing options.

To illustrate, imagine you're holding Ethereum (ETH), but suddenly need immediate liquidity without selling your precious asset. Oasis.app lets you lock your ETH into a collateralized vault, mint DAI stablecoins, and use those stablecoins freely—maybe to buy more crypto at dips, pay expenses, or explore additional investments. When ready, repay the loan and reclaim your collateral. Simple, fast, stress-free.

This practical usability is exactly why studies like the recent CoinTelegraph market research observed growing popularity of collateralized debt positions (CDPs) in crypto investing, particularly through user-friendly platforms catering to everyday crypto enthusiasts. Oasis.app clearly reflects this trend by stripping away clutter, empowering crypto investors at any experience level, and simplifying financial actions previously seen as daunting or reserved for crypto experts.

But here's an essential question you'll no doubt be asking—Is Oasis.app actually as easy and intuitive as it claims, or will it turn out as confusing as other platforms you've tried?

In the next section, we'll explore exactly what's waiting for you behind Oasis.app’s sign-up and onboarding. Is it as easy as clicking a few buttons, or will it leave your head spinning?

The Great Oasis.app User Experience: Simple or Confusing?

Think about it for a moment—one of the biggest frustrations around crypto platforms usually comes down to the user experience. Nobody enjoys feeling lost or overwhelmed by a cluttered interface when dealing with something as important as crypto assets. You want simplicity, clarity, and speed—but does Oasis.app genuinely deliver it?

Let's be honest here: first impressions matter, especially for crypto users hesitant about complicated tech. Even crypto veterans can get irritated by overly complex interfaces. As Steve Jobs famously said:

"Simple can be harder than complex."

This quote perfectly captures the design challenge Oasis.app faces. The good news? Oasis.app developers seem to take user-friendly design seriously. Navigating Oasis.app feels natural—not like solving a complicated math problem, but more like setting up a social media profile you're already familiar with.

Sign-up and Verification Process

Signing up is the first thing you have to do, right? Nobody loves long, tedious registration processes, and thankfully Oasis.app knows that. The sign-up is straightforward and takes less than a couple of minutes for most users. You just connect your wallet, like MetaMask or WalletConnect, confirm some basic details, and you're pretty much set.

- No lengthy forms to fill out

- Wallet integration streamlines the entire setup

- Minimal personal information required

For the privacy-conscious out there, this minimalist approach is definitely appreciated. Plus, Oasis.app sticks to high safety standards, ensuring each setup step feels secure. But is it quick enough to get you managing your assets or loans immediately? Let's see.

How Quickly Can You Start Managing Assets or Getting Loans?

The appeal of Oasis.app isn't just in easy registration—it's about how quickly you can start doing what you actually signed up for. Fortunately, they've made accessibility a major priority.

As soon as you've finished connecting your wallet and verifying basic account info (usually instant or within minutes), you're free to start interacting. Want to deposit ETH collateral or immediately explore available loan terms? Oasis.app makes this practically instantaneous:

- Instant wallet balance visibility

- Clear loan or collateral choices presented upfront

- No waiting periods or unnecessary delays after registration

A recent usability study from Nielsen Norman Group indicated that platforms streamlining time-to-task significantly increase overall satisfaction—users get exactly that with Oasis.app. You can log in and start managing within minutes. It's genuinely user-focused, which in crypto is a refreshing surprise.

But simplicity doesn't always mean safety. Is Oasis.app secure enough to trust your valuable crypto assets fully? Do they have precautionary measures robust enough against potential risks or hacks?

Curious about the real risks? Keep reading as I closely research Oasis.app's safety and security—where I reveal if it's truly a reliable fortress for your crypto or just a pretty user interface masking deeper vulnerabilities.

Is Oasis.app Safe and Secure Enough?

Let's be real—nothing sends chills down a crypto user's spine faster than the mere idea of losing assets or having sensitive data compromised. We all heard the horror stories of exchanges being hacked and wallets emptied overnight.

Safety isn't just a nice-to-have benefit; it's an absolute necessity for any platform handling your cryptocurrency. So, how does Oasis.app stack up? Is your hard-earned money going to sleep peacefully, or should you keep scrolling for another option?

"Trust takes years to build, seconds to break, and forever to repair." — Anonymous

In crypto, trust is king, and security is a direct reflection of how much trust a platform deserves. Oasis.app clearly takes this seriously, but let's look beyond claims and see what they actually do to keep your assets safe.

Oasis.app Security Features at a Glance

- Non-custodial Design: One immediate advantage we have with Oasis.app is its non-custodial approach. This simply means that Oasis.app doesn't hold your digital assets directly; you maintain full control through your own wallet. If you're worried about a third party mishandling your cryptos, this definitely eases your mind.

- Industry-standard Encryption Protocols: Oasis.app uses secure encryption standards (like SSL/TLS) to protect your personal data and transactions. Having these protocols in place reduces the risk of data interception and enhances user privacy—both critical in the crypto space.

- Integration with Trusted Wallets: You can smoothly connect with popular secure wallets like MetaMask and Ledger hardware wallets. This allows you to rest confidently knowing your crypto assets remain safely in your own carefully chosen wallet solution.

- Regular Audits and Transparency: Oasis.app regularly submits itself to security audits by third-party specialists to verify its platform's integrity and find vulnerabilities before they become dangerous to users. That extra step can truly mean the difference between confidently growing your crypto portfolio and anxiously checking your balance every hour.

Has Oasis.app Experienced Any Notable Security Issues?

It's important to address the elephant in the room upfront: Has Oasis.app faced any alarming security incidents in the past?

As of now, Oasis.app hasn't encountered any significant security breaches or controversies that would raise concerns. That's impressive and reassuring, as even popular names like Binance and KuCoin have experienced security issues in the past. Knowing that Oasis.app has currently maintained a clean security record gives it a trustworthy edge in my book.

However, it always pays to stay vigilant. Make use of Oasis.app's security features to their fullest, including integrating with reliable wallets and practicing good crypto hygiene—like activating two-factor authentication (2FA) on your wallet or device. Staying security-conscious is the absolute best practice.

Since we've just talked about security, you might naturally wonder: What about fees and hidden costs? Are you paying for security through high hidden fees, or is Oasis.app's pricing as clear as their safety reputation?

Stick around because I'm about to give you the straight-up truth on Oasis.app's pricing—no fluff, no surprises—just the facts to help you decide if the fees justify the services you're getting.

Oasis.app Fees — Hidden Costs or Transparent Pricing?

Ever felt the sting of hidden fees sneaking up on you? Trust me—there’s nothing more annoying than discovering unexpected costs after you've already begun using a crypto service. Transparent pricing should be the standard, not a luxury, right? Let's take a closer look at how Oasis.app handles its fees to see if they're playing fair or secretly padding the bill behind our backs.

"Beware of little expenses; a small leak will sink a great ship." – Benjamin Franklin

Transaction Fees Clearly Explained

One of the things I immediately liked about Oasis.app was its openly stated fee structure. There's no complicated math or irritating fine print; everything's spelled out clearly from the start.

- Borrowing fees: When taking out a loan against your crypto collateral, Oasis.app clearly lists the current stability fees (their version of loan interest). These fees are dynamic and can change based on market conditions. Still, you'll always see them prominently displayed before you confirm any transaction—no nasty surprises here.

- Transaction fees: Oasis.app itself doesn't layer on extra transaction fees. However, since it interacts with the Ethereum blockchain, standard gas fees apply. These fees aren't controlled by Oasis—instead, they're dictated by Ethereum network congestion. Oasis.app conveniently provides fee estimates upfront, so you're fully informed before hitting the "confirm" button.

- Liquidation fee: This is crucial to know. If the crypto market dips significantly and your collateral falls beneath its threshold, liquidation can occur, and there's an added liquidation penalty. Thankfully, Oasis.app transparently outlines these scenarios right on their user dashboard, always reminding you how close (or comfortably far) your position is.

I appreciate that Oasis.app doesn't treat its fees as secrets—they make it easy for even beginners to grasp exactly how much they'll pay. No sleepless nights worrying about hidden charges here!

Are Fees Competitive Compared to Other Crypto Platforms?

Now, transparency is excellent, but if the fees are inflated—well, transparency alone won't ease that sting. Here's how Oasis.app stacks up against some popular crypto lending and asset management platforms:

- MakerDAO: Oasis.app essentially serves as the primary user interface for MakerDAO, so their fees are identical. Compared to many centralized lending platforms, Oasis.app (MakerDAO) stability fees often prove competitive—especially with the absence of extra "service charges."

- Compound and Aave: These decentralized platforms vary their interest rates dynamically based on protocol usage. Oasis.app stability rates frequently align closely with what these decentralized giants offer, making them a comparable choice for DeFi enthusiasts.

- Celsius and BlockFi (prior to their challenges): Centralized lending platforms previously offered tempting rates, but recent turmoil severely shook user confidence. With transparency and decentralization being prime selling points today, Oasis.app’s predictability (and reputation) is a compelling alternative, despite occasional fluctuations in the stability fee.

While no platform can straightforwardly claim to be the cheapest always, Oasis.app holds its own with what I'd call competitive, transparent pricing. Most importantly, these clear upfront fees feel like a breath of fresh air in a crypto world notorious for hidden surprises.

But wait—are transparent fees alone enough to justify using Oasis.app? Or could there be hidden drawbacks lurking just around the corner? Hold tight, because next we'll uncover the genuine pros and cons of Oasis.app that you absolutely need to know before jumping in. Curious yet? Let's keep exploring!

Oasis.app: Pros and Cons You Should Know Before Starting

Let's get real. No crypto platform is perfect, and Oasis.app certainly isn't an exception. While I've found some truly remarkable features that could streamline your crypto management, there are also aspects you might find less impressive. Knowing both sides of the coin will help you figure out if this tool matches your crypto needs.

Top Advantages of Using Oasis.app

- User-Friendly Interface: What stands out immediately is Oasis.app's intuitive design. It's clear this app was made with everyday crypto holders in mind, not just traders or technical wizards. This helps cut the stress and confusion typically associated with managing crypto assets.

- Transparent and Competitive Fees: Unlike many platforms I've reviewed, Oasis.app makes their fee structure crystal clear. A transparent understanding of fees is crucial—after all, no one appreciates surprises when managing their hard-earned crypto.

- Efficient Asset Management and Loans: I'm genuinely impressed by Oasis.app's collateralized lending feature. It gives crypto holders easy and fast access to loans without having to sell their crypto—a huge plus if you’re looking for liquidity but still believe in your assets’ long-term potential.

- Strong Security Standards: I'm always cautious about security, and you should be too. Thankfully, Oasis.app doesn’t cut corners here. With comprehensive encryption and custody protocols, they’ve got a solid approach to keeping your crypto assets safe.

"The single biggest way to impact an organization is to focus on leadership development. There is almost no limit to the potential of an organization that recruits good people, raises them up as leaders, and continually develops them." – John C. Maxwell

You might wonder why I picked this quote. It's simple—much like strong leadership impacts an organization, choosing the right crypto platform can massively enhance your overall success and peace of mind as a crypto enthusiast. Oasis.app packs impressive leadership-like qualities: clarity, transparency, efficiency, and thorough security management.

Main Oasis.app Drawbacks or Challenges

- Limited Asset Support: One thing I noticed immediately was a relatively narrow range of coins and tokens supported on the platform. If your crypto portfolio features niche altcoins, this could be frustrating.

- No Mobile App (Yet): At the time of writing, Oasis.app is browser-only. Without a native Android or iOS application available, mobile users might feel left out or inconvenienced, especially if you prefer managing assets on the go.

- Beginners Might Still Face a Learning Curve: While Oasis.app is straightforward, certain functionalities related to collateralized lending could initially intimidate crypto newbies. The details involved in lending processes can feel daunting if this is your first rodeo.

Identifying what might bug or benefit you about a crypto app is personal, right? And that's exactly why knowing both the strengths and weaknesses of Oasis.app can put you miles ahead in making an informed decision.

But wait — want to avoid confusion with similarly named tools? Curious about the resources professionals trust in the crypto world? Keep reading because I'll soon reveal expert resources you can't afford to ignore!

Expert Resources Worth Checking Out for Crypto Enthusiasts

Let's face it—crypto can be intimidating. I still remember my earlier days navigating the crypto maze, wishing someone had pointed me toward trustworthy resources early on. So, to keep your crypto journey smoother than mine was, I want to share a few valuable resources I've personally come to trust.

But hold on—first things first. Did you know the term "OASIS" is often mixed up with healthcare-related assessments? Yeah, it's confusing! To clear things up a bit, let me give you a quick heads-up to keep you from running into the wrong type of OASIS down the road:

- CMS.gov OASIS-D Guidance — If you've ever googled "OASIS" without crypto-related keywords, you might've landed here accidentally. This guide from CMS deals specifically with healthcare assessments—not crypto. If you ever bump into this during your crypto search, now you'll know the difference (and can save yourself a headache).

- Axxess on OASIS-E vs OASIS-E1 — Another common source of confusion, this explains subtle differences between healthcare versions. Helpful if you accidentally took a wrong turn while researching Oasis.app.

- HealthRevPartners OASIS Overview — This documentation clearly breaks down healthcare-related OASIS assessments, making obvious the stark difference between healthcare terminology and crypto platforms. Keep it bookmarked just in case someone tries to talk you into the "wrong OASIS."

"Education is the passport to the future, for tomorrow belongs to those who prepare for it today." — Malcolm X

Why am I telling you this in a crypto article? Because I've seen plenty of confusion out there—people mixing up Oasis.app in cryptocurrency with entirely unrelated tools in healthcare. Trust me, clarity on the basics saves tons of time later.

Now, knowing clearly what isn't Oasis.app, wouldn't you like simple answers to the most frequently asked questions about the crypto Oasis app itself? Like, is it really free or just another hidden-fee minefield?

Stick with me—I promise the very next section answers all those burning questions.

Oasis.app FAQ: Straight Answers to Common Questions

Let's clear things up! There are a few common questions floating around about Oasis.app and some confusing terms that sound similar but mean something entirely different—like healthcare's OASIS assessment. Trust me; you're not alone if you've got these mixed up. Here are the straightforward answers you've been looking for.

How Long Does It Take To Complete An Oasis Assessment?

This question gets many crypto enthusiasts scratching their heads. If you've stumbled upon "Oasis Assessment," know that this is actually healthcare-related terminology, completely unrelated to the crypto-platform Oasis.app. Healthcare Oasis assessments, like the ones described by CMS.gov, typically require extensive data collection and can take anywhere from an hour to several hours.

The crypto-based Oasis.app simply shares a name but has nothing to do with healthcare assessments. Completely different beast!

Is the Oasis App Free?

Here's where it gets interesting—because there's confusion stemming from similarly named apps on platforms like CNET or Android app stores. The official crypto lending and asset management platform Oasis.app isn't entirely free. There aren't upfront costs just for signing up, but there are transaction and interest fees applied when taking collateralized loans or executing crypto-related actions. It's crucial to distinguish Oasis.app clearly to avoid confusion with similarly named lifestyle or productivity apps. Don't worry, though; earlier in this overview, I've outlined exactly how these fees work, so you're completely clear on every detail.

What's the Difference Between Oasis-E and Oasis E1?

Again, we've stepped briefly back into healthcare territory. Oasis-E and Oasis E1 are versions of a home health assessment framework discussed frequently by trusted resources like the healthcare experts at Axxess. These terms focus exclusively on medical patient evaluations. They have zero connection to crypto asset management or lending functionalities offered by Oasis.app. Simply put—one is patient health data, and the other is crypto finance. No crossovers here whatsoever.

What Is Included in an Oasis Assessment?

If you've found yourself confused about what goes into an "Oasis Assessment," let me quickly put your mind at ease—it's strictly healthcare. Resources like HealthRevPartners clearly describe Oasis assessments as medical evaluations containing patient condition information, home healthcare needs, or Medicare patients' eligibility.

On the other side, Oasis.app—the crypto financial platform—is all about managing your digital assets and leveraging decentralized finance tools for maximum benefit. Completely separate topic, I promise.

Ready for my final take on if Oasis.app is truly worth your time and effort? The complete breakdown and personalized recommendation are coming right up—so stick around and find out if it's the right platform for you or if you're better off exploring other options. Curious yet? Of course, you are—let's wrap it all up!

A Quick Recap and Final Thoughts—Is Oasis.app Right for You?

Quick Rundown: Oasis.app Hits and Misses

Now that we've gone through all the ins-and-outs of Oasis.app, let's briefly recap what stood out most clearly.

- User-Friendly Interface: Oasis.app gives investors an easy-to-understand and quick-to-navigate crypto borrowing and management platform. This is especially helpful if you're new to DeFi lending and don't want unnecessary complexity.

- Security Credibility: Based on my evaluation, Oasis.app takes good security precautions. It actively implements measures like multiple audits, reliable smart contract interactions, and transparent custody policies to protect your crypto assets.

- Clear and Decent Fees: Oasis.app holds up well against other similar platforms when it comes to fees. Pricing is transparent, predictable, and doesn't spring unpleasant surprises when you least expect them.

- Some Learning Curve: While Oasis.app is simpler than many crypto platforms, absolute beginners might find aspects of collateralization and loan management confusing at first.

- Asset Support May Be Limited: For seasoned crypto traders seeking a variety of tokens, the number of supported cryptocurrencies could be restrictive.

In summary, Oasis.app seems ideal if you're looking for straightforward, reliable DeFi lending solutions and prefer simplicity over heavy, complicated trading tools.

Further Considerations Before Signing up

Although Oasis.app has compelling strengths, here’s what I'd recommend you verify or think about before fully committing:

- Do Your Test Run First: Open a small test position or loan to experience its functionality and feel comfortable before fully committing substantial assets.

- Double Check Supported Assets: Make sure Oasis.app provides the crypto assets you're interested in and confirms sufficient liquidity. Nothing is more frustrating than joining a platform only to discover later that your favorite tokens aren't supported.

- Understand Collateralization Risks: Always clearly know your liquidation risks. Oasis.app simplifies this, but no platform can entirely erase market volatility or crashes, so plan your collateral positions accordingly.

Should I Try Oasis.app Out?

If you're a beginner or intermediate crypto investor looking to explore lending, earning interest, or collateralizing your crypto in a streamlined, intuitive manner—yes, Oasis.app is likely a good fit.

If you're a specialized trader, deeply involved with niche coins, or require extensive customization and advanced functionality, Oasis.app might feel limiting. More seasoned crypto aficionados could benefit from pairing Oasis.app alongside other advanced platforms for a well-rounded DeFi experience.

Final Word: My Conclusion as a Crypto Enthusiast

With all the information I've compiled, Oasis.app earns high marks for simplicity, transparency, and security. It's an appealing option for crypto investors tired of cryptic platforms with hidden charges, complicated interfaces, and obscure terms.

However, don't just rely on my perspective—always verify directly by visiting the Oasis.app official website, checking their official FAQs, documentation, and community feedback before diving in head-first.

Ultimately, I believe Oasis.app provides substantial value and merits consideration. Whether you're dipping your toes in crypto lending for the first time or looking for a clear, easy-to-handle asset management solution, Oasis.app definitely deserves a shot.

Happy crypto investing—stay smart, vigilant, and most importantly, have fun exploring the possibilities crypto tools like Oasis.app bring to the table!