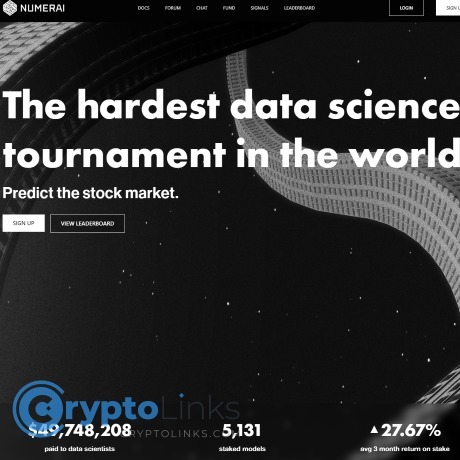

Numerai Review

Numerai

numer.ai

What is Numerai project?

The Numerai Hedge Fund, an innovative investment platform, has disrupted the traditional hedge fund industry. Unlike conventional investment firms, hedge funds operate in a less regulated space and cater primarily to accredited investors. With minimum entry requirements often reaching the hundreds of millions of dollars, hedge funds have been traditionally perceived as the preserve of the wealthy.

The founder of Numerai, Richard Craib, observed a significant inefficiency in how hedge funds were operating when he worked as a quant in a hedge fund shortly after his graduation from UC Berkeley and Cornell in mathematics and economics. He recognized that hedge funds relied on primitive data models to predict asset prices and guarded their financial data jealously. In 2015, he established Numerai to solve these problems and introduce "network effects" to hedge fund operations.

By leveraging the power of crowdsourcing and protecting the confidentiality of underlying data, Numerai sought to generate more accurate price projections and become the most profitable hedge fund in the world. Through this approach, Numerai has created a unique platform that has revolutionized the hedge fund industry and provided investors with access to investment opportunities previously reserved for the wealthy.

Why is Numerai good for?

Numerai, an innovative hedge fund platform, operates using a unique data science approach that leverages the power of crowdsourcing to generate profitable investments. This approach involves giving users existing datasets that have been modified to conceal the assets they refer to. These users then participate in weekly tournaments where they submit predictions generated by their data models. Numerai applies these predictions to new sets of market data and rewards users whose submissions generate accurate predictions with payouts that are usually paid out a month after the tournament has concluded.

Behind the scenes, Numerai tracks the most profitable users' predictions and uses them to create a "meta-model." This meta-model is then utilized by Numerai to trade assets more efficiently. According to their Medium article, Numerai's meta-model is less correlated to linear or machine learning models and has been found to be more effective in back-testing.

What sets Numerai apart is its trustless infrastructure - Numerai keeps its financial data masked, and users keep their data models private since only their predictions are shared with Numerai. This approach ensures the confidentiality and privacy of user data while enabling Numerai to generate profitable investments. With its innovative approach, Numerai is changing the way hedge funds operate and providing investors with access to investment opportunities that were previously limited to the wealthy.

How is with The Numeraire Token (NMR)?

Numeraire Token (NMR) plays a crucial role in the Numerai ecosystem. Initially, Numerai rewarded winners of their weekly data tournaments with Paypal but later switched to Bitcoin after a dispute with Paypal.

However, using Bitcoin as a payment method proved cumbersome for Numerai, and they realized that users needed additional incentives to create high-quality data models with accurate predictions. To address this, Numerai introduced the Numeraire Token, which serves as an incentive mechanism to encourage users to submit high-quality predictions.

The Numeraire Token is an ERC-20 token that is used to stake on predictions generated by data models submitted to Numerai's weekly tournaments. Users who stake Numeraire Tokens on predictions that perform well receive additional tokens as a reward. By staking tokens, users are incentivized to submit accurate predictions and penalized for submitting inaccurate ones, resulting in higher-quality data models and predictions.

Moreover, Numeraire Tokens have a fixed supply of 21 million, and Numerai has committed to using a portion of its profits to buy back and burn tokens, creating scarcity and increasing the value of NMR for token holders. With its unique role in the Numerai ecosystem, Numeraire Token has become a valuable asset for data scientists and investors alike.

What is the purpose of Numeraire?

Numeraire (NMR) is a unique ERC-20 token created on the Ethereum blockchain in 2017 by Numerai, a decentralized hedge fund. The token serves two primary purposes: to incentivize contestants to create high-quality data models and to provide a more convenient payout method. In weekly data science tournaments, competitors must stake NMR when submitting their predictions. The payout they receive is partially determined by the amount of NMR staked and the accuracy of their predictions. Unsuccessful predictions result in the burning of the stakes, making Numeraire a deflationary asset.

Numeraire's use-case has recently expanded to include staking and payment within the broader Erasure ecosystem. Erasure, launched by Numerai's founder, Richard Craib in 2019, is a marketplace where users can buy and sell data and request specific information. Numerai's participation in Erasure is part of a larger effort to decentralize and share data. Erasure seeks to expand the notion of "skin in the game" into social interactions and offers a browser plug-in that only shows information from individuals who have staked cryptocurrency on their opinions.

Interestingly, there was no ICO launched for Numeraire. Instead, Numerai airdropped 1 million NMR tokens to its active users, which was around 12,000 at the time. Initially, Numeraire had a maximum supply of 21 million, the same as Bitcoin. However, it has undergone a number of changes since then.

Numerai's decentralized hedge fund project was backed by private investors including other hedge funds, receiving a total of $7.5 million in 2016. Today, Numerai continues to receive investments and has achieved notable success through its unique approach to data modeling in the financial market.

Is there limited supply of Numerai Token(NMR)?

In mid-2020, Numerai reduced the maximum supply of Numeraire (NMR) tokens from 21 million to 11 million by burning the excess supply. This move towards decentralization allowed the token's smart contract to manage NMR issuance and burning. Prior to the reduction, NMR tokens were only minted as necessary for payout to successful participants in Numerai's weekly data science tournaments. However, Numerai set aside 3 million NMR for a tournament ending in 2028 and an additional 1 million NMR for future airdrops and partnerships. This leaves a total supply of 7 million tokens, of which 2.5 million are in circulation. The location and use of the remaining 4.5 million tokens have been subject to some controversy and speculation.

How can I buy Numeraire Token(NMR)?

If you're interested in acquiring Numeraire, you can find it primarily on Bilaxy and Bittrex, which make up roughly USD$1.4 million of its daily trading volume of USD$2 million. Bilaxy is particularly popular, accounting for nearly half of all Numeraire trading. Although Bittrex is more well-known, Bilaxy has been tested and found to be a safe platform to use.

Fortunately, there is substantial trading volume on these platforms, indicating that liquidity is strong. Therefore, you should have no difficulty trading on either of these exchanges. Keep in mind that the only way to obtain Numeraire, aside from winning Numerai's data science tournaments, is to purchase it from a cryptocurrency exchange. Additionally, you must possess some NMR to stake and enter the tournament.

Is Numerai following the roadmap?

In the world of finance, Numerai and its native token, Numeraire (NMR), are gaining traction as a force to be reckoned with. While the long-term roadmap for Numerai is not explicitly defined, founder Richard Craib has laid out the company's "master plan" in a Medium article. This includes goals to monopolize intelligence, data, and money before ultimately decentralizing the monopoly.

NMR serves as both the stake and reward for data scientists in Numerai's weekly data science tournaments. As the platform continues to grow and new participants enter the competitions, the demand for Numeraire is expected to rise. The introduction of Erasure, a new platform that uses NMR for purchasing and staking information, will also drive demand for the token.

While Numerai aims to become the world's most powerful hedge fund, the focus of the team has shifted to Erasure. Numerai is now a part of this new ecosystem that aims to bring "skin in the game" to every online interaction and transaction. It appears that Numeraire will continue to be the primary asset used for these purposes in Erasure's future projects.

What is our opinion about Numerai?

Numerai is a cryptocurrency project that is truly one of a kind. The project bears similarities to HedgeTrade, another platform where users predict the movement of assets, with a key difference being that on HedgeTrade, predictions are sold and bought using the HedgeTrade token.

In contrast, Numerai aggregates predictions into a meta-model for a hedge fund. Other similar projects include QuantConnect, Quantopian, and WorldQuant, but they lack the added security and incentive mechanisms that Numerai offers.

One major advantage of Numerai is the use of smart contracts to issue rewards and burn stakes, providing added security and trust. Additionally, the staking mechanism offers data scientists a greater incentive to submit accurate models, unlike other hedge funds that lack such incentive.

While it remains to be seen whether Numerai will achieve its goal of becoming the world's most powerful hedge fund, the project is unique and holds much promise for the future. Richard Craib, Numerai's founder, has repeatedly highlighted the project's strengths, including its vetting process for data scientists, open participation, and use of smart contracts.

What do you think overall about the Numerai token(NMR) and project?

When considering the Numeraire token, there are some factors to keep in mind. One of the main concerns is the suspicious supply of NMR tokens. Richard Craib, the founder of Numerai, has kept over 400,000 NMR for himself, and other addresses also contain significant amounts of NMR. This may raise concerns for some investors as it can be a red flag when the creator of a token holds a substantial amount of it.

Another factor to consider is NMR's price potential. While its performance has been impressive compared to most other cryptocurrencies, it didn't rise significantly during the 2017/2018 bull run, which suggests that it may not be an asset that will 10x anytime soon. Additionally, since NMR is burned every time a data scientist loses a tournament on Numerai or when someone submits faulty information on Erasure's marketplace, its total supply will gradually decrease, which could lead to a downfall of both Numerai and the Erasure ecosystem.

However, the likelihood of the last NMR token being burned anytime soon is slim, as both Numerai and Erasure have a lifetime ahead of them until at least May 2028. This is when the mega data science tournament is set to conclude on Numerai, and the 3 million tokens won will likely be sold, introducing a fresh supply of NMR to markets via exchanges for others to purchase and use to be staked in both Numerai and Erasure.

Ultimately, investors should do their own research and make their own decisions. This information is not financial or investment advice, but it is important to consider when deciding where to invest.