Hashtag Investing Review

Hashtag Investing

www.hashtaginvesting.com

Hashtag Investing Review Guide: Everything You Need to Know + FAQ

Torn between joining yet another investing community and keeping your sanity? Tired of open forums that promise signal but deliver noise? Wondering if Hashtag Investing is actually worth your time?

If you’ve been bouncing between Discords, subreddits, and X/CT threads, you’ve seen the same loop: hot takes, hidden paywalls, flaky “alpha,” and DMs you should never open. What you really want is a place that’s helpful, sane, and safe—without wasting hours.

Real talk: most investors don’t need more information—they need better filters, safer spaces, and clearer frameworks.

The real problems most investors face

It’s not that there’s too little content—it’s that there’s too much, and most of it isn’t actionable. Here’s what trips people up over and over:

- Too many communities, not enough signal: Open forums reward speed over accuracy. Research from MIT (Vosoughi, Roy, Aral, 2018) showed false news spreads faster than truth on social platforms, which aligns with what we see in finance chatter: heat gets clicks; nuance gets ignored.

- Paywalls everywhere, unclear value: You subscribe, you skim, you cancel—repeat. Most services don’t tell you what you’ll actually learn or how fast you’ll get ROI.

- Mixed quality content: A great thread today, a meme storm tomorrow. Without consistent curation, your feed becomes a dopamine factory, not a learning tool.

- Beginner-unfriendly vibes: Ask a basic question on some forums and you’ll get mocked or ignored. That kills learning momentum.

- Safety worries: Unsolicited DMs, “guaranteed returns,” and shady links. The SEC regularly warns about social media investment schemes, and Chainalysis has tracked billions lost to scams across crypto in recent years—bad actors love public finance spaces.

- Unclear fit for crypto folks: If you’re crypto-first, you want macro and process that strengthen your edge—without drowning in pure equities content or day-trade noise.

There’s a reason classic studies like Barber and Odean’s “Trading Is Hazardous to Your Wealth” exist: when you’re overloaded and overconfident, performance suffers. A good community should reduce those risks, not amplify them.

What I promise in this review

You’ll get a straight answer on whether Hashtag Investing belongs in your toolkit. I’ll keep it practical and zero-fluff. Expect:

- What Hashtag Investing actually offers and how it works in real life.

- Pricing clarity and what’s free vs what might be premium.

- Content quality and cadence: interviews, explainers, market takes—what shows up and how useful it is.

- Community experience: vibe, moderation, and whether beginners get real help.

- Platform usability: web, email, and any chat tools they use—what’s smooth, what’s clunky.

- Privacy basics: what to post, what to avoid, and how to stay scam-safe.

- Crypto reader fit: where it helps your process and where you’ll still want crypto-native sources.

No sugarcoating. If it saves you time and helps you think better, I’ll say so. If it’s a pass for certain use cases, I’ll flag that too.

How I evaluate platforms (so you know what my verdict is based on)

Every platform gets the same framework. Here’s what I look for and how I assess it:

- Usefulness over fluff: Do you get concrete takeaways you can apply within a week? I look for playbooks, checklists, and frameworks—not just opinions.

- Credibility and authorship: Are contributors named with real backgrounds? Can you verify their work elsewhere (articles, talks, research)? Anonymous hot takes don’t cut it.

- Ease of use: Clear navigation, clean onboarding, and email that respects your time. If it takes more than a few clicks to find value, that’s a red flag.

- Transparency: Pricing that’s easy to find, straightforward cancellation, and honest descriptions of what’s inside. No bait-and-switch.

- Community health: Active moderation, low spam tolerance, real answers to real questions. I check response quality, not just message counts.

- Privacy and safety: Sensible rules about DMs, clear warnings about scams, and no pressure to overshare personal data.

- Fit for crypto-focused readers: Strong on macro, risk frameworks, and process? Good. Pretending to be a signal service? Not good. I weigh how it complements crypto-native research rather than replacing it.

On top of that, I pay attention to time-to-value—how fast a new member can get oriented and learn something that improves their process. If the first week doesn’t move the needle, I’ll call it out.

So, does Hashtag Investing fix the common pain points and earn a spot in your routine—or is it just another tab you’ll ignore in a month? Let’s find out by looking at what it is, why it exists, and what you actually get inside.

What is Hashtag Investing? Quick look and why it exists

If you’ve ever opened five tabs, doomscrolled X, and still felt like you learned nothing you can use, you’ll get why Hashtag Investing exists. It’s an investor community and content hub built to help retail investors connect, learn, and apply curated insights without drowning in hype. Think fewer hot takes, more thoughtful frameworks. Less chaos, more clarity.

“You don’t need more posts. You need better filters.”

Behavioral research backs this up: noise and herding can push us into inconsistent or copycat decisions. If you’ve read about decision “noise” (see Daniel Kahneman’s Noise) or herd behavior in markets, you know curation isn’t a luxury—it’s an edge.

Background and mission in simple terms

Hashtag Investing is for retail investors who want signal over sizzle—people learning the craft, improving process, or sharing what actually works. The mission is straightforward: create a friendly place for smarter conversations and practical learning, without the toxicity you see in massive public threads.

Expect a tone that’s approachable, not guru-ish. You’ll typically see content that helps you build judgment, like:

- Process-first interviews with portfolio managers or seasoned investors (how they think about risk, position sizing, and catalysts).

- Explain-it-like-I’m-smart guides on key ideas: reading a 10-K faster, understanding FCF, or spotting revenue quality.

- Macro context that makes headlines useful rather than scary, paired with frameworks you can reuse.

It’s built for people who’d rather learn how to fish than chase every alert. If that reduces your stress and improves your filter, it’s doing its job. On that note, information overload is a real drag on results—good curation fights that.

What you actually get

You can expect a mix of content and community touchpoints that feel curated and practical:

- Articles and explainers that focus on process, frameworks, and case studies rather than clickbait.

- Interviews and conversations with investors, analysts, or operators—useful for pattern recognition and mental models.

- Newsletter highlights that round up timely market ideas, notable charts, and resources worth saving.

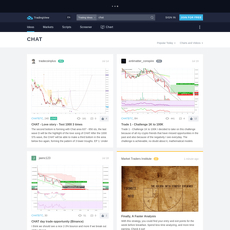

- Community space (often on a third‑party platform like Slack or Discord) where members share research, ask questions, and swap tools.

Sample week-in-the-life:

- Read a post on “building a pre-earnings checklist” and save the template.

- Skim an interview where a manager explains why they didn’t take a popular trade—and what their risk triggers were.

- Drop into a thread on how members size positions when volatility spikes, and pick up a new rule of thumb.

Who it’s best for (and who it’s not)

- Best for: learners and practitioners who want curated conversations, stronger investing process, and steady skill-building. Great if you like reading, note‑taking, and asking thoughtful questions.

- Not ideal for: traders who only want real‑time signals, pure crypto alpha, or “buy/sell now” calls. If you measure value only by immediate trade alerts, this isn’t that.

Put simply: if you want to get sharper and calmer while you invest, you’ll feel at home. If you want a siren blaring entries and exits, you won’t.

Key strengths at a glance

- Curation over chaos: fewer threads, higher signal, less fatigue.

- Approachable tone: no shaming beginners; thoughtful answers beat snark.

- Networking value: connect with peers who share templates, workflows, and real lessons learned.

- Cross‑asset perspective: while stock‑first, the frameworks translate well for crypto and macro thinking.

- Cleaner environment than giant open forums: moderation and culture matter here.

So what does a typical day inside actually feel like—are the threads active, are beginners treated well, and does the content land as “actionable” or just feel‑good? In the next part, I’ll show you the real community vibe, content cadence, and how the platform handles safety and privacy. Curious about DM scams, channel quality, and how fast you can get up to speed?

Let’s look at the day‑to‑day experience next.

Features and experience: content, community, and usability

Community vibe and moderation

I care about two things when I test a community: can I ask a “basic” question without getting roasted, and is spam shut down fast? In my time with Hashtag Investing, the tone feels grounded and constructive. Threads read like conversations you’d want to join—people explain their thinking, link sources, and ask follow-up questions instead of flexing. That’s rarer than it should be.

Moderation appears intentional rather than heavy-handed. The signal-to-noise stays high because low-effort “what coin next?” posts don’t linger, and promotional fluff doesn’t get oxygen. There’s room for disagreement, but the discussion tends to be about the idea, not the person. If you’ve been burned by loud Discords or chaotic subreddits, this calmer pace is refreshing.

“Communities are a moat when they teach you how to think, not what to buy.”

Why this matters: research has shown false or sensational content spreads faster on open social platforms where moderation is weak. The famous MIT study on Twitter/X misinformation highlighted how quickly low-quality signals amplify. A curated, rule-based space helps you avoid that trap and stay focused on learning and process rather than chasing the latest rumor.

- Beginner-friendly: Newer investors get helpful answers more often than sarcasm. That lowers the fear of asking and speeds up learning.

- Respectful debate: It’s normal to see someone post a thesis, then others poke holes with data and sources. No pile-ons, no dunking culture.

- Low spam tolerance: Promotional DMs and “PM me for signals” types don’t last long. If you encounter it, report and move on.

Content quality and cadence

The content mix is steady and practical. Expect a rotation of interviews, explainers, and market takes that are digestible in 5–15 minutes. Think frameworks and process over hot takes. You’ll see breakdowns of investing concepts with real-world examples—things you can adapt to your own workflow the same day.

- Interviews: Practitioner chats that unpack “how” and “why,” not just “what.” You’ll pick up tools like checklist items, risk rules, and idea-sourcing tactics.

- Explainers: Plain-English rundowns of topics like liquidity cycles, earnings quality, factor rotations, or position sizing. No jargon walls.

- Market notes: Concise views on what matters now, with links out to primary sources or charts so you can verify and go deeper.

Is it actionable? Not in the “buy/sell this ticker at 9:32 AM” sense. It’s actionable in the way that matters: better questions, cleaner process, fewer biases. For example, I saved a simple pre-trade checklist I first saw discussed here—variation of what investors like Mohnish Pabrai and Guy Spier advocate—covering thesis, catalysts, risk, alternatives, and exit plan. That one habit alone can curb impulsive moves and is backed by research across fields that checklists reduce errors.

Cadence-wise, it’s consistent without spamming your inbox. Enough to build a weekly rhythm, not so much that you’ll start hitting archive. I set aside a block each week to read, annotate, and tag pieces to revisit—compounds nicely over time.

Platform experience (web, email, and social)

The site is straightforward: content is easy to find, loads quickly on mobile, and category labels make sense. Search does what you expect: type a topic, get relevant hits. No labyrinths. Email is clean, links to source articles work, and unsubscribe is obvious (small detail, big trust signal).

If or when community chat is offered (often on Slack or Discord in this niche), the setup is standard: join link, verify, pick channels. Two quick wins if you join:

- Tune notifications: Set @mentions and threads you follow only. You’ll avoid the “1,248 unread” syndrome.

- Star high-signal rooms: Whatever channels house frameworks, research drops, or Q&A with hosts—pin them. Hide the meme/ad channels if they exist.

On social, think of their presence as a highlights reel. The deeper value lives on the site and in your inbox, where context isn’t chopped into soundbites.

Privacy and safety basics

Investing communities attract impostors and opportunists. Most platforms fight this, but you’ll still want to harden your own setup. A few non-negotiables:

- Lock down DMs: Set DMs to friends-only (Slack/Discord settings) or at least treat every unsolicited message as suspicious. No screenshots of accounts, no “quick favors.”

- Verify URLs: Bookmark official links. Check domain spelling before you click. If someone sends a “special access” link, assume it’s a phish until proven otherwise.

- 2FA everywhere: Email, any chat app, and the site if supported. Authenticator app > SMS.

- Don’t share PII: No phone numbers, no brokerage statements, no tax docs. Keep your identity threadbare unless you choose otherwise.

- Report and move on: If you see spam or a suspicious profile, report it instead of engaging. Fast reporting keeps the community clean.

If you want a primer on spotting social scams, the FTC’s consumer advice pages are a good refresher. The short version: trust slowly, verify always.

For crypto readers: is there value here?

Yes—if you value cross-training. Crypto-native communities will always beat it on on-chain nuance and real-time token chatter. But the edge here is everything around the trade: macro context, risk discipline, and the research habits that keep you from chasing every shiny narrative.

- Macro and liquidity: Understand rates, ETF flows, and liquidity cycles that often explain why all risk assets breathe in sync. That context helps you avoid fighting the tape.

- Frameworks that travel: Adoption S-curves, unit economics, network effects, and scenario mapping apply to tokens just as well as equities.

- Risk and sizing: Position sizing rules, stop frameworks, and journal templates. Boring? Maybe. Effective? Definitely.

- Research habits: How to tag sources, compare theses, and log catalysts. This is the difference between having opinions and having a process.

Where you’ll still want crypto-native intel:

- On-chain analytics: Real-time flows, DEX/liquidity pool movements, validator behavior.

- Token design: Emissions, lockups, governance proposals, treasury activity.

- Protocol risk: Audits, bug bounties, MEV dynamics, bridge exposures.

Pairing both worlds works. Use Hashtag Investing to sharpen your thinking and risk frameworks, then plug those into your on-chain tools and crypto communities. You’ll notice your PnL stabilizes because your decisions stop being purely reactive.

Want the practical part? Next up I’ll show you exactly what’s free vs. paid, how to join, and how to set things up in under five minutes so you avoid notification hell. Ready to get the most out of week one without wasting time?

Pricing, access, and getting started

You want the shortest path to value: what’s free, what might cost money, how to join in minutes, and how to make week one actually count. Here’s the straight shot so you don’t wander through yet another signup maze.

Is Hashtag Investing free or paid?

Hashtag Investing typically offers a blend of free and potentially premium access. Historically, you could read public articles and subscribe to a newsletter at no cost, with occasional premium options for deeper community access, workshops, or special content drops. Because these details can change, always confirm current options directly on the official site.

- Usually free: public articles, interviews, and the main newsletter. These give you a feel for the tone and signal quality without pulling out a card.

- Potentially paid: structured cohorts, premium chat spaces, or advanced sessions if they’re running them. Pricing and availability tend to evolve.

- Where to check: visit hashtaginvesting.com for the latest on pricing, trials, and what’s included.

Pro tip: if a premium tier is offered, look for basics like a clear refund window, auto-renew terms, and whether you can cancel self-serve. A quick scan of the pricing page and Terms usually answers this in under a minute.

How to join and set yourself up right

Fastest way to go from “just signed up” to “actually getting smarter” is to set a clean signal path on day one. I’ve tested this flow across dozens of platforms—it works.

- 1) Subscribe with intent: Head to the homepage and subscribe to the newsletter. Confirm the email (watch Promotions/Spam).

- 2) Make their emails find you: Add the sender to your contacts. In Gmail, create a filter for “from: hashtaginvesting.com” and star/label it “Investing/Reading.” You’ll thank yourself later.

- 3) Join the community space (if available): If there’s a Slack or Discord link, request access. Use a handle that doesn’t reveal personal info. Disable DMs from non-friends by default—you can always open them later.

- 4) Set sane notifications: Turn off @channel/@everyone pings, enable only mentions and direct replies. Research from UC Irvine/Microsoft shows it can take ~23 minutes to refocus after interruptions—protect your attention.

- 5) Pick your first threads wisely: Follow channels like “macro,” “fundamentals,” or “beginner-questions.” Star 2–3 high-signal contributors and mute anything that feels noisy within the first hour.

- 6) Ask one focused question: Use a simple template: ticker/asset, your thesis in 2 lines, time horizon, one specific question. This gets helpful replies and places you on the radar (without spamming).

- 7) Build a quick capture system: Save best posts to Notion, Evernote, or Readwise. Keep a lightweight watchlist. Small habit, huge payoff.

- 8) Time block your reads: Pick a 20–30 minute weekly slot for their newsletter highlights. Nielsen Norman Group has long noted that well-run newsletters are still a top channel for engaged learning—if you treat them like an appointment.

“A wealth of information creates a poverty of attention.” — Herbert A. Simon

Guard your focus like capital. You’re not joining for more noise—you’re joining for better decisions.

Cancellation and data control

If you later decide it’s not for you, exiting cleanly takes just a few clicks. Keep your data footprint tight.

- Emails: Unsubscribe via the footer link in any newsletter. In Gmail, you can also hit the native “Unsubscribe” next to the sender.

- Paid plans (if applicable): Cancel from the account/billing page on the official site. Screenshot your confirmation and note the renewal date.

- Community spaces:

- Slack: Open Slack > Workspace name > “Leave workspace.” You can also request message deletion from admins if needed.

- Discord: Right-click the server > “Leave Server.” Consider clearing any personal info from your profile first.

- Data removal: Check the site’s Privacy Policy for GDPR/CCPA instructions. Typically, you can request data deletion via a contact form or support email. Ask for confirmation when it’s done.

- Revoke app access: If you connected Google/Apple/Discord, revoke permissions in your account settings with those providers.

Simple rule of thumb: share less, store locally what matters, and always keep an exit path bookmarked.

Support and responsiveness

If you hit a snag, you’re not stuck. Here’s how to get help fast.

- Main help channel: Use the site’s contact page or footer email listed on hashtaginvesting.com. Typical response times for platforms like this range from 24–72 business hours.

- Community moderation: If you see spam or sketchy DMs, report it to the moderators inside Slack/Discord, and block the sender. Screenshots help speed things up.

- Billing questions (if any): Include your signup email, last 4 of the card (not the full number), and the date you were charged. Clear, concise tickets get solved first.

- Status check: If there’s a newsletter delay or link issue, give it an hour, then reach out with the subject line and date. Most hiccups are quick fixes.

I’ll leave you with a simple 7-day framework that tends to work: two quality reads, two saved notes, one thoughtful question. Repeat. It compounds.

You’ve got the playbook to get in and get value—so here’s the million-satoshi question: how does Hashtag Investing actually stack up against the big Discords, subreddits, and X threads you already scroll? Let’s compare signal-to-noise, moderation, and speed next.

How it compares to other investing communities

I’ve stress-tested a lot of communities, from noisy Discords and sprawling subreddits to high-velocity Twitter/X threads. Hashtag Investing sits in a different lane: slower than breaking-news feeds, but cleaner, calmer, and easier to learn from without getting swept into hype cycles.

“You don’t need more voices. You need better filters.”

Here’s exactly where it shines—and where it doesn’t—so you can decide if it matches how you learn and make decisions.

Hashtag Investing vs big open forums

Think Reddit, giant Discord servers, and Twitter/X. They’re unmatched for speed and crowd energy. But speed cuts both ways.

- Signal-to-noise: Open forums move fast, but shallow threads and hot takes are everywhere. A well-known Science study (2018) found false news spreads faster than true on Twitter—proof that speed alone isn’t your friend. Hashtag Investing’s curated feel reduces the churn, so you spend more time learning and less time arguing with anonymous avatars.

- Quality of discussion: On a big subreddit, ask about building a long-term process and you’ll get 50 conflicting replies and 5 memes. In Hashtag Investing, I typically see 2–4 thought-out responses with links to resources, frameworks, or interviews that actually answer the question.

- Moderation: Large communities often rely on reactive moderation; spam and bad actors slip through. Here, moderation is tighter and the tone leans constructive, which nudges better behavior and keeps threads usable a week later.

- Speed of news vs depth of insight: Twitter/X wins if you need the headline in 30 seconds. Hashtag Investing tends to arrive later with context and tradeoffs, which is more useful for portfolio decisions than for chasing minute-by-minute moves.

- Accountability and context: Open forums reward virality, not follow-through. Hashtag Investing’s content—interviews, explainers, and member discussions—leans on repeat contributors and an editorial layer, so ideas stack over time instead of evaporating in the feed.

Real-world example: during a hot CPI print, Twitter will deliver instant charts and bold predictions. Hashtag Investing isn’t trying to front-run the tape; it’s more likely to publish a short explainer on what the print means for risk assets, rate expectations, and how to stress-test your portfolio if volatility sticks. Less adrenaline, more staying power.

If you’re crypto-first: is this worth your time?

It can be—if you use it for what it does best: sharpening the process around your crypto decisions.

- Where it helps: Macro context (liquidity, rates, cycles), risk frameworks, position sizing, journaling habits, thesis-building, and learning from equity-style research methods that translate well to crypto fundamentals and token design.

- Where you’ll still need crypto-native intel: On-chain flows, gas dynamics, validator updates, airdrop farming strategies, NFT mints, MEV tricks, client release notes, and token-specific Discords. That’s a different toolkit—analytics dashboards, code repos, and protocol forums.

Quick mental model: use Hashtag Investing to build the engine (how you think), and use crypto-native sources for the fuel (raw data and edges). When the next big narrative spins up—think L2 rotations or a major network upgrade—you’ll have a sturdier process to separate momentum noise from durable signals.

Who should pick it—and who should skip it

- Pick it if you want curated conversation, steady learning, and practical frameworks you can reuse across assets (equities, crypto, ETFs). You prefer fewer, better inputs over 100 tabs of chaos.

- Skip it if you want real-time trade alerts, alpha calls, or deep on-chain analytics. If your edge is speed-arbitrage on CT or mining micro-structure signals, this won’t replace your existing feeds.

Pros and cons summary

- Pros

- Curated feel with a friendlier signal-to-noise ratio

- Approachable content that compounds into better process

- Networking without the swarm—easier to find thoughtful voices

- Cons

- Not built for real-time trade calls or breaking-news speed

- Depth varies by topic; some threads are “very good,” not “expert-only”

- Crypto-native intel still needs separate tools and communities

If you had a simple playbook to extract value in your first seven days—who to follow, what to mute, and how to turn one newsletter into an actual decision—would you use it? That’s exactly what I’m about to share next.

My hands-on take and practical tips

What impressed me

I went in expecting another noisy chat space. I didn’t get that. The tone is calm, practical, and friendly. Posts read like people thinking through decisions rather than trying to win arguments. That alone cuts a lot of mental fatigue.

- Less hype than public feeds: Threads tend to be thesis-first: what’s the idea, what’s the risk, what would make you exit? When someone shares a chart, they also share the “so what.”

- Structured learning via content drops: The interviews and explainers come with enough context to be useful. A good example: an interview walking through a simple Risk = Probability x Impact framework, then showing how that maps to position sizing. No secrets, just clean process.

- Beginner questions get real answers: I saw a question on “how to track catalysts without being glued to screens.” The best reply shared a 3-step workflow with calendar tags and a weekly re-check—actionable, not vague.

There’s a reason this style works. Research on information overload shows too many low-quality inputs lead to worse decisions (Eppler & Mengis). And spaced learning improves retention (Cepeda et al.). The cadence here nudges you to learn in chunks, not chase every ping.

What could be better

- Clarity on what’s premium: If advanced features or deeper content require payment, label them upfront with a “free vs. paid” badge so expectations are clean from day one.

- Paths for crypto readers: A simple “start here if you’re crypto-first” page would help. Point to macro primers, risk frameworks, and a shortlist of members who write with a crypto lens.

- Moderation consistency: The vibe is good, but pinning a short code of conduct and a 24-hour SLA for spam/DM reports would keep quality strong as new folks arrive.

Who gets the most value (use cases)

- Beginners who want structure: You’ll find explainers and checklists you can reuse. If you’re building a first portfolio, the “process over hot takes” culture helps you avoid common mistakes.

- Intermediate investors polishing frameworks: If you already track ideas and write theses, the curated conversations push you to sharpen your edge—entry/exit criteria, risk buckets, and post-mortems.

- Time-strapped professionals: If you can give investing 3–4 hours a week, the curated feed saves you from scrolling through endless noise. You’ll get a few high-signal reads and move on.

- Crypto people who want macro and process: If you live on CT and Discord, this is a nice counterweight. You’ll pick up valuation thinking, risk controls, and market structure context you can port back to on-chain ideas.

Tips to get ROI fast

- Day 1: skimming strategy. Open the latest newsletter and read the top 3 pieces. Anything older than 30 days? Save it for a quiet slot. Recency beats rabbit holes.

- Star high-signal voices. Find 3–5 members who share frameworks, not just tickers. Star them and mute anything that doesn’t teach you something. Protect your attention.

- Turn off push-by-default. Set community pings to mentions only. A 2023 productivity study found interruption cost stacks quickly; batch your checks twice a day instead.

- Build a 5-minute note template. After any read, jot: Thesis (1 sentence), Key risks (3 bullets), Trigger to exit (1 line), Data to monitor (2 items). Checklists reduce errors (see Gawande’s work on checklists in complex decisions).

- Run a weekly 30-minute review. What did you learn? What action, if any, did you take? Barber & Odean showed overtrading hurts returns; this pause keeps you selective.

- Use the “two-tab rule.” When someone posts an idea, open two tabs: company/asset page and a skeptical counterpoint. You’ll avoid anchoring and confirmation bias.

- Ask one thoughtful question. Not “is XYZ going up?” Try “What would invalidate your thesis on XYZ, and what’s the lagging vs. leading signal?” You’ll get better replies and get noticed by serious members.

- Protect your DMs. Cold DMs offering guaranteed returns? Block. If a model or file is shared, assume it’s unvetted. Keep convos in public threads where others can sanity-check.

- Create a “stop-doing” list. Mute tickers you don’t follow. Hide channels you never read. Every mute is a gift to your future self.

Simple rule I use: if a post doesn’t change my process, my risk, or my watchlist, I scroll past it. Curiosity is good. Compulsion isn’t.

If you’re wondering how safe it is, whether crypto gets enough attention, or what the app options look like, want the straight answers without the fluff? That’s exactly what I’m covering next in the quick-hit FAQ—want the shortcut?

FAQ: quick answers people look for

Is Hashtag Investing legit and safe?

Yes—it's a real investor community and content platform. The usual internet rules still apply:

- Never share account credentials, portfolio screenshots with balances, or personal IDs.

- Avoid unsolicited DMs offering “guaranteed returns,” mentorship, or private signals. That’s where most scams start.

- Verify claims before you act. Ask for sources, timestamps, and links to original filings or data.

If you want a reality check on risk, the FBI’s 2023 IC3 report shows investment scams caused over $4.5B in losses—much of it seeded over social platforms. You can read it here: IC3 2023. FINRA and the SEC also warn about social-media “experts” and impersonation scams: FINRA Investor Insights and Investor.gov protections.

Rule of thumb: if it needs urgency, secrecy, or crypto gift cards, it’s a scam.

Does Hashtag Investing cover crypto or just stocks?

Expect broader investing first—equities, macro, process. That said, there’s solid overlap that helps crypto traders: liquidity cycles, rates, risk frameworks, and position sizing. If you want protocol-level research, on-chain analytics, or real-time crypto flows, pair this with crypto-native sources (Glassnode, Messari, Nansen, token-specific discords, on-chain scanners).

Practical combo that works:

- Use Hashtag Investing for macro context (Fed, yields, volatility regimes) and process.

- Use crypto-native tools for execution (gas, token unlocks, funding, perp skew, on-chain alerts).

Is there an app or only web/email?

Plan on the website and email for content. If there’s a community chat, it typically runs on a third-party platform (Slack or Discord). These things change, so check the current options on the official site: hashtaginvesting.com.

How do I get the most out of it in week one?

Keep it simple and intentional. Here’s a fast setup that works:

- Read the latest highlight post and save 2–3 pieces that match your goals (e.g., risk management, macro watch).

- Follow a few high-signal contributors—the ones citing data, filings, or charts with context.

- Set sane notifications: weekly digest on, real-time pings off (unless there’s a topic you actively trade).

- Ask one thoughtful question to get on the radar. Example: “For small-cap or alt exposure, what’s your rule for max position size when volatility is 2x the 1-year median?”

- Create a capture system: a notes doc with one section for “ideas to test” and one for “rules to keep.”

- Schedule one review session (30 minutes, end of week) to summarize what you’ll actually try next week.

Tip: You’re aiming for one behavior you keep, not 20 half-finished experiments. Think: a tighter stop rule, a better entry checklist, or a macro dashboard you’ll actually check.

Final word

Bottom line: this is a smart pick if you want curated investing conversation and steady learning without the chaos of public feeds. It won’t give you hot trade signals or replace crypto-native research, but it’s great for building a durable process and meeting people who speak the same language. If that’s what you need, take a look here: https://www.hashtaginvesting.com/.