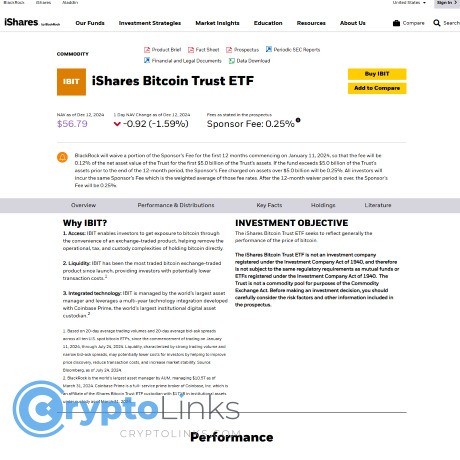

BlackRock iShares Bitcoin Trust ETF Review

BlackRock iShares Bitcoin Trust ETF

ishares.com

BlackRock iShares Bitcoin Trust ETF: Everything You Need to Know (With FAQs)

The iShares Bitcoin Trust ETF has been stirring up curiosity, and for good reason—it offers a way to potentially benefit from Bitcoin’s massive growth without the hassle of actually owning it. But let’s be real: the idea of investing in an ETF tied to a volatile asset like Bitcoin leaves plenty of questions swirling in your mind. Is it safe? Is it even worth it? And what’s the catch everyone keeps talking about? Look, skepticism is normal, especially when crypto is involved, but here’s the good news: understanding this ETF doesn’t have to feel like decoding a secret language. It’s time to clear up the confusion, break down how this works, and figure out if it’s the game-changing opportunity you’ve been waiting for—or just another shiny buzzword in the investment world.

Have you been catching whispers about the iShares Bitcoin Trust ETF? Maybe you've heard friends or colleagues mention it and wondered, "Is this worth my attention? How does it even work?" You're not alone—curiosity about it is everywhere, and for good reason.

Whether you're already invested in Bitcoin or you've just been sitting on the sidelines, unsure about diving in—let me tell you: this ETF might be the bridge that connects you to the crypto world, without you needing to own Bitcoin directly. Sounds intriguing, right? Let me walk you through the essentials, step by step, so you know what the buzz is all about.

What are the common concerns about Bitcoin ETFs?

First, let’s talk about the sticking points. Bitcoin ETFs—while incredibly promising—come with their fair share of concerns and confusion. Folks often ask:

- "How does a Bitcoin ETF actually work, and what’s the catch?"

- "Are they legit or just another overly-hyped financial product tied to crypto?"

- "And most importantly, what sort of returns can I expect?"

Beyond that, there’s the trust factor. Bitcoin ETFs are still a relatively new addition to the investment world, and new usually means skepticism. People want to ensure they’re not throwing their hard-earned money into something risky or prone to scams.

Why you need to clear up confusion

Let’s face it: no one wants to invest in something they don’t fully understand. Not only could that make you hesitant to start, but it could also lead to decisions you regret—like investing without realizing the potential risks. Learning the basics is the first step to eliminating doubt and giving yourself confidence in your investment choices.

How this article solves those problems

Here’s the thing: understanding the iShares Bitcoin Trust ETF doesn't have to be complicated. This post is here to break it all down in plain language. By the time you reach the end of this, you’ll have answers to the major questions: What makes this ETF distinct? Does it have any advantages over directly purchasing Bitcoin? Who’s behind it, and can we trust them? There’s a lot to unpack, but we’ll keep it simple, clear, and actionable every step of the way.

Oh, and before you go, wouldn’t you want to understand what actually defines the iShares Bitcoin Trust ETF and how it works? Get ready—I’ll answer those questions in the next part!

What is iShares Bitcoin Trust ETF?

Let’s cut to the chase: What exactly is the iShares Bitcoin Trust ETF, and how does it stand apart? If you’ve been eyeing Bitcoin but aren’t quite ready to leap into the wild world of crypto wallets, blockchain jargon, and exchange fees, this might just be the solution for you.

A Quick Overview

The iShares Bitcoin Trust ETF is a financial product that tracks the price of Bitcoin. Think of it like this: instead of buying actual Bitcoin and figuring out where to store it safely, you can invest in this ETF to get exposure to Bitcoin’s market performance via the stock market. Simple, right?

For instance, say Bitcoin is trading at $30,000. Instead of buying a full Bitcoin (or figuring out fractional purchases), you can hold shares in the ETF, which are designed to mirror Bitcoin's price movements. It’s a streamlined way to go along for the Bitcoin ride without actually buying or holding the coin itself.

Why It Matters to Investors

Here’s where things get really interesting. Investing in cryptocurrency can seem overwhelming, especially if you’re new. People hear terms like “private keys,” “cold wallets,” or “seed phrases,” and immediately feel out of their depth. And hey, let’s not forget the constant anxiety about hacks or forgetting your password and losing access to your funds forever.

The iShares Bitcoin Trust ETF takes all of that complexity and wraps it up into something familiar: a stock. That’s it. No wallets, no passwords, no exchanges. Just imagine logging into your brokerage account, clicking “Buy,” and instantly having exposure to Bitcoin. This ease of access is a game-changer, especially for traditional investors curious about crypto but hesitant to deal with the complications.

A study by Investopedia notes that simplicity is a key factor driving the growth of crypto ETFs. And let’s be honest—sometimes, removing friction is all it takes to get people on board.

Who’s Backing It?

Here’s the big reveal: the iShares Bitcoin Trust ETF is managed by BlackRock. Yes, that BlackRock. If you’re not familiar, BlackRock is a powerhouse—one of the largest and most respected asset management companies in the world. With their name attached, the trust comes with a layer of credibility that’s hard to ignore. Investors aren’t just betting on Bitcoin here; they’re aligning with a name that manages over $9 trillion in assets globally. That says something.

“Confidence comes not from always being right but from not fearing to be wrong.” – Peter T. McIntyre

When BlackRock came into the fold, it gave Bitcoin ETFs a respectability boost among traditional investors who may have rolled their eyes at crypto in the past. Combine that with their reputation for strict due diligence, and it’s not surprising why this trust is making waves.

Still Wondering How It Works?

Okay, so now we know what the iShares Bitcoin Trust ETF is and who’s behind it. But how exactly does it all come together? What magical mechanisms make it track Bitcoin’s price so closely while staying compliant with financial regulations? Well, buckle up! That’s where things get even more fascinating—and I’ll uncover it all next.

How does the iShares Bitcoin Trust ETF work?

Alright, let’s get to the good stuff. If you’re curious about the inner workings of the iShares Bitcoin Trust ETF, you’re not alone. How does it actually function? How does it connect the dots between Bitcoin and traditional investments? Let me break it down for you in a way that’s easy to follow.

Price tracking and performance

The core idea behind this ETF is pretty straightforward—it mirrors the performance of Bitcoin. Imagine you wanted to invest in Bitcoin, but instead of dealing with wallets, passphrases, or exchanges, you bought shares of something that automatically tracked its price. That’s exactly how this ETF works. When Bitcoin’s price shoots up, your investment grows. If Bitcoin dips, well, your shares take a hit too. It’s essentially a way to ride the Bitcoin rollercoaster without directly owning Bitcoin.

A study published by Morningstar suggests that ETFs tend to reduce the entry barriers for new investors by simplifying the process and providing transparency. That’s especially important in a volatile space like crypto where managing your assets can feel overwhelming at times. The iShares Bitcoin Trust offers that streamlined exposure.

Custodian and storage

Here’s a question I get a lot: "Where does the Bitcoin actually go?" It’s a great question because you’re not just investing in thin air. The fund’s Bitcoin holdings are stored with Coinbase Custody Trust Company. If you haven’t heard of them, they’re one of the most reputable names in secure crypto storage. Think of Coinbase Custody as a high-tech vault with multiple layers of security protecting the assets at all times.

Why does this matter? Because when it comes to crypto, security is everything. Hacks and cyber threats are among the scariest parts of being in this game. A well-recognized custodian like Coinbase Custody adds a layer of trust that’s hard to overlook.

The tech behind the structure

Here’s where things get a little more technical—but don’t worry, I’ll keep it simple. The ETF operates within a regulatory framework, yet still uses innovative mechanisms to stay closely tied to Bitcoin’s performance. Basically, it’s structured to comply with legal requirements while ensuring investors can directly benefit from what Bitcoin is doing in the market. This regulated approach lets traditional investors participate in what might otherwise feel like the uncharted waters of crypto.

One key thing: ETFs like this don’t physically hold all the Bitcoin they track. Instead, they use a structure that guarantees the performance mirrors Bitcoin prices as closely as possible. It’s a clever workaround to keep things both legal and efficient.

“Simplicity is the ultimate sophistication.” — Steve Jobs

When I look at the iShares Bitcoin Trust ETF, this quote comes to mind. Its genius lies in how simple it is to invest in Bitcoin through a familiar traditional finance setup, yet powerful enough to offer exposure to a digital asset that’s shaking up the world.

Now here’s the real kicker: If you think this is all there is to safety and functionality, think again. The next question might already be creeping into your mind—how safe is this? And what should you watch out for? Stay with me, because we’re just starting to uncover what you really need to know before taking the plunge.

Is the iShares Bitcoin Trust a Safe Investment?

Let’s be honest—when you’re putting your hard-earned money into anything, safety is the first thing on your mind. And when it comes to a Bitcoin ETF, the question of “How safe is this?” becomes even more critical. So, let’s break it down together.

Regulatory Safeguards

One of the biggest reasons people shy away from investing in Bitcoin directly is the lack of regulation. Scams, hacks, and 'rug pulls'—we’ve all heard the horror stories. But here’s the good news: the iShares Bitcoin Trust operates within a tightly regulated framework. This isn’t some shady back-alley crypto project; it’s legit and compliant with U.S. financial regulations.

In fact, the ETF itself benefits from being under the watchful eye of BlackRock, which already has a long-standing record of managing massive asset portfolios responsibly. And let’s not forget that its Bitcoin storage is handled by Coinbase Custody Trust Company, which is fully regulated and known to be a fortress when it comes to crypto security.

“Regulation gives confidence to investors—but let’s not forget, regulation doesn’t equal immunity from risks.”

Who’s Running the Show?

Let me tell you why this matters: when you invest in financial products, credibility goes a long way in making you sleep better at night. With BlackRock in charge, this isn’t like betting on an anonymous ICO or some trendy but fly-by-night blockchain startup. BlackRock has managed billions (even trillions) of dollars over decades, meaning they’re pros at playing the long game.

On top of that, companies like iShares Delaware Trust Sponsor LLC and Coinbase Custody bring even more layers of oversight to the table. It’s like having a team of financial bodyguards watching your investment. That’s a pretty big deal, especially if you’re new to crypto.

Risks Involved

It would be dishonest to say this is a “set it and forget it” type of investment. Bitcoin, by its very nature, is volatile. The value of your ETF investment will rise and fall with the price of Bitcoin itself. If you’ve watched Bitcoin’s story play out over the last few years, you already know—20% swings in a single day? That’s totally possible. And let’s be upfront: it’s not just Bitcoin’s price; regulatory changes or global market disruptions could throw a curveball.

But risk isn’t necessarily a bad thing. Some of the world’s best investment opportunities come from markets with higher risk. The iShares Bitcoin Trust ETF doesn’t eliminate market fluctuations—but it does take a lot of the uncertainty out of how your Bitcoin is stored, accessed, and regulated.

Now, this brings up a critical question: with BlackRock and Coinbase taking the wheel and regulations keeping things in check, does it make things completely foolproof?

A Question Worth Pondering...

If all the pieces are in place—regulated management, secure storage, and experienced oversight—what does it mean about who truly "owns" the trust and why that matters for your confidence? Let’s explore next.

Who Owns the iShares Bitcoin Trust?

Ownership—it’s a big deal when it comes to where you’re placing your money. Let’s unpack who the real players are behind the iShares Bitcoin Trust, because understanding this could be the reassurance you need to trust or rethink this ETF in your portfolio.

Key Players in the Game

BlackRock is at the core. Yes, we’re talking about the same BlackRock that manages trillions of dollars in assets globally. They are the entity managing the iShares Bitcoin Trust ETF. You might’ve heard of them in every major market conversation—it’s a financial powerhouse known for trust, regulation compliance, and straight-up reliability.

Backing BlackRock is iShares Delaware Trust Sponsor LLC, which acts as the sponsor for the fund. These entities are part of the finely tuned gears that ensure this ETF operates within a secure and regulated framework.

And then there’s Coinbase Custody Trust Company. This entity doesn’t just store the Bitcoin for the fund—it’s renowned for its top-tier crypto security. When you picture where the Bitcoin is held, imagine vaults guarded by the most advanced tech, all designed to keep every satoshi safe. Coinbase Custody is the kind of name that instantly makes you feel a little more comfortable about where the trust’s underlying Bitcoin is sitting.

Why Knowing the Owners Matters

Here’s a golden rule in investing: trust the team as much as the product. Because let’s face it—would you rather bank on an unknown entity or a project driven by some of the most respected names in finance and crypto?

- BlackRock: The confidence booster. They’ve been in the wealth management game for decades, so when they step into Bitcoin ETFs, it’s not on a whim.

- Coinbase Trust: A fortress for Bitcoin security. They’re not just a crypto custodian—they're the crypto custodian, endorsed by top players in the space.

- The partnership: You’ve got tradition meeting innovation. BlackRock brings its decades of expertise to the table, while Coinbase introduces top-level crypto mastery.

What This Means for You

So what’s the takeaway here? It’s simple: knowing who’s running the show should give you peace of mind. You’re not placing your funds into some mysterious black hole. These are established powerhouses with a lot riding on their reputation. If there’s a team to bet on in the world of Bitcoin ETFs, you could do a lot worse than this trio.

“In a world of uncertainty, trust is the currency that pays the highest dividends.”

And honestly, that’s exactly what this ETF seems to offer—an option for Bitcoin exposure with layers of trust built into its foundation.

Now… you’re probably wondering, with such strong backers, what lies ahead for this ETF? Will it truly deliver on its promise, or is it the next big gamble? Let’s take a look at the predictions and find out what the future might hold.

Predictions for iShares Bitcoin Trust’s future

Everyone loves talking about the future, right? Whether it's Bitcoin itself or ETFs tied to it, the buzz around price predictions can make or break investor confidence. Let’s see what’s brewing for the iShares Bitcoin Trust. Spoiler: some experts are quite optimistic!

Price forecasts

Let’s cut right to the chase—analysts are predicting that the iShares Bitcoin Trust ETF could see a massive growth potential in the short term. We’re talking about possible gains of over 70% in the next three months. That’s no small number. If these experts are right, the price could range between $87 and $105 during this period.

Is this just hype? Maybe not. Keep in mind that institutional adoption of Bitcoin has been climbing steadily, and products like the iShares ETF make it easier for big money to flow in. An ETF of this kind acts as a gateway, simplifying the process for traditional investors to enter the crypto world. This means more hands on deck, and potentially, more price action.

What experts say

Don’t just take my word for it—the pros are talking, too. Industry analysts and insiders have highlighted how Bitcoin ETFs like iShares could play a role in reshaping the broader crypto investment landscape. A report by Bloomberg Intelligence even stated that ETFs like this can help bridge the gap between “traditional finance and crypto,” which could accelerate mainstream adoption.

"A rising tide lifts all boats. With big players like BlackRock entering the game, the tide is coming in fast." —Crypto Industry Analyst

Translation: this isn’t just any small crypto experiment. This ETF has heavyweight backing from institutional giants who are shaping the future of digital assets in the mainstream financial world. Sure, prices may remain volatile, but there’s a sense of momentum here that’s hard to ignore.

Why predictions matter for investors

Here’s the thing—price predictions aren’t just for daydreamers who want to get rich overnight. They’re a strategic tool. Understanding what experts foresee gives you a chance to spot trends early, identify potential buying windows, or prepare yourself for the risks ahead.

Plus, with crypto, timing can be everything. Imagine hopping aboard when prices are on the lower end of the forecast and watching your investment ride the wave. As exciting as that sounds, don’t forget: Bitcoin and ETFs tied to it are still volatile, and forecasts, though helpful, are not guarantees.

So, the real question is: are these numbers exciting you, or making you cautious? Either way, you’re gearing up for a roller coaster ride. What’s the next step? To see if this ETF pays dividends or holds up its credibility—things that we’ll explore next. Curious yet? Let’s keep rolling!

FAQs about the iShares Bitcoin Trust ETF

Let’s tackle some of the most burning questions surrounding the iShares Bitcoin Trust ETF—the ones you've probably Googled more than once before landing here. Whether you're curious about returns, its legitimacy, or how to jump in, I've got you covered right here.

Does the trust pay dividends?

Let’s be real—if you’re hoping for a steady income stream from this ETF, it's best to manage your expectations now. No, the iShares Bitcoin Trust ETF doesn’t pay dividends. Its value comes directly from mirroring Bitcoin’s performance, which is all about capital appreciation rather than regular payouts.

Here’s an example: Think of it as planting a tree that grows fruit over time, but you can’t pick the fruit whenever you like. The value is in letting it grow. It’s more for those playing the long game or banking on Bitcoin’s price going up.

Is it legit?

A one-word answer would be: Absolutely. But let’s expand on that because trust (pun intended!) is everything in crypto. Backed by BlackRock—arguably the king of global asset management—this ETF operates within a strictly regulated framework. That means there’s oversight, accountability, and extra layers of security that you don’t get from unregulated crypto markets.

To put it plainly: “This isn't the wild west; it's more like well-paved roads with traffic laws.”

The involvement of companies like Coinbase Custody, known for their industry-leading storage practices, only reinforces that legitimacy. So yes, you can breathe a little easier knowing this is the real deal.

How do I invest?

If you’ve decided this ETF fits your strategy, investing is surprisingly straightforward. No need to open a crypto wallet or stress over private keys. You can invest in the iShares Bitcoin Trust ETF just like you would with a regular stock or mutual fund.

- Step 1: Open an account with a broker or investment platform that offers ETFs.

- Step 2: Search for the iShares Bitcoin Trust ETF by its ticker symbol or name.

- Step 3: Choose how many shares you'd like to buy based on your budget and strategy.

- Step 4: Place your order and voilà—you’re a Bitcoin ETF investor!

Pro Tip: If you're new to this, you might want to start with a fractional share or dip your toes in with a smaller amount. It’s an affordable way to get familiar with how ETFs work without diving in headfirst.

“The best time to start investing was yesterday. The second best time is today.”

Curious about more insights?

Questions like, "What’s the best way to keep exploring this ETF?" or "What other resources can help me feel more confident?"—I’ll guide you to must-have tools and info that might just level up your understanding. Ready to keep going?

Other Useful Resources for Deeper Research

Let’s face it—when it comes to understanding something as detailed as the iShares Bitcoin Trust ETF, you might still have questions or need to double-check the information. That’s totally fine. After all, the smartest investors know where to dig deeper. So, here’s a list of some killer resources you should have on your radar to get the bigger picture.

Where to Find More Information

If you’re serious about diving into the finer details and want the official word, some go-to sources are:

- BlackRock’s official page: They manage the iShares Bitcoin Trust ETF, so their website offers first-hand, reliable data. You’ll find clear insights about the fund’s structure, performance metrics, and updates straight from the source.

- SEC Filings: Since this ETF is regulated, keeping an eye on filings from the U.S. Securities and Exchange Commission ensures you stay informed about any compliance updates or fund-related announcements.

- Coinbase Custody Resources: Since Coinbase Custody handles Bitcoin storage for the ETF, their resources can give you an inside look at the security measures in place.

Bookmark these links—dissecting info from trustworthy platforms can save you from chasing misleading headlines or unreliable opinions.

Why You Should Check These Out

You don’t just want to rely on surface-level knowledge; you want to make your investment decisions backed by sources with authority. These resources provide information directly from the people and institutions involved in managing, regulating, or safeguarding the iShares Bitcoin Trust ETF. That’s a whole different level of confidence.

Think about it: You wouldn’t buy a car without thoroughly researching its features from the manufacturer, right? The same logic applies here. When your money’s on the line, checking the source is a no-brainer.

Now, here’s something to think about—how do all these details fit into your financial goals? The final piece of the puzzle is coming up. Let’s see how it all ties together in the next section!

Final Thoughts: Is the iShares Bitcoin Trust ETF for You?

Alright, let's bring it all together. Is the iShares Bitcoin Trust ETF the right fit for you? That’s the million-dollar question, and it really depends on what you’re looking for as an investor. Let’s break it down.

Weighing the Pros and Cons

First off, the upside is pretty clear: this ETF makes it super simple to get Bitcoin exposure. You don’t have to worry about setting up a crypto wallet, remembering private keys, or figuring out how to move funds between exchanges. For someone who’s been on the fence about crypto because it seems daunting, this could be a great entry point.

But don’t ignore the risks. Bitcoin is still as volatile as it gets. Even though the ETF is managed by big players like BlackRock, the value of your investment will largely depend on Bitcoin’s price movements, which can be a rollercoaster ride. If you’re not prepared to stomach sudden dips (and sometimes sharp rebounds), this might not be your thing.

For instance, in 2023, Bitcoin saw price swings of as much as 10% in a single day. Imagine holding an ETF tied to that kind of movement. Are you okay with that kind of risk? If yes, this ETF could be a golden opportunity for you. If not, you might want to explore alternatives or start with something less volatile.

Where It Fits in Your Portfolio

This isn’t one of those investments you toss in any portfolio and call it a day. It’s more like a specialty tool—it can work wonders for certain goals but isn’t for every scenario. If you’re already into stocks or other ETFs and want to sprinkle in some Bitcoin exposure, this could be a great way to diversify your portfolio. It offers a unique balance where you’re bringing in crypto without veering too far from traditional investment systems.

However, if you’re someone who prefers consistent, steady growth or relies heavily on dividends, this might not make sense for your strategy. Bitcoin doesn’t pay dividends, so the ETF doesn’t either. It’s more about growth potential here, and you'll have to decide if that's what you're after.

Take Action or Wait—Your Call

The beauty of investing is that the decision is yours. Now that you know how this ETF works, the risks, and what it offers, it’s time to ask yourself a few key questions:

- Do you believe in Bitcoin’s long-term growth?

- Are you comfortable with the ups and downs that might come?

- How does this fit into your overall financial goals?

If your answers align with what this ETF offers, it might be time to take action. Platforms like Fidelity, Robinhood, or your usual brokerage make it easy to get started. But if you’re still uncertain, there’s no harm in watching from the sidelines for a while. Keep an eye on Bitcoin’s price, see how this ETF performs, and jump in when (or if) it feels right for you.

At the end of the day, the iShares Bitcoin Trust ETF is a great stepping stone for traditional investors who are curious about crypto but not quite ready to dive into the deep end. Whether you’re all in or waiting to see how things shake out, one thing’s for sure—this product is paving the way for more crypto adoption in the world of traditional finance. And that alone makes it worth watching.