Coinspectator Review

Coinspectator

coinspectator.com

Coinspectator Review Guide: Should You Rely On This Crypto News Platform?

Have you ever found yourself lost in the crazy-fast crypto news cycle, desperately trying to keep up with all the latest trends, token prices, and market swings? I totally know that feeling — as someone deeply involved in the crypto world, it's a constant battle to filter out junk and find truly reliable info.

You're not alone if you're wondering about Coinspectator. It's become widely popular among crypto enthusiasts as one of those platforms that promises to ease your news-gathering burden and keep you ahead of the chaos. But is it actually as helpful as everyone claims?

Let me break this down for you step by step in my honest Coinspectator review. By the end, you'll have a clear picture whether this news aggregator is really worth your attention or just another platform adding noise in an already busy crypto market.

Why Finding Reliable Crypto Info Feels So Tough Nowadays

We all struggle with keeping our head above water when it comes to crypto news—and there's a strong reason why. Every single day, thousands of sources churn out endless cryptocurrency content aimed at capturing your clicks instead of providing real value.

- Misinformation is everywhere: According to studies, crypto-related misinformation on platforms increased by a staggering 500% over the past two years. That's a LOT of clutter.

- Clickbait articles dominate search results: Headlines screaming "This Crypto Will Make You Rich Overnight!" do little more than confuse traders searching for genuine investing insight.

- Marketing hype vs. genuine analysis: It's genuinely difficult to tell if the article you're reading provides honest insight or is just promotional fluff paid by a crypto sponsor.

All this chaos leads to confusion, frustration, and sadly—even losses for folks who just want clear-cut, trustable guidance in the unpredictable crypto market.

Why This Coinspectator Review Matters

Let's get honest for a second — you deserve platforms that respect your time and help you confidently navigate the crypto world. That's EXACTLY why I'm writing this Coinspectator review. My aim here is to help you cut through the noise and decide quickly if Coinspectator actually simplifies your crypto-investing life or just piles on more confusion.

Here's Exactly What I'll Cover In This Post:

- How Coinspectator functions as a crypto news aggregator platform (no techie jargon!)

- A closer look at the standout features you should know about

- Honest pros and cons that matter the most to serious crypto enthusiasts

- And above all—I'll answer the big question on your mind: Should Coinspectator become part of your crypto toolkit, or will it just clutter your bookmarks?

Ready to discover precisely what Coinspectator is all about, and if it can truly help simplify your crypto experience? Let's jump to the next section where we'll unpack exactly how this platform works stylistically and practically—it might just surprise you.

What Exactly Is Coinspectator and How Does It Work?

Have you ever scrolled endlessly through Twitter, Telegram groups, or various crypto-news sites, only to end up more confused than when you started? Trust me, I've been there. That's why platforms like Coinspectator are often recommended by fellow crypto investors. But what exactly does Coinspectator bring to the table, and how does it make tracking crypto news simpler?

"Knowledge is power. Information is liberating." – Kofi Annan

How Coinspectator Gathers Crypto News

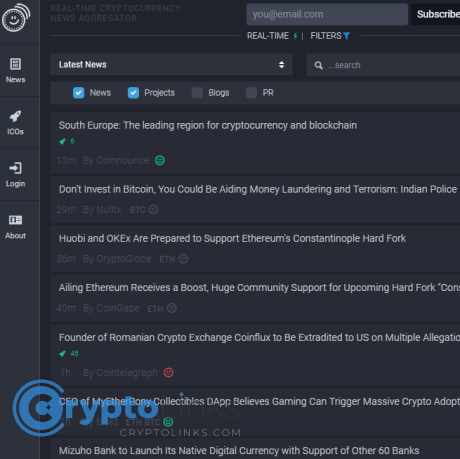

Coinspectator operates essentially like the Google News or Reddit of cryptocurrency, acting as a comprehensive, one-stop-shop aggregator. It scours the internet continuously, pulling crypto-specific news headlines and articles from many respected and widely-used sources such as CoinDesk, CryptoSlate, and Cointelegraph. Basically, it does all the hard work so you don't have to.

The benefit here? Instead of navigating dozens of open tabs and sifting through piles of updates, everything flows neatly into a single feed. It's organized, current, and convenient enough that it might seriously change your research routine. According to a survey by Reuters Institute, nearly 60% of investors prefer using aggregated feeds precisely because it saves time and reduces stress, something we can all appreciate in such a fast-paced, sometimes crazy crypto world.

Customization and Personalization Features

Another element I found especially interesting is Coinspectator's ability to seamlessly cater to your unique investment interests and habits. The platform allows you to customize your newsfeed through intuitive filtering features. Imagine only showing content about Bitcoin and Ethereum—or maybe you are hunting for news about altcoins or specific DeFi projects? With Coinspectator, that's quick and easy.

This targeted set-up significantly cuts down the noise and helps you keep focused on exactly what's important to your strategy, whether you're a conservative investor or a bullish altcoin trader.

Real-Time Updates, Live Feed, and Alerts

Let's be honest: Speed matters immensely in crypto trading. Coinspectator delivers by continuously refreshing its live feed, which means you're always getting the latest crypto news as it's published across multiple sources. If a token just got listed on a big exchange, or Elon Musk tweeted something groundbreaking (again!), you'll hear it first on Coinspectator.

The platform even offers timely push notifications and alerts. Did you know faster news consumption correlates highly with better trade timing? According to a Bloomberg report, investors leveraging real-time feeds secure more advantageous positions and outperform slower-responding traders.

But hang tight—does Coinspectator have the easy-to-use interface and insightful social sentiment analysis that crypto traders desire? Let's uncover that next, to see if it's truly worth your precious time.

Coinspectator's Best Features You Should Know About

Let's face it—the crypto world moves fast, and a site needs certain standout features to help you keep pace. When I first checked Coinspectator, a few things stood out immediately. So let me quickly share with you those features that genuinely helped me stay ahead of the curve.

Intuitive Interface and Easy Navigation: Crypto Simplicity at Its Best

Nobody wants a headache from complicated websites, especially in cryptocurrency where timing truly matters. From the moment I opened Coinspectator, I noticed the design is straightforward and clean. You don't have to scroll endlessly or battle pop-ups just to find the news you're after. Everything is presented neatly—new headlines at the top, and convenient filters to narrow down to exactly what sparks your interest.

- Clean Dashboard: Headlines are easy-to-read and organized chronologically, freeing you from the cluttered feeling many news aggregators bring.

- Rapid Onboarding: Even if you're brand-new to crypto investing, you won't feel intimidated or lost by Coinspectator's layout. It's refreshingly beginner-friendly, with clear navigation menus.

"Design is not just what it looks like and feels like. Design is how it works." – Steve Jobs

This quote couldn't be more fitting. Coinspectator genuinely nails "how it works," making trading or investing decisions smooth and frustration-free.

Wide Range of Sources Means Wider Crypto Insights

One standout I appreciated about Coinspectator is the diverse sources of news it compiles. You'll find trusted crypto giants like CoinDesk, Cointelegraph, Bitcoin Magazine, and even smaller crypto blogs and forums providing valuable niche insights. Trust me: Having this level of breadth saves so much time vs. hopping between a dozen tabs trying to keep up.

- Less Time Searching: Coinspectator draws in quality content from multiple trusted crypto sources to give you a fuller perspective, fast.

- Trusted & Reliable: No more worrying about misinformation—Coinspectator consistently pulls from respected voices in crypto news and analysis.

Research from Nielsen shows 92% of consumers trust recommendations from multiple credible sources over a single site. By collecting information from different reputable crypto news outlets, Coinspectator helps you make more confident investment decisions.

Social Sentiment and Trending Crypto Topics: Know What's Hot, Before It's Hot

Here's a magic feature I personally enjoy: Coinspectator doesn’t just show news—it also tracks what people think about different cryptocurrencies. With sentiment tracking features, you see social media and public consensus shifts quickly. You’ll know if excitement around a coin is spiking, enabling better-informed trades and spotting trends early on.

- Real-Time Sentiment: Quickly gauge investor temperament—are people bullish, bearish, or neutral on a project?

- Trending Crypto Insights: Spotting emerging trends or coins getting unexpected attention as early as possible means major upsides on potential investments.

Think about Dogecoin in early 2021—social sentiment was buzzing weeks before prices soared. With a tool like Coinspectator, catching those pre-hype signals before the masses do could mean big advantages in your crypto plays.

These carefully crafted features are no accident—they're specifically designed to ease your crypto journey and sharpen your edges as an investor. But as good as these highlights are, is there perhaps a downside you should be wary of? Could Coinspectator's benefits actually become your crypto investing bottleneck? Keep reading; I'm about to reveal something you'd never saw coming in the next section.

What Are the Downsides of Using Coinspectator?

I promised transparency from the start—so let's honestly discuss a few drawbacks I've noticed when using Coinspectator myself. Even the best crypto tools aren't perfect, and recognizing those imperfections helps us make smarter decisions in this fast-moving market.

Information Overload Potential

Ever heard the phrase "Too much of a good thing?" Well, Coinspectator runs into this problem at times.

Because Coinspectator pulls from dozens of crypto news websites simultaneously, your feed can quickly become cluttered, especially during rapidly moving market events. A 2022 study by researchers at Stanford found that excessive data exposure actually reduces investor decision-making quality rather than improves it. Receiving countless headlines every hour might sound great—until you find yourself mentally exhausted, losing track of what's relevant or missing genuinely important news amidst the noise.

Personally, I've experienced moments when the sheer volume of headlines made trading or investing harder instead of simpler. To counteract this, you need excellent filtering skills or carefully adjust Coinspectator settings, otherwise, you may end up feeling overwhelmed rather than enlightened.

Lack of Original Analysis

Another weak point is Coinspectator's limited original commentary or deep market analysis. Because it mainly aggregates news rather than creating its own content, you won't find unique insights or thorough analyses from their own dedicated crypto experts.

"An aggregator gives you bits and pieces—but deep analysis turns those bits and pieces into gold." – Crypto analyst, Simon Carter

If you're someone looking for in-depth crypto analysis to genuinely understand market behavior, Coinspectator alone may leave you feeling unsatisfied. It lacks articles or thoughtful commentary that break down complex crypto topics, relationships, or trends—which is something many dedicated crypto investors say they value highly when researching investing decisions.

Limited Depth of Information

While quick updates and headlines can keep us informed, they often lack context or details crucial for quality investing decisions. For instance, a headline like "Ethereum network upgrades completed" doesn't tell me the full story. What were the actual changes? How will those affect transaction costs or cryptocurrency prices? Coinspectator frequently leaves you needing more clarity or richer context, which specialized crypto sources or detailed blogs like mine ensure readers always receive.

I often find myself needing to click several links to external sources to get a full understanding—easily disrupting the workflow.

This limited detail might be a non-issue for experienced crypto insiders already following the market closely. However, newer investors looking to understand crypto thoroughly could quickly feel lost or disappointed when essential context or specifics aren't readily available.

Now, here's the million-dollar question to keep you engaged—How can you still ensure you're extracting maximum value from such an aggregator like Coinspectator, despite these shortcomings? Stick around—I’ll answer exactly that next!

Getting Value Out of Coinspectator as a Crypto Investor

You and I both know crypto moves fast—blink and you might miss out! That's precisely why leveraging Coinspectator the right way can help you stay sharp in a quickly evolving market.

Identifying Market Movements Fast

Timing in crypto isn't just important; it can dictate profit or loss. Coinspectator's real-time news updates ensure you're never late to the party. Think back to when Elon Musk first tweeted about Dogecoin—it wasn't mainstream news immediately, but I remember seeing it pop up fast on my Coinspectator feed. Investors using this platform got the information early enough to jump in before others caught wind of the buzz.

According to a recent investor study, being among the first 10% of people aware of a potential cryptocurrency trend could significantly impact your returns. Coinspectator brings you this edge by feeding you crucial market movements seconds after they're reported.

News Feeds for Trade Decisions

Using Coinspectator isn't just about news consumption; it directly helps shape smarter trade decisions. By following their concise headlines and trending stories, you're essentially getting actionable data. I personally use this real-time feed as part of a bigger investment checklist:

- Quickly glance at headlines to spot breaking news or announcements.

- Check deeper if it's relevant enough to move a market.

- Act swiftly based on careful verification and my trading strategies.

A reliable news aggregator like this means you won't end up trapped trading on old or sketchy intel. Your trading decisions become confident and timely rather than guesswork-driven.

Keeping Tabs On Market Sentiment

Investor sentiment matters far more in crypto than traditional markets because cryptos heavily depend on community perception. Coinspectator’s built-in social sentiment analytics let you tap directly into investor emotions.

Remember the sudden hype around Shiba Inu token last year? Those plugged into sentiment data quickly recognized the positivity among the community way before headlines shouted it everywhere. That kind of emotional pulse-checking puts you a step ahead. Numerous studies confirm sentiment analysis has a measurable impact on crypto markets and price action. Coinspectator brings this invaluable emotional gauge straight to your fingertips.

"Your success in crypto isn't just about technical talent or market knowledge—understanding market sentiment lets you see invisible opportunities others overlook." - Anonymous professional crypto trader

Using these targeted insights from Coinspectator, you'll know precisely how crypto communities feel—optimistic, fearful, skeptical, or excited—letting you seize perfect moments to trade or step back a bit.

Ready to take your crypto awareness to the next level? Do you wonder what golden crypto investing principles top experts swear by? Well, keep reading—I'll answer your crucial questions next!

Frequently Asked Questions about Crypto Investing (Answered!)

Let's hit pause for a moment on the Coinspectator review—I want to talk directly to you about some of the most burning questions my readers often ask about cryptocurrencies. I've learned that simplifying complex things can give you priceless clarity—so here are answers you really don't want to miss.

What's the Golden Rule of Investing in Crypto?

Legendary investor Warren Buffett once said:

"Be fearful when others are greedy, and greedy when others are fearful."

Jon Najarian, seasoned investor and co-founder of Market Rebellion, agrees by highlighting the exact same advice for crypto:

- Buy during times of market fear when people panic and prices are dropping. These are discount opportunities.

- Avoid getting swept up in the hype when everyone else is euphoric—by then you're probably too late.

Which Cryptocurrencies Are Most Recommended?

While it's impossible to predict the future, leading experts from trusted exchanges like ZebPay and crypto-focused investors often highlight a few strong contenders:

- Bitcoin (BTC): Still the flagship crypto asset and considered a solid "store of value."

- Ethereum (ETH): Often called the backbone of decentralized apps and smart contracts.

- Cardano (ADA): Praised for its rigorous academic approach, eco-friendliness, and reliable smart-contract platform.

- Binance Coin (BNB): Popular among traders offering reduced fees and widening utility in DeFi.

Not to push you one way or the other—but in any portfolio, diversity is your best ally. So spread your investment across different solid projects instead of chasing hype.

What's Basic Cryptocurrency Knowledge Worth Knowing?

When you're just getting started, the crypto world can feel overwhelming—I totally get that. Resources like courses offered by Coursera simplify crypto basics perfectly. Here are core concepts every newbie should know:

- Blockchain: The decentralized database technology behind cryptocurrencies—safe, secure, transparent, and irreversible.

- Mining: The consensus process used to verify and add transaction data into the blockchain. Miners earn crypto rewards for their efforts.

- Wallets: Tools where you securely store your cryptocurrencies. Think of these like secure bank vaults.

- Exchanges: Platforms where crypto assets are bought, traded, and sold.

Understanding these four pillars gives you a clear foundation for smart, stress-free crypto investing.

What's the Single Best Crypto Advice?

Investopedia offers one timeless piece of crypto advice we've all heard—but far too many fail to truly follow:

"Only invest what you are comfortable losing."

This simple advice packs serious wisdom: Aim for gains, but emotionally prepare for volatility. Keep your crypto investments manageable and always secure your digital assets carefully. That way, price fluctuations won't disrupt your peace of mind or your financial well-being.

Wondering how Coinspectator holds its own among competing platforms like CryptoPanic or Cointelegraph? Keep reading—I'll answer that exact question in the section below.

Are There Similar or Better Crypto-News Platforms to Consider?

Before fully committing your crypto-news routine to Coinspectator, let’s quickly see how it compares with other popular crypto news platforms. After all, every great investor knows the value of keeping their options open.

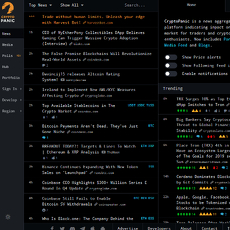

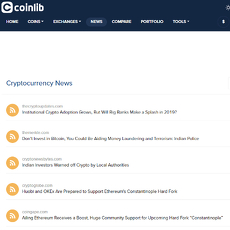

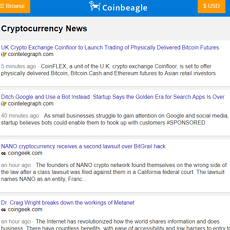

Comparing Coinspectator to Platforms Like CryptoPanic and Cointelegraph

Coinspectator isn’t the only game in town when it comes to quick crypto news aggregation. Let's compare it with two heavyweights you might already know: CryptoPanic and Cointelegraph.

- CryptoPanic: CryptoPanic has gained popularity for its ultra-minimalist, distraction-free interface and strong integration with social media sentiment. Unlike Coinspectator's more visually rich layout, CryptoPanic's clean style appeals to traders who prefer pure, rapid-fire information. On the downside, CryptoPanic’s design can feel a bit intimidating to beginners looking for clarity.

- Cointelegraph: This isn’t an aggregator; it’s an original news content publisher focused specifically on crypto. If you're after deeper insights or opinion pieces about blockchain technology and market analysis, Cointelegraph provides these firsthand reports. But you sacrifice instant headline aggregation, so checking different sources will become necessary for quick updates.

So, How Does Coinspectator Stack Up Overall?

“Information isn't power. Information is only potential power. Action is power.” — Tony Robbins

Coinspectator shines at saving users from the hassle of checking numerous crypto news sites individually. Its strength lies in delivering crisp, aggregated headlines from dozens of platforms in real-time, perfect for any investor who needs fresh data quickly. However, it lacks original, deep-dive articles and market analysis you'd find at Cointelegraph or similar specialized sites.

If quick snapshots and real-time social tracking capture your attention, Coinspectator could be your mainstay. But realistically, for deeper research and analysis, you'll probably still want supplementary sources.

Maybe you’re wondering right now: “If I have Coinspectator, what resources should I pair it with to cover all my crypto-investing bases effectively?”

Don’t worry—I’ve got you covered. Keep reading because next I'll share handy resources from my crypto-toolkit that work seamlessly alongside Coinspectator to boost your success as a crypto investor.

Additional Helpful Crypto Resources You Shouldn't Miss

While Coinspectator does a solid job of keeping your finger on the crypto news pulse, let's talk about some extra crypto resources you'll definitely want in your toolkit. As a long-time crypto fan, I've bookmarked quite a few key resources that seriously boost my investing effectiveness—and I think you'll find them immensely helpful as well.

Useful Crypto Resources Worth Bookmarking

You're probably wondering—what else do I need besides Coinspectator to become a savvier investor? Glad you asked! Here are several top-notch resources trusted by crypto beginners and veterans alike:

- Crypto News Portals: Platforms such as CoinDesk, Cointelegraph, and The Block provide deep analyses, breaking news, and exclusive insights. Pairing Coinspectator’s quick pulse on trending topics with detailed breakdowns from these sites can give you the perfect crypto information blend.

- Crypto Forums and Communities: Resources like Reddit’s r/CryptoCurrency, BitcoinTalk, or Telegram groups can enrich the way you follow market sentiment and spot hidden insight gems before they go mainstream. After all, sentiment-driven trades can sometimes offer great entry points based on community signals.

- Portfolio Trackers and Tools: Apps and services such as CoinTracking, Blockfolio, or Delta make life easier by letting you easily manage and track your crypto assets in real-time. Keeping clearer visibility of your investments can significantly reduce stress and boost confident decision-making.

- Crypto Educational Platforms: Coursera and Binance Academy offer fantastic cryptocurrency courses you can complete at your own pace. From beginner fundamentals to advanced blockchain strategies, these courses help sharpen your knowledge, helping you outsmart the crypto hype.

- Secure Crypto Wallets: You can't stress enough the importance of keeping your digital assets safe. Trusted wallets like Ledger, Trezor, or MetaMask add essential layers of security that every responsible crypto holder needs in today's unpredictable online landscape.

Combining Coinspectator’s live news alerts with these resources can genuinely level up your crypto investing game. Want to learn if Coinspectator alone is enough or if you'll need to mix-n-match multiple sources to get the most accurate crypto outlook? Great question—and that's precisely what we'll tackle next!

Final Verdict: Should You Rely On Coinspectator?

Alright, you've reached the end of my thorough Coinspectator analysis—and here comes the moment you've been waiting for: Is it worth adding Coinspectator to your trusted crypto resources?

Who Benefits Most from Coinspectator?

Coinspectator works best if you're the type of crypto enthusiast who thrives on being first to know what's happening in the market. If you're trading frequently, chasing short-term profits, or just prefer your finger firmly on the crypto pulse with instant headlines, Coinspectator could become your go-to source.

The site's real-time updates and trending-topic features genuinely deliver rapid value. Day traders or investors who rely heavily on brief, instant updates to capitalize on market volatility are going to appreciate Coinspectator's fast-paced aggregation.

Key Things to Keep In Mind Before Using Coinspectator

Before you jump right in, keep in mind:

- It’s a Quick-Scan Platform: Coinspectator aggregates short headline-style news rather than providing in-depth analysis or context. Don't rely on it alone when making important, deep-dive decisions.

- Information Overload is Real: The rapid-fire news stream can easily become overwhelming, so use customization options carefully and keep your feed manageable.

- Confirmation Bias Risk: Coinspectator’s trending sentiment can influence your thinking—be aware of herd mentality. Always double-check important info with trusted analytical sources.

Understanding these considerations first will significantly boost how effectively you can tap into Coinspectator.

My Personal Recommendation & Thoughts

Speaking personally as the owner of a comprehensive crypto review site, Coinspectator does hold real value—if used correctly. I've personally found it incredibly helpful for quickly scanning what's currently buzzing and catching the market sentiment at a glance. I find myself frequently using it alongside more analytical, detail-rich resources, rather than exclusively.

Honestly, there are days when fast-moving headlines have tipped me off early on trending coins. For instance, I was able to spot momentum building around certain smaller altcoins that were suddenly breaking news. This allowed me to run my own research quickly enough to make timely moves before wider market awareness took hold.

If I had one recommendation, though, it would be for Coinspectator to incorporate just a little more original expert commentary or deeper analyses alongside headlines. A smart integration of curated insights would greatly increase the value, preventing users from having to bounce constantly between sites for the big picture.

Wrapping It Up: Is Coinspectator Worth It? (Conclusion)

To wrap things up clearly and definitively—yes, Coinspectator does deserve a spot in your crypto bookmarks, especially if staying ahead with instant news is crucial for your investing style.

However, it truly shines when complemented with deeper analytics or expert insights from trusted resources such as those I recommend regularly on Cryptolinks. Make Coinspectator part of a wider toolset rather than your sole information source, and you'll maximize your chances to succeed in the volatile yet highly rewarding crypto market.

After all, smarter investing comes down to preparing yourself with the right combination of timely news, impactful insights, and disciplined decision-making. Coinspectator can definitely play a valuable role in that combination.