Decentralized Exchanges: The Rise of Uniswap and Others

Navigating the labyrinth of cryptocurrency exchanges can be daunting, with traditional platforms often giving traders a rough ride through exorbitant fees, security worries, and invasive KYC procedures. It’s enough to make anyone yearn for a breath of fresh air. Enter the revolutionary world of Decentralized Exchanges (DEXs), where the winds of change are blowing fiercely. These platforms promise a trading evolution, slashing costs, bolstering privacy, and giving power back to you, the user. Among these market disruptors, Uniswap takes the limelight, but it is certainly not alone. Get ready to explore how these DEXs are shaking up the status quo and why traders are flocking to them in droves.

Ever found yourself scratching your head, pondering which decentralized exchange (DEX) might be the true trailblazer in the ever-evolving crypto space? Or maybe you’re curious about why DEXs are gaining such momentum in an industry already packed with trading options. If so, you’re in the perfect spot to quench that thirst for knowledge.

The Challenges of Traditional Exchanges

It’s not exactly breaking news that traditional exchanges come with their fair share of headaches. Let me paint you a picture with some real-life pain points:

- High fees: Ever felt the sting of outrageous trading fees? Traditional exchanges can often leave a gaping hole in your digital wallet.

- Security concerns: Hacking scandals hitting the headlines ring a bell? That’s the nightmare scenario for traders on centralized platforms.

- Lack of privacy: Ever feel like you’re trading in a glass house? Traditional platforms often require intrusive know-your-customer (KYC) measures.

A New Era of Trading: Decentralized Exchanges

Enter the era of DEXs – a beacon of hope innovating the trading experience. These platforms are sprouting up like wildfire, offering solutions that turn the old exchange model on its head. What’s their secret? They allow peer-to-peer trades directly, and that’s just the beginning. Here’s a quick glimpse into the DEX revolution:

- Lower fees: Goodbye hefty cuts on your trades. DEXs typically offer a more cost-effective structure, keeping more coins in your pocket.

- Better privacy: No more oversharing. Engage in trading without dishing out your life story.

Impressed yet? It’s hard not to be when you consider how DEXs are redefining the face of crypto trading. Intrigued by which exchanges are leading this charge? Stay tuned – that revelation is just around the bend.

Leading the Pack: Uniswap and Other Stellar DEXs

When it comes to decentralized exchanges, Uniswap has rapidly become a household name. Its user-friendly interface and extensive pool of ERC-20 tokens make it a go-to choice for crypto enthusiasts. Yet, it’s not the only player on the field. Other DEXs like PancakeSwap, Curve, 1inch, and dYdX are also making waves, each contributing to a robust ecosystem that champions the ethos of decentralization.

Understanding Different Types of DEXs

The realm of decentralized exchanges is as diverse as it is innovative. Here’s a peek into the variety that’s shaping the trading landscape:

- Automated Market Makers (AMMs): Pioneered by the likes of Uniswap, they eliminate the need for order books, instead using mathematical formulas to price assets.

- Order Book DEXs: These platforms take a page from the traditional exchange playbook and match buyers with sellers, usually in a trustless manner.

- DEX Aggregators: By scanning multiple DEXs, aggregators find the best trade prices and can split orders across platforms to minimize slippage.

Each of these DEXs serves a distinct purpose and caters to different preferences within the crypto community. But how do we sift through the choices to find the one that matches our trading style and need for security? That’s the big question.

Comparing Top DEXs

When you hear about the success stories of seasoned traders, realize that their choice of platform plays a crucial role. For instance, let’s take Uniswap’s non-custodial trades, which give investors full control over their funds. Or look at PancakeSwap’s low fees on the Binance Smart Chain, serving as a beacon for cost-conscious users. dYdX, on the other hand, might attract those looking for a decentralized leverage trading experience.

“In the ever-evolving crypto ecosystem, the only constant is innovation.”

Finding the golden thread that connects successful crypto trading experiences often takes us back to the platforms they use. Think you might favor a DEX that streamlines the process with an easy-to-navigate interface, or would you prefer one with a treasure trove of advanced features?

In the end, it’s not just about the platform’s features… it’s also about the vibrant communities that rally behind these DEXs, each of them building a piece of the decentralization dream.

Curious about how these innovative platforms are overcoming traditional trading challenges and what sets them apart in the eyes of crypto connoisseurs? Stay tuned, as we’ll delve into the inner workings of Uniswap and walk through a hands-on trading experience that could redefine the way you think about crypto exchanges.

Trading on Uniswap: A Case Study

Uniswap has emerged as a colossus in the realm of decentralized exchanges (DEXs), unlocking a world of ERC-20 tokens for individuals eager to navigate the Ethereum blockchain. Here’s a glimpse into this lionized platform’s operation.

How to Get Started with Uniswap

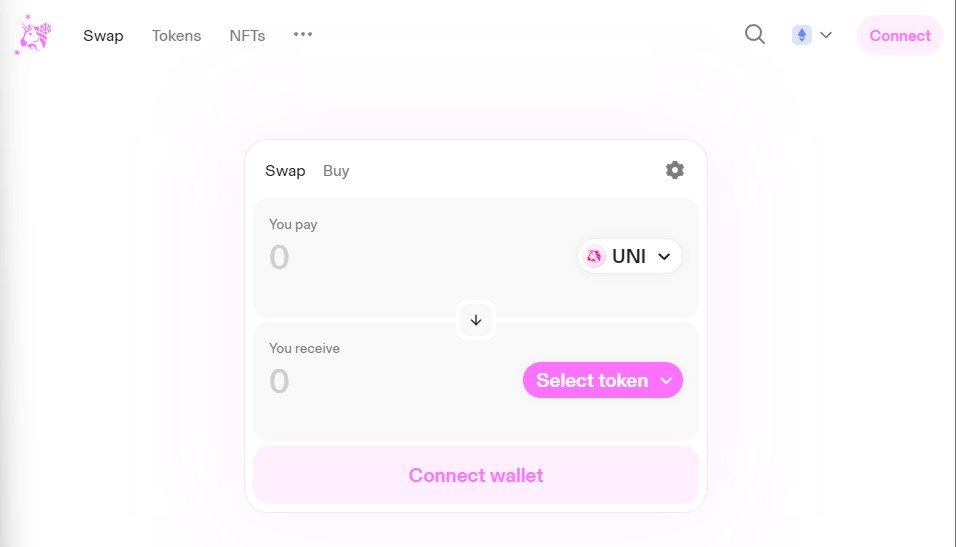

Embarking on your Uniswap journey is simpler than you might envision. The user-friendly nature of the platform means that bullish rookies and bearish veterans alike can start trading with a few straightforward steps:

- First things first, you’ll need a wallet compatible with Ethereum, like MetaMask or Trust Wallet.

- Connect your wallet to the Uniswap interface.

- Make sure you have some Ethereum to handle transaction fees (yes, gas fees are still a thing).

- Select the tokens you want to swap, and voilà—execute your trade with confidence.

Uniswap Features and Benefits

What’s the secret behind Uniswap’s ascent to the throne? It boils down to a blend of features that ensure a seamless user experience:

- Peer-to-peer swaps without an intermediary? Check.

- A constantly growing pool of tokens? Absolutely.

- Liquidity provision opportunities with earning potential? You bet.

And that’s just scratching the surface. Uniswap’s simplicity, combined with its Automated Market Maker (AMM) system, is a fresh air gust in the crypto ecosystem.

“Innovation is the calling card of the future.” – Now, this resonates deeply when we observe Uniswap’s dance with blockchain technology.

We’ve explored the bedrock of starting off with Uniswap and its juicy features. But perhaps you’re mulling over what could be the downsides or limitations. Rest assured, there’s more to dissect on that front.

How might changes in the blockchain landscape impact platforms like Uniswap? And what innovations could they potentially employ to stay ahead of the curve? Keep your curiosity piqued, as we’re not done unraveling the tale of decentralized exchanges.

Exploring the Horizon of Decentralized Exchanges

In the ever-evolving landscape of cryptocurrency trading, decentralized exchanges (DEXs) have carved out a niche that continues to burgeon with promise. The all-important question looms on the horizon: Could these platforms herald the end of traditional exchanges as we know them?

The Regulatory Maze and DEXs

As we venture further into the realm of DEXs, it’s impossible to ignore the shadow of regulatory scrutiny that dances around their periphery. It’s a world where innovation races ahead, but the clutch of regulation is never far behind.

- How will DEXs navigate the complexities of international financial laws?

- What mechanisms will they implement to ensure compliance while preserving user autonomy?

- Can they withstand the pressure and continue to operate with the freedom that has so far been their hallmark?

These are not just hypothetical scenarios; they are very real challenges that will shape the trajectory of DEXs. Take, for example, the case of decentralized finance (DeFi) lending platforms encountering the cautious gaze of regulators. It’s a delicate tango between innovation and oversight, and the steps they take next could set a precedent for DEXs at large.

Staying a step ahead of these challenges, some DEXs are proactively engaging with regulatory bodies, seeking a middle ground that satisfies both the call for regulation and the ethos of decentralization. A proactive mover in this arena can illustrate how the future might unfold for others.

“Innovation is the calling card of the future; regulation ensures it reaches us safely.”

Such sentiments resonate with market participants who see regulation not as a hurdle, but as a necessary evolution, ensuring a stable and secure trading environment.

Are we then witnessing the gentle ebb of centralized power, giving way to a more democratized trading ecosystem? The game is on, with DEXs crafting novel approaches to privacy and autonomy while keeping the gatekeepers of regulation in the loop.

So, as we bridge the gap towards the subsequent chapter of our discussion, let’s ponder – will the push and pull of regulations and the innovative spirit of decentralized exchanges find a harmonious balance? Stay tuned as we navigate this intricate dance and uncover the potential that lies in the balance.

But don’t let the suspense stop here; there’s more to delve into. What resources could further illuminate this path? Keep reading, for the answers await as we bridge the gap between curiosity and knowledge in the next segment.

Resources for Further Learning

The world of decentralized exchanges is fascinating, complex, and constantly evolving. For those eager to dig a bit deeper and expand their knowledge, there are a plethora of resources available that can illuminate the intricacies of DEXs and their impact on the crypto landscape. Here are some hand-picked, comprehensive materials for you to explore:

Helpful Academic Resources

For a scholarly take on the subject, the following academic papers offer deep analyses and insights:

- An informative piece titled “An Empirical Analysis of Decentralized Exchanges” sheds light on the performance and issues encountered by DEXs. You can dive into the research here.

- Interested in the strategic trends and future outlook of decentralized finance? This whitepaper is a gold mine of forward-looking statements and predictions.

- The game-changing role of Automated Market Makers in the finance industry is meticulously discussed in this journal article. It’s a must-read for enthusiasts wanting to understand the mechanics at play.

Understanding DEXs on Binance

If you’re looking for more practical insights, consider this detailed blog post by Binance that simplifies the concept of DEXs for the everyday reader. It’s a treasure trove of information, straight from one of the leading cryptocurrency exchanges in the world. Check out the full post here.

How DEXs are changing the Crypto Landscape

Think about the last time you wanted to swap a token on a whim or engage with a new digital asset – how did you do it? For many of us in the crypto space, decentralized exchanges (DEXs) are rapidly becoming our go-to venues for such activities. The landscape of crypto trading is evolving, and DEXs are at the heart of this transformation, enabling a degree of autonomy that was previously unimaginable.

Adopting DEXs: Challenges and Opportunities

When we talk about adopting DEXs, it’s a double-edged sword. On one hand, these platforms offer us freedom from centralized authorities, lower fees, and anonymity. But let’s not gloss over the hurdles either. User experience can be a bit clunky, there’s a learning curve for beginners, and there can be liquidity issues. Yet, it’s this same grass-roots, organic trading environment that’s nurturing innovation and community-driven finance – think liquidity mining and yield farming, which have opened doors to new forms of earning in the crypto ecosystem.

It’s not all about speculation, though. Real-world use cases are sprouting up, signaling a maturing market. Artists and musicians are using DEXs to trade NFTs, while developers are exploring ways to use them for decentralized finance (DeFi) services. And as regulation tightens around centralized platforms, DEXs stand as bastions for those prioritizing privacy and fewer restrictions.

Wrapping It Up

As we watch the rise of platforms like Uniswap, with its intuitive interface and a vast array of ERC-20 tokens, it becomes increasingly clear that DEXs are not just a passing trend. They’re spearheading a trade revolution, inviting both novice and seasoned traders to experience the freedoms and flexibilities of decentralized markets. Users are no longer mere participants; they’re taking on significant roles as liquidity providers and governance voters, actively shaping the very platforms they’re trading on.

This shift towards decentralized trading isn’t just a blip on the radar. It’s carving a lasting imprint on the crypto sphere, empowering individuals, and reinforcing the ethos of what cryptocurrencies were built upon – an unhindered, decentralized financial system. The journey of DEXs is far from over; it’s an exciting time to be a part of this evolving narrative, where the ultimate benefactor is the individual trader, equipped with the tools for a self-sufficient and more democratic trading environment.

So, whether you’re a crypto rookie ready to make your first token swap or a veteran aiming to maximize decentralized finance strategies, the burgeoning world of DEXs has something for everyone. Adaptability is key, and with the rapid innovations in this space, who knows what the next chapter will reveal? One thing is for certain – the crypto trading landscape will never be the same again, and DEXs will have played a pivotal role in that change.