Bitcoin versus Bitcoin SV: Which is the Real Bitcoin? – Differences Explained and the Truth Revealed

Is Bitcoin SV the “real” Bitcoin? Or does Bitcoin, the original cryptocurrency, still hold the crown? If you’ve been following cryptocurrency, you’ve probably heard the debates, the controversies, and the heated arguments about these two coins. But what’s really going on here?

The Bitcoin vs. Bitcoin SV debate isn’t just noise; it’s a clash that touches the heart of what cryptocurrency stands for. With both coins claiming to carry the “true vision” of Satoshi Nakamoto, it’s easy to get lost in the storm of arguments, technical talk, and bold claims. Why does this matter? Because confusion in crypto isn’t just frustrating—it’s risky. It influences where your money goes, what technology you trust, and how you see the future of decentralization. If you’ve ever felt unsure about which path to follow or who’s telling the truth, you’re not alone. Understanding these differences isn’t about picking sides—it’s about making smarter, more informed decisions in a world that’s already complicated enough. This isn’t just a fight over coins; it’s a battle over principles, innovation, and the future of blockchain itself. Let’s cut through the noise and make sense of it all.

The crypto space is filled with buzzwords, bold claims, and technical jargon that can sometimes feel overwhelming. Whether you’re a seasoned investor or someone just curious about the whole Bitcoin vs. Bitcoin SV debate, it’s time to clear the fog and get to the bottom of it all. So, let’s start with what the fuss is all about and why understanding this showdown matters more than you think.

Why This Matters: The Confusion Around Bitcoin and Bitcoin SV

Bitcoin isn’t just the world’s first cryptocurrency—it’s a symbol of decentralization, financial independence, and blockchain innovation. But since its early days, arguments about what Bitcoin truly represents have triggered heated divisions within the community, especially after controversial forks like Bitcoin SV (BSV) came along. You might be wondering: does it even matter which one is the “real” Bitcoin? Here’s why it does.

When confusion like this surrounds a cryptocurrency, it goes beyond online arguments. It impacts wallet compatibility, transaction reliability, investment confidence, and even the long-term future of blockchain technology. Understanding the distinctions isn’t just about picking sides—it’s about protecting your own knowledge and investments as the crypto world continues to grow.

The Pain Point: What Happens When Forks Divide Users?

What happens when a single cryptocurrency splits into multiple versions, each claiming to stay true to the original vision? It creates confusion among users, divides entire communities, and introduces risks for investors. After all, if you can’t tell what’s genuine and what’s not, how do you navigate decisions in a rapidly evolving market?

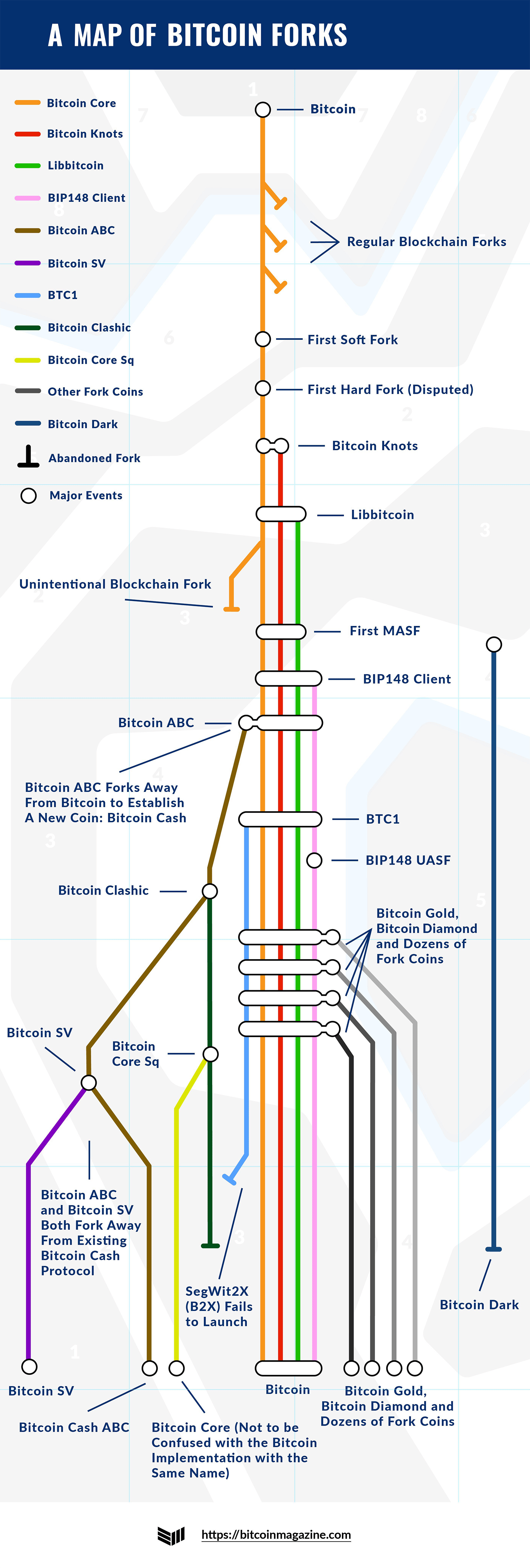

A perfect example of this is when Bitcoin Cash (BCH) forked off from Bitcoin in 2017. Shortly after that, another split occurred, giving birth to Bitcoin SV. Each fork leads to new factions, new claims, and, of course, confusion for regular crypto enthusiasts just trying to stay informed. Now BTC and BSV aren’t just different coins—they’re representations of two competing ideologies. But how did such forks come about in the first place? (We’ll get into that soon!)

The Goal: Get Clarity (Once and for All!)

Here’s the kicker: the Bitcoin vs. Bitcoin SV debate isn’t just about what these coins can do—it’s about understanding which one aligns closer to the original principles laid out by Bitcoin’s mysterious creator, Satoshi Nakamoto. By untangling the differences between these two coins, we’ll uncover:

- Why some call Bitcoin SV the “true Bitcoin” and whether there’s truth to it.

- What makes Bitcoin (BTC) still the favored cryptocurrency in the global market.

- The controversies, claims, and myths that continue to cloud BSV’s reputation.

These aren’t just theories or hype; these are crucial questions that impact how you approach the crypto space, especially if you’re thinking about investing. But when did this all begin? Why did the forks happen?

Stick with me as we uncover the origins of this divide and the events that led Bitcoin SV and Bitcoin to go head-to-head in one of the biggest debates in crypto history. Trust me, it’s going to get even more interesting!

The Bitcoin Forks: How We Got Here

Bitcoin’s journey hasn’t exactly been smooth. Despite revolutionizing money as we know it, it also cracked open a treasure chest of debates, disagreements, and, you guessed it, forks. Among them, Bitcoin SV (BSV) stands out as one of the most talked about and controversial. But why did Bitcoin get split in the first place? Let’s break it all down.

A Brief History of Bitcoin’s Forks

The first big fork in Bitcoin’s history came in 2017 with Bitcoin Cash (BCH). Why? Because Bitcoin insiders couldn’t agree on one major issue—block size. Some argued that Bitcoin’s 1 MB block size was too small and needed to be increased to make the network faster and cheaper for transactions. Those who believed in a larger block size broke off, creating Bitcoin Cash (BCH).

Not long after, Bitcoin Cash itself faced its own civil war. In 2018, disagreements arose again about how development should progress, leading to yet another fork: Bitcoin SV, short for “Bitcoin Satoshi Vision.” This was BSV’s dramatic entrance into the crypto world.

Fun fact: A block size disagreement may sound like tech jargon, but it’s at the core of what splits communities and creates new cryptocurrencies. It’s also where a lot of the current BTC vs. BSV friction comes from.

Why Do Forks Matter in the First Place?

Let’s say you’re baking a pizza with friends. Now imagine half the group suddenly decides they want a massive New York-style pizza, while the others insist on sticking with the original Neapolitan recipe. That’s essentially what happens during a Bitcoin fork. Developers, miners, and users find themselves on opposite sides of the table with no compromise possible.

Forks matter because they reshape entire ecosystems:

- They split communities, power dynamics, and resources between teams.

- Investors often face confusion about which chain to follow or trust.

- It opens the door for rivalries, forcing people to reevaluate what the “true” Bitcoin—or any other fork—really stands for.

The bottom line is, forks aren’t just technical tweaks; they’re philosophical and emotional battles over what’s truly essential for the blockchain’s future.

The Origins of Bitcoin SV

You can’t talk about Bitcoin SV without mentioning Craig Wright—a man shrouded in bold claims, legal disputes, and undeniable controversy. Craig Wright has repeatedly claimed to be none other than Satoshi Nakamoto, Bitcoin’s mysterious creator. Love him or hate him, he’s one of the driving forces behind Bitcoin SV.

The creation of Bitcoin SV came with a mission: to restore Bitcoin to what Wright and his followers claim is Satoshi Nakamoto’s original vision. They argue that Bitcoin had “lost its way,” focusing too much on being a digital asset (like gold) rather than a simple, scalable digital cash system. Hence, Bitcoin SV’s name—Satoshi Vision—reflecting its ambition to carry the torch of Bitcoin’s “true” purpose.

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” That’s a famous quote from Satoshi Nakamoto. Ironically, it’s something many in the BSV camp use to defend their stance—claiming that BSV holds the real key to Satoshi’s dreams. Do they? That’s where things get tricky.

The global crypto community is largely skeptical of Wright’s claims. His assertions of being Satoshi? Highly debated. His lawsuits against those who doubt him? Fuel for the controversy fire. But whether you believe him or not, Bitcoin SV exists because of his belief that Bitcoin needed to go back to a purer, unaltered state.

With all this history and heated debate, it’s no wonder the Bitcoin vs. Bitcoin SV rivalry stirs such strong opinions. But beyond the drama, what actually makes these two cryptos so different at their core? Let’s unpack those technical differences next.

Bitcoin vs. Bitcoin SV: The Core Technical Differences

At first glance, Bitcoin (BTC) and Bitcoin SV (BSV) might seem similar—they both share “Bitcoin” in their names and stem from the same origin. But the truth lies in the details, especially when it comes to the technical differences that set these two apart. Here’s where things get really interesting.

Block Sizes and Scalability

Let’s start with one of the biggest eye-catchers: block sizes. Bitcoin, the original, operates with a block size limit of 1 MB (sometimes 2 MB with SegWit enhancements). This was designed to keep the network secure and decentralized. But Bitcoin SV? It goes big. Like, REALLY big. BSV’s block size is essentially “uncapped,” meaning huge chunks of data can fit into a single block.

So, what does this mean in real life? Imagine a highway. Bitcoin has carefully designed lanes allowing steady traffic to flow without jams, but with clear speed limits. BSV, on the other hand, is like turning that highway into an open field—allowing as much traffic as you want but sacrificing some control over the structure.

- Transaction speed: BSV supporters argue that larger blocks enable faster processing and lower fees, making it a better choice for everyday payments.

- Counter-point for BTC: Bitcoin enthusiasts argue that bigger blocks make the system harder to run for everyday users, putting scalability at odds with decentralization.

Fun fact: In 2021, BSV processed a record-breaking 2 GB block. Sounds impressive, right? But many critics argue this kind of size doesn’t make the network more practical—it only raises questions about sustainability. Spoiler: scalability isn’t always the solution to every problem.

Decentralization vs. Centralization

This is the battleground of $freedom$ vs. $control$. Bitcoin is famous for its decentralized design, where miners across the globe participate equally in its security network. No one entity or small group can call the shots.

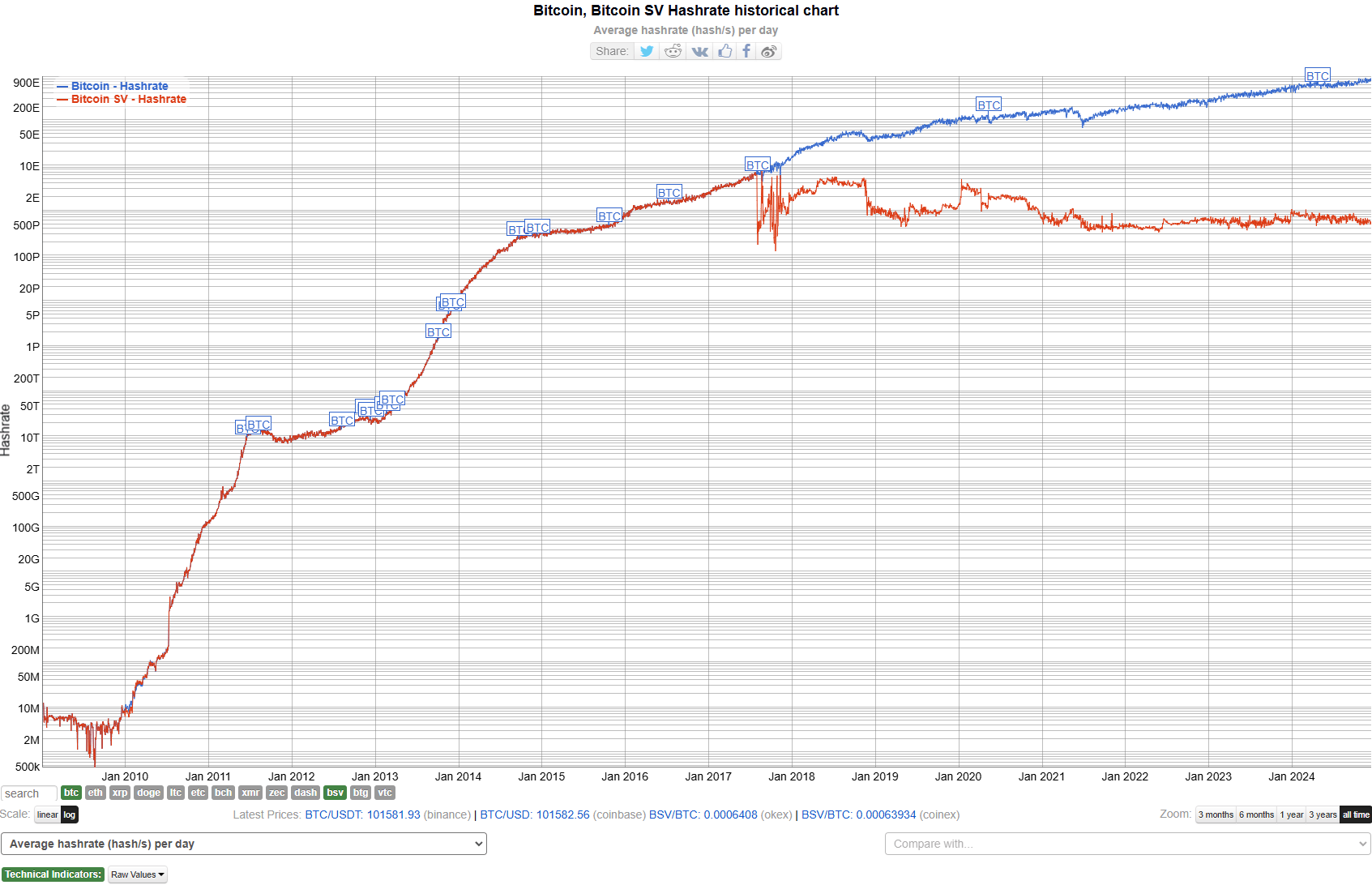

Then we have Bitcoin SV. Its larger block sizes and the hardware requirements to mine the network make it a lot tougher for individuals to participate. Guess what happens when only the big players—a.k.a. data centers or major mining operations—can afford to play? Many argue that the BSV network becomes more centralized as a result, which is, quite frankly, against everything Bitcoin originally stood for.

If Bitcoin is your modern-day Robin Hood, some critics would say BSV feels more like a kingdom ruled by the wealthiest knights. One Reddit user put it well:

“The dream of smaller guys participating in securing the network feels more alive in BTC than BSV.”

Security and Development

Now let’s talk about something that’s not always front-page news but matters big-time: security. Bitcoin’s network is often described as “battle-tested.” With over a decade of operation and the strongest community of developers safeguarding it, trust is at the core of BTC.

Bitcoin SV, meanwhile, faces challenges here. Critics argue that the network hasn’t seen the same level of scrutiny by researchers and developers as Bitcoin. There’ve been reports of vulnerabilities on multiple occasions, and in some cases, hackers have exploited these. That’s not to say BSV lacks potential, but trust issues? They’re there.

- BTC’s edge: With thousands of active contributors and a $500 billion+ network to secure (yes, that’s BILLION), Bitcoin attracts some of the world’s brightest minds. Regular updates ensure the ecosystem stays robust.

- BSV’s challenge: The development team’s focus on scaling has been polarizing, with critics saying it’s cutting corners on other priorities including experimentation and security testing.

Here’s something to think about: Would Satoshi Nakamoto, wherever they are, have envisioned a network leaning heavily toward miners or developers who hold the most power? Or do they stand for something more balanced? The answer might surprise you as we get into the next section.

The big debate: What is the “real Bitcoin”?

Let’s get real for a moment. When someone mentions Bitcoin, chances are they’re talking about BTC. But then there’s Bitcoin SV, screaming from the sidelines, claiming to be the one true Bitcoin. How did it come to this? And why is everyone so fired up about “realness” anyway?

The philosophy behind Bitcoin

To understand this, we need to rewind to why Bitcoin was created in the first place. Back in 2008, Satoshi Nakamoto introduced Bitcoin as a decentralized, peer-to-peer cash system—free from banks, governments, and middlemen. It was revolutionary: a financial network built on math, cryptography, and the idea that no single person could control it.

At the heart of Satoshi’s vision was decentralization, trustlessness, and a system that puts users in control. “The root problem with conventional currency is all the trust that’s required to make it work,” Nakamoto wrote in the Bitcoin whitepaper. This wasn’t just about money; it was about freedom.

Both Bitcoin (BTC) and Bitcoin SV (BSV) claim to uphold this vision, but their interpretations differ wildly. This is where things get… messy.

Arguments of the BSV camp

Supporters of Bitcoin SV believe it’s the real Bitcoin because they claim it adheres more closely to Satoshi’s original whitepaper than BTC does. Let’s take a look at their main arguments:

- Transaction Costs: BSV champions much larger blocks (gigantic compared to BTC) to allow for faster, cheaper transactions. They argue this makes Bitcoin usable as an everyday currency, fulfilling the original promise of being “electronic cash.”

- Scalability: By removing block size limits, BSV aims to scale infinitely. Its supporters argue BTC’s 1 MB block size cap is a bottleneck, turning Bitcoin into “digital gold” rather than usable cash.

- “Original Intent” Argument: The BSV community often cites the Bitcoin whitepaper line about “a purely peer-to-peer version of electronic cash.” To them, anything less than this focus on payments is not Bitcoin.

- Craig Wright’s Claims: A large part of their argument rests on Wright’s insistence that he is Satoshi Nakamoto, and therefore, his vision for Bitcoin (manifested in BSV) should hold weight. But we’ll talk more about that drama soon…

For the BSV crowd, Bitcoin isn’t just technology—it’s about restoring what they see as Satoshi’s lost vision. But there’s always another side to the coin, right?

Arguments of the BTC camp

Let’s switch gears to how most of the crypto community views Bitcoin: BTC is the original, and Bitcoin SV is simply another fork. Here’s what BTC supporters argue:

- Network Security: Bitcoin’s decentralized network is battle-tested and supported by the largest mining network in the world. They argue that BSV, with its smaller community and mining hashpower, is far less secure.

- Philosophy vs. Reality: BTC enthusiasts often point out that scalability isn’t just about increasing block sizes. They emphasize Layer 2 solutions like the Lightning Network, which enhance BTC’s scalability without sacrificing decentralization.

- Satoshi’s Silence: The BTC community respects the fact that Satoshi Nakamoto left the project in 2010. They don’t believe anyone (including Craig Wright) speaks for Satoshi, so claims based on “original intent” often fall flat.

- Adoption: Simply put, BTC is where the action is—it’s the cryptocurrency held by institutions, accepted by merchants (like Overstock and Tesla, at least sometimes), and traded globally. For BTC supporters, the real Bitcoin is the one that’s actually being used.

One BTC advocate summarized it this way in a crypto forum: “BSV keeps arguing about theoretical purity while BTC is actually changing the world.”

So, where does this leave us?

This debate isn’t just about technology; it’s personal. It’s about loyalty, belief systems, and what different groups think Bitcoin should represent. But if there’s one thing we can agree on, it’s this: the question of “which is the real Bitcoin” isn’t fading away anytime soon.

Still, don’t you feel like there’s an elephant in the room we haven’t fully addressed yet? Yep… Craig Wright. Is he really Satoshi Nakamoto, or is this just part of the drama that’s been fueling the Bitcoin SV controversy all along? Let’s get to the heart of it in the next section.

What is the BSV controversy really about?

When it comes to Bitcoin SV (BSV), the word “controversy” seems to follow it everywhere, like a shadow. Between its vocal supporters and harsh critics, BSV has sparked heated debates that are as much about its technology as they are about the people involved with it. But what’s fueling this chaos? Let’s break it down and get into the heart of the drama.

Craig Wright’s controversial claims

For many, the BSV story is impossible to separate from one man: Craig Wright. If you’ve been in the crypto space long enough, you’ve probably heard about his controversial claim of being Satoshi Nakamoto, the pseudonymous creator of Bitcoin. Sounds like a blockbuster movie storyline, doesn’t it? But here’s the problem: This claim has been met with significant skepticism.

While Wright insists that he’s Satoshi, the evidence he’s provided has been fiercely challenged. Cryptographic signatures—which could verify his claim—have often been dismissed as insufficient or even falsified by experts. And unfortunately for BSV, the weight of this claim hangs heavy over its ecosystem. For some crypto enthusiasts, supporting BSV feels like endorsing Wright’s unproven narrative. As one Twitter user once put it: “Bitcoin SV will always be a ‘what if’ story until the truth behind Craig Wright’s claims comes out.”

The result? Serious reputational damage. And in the crypto world, reputation matters as much as innovation.

De-listings and lawsuits

If the Craig Wright drama wasn’t enough, there’s another layer of controversy: de-listings. Major cryptocurrency exchanges such as Binance and Kraken have removed Bitcoin SV from their platforms, citing “ethical concerns” and insufficient demand. These moves were likely not just marketplace decisions but also reactions to Wright’s history of filing lawsuits against his critics. Whether these lawsuits were meant to protect his reputation or stifle dissent, they’ve created plenty of bad press.

When exchanges act as gatekeepers of legitimacy, a de-listing can have a huge ripple effect. BTC remains on almost every exchange globally, while BSV has to fight just to stay visible. For the average investor, not seeing BSV on their favorite exchange begs the question: Can it be trusted? This lack of broad accessibility is a major hurdle for Bitcoin SV’s adoption and credibility.

It’s not just about exchanges, either. Lawsuits from Wright and the BSV camp have targeted well-known figures in the crypto world, including Ethereum’s Vitalik Buterin and Bitcoin Core developers. These legal battles only add fuel to the fire, making it easy to see why BSV has become a polarizing presence in the crypto space.

The bigger issue

When you take these controversies in total—questionable claims, legal disputes, and widespread de-listings—it becomes clear that BSV’s challenges extend far beyond the technical aspects. Here, the problem isn’t just about block sizes or scalability arguments; it’s about trust. Can a cryptocurrency thrive when its ecosystem is deeply tied to a controversial figure? And how much faith can investors put in a project that constantly seems embroiled in drama?

The fallout from these controversies has left BSV with a fiercely loyal but relatively small user base, struggling to clear its name while pushing its “original vision” narrative. So, what does that mean for its future potential for growth and adoption? Could Bitcoin SV ever shake its baggage—or will it always remain the misunderstood cousin of Bitcoin?

Before you think about investing your hard-earned money into BTC or BSV, wouldn’t it be smart to see which one really dominates when it comes to market trust, adoption, and long-term value? Let’s dig into that next—because things are about to get really interesting.

The Investment Perspective: BTC vs. BSV

If you’re thinking about Bitcoin or Bitcoin SV from an investment standpoint, you’ve probably asked yourself: “Which one is the safer bet for my hard-earned money?” Let’s break it all down because crypto investments come with risks—and incredible opportunities if you’re smart about it. Here’s what you need to know before making a move.

Bitcoin’s Dominance in the Market

There’s no sugarcoating this—Bitcoin (BTC) is a giant. It’s not just the first cryptocurrency; it’s the one with the most trust, adoption, and liquidity. If the crypto market was a galaxy, Bitcoin would be the sun. Why does this matter? Because when you’re deciding where to invest, liquidity and adoption equal stability. Even during chaotic market swings, BTC has managed to hold its ground as the undisputed leader.

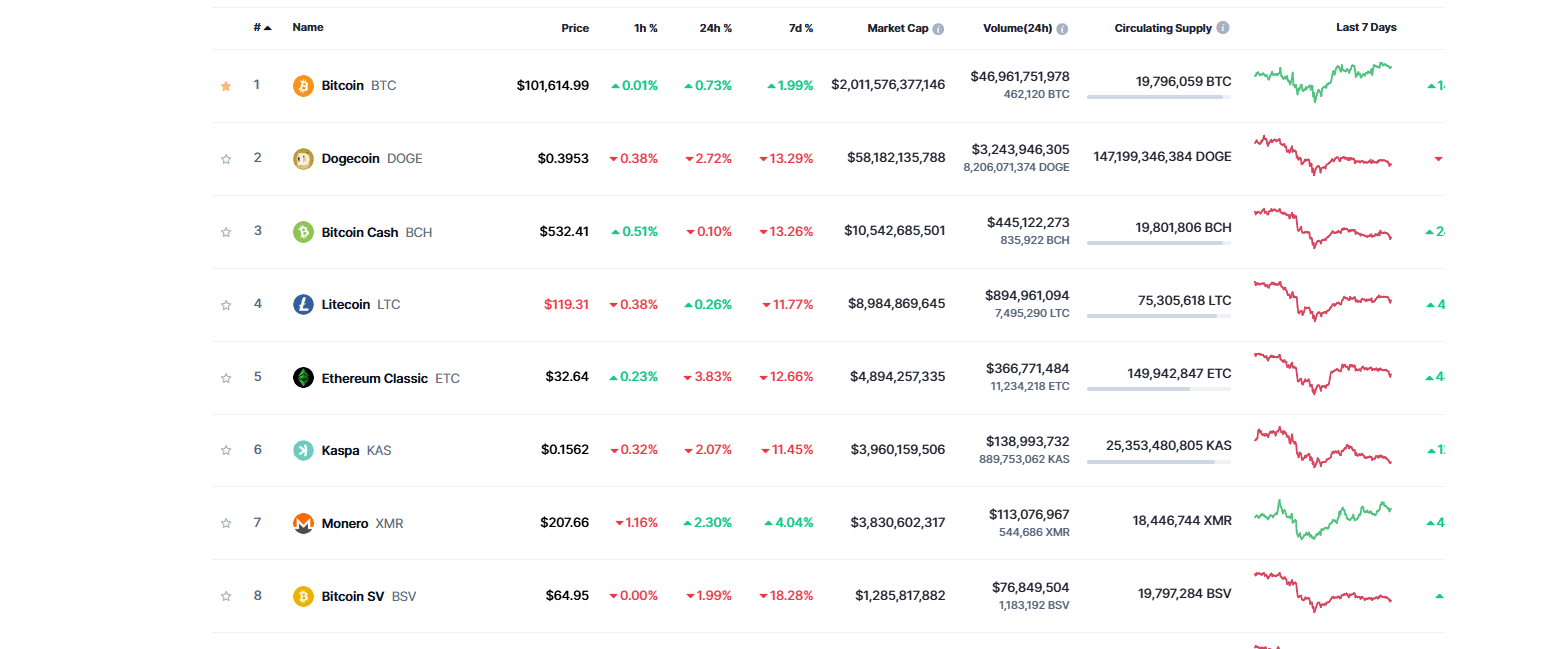

Take a quick look at Bitcoin’s dominance in market capitalization. At the time of writing, Bitcoin represents nearly 50% of the entire crypto market cap—a statistic that only reinforces its unmatched position as the go-to cryptocurrency for institutions, retail investors, and even government entities exploring crypto options.

Think of companies like Microstrategy. This tech giant bet heavily on BTC, purchasing billions of dollars worth. Why? Because Bitcoin is seen as digital gold, a long-term hedge against inflation, and a store of value. You don’t hear companies doing the same with Bitcoin SV.

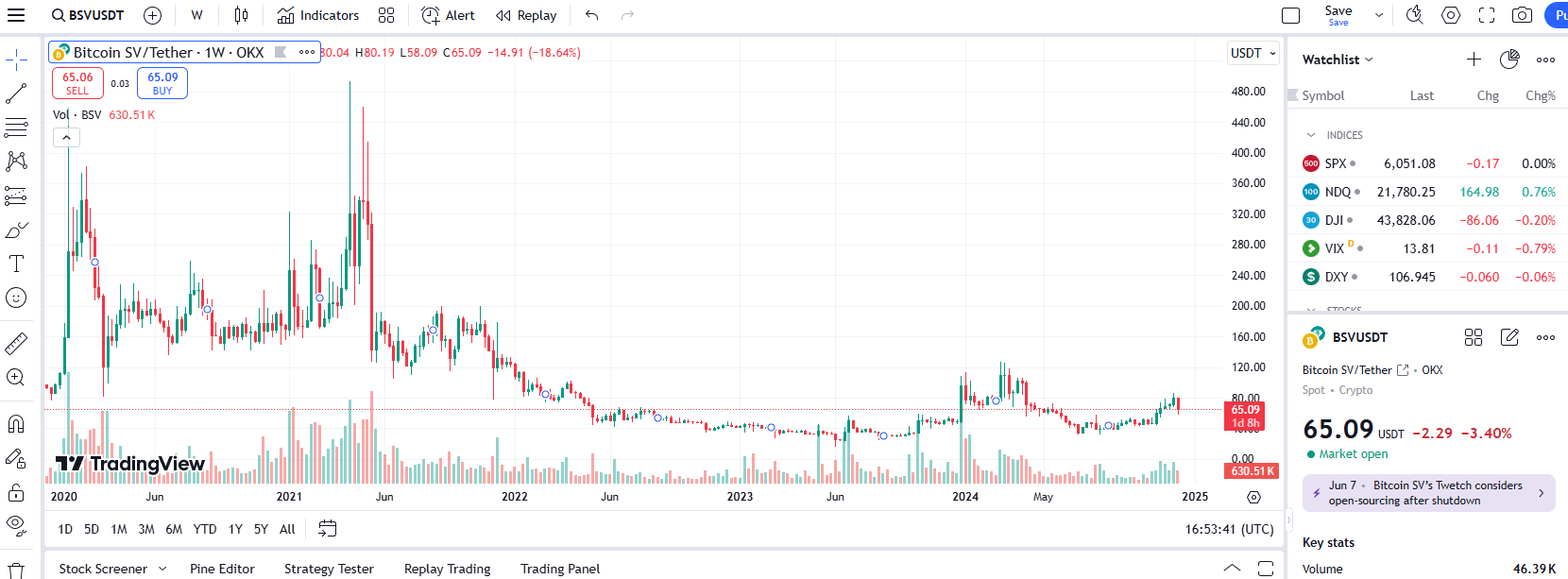

Bitcoin SV’s Challenges and Price Dynamics

Let’s be honest—Bitcoin SV (BSV) doesn’t have the same traction. Sure, its proponents believe in its vision, but in reality, it has struggled to gain adoption. Most exchanges don’t list BSV with the same prominence as BTC, and some have even completely delisted it. Why? A lot of it comes down to controversies surrounding the ecosystem, as well as lower trading volumes.

There’s also less consistent price action with BSV. Volatility can be an opportunity, but it can also leave you exposed. Without broader adoption and visibility, Bitcoin SV struggles to attract the same steady stream of investors or the institutional interest that BTC enjoys. Many traders question whether it can stand the test of time in a rapidly evolving market.

Risks and Opportunities

Let’s talk risks, though, because they shouldn’t be ignored. Every cryptocurrency investment comes with them, but the stakes between BTC and BSV can be very different.

- BTC Risks: Bitcoin still faces criticism for its scalability issues (higher fees, slower transaction times). However, thanks to the Lightning Network and ongoing development, these problems are not show-stoppers.

- BSV Risks: On the other hand, BSV’s risky reputation with de-listings, legal battles, and an underwhelming market presence makes it much more speculative. You can almost hear the “high risk, high reward” argument—but is it worth rolling the dice?

As for opportunities, BTC clearly stands out as a more secure option long-term. Its adoption by big players and ability to weather market trends proves it is no flash in the pan. BSV’s opportunity lies in its uncapped block size, which could, in a hypothetical world, attract industries needing to process massive transactions at low fees. But for now, it’s still mostly potential rather than reality.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

Crypto is no different. It’s not just about chasing flashy numbers—it’s about understanding the value behind those numbers. And that’s where BTC overwhelmingly keeps winning. But could BSV’s potential surprise everyone someday?

Here’s a thought: Can the technology backing your crypto influence how secure your investment is? Or, does value come solely from the market’s perception? That’s where the next piece comes in. Let’s take this one step further and really sort the wheat from the chaff. Think your Bitcoin is real? Let’s make sure!

How to Check if Your Bitcoin is Real?

One of the most common questions I come across is, “How can I be sure the Bitcoin I have is real?” Whether you’re new to crypto or an OG hodler, this is a valid concern. With multiple forks, wallet types, and scams floating around, staying on top of your Bitcoin’s authenticity is critical. Don’t worry—it’s easier than it sounds! Let me show you.

Using Blockchain Explorers

If you want to verify your Bitcoin, a blockchain explorer is your best friend. Think of it as a search engine for blockchain transactions. Blockchain explorers allow you to check if a transaction has been successfully sent, received, and confirmed—and yes, they work for both BTC and BSV. Here’s how you can do it:

- First, get your transaction ID (TXID). This is a long string of letters and numbers that serves as the “receipt” for your transaction.

- Head to a blockchain explorer. For Bitcoin, you can use something like Blockchain.com. For Bitcoin SV, try an explorer like Whatsonchain.

- Paste your TXID into the search bar.

- Hit ‘Search’ and check the details. If the transaction appears with the appropriate confirmations, your Bitcoin is good to go!

Blockchain explorers also let you see additional details like the amount transferred, fees, and timestamps, giving you full transparency. You don’t have to take anyone’s word for it—you can verify it yourself!

Wallet Differences: BTC vs. BSV

Wallets play a big role in ensuring your Bitcoin is the “real deal.” BTC and BSV are stored on entirely separate blockchains, which means they can’t exist in the same wallet. If someone claims your Bitcoin can be accessed through a dubious or generic wallet without clarity about which blockchain it connects to—red flag alert.

Here’s a quick rule of thumb to stay safe:

- Use a trusted wallet that clearly mentions its support for BTC or BSV. Some wallets, like Electrum, are well-known for BTC. For BSV, you might check out wallets like HandCash or Centbee.

- If you ever receive Bitcoin from someone, confirm the address carefully. BTC addresses always start with “1,” “3,” or “bc1”, while BSV addresses often start with “1” or “q”. Double-checking ensures you’re working with the right cryptocurrency.

Spotting Fake Bitcoins

Unfortunately, scams are rampant in the crypto world. Fake Bitcoin often takes the form of Ponzi schemes, phishing attempts, or counterfeit apps. Let me share a real-life example: back in 2019, fake wallet apps on Google Play scammed users by impersonating legitimate businesses. One wrong download could have drained your funds in seconds!

Here’s how you can steer clear:

- Only download wallets or software from official sources. Never trust random downloads or links sent over social media.

- Double-check any coin before sending or receiving funds. If someone insists their “Bitcoin” behaves differently than what you know—warning bells! It might not be BTC or BSV at all.

- When in doubt, turn to the community. Check Reddit forums, Telegram groups, or even Twitter for reports of suspicious platforms or wallets.

Why Must You Verify Your Bitcoin?

To wrap this up, here’s a quote by Satoshi Nakamoto: “If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” This underscores the trustless nature of Bitcoin—it’s not about belief, but validation through cryptographic proof. Ensuring your Bitcoin is real isn’t just about peace of mind—it’s about staying true to what the technology represents: transparency, security, and freedom.

Curious to dig deeper? Wondering where to get reliable insights to keep your crypto journey safe? There’s a mountain of resources out there that can take this knowledge to the next level. Let’s explore them next!

Additional Resources to Understand Bitcoin vs. Bitcoin SV Better

Sometimes, it takes more than one article to get to the bottom of something as complex as Bitcoin versus Bitcoin SV. If you’re ready to keep exploring and make your own informed conclusions, I’ve got you covered. Below are some excellent resources to help you cut through the noise, explain both sides of this debate, and sharpen your understanding of both BTC and BSV.

Books and Online Content

First up, let’s talk about some books and online documents that have helped millions of crypto enthusiasts gain clarity. One must-read resource is the book “Mastering Bitcoin” by Andreas M. Antonopoulos. It’s like having a Bitcoin guru walk you through everything from fundamentals to advanced concepts. If you’re looking to dig into BTC’s philosophy and technical details, this book is an unbeatable starting point.

On the Bitcoin SV (BSV) side, the official Bitcoin SV Academy offers online courses and articles that present their perspective of the technology. It’s fascinating to see how they view their mission to follow what they believe to be Satoshi Nakamoto’s original vision. You can check out their educational materials for free on their platform.

Want something quicker to browse? Several forums and Reddit communities often host lively debates about BTC and BSV. While you should tread carefully (there’s a mix of biased opinions), these dialogues can give you some insight into what real users and developers think and argue about.

Updates from Cryptolinks.com

For those who prefer keeping things current, don’t forget that I regularly publish unbiased crypto reviews and news on Cryptolinks.com. Whether it’s Bitcoin, Bitcoin forks, or even newer developments, I make it my mission to give you straight-up facts with no hidden agenda. You’ll find updated reviews of wallets, exchanges, and other tools that keep the crypto space moving forward. Plus, I always aim to clarify concepts that might feel overwhelming in other resources.

More Ways to Keep Learning

If you prefer videos, YouTube channels like Coin Bureau and aantonop (run by Andreas himself) can literally change the way you think about Bitcoin. Through their videos, they unpack topics like decentralization, forks, and controversies in ways that really stick. Similarly, podcasts such as “Unchained” and “The Pomp Podcast” dive into deep conversations with key players in the cryptocurrency ecosystem, offering fresh perspectives you won’t find in articles or books.

And let’s not overlook Twitter. Often called “Crypto Twitter,” it’s buzzing with opinions, leaks, and updates from prominent figures like CZ from Binance, Vitalik Buterin, and even Craig Wright himself (who actively posts opinions about Bitcoin SV).

While these resources may not give you all the answers, they’ll broaden your perspective. The more you learn, the easier it will be to form your own judgement on topics like decentralization, block size, and even the never-ending battle about “the real Bitcoin.”

But here’s the big question: with all this knowledge at your fingertips, is Bitcoin SV really a closer match to Satoshi’s vision, or does Bitcoin’s massive adoption speak for itself? We’ll get to that soon—stay with me.

BTC or BSV: So, What’s the Truth?

The BTC vs. BSV debate isn’t going away anytime soon. But now that we’ve walked through the history, the differences, the drama, and even the practical side of things, let’s get straight to the real question: which one should you be paying attention to? Let’s wrap it all up in a way that makes sense and helps you move forward as a crypto enthusiast or investor.

Reassessing the Key Points

Let’s get back to the basics for a moment. Bitcoin (BTC) is the original cryptocurrency, the one with the largest market cap, and the most decentralized blockchain ecosystem. It’s trusted by millions worldwide, not just by crypto nerds but also by institutional investors and governments exploring its use as a legitimate digital asset.

On the other hand, Bitcoin SV (BSV) has a different focus. It pushes the idea of large block sizes for faster, cheaper transactions and claims to strictly follow Satoshi Nakamoto’s whitepaper. But it’s shadowed by controversies, centralized power accusations, and increasing skepticism.

The truth here is simple: BTC and BSV serve different purposes and appeal to different types of users. While BTC takes its role as a store of value and “digital gold,” BSV positions itself as a high-throughput protocol for more practical use cases like payments and business applications.

My Honest Take

To be honest, I lean on the side of Bitcoin (BTC). But here’s why.

The global crypto community validates Bitcoin’s dominance daily. From its unmatched security due to its immense mining power to its widespread adoption, BTC continues to lead the pack in both reputation and utility. Look at El Salvador adopting it as a legal tender or even major companies like MicroStrategy pumping billions into it for reserves. Bitcoin isn’t just tech—it’s a movement.

For Bitcoin SV, while some tech aspects like unlimited block sizes sound exciting, the execution hasn’t fully lived up to its promises. The lack of decentralization concerns me, along with the ongoing controversies surrounding key figures in its ecosystem. That doesn’t help its case when trust is everything in crypto. And, let’s face it, much of BSV’s “hype” ends up revolving around drama, not development.

That being said, I know this isn’t just about my opinion. BSV suits a different type of person. If you’re looking for something geared toward enterprise use at scale and don’t mind the risks, it could be worth exploring. I just don’t see that vision materializing at the same level BTC has achieved.

What Should You Do Next?

At this point, the ball is in your court. The world of crypto changes fast, so whether you’re sticking with Bitcoin or curious about Bitcoin SV, staying informed is the best thing you can do.

- Take advantage of tools like blockchain explorers to understand what’s happening with your crypto funds.

- Engage with online communities and forums to hear different perspectives. But be skeptical—don’t follow the hype without research.

- Check out trustworthy resources like Cryptolinks for quality information on cryptocurrencies and blockchain updates.

Remember, your decision about BTC or BSV should align with your goals. Is it long-term value you’re after, or do you care more about fast transactions and different use cases? Think about that as you weigh your options.

Final Thoughts: The Ongoing Story

Honestly, this isn’t the kind of debate that will have a “winner” anytime soon. Both BTC and BSV will keep evolving, and their success will ultimately depend on how well they serve people’s needs. So, instead of choosing a hard side, focus on what’s most important: real innovation and creating financial freedom for everyone.