Crypto Halving 2024: What to Expect

Ever been caught up in the whirlwind of curiosity around crypto halving and its market-shaking potential, especially now with the 2024 Bitcoin. This seismic event sparks endless debates and speculation in the crypto sphere for good reason. We’re cracking open the vault on crypto halving to shed light on its real impact on the market and your investments. From understanding the nuts and bolts that drive this phenomenon to sketching out what it means for miners and investors alike, we’re navigating through the maze to bring clarity right to your doorstep. Whether you’re knee-deep in the crypto world or just dipping your toes, brace yourself for a journey into the heart of what makes crypto halving the buzzword it is today, and what the 2024 chapter could unfold for us all.

The Mystique of Crypto Halving

Every few years, Bitcoin and several other cryptocurrencies experience what’s known as a halving event. This pivotal occurrence can trigger significant market movements, but what underlies its importance, and why does it generate such widespread buzz?

Promise solution

Together, we’ll explore the intricacies of what crypto halving entails, with a particular focus on the highly anticipated Bitcoin halving in 2024. We aim to demystify its implications for all market participants—from miners grappling with reward reductions to investors eyeing potential market upheavals. Whether crypto is your passion or profession, there’s valuable insight in store for everyone.

The Basics of Halving

To fully grasp the phenomenon of halving, it’s crucial to understand both its technical and economic foundations. In essence:

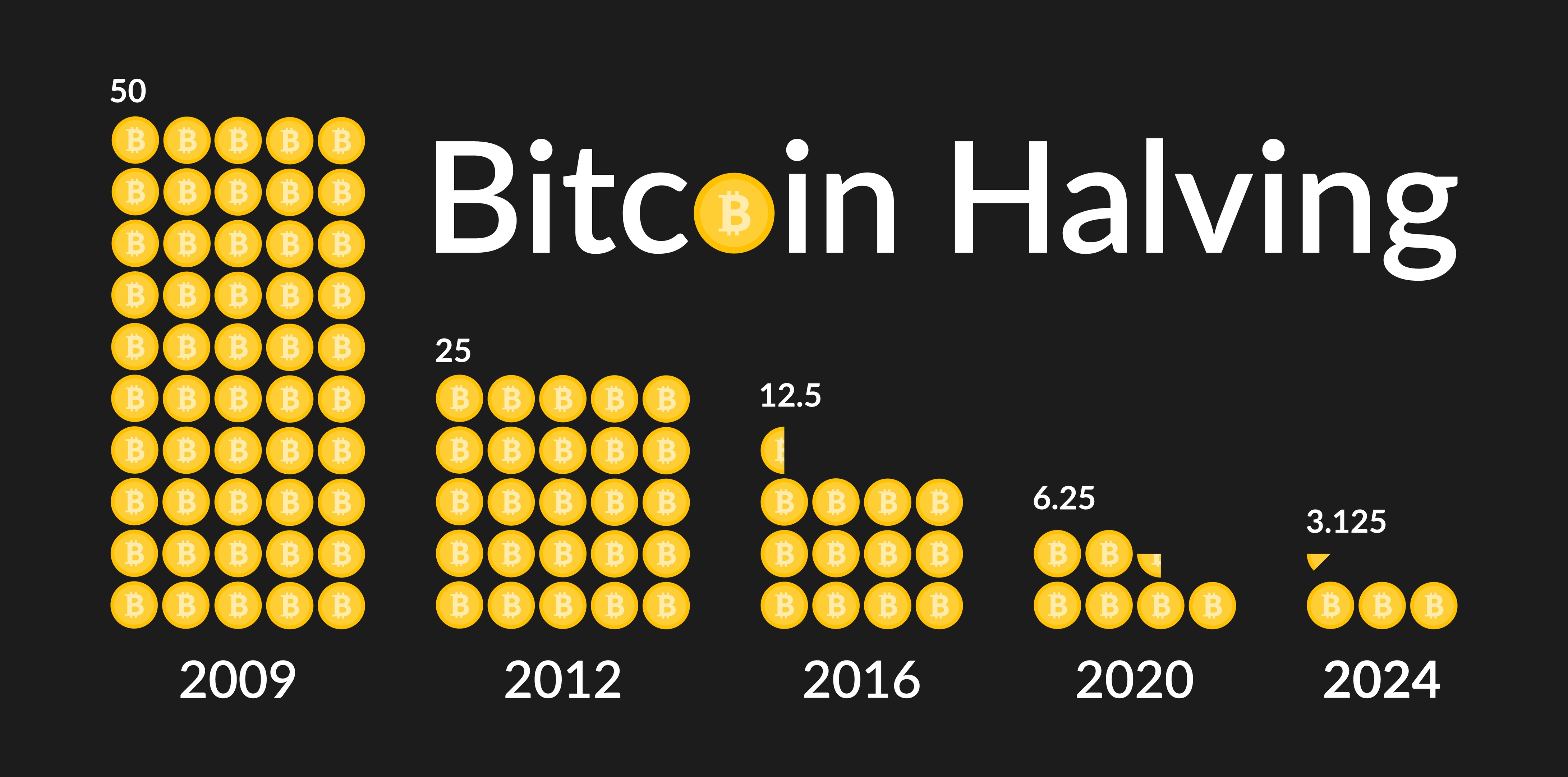

- Halving cuts the reward for mining new blocks in half, which happens roughly every four years for Bitcoin. This mechanism is built into the protocol to control inflation and mimick the scarcity (and value increase) similar to precious metals like gold.

- This reduction in block rewards directly impacts miners’ profitability, potentially leading to decreased network hashrate if prices don’t adjust upward to compensate for the reduced incentives.

- For investors and the market at large, halvings are historically associated with significant price rallies and increased volatility, offering both opportunities and risks.

Understanding these core aspects sets the stage for deeper exploration into how such an event could reshape the landscape of crypto investing and the entire ecosystem. With the 2024 Bitcoin halving peeking over the horizon, predicting its impacts becomes an even more intriguing puzzle.

So, what can we learn from past halvings, and how might they inform our strategies moving forward? Curious about the immediate effects on mining and the broader market reactions? Stay tuned as we take a closer look at the past to unravel predictions for Bitcoin’s next big milestone. What will the 2024 halving spell for the future of cryptocurrency? Let’s keep digging for answers.

The 2024 Bitcoin Halving Deep Dive

Have you ever stood at the edge of a diving board, toes curled over the edge, heart pounding with anticipation? That’s the feeling many in the crypto community get when we talk about the upcoming Bitcoin halving in 2024. Let’s take a plunge into what this event really means for the world of cryptocurrency, and more importantly, for you.

Historical Context

Looking back at previous Bitcoin halvings is like flipping through a photo album of the crypto world’s growing pains and triumphs. Each halving event has been a watershed moment, impacting the market in ways both predicted and utterly surprising. From the first halving in 2012, which saw a slow but steady increase in Bitcoin’s value, to the dramatic rally leading up to and following the 2016 and 2020 halvings, history has given us a rich tapestry of data to draw from. Yet, it’s crucial to remember that while history can guide us, the future remains unwritten.

The Immediate Effects on Mining

The halving slashes the block reward miners receive for their efforts by half, a change that hits like a wave, reshaping the mining landscape. This reduction forces a Darwinian shake-up in the mining world, where only the fittest (or most efficient) survive. It’s a moment that tests the resilience and adaptability of the network. Yet, paradoxically, this seismic shift sows the seeds for greater security and stability within the network as miners upgrade and optimize to remain competitive. Can this be the catalyst that propels us into a new era of mining efficiency? Only time will tell.

Predicting the Ripple Effects

The ripples from the halving extend far beyond the mining pools, potentially stirring up a tidal wave of change across the entire Bitcoin ecosystem. Speculating on how this event will affect Bitcoin’s value, market stability, and investor interest is akin to reading tea leaves – a blend of art and science. Will we see a surge in value as supply tightens? Or will the markets react with caution, leading to a period of volatility and uncertainty? These are the questions on every investor’s lips.

“Change is the only constant in life.” This quote encapsulates the ethos of the crypto world, especially in the context of the halving. It reminds us that while we can study the past and speculate on the future, the true outcome remains shrouded in mystery.

As we peel back the layers of the 2024 Bitcoin Halving event, we’re reminded that in the world of cryptocurrency, the only certain bet is on change itself. But what does this mean for you as an investor or enthusiast? Will the historical winds blow in favor of monumental growth, or are we headed for uncharted waters fraught with challenges?

The stage is set, and the players are taking their positions. As we inch closer to this pivotal moment, remember that the key to navigating these turbulent waters lies not just in understanding the immediate effects but in anticipating the long-term trajectory of our decisions today. Are you ready to explore which cryptos will shine in 2024? Stay tuned, as that curious thought unfolds in our next exploration.

Which Cryptos Will Shine in 2024?

As we edge closer to the much-anticipated 2024 Bitcoin halving, the crypto landscape buzzes with predictions about which cryptocurrencies will rise to prominence. Bitcoin might be the talk of the town, but let’s not forget the multitude of digital currencies waiting in the wings, ready to take the spotlight. Today, we’re turning our gaze towards these emerging stars, exploring innovative sectors poised to push certain cryptos into the limelight.

The Rising Stars

“Opportunities are like sunrises. If you wait too long, you miss them.” – William Arthur Ward

This quote captures the essence of timing in the crypto world perfectly. With the upcoming Bitcoin halving, savvy investors are scouting for opportunities beyond the usual suspects. Here are a few cryptos that are on the brink of becoming household names:

- Solana – Known for its incredible transaction speeds and low fees, Solana has been a favorite among developers and investors alike. As the demand for scalable and efficient blockchain solutions grows, Solana is well-positioned to benefit.

- Avalanche – With its unique consensus mechanism, Avalanche provides a robust platform for decentralized apps. Its ability to process thousands of transactions per second without compromising on decentralization makes it a strong candidate for substantial growth following the halving.

- Ethereum Layer 2 solutions – With Ethereum’s switch to Proof of Stake, Layer 2 solutions are becoming increasingly crucial for improving the network’s scalability and usability. Projects like Polygon and Arbitrum offer promising enhancements, ensuring Ethereum’s ecosystem remains vibrant and continues to thrive.

DeFi, AI, NFTs, and Gaming: The Key Drivers

The crypto universe is evolving rapidly, with DeFi (Decentralized Finance), AI (Artificial Intelligence), NFTs (Non-Fungible Tokens), and blockchain gaming carving out significant niches. These sectors are not just buzzwords; they represent the frontline of innovation, driving adoption and utility in ways we’ve only begun to imagine. Let’s take a quick look at how they’re influencing the crypto market:

- DeFi – Transforming traditional finance by making it decentralized, transparent, and accessible. Expect DeFi platforms and tokens to gain further traction as they continue to challenge and redefine financial services.

- AI – With the world waking up to the potential of AI, crypto projects that incorporate artificial intelligence for smarter, more adaptive technologies are gaining attention and could see significant growth.

- NFTs – Beyond digital art, NFTs are making waves in identity verification, content monetization, and more. Their unique ability to verify ownership and provenance digitally could propel further innovations and use cases in the crypto space.

- Gaming – The intersection of blockchain and gaming has opened up a new frontier for play-to-earn models, in-game assets ownership, and decentralized gaming economies. As this sector matures, expect gaming cryptos to skyrocket.

With the crypto halving event as a backdrop, these sectors and the cryptocurrencies leading them are poised for explosive growth. But as we marvel at the potential of these rising stars, one question remains—when is the right time to invest?

Stay tuned for our next discussion on timing your investment around the halving, where we’ll explore market patterns and strategic insights to help you make informed decisions. Are you ready to navigate the tides of the halving and position yourself for success? Let’s find out together in the next segment.

To Buy or Not to Buy: Timing Your Investment Around Halving

As the halving event draws near, the crypto community becomes electrified with speculation and theories about the best investment strategies. It’s a period characterized by heightened interest and potentially lucrative shifts in the market. But when it comes to optimizing your investment in relation to the halving cycle, it’s essential to navigate the waters with both historical insight and an eye on future trends.

The Pre-Halving Surge

Let’s take a closer look at the patterns of market activity leading up to past halvings. Is it wise to get in early? Historical trends suggest that there is often a significant surge in both interest and value as a halving event draws closer. For instance, in the months leading up to the 2020 Bitcoin halving, we observed a substantial increase in Bitcoin’s price. This phenomenon can be attributed to the anticipation of reduced supply and the resulting scarcity driving up demand.

- Study Reference: A study analyzing the 2016 and 2020 Bitcoin halvings showed a noticeable pre-halving increase in price, suggesting a pattern that savvy investors can look into.

- Real Sample: In the 12 months preceding the 2020 halving, Bitcoin’s value increased by over 150%, showcasing the potential for pre-halving market surges.

Post-Halving Dynamics

But what happens after the confetti settles? The aftermath of a halving is equally fascinating. While the immediate effects on the market’s pricing can be volatile, historical data hints at a more stabilized and upward trajectory in the long term. After the initial adjustments, the reduced supply begins to press against steady or increasing demand, often leading to a gradual price increase. However, it’s crucial to remember that past performance is not always indicative of future results, and external factors can influence outcomes.

“The market is a device for transferring money from the impatient to the patient.” – Often attributed to Warren Buffet, this quote resonates deeply when considering investment strategies around crypto halving events.

Attracting both excitement and anxiety, the post-halving period is a testament to the investor’s discipline and long-term vision. The key question remains: Is it better to adjust your sails before the storm, or is the real treasure found in navigating through it?

Indeed, understanding the dynamics at play before and after a halving can significantly inform your investment strategy. But, as we journey through these speculative waters, remember that the true potential of your investment might not be immediately apparent. Patience and strategy are your best allies.

So, with the 2024 halving on the horizon, are you well-positioned to capitalize on these cycles, or will you be caught off-guard? The answer, as with many things in the crypto world, may not be straightforward. But one thing is for sure: knowledge is power. And as we inch closer to this pivotal event, staying informed will be more crucial than ever.

What predictions can we make about Bitcoin’s future value post-2024 halving? The transition to Part 5 promises deeper insights into expert forecasting and the factors that could influence Bitcoin’s trajectory in the aftermath of the next halving. Stay tuned!

Price Predictions: A Glimpse Into Bitcoin’s Future

Everyone’s buzzing with one burning question – what’s the potential value of Bitcoin after the highly anticipated 2024 halving? With expert analysis and predictions swirling around, let’s sift through the forecasts and shed some light on the future of Bitcoin’s valuation.

Expert Forecasting

When it comes to expert predictions on Bitcoin’s price post-2024 halving, opinions vary, but they all paint an intriguing picture of potential growth. We’ve seen analysts predict everything from modest increases to astronomical surges, and while no one can say for sure, the consensus leans towards optimism. Here are a few key points experts agree on:

- Reduced supply and increased demand could drive the price up.

- Historical patterns suggest a bullish trend following halving events.

- Market maturity might lead to less volatility post-halving.

Remember, “Experts often have more data at their fingertips but predicting markets is always a gamble.”

Factors Influencing Future Value

Several external factors could significantly impact Bitcoin’s future value trajectory. It’s not just about the halving; it’s about the broader ecosystem influencing Bitcoin and its standing in the world of finance. Let’s peek at some of these critical factors:

- Regulatory Changes: More stringent or supportive regulations worldwide could sway Bitcoin’s price heavily.

- Technological Advancements: Innovations in blockchain and cryptocurrency could enhance Bitcoin’s utility and appeal.

- Market Dynamics: Overall market trends and investor sentiment play crucial roles in shaping Bitcoin’s value.

As Steve Jobs once wisely said, “You can’t connect the dots looking forward; you can only connect them looking backwards.” This sentiment rings particularly true in the volatile world of cryptocurrency, where today’s educated guesses are tomorrow’s historical data points.

As we wrap our minds around these predictions and factors, one can’t help but wonder about the timing. Is the post-halving world the right time to double down, or should strategic shifts wait for clearer signs? In the upcoming section, we’ll explore how to prepare your portfolio for 2024, considering the halving’s potential aftermath. Are you positioned to leverage the halving event to your advantage, or is it time for a strategic realignment? Stay tuned, and let’s find out together.

Preparing Your Portfolio for 2024: Strategies and Tips

As the anticipation for the 2024 halving event heats up, you might find yourself questioning the best ways to adjust your investment strategy to not just weather the storm, but sail smoothly through it. The trick? Balancing risk and reward, mastering the art of diversification, and picking your investment horizon wisely.

Diversification and Risk Management

Putting all your eggs in one basket has never been a prudent approach, especially in the volatile world of cryptocurrency. The upcoming halving presents both opportunities and risks. How to strike the right balance? By diversifying your portfolio. Consider not only different cryptocurrencies but also explore various sectors within the crypto world, like DeFi, NFTs, and even mining investments. But remember, diversification is not just about adding more assets; it’s about adding the right assets that don’t move in tandem.

Long-term vs Short-term Investing

Another vital consideration is the time horizon of your investments. The halving event can cause short-term volatility but also offers long-term growth potential. Are you prepared to ride out the potential short-term storms for the sake of long-term gains? Historical data suggests that patience pays off when it comes to halving events, but it also highlights the importance of being able to adapt and react to short-term market movements.

Real samples and studies back these strategies. For instance, Forbes.com discusses the implications of the halving on market dynamics, emphasizing the potential for increased Bitcoin prices due to reduced supply. Similarly, the Economic Times and ProShares delve into how previous halvings have favored those with a long-term investment strategy.

The forthcoming halving event isn’t just a technical milestone; it’s a pivotal moment that could redefine your portfolio’s performance. Whether you’re leaning towards a conservative approach by focusing on established cryptos or aiming to capitalize on emerging opportunities, remember: knowledge, diversification, and a well-considered investment horizon are your best tools.

But, as we contemplate the diverse strategies and tips for preparing our portfolios, one question vividly stands out:

“What more can we do to ensure we’re not just surviving, but thriving in the post-halving world of 2024?”

Stay tuned, as we explore deeper into additional resources and insights that could be your guiding light in the ever-evolving landscape of cryptocurrency. The journey is far from over; in fact, it’s just another beginning.

Further Reading and Resources

So you’ve ridden the wave through the ins and outs of crypto halving, exploring its profound effects on the crypto universe, from miners to markets to your very own investment strategies. But the journey doesn’t end here; there’s a whole world of knowledge out there waiting to be uncovered. For the curious minds eager to keep learning, I’ve gathered a handpicked selection of resources and communities that will satisfy your thirst for more. Let’s check them out.

Recommended Articles and Analyses

Understanding the whirlwind of crypto halving necessitates digging into quality reads that illuminate its every angle. Here are a few standout pieces I’d recommend:

- “The Bitcoin halving reduces the block reward…” – Forbes.com: A succinct breakdown of the economic implications of Bitcoin halving and its potential effects on the market.

- An explanation of how Bitcoin halving works – economictimes.com: For those new to the concept, this provides a solid foundation on the mechanics of halving and why it’s a big deal.

- Everything you need to know about the next Bitcoin halving – proshares.com: A comprehensive guide that dives into predictions and the broader impacts of the upcoming halving event.

Engage With the Community

No one can navigate the crypto waters alone. Joining a community can not only buoy your spirits but also provide invaluable insights. Here’s how:

- Reddit: Check out subreddits like r/Bitcoin and r/CryptoCurrency for lively discussions, heated debates, and shared wisdom from fellow enthusiasts.

- Twitter: Follow leading influencers and thought leaders in the crypto scene. They often share cutting-edge analyses and prognostications about the market’s direction.

- Forums: Platforms like BitcoinTalk and CryptoCompare foster in-depth discussions that can add layers to your understanding of halving and its ramifications.

Conclusion: The Road Ahead

As the clock ticks down to the 2024 crypto halving, excitement and speculation reach fever pitch. But amid the buzz, remember that staying educated and engaged is your best strategy.

With halving events, the crypto scene witnesses remarkable transformations. But by arming yourself with knowledge from trusted sources and tapping into the collective wisdom of the community, you’re not just a spectator but a savvy participant in the unfolding history of cryptocurrency.

So keep exploring, keep questioning, and above all, keep learning. The path ahead is as promising as it is unpredictable, but together, we can navigate the twists and turns, ready for whatever comes our way.