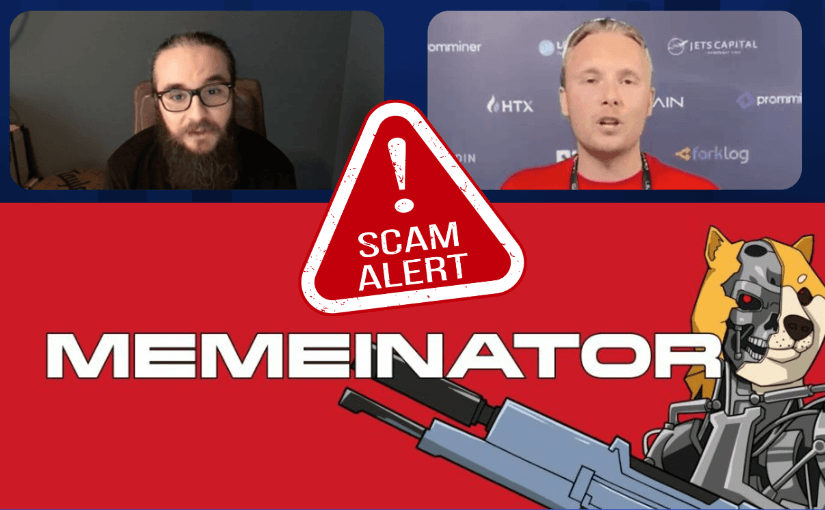

Why Memeinator.com Is Under Fire: $7 Million Missing Stolen by Team of Marco Tonetti and Dylan Lee?

Have you ever seen a crypto project that exploded onto the scene, making bold claims, but then left everyone scratching their heads—or worse, empty-handed? What if I told you stories are surfacing about Memeinator.com being such a project? This bustling platform, designed to dominate the meme token universe, now finds itself at the intersection of controversy and distrust. With $7 million reportedly missing and allegations flying against its team Marco Tonetti and Dylan Lee, there’s no shortage of questions.

Is it all smoke and mirrors, or are these accusations rooted in truth? Let’s start uncovering the details and highlight some of the most glaring concerns.

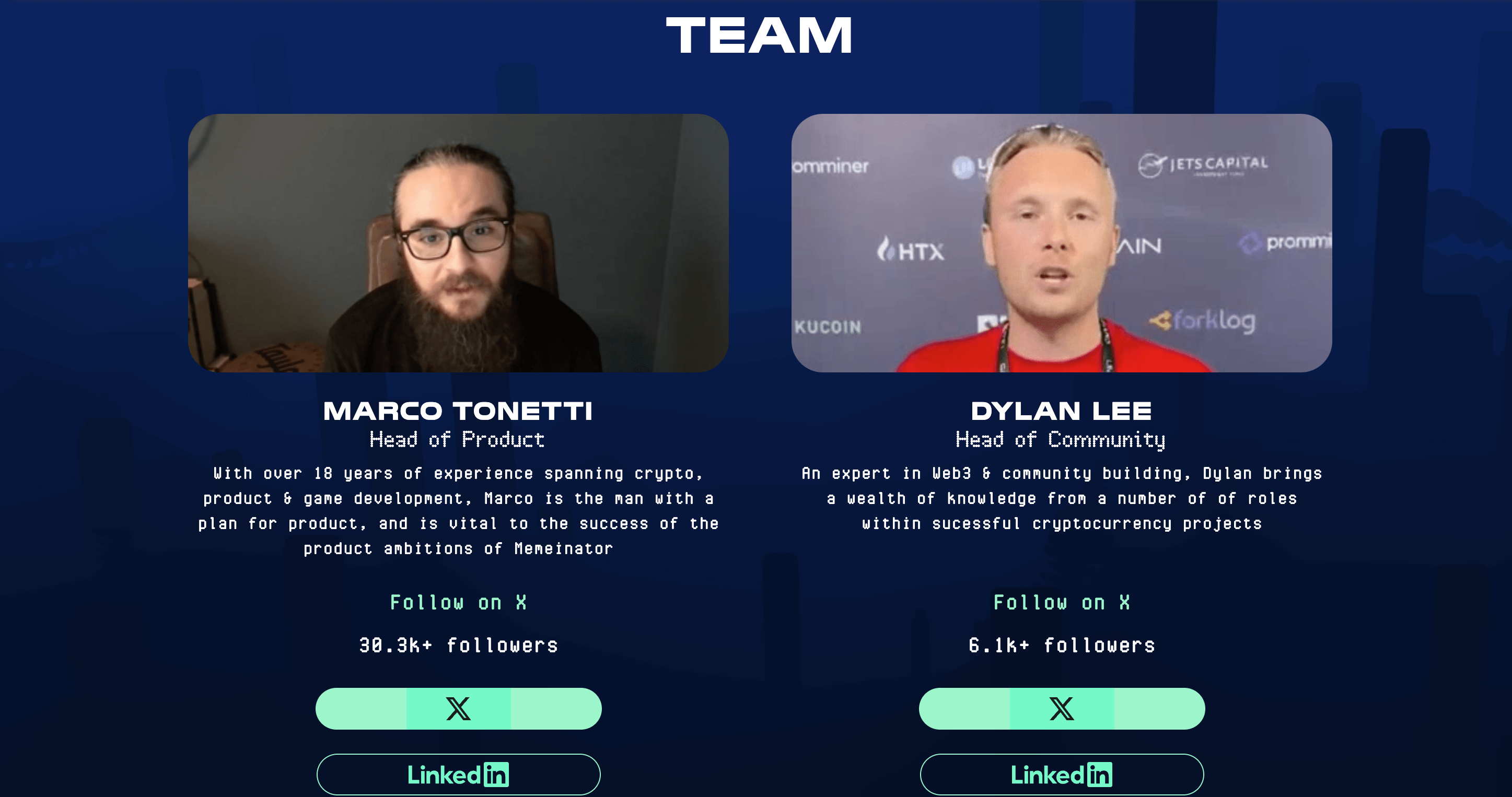

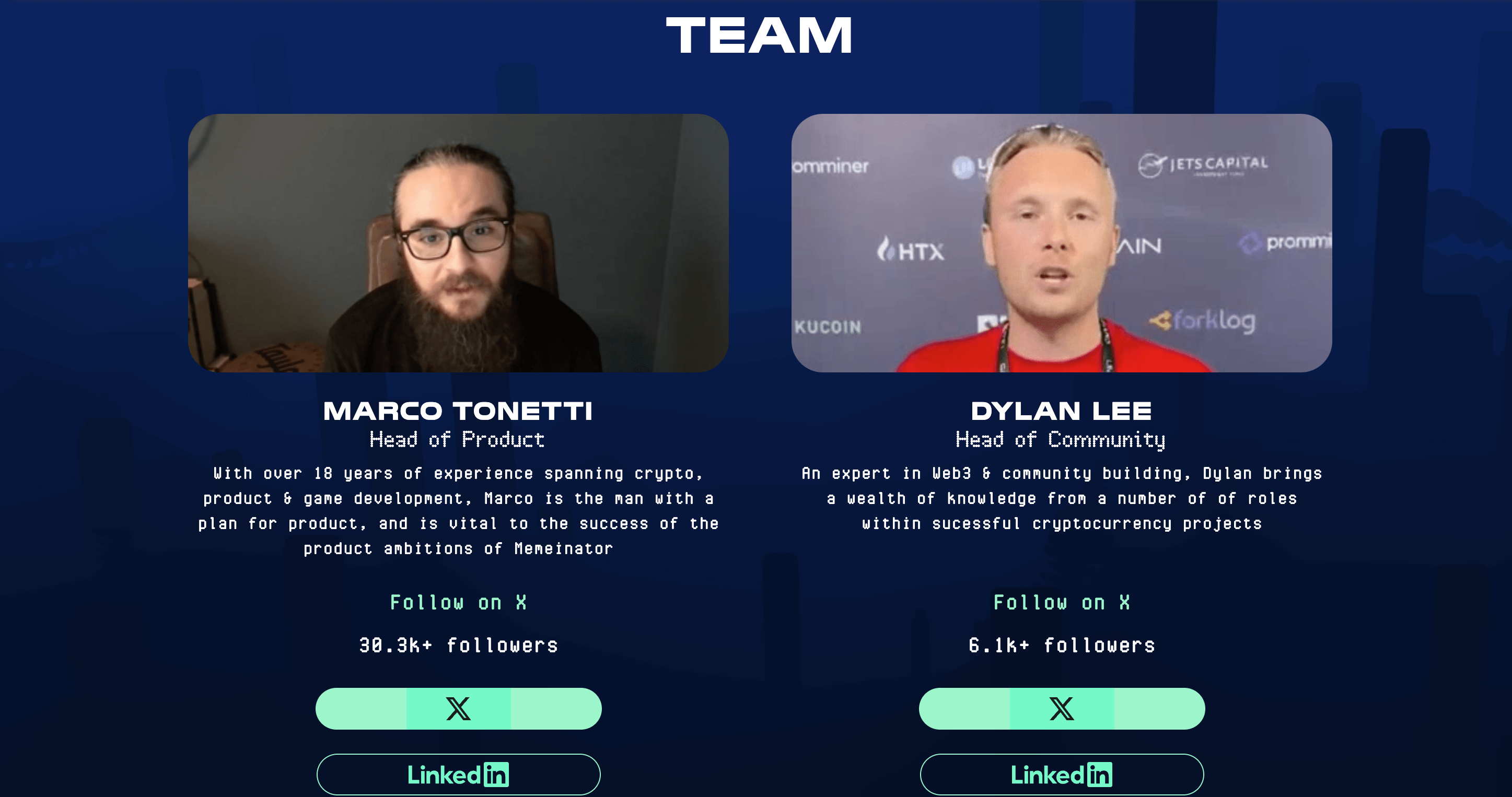

Source of video Marco Tonetti – Memeinator website before he deleted the video from the site.

https://www.linkedin.com/in/marco-tonetti-5159602b/

https://x.com/MarcoTonetti

Source of video Dylan Lee – Memeinator website before he deleted the video from the site.

https://www.linkedin.com/in/dylanleeeth/

What are the major concerns about Memeinator.com?

When it comes to crypto, users often talk about risky investments, but with Memeinator.com, the conversation turns darker. Some questions hit harder than others—how did this platform, which promised so much, end with such heavy allegations of misuse? Here are red flags you simply can’t ignore:

Huge promises, zero delivery: A red flag?

Big buzz, bigger promises—doesn’t this sound familiar in the cryptocurrency space? Memeinator.com claimed it would transform the meme token industry with cutting-edge innovation. But where is that innovation? From reports and social media chatter, it appears that all investors have gotten so far are sweet words and no action.

This isn’t a new tactic. Scammers often pour effort into marketing while quietly neglecting actual development. The flashy claims made about Memeinator.com are now being viewed as a smokescreen. For a project that promised so much to its community, the lack of delivery could be one of its loudest warning bells.

Suspicious patterns in user fund management

It gets even worse when you zoom in on what affects people most: their money. Allegations surfaced that funds entrusted to the platform weren’t just mismanaged—they vanished entirely. Across Reddit threads and Twitter storms, investors are sharing stories about being unable to withdraw their funds. A shared narrative of failed transactions and ignored support tickets is emerging, all pointing toward a singular, grim revelation: $7 million has seemingly disappeared.

Now the real question nobody can shake off: Where did all that money go? If even portions of these allegations are true, this isn’t negligence—it’s theft at scale. Understanding this issue means looking into the people at the center of it.

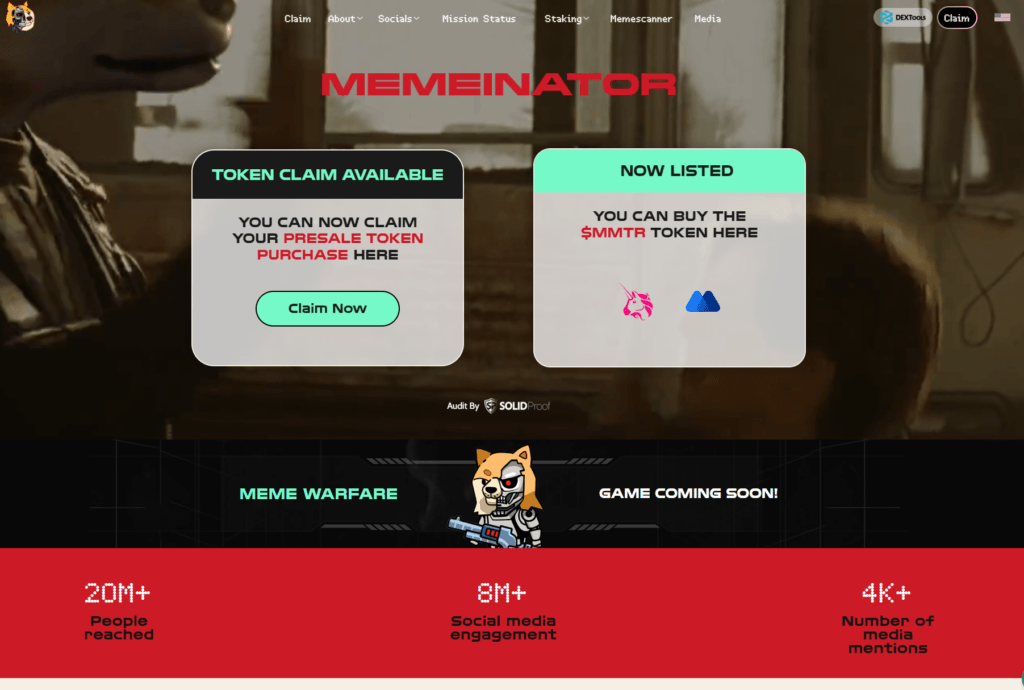

Source of picture: Memeinator.com before it was deleted

A closer look at Marco Tonetti and Dylan Lee

Behind every platform are players pulling the strings. In this case, those are Marco Tonetti and Dylan Lee. But who are they, and why is the crypto world so suspicious? Crypto projects live and die by the trust placed in their teams, and with every claim of fraud against these two, that trust is burning fast.

Tonetti and Lee are being called out for their lack of transparency, both about Memeinator.com’s operations and about their backgrounds. If you look at their records, there’s always that lingering feeling: Are these truly figures you’d trust with millions of dollars of your money?

Could Memeinator.com really be a carefully orchestrated scam by its teams, or is there another side to this story? No one knows just yet. What’s clear is that these allegations are too serious to dismiss as just internet drama.

But here’s where things really get interesting—how did Memeinator.com even rise to such popularity in the first place? Stay tuned because you’re going to want to see how they crafted this buzz and convinced so many investors to jump in.

The backstory: What is Memeinator.com, and how did it rise to popularity?

Imagine a place where memes meet the cryptocurrency world—a seemingly playful concept turned investment opportunity. That’s exactly what Memeinator.com pitched itself to be. If you were on social media or browsing crypto forums, you probably couldn’t ignore the buzz surrounding it. But how did a project like this get such an explosive start? Let’s break it down and see how the hype unfolded.

The idea behind Memeinator.com

The foundation of Memeinator.com was built on the allure of meme tokens—funny, entertaining coins inspired by internet culture. Tokens like Dogecoin had already proven that the meme-token craze could capture imaginations. Memeinator.com claimed it would “revolutionize the creative economy of memes” and give users the power to contribute, vote, and earn from viral internet trends.

It sounded like the perfect storm: a booming meme culture fused with a growing cryptocurrency market. The idea was simple but so engaging. And let’s be honest—who doesn’t want to invest in something that feels so lighthearted yet promises staggering profits?

Marketing tactics: Did they mislead investors?

Memeinator.com didn’t rise to popularity on good ideas alone. Their marketing machine was relentless. They maximized every digital corner, flooding social media platforms with ads and flashy campaigns that made you think you were late to the party if you weren’t investing yet.

- Hyped-up influencer endorsements. They tapped into influencers with big crypto-followings, some of whom hardly seemed credible, but their audiences took the bait.

- Exaggerated claims. Memeinator.com promised ROI figures that almost sounded fictional—but hey, it’s crypto, right? Many investors fell for this optimism without questioning the fundamentals.

- Scarcity tactics. Seriously, the whole “limited opportunity” pitch is a classic trick. Users were told to act quickly before they missed out on the next “big thing.”

One user shared in a crypto forum that they invested within minutes of seeing an ad for Memeinator.com. They said, “I couldn’t shake off the feeling I’d be kicking myself in a year for not getting in early.” And now? Regret, plain and simple.

The hype train: Who fell for it, and why?

The success of Memeinator.com’s launch wasn’t just about marketing—it was about playing into psychology. Investors across all levels bought into the FOMO (Fear of Missing Out) epidemic. Studies have consistently shown that cryptocurrency attracts a high percentage of first-time investors, many of whom lack experience in identifying scams. This isn’t a jab at anyone—it just highlights how easy it is to fall for savvy campaigns promising gold at the end of the rainbow.

Here’s the catch: Memeinator.com didn’t just attract seasoned investors hoping to diversify their portfolios. It climbed to popularity by reeling in newcomers who were drawn to the fun and relatable side of crypto. Memes might feel harmless, but when bundled with “life-changing” promises, people don’t always think twice about risks.

“The bitter truth? Scammers know how to tap into emotion, urgency, and desire. They sell you more than just a token—they sell you a dream.”

So, how does a platform that seemed so entertaining and promising take a turn for the worse? Why would, Marco Tonetti and Dylan Lee, allegedly betray an entire community? And most importantly, what evidence points to a potential orchestrated scam? I’m digging into it all next.

What exactly are the scam allegations against Marco Tonetti and Dylan Lee?

Let’s face it—trust is hard to come by in the cryptocurrency world, and when something feels off, it often is. Memeinator.com promised to reshape the future of meme tokens, but as time passes, alarming details continue to emerge about its team, Marco Tonetti and Dylan Lee. So, what’s the buzz? Let’s look at the voices of investors, missing funds, and whether this was all part of a calculated exit scam.

User complaints and testimonies

The loudest alarm bells are coming from the very people who believed in this platform—the investors. Many have shared their heartbreaking experiences, and their stories paint a grim picture:

- Inconsistent or nonexistent responses from the platform’s support team.

- Deposited funds vanishing without explanation or traceability.

- Promises of rewards or returns that never materialized.

Take Lisa’s story (shared on a popular Reddit thread). She explained how she invested $5,000 into Memeinator.com after being convinced by its overwhelming hype and social media buzz. A month later, her account was frozen, and repeated attempts to withdraw her funds were ignored. To quote Lisa: “It felt like we were just handing over our money to a black hole.”

This is just one example among many. These firsthand accounts can’t be overlooked—they’re not just isolated incidents but a growing pattern of similar complaints.

$7 million missing: Where did the funds go?

Here’s the million… oh wait, the $7 million question: where did all that money go? That figure doesn’t appear out of thin air. Blockchain investigators and independent researchers have pointed out suspicious financial patterns within the project. These include:

- Questionable transfers linked to wallets rumored to belong to the team.

- A significant number of funds being converted to privacy-focused coins like Monero, making them harder to trace.

- Lack of any public transparency about where funds were being allocated, even after repeated user concerns.

How does one simply misplace $7 million? This is where doubts shift into outright accusations, with calls for legal action against Marco Tonetti and Dylan Lee growing louder by the day.

Signs of a planned exit scam?

Let’s be real—this is what it looks like when team pull off a premeditated rug pull. Scams like these don’t happen overnight, and Memeinator.com shows all the classic signs of an exit scam:

- Over-the-top promises in the initial stages, paired with flashy marketing to build massive hype.

- The teams suddenly going quiet or offering vague, overly defensive excuses when questioned.

- A sharp decline in platform updates followed by users being locked out of accounts or denied withdrawals.

Can a scam like this be a coincidence? Or were Tonetti and Lee crafting their escape plan from day one? The absence of clear communication only feeds the suspicion. Were these two leading their community down a path they never intended to deliver on?

“It’s not the money we lost—it’s the betrayal,” one frustrated investor wrote online. “They played with our hopes and trust like it was nothing.”

This kind of emotion hits deep, doesn’t it? And it begs the question… What steps can we take to avoid falling for projects that raise so many red flags?

How to Spot Similar Scams in the Cryptocurrency World

Scams like Memeinator.com aren’t new to the cryptocurrency world—and sadly, they’re not going anywhere soon either. But the good news? There are clear signs that can help you separate a potential scam from a legitimate project. By staying sharp and informed, you can shield your investments and avoid becoming the next victim. Let’s uncover the common mistakes investors make and how you can avoid them.

Too-good-to-be-true promises are always a warning sign

You’ve heard the saying before: “If it sounds too good to be true, it probably is.” That couldn’t be more spot-on in the crypto world. Many fraudulent projects thrive on hype, promising massive, unrealistic returns or revolutionary technology that seems almost magical.

For example, Memeinator.com reportedly promised groundbreaking innovations in the meme token sector, but where was the proof? Did they back up these claims with actual tech demonstrations, working products, or detailed roadmaps? The answer was a loud no. Scammers know how to talk a good game and get emotions running high, especially the fear of missing out (FOMO). But as an investor, it’s your job to look out for:

- Vague promises without detailed technical explanations.

- Overemphasis on marketing with little or no focus on the product itself.

- Ridiculously high return-on-investment (ROI) claims. Some scams even dangle figures like 300% or 500% returns in weeks—red flag!

Poor transparency and unverifiable claims

Lack of transparency is a cornerstone of scam behavior. Many fraudulent crypto projects operate in the shadows, hiding behind a shiny website or charismatic videos but offering no real data or proof about their operations.

Ask yourself questions before trusting a project:

- Can I verify the team behind this? Scammers often use fake names or stock images to build fake profiles. A reverse image search might reveal something unexpected.

- Do they have a registered company? This itself isn’t a guarantee of safety, but legitimate projects often have clear corporate documentation.

- Is their whitepaper solid? Whitepapers should include clear, transparent goals and technical frameworks. If it reads like an empty sales pitch or is filled with buzzwords, that’s a red flag.

Remember this: if a project hides essential information or overwhelms you with marketing, they might be hiding their true intentions, not just company details.

“The biggest trick scammers pull is making you think you’re the one who’s missing out. Don’t fall for the smoke and mirrors.” – Anonymous Crypto Advocate

What investors should always research beforehand

So, how can you protect yourself? Every single step you take before investing matters, and skipping even one could cost you. Here’s a checklist to keep in your back pocket:

- Check the team: Look up the founders and team members. Are they real people? Do they have a proper LinkedIn profile or a history in this industry?

- Review the tokenomics: Always check how a project plans to handle its tokens. Who owns the largest share? Are the tokens pre-mined? Is there potential for a pump-and-dump?

- Verify partnerships and endorsements: If a project claims it’s backed by major brands or influencers, double-check. Scammers often lie about partnerships—or worse, invent them.

- Check online reviews: Reliable resources like forums, Reddit, or reputable review sites can reveal warning signs that your own research may miss.

- Don’t let FOMO cloud your judgment: Scammers play on emotions, especially hype. As tempting as a fast investment may seem, it’s better to lose an opportunity than to lose your savings.

Cryptocurrency offers incredible opportunities, but these opportunities come with risks. Scammers have become increasingly sophisticated, making it even more urgent for investors to use critical thinking every step of the way.

But here’s the thought that likely remains on everyone’s mind: Is the crypto community doing enough to expose these shady projects? Or are there insiders spilling secrets that might shift the narrative? Learn what the buzz is on Reddit, Twitter, and beyond in the next part.

What the crypto community is saying about Memeinator.com

It’s no surprise that when a crypto project starts to crumble, the community is where the truth often surfaces first. Discussions explode, stories unfold, and the raw emotions of victims flood social platforms. That’s exactly what’s happening with Memeinator.com right now. Let’s check out what people are saying and how the crypto world is responding to this ongoing saga.

Reddit’s reaction to Memeinator.com’s controversy

If you’ve spent any time in crypto-related subreddits, you already know how quickly people can piece together details when something feels off. Reddit is currently buzzing with threads about Memeinator.com, and many aren’t pulling any punches.

In one post, a user claiming to be an investor wrote, “I put in $15k because the team promised insane returns, only to see my funds drained within weeks. When I contacted them, silence. Total silence.” This thread picked up hundreds of comments, with users dissecting the project’s dubious claims about fund security and promises that now seem laughable in hindsight.

Others are sharing screenshots of transactions they say were routed to obscure wallets, sparking questions about whether these were the actions of an elaborate exit scam. It’s clear people feel betrayed, but even more alarming is how easily this project flew under the radar—until now.

Twitter trends: #MemeinatorScam?

Move over #ShibaToTheMoon, there’s a new hashtag dominating crypto Twitter: #MemeinatorScam. This is where the controversy has not only gained traction but also gone mainstream. Influential crypto accounts, some boasting over a million followers, have started chiming in on the situation.

One popular tweet reads,

“Crypto keeps blaming regulators for overreach, but projects like Memeinator.com make the case for tighter scrutiny. $7 million gone? Investors deserve better.”

That tweet alone racked up thousands of likes and retweets, showing just how wide the conversation has spread. It’s also worth noting that users are tagging @TheMemeinator__ directly, demanding answers. As of now, their account has gone radio silent—not exactly the response you’d expect from a legitimate project under mounting pressure.

The most shocking insights, though, might be coming from people who claim they were involved with or closely connected to Memeinator.com. Allegedly, some have stepped forward anonymously, issuing damning accusations about how the project was run.

- Claim 1: The team deliberately funneled funds into offshore accounts well before the platform went live, signaling premeditated foul play.

- Claim 2: Internal chats reveal team of Marco Tonetti and Dylan Lee allegedly ignored concerns over legal compliance raised by junior team members.

- Claim 3: Reports of former employees unpaid and contracts terminated abruptly suggest the team might have been scrambling to escape long before the controversy erupted.

Of course, these claims lack hard evidence at the moment, but if even a fraction of them turn out to be true, it paints a grim picture of a calculated betrayal. You might wonder, though, why no one flagged these behaviors sooner? Were people afraid to speak out? Did they benefit in some way? The deeper you look, the murkier this entire situation becomes.

The crypto world thrives on community trust, but this incident shows how fragile that trust can be. As users demand transparency and accountability, you can’t help but wonder: Will Marco Tonetti and Dylan Lee ever face the heat? Or will they manage to slip away unnoticed?

Marco Tonetti and Dylan Lee: What do we really know about them?

When a project collapses under allegations like this, the first question many of us ask is: Who are the people behind it? Marco Tonetti and Dylan Lee, the brains behind Memeinator.com, seem to be the centerpiece of this entire controversy—but do we really know enough about them? Let’s break it down and see why these two figures are now the focus of heavy scrutiny.

Past projects and history in crypto

Cryptocurrency thrives on trust—or at least what’s left of it. That’s why knowing a teams’s track record can give you a better sense of what to expect. Marco Tonetti and Dylan Lee, however, appear to have operated in murky waters even before Memeinator.com.

There’s chatter in certain online communities that these two have popped up in previous, less-than-savory projects. In fact, users on Reddit and Telegram have claimed that Tonetti and Lee were linked to another project that allegedly vanished after raising significant funds—but the trails, like clockwork, seem to disappear as quickly as the funds themselves.

If a person burns their role in one project, jumping to another with a fresh new brand is a common strategy in the crypto world. It allows them to wash away the stains of the past—at least temporarily. Do some of their previous projects perhaps share similar patterns of operation? That’s something to think about.

Current silence or defensive comments?

In situations like this, words—or the lack of them—speak volumes. Surprisingly (or maybe not), Marco Tonetti and Dylan Lee have largely remained silent in the face of these allegations. And when there has been any response, it feels like smoke and mirrors rather than real answers.

Here’s the thing: silence from leadership during such storms doesn’t just look bad; it fuels suspicion. Victims have every right to demand explanations, and many have taken to forums and social media asking, “Where is my money?” The lack of clarity or even an attempt at addressing the backlash raises one glaring question—are they hiding something they can’t justify?

On the rare occasion they’ve made comments, it’s been defensive at best. Some responses reportedly aimed to shift the blame onto “market conditions” or “misinformation.” It’s a convenient strategy that other exposed teams have used: cast doubt on critics rather than deal with facts. But the question remains—where’s the transparency?

“People don’t just lose trust in the project. They lose trust in the entire ecosystem.”

And that’s the real tragedy here. The actions of these teams don’t just burn investors; they chip away at the cryptocurrency community’s reputation itself. The very people who try to build honest projects suffer because of bad actors like these. It makes you wonder: Will Marco and Dylan ever face the accountability they owe to the people?

So what happens next? Can those affected ever hope to recover even part of their funds? Let’s explore where things stand with legal actions or community efforts in the next section. Could there be any light at the end of this very dark tunnel?

Is there any hope for recovering the $7 million?

Let’s face it—seeing millions of dollars just disappear is more than just financially draining; it’s crushing on an emotional level too. Many are asking the big question: Can anything be done to bring this money back into the hands of the rightful owners? The truth is, the road to recovery is far from smooth, but it’s not entirely impossible. Let’s break it down.

Legal action: Can victims take Memeinator.com to court?

The first thought that likely crosses anyone’s mind in these situations is legal action. Can the alleged victims unite and take Memeinator.com—or more specifically, its fteam Marco Tonetti and Dylan Lee—to court? The short answer is yes, but it’s complicated. Why?

- Jurisdiction issues: Blockchain platforms often operate across borders, and determining where a lawsuit can be filed (or even where the teams are located) is the first hurdle.

- Proof of wrongdoing: Victims will need detailed evidence, including transaction records, platform promises, and communications to prove the case. Without this, most legal cases fall apart.

- Scam anonymity: Many alleged scams design their operations to avoid legal accountability. Even when they’re caught, tracing the diverted funds to real identities is tricky.

But there are success stories. In a recent similar case, investors united and filed a class-action lawsuit against a fraudulent platform. It showed that, with coordination, perseverance, and solid proof, there’s at least a chance.

“Justice may be slow, but it’s not impossible. Stay strong, never let fraudsters sleep peacefully.” – Anonymous Crypto Investor

For anyone impacted, seeking help from legal experts with experience in crypto could be the first step forward. It’s a long shot, but it’s better than sitting back feeling helpless.

Regulation and crypto scams

Here’s the harsh reality: scams like this thrive because cryptocurrency operates in a space where regulation is, well, pretty much playing catch-up. The decentralized nature of crypto—which makes it so attractive—is the very reason it becomes a breeding ground for fraud.

But there’s another side too. Governments and law enforcement around the world are starting to crack down. For example, the SEC in the United States has ramped up investigations into suspicious crypto platforms. Just this year, several high-profile crypto scams were busted, saving millions for potential future victims. Yet regulation often feels reactive, not proactive, leaving many victims with little immediate hope.

- Why regulation still matters: Proper oversight could mean platforms like Memeinator.com never get the chance to scam investors in the first place.

- Protecting the future: Even though it comes too late for some, increased action today could prevent another large-scale scam tomorrow.

So, is there any solace here? If anything, this situation proves that the crypto space desperately needs better protection mechanisms. But for those hoping to recover funds, these changes might arrive too late to make a difference.

But wait—what about smarter ways to protect yourself before it’s too late? What if there were actionable strategies that could help you spot the next Memeinator before even dipping a toe in? In the next part, let’s explore how you can protect yourself and your investments. Because, honestly, in this wild crypto world, knowledge is your best shield…

What can we learn from this? Protecting yourself in the crypto world

It seems like every day there’s another story about someone losing their life savings to a cryptocurrency scam. Even when projects come wrapped in shiny marketing, big promises, or even seemingly trustworthy teams, the truth can be obscured until it’s far too late. So, how do we avoid getting burned in this still largely unregulated space? Let’s look at what keeps investors safe in a world full of questionable projects.

Due diligence is vital when investing

We’ve all been there, right? You see an exciting project, and you’re tempted to jump in before it’s “too late.” But here’s the thing: rushing into investments without checking the fundamentals is one of the easiest ways to get scammed. Before you even consider hitting that “buy” button, there are some non-negotiable steps you should take:

- Research the team: Look into the founders and developers. Are they publicly known? Do they have a transparent history? Past behavior is often the best predictor of future actions.

- Examine the whitepaper: A legitimate project will have a clear, detailed whitepaper explaining its goals, tokenomics, and roadmap. Be cautious of buzzwords and vague promises that sound impressive but mean nothing.

- Check reputable forums: Communities on platforms like Reddit and trusted cryptocurrency forums are often the first to raise red flags. A quick search can save you from a world of pain.

These steps aren’t guarantees, but they help minimize your risks. Remember, a legitimate project should stand up to scrutiny—it’s your right as an investor to ask questions and expect answers.

Why you should never invest more than you can afford to lose

This one is simple but so often ignored. Think about it—why risk money you can’t afford to lose? The crypto market is volatile and risky by nature, and scams like Memeinator.com only add to the danger. By keeping your investments within a range you can live without, you’re lowering the chances of feeling completely devastated if something goes wrong.

Why does this matter so much? Because greed and FOMO (Fear of Missing Out) are powerful emotions in the crypto space. Scammers know how to tap into these emotions, pushing people to take risks they wouldn’t normally consider. But if you remind yourself of this golden rule—only invest disposable income—it becomes much harder for anyone to manipulate you into reckless decisions.

So, what’s the secret to navigating this unpredictable world of crypto while staying safe? Are there better ways to distinguish the red flags from the green lights? Stay tuned—there’s more to uncover in the next section.

So, is Memeinator.com the latest crypto scam?

After everything we’ve looked at, there’s one question left to answer: is Memeinator.com truly a scam? When you connect the dots—missing funds, unanswered questions, stories of angry investors, and the founders’ behavior—it’s hard to imagine anything else. Let’s break it down one final time.

The evidence against Marco Tonetti and Dylan Lee

First, let’s remember that around $7 million of user funds have reportedly vanished without proper explanation. This isn’t just an accusation floating around—it’s backed by numerous complaints from investors who trusted the project. These aren’t isolated incidents; they’re a pattern. The minute users start asking where their funds went, and the team stays silent or offers vague excuses, something is clearly off.

Marco Tonetti and Dylan Lee, the supposed masterminds of this project, have done little to ease those concerns. Their actions—whether disappearing from the public eye or avoiding community questions—speak louder than words. Let’s not forget the suspicious signs of a well-planned exit strategy: bold promises, fast-talking marketing, and a sudden vanishing act when it’s time to deliver. It’s Crypto Scam 101, and it feels like investors walked straight into the trap.

According to a 2022 study by Chainalysis, rug pulls and exit scams accounted for over $3 billion in stolen cryptocurrency in a single year alone. Scams like Memeinator.com aren’t rare—they fit a troublesome pattern. And this case adds another tragic chapter to the ongoing story of crypto fraud.

Resources for further insights and updates

If you’re looking for more information or want to stay updated on this situation, here are some places to start:

- Reddit – Search for keywords like “Memeinator” or “#MemeinatorScam” to find discussions from affected users and crypto enthusiasts.

- Twitter – Follow hashtags like #MemeinatorScam, as these tend to pick up momentum when something shady happens in the crypto space.

- Cryptolinks – We keep our eyes on the latest news and developments, so stay tuned for updates as this unfolds.

Additionally, reliable news sources like CoinTelegraph and Decrypt often cover major scams, so it’s worth checking them out to see if new evidence or investigations come to light.

Closing Thoughts: Lessons from this disaster

At the end of the day, Memeinator.com serves as a painful reminder of how dangerous the crypto space can be when greed overtakes caution. The flashy marketing campaigns, the bold claims, and the promise to “revolutionize” a space already crowded with questionable projects—it all worked perfectly to lure in unsuspecting investors.

But here’s where we, as a community, need to do better. It’s easy to get caught up in hype, especially when everyone around you seems to be throwing their money into the next big thing. And that’s exactly why projects like this thrive: they exploit our excitement and trust. The result? Stories like this one, where real people lose their hard-earned money.

Always remember some basic rules:

- Don’t trust big talk. If a project promises the moon and can’t back it up with facts, research, or transparency—it’s not worth your time.

- Do your own research. Look into the people behind a project. If they’ve been involved in shady activities before or lack credibility, stay far away.

- Invest wisely. Never put in more than you can afford to lose. It might be tempting, but the risks in crypto are real.

Ultimately, the story of Memeinator.com is a frustrating yet important lesson for all of us. Scams like this highlight the pressing need for better regulation and more accountability in the cryptocurrency space. Until that day comes, the responsibility falls on us—to stay informed, skeptical, and prepared.

The crypto world can be exciting and full of potential, but only if approached with caution. Let this serve as a reminder that while FOMO might cloud your judgment, your due diligence is what truly protects you.