Simple Bitcoin Price Prediction

How to Simple and Best Predict Bitcoin Price, Altcoin prices or Cryptocurrency prices overall

Trading in cryptocurrencies has continued to grow in popularity. An increasing number of enthusiasts and professionals have been focussing their attention to the cryptocurrency market to capitalise on price movements. The volatile and early nature of the cryptocurrency markets can often make it difficult to predict price movements. Despite this, there are full-time professional cryptocurrency traders so it is undoubtedly possible. We present some of the top tools these traders use in assisting them in predicting the price of Bitcoin and other cryptocurrencies.

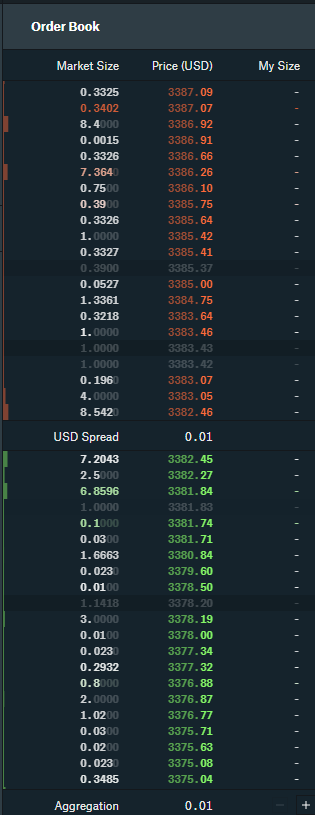

1. Order Book

Everybody thinks that professional traders sit in front of charts all day. Some have a notion that traders have a Martini in one hand and a chart on the screen which will send a clear signal to them every time the market is about to move.

The reality is that one of the most widely used tools by professional traders is the order book. The order book consists of the bids and orders in a market at a given point in time. It is the true reflection of what is going on in the market at that moment in time.

Many cryptocurrency exchanges enable you to freely access their order book even if you are not a client. A highly liquid exchange such as Coinbase Pro provides a good gauge of what is going on in the market and how buyers and sellers are behaving.

Coinbase Pro Order Book BTCUSD

2. Depth Chart

This is simply a graphical representation of the order book. It can assist users in quickly identifying whether there are more orders building up on the side of buyers or on the side of sellers.

Bitstamp Depth Chart

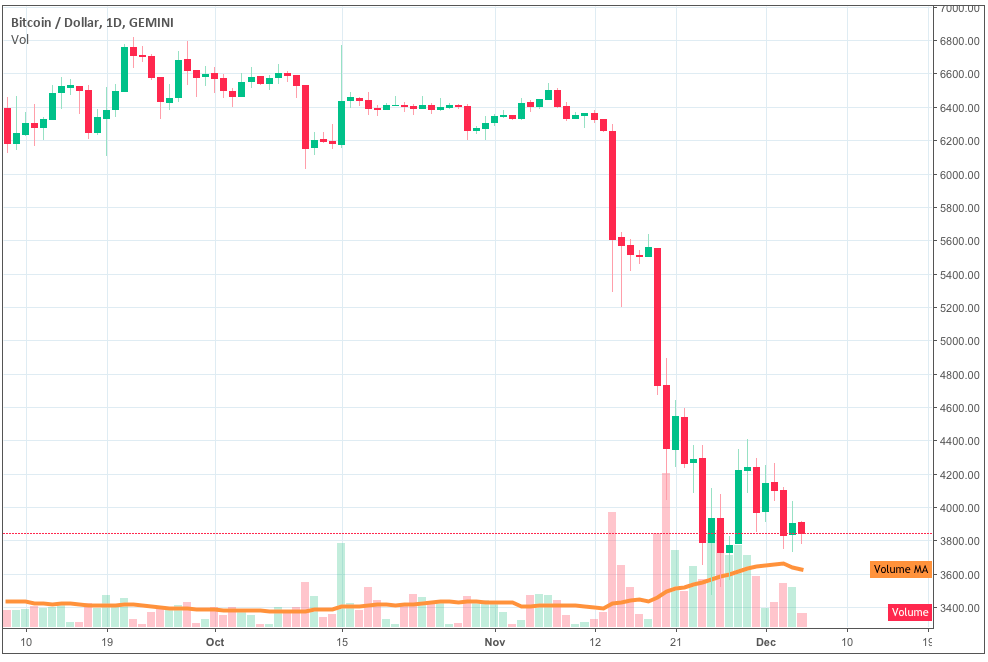

3. Technical Analysis

This is the charting world of trading. Technical analysis is essentially the analysis of past price data to inform future decision making. The most common form of this is Japanese Candlestick charts which is what traders commonly use to graphically display price.

Japanese Candlestick Pattern of Bitcoin Versus USD on Gemini Exchange

It isn’t as straightforward as watching a chart and getting clear signals. The world of technical analysis goes deep. Traders apply analysis techniques to get a small probabilistic advantage over the market and capitalise on it over a long period of time. There are patterns which can be studied in the candlestick charts but traders also commonly apply indicators and other techniques to assist. Volume is often used to gauge the strength of a move and areas of important trading activity are often marked with horizontal lines and trend lines.

Some valuable software tools which are commonly used by traders in this area are TradingView and Coinigy. TradingView provides a wide range of tools and also has a large community of cryptocurrency traders posting and discussing their ideas and analyses. TradingView also enables traders to conduct their analysis on the traditional markets. Coinigy is a platform which is just focused on cryptocurrencies but also enables traders to link up to exchanges via their platform.

4. Fundamental Analysis

Fundamental analysis involves researching the properties of a project to assist in predicting its price movements. One of the most effective ways to do this in cryptocurrencies is to assess the operating health of the network. This can be done by examining data from block explorers. This will give an idea of how secure the network is and what kind of value it is providing by supplying data on metrics such as the hash rate (a good gauge for the security), transactions per day, and average fees. Popular explorers for Bitcoin include blockchain.info and btc.com.

Other relevant information can be found from other information sources regarding the project. Most projects will have a whitepaper detailing the project. There is also likely to be a website and online channels such as Reddit, Twitter, and BitcoinTalk where the value of the project is discussed. Many cryptocurrency projects are open-source which enables their code to be evaluated and contributed to by the developer community. It can be useful to check the Github page of open source projects to assess the level of activity which is taking place there.

5. News Developments

Key news developments also play a role in price. News plays a role in both the traditional markets and in the cryptocurrency markets. In the stock markets, when the earnings of a company are different from what analysts have expected, the price will typically adjust to reflect this. In the cryptocurrency markets, key news developments often relate to the development of the business ecosystem and the involvement of large corporations and governments. Traders can keep up to date with key upcoming events by using calendar websites such as coinmarketcal.com. News aggregators such as cryptopanic.com can also be used to check all of the key news developments from one place.