Does Bitmain’s $80 Million Investment Mark the Bear Market Turnaround Point?

CoinDesk has recently reported that according to mining farm operators in South West China, Bitmain is setting to invest hardware to the tune of $80 to $100 million for their own cryptocurrency mining operations. The company which typically derives the vast majority of its revenue from the sale of such hardware may be sensing changing conditions given its purported willingness to dedicate this hardware to its own mining.

The price of cryptocurrency market leader bitcoin is down 80% from all-time highs and the prices of the majority of altcoins have also been falling since early 2018. In this latest post, we analyse whether the decision of mining behemoth Bitmain marks a change in conditions for the cryptocurrency market.

Breaking Down the Decision

The sale of hardware equipment has become an increasingly dominant part of how Bitmain earns its revenue. The share of revenue which comes from mining hardware sales increased from 79% of the total revenue in 2015 to 94% for the first half of 2018.

Over the same period, the proportion of revenue coming from proprietary mining dwindled. However, in absolute terms, revenue has increased across all the areas of business which Bitmain is involved in.

The Mining Metrics

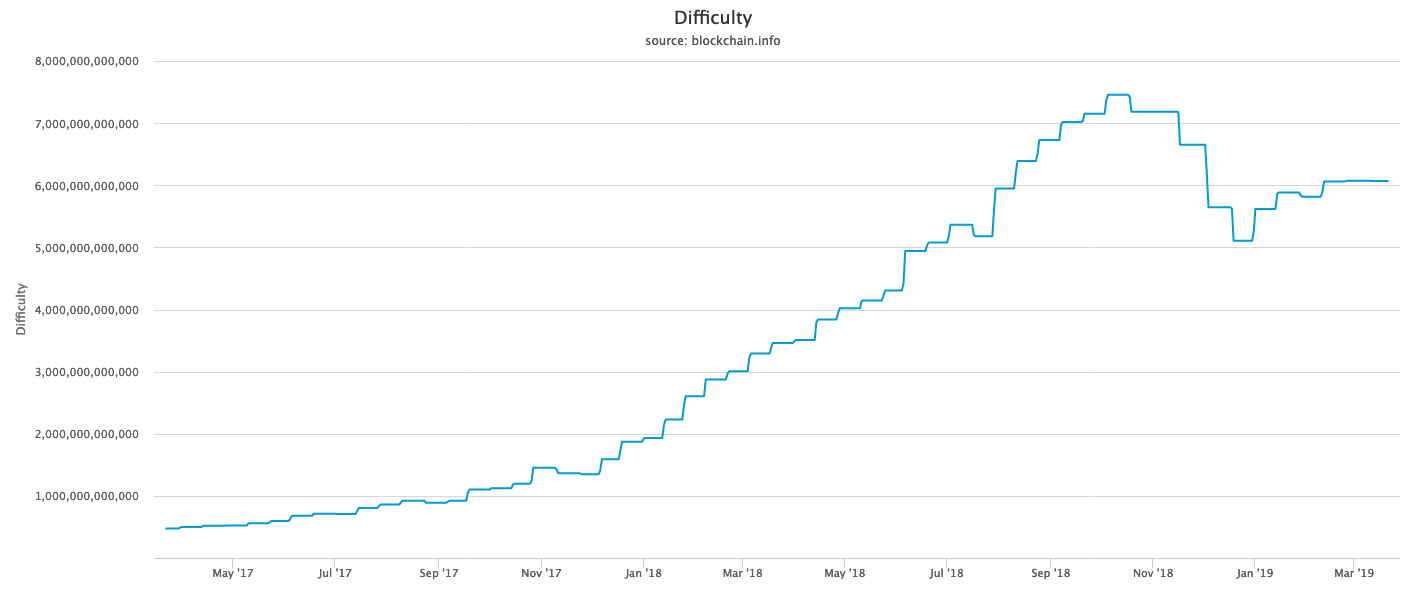

Declining cryptocurrency prices can result in miners having to drop out of the market due to difficulty meeting the costs of running an operation. However, the proof-of-work system is intelligently designed in the manner that the difficulty to mine adjusts in response to miners dropping out meaning a greater share of the rewards will go to the miners that continue to operate.

Significant amounts of mining operations were forced to shut down in October to November last year. This was believed to be mostly miners using the older hardware devices that failed to mine sufficient cryptocurrency to keep up with the costs of operating the hardware.

The shutdown of what is estimated to have been hundreds of thousands of miners resulted in a corresponding drop in the difficulty to mine. Bitmain may be viewing the adjustment in the difficulty to mine as the right time to capitalize and dedicate a greater share of their hardware towards proprietary mining operations as opposed to selling the hardware.

The opportunity cost of such a decision is certainly not small. The report by CoinDesk estimates $80 to $100 million worth of hardware will be put to work that could have been sold to consumers.

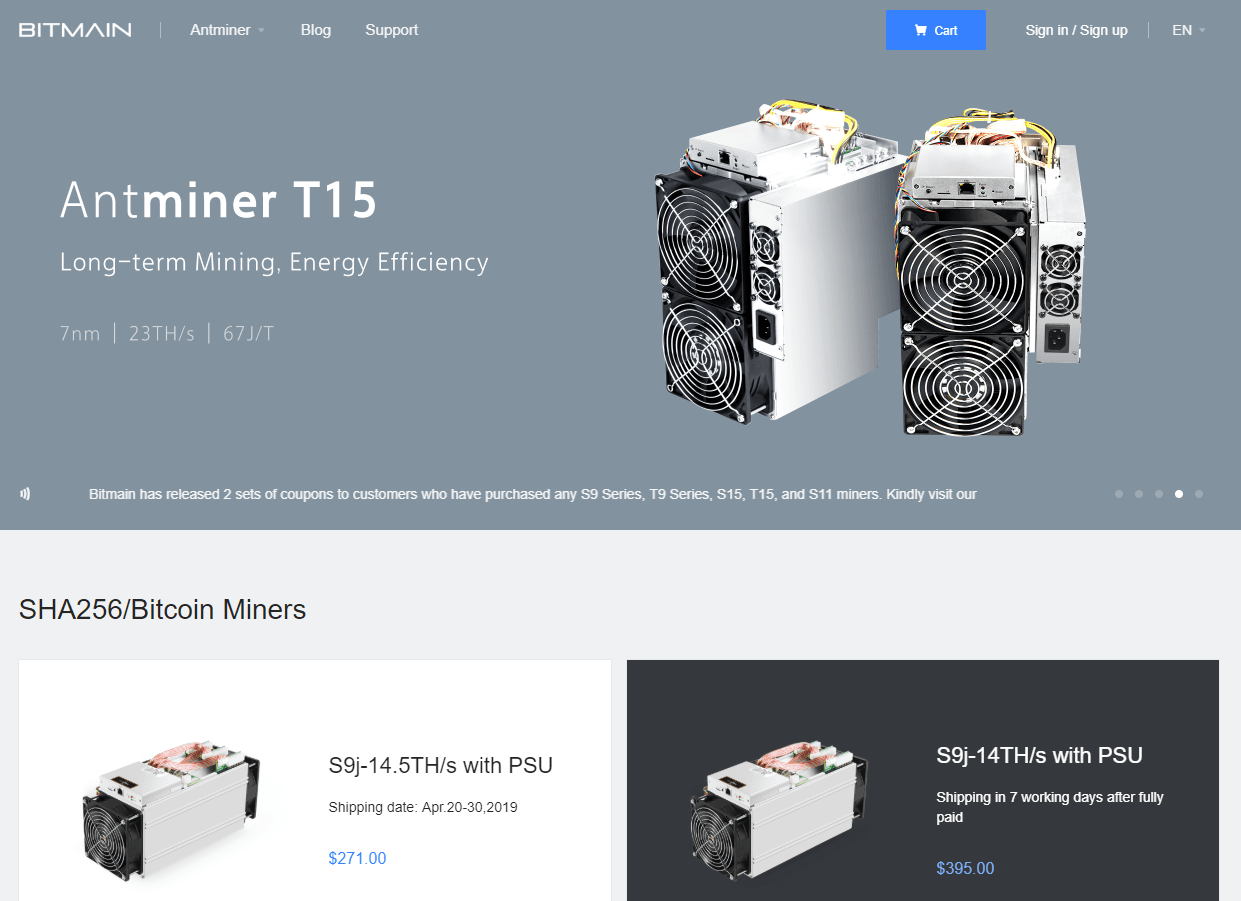

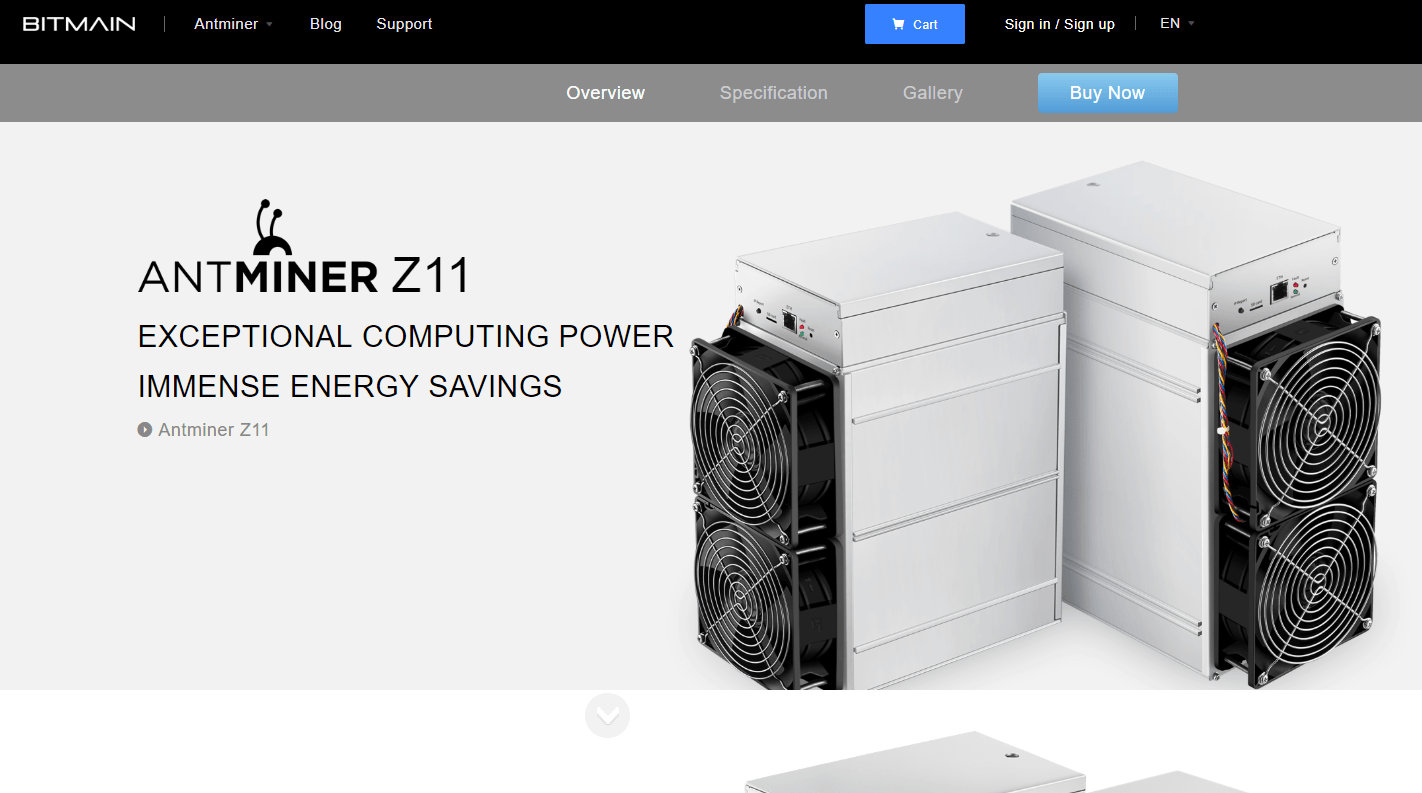

Shiny New Hardware

There is likely more parts playing into this decision than the drop in network difficulty. Bitmain recently released its latest lines of hardware equipment for mining the Bitcoin network.

Not surprisingly, the hardware is already sold out on the Bitmain website. Bitmain is likely taking this opportunity to apply a significant amount of this more powerful hardware for their proprietary operations while the majority of the competition will still be utilizing less powerful hardware.

The Relationship of Mining to Price

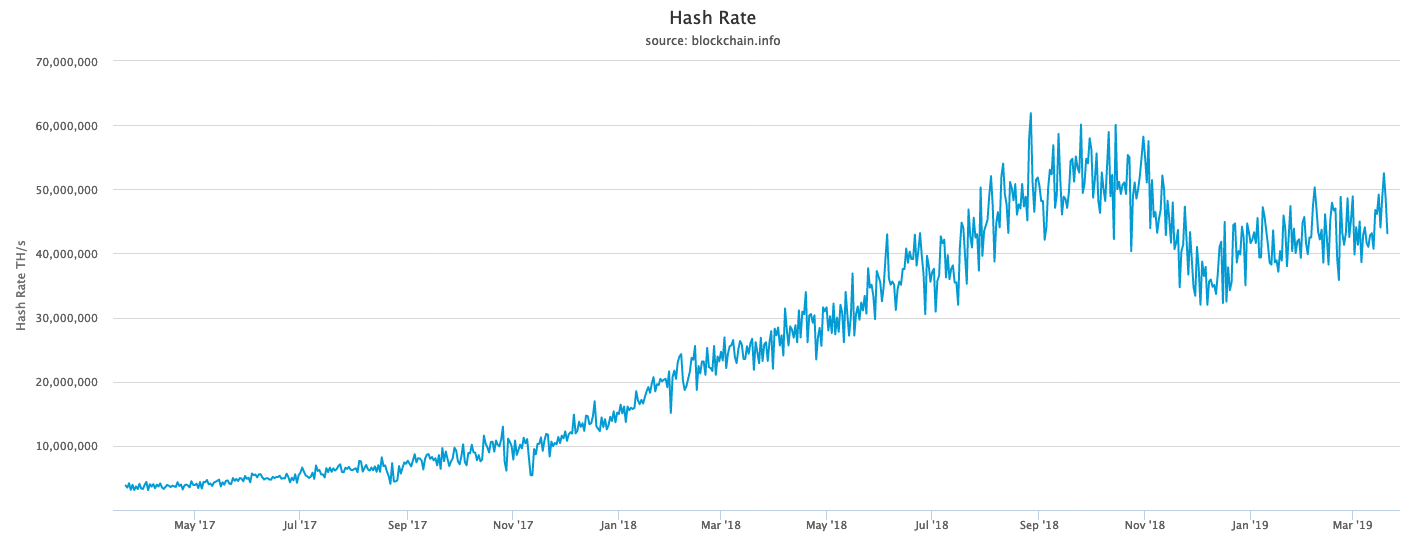

The more powerful the equipment being applied to the network for mining and the greater the number of miners, the higher the hash rate will be. The hash rate is a measure of the computing power being put towards mining blocks.

The higher the hash rate is, the more secure the network is and the more expensive the network is to attack by a malicious entity. Despite prices declining throughout 2018, the hash rate has tripled reflecting more powerful hardware being applied to mining the network as well as a greater number of miners.

Bitmain’s latest hardware being applied by both Bitmain themselves and whatever consumers managed to purchase the hardware will likely have a significant impact on the hash rate. The newest models have a hash rate of up to 28 TH/s whereas the most powerful previous models had a hash rate of 14 TH/s.

The newest models are scheduled to ship in early April. There will likely be a significant impact on the hash rate around this time period as we are likely to see both the latest models and older models simultaneously mining the network.

There will likely be a grace period before we see a situation similar to October and November of 2018 where the older models are forced to come offline due to difficulties in meeting costs. However, a price crash may accelerate this process happening with estimates that many hardware models will become unprofitable if the price of bitcoin were to drop below $3,000.

The increased hash rate we are likely to see as the latest models are deployed will decrease the chances of prices dropping below $3,000 as the network becomes fundamentally more secure. Bitmain may very well be strategically deploying their hardware to their own mining operations foreseeing that the bear market could be near its conclusion.