Ways to Assess Whether Cryptocurrency Markets Can Bounce Back in 2019???

2018 is officially behind us but whether the bearish declines of the cryptocurrency market are behind us is a whole other question. Cryptocurrency analysts have been struggling to determine whether the bottom for the markets are in. In this latest post, we analyse the key factors to take into consideration when assessing whether the cryptocurrency markets are likely to bounce back in 2019 or continue to decline. We also present some of the main tools that can be used to help in coming to your own conclusion about whether cryptocurrencies have bottomed out or are bound to bounce back soon.

Technical Analysis

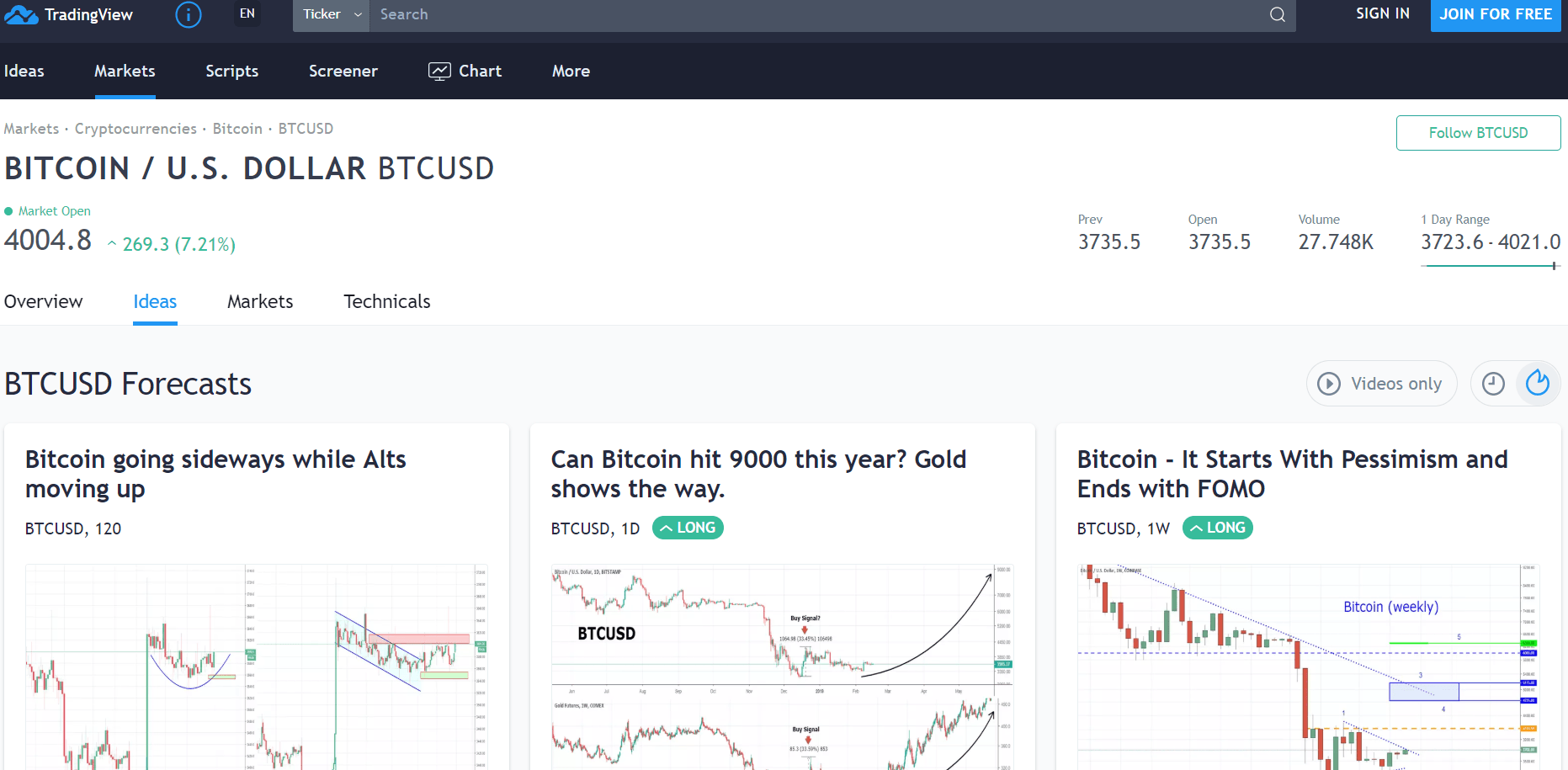

Technical analysis has been the primary tool of cryptocurrency analysts for a long time. Leading technical analysis software provider TradingView recently added ticker symbols TOTAL and TOTAL2 which track the market cap of all cryptocurrencies and all cryptocurrencies excluding bitcoin respectively.

Analysts have been pointing out that we have been forming higher lows recently which is a sign that the downward movements may be ending. However, prices in most major cryptocurrencies such as bitcoin have failed to yet form a higher high indicating that further downward movements may be in store. Research has also shown momentum is one of the key factors that go into where price is likely to move. After prices declining for all of 2018, momentum is currently strongly on the downside. You can conduct your own technical analysis with tools such as TradingView and Coinigy. TradingView focuses on all markets and Coinigy focus solely on the cryptocurrency markets.

Blockchain Data

There is no better way to assess the strength of projects than by delving into data occurring on the actual blockchain. Blockchain explorers are services which provide this data to us that can be extremely useful for analysing the strength of the networks comprising the market. For example, even though price continued to decline throughout 2018, the hash rate on the bitcoin blockchain tripled from 15 EH/s to 45 EH/s/. The reason for this is the development of new hardware which is more efficient at mining on the bitcoin network. The rise in hash rate also makes the network more secure as it acquires a more expensive acquisition of hardware to launch an attack on the network.

There are a number of other key metrics which can be used to assess how much the network is actually being used. Metrics such as transactions per day, USD volume traded on exchanges, and the size of transactions waiting to be confirmed can all be used to gauge the strength of a network.

Blockchain.com is the leading blockchain explorer for the bitcoin network. Ethplorer.io can be used for the Ethereum network and btc.com can be used for the bitcoin cash network. Different metrics are going to be important for different blockchains. For example, on the Ethereum network, total daily gas used is going to be an important metric for assessing the activity of smart contracts on the network.

Research

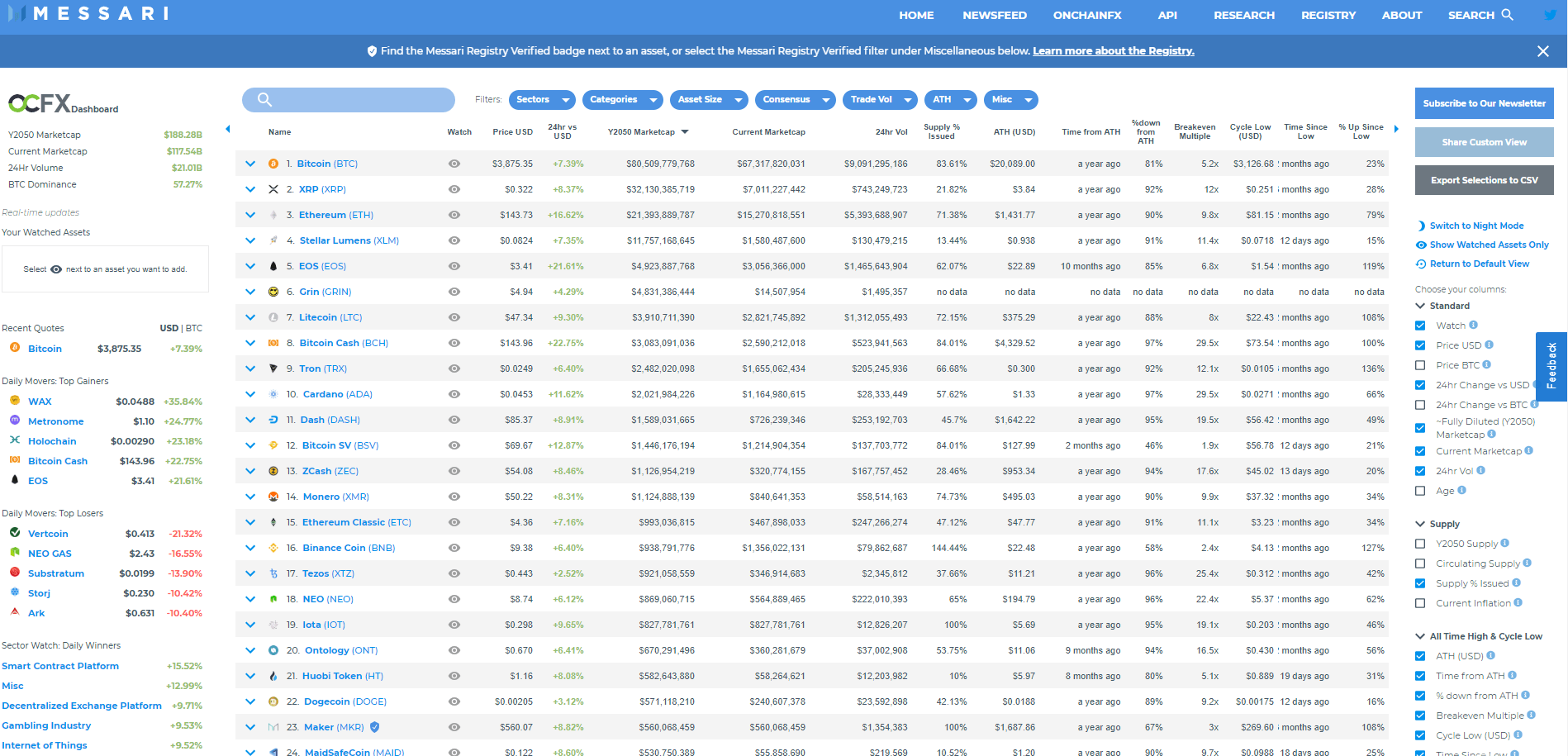

Research has always been important in defining and investigating the future direction of the blockchain industry and cryptocurrency markets. Many may be aware of BitMEX as the leading provider of cryptocurrency derivatives but they also have a research team. The research team produces high-quality investigations into matters regarding technology, economics, markets, and more. Users can sign up to a crypto digest with compiles the key research regularly and emails to subscribers as a newsletter.

Other newsletters have also been noted to include high-quality research in their reports. Messari, the data provider that acts as a competitor to CoinMarketCap, has been highly regarded for the research they include in their newsletter. Not all of their information is free however and they do also have a premium subscription service to access certain research. Another newsletter of note is the one provided by blockchain analysis company Chainalysis. Some other top sources of research include CoinMetrics which delves into data and blogs published by Blockstream which a company that builds products and services focused around the bitcoin ecosystem.

The Key Events

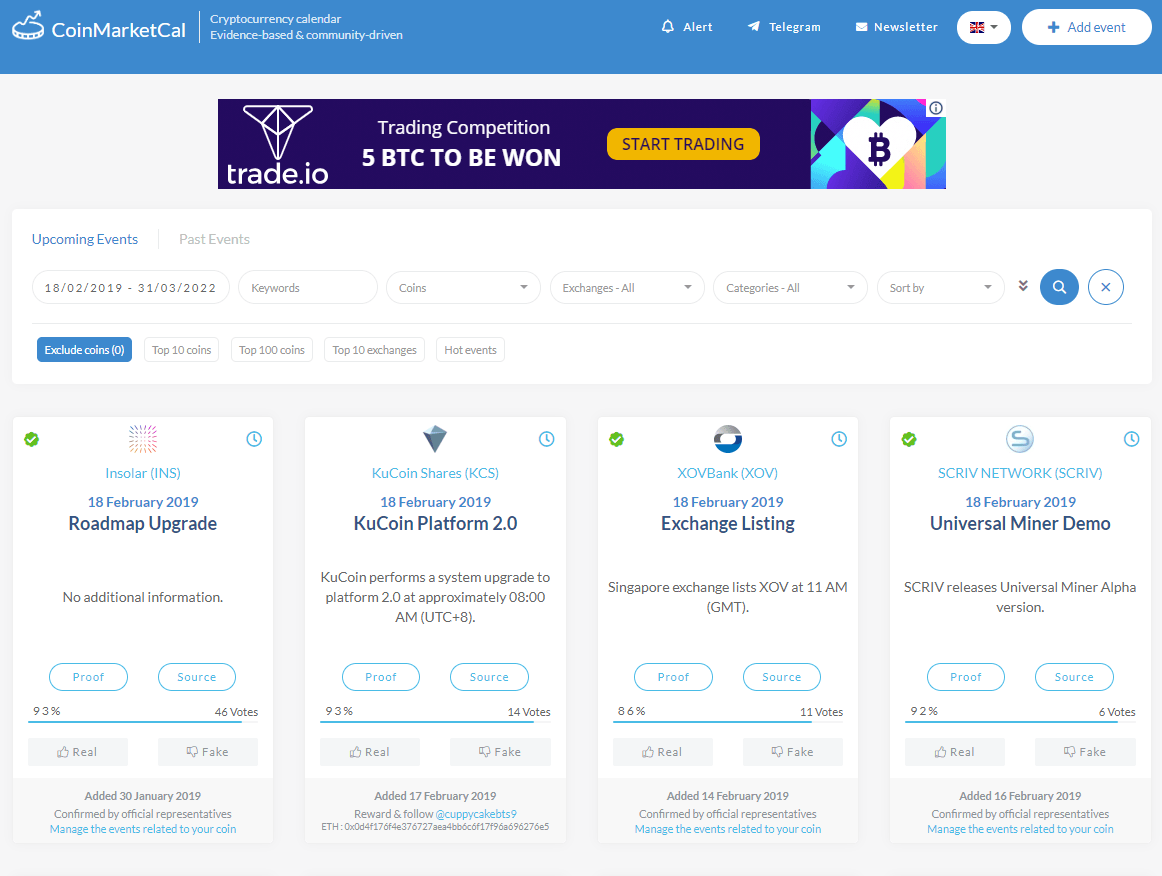

We have a big event upcoming in 2020 with the block reward for bitcoin blocks being halved. Until then, there is sure to be plenty of other significant events including upgrades, conferences, and mainnet launches. There are a number of tools traders can use to keep up with these events. Calendars such as CoinMarketCal and Coin Calendar can be used to monitor for events. Many of these tools also allow the user to get notifications on the day of the event.

Current Topics of Discussion

Keeping up to date with trending topics is another way of assessing the likelihood of a bounce-back or continued decline. Topics such as privacy and the block size in bitcoin have been causing a bit of a stir so far in 2019 and these issues can often play into how projects perform. Keeping up to date with these topics can be done in a number of ways. News outlets such as CoinTelegraph and CoinDesk report on all the recent topics of interests and are an easy way to stay up to date. If users wish to get more involved in the discussion, they can take to social media and voice their opinions. Twitter, BitcoinTalk, and Reddit are all places trending topics are actively discussed.