The Role of Smart Contracts in Modern Finance

Have you ever stopped to think just how radically finance would change if trust issues, delays, and costly third-party risks simply vanished? What if I told you there’s a technology making exactly this happen—right here, right now? It’s not sci-fi and certainly not fantasy; it’s smart contracts, at the very forefront of today’s financial revolution.

Reviewing countless cryptocurrency platforms daily for Cryptolinks.com, I constantly come across fascinating questions about smart contracts. Readers often wonder how smart contracts really impact finance and—more importantly—how such revolutionary tech might directly benefit them.

Finance Today: What’s Currently Holding Us Back?

Let’s face the truth: Traditional finance and banking are full of friction points. You’ve felt these frustrations many times, haven’t you?

- Endless paperwork and thousands of forms.

- Excruciating delays for simple transactions.

- Steep fees taken by countless unnecessary middlemen.

- Complex transaction processes causing confusion and mistrust.

These inefficiencies are not just annoying—they drain significant financial resources and open avenues for fraud, disputes, and lots of headaches. In short, traditional banking is overdue for a serious upgrade.

Smart Contracts Offer a Fresh Answer

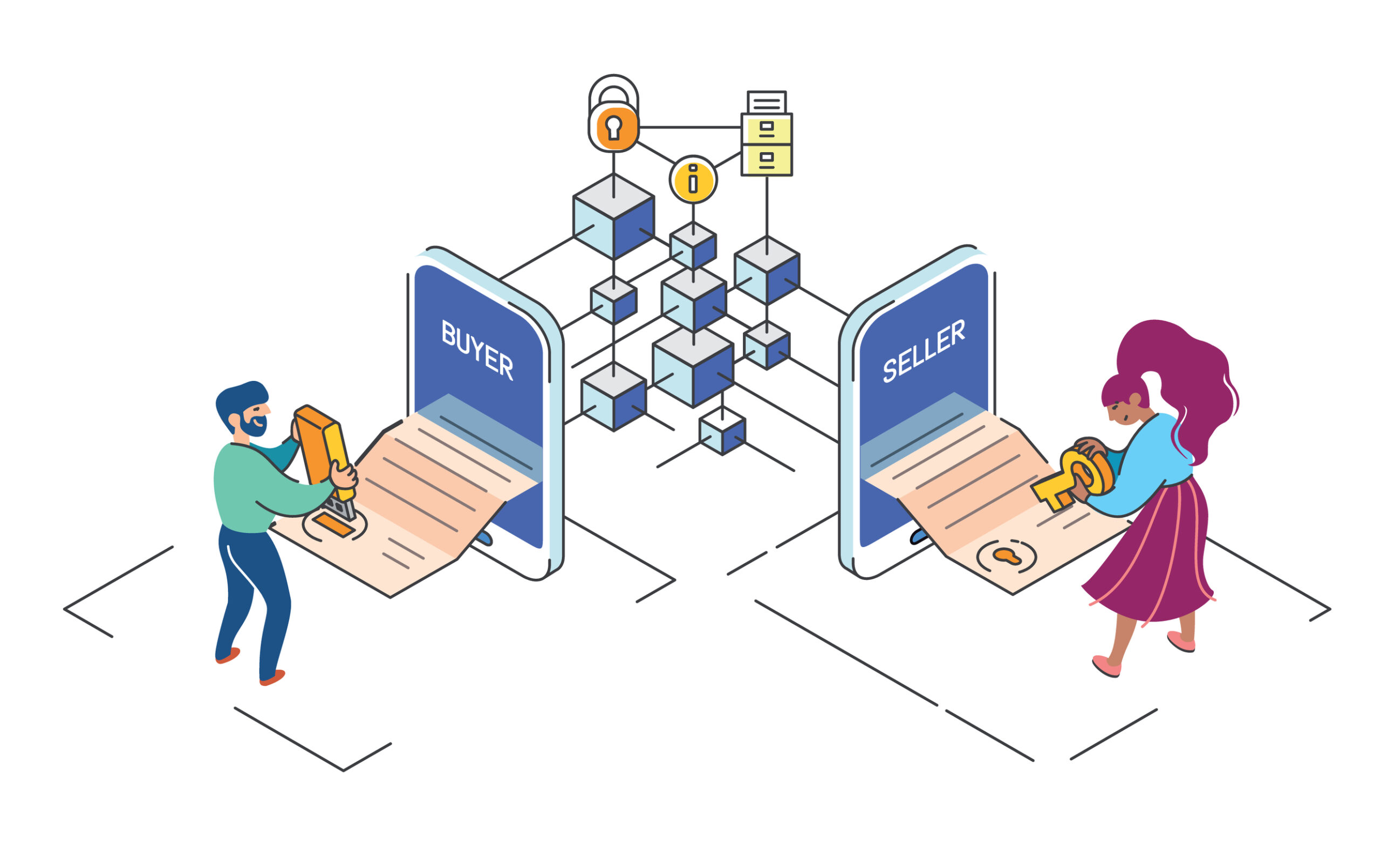

That’s where smart contracts come to the rescue. Think of smart contracts as digital contracts living within blockchain platforms. They’re programmed to self-execute once certain specified conditions are met. No more endless waits, no more dubious intermediaries—just fast, secure, and trustworthy transactions taking place automatically and transparently.

I like to think of smart contracts as impartial referees. They enforce the rules automatically without bias, ensuring all parties involved keep their end of the bargain. According to a recent report published by McKinsey & Company, blockchain-based smart contracts could drastically reduce settlement times and transaction costs, saving global economies billions each year. Amazing, isn’t it?

Imagine a Finance World Without the Frustration

Just picture how effortless managing finances would be if:

- Transactions were verified and finalized instantly, without days-long waiting periods.

- The usual exorbitant banking fees vanished, boosting both your personal savings and business profits.

- You had absolute confidence in transaction transparency at every stage of the process.

This isn’t just idealistic dreaming or a scene from a futuristic novel—this world is gradually becoming a reality, powered by smart contracts at the core. Leading companies, from global banks to fintech startups, are already adopting these automated solutions at an accelerating pace.

Curious to know precisely how smart contracts work in terms of your finances? Want to get a clear, straightforward explanation that cuts through the jargon?

Keep reading—I promise you’ll find the answer in the next part!

First Things First: What Exactly Is a Smart Contract in Finance?

If you’ve been hearing the term “smart contracts” buzzing around finance and crypto circles, you might be wondering: what exactly are they? Don’t worry—it’s simpler than it sounds, and I’ll guide you through it step-by-step (promise!).

It’s Just Computer Code—But So Much More Powerful

At their core, smart contracts are simply small computer programs running on blockchain networks—like Ethereum, Binance Smart Chain, or Cardano—that execute actions automatically when predetermined conditions are met. Think of smart contracts as money transactions or financial agreements with built-in automatic triggers, ensuring obligations are fulfilled immediately, without delay or human error.

Sound too abstract? Imagine buying a car and having funds released to the seller only when the ownership documents get digitally verified. Or, picture making sure your payments get refunded instantly if that eagerly-awaited concert is canceled. Smart contracts automate exactly these types of assurances—smoothly, quickly, and transparently!

“Smart contracts represent the digital handshake of the future; trust is built into every transaction.” – Vitalik Buterin, Ethereum co-founder

How Different Are They From Traditional Agreements?

Now, you’re probably familiar with traditional contracts: lengthy documents stacked with confusing legal jargon, expensive lawyer fees involved, and days—if not weeks—to get everything finalized. Smart contracts contrast massively with this old-school setup:

- Automation: No manual monitoring or verification needed—everything happens based on fixed conditions and triggers within the contract.

- Cost efficiency: Forget hefty fees. Removing third-parties and paperwork cuts down costs significantly.

- Speed & accuracy: Eliminating manual inputs means transactions are quick and free from human errors.

In fact, a recent IBM study on blockchain technology confirmed that smart contracts can save up to 80% of regular transaction expenses in sectors like finance, transportation, and supply chain management. Impressive, right?

So, now that we’ve demystified smart contracts—ever wondered just how deeply they’re shaking things up in specific financial sectors? Join me as I explain exactly how they’re transforming today’s financial landscape next. Curious? Good—let’s keep exploring!

The Big Picture: The Impact of Smart Contracts on Modern Finance

One thing’s crystal clear—smart contracts aren’t just another trendy buzzword swirling around finance circles. They’ve become a financial revolution in their own right, fundamentally changing the way we transact, trade, and build trust. But what exactly is their real-world impact? Let’s explore three incredible ways smart contracts are drastically transforming modern finance.

Automating Finance: Fast & Secure Transactions

Remember those nights when you nervously refreshed your banking app to see if your transaction finally went through? Or worse, had your heart sink when your money got stuck due to a banking error?

Smart contracts eliminate this painful friction by automating and speeding up financial transactions like never before. Because they trigger automatically the moment agreed conditions are met, they’re lightning-fast and trustworthy. There’s no more waiting, no unexpected hold-ups, and no potential manipulation in the middle. According to a Deloitte report, transaction settlement times can shrink dramatically—from days to mere seconds—thanks to these clever bits of code.

“The significant reduction in settlement time provided by smart contracts can lead to more efficient markets and substantial liquidity benefits.” — Deloitte Insights

Reducing Costs: Forget About Unnecessary Fees

Ever felt outraged checking your account and wondering why so many hidden little fees were nibbling away at your funds? Third parties and intermediaries have historically enjoyed hefty commissions and charges from financial transactions—until smart contracts stepped in.

By instantly executing transactions on a decentralized blockchain network, smart contracts cut intermediaries right out of the equation. This means no more unfair middlemen fees, no inflated commission cuts, and ultimately, more money left in your pocket. A study from Capgemini found businesses could reduce operational expenses by around 30-40% by using smart contracts instead of traditional arrangements. Think about what you—or your business—could save!

Enhancing Transparency and Trust

Financial scandals, corruption, hidden clauses… sadly, these shady practices have plagued the financial industry for years, diminishing trust among all of us. But imagine a new world where every agreement is transparent, traceable, and tamper-proof. That’s exactly the magic that smart contracts offer.

Smart contracts operate on blockchain networks, ensuring every agreement, transaction, and interaction is publicly recorded and auditable. There’s no hidden fine print, no secretive backroom transactions—everyone involved sees exactly what’s happening in real-time. This high level of transparency rebuilds trust among consumers, companies, and even governments, ushering in a healthier and more trustworthy financial environment. As the influential SSRN study points out, transparency via blockchain-smart contracts significantly improves accountability across financial sectors.

Feeling curious about practical examples where this powerful technology is already reshaping financial realities? Ready to see exactly how smart contract magic is transforming areas like lending, borrowing, insurance, and trade finance right now? Keep reading; you’ll be amazed at what’s truly possible today.

Smart Contracts at Work: Real-life Use Cases in Finance

You might be thinking, “Okay, smart contracts sound cool, but how does all this theory play out in the real world?” Good question—it’s always exciting when we start to see groundbreaking ideas actually working their magic outside critical papers and theories. Let’s check out some practical examples where smart contracts are reshaping finance right now.

Decentralized Finance (DeFi): Lending, Borrowing, and Yield Farming

If you’re even remotely curious about cryptocurrency, you’ve probably heard a thing or two about DeFi, the movement flipping traditional finance entirely on its head by making everyone their own bank. Smart contracts power some of DeFi’s most popular applications, such as lending, borrowing, and yield farming.

For example, platforms like Aave and Compound utilize smart contracts for totally automated and transparent lending and borrowing. No paperwork, waiting times, or third-party approvals. Just connect your crypto wallet, deposit your assets, and you’re either earning interest or taking out instant collateralized loans directly from other DeFi participants.

- Lending and borrowing: Smart contracts automatically handle interest rates, loan terms, liquidation events, and repayments without human involvement—increasing speed and security.

- Yield farming: Liquidity pools like those on Uniswap or PancakeSwap reward users for supplying assets to maintain liquidity. Smart contracts completely automate asset distribution, rewards, and transaction fees among thousands of participants instantly.

“DeFi powered by smart contracts isn’t just about a new financial system—it’s about empowering everyday people.” – Andreas Antonopoulos

Insurance: Speeding Up Claims

Insurance can be frustrating, slow, and sometimes plain unfair. Smart contracts are eliminating these annoyances by enabling automatic claim payments. How? By linking insurance agreements directly to outside data sources, known as oracles, smart contracts instantly verify when claim conditions have been fulfilled.

Let’s say you’ve bought travel insurance for your flights. If the flight’s delayed or canceled, a smart contract can automatically fetch confirmed delay data from airline schedules in real-time—instantly triggering a payout directly into your digital wallet, no questions asked, no paperwork needed. Platforms such as Etherisc have successfully implemented smart-contract insurance, proving it’s more than just a nice idea—it’s here now, and making people’s lives easier.

Trade Finance: Reducing Risk and Overpricing

Trade finance has historically been intransparent and prone to costly disputes and delays, especially in international commerce. Smart contracts directly tackle these issues, helping businesses trade confidently and fairly.

According to research published by the ACM Digital Library, integrating smart contracts significantly reduces pricing unfairness and commitment frictions that plague traditional trade financing arrangements. By triggering automatic payments when shipment receipts are digitally confirmed, smart contracts completely erase any gray areas or costly surprises.

Think about that—no hidden price manipulation, no complicated negotiations after the fact, just clear-cut, automated, fair transactions. That’s an enormous win for transparency.

But how do smart contracts become the perfect fit for an even more revolutionary sector, like decentralized finance? Could they perhaps prove crucial to creating entirely new financial products we’ve never even dreamed of? Let’s find out—keep reading, you’re gonna love what’s coming next!

Smart Contracts & Decentralized Finance: A Match Made in Blockchain Heaven

Remember the thrill when cryptocurrency first stormed financial markets, promising a revolutionary new world free from central controls? Decentralized Finance, popularly known as DeFi, harnesses that very excitement — and it takes it to the next level.

But what’s fueling DeFi’s rocket boosters? You guessed it: smart contracts.

These groundbreaking self-executing agreements power the core functions of the entire Decentralized Finance ecosystem. In fact, DeFi and smart contracts are such a perfect pairing, it’d be difficult to envision one thriving without the other.

Yield Farming and Liquidity Provision Explained

Let’s talk about two exciting DeFi trends everyone’s been buzzing about — Yield Farming and Liquidity Provision. You’ve probably heard these terms floating around crypto forums or Reddit channels, but what exactly do they mean?

- Yield Farming is like planting crypto seeds to grow more crypto. By lending or staking your tokens on DeFi protocols, you earn rewards or additional tokens over time. It’s basically putting your crypto holdings to work while you sleep. Pretty nifty, right?

- Liquidity Provision goes hand-in-hand with yield farming. It means offering your crypto assets to a decentralized exchange (DEX) liquidity pool so anyone can swap tokens easily. You’re rewarded for your service by receiving transaction fees or even governance tokens. It’s about sharing value and ensuring smooth transactions for everyone.

According to insights shared by blockchain experts at AntiEr Solutions, these mechanisms have strongly contributed to the explosive rise of DeFi, attracting countless new investors and billions of dollars into crypto markets.

“Yield farming has ignited huge expansion in DeFi, unlocking endless earning potential and reshaping the way we see cryptocurrency markets.”

Put simply, yield farming and liquidity provision capture the essence of democratizing finance, rewarding you for participation without traditional intermediaries.

Why Does DeFi Need Smart Contracts Anyway?

Good question! Think of smart contracts as the invisible hands behind DeFi’s smooth operations, quietly executing actions according to predefined terms with zero human intervention. Without smart contracts, DeFi platforms like Uniswap, Compound, or Aave simply wouldn’t function. They would lack automation, security, and speed—all the qualities that set DeFi apart from traditional finance.

- Automation: Smart contracts automatically execute financial deals without time-consuming paperwork or middlemen taking hefty cuts.

- Transparency: All parties can openly track transactions on the blockchain, erasing information asymmetries and mistrust.

- Security and Immunity to Manipulation: Once a smart contract is coded and reviewed, its terms cannot be altered or tampered with, assuring fairness for everyone involved.

In short, smart contracts provide DeFi’s heart and soul—transparent, automated trust.

But here’s the twist: DeFi is just the tip of the iceberg—could smart contracts also turn trade finance upside down and fix age-old financial headaches? Curious how smart contracts streamline international trade, save massive costs, and lower risks?

Keep reading—I promise it’ll be worth it.

Trade Finance and Smart Contracts: Saving Time, Cutting Costs and Lowering Risk

Imagine you’re an importer desperately waiting for your shipment. Days turn into weeks, documents are scrambled between banks, delays mount, and frustration runs high. Sounds familiar, right? Unfortunately, that’s reality in traditional trade finance.

But here’s the cool part—the tech-driven solution called smart contracts is about to put an end to all this chaos.

Getting Rid of Trade Finance Pain Points

International trade is essential—I mean, your coffee beans likely came from Brazil, your phone from China, and your sneakers from Vietnam. Yet behind these everyday items is a world of complex processes and, too often, a minefield of glitches:

- Documentation Disasters: Manual errors in paperwork that lead to costly delays and disputes.

- Slow Settlements: Traditional banks holding back approvals, creating long waiting periods between shipment and payment.

- Fraud and Miscommunications: Lack of transparency that leaves room for misunderstandings and deceitful activities.

These pain points hit deeply, both emotionally and financially, creating uncertainty that harms business relationships around the globe.

Smart Contracts as the Ultimate Trade Trust Builder

Here’s the game-changer: smart contracts act as automated supervisors—no biases, no mistakes. As soon as agreed-upon conditions (like goods inspection or shipping confirmation) are met, payments are released automatically, securely, and instantly.

This isn’t just theory. According to a research study published by ACM Digital Library, smart contracts significantly reduce pricing errors and commitment frictions that dominate traditional trade finance. By eliminating manual errors and speeding up settlements, trust between global partners is rapidly restored.

Even better, aside from efficiency, companies adopting smart contracts see a dramatic drop in costs. No intermediaries mean lower fees, less paperwork hassle, and faster deal approvals. Companies like Maersk, IBM, and Wave have already embraced these blockchain-based solutions, making global trade smoother—and stakeholders happier.

“Trust takes years to build but seconds to destroy.” – Anonymous

And here’s a fascinating thought: Could smart contracts make trust instant and contracts foolproof? If you’re intrigued by smart contracts’ enormous potential, wait till we reveal the real risks involving this tech. Are smart contracts truly risk-free, or are there hidden cracks beneath this shiny surface?

Challenges and Risks: Are Smart Contracts Really Risk-Free?

Hey, let’s be frank—every cool technology like smart contracts brings amazing benefits, sure. But they also carry some real challenges and risks. Honest insight helps build trust, so let’s openly look at some of the downside risks and hurdles associated with smart contracts.

Bugs and Errors in Programmed Code

No one writes perfect code all the time; human error will always exist. And because smart contracts are ultimately just computer programs, they’re definitely not immune. Remember the infamous DAO (Decentralized Autonomous Organization) incident back in 2016? That hacking fiasco was courtesy of flaws in the underlying smart contract code, leading to over $50 million worth of ether being drained from the system.

Unfortunately, the DAO wasn’t an isolated incident. More recently, we’ve seen other security incidents, including:

- Poly Network Hack (2021) – Attackers exploited a vulnerability in cross-chain smart-contract technology, stealing around $600 million worth of crypto (thankfully, it was mostly returned).

- Nomad Bridge Attack (2022) – A smart-contract bug allowed exploits in the transaction verification process, costing the network nearly $200 million.

Situations like these showcase how one tiny coding error—sometimes just a single misplaced digit—can open doors to huge losses. A report by Chainalysis confirmed that 2022 marked a new record, with $3.8 billion lost due primarily to smart contract hacks and exploits. A staggering number, right?

“To err is human; to really foul things up requires a computer.” – Paul Ehrlich

Regulatory and Legal Questions

On top of coding vulnerabilities, another issue is the patchwork of laws and regulatory confusion surrounding smart contracts. If something does go wrong with a smart contract, where exactly do you turn for legal recourse?

Because decentralized smart contracts execute automatically, traditional legal frameworks often struggle to define accountability. Who do you sue if things fail? The developer? The blockchain itself? That’s currently unclear in many jurisdictions, and different countries treat smart contracts very differently.

- In the U.S., for instance, some states like Arizona and Tennessee have already recognized smart contracts as legally binding contracts, while others lag behind.

- The European Union’s MiCA (Markets in Crypto-Assets) regulation is attempting to create clearer guidelines but remains somewhat ambiguous in enforcement and jurisdictional reach.

This legal uncertainty doesn’t just matter for big companies; it directly impacts everyday users and investors too. The lack of clarity can slow adoption, scare away investors, or restrict opportunities simply due to fear of legal complications or regulatory crackdowns.

Clearly, smart contracts aren’t a magic pill without any risks. But with proper auditing, rigorous testing, clearer regulation, and responsible development standards, many of these issues can be managed—maybe even minimized.

Curious to find out more ways to safely navigate the world of smart contracts so you avoid these pitfalls? Stick around! In the next part, I’ll share two fantastic resources that’ll empower you with even clearer insights. Ready?

Two Fantastic Resources To Understand Smart Contracts Even Better

If you’re anything like me, you love the idea of smart contracts and their enormous potential—but maybe your curiosity goes even deeper. The financial benefits of smart contracts are so impressive that just scratching the surface won’t do. So, let me share two excellent resources I personally trust that can help you quickly level up your knowledge and really see how these automated contracts are reshaping modern finance.

Hedera’s Smart Contract Guide

You simply can’t go wrong with Hedera’s clear and concise guide. Not only does Hedera simplify complex concepts, but they also help you understand exactly why smart contracts are such game-changers for the finance sector. Their page explains—in plain English—how smart contracts make financial transactions drastically more efficient, transparent, and trustworthy. Trust me, it’s an eye-opener.

Legitt AI Explores Smart Contracts in Financial Services

The second gem is from Legitt AI, specializing particularly in smart contracts within banking and financial services. They present practical examples of how these powerful digital contracts achieve higher efficiency, reduced risks, and enhanced coordination among financial institutions. If banking-focused insights are your cup of tea, definitely give it a read.

Now, these resources will definitely quench your immediate thirst for knowledge—but here’s an intriguing question to keep your curiosity alive: how exactly do smart contracts shape our entire financial future? Stick around; I think the next section might hold the surprising answer you’re looking for!

Looking Ahead: How Will Smart Contracts Shape Finance Tomorrow?

If you’ve been excited about smart contracts so far—trust me, we’re only just scratching the surface of what’s possible. The real innovations are yet to come, and they’re shaping up to revolutionize a range of sectors we haven’t fully considered yet—from housing to investing and even governments themselves. Let’s check out some intriguing possibilities we’re likely to see soon.

New Innovations on the Horizon

One of the coolest areas we might soon see more smart contract adoption is real estate. Imagine effortlessly buying or selling a property, no lengthy escrow processes, no messy paperwork—just quick, seamless transactions automatically triggered by verified data. Tokenizing real assets into digital representations isn’t a far-fetched fantasy; it’s already starting in places like the United Arab Emirates and Switzerland, where luxury properties have been tokenized and sold to multiple investors smoothly and transparently.

Beyond real estate, broader banking integration seems inevitable. Top-tier financial institutions like JPMorgan Chase and HSBC are already conducting pilot projects with smart contracts to streamline complex banking processes, reduce operational burdens, and shorten settlement cycles. Soon we could expect everyday banking functions—like cross-border payments or even personal loans—to run through secure smart contracts, cutting fees, speeding up transactions, and better protecting customer funds.

Even governments might jump aboard smart contract tech more fully. In fact, according to the World Economic Forum, blockchain-based smart contracts could automate key processes in public finance—like tax collection, welfare payment distribution, or transparent budgeting—dramatically reducing corruption risks and inefficiencies.

Can We Entirely Replace Old-school Finance?

But wait—is replacing traditional models entirely even realistic, or more important, desirable? Honestly, probably not entirely. Even though I’m a strong believer in smart contracts’ promise, financial systems rarely operate in black and white. Traditional finance institutions offer certain protections, familiarity, and legal frameworks still under evolution in decentralized finance. Smart contracts will certainly complement traditional finance effectively, but some things might always require a human touch.

A hybrid approach might turn out to be the sweet spot—combining automated speed, efficiency, and transparency from blockchain-based contract technology with the flexibility, maturity, and regulatory compliance offered by traditional finance. After all, financial transformations aren’t simply about head-to-head winners. It’s about creating something new, practical, reliable—and ultimately better for you as a user.

Wrapping it Up: The Promise of Smarter, Simpler, and Safer Finance

Smart contracts have come a long way, offering enormous promise to reshape how we handle money, investments, and business globally. We’ve seen impressive real-world applications that solve real-world problems already—and we’ve barely begun. The road ahead certainly looks promising, filled with faster, clearer, fairer finance options available to us all.

Whether you’re an active investor, a financial professional, or simply someone who wants smarter control over your personal transactions, understanding smart contracts isn’t just about keeping up—it’s about staying ahead. The future belongs to smart, informed individuals who continuously explore, experiment, and learn.

So keep looking deeper, ask questions, and stay curious about smart contracts—after all, they’re poised to make finance simpler, smarter, safer, and better. Exciting times ahead!