The Rise of DeFi 2.0: What You Need to Know

Have you ever found yourself asking: what’s next in decentralized finance? After DeFi took off like a rocket, there’s now a fresh buzzword sweeping the crypto universe—DeFi 2.0. But really, what in the world is DeFi 2.0? And why is everyone talking about it like it’s the next big thing in cryptocurrency?

If you’re feeling overwhelmed or a bit lost by the lightning-fast rise of crypto apps and finance tools lately, trust me—you’re not alone. DeFi originally stepped in promising decentralized finance freedom, but we’ve all experienced some headaches along the way, right? Whether it’s those intimidatingly-high gas fees on Ethereum, shaky liquidity pools, or ultra-complex governance systems that seem to be built only for blockchain veterans—there’s plenty that needs fixing in classic DeFi.

The great news is DeFi 2.0 is here, and it’s promising real solutions—a smarter, faster, and much more user-friendly approach that could move decentralized finance closer to mainstream adoption.

What’s Been Holding Back DeFi So Far?

Let’s be real: We love the core idea behind decentralized finance and its mission to reshape our financial world—but we’ve also hit some frustrating walls along the way.

High Fees and Scalability Problems

Ever tried to swap tokens on Ethereum only to realize the transaction fee costs nearly as much as the tokens themselves? Yeah, me too—countless times. Ethereum’s high gas fees have been a roadblock, closing doors on smaller investors and slowing DeFi growth when it mattered most. A recent CryptoBriefing analysis found that transaction fees hit $70 per swap at peak moments last year—clearly not sustainable if decentralized finance hopes to reach everyone.

Liquidity Woes

We all remember when liquidity mining first took off, offering eye-popping returns and attracting users left and right. It looked like the Holy Grail, until reality kicked in. Those incredible yields eventually dropped, early adopters cashed out and moved on, pools ran dry, and the hype fizzled. Left behind were shaky liquidity pools and smaller investors wondering where the reliable opportunities went.

Overly Complicated Governance

Governance token voting at first seemed like a fantastic idea, giving us decentralized, community-driven decisions. But have you ever actually participated? For many of us, the complex systems and highly technical proposals can make governance feel exclusive, confusing, and—ultimately—not worth the hassle. This leaves plenty of casual crypto investors disconnected from the projects they’ve invested in.

The Promise of DeFi 2.0

Here’s where the excitement kicks in. DeFi 2.0 isn’t just some crypto jargon—it’s a new wave of smart, user-friendly solutions tackling the very headaches you and I faced with the first generation.

- Cutting transaction fees: DeFi 2.0 protocols are already operating with vastly lower transaction costs through layer-2 solutions, alternative blockchains, and innovative cryptography.

- Sustainable liquidity: New liquidity options and incentive structures mean steadier returns, richer pools, and longer-lasting community involvement to help everyone win.

- Simplified, inclusive governance: The newest DeFi models are rearranging their governance, making decision-making simpler and more open, so everyone—not just the whales and experts—can join the conversation.

What’s Coming Up Next?

Now that we’ve pinpointed the issues holding back DeFi, the real question becomes clear: what exactly does DeFi 2.0 look like in detail, and why is the decentralized finance community so hyped about it? If you’re ready to fully understand this next-gen DeFi revolution and how it might enhance your crypto experience, keep reading—you’re about to find out.

What Exactly Is DeFi 2.0?

You’ve heard the buzzwords and seen trending hashtags, but you’re probably still asking yourself—what exactly is this DeFi 2.0 everyone seems so excited about? Let me simplify this for you: DeFi 2.0 is essentially the upgraded, improved version of decentralized finance. Imagine trading in your old, clunky smartphone for the latest sleek model loaded with features—it’s basically that kind of leap forward.

“Every once in a while, a revolutionary technology emerges that promises to make our lives better—DeFi 2.0 is shaping up to be exactly that.”

From DeFi 1.0 to 2.0: What’s the Difference?

DeFi 1.0 introduced incredible ideas: decentralized exchanges (DEXs), yield farming, and lending platforms. Yet, despite its powerful promise to put money back into your own hands, DeFi 1.0 struggled with annoying limitations:

- Crazy high Ethereum gas fees: Ever felt robbed paying higher fees than the transaction itself?

- Liquidity headaches: Pools drying up overnight leaving you stranded with falling rewards.

- Confusing governance systems: Have you ever voted confidently on protocol changes? Honestly, neither have I—it’s often overly technical and exclusive.

DeFi 2.0 arrives exactly when we’re fed up with these frustrations, aiming to transform these flaws into breakthroughs. Instead of abandoning DeFi’s ideals, it builds upon them with smarter approaches to make crypto finance more streamlined, sustainable, and accessible for everyone.

Why Is DeFi 2.0 Happening Now?

So why exactly is DeFi 2.0 taking off at this moment? Three major reasons why this shift is happening right now include:

- User frustration turning to demand: When users get tired enough of outdated, expensive processes, that’s precisely when innovative market solutions evolve. The market listens loud and clear to your pain points.

- Technological innovation is ready: New layer-2 scaling solutions and more user-friendly protocols have reached maturity and are actively implemented. Projects like Arbitrum, Optimism, and Polygon are already cutting gas fees dramatically and boosting transaction speeds, responding directly to community demands.

- Backing from influential names: Big players and decentralized autonomous organizations (DAOs) like OlympusDAO and Tokemak are pioneering new liquidity management strategies, proving significant industry support drives quicker adoption.

According to crypto analytics firm Dune Analytics, DeFi platforms on Layer-2 solutions like Optimism and Arbitrum already reduced user fee costs significantly—up to 90% in some cases compared to Ethereum mainnet. Lower fees plus faster transactions equal happier users (you and me).

We’re truly witnessing a significant inflection point: a giant leap forward driven by practicality paired with innovation—no abstract promises, just real-world usability improving day-by-day.

If you’re excited by these advances but want real examples, don’t worry—I’ll guide you step-by-step into the most promising platforms and innovations shaking things up with DeFi 2.0. The question you’re likely asking now: “What’s specifically changing? How exactly is DeFi 2.0 making crypto finance simpler, faster, and easier?” Let’s answer precisely these questions next—keep reading because you definitely don’t want to miss what’s coming up.

Key Innovations in DeFi 2.0

We already know DeFi 2.0 isn’t inventing crypto finance from scratch—it’s tuning up our experience and giving us solutions we’ve been craving all along. Let’s break down some awesome ways DeFi 2.0 is spicing things up.

Enhanced Scalability—Say Goodbye to Gas Fee Nightmares

You’ve all been there (I have too)—ready to jump into an amazing DeFi opportunity, and then feeling that sinking frustration when you see the gas fees.

But here’s the relief: DeFi 2.0 embraces solutions like Layer 2 scaling protocols—think Optimism, Arbitrum, and zkSync. These innovations drastically reduce transaction costs and speed up your trades for a smaller fraction of the original Ethereum gas cost. For example, Arbitrum offers gas fees roughly over 90% cheaper than regular Ethereum transactions. Simply put, it’s about getting you more accessible, affordable DeFi action without cringing at every click.

“Blockchain scalability is essential to unlocking true DeFi adoption—and it’s finally here.” — Vitalik Buterin, Ethereum founder

Liquidity Solutions for Everyone—Sustaining Your Passive Income Streams

We all loved the first wave of yield farming, but let’s face it—those early lucrative yields often didn’t last. DeFi 2.0 introduces a fresh take with smarter liquidity concepts—such as Protocol-Owned Liquidity (POL) and stability-focused pools—that give you rewards for the long haul rather than short-lived profits.

Take OlympusDAO (OHM), widely recognized for reshaping liquidity provision into POL. Instead of depending on users to keep pouring in liquidity constantly, the protocol itself provides liquidity, ensuring sustainability and more consistent returns to anyone taking part. This approach reduces volatility and panic-selling-induced crashes—rewarding you more steadily and reliably.

- No more stressful pool jumping.

- Sustainable yields instead of boom-and-bust.

- Real passive income—no catch, just smarter strategies.

Simple and Inclusive Governance—Your Voice Really Matters Now

Remember those complex, time-consuming governance votes where it seemed pointless even to try? DeFi 2.0 projects are finally realizing something crucial: if people like you and me aren’t engaged, what’s the point of decentralized governance?

That’s why new forms of user-friendly decision-making have emerged:

- “Snapshot”-style voting—no transaction fees, just easy one-click voting.

- Delegation and representative democracy models—where your vote or tokens can empower active community members you trust.

- Clear, jargon-free proposals and intuitive tracing of how your participation helps shape the ecosystem.

For instance, platforms like Compound and Uniswap have already implemented easy-to-use Snapshot voting interfaces, making governance transparent and engaging again.

“When governance includes everyone, crypto communities grow stronger than ever.” — Cooper Turley, DAO strategist

Can you feel it yet? DeFi 2.0 isn’t just another buzzword; it’s a real step towards a smarter, friendlier, and more sustainable future for decentralized finance. But here’s a big question we need to explore next: is DeFi 2.0 strong enough to seriously challenge banks and traditional finance? Stick with me—I’ll answer that next.

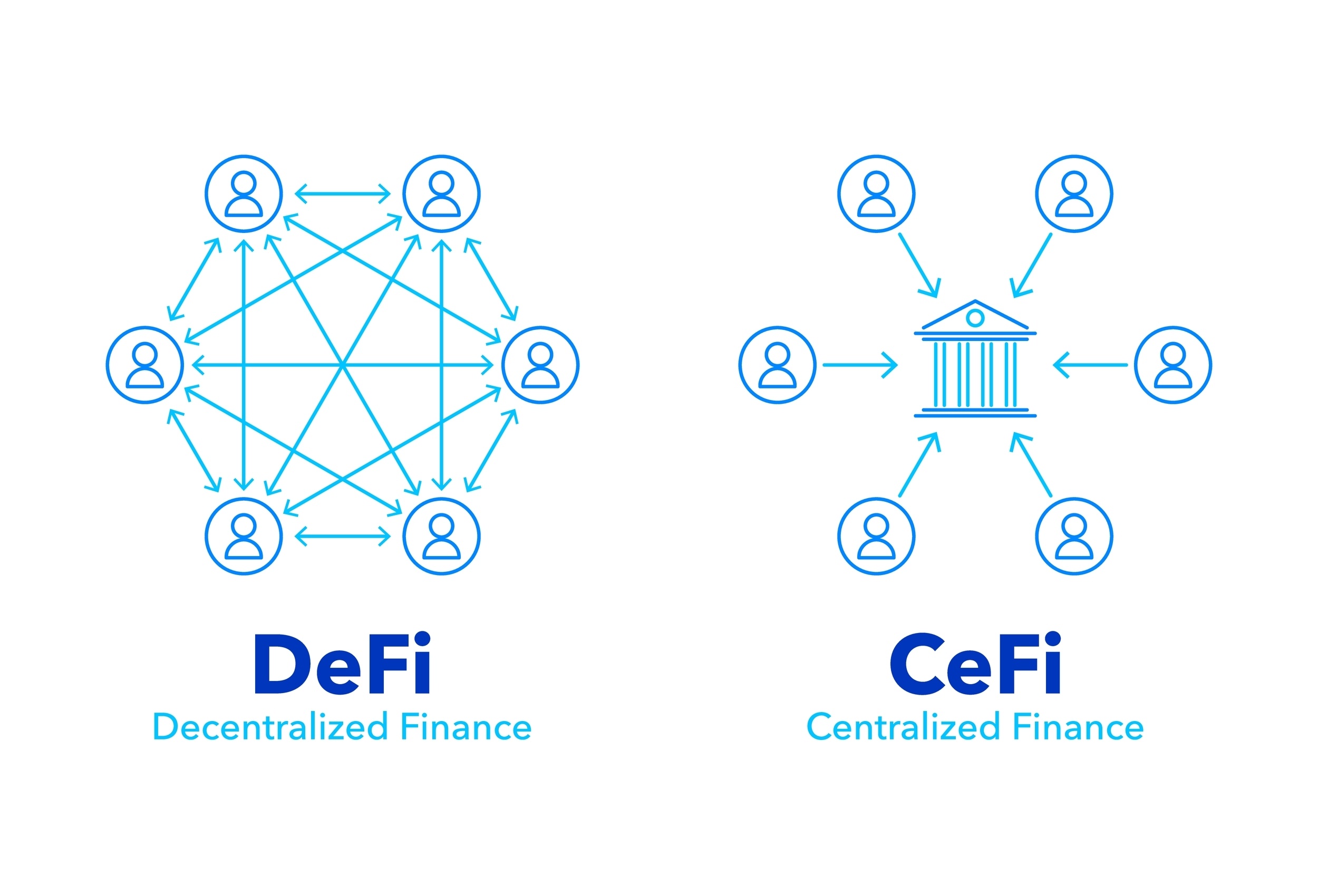

Will DeFi 2.0 Replace Traditional Finance and Banks?

You’ve probably heard crazy predictions before, right? “Bitcoin will kill banks!” or “DeFi is the bank’s death sentence!” Let’s pause right here—sure, those headlines get clicks, but is DeFi 2.0 really going to put traditional banking out of business?

“Disruptive innovation can hurt if you’re not the one doing the disrupting.” – Clayton Christensen

It’s true, DeFi 2.0 is disrupting finance, shaking things up by making transactions faster, cheaper, and simpler. But let’s genuinely ask ourselves: Are banks truly set to vanish, or are we misunderstanding what’s actually at play here?

Banks vs. DeFi 2.0: Are They Really Rivals?

Make no mistake—traditional banking and DeFi 2.0 target completely different spheres of influence and come with entirely different strengths.

- Banks: reliable, regulated, and serve as gateways between fiat (like USD and EUR) and the digital world. They provide security you’d trust to buy your home or hold your retirement savings.

- DeFi 2.0: innovative, borderless, permissionless, and built around flexibility, yield-earning potential, instant transactions, and freedom from institutional controls. Ideal for those who crave financial autonomy.

The reality is more complex than “one replaces the other”—it’s about recognizing what you’re looking for in financial services at any given moment.

How Banks Are Reacting to DeFi 2.0

You might be surprised, but banks aren’t just sitting around nervously. Some banks are actively interested and already experimenting with DeFi models.

- JPMorgan Chase, for instance, is deeply involved with blockchain—running dedicated blockchain teams to pursue solutions to improve cross-border transactions.

- Meanwhile, Société Générale has tested decentralized lending platforms to issue digital bonds, steps previously unimaginable from traditional banking standpoints.

Banks see the power of DeFi tech—the transparency, reduced costs, and incredible speed—and they’re starting to embrace these innovations over fighting them.

The Real Future Scenario: Coexistence and Integration

Here’s what’s much more likely to happen (ready for a truth bomb?): banks and DeFi will find ways to coexist by integrating the best of both worlds. Think about it:

- You might end up using digital wallets for instant DeFi loans while still using traditional banks for your mortgage.

- Your bank might offer decentralized staking products, allowing traditional customers earnings similar to crypto-savvy individuals.

- Or banks could incorporate automated, decentralized finance technologies behind-the-scenes—speeding up transactions and reducing fees for all of us.

Studies agree too. A recent research report by World Economic Forum found traditional finance institutions increasingly view decentralized protocols not as threats but as valuable tools to level-up their financial products and remain competitive.

The result? You get a smoother, faster, cheaper, and more flexible financial ecosystem—a genuine win-win for everyone involved.

So instead of worrying about DeFi 2.0 completely destroying banks, maybe we should actually be asking this:

How exactly is DeFi 2.0 going to transform key aspects of finance—starting with things you rely on every day, like liquidity mining?

What’s Changing for DeFi Liquidity Mining?

Liquidity mining—you remember those early days, don’t you? Pouring into DeFi platforms, hunting generous yields, and riding massive waves of excitement. It felt revolutionary. It was revolutionary—but it wasn’t perfect. I’m sure you’ve noticed how the shine has dimmed lately, leaving many of us wondering what happens next.

The Problems with Traditional Liquidity Mining

Let’s talk honestly about what went wrong with liquidity mining as we’ve known it:

- Unsustainable Rewards: Many projects lured early adopters with sky-high APYs that couldn’t last. Sure, getting 1,000% yields was fun at first, but when the returns rapidly crumbled, investors like you and me were left holding the bag.

- Impermanent Loss Hit Hard: Supplying liquidity to pools meant you could lose value if token prices shifted dramatically. I bet you’ve had moments where you checked your returns and thought, “Wait—what just happened!?” According to a study by Bancor, over 50% of liquidity providers suffered impermanent loss outweighing their fee earnings in popular AMM pools.

- Liquidity Draining Quickly: Early miners would simply jump ship the second rewards tapered off, draining liquidity pools—hurting not only returns but stability and trust. Remember that discouraging feeling of seeing liquidity vanish practically overnight?

“Liquidity mining’s first wave was a sprint—but wealth creation is always a marathon.”

Smarter Liquidity Mining with DeFi 2.0

Here’s the great news: DeFi 2.0 platforms have stepped up their game, designing smarter liquidity programs focused on long-term value, not short-lived hype. Here’s how:

- Protocol-Owned Liquidity (POL): Platforms like OlympusDAO pioneered approaches where protocols own their liquidity, reducing dependence on unreliable insiders. This means liquidity stays stable, lessening those painful market swings that wreaked havoc with your investments.

- Better Incentive Structures: DeFi 2.0 introduces more thoughtful tokenomic designs, distributing rewards slowly and sustainably over time. This shift encourages lasting participation rather than frenzied farming, as seen previously with projects like Curve Finance’s CRV token distribution model.

- Reducing Impermanent Loss: With innovative pool structures—such as single-sided liquidity pools from projects like Tokemak—investors face significantly lower risk levels. It’s a smarter way to participate without that constant lurking fear of impermanent loss eating into your profits.

DeFi 2.0 liquidity mining isn’t about chasing temporary hype—it’s about building strategies that steadily grow your crypto portfolio, providing both the peace of mind and gains you’re searching for. But before jumping in head-first, you might wonder: are there hidden risks or challenges we should watch out for? Great question, and I’ll unpack that for you next, so you’ll know exactly how to stay ahead in DeFi 2.0.

Risks & Challenges with DeFi 2.0

All those glittery DeFi 2.0 promises we’ve covered sound fantastic, right? I get it—exciting innovations make your eyes sparkle and your heart race, dreaming about potential profits. But let’s pause for a quick moment. Just like your grandma always told you, “If it sounds too good to be true, it probably is.”

Don’t worry; I’m not here to scare you off—far from it. Instead, I want you to step into DeFi 2.0 fully aware and prepared because, let’s face it, crypto is still the Wild West, and shiny new trends often carry hidden hazards. Let’s talk honestly about some of those risks you need to be cautious of.

Technical and Security Risks

Firstly, let’s touch on one key issue that’s been the itch in crypto’s back from day one: security. DeFi 2.0—amazing as it is—isn’t immune to hacks and technical vulnerabilities. Flash loan attacks, smart contract exploits, and bugs are still around and evolving. According to CertiK’s Annual DeFi Security Report, more than $3.1 billion was lost last year alone to crypto hacks, mostly from vulnerabilities in DeFi protocols—a hefty warning sign we can’t just ignore. No matter how slick these new platforms may look, it’s wise to proceed carefully.

Take, for example, projects like Poly Network and even industry titans such as Ronin Network of Axie Infinity. Both suffered massive breaches—Poly Network losing an astounding $600 million in a single hack, and Ronin Network facing a painful crypto heist of over half a billion dollars. Even the best-designed projects can stumble if there’s the tiniest flaw in their code.

- Smart Contract Risk: Remember, many DeFi 2.0 projects still heavily depend on smart contracts—tiny computer scripts managing billions of your hard-earned dollars. Although DeFi 2.0 developers might be more careful, mistakes can still happen. Always search for audited platforms, double-check independent security reports, and stay alert.

- Flash Loan Attacks & Rug Pulls: These risks haven’t vanished with newer systems—hackers keep getting smarter. Always watch out for big bold claims promising overly juicy rewards.

Regulatory Concerns

Now, let’s talk regulations. Oh no—not those dreaded regulators! As much as we cherish decentralization, governments worldwide have their own ideas. The buzz about DeFi 2.0 hasn’t escaped their notice either, and lawmakers are starting to take an increased interest in how decentralized finance is developing. For instance, the US Securities and Exchange Commission (SEC) is already probing DAO structures and token offerings. Regulatory gray areas can pose serious roadblocks.

This uncertain regulatory landscape brings two main concerns for you as an investor:

- Unclear Legal Status: What regulators decide today can drastically affect tomorrow’s market. For instance, just think about the turbulence Ripple Labs faced when the SEC came knocking. Regulatory actions can impact user access, platform liquidity, and token value overnight.

- Compliance Costs: DeFi projects could face increased compliance costs, leading to higher operating expenses passed to users in the form of fees or narrower profit margins.

“The biggest risk is not taking any risk… In a world that’s changing really quickly, the only strategy that’s guaranteed to fail is not taking risks.” – Mark Zuckerberg

Mark might have a point there. Embracing risks can sometimes bring great rewards. However, smart risk-taking isn’t blindly jumping into the unknown. It’s about knowing exactly what dangers might lie ahead, keeping your eyes open, and preparing yourself to make informed decisions. Are you ready to navigate these DeFi 2.0 risks safely?

Luckily for you, understanding the risks is only the first part of the equation—next, we’ll see exactly how you can get involved with DeFi 2.0 in safe, smart ways. Curious how you can actually participate in this groundbreaking innovation today, without unreasonably risking your crypto assets? Let’s answer that, up next!

How to Get Involved with DeFi 2.0 Today

Excited about DeFi 2.0 yet? I thought so. Now comes the good part: actually dipping your toes into these promising new waters. But if you’re anything like me, you’re probably wondering—where should I start? Let’s talk about how you can begin benefiting today, step by step.

Choosing Reliable Projects — Let’s Get Strategic

The crypto space is full of shiny promises, but we both know not every project is a hidden gem. So the key question you need to answer is: how exactly do I pick reliable and promising DeFi 2.0 projects?

My best advice from years in this field: look for clarity, community, and credibility:

- Transparent Teams: Check who’s behind the project. Open and known founders tend to be more accountable. Secret teams are a red flag.

- Strong Community Signals: Pay attention to community engagement. Vibrant Discord chats, active Twitter followers, and involved communities often indicate a supportive ecosystem around the project.

- Solid Audits and Reviews: Always check if reputable security firms like Consensys Diligence or CertiK have audited the project’s code. An audit reduces your security risks dramatically.

- Sustainable Tokenomics: Look carefully at how tokens are distributed and used, ensuring they’re incentivizing long-term value—not short-term pump-and-dump schemes.

“Risk comes from not knowing what you’re doing.” — Warren Buffett

This quote couldn’t be truer when choosing your DeFi projects. Always spend those extra 10 minutes doing proper research—it’ll save you a ton of headaches.

Platforms Worth Checking Out Today

Now comes the fun part—real-world suggestions. While there are dozens of amazing DeFi 2.0 projects emerging, here are some standout ones I think you might want to look into right now:

- OlympusDAO: Transforming liquidity mining with sustainable incentives and a unique bond-based system, OlympusDAO spearheaded the DeFi 2.0 movement and remains a reliable pick.

- Tokemak: A liquidity control protocol designed to simplify decentralized market-making and reduce fragmentation issues—definitely one to watch in the DeFi 2.0 sphere.

- Abracadabra Money: Innovatively combines yield-bearing assets and collateralized borrowing, ensuring you can get liquidity without sacrificing your current rewards.

I personally like these platforms because they’re actively tackling key issues I’ve mentioned earlier, providing real solutions rather than mere promises. But of course, always exercise caution—do your own homework before investing.

Feeling eager to learn even more? Wondering what resources top crypto experts use to stay ahead?

Stick around, because in the next section I’ll suggest some resources I regularly use. Trust me, you won’t want to miss these gems—they’ve definitely helped me grow my own crypto know-how. Let’s explore them together.

Extra Resources to Learn about DeFi 2.0

By now, you’ve probably picked up on the excitement around DeFi 2.0—it’s hard not to! But if you’re anything like me, you’re hungry to know more about exactly how it works and what it can do for us crypto lovers. Good news, I’ve got a couple of gems for you—resources I personally swear by and have found incredibly clear and helpful.

Coin Bureau’s Guide: Plain-English Breakdown at Its Best

The first one you absolutely need to bookmark is Coin Bureau’s guide to DeFi 2.0. Now, I really like Coin Bureau because they’re terrific at cutting through all the technical buzzwords and helping everyday crypto enthusiasts (like you and me!) genuinely understand what’s going on.

They clearly lay out all the key upgrades from DeFi 1.0, emphasizing real-world improvements like solving those irritating high Ethereum gas fees and liquidity frustrations. If you want the full picture clearly spelled out, jump straight into their guide right here.

Morpher’s Analysis: A Refreshingly Simple Overview

Another great place worth visiting—I personally love this breakdown—is the Morpher analysis. They approach DeFi 2.0 from a relatable perspective, looking carefully at what makes the new generation of decentralized finance not just exciting but also sustainable and accessible.

Morpher has a knack for compressing complex crypto concepts into bite-sized, easy-to-follow information. If you’ve ever felt DeFi descriptions can get overly complicated (which, let’s face it—they often do), check out Morpher’s DeFi 2.0 overview here. You’ll thank me later.

Why These Resources Are My Go-To’s

Both Coin Bureau and Morpher emphasize what matters most—how DeFi 2.0 is actually shaping our real crypto investments, decision-making, and the practical stuff we care about. They’re backed by solid research, real-world examples, and don’t throw unnecessary jargon your way.

Speaking from experience, having resources like these helped me quickly wrap my head around DeFi 2.0 and spot early opportunities. I encourage you to bookmark them and refer back whenever you’re feeling fuzzy about what’s next in the crypto space.

Ready for the big question: How could all this impact your investments and crypto moves from here on out? Well, I’ve got some important insights for you, and trust me, you’ll want to know exactly what DeFi 2.0 means for you in practice. Curious? Let’s see how your crypto portfolio is going to change in the near future—stay tuned to the next part to find out.

What DeFi 2.0 Means for You and Crypto’s Future

At this point, you’re probably thinking—great, DeFi 2.0 sounds promising, but what does it actually mean for my investments? Let’s break things down practically so you know exactly how it affects your crypto journey.

How Does DeFi 2.0 Affect Your Investments?

Here’s the real-deal: With improved scalability and lower gas fees, DeFi 2.0 means you’ll spend far less on transactions, giving you significantly better returns on smaller investments. This should immediately increase your ability to access and profit from DeFi products, regardless of budget limitations.

Because liquidity mining is becoming more strategic and sustainable, instead of jumping from one short-lived pool to another, you can now find long-term value and reliable earnings. Projects like OlympusDAO are already experimenting successfully with protocol-owned liquidity, a smarter approach that was almost unheard of in early DeFi.

Also, simpler and more inclusive governance means your voice matters. Projects like Curve Finance and Aave have begun experimenting with more intuitive voter participation, and now everyday crypto users—not just whales—can actively influence the platforms they’re invested in. Ultimately, greater involvement typically leads to better project health, sustainability, and higher returns.

What Should You Do Next?

Right now, it’s crucial you stay ahead to benefit fully from these developments. Here’s my practical advice for staying ahead in the DeFi 2.0 wave:

- Keep an Eye on the Innovators: Platforms like Tokemak, OlympusDAO, and Abracadabra Money have drawn serious attention with their fresh solutions. Make a point of tracking what these protocols are doing.

- Join Active Crypto Communities: Don’t go solo. Stay connected via Discord channels, crypto subreddits, and Telegram groups—some of the best tips and early info happen through engaging with other users who share your interests.

- Make Risk Management a Priority: DeFi 2.0 might be safer and easier, but always remember risk remains. Continue to spread investments across several promising projects instead of going “all-in” on one.

“Early adoption plus well-informed choices equals a powerful edge in crypto.”

Final Thoughts: Get Ahead of the Curve

The shift to DeFi 2.0 is a fantastic opportunity for us as crypto investors. Deloitte recently published research suggesting decentralized finance adoption is expected to follow an exponential growth curve, similar to internet adoption in the early 2000s. Imagine having the chance to recognize and jump onto opportunities the way early internet investors did. DeFi 2.0 provides exactly that chance for crypto enthusiasts today.

So here’s the takeaway—if you’re serious about crypto and your financial future, now is definitely the best time to familiarize yourself with DeFi 2.0.

I’ll continue doing the hard work on your behalf, keeping you updated right here at Cryptolinks.com, so you don’t miss a beat.

Happy investing!