Non-fungible Tokens, the Metaverse, and the Future of Play-To-Earn Titles

Non-Fungible Tokens have sky-rocketed in popularity throughout 2021, with many artists becoming” millionaires through utilizing blockchain technology and creating verifiable art. However, over time, NFTs have evolved way past just being pieces of art and have seen their wake in the music industry and the gaming industry. All of this has contributed to the exponential growth of the NFT marketplace, alongside companies re-thinking how they do business and what their developments are going forward.

But before we dive too deep into the world of non-fungible tokens (NFTs), the metaverse, and play-to-earn titles, we’ll first need to go through the history of NFTs first, as well as why they became a requirement in today’s overall ecosystem of digital worlds. We will be taking an in-depth look at non-fungible tokens (NFTs), the current state of the metaverse, and what the future holds for play-to-earn (P2E) titles currently in development or planned for future development.

The Case for Non-Fungible Tokens (NFTs)

Non-Fungible Tokens (NFTs) are cryptocurrency assets that are essentially indivisible as well as unique in their own way.

To make this a bit clearer to understand for someone who’s just learning a bit about this topic, here is the perfect real-world example.

A fungible token is a token that always has an equal value to another token. For example, 1 BTC will always be equal in value to 1 other BTC, or in a real-world case, a 10 U.S. dollar bill will always have equal worth to 1 other 10 U.S. dollar bill. These tokens or currencies are interchangeable, as they hold equal value. NFTs are not like this due to the fact that each of them has its own unique property associated with them, which differs in value. NFTs can also be used to represent tangible and intangible items. They were launched initially on the Ethereum blockchain and were based on the ERC-721 token standard; however, over time made their way to other blockchain networks as well.

The Case for Non-Fungible Tokens (NFTs)

They are non-interoperable, indivisible, indestructible, and tokens that can easily and always be available for verification within the blockchain network.

This is due to the fact that all of the data within these NFTs is stored within the blockchain network they are initially minted on, and what this means is that nobody can actually destroy them or remove the original owner’s ownership from them. Not a single NFT token out there can be replicated, and as such, each of them has its own unique properties associated with them. NFTs also have properties within them that always prove who the original creator of the NFT is, which can come in handy within the world of art specifically as there is always evidence of who the artist is. In the outside world, where we deal with physical artworks, experts need to analyze them in-depth, for hours, weeks, or even months in some cases to truly verify who the original artist of that artwork was, while with NFTs, the information will always be there. This serves an additional role as this means that not a single NFT out there can be replicated due to the fact that each of them has its own unique properties associated with them.

Some artists will even create NFTs in bulk, for example, 12,000 unique art pieces, and the metadata stored within each NFT can indicate which NFT a person has. Some of those NFTs will have a higher value associated than others, and typically, the first one ever released will hold the highest value, although this isn’t always the case.

Non-Fungible Token (NFT) Utility Across Different Projects

There have been literally hundreds of NFT projects released after they gained a high level of popularity, and every single one of them is unique and has its own value associated with it. Some projects will even add stats to their NFTs, which can be specifically handy within gaming environments. Without naming individual projects, here is how some of them have utilized NFT technology.

There have been cases or projects where an NFT is split across different levels of rarity, such as common, unique, rare, elite, super, ultra, and so on, with the concept being that the highest number of NFTs released for that set will fall in the common category, and have the lowest value of the bunch, while the rarest ones will be in the ultra-category and have the highest value. Each of those categories could provide the NFTs with different stats.

For example, if they are just works of art, these categories could indicate what kind of level of detail the NFTs have, will the person drawn have a specific nose type, eye color, mouth shape, hairstyle, and so on. In gaming or metaverse environments, however, these NFTs could also have stats associated and connected with in-world functionality.

For example, let’s use a weapon within a game built on blockchain technology as an example. The common variation of this weapon would provide the player with +10 damage, while the unique would provide the player with +15 damage, and the ultra-weapon would provide the player with +50 damage. This would lead to an in-game advantage and would, in turn, increase the value of the NFT in question due to the fact that it would be both much rarer to collect and would provide the player with a high level of utility.

Non-Fungible Token (NFT) Utility Across Different Projects

Let’s use another, the more realistic use-case for these NFTs within metaverses, as not every game out there will provide players with a competitive advantage if they pay. For example, there are also games with a much higher level of fairness, where the only things you can pay or earn within them are in-game cosmetic items. What these essentially do is change the color or style of your armor or shoes. So, if by default, everyone has the silver, common armor and shoes, you could have a special, Gucci-design or Yeezy-design armor that’s ultra-rare and showcase your own style within that specific universe, and while you will not have a competitive advantage, the game’s world will see you as a player with a higher social status as you can showcase your unique style through the utilization of these NFTs.

What this means is that NFs are valuable due to the fact that they provide a specific level of scarcity and due to the fact that their value depends on the level of utility they provide a project with.

If an NFT was created by a brand or a specific artist, it would hold more value due to the fact that it was created by that specific brand or artist as well.

How The Non-Fungible Tokens (NFTs) Are Re-Shaping Gaming and the Metaverse

Non-Fungible Tokens (NFTs) are fully decentralized. What this means is that they are minted on and operate through blockchain networks which are run and validated by nodes spread across the globe. In other words, no central authority has full control over NFTs, and as such, cannot restrict them nor censor them, or block them within a specific project.

To get a clearer perspective of how all of this works, we will be using the current metaverse and games developed throughout the Web 2.0 era so you can have a clearer perspective of how all of this works.

Within games such as Call of Duty Warzone or Fortnite, for example, which are currently some of the most popular titles being played across the globe, you are given the opportunity to purchase skins with real money (USD or other currencies which are supported). These skins do not give you a competitive advantage in any way. However, they do change your looks within the game. You can buy a skin, which enhances your gameplay experience by giving you heightened confidence and excitement due to the fact that you have a skin that makes you feel something during the gameplay sessions and can be used as a status symbol across the community or circle groups which enjoy the title in question.

However, with the current infrastructure of these virtual worlds, once you buy the skin, you are technically not the owner of the skins. Yes, they are tied to your account, and only you can access them, but they are virtual items that cannot ever leave the specific virtual world in question and are bound to your account only.

What this means is that if you get carried away and spend $500 on skins in Fortnite, for example, in that case, you can never re-sell the skins in the future or send them to another account within the Fortnite universe. This also means that they can never really leave that specific game and have utility within another game that is not Fortnite. For example, you cannot really interchange items or skins between Call of Duty Warzone and Fortnite, as they are bound to each game specifically.

Through the Web 3.0 infrastructure that is currently being built upon, as well as the evolution of blockchain technology as well as non-fungible tokens, this has completely re-shaped the industry as we know it today.

Here is how. Each NFT is minted within a specific blockchain network, be it the Ethereum blockchain, the TRON blockchain, the Solana blockchain, and so on. Each of these blockchain networks has its own token standard that the NFT in question needs to follow in order for it to be successfully minted and work within the specific ecosystem in question.

Another aspect about each blockchain network is the fact that each of them has its own set of games, metaverses, and other decentralized applications which have been developed on top of them.

For example, Solana has a huge ecosystem of decentralized applications (dApps), such as Star Atlas, Tribe Land, Aliens VS People, Solobrador, as well as other games or metaverses built upon it. Ethereum is by far the leader in this due to the fact that some of the largest games in the crypto sector right now are built on top of the Ethereum blockchain.

For example:

- Axie Infinity is a blockchain-based game that utilizes non-fungible tokens (NFTs) that are built on top of the Ethereum blockchain and has its native cryptocurrency token known as AXS.

- The Sandbox is also a virtual world that has the SAND token as well as non-fungible tokens (NFTs) that’s also fully Ethereum-based.

However, unlike centralized games, this is where NFTs can truly shine. Whenever you buy, earn, or create or mint an NFT within a specific blockchain network, it can be transferred to any cryptocurrency wallet and utilized within the entire ecosystem, assuming the developers of the game have added utility to it.

So, for example, let’s say that you have NFTs minted on the Ethereum blockchain, and you decide that you want to buy NFTs in The Sandbox worth $500, similarly to the case with Fortnite’s skin purchases discussed prior. Time passes on, and you get bored or tired of them and want to recoup your mine and re-sell them. Through NFTs as well as blockchain technology, you can go to a marketplace, such as OpenSea, where you can put up the NFTs for sale or for auction, and essentially sell them, either at a loss, at an equal value as the one you bought them for, or in cases where they have increased in scarcity, a profit.

This means that you aren’t just throwing money away for a skin that’s located on a corporation’s servers, which can be shut down at any time. While Epic Games can close down the Fortnite servers, as they are the central authority that controls them and has the authority to do so, in decentralized ecosystems such as Ethereum’s, no single user or entity has the ability to close the server in question. This means that you have full control and ownership over the skins that you end up buying, and as such, are not just throwing away $500 to look cool but are buying NFTs, which you can then resell in the future.

Now, there are also projects which connect these NFTs in different ways. There have been specific projects developed throughout the history of NFT technology that have utility across a variety of different games or metaverses. So, an NFT you own might just be skin in one metaverse, while it might fill the role of a rare weapon with enhanced stats within another game built upon the same blockchain. This means that you can essentially transfer the NFT from one game, or metaverse, to another game or metaverse, where it will still maintain actual value or utility within that specific world, something which was not possible, or at least not constructed well within any Web 2.0 games or metaverses which were developed.

Meta (Formerly Facebook) Ramps Up the Speed

Non-fungible tokens (NFTs) were rising in popularity steadily throughout 2021, but things really kicked up a notch when Facebook announced their rebranding to Meta.

In fact, the social media Brand Facebook’s parent company changed its name to Meta and updated its logo to an infinity loop logo, which is a close representation of the letter M. The co-Founder of Facebook, Mark Zuckerberg, made an announcement that the social media company changed its name to Meta and shared how its logo has been updated.

This update, according to the company in question, was a representation of the move into the metaverse, which they define as a world where people can experience a parallel life to their real-world existence. The company chose Meta due to its connotations with possibility and a future where there is more to build, and the word translates to “beyond” in Greek.

Meta (Formerly Facebook) Ramps Up the Speed

This update kicked things off as Microsoft started incorporating Avatars within their Microsoft Teams software package, and the race started between all of these centralized corporations towards building their own metaverses, where people could experience a second reality from the one they already have.

However, this raised speculation within the cryptocurrency community, as the whole concept of the metaverse should have been centered around decentralization and for users to have the freedom to use it outside of specific ecosystems. For example, we could see Facebook accounts as a requirement in order to access Meta’s take on the metaverse, which is a big red flag for people who want to maintain a high level of anonymity while being online. The blockchain-based project did, however, follow, and a huge investment opportunity arose as a result of this heightened interest in the industry as a whole.

Note that Meta (formerly Facebook) also owns and develops the Oculus Rift virtual reality headset, which showcases just how early they have planned this shift towards virtual reality. While the current applications do not require a virtual reality headset in order for them to be accessed, it does make the experience a lot more realistic, and the technology showcases what our future might eventually look like in the long term.

Overall, this is a move anticipated by many and could re-shape the way we perceive virtual experiences throughout the following decades.

Investment Opportunities within the world of Non-Fungible Tokens

The investment opportunities which are seen within non-fungible tokens (NFTs) are reliant on their use case as well as the creator behind them. In other words, when we look at the world of digital artworks, which we discussed at the very start, they are essentially worth what buyers are willing to pay for them, and this is a purchase price which is based on their scarcity as well as the overall value of the artist that created them. In the physical world, some of the oldest artworks typically sell for millions, while in the world of crypto, Beeple sold an NFT for $69 million.

There are also utility-based non-fungible tokens (NFTs) out there, which give users specific bonuses within the metaverse or within a game, and have a distinctive look to them. They can even offer a competitive advantage.

What this means from the perspective of an investor is the fact that they can buy rare and scarce NFTs used within a metaverse or a game that’s in a period of growth and sell them at a later point in time when their utility or value increases. Investors can also buy artworks from popular NFT artists today the moment they are released and sell them a few months down the line when these artworks become scarce.

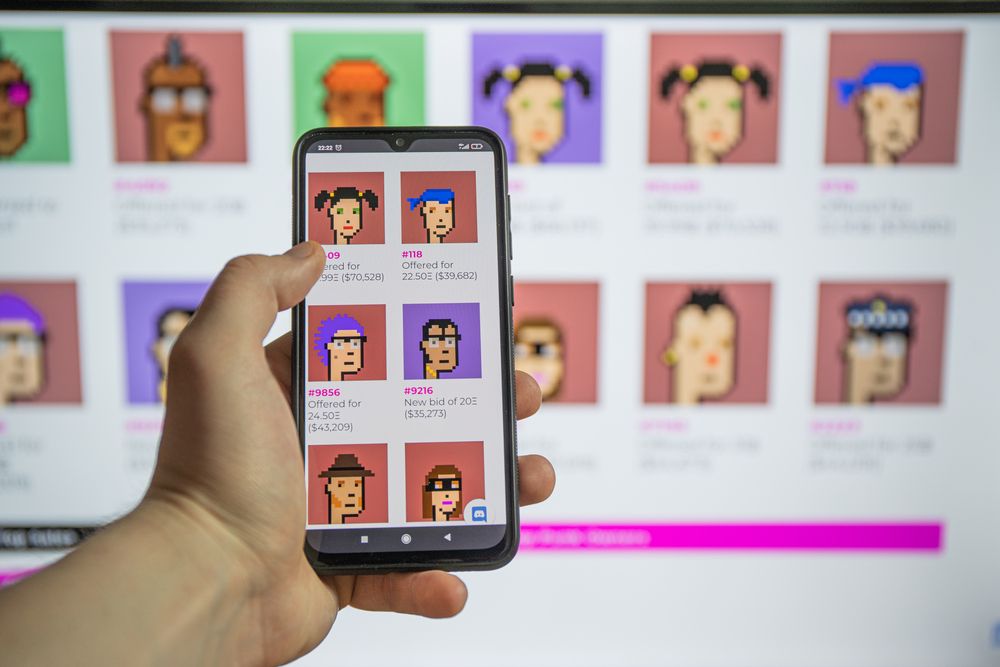

Projects such as CryptoPunks have been released historically, and we will be using that project as an example here. It is a collection of 24×24, 8-bit style pixel art images. They are limited to only 10,000. This means that that amount of CryptoPunks can ever exist.

Investment Opportunities within the world of Non-Fungible Tokens

What this leads to is a high level of scarcity, which will only increase their value throughout the future.

Popular Non-Fungible Token Platforms

As we previously discussed, non-fungible tokens (NFTs) have become available on multiple blockchain platforms, including Ethereum, Polkadot, WAX, Cosmos, Tezos, Flow by Dapper Labs, the Binance Smart Chain, Solana, Tron, and EOS, to name a few.

Each of these blockchains offers a specific NFT token standard that makes the token in question compatible across the entire ecosystem of decentralized applications (dApps) built within that specific blockchain network, alongside all of the wallets that support those tokens standards specifically.

As such, non-fungible tokens (NFTs) can be used as a form of identification and certification, as well as documentation due to the fact that all of the data which is stored within them is essentially stored on the blockchain platform through which they are minted on.

When you trade non-fungible tokens (NFTs), you will be required to ensure that you are using a compatible marketplace for the token standard that your non-fungible tokens (NFTs) are minted through.

Some of the most popular options out there currently include:

- OpenSea

- Rarible

OpenSea

OpenSea is a non-fungible token (NFT) marketplace that is built on top of the Wyvern Protocol, which is a set of smart contracts that run on the Ethereum blockchain. What this means is that any non-fungible token (NFT) that was minted on the Ethereum blockchain is fully compatible with the OpenSea store and can be sold, thereby its owners or creators.

The marketplace facilitates the process of trading, sales, and purchases for all non-fungible tokens (NFTs) that are built on the Ethereum blockchain.

Rarible

Rarible is yet another non-fungible token (NFT) marketplace that uses the Ethereum blockchain as a means of embedding an NFT with the full history of its owner, as well as its full transactional history. It stands out, however, due to the fact that it allows creators to program royalties in the assets that they mine.

What this means from the perspective of a creator is that they can essentially post a royalty percentage they would like to receive within each sale of a non-fungible token (NFT). In other words, if the creator sells a token for $100, they receive the full $100, minus the trading fees, in the form of Ether (ETH) tokens. However, if that NFT sells again in the future, for, let’s say, $200, the original creator can get a % of that $200 down the line. And this can stack up with each sale in the future.

The Rise of Play-to-Earn Titles

Play-to-Earn (P2E) is an emerging as well as trending business model which has taken the decentralized finance (DeFi) gaming industry by storm. This has led to gamers who contribute time towards playing some of their favorite games to end up getting something in return and are productive as a result. In accordance with some estimations out there, the global gaming market is expected to reach a value of $268 billion by the year 2025. Given the fact that a career in gaming has been encouraging in many countries, this further facilitates the shift towards a digital world.

The Play-to-Earn (P2E) business model is just as it would sound like; it is a business model where players are given the opportunity to play a game, wherein doing so, they can earn cryptocurrency or other in-game items in the form of a non-fungible token (NFT) which can, later on, be converted into cryptocurrency through sales conducted on secondary markets such as OpenSea, which would eventually be turned into FIAT currency such as the U.S. dollar.

The key component when it comes to this model is to give gamers ownership over specific in-game assets, which in turn allows them to increase their value through simply playing the game, something they would do by default and are already going in thousands of current games. Typically, within the crypto world, defining the ownership or even transferring it is made possible through the usage of non-fungible tokens (NFTs), something we have heavily discussed thus far.

Through taking part within this in-game economy, players can create value for other players within the ecosystem and for the developers. They would receive a reward in the form of an appreciating in-game asset, and these assets can come in the form of just about anything out there. Each of them varies in terms of scarcity, and as a result, players are essentially rewarded for putting in the time as well as effort within the game.

Think about it this way; in games such as World of Warcraft, players are constantly engaging in raids, where they collaborate with each other to defeat difficult dungeons and bosses, with the goal of getting a rare item within the game that will boost their stats. Within the current business model of that game specifically, players pay a monthly subscription in order to access the content in the game. However, they cannot convert the items they get, which are rare, into real-world money, which can be used just about everywhere. Play-to-Earn (P2E) titles essentially change this by making those items that are difficult to find extremely valuable due to their scarcity, which could in turn potentially result in players actually earning a living wage simply through playing the game and finishing those raids.

At the current point in time, there is a debate if Play-to-Earn (P2E) should be freely accessible. However, the truth, in this case, is that each developer will end up taking their own path in regards to this. Some developers will make their games accessible free of charge, while others might require some contribution in order to play, just so it is profitable for the developers to carry on with the developments of the game in question. This will typically be in the form of a native cryptocurrency token within that game’s economy, wherewith each transfer, the company behind that game can get a little kick-back through a percentage of each transaction, such as the fees found within cryptocurrency exchanges, as a means of incentivizing the developers to carry on work for that specific game. Some of the most popular Play-to-Earn (P2E) games in 2021 were: Axie Infinity, Decentraland, and The Sandbox.

Axie Infinity

Axie Infinity was the first game to hit $1 billion in sales that was developed on top of the Ethereum blockchain and has been one of the most popular Play-to-Earn (P2E) titles on the market. It was inspired by popular games such as Pokémon and Tamagotchi, where players are given the opportunity to collect, breed, raise battle, and trade creatures that are token-based, called Axies.

The Rise of Play-to-Earn Titles

Each of these creatures can take a variety of different forms, and there are over 500 different body parts that are available, such as plant parts, bugs, birds, beasts, and so on. Each of them classifies in four different rarity scales, such as common, rare, ultra-rare, or legendary, and each of them has its own value. The native cryptocurrency within this game is known as Axie Infinity Shards (AXS), which is used as a means of participating within the governance of the game and can even be staked.

Decentraland

Decentraland is another prominent project within the cryptocurrency space that has seen a high level of popularity. It is a virtual world, which runs on top of the Ethereum blockchain that essentially lets players create, experience as well as monetize different content as well as applications.

Decentraland

Through it, users are given the opportunity to purchase plots of land, and they can moderate it in a way that makes it more attractive through building on it and monetizing it. The native cryptocurrency token used within Decentraland is known as MANA. MANA is an ERC-20 token. There is a second token within this world, known as LAND, which is a non-fungible token (NFT) based on the ERC-721 token standard. The MANA token can be used as a means of payment for different names, wearables, avatars, and other things that are available within the Decentraland Marketplace.

The Sandbox

The Sandbox is essentially this blockchain-based virtual world that allows players to earn while they play the game. According to their whitepaper, the main goal of the game is to introduce blockchain technology within the world of gaming in a way that proves to be successful.

The Sandbox

There are two different tokens that make this game work; and the first one is an ERC-20 token known as SAND, which serves the role of the utility token and has a finite supply of three billion, while the other is a non-fungible token (NFT) known as the LAND token, where only 166,464 tokens in existence within the virtual world. LAND as a token can be used to let users host games, create housing, build multiplayer experiences, and a lot more.

The Future of Play-To-Earn (P2E) Titles

It is clear that Play-To-Earn (P2E) cryptocurrency titles are here to stay due to the fact that they make the experience of playing games or just living within virtual worlds a worthwhile experience. In the future, we can expect to even earn living wages just through working within these virtual worlds, doing things that we enjoy doing. What was once a part-time hobby which was mainly done just for fun, and was considered by many unenthusiastic about the virtual worlds as a means of just spending time on something we live, without much feedback in return, will now become a whole new, secondary world where we can live, party, meet with other people and earn money through participating within each one of those activities.

The evolution of blockchain technology, as well as the heightened interest within cryptocurrency tokens, alongside the rapid increase of popularity of non-fungible tokens (NFTs), has showcased just how much interest there is within this industry and the growth of the total value locked within some specific blockchains, or the overall transactions made on a daily basis within these metaverses is an indication of how profitable this can be as a business going forward.

The future seems bright for these titles, and we can clearly see that we are just at the beginning of something truly spectacular. What might be now simplistic, 2D, or 3D environments could one day evolve into realistic, life-like environments that we might not differentiate from real ones, given the fact that corporations are pouring billions within these virtual worlds.