How to Secure Your Crypto Assets Effectively

Imagine waking up tomorrow and finding your crypto stash wiped clean—no warning, no explanation, just gone. That gut twist isn’t just a horror story for someone else; it can hit anyone, no matter how careful you think you are. Far too many people lose their Bitcoin and Ethereum not because of some mastermind hacker, but because of simple, avoidable mistakes—like trusting the wrong wallet, letting a weak password slip, or falling for a fake email that looked just real enough. The truth is, serious losses don’t take much; sometimes, it’s a forgotten password, a scribbled-down seed phrase, or logging in on Wi-Fi that someone else is watching. But here’s the catch: protecting your coins doesn’t mean you have to turn into a cybersecurity genius or go off-grid. With a handful of clear steps, anyone can stop most thieves in their tracks, add real barriers to hacks and scams, and finally get peace of mind—not just for your coins, but for yourself. Stick around because once you see how easy some of the best protections are, you’ll wonder why you didn’t put them in place sooner.

Crypto Security Problems: Why People Lose Their Coins

It only takes one careless moment for everything to fall apart. Over the years, I’ve seen classic mistakes that make people sitting ducks for thieves, like:

- Trusting exchanges to hold all their coins

- Writing down a seed phrase on an easy-to-lose notepad

- Reusing the same password everywhere—crypto, email, social accounts

Hacks, scams, and just plain bad luck have cost people billions. In fact, a recent crypto crime report showed hackers stole over $3.8 billion from crypto users in 2022 alone! But you don’t even have to be the target of a massive hack to lose your funds. Sometimes, all it takes is a lost password, a misplaced seed phrase, or clicking a link you shouldn’t have.

What Goes Wrong and Why People Get Hacked

Let’s be real—most people don’t lose their coins in some Hollywood movie-style heist. It’s usually small stuff gone wrong:

- Weak passwords: Still using “password123” or your dog’s name? Hackers love that.

- Phishing emails: You get a link that looks legit, you click…and suddenly your wallet’s drained.

- Insecure networks: Using public Wi-Fi at the airport to log into your exchange? That’s risky business.

- Mixing up hot and cold storage: Leaving everything in a hot wallet when you don’t need to? That’s like hiding your life savings under your pillow.

I’ve heard stories of people copying their seed phrases into cloud notes “just for a second” and then forgetting all about it—until their coins are gone. It can happen so fast you won’t even know what hit you.

The Promise: You CAN Protect Your Crypto

Here’s the bright side: you don’t need to be a tech wizard to keep your crypto safe. I’ve worked with total beginners and old-school Bitcoiners, and the principles always work: with a few solid steps, anyone can guard their crypto like a pro. You just need to understand the biggest threats—and smart, simple ways to avoid them. By the end of this series, you’ll have actionable steps you can take today to lock down your coins (without freaking out or buying a bunker in the woods).

Why This Matters for Everyone in Crypto

It’s not just the headlines. It’s real people—like you—that are losing coins because of small mistakes. A wallet gets hacked. Someone sends coins to the wrong address. Or worse, someone close to you figures out your password. Whether you’ve got $50 or $50,000 in crypto, the risks are the same. Nobody’s immune. But the good news? Once you make a few easy changes, you’re suddenly way ahead of most people in the game.

Want to see what actually keeps your crypto secure (and what doesn’t)? Next up, I’ll break down the simple basics—even the experts trust these. You might be surprised by what actually makes a difference… Curious? Keep reading!

Understand the Basics: How Crypto Security Actually Works

Here’s the thing: most people hear about crypto and think it’s all about getting rich quick—but security is the real backbone behind the tech. If you don’t understand why crypto is so different from your bank account, a small slip-up could cost you everything. I want you to know exactly how it works so you avoid those rookie mistakes.

Hot Wallets vs Cold Wallets: The Essentials

Imagine your pocket wallet versus a safe buried underground. Both hold money, but only one is connected to the wider world all day. That’s the difference between hot wallets and cold wallets in crypto:

- Hot wallets are always connected to the internet—think apps like MetaMask or Trust Wallet. Super easy for swapping tokens, but they’re prime targets for hackers. Over $3.8 billion in crypto was lost to hacks in 2022 alone, much of it from hot wallets (source: Chainalysis).

- Cold wallets are offline, like a hardware device or even a piece of paper with your keys on it. No internet? Hackers can’t even see you, let alone touch your coins.

I keep a small amount in hot wallets for daily use. Everything else stays in cold storage. Why? Because one tiny mistake on a hot wallet—maybe clicking a dodgy link or connecting to a sketchy DApp—and your funds can vanish before you even notice. Sounds scary because, well, it is.

Why Private Keys and Seed Phrases Matter

I’ve seen way too many people treat private keys like a regular password, but here’s the truth: a lost private key or seed phrase means you’re locked out forever. No “forgot my password” option. No helpful customer support. Your crypto is just…gone.

“Not your keys, not your coins.”

That’s a saying every crypto user needs drilled into their brain. Your private key or seed phrase is basically the code to your vault. If anyone else gets it, game over—they empty your wallet and you’re left staring at zeros.

- Do not store it online. Never, ever screenshot or copy it into any cloud service. Hackers target these.

- Never share it—even with trusted friends. Social engineering attacks are real, and people do get fooled.

- Write it on paper, keep it in a safe place. Or use a metal backup plate if you want protection from fire or water.

- Never type it into a website you don’t control. Lots of fake wallet “recovery” sites are traps. Google can’t always keep up.

I still remember a friend who kept his seed phrase in an email draft “for convenience.” His Gmail got hit in a breach—he lost everything, and nobody could help. The sick feeling in his stomach was gut-wrenching. Trust me, it’s not worth the shortcut.

Understanding these basics is what separates safe crypto holders from everyone else. Want to know if there are safer, more practical ways to store your coins for the long haul? You’re going to love what’s coming next…

Best Ways to Store Your Crypto: Hot, Cold, or Paper Wallets?

Ever felt overwhelmed by all the wallet options out there? You’re not alone. When I first started, words like “cold storage” and “hardware wallet” sounded like spy gadgets from a movie. But here’s the honest truth: if you want real peace of mind, you’ve got to know not just where your crypto is, but how it’s actually stored.

Cold Storage for Maximum Security

When I say “cold storage,” I mean keeping your crypto offline—totally out of reach for hackers. Hardware wallets (like Ledger and Trezor) and even simple paper wallets are gold standards here.

- Hardware wallets are small USB devices that keep your private keys offline. A study by Chainalysis found that funds stored on hardware wallets are virtually never lost to hacking (unless somebody physically gets hold of them).

- Paper wallets—literally just a piece of paper with your private key written down—were pretty common back in Bitcoin’s early days. These days, hardware wallets are a lot safer, but paper wallets can still work in emergencies when you’re confident you can keep that paper safe from fire, water, or nosy roommates.

Setting up a hardware wallet? Always buy direct from the manufacturer, never from eBay or a random seller! Too many horror stories out there of people receiving tampered devices (just check the reviews).

As one user put it on Reddit,

“My Ledger is boringly safe—exactly the way I want it.”

Hot Wallets: The Convenience & The Risks

Hot wallets, like MetaMask or Trust Wallet, are what most people start with. They run on your computer or phone—super handy, but also easily targeted by malware, viruses, or just a stolen phone.

- I’ve seen way too many stories where folks kept their life savings in a browser extension wallet and lost it all to a simple phishing attack.

- Crypto exchanges often keep much of their customers’ crypto in their own hot wallets (Coinbase, Binance, etc.), but even the biggest names have been hacked in the past. Remember the infamous Mt. Gox disaster? $450 million gone, just like that.

- For daily spending or quick trades, a hot wallet makes sense. But never use it for your main stash. If you wouldn’t carry all your cash in your back pocket around town, don’t keep all your coins in a hot wallet either!

Securing Physical Wallets

Tech gets the spotlight, but let’s be honest—a thief with a crowbar can be just as devastating as a hacker. That’s why you want to treat your hardware wallet, or even a paper backup, like treasure.

- Store your device in a home safe, a bank vault, or another secure location only you and people you trust know about. It sounds over-the-top, but it works.

- Don’t label your backup as “crypto keys” or something obvious. This is one time when a little paranoia pays off.

- Consider having a backup paper wallet locked away, just in case your hardware wallet gets lost, broken, or stolen.

It’s wild, but the most common reason people lose crypto stored offline isn’t hacking—it’s forgetting where they put it. According to Chainalysis, as many as 20% of all Bitcoin may be lost forever because people lost access to their wallets.

So—where’s the sweet spot between privacy, security, and not making yourself crazy? I’ll give you a hint: how you store your coins is only half of the puzzle. The next challenge? Keeping your crypto transactions private (or at least as anonymous as possible).

Ever wonder just how “invisible” your crypto actually is—or who might be watching? Don’t miss what comes next.

Protecting Your Privacy: Staying Anonymous (or At Least Safe!)

Let’s be real—everyone wants to think crypto is some kind of magic privacy shield. But the truth? Blockchain is more like living in a glass house. All your transactions are out there, forever, for anyone with a blockchain explorer and a little patience. The moment you send or receive crypto, you’re leaving digital breadcrumbs. The whole world, even your nosy neighbor (or worse, someone with bad intentions), could be watching.

Can the IRS See Your Crypto Wallet?

Spoiler alert: yes, they absolutely can. Every bitcoin, Ethereum, and most altcoins exist on public ledgers. Sure, your name isn’t splashed across the blockchain, but your wallet address and transactions are—clear as day.

There are already stories of people being caught because investigators simply tracked wallet activity. Remember when the IRS cracked the Bitcoin mixer case in 2019? They didn’t hack anything. They just watched the blockchain. If your exchange account is linked to your personal details (KYC—know your customer—anyone?), all it takes is a few clicks for your financial history to come together. Scary but true.

“The blockchain is public—not private. It remembers everything. Be careful what you share and where you share it.”

Steps to Keep Nosey People Away from Your Transactions

You don’t have to be a privacy ninja, but a few simple tweaks can make a big difference. Here’s what I do and what I see smart users doing out there:

- Use multiple wallets for different purposes. One for daily use, another for savings, another for that secret Degen play. Mixing up your addresses keeps your balances and movements harder to link.

- Try a crypto mixer—but be aware, some are legal gray areas and certain governments are watching. Still, they scramble up the trail if you’re serious about privacy.

- Avoid sharing your main wallet address in public or to people you don’t totally trust. Treat it like your bank account number. Would you tweet your savings account right now?

- Monitor your own wallets. Use blockchain explorers to see what’s visible. You’ll be surprised at how much anyone can see.

Data firm Chainalysis reports have shown just how easy it is for law enforcement—and scammers—to follow crypto transactions. If you want to stay clear of snoopers, it’s all about making their job a whole lot harder.

Avoiding Oversharing

I can’t stress this enough: Loose lips sink ships. Every time someone posts, “Just scored 1 ETH!” or flashes a screenshot of their latest NFT flip, it’s like holding up a neon sign: “Hey world, I have valuable crypto to steal!”

Criminals don’t have to be hackers. There’s a sad story from 2022 where a so-called “friend” robbed someone after spotting crypto activity on their social feed. Even telling casual acquaintances about your holdings can make you a bigger target than you realize. Online or offline, keep your stash quiet. Bragging rights just aren’t worth it.

So, does keeping things private stop at using mixers and not boasting online? Not even close! What really makes or breaks your security is something that sounds almost too simple—and that’s how you lock down your actual accounts. Ever wondered why some people still lose coins even after following all the “privacy” tips? The answer is one click away—wait till you see why two-factor authentication and strong passwords are the real game-changers…

Extra Protection: Two-factor Authentication & Strong Passwords

Let’s be real—when it comes to messing up your crypto security, most slip-ups start with weak passwords and lazy account protection. I can’t count how many times I’ve seen folks lose their coins just because someone guessed (or phished) their password. Fact: Over 80% of hacking-related breaches are due to stolen or weak passwords, according to Verizon’s Data Breach Investigations Report. Your first line of defense really does start with the basics.

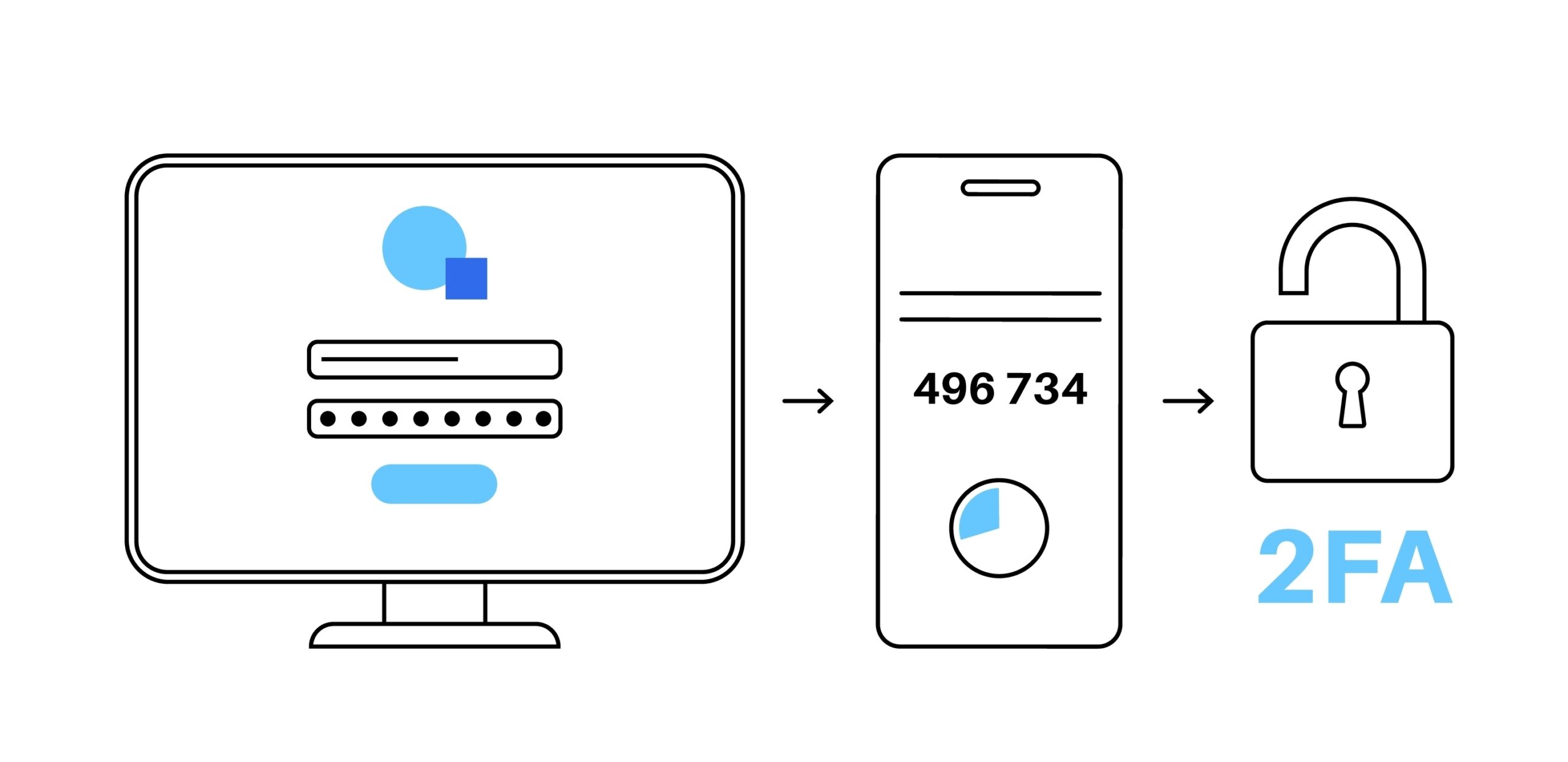

Why 2FA is a Must

If your exchange, wallet, or email doesn’t have two-factor authentication (2FA) enabled, you’re basically leaving your front door unlocked. Picture this: Even if someone gets hold of your password, they still can’t barge in without that extra code from your phone or authenticator app. It turns your login into a locked vault, not a cracked window.

- Always opt for an authenticator app (like Google Authenticator or Authy) rather than SMS codes. SIM swapping is real—hackers can steal your number and use it to break into your accounts.

- Keep backup codes secure—write them down on paper (not on your phone or PC!) and stash it somewhere nobody’s going to find it.

“Security is not a product, but a process.” – Bruce Schneier

Trust me, that second step saves you from most of the horror stories you see circulating in crypto Twitter.

Password Do’s and Don’ts

I know, you’ve heard “use strong passwords” a thousand times, but have you really acted on it? A password isn’t meant to be your dog’s name and your birthday.

- Randomize and lengthen. The longer and more random your password, the better. Use a combo of letters, numbers, and symbols (and absolutely nothing related to you).

- No repeats. Never recycle passwords across different crypto(wallets, emails, exchanges). If one gets hacked, you don’t want the rest to collapse like dominos.

- Consider a password manager. These tools generate and store strong, unique passwords for every site—so you don’t have to keep it all in your head.

I’ve seen even seasoned traders trip up by reusing an old password that got leaked in a massive data breach last year… and that’s all it took for their funds to disappear overnight.

Managing Recovery Phrases

This is where almost everyone gets nervous—one slip and, poof, everything’s gone. Your recovery (seed) phrase is the ultimate key to your castle. But if you keep it in a Google Doc or photo gallery, you might as well hand it to the first scammer knocking on your door.

- Never type your seed phrase into any website, even if it looks official. Phishing sites are slick—they’ve fooled people with decades of experience.

- Write down your phrase on paper (or two copies—one for home, one for a safe spot elsewhere). If you want to go full spy-mode, split the phrase into two and store the pieces in separate secure spots.

- If you store anything digitally, encrypt it, and hide it on a device that doesn’t touch the internet. It’s risky, so only do this if you really know your way around encryption.

Does all this sound paranoid? Think about this: Even major crypto influencers have lost millions to simple recovery phrase mistakes. The stakes couldn’t be higher.

I’ve got a trick coming up that almost nobody uses, but it could save your coins from hackers and snoopers lurking online. Wonder what it is? You’ll want to see the next section—trust me, even seasoned crypto holders rarely do this one thing that seriously levels up your security. Ready for the next step?

Using Tools to Stay Safe Online

Ever felt your stomach drop after clicking a sketchy link or using public Wi-Fi for a quick crypto check-in? Believe me, you’re not alone. Technology isn’t just for convenience—it can literally make or break your crypto security. If you’re serious about keeping your coins, it’s time to get a little bit nerdy with your online setup.

Does a VPN Actually Help?

Picture this: You’re logging into your wallet from a hotel or a random café. Without a VPN, anyone snooping on that network (and it’s shockingly easy) can potentially watch your traffic, grab your login, or worse.

- VPNs mask your location and encrypt your internet traffic, throwing off hackers who might target you based on your IP address.

- They’re super helpful for bypassing phishing sites or even dodgy Wi-Fi setups where someone is lurking to scoop your details.

- Even big names have fallen to attacks launched through public Wi-Fi—don’t be the next cautionary meme.

As Edward Snowden said,

“Encryption works. Properly implemented strong crypto systems are one of the few things that you can rely on.”

Take that wisdom—VPNs are a solid start, but they’re just part of the battle.

Keeping Your Devices Clean

If your device is infected, it doesn’t matter how private your keys are. Malware can be sneaky, hiding in fake wallet apps or browser extensions. According to a security report by Check Point, crypto-targeting malware attacks exploded by over 400% in 2023. The risk isn’t theoretical—it’s happening right now.

- Always update your OS, browser, and wallet apps. Hackers love old, unpatched software.

- Avoid “free” downloads promising huge returns or “secret” crypto features. If it’s too good to be true, it probably is hiding a virus.

- Keep a dedicated device for your wallet if you’re holding serious funds. Treat it like a VIP pass—no random apps allowed.

Watch Out for Phishing Attacks

Ever get an urgent email saying “Your wallet is compromised—click here”? That nervous energy you feel is on point. Phishing is the number one way people get drained—no hacking required, just trickery. Even pros mess up. One wrong click or typing your seed phrase into a lookalike website, and poof, your funds are gone.

- Double-check URLs. Scammers often create sites like “binancee.com” instead of “binance.com”—a single extra letter, and you’re toast.

- Bookmark official sites and only use those for logins.

- Don’t ever type your seed phrase unless you’re 100% sure you’re in the right place, and never share it with anyone, no matter how “official” they sound.

- Some browser extensions, like MetaMask, can reveal warnings if a site is blacklisted—keep them updated, and listen to them!

Here’s a little secret: Most successful crypto hacks rely on human error, not genius-level hacking. Be skeptical, always double-check, and trust your gut if something feels off.

Ready to step it up and build habits that keep your crypto safe for the long haul? Ever wondered what happens if you leave coins sitting on exchanges or forget to back up your wallet? I’ve got some battle-tested tips coming up next that you won’t want to miss…

Making the Right Habits: How to Stay Secure Long-Term

Okay, so you’ve set up a solid wallet and protected your keys, but here’s where most folks get lazy. Long-term security is not just a checklist you tick off once – it’s more like brushing your teeth. One little slip and… well, nobody likes a toothache, right?

Don’t Leave Crypto on Exchanges

Let’s get real: exchanges are handy, but they’re not your personal bank vault. Even the most reputable platforms, like Mt. Gox (remember that disaster?) and recent domino collapses, have lost billions in user funds. In 2022 alone, about $3.8 billion was lost to exchange hacks according to Chainalysis. That’s enough to make anyone sweat.

- After buying coins, move them to your private wallet. Don’t risk it just for convenience.

- Split your funds: Only keep what you actually plan to trade on exchanges. Everything else? Out of there.

- Check for withdrawal limits or fees in advance. You don’t want to scramble if a platform freezes accounts.

“It’s not your keys, it’s not your coins.”

Backing Up Your Wallets

Say it with me: “If my house burns down, will I lose my crypto?” Sounds dramatic, but it happens. I’ve heard horror stories of people losing everything just because they had a single backup hidden in a sock drawer—or worse, saved on their laptop. Laptops break, socks get lost, and life just loves a plot twist.

- Don’t just write it down once! Create multiple backups of your seed phrase and store them separately—think safe deposit box, or even a trusted family member who doesn’t lose things.

- Test your recovery process once in a while. This might sound scary, but you want to know your backup actually works before you need it.

- Keep your backups updated. Swapped wallets or added new assets? Don’t forget to update those backups, too.

Training Yourself to Spot Scams

There’s a new scam every week. Sometimes it’s a message from a “support agent,” sometimes it’s a friend with a compromised account, and sometimes it’s a wild investment promise that’s just a little too exciting.

- Stay skeptical: If you get a weird message—pause. Double-check the source.

- Never rush: Scammers love to crank up the pressure. If someone says “hurry up and send funds or lose out,” that’s a red flag the size of a whale.

- Do your research: Google the website, the offer, or even copy-paste the message into Reddit or a forum to see if it’s a known scam.

The best defense? Keep your guard up. I know it can feel tough or even “paranoid,” but trust me, the moment you let it slip, that’s when the bad guys pounce. Think of it this way: you don’t need to be perfect, just tougher to crack than the next target out there.

But what if there were more ways to level up? What if you could tap into resources that the best in the game rely on? Curious where to learn smarter, faster, and safer? Stick around—some of my favorite guides and go-to places for crypto security are coming up next!

Learning More: Resources for Supercharging Your Security

Let’s be honest—crypto security isn’t something you figure out once and then forget. New scams pop up, tech changes, and what was bulletproof last year could be a soft target today. If you ever feel lost, you’re not alone. The people who stay the safest are the ones who keep learning. So where do you go for trustworthy info?

Putting It All Together: Stay Smart, Stay Safe

Alright, let’s bring everything home. You’ve made it through the maze of crypto security basics, wallet choices, passwords, privacy tips, and habits. If you’ve started applying some of these lessons, you’re in a far better position than most people I see in the space.

Making Crypto Security Routine

Here’s the real trick: weave these practices into your everyday life. Security isn’t a box you check and forget about. The landscape changes constantly—new malware, phishing attacks, and creative scams pop up every year.

I check my wallet security along with other digital routines—backing up photos, changing a few passwords, and making sure my security app is still installed. I know people who set a calendar reminder every three months just to check their wallets and backup copies. It’s boring, but it pays off.

Think of it like brushing your teeth. Just a small daily effort, and you avoid bigger headaches later. If you ever upgrade your phone, laptop, or move to a new computer, use that as a reminder to review your wallet access. Run through a quick checklist:

- Do I still know where my recovery phrase is?

- Is my hardware wallet firmware up to date?

- Are my passwords unique and strong?

Taking a few minutes every so often can make a life-changing difference.

If You Slip Up, Act Fast

Mistakes happen—even to the pros. What matters is how fast you respond. Lost a recovery phrase? Suspect that a phishing site grabbed your details? Act immediately.

- Move your funds to a safe, clean wallet as soon as you suspect trouble.

- Reset your passwords and disable compromised accounts.

- If you’ve been targeted by malware, wipe your device before using it for crypto again.

In one well-known example from last year, a crypto trader realized he’d clicked a fake wallet site nearly two days before the scammer emptied his account. He was able to move the majority of his funds just in time because he regularly checked his balances and security logs. The lesson: speed can save more than just your nerves.

And if something happens, don’t beat yourself up—most people in crypto have at least one close call. What matters is learning and adjusting for next time.

Final Thoughts: Your Keys, Your Coins

Crypto gives you real ownership—but that freedom comes with the need for vigilance. It’s a bit like carrying cash: you wouldn’t wave wads of bills around in public, so don’t treat your private keys or seed phrases carelessly either.

I’ve seen too many people get burned because they thought hacks would “never happen to them.” The reality? Crypto is pretty safe if you respect security and stay proactive with your setups and habits.

Let your peace of mind be your best asset. Knowing you’ve got your bases covered, you can focus on what matters most—watching your crypto grow instead of worrying about losing it.

Your keys, your coins. Simple as that. Keep ’em safe, and you’ll have nothing to fear.