Crypto’s Wild 48 Hours: Polygon Buys, Celestia’s “1TB/s” Flex, and Memes Mooning — What I’m Watching Before the Next Pump

Ever feel like you can’t even make coffee without crypto rewriting the whole meta? That’s been the last 48 hours—fast, noisy, and honestly a little dangerous if you’re reacting instead of thinking.

In one short window we’ve got:

- Polygon making acquisition-style moves (the kind that can shift an ecosystem narrative overnight).

- Celestia grabbing attention with a monster “1TB/s” throughput story (the sort of headline that travels faster than context).

- Meme coins doing what meme coins do best—ignoring logic and sending anyway, pulling liquidity like a magnet.

If you’re trying to position for the next pump without getting chopped into pieces, this is the kind of week that decides portfolios. Not because every headline is “bullish”… but because narrative rotations tend to start exactly like this: a few big stories, a flood of copycats, then the leverage shows up and everything gets exaggerated.

My rule: when the market starts moving this fast, the edge isn’t “seeing green candles early.” It’s understanding why the crowd is rotating and where the traps usually are.

The problem: hype moves faster than research (and that’s how people get rekt)

Most traders see price first and ask questions later. That’s normal—humans are wired for attention, not due diligence. And crypto is basically an attention market with a chart attached.

There’s even research showing that attention spikes can lead to temporary mispricing. One classic paper found that when retail attention surges, assets can get bid up simply because more people are looking at them, not because fundamentals changed (Da, Engelberg & Gao — “In Search of Attention”). In crypto, where information moves through social feeds at light speed, that effect can feel amplified.

What’s tricky right now is that these aren’t isolated mini-stories. They connect to bigger rotations:

- L2 consolidation and ecosystem “power moves” (why acquisitions suddenly matter again).

- Modular scaling narratives (big performance numbers that sound like magic if you don’t translate them).

- Perps + points + meta trades (where leverage quietly becomes the engine).

- Meme liquidity cycles (where the “community” talk often arrives right when smart money is looking for exits).

And the risks hiding under the hype are the same ones I see every cycle:

- Unlock schedules that turn “bullish news” into a sell-the-news event.

- Thin liquidity that makes entry easy and exit painful.

- Fake volume (especially when a coin appears out of nowhere with “insane activity”).

- Leveraged hype where funding goes bananas and one wick resets everyone’s portfolio.

So when I see Polygon headlines + Celestia performance flexing + memes catching a bid all in the same two-day stretch, I don’t think: “Which one do I ape?”

I think: “Which narratives are forming, which are marketing, and where is the market most likely to punish lazy entries?”

Promise: I’ll break the last 48 hours into “what happened / why it matters / what I’m doing”

I’m going to keep this simple and useful. I’m mapping what just happened into three buckets:

- Polygon + acquisitions — what the market thinks they’re buying (and what can go wrong after the headlines).

- Celestia + the “1TB/s” narrative — what that kind of number can mean in real life, and what it doesn’t mean.

- Memes + DeFi momentum — how liquidity moves when attention and leverage start feeding each other.

Then I’ll finish with the exact pre-chase checklist I use before I touch anything that’s already vertical. No fortune-telling—just signals, positioning, and risk.

Who this is for (and who should skip it)

This is for you if you’re any of the following:

- An altcoin/DeFi trader trying to catch rotations early without becoming exit liquidity.

- An airdrop hunter watching narratives because narratives decide where incentives go next.

- A builder tracking where mindshare is heading (because mindshare tends to bring devs, liquidity, and users).

You should skip if you only want price predictions. I’m not here to tell you “this coin will 10x by Friday.” I’m here to show you how I read a chaotic week so you can make cleaner decisions.

Now here’s the question: if you had to pick what actually shifted market mood first—Polygon’s acquisition energy, Celestia’s throughput headline, or meme liquidity sucking oxygen out of everything else—what would you choose?

Good. Because in the next section, I’m laying out the clean 48-hour timeline and the exact moments the vibe flipped—so you can see the rotation forming instead of chasing it late.

The 48-hour timeline: what actually moved the market mood

When crypto “changes” in two days, it’s usually not because fundamentals flipped overnight. It’s because attention moved, and then leverage + liquidity followed it like a heat-seeking missile.

Here’s how the mood shifted across my screens over roughly 48 hours (UTC-ish, because this stuff hits X in waves):

- Hour 0–8: Polygon-related ecosystem headlines start circulating again, with the tone leaning “build + consolidate” instead of “just ship another partnership.” The market reads this as serious strategy, not random announcements.

- Hour 8–18: Celestia’s “1TB/s” narrative spreads fast. The number is so big it becomes a meme, then a debate, then a positioning game: “modular is back.”

- Hour 18–30: Perps chatter heats up. You can feel it when timelines go from “interesting tech” to “what’s the ticker + what’s the leverage.” That’s usually the inflection point.

- Hour 30–48: Meme coins pull liquidity like a magnet. This is the part where smart people pretend they’re above it… while quietly checking charts and routing through the most liquid pools.

If you want one sentence that explains the mood: builders gave traders a story, traders added leverage, and memes harvested the attention overflow.

Polygon’s acquisitions: what they’re likely trying to “buy” (talent, tech, users, or narrative)

When an ecosystem starts behaving like it’s in “acquisition mode,” I don’t just ask what they bought. I ask what they’re trying to buy that’s hard to build quickly.

In crypto, acquisitions (or acquisition-style moves) usually aim at one of four things:

- Talent: A team that can ship faster than you can hire. In practice, this is the most common “real” reason.

- Tech: A missing piece in the stack—wallet UX, ZK tooling, dev infrastructure, privacy modules, account abstraction, indexing, sequencing, etc.

- Users + distribution: A product with sticky daily usage (wallets, tools, consumer apps). This is rare and extremely valuable when it happens.

- Narrative + mindshare: The market often reprices the token before integration works, simply because the story becomes easier to repeat: “they’re consolidating the stack.”

And yes—sometimes it’s also defensive. If a competitor could buy the same team/tech and box you out, you pay up to prevent that.

One reason acquisitions move tokens early is that crypto is an attention market. Academic work on crypto pricing has repeatedly found that investor attention and momentum matter a lot (for example, Liu & Tsyvinski’s research on crypto return factors has been widely cited for showing that momentum-like behavior is a real force here). So the token can run on “this will matter” long before the chain’s revenue reflects it.

What Polygon buyers and holders should watch next (integration risk checklist)

After acquisition news, my first job is to kill my own excitement with a checklist. Because the graveyard is full of “great acquisitions” that never shipped anything meaningful.

- Is there a real integration plan, or just vibes?

What I look for: a concrete product page, repo activity, hiring, a migration path, or a timeline that’s more specific than “soon.” - Does it add users/revenue, or just brand?

If it’s a developer tool, I want to see dev adoption. If it’s a consumer product, I want to see retention. If all I see is logo-swapping, I treat it as narrative-only. - Are token incentives coming (good), or is there dilution/overhang (bad)?

Sometimes incentives bring activity; sometimes they bring mercenary farmers who vanish the second APR drops. I watch for emissions schedules, unlock cliffs, and any “we’ll reward users later” language that quietly implies sell pressure. - Timelines: weeks, months, or “someday”?

Crypto traders price catalysts. “Someday” is how you hold a bag through three meta rotations.

If you’re holding or trading around this theme, the key is simple: integration risk is the real risk. Not the headline.

Celestia’s “1TB/s” beast: what that number might mean (and what it definitely doesn’t)

Let’s translate the “1TB/s” flex into normal human language, because this is where people get tricked by unit porn.

Celestia’s headline number is about data availability throughput under specific assumptions. That’s not the same as “the chain does 1TB/s of user transactions.” It’s closer to: how much data the network could make available to participants given certain conditions (hardware, network bandwidth, erasure coding parameters, how sampling is done, whether it’s burst vs sustained, etc.).

Here’s what that number might mean:

- The DA layer could theoretically support a lot more rollup/appchain data posting than today’s norms.

- Modular teams get a marketing sledgehammer: “capacity isn’t the limit anymore.”

And here’s what it definitely does not mean:

- It’s not “1TB/s TPS.” Execution throughput depends on execution environments, sequencers, provers, and state growth constraints.

- It’s not guaranteed sustained throughput on mainnet. Lab demos and best-case assumptions are not the same thing as adversarial real-world conditions.

- It doesn’t remove every bottleneck. If DA gets cheaper, the next bottleneck often becomes latency, sequencing, MEV, proof generation time, or the UX of bridging/liquidity.

This is why I treat huge throughput claims as a two-part signal: 1) attention catalyst, 2) homework assignment.

The practical take: how modular scaling narratives pump (and how to sanity-check them)

Modular narratives pump in a predictable way: a big number drops → people argue about it → the argument itself becomes distribution → capital rotates into anything that “touches the stack.”

My sanity-check framework is quick and boring (and it saves me):

- What part of the stack is improving?

DA (data throughput + cost), execution (running tx), or settlement (finality/security)? If someone blurs these, I slow down. - Who benefits immediately?

Rollups posting lots of data benefit from cheaper DA. Appchains benefit if deployment is easy and liquidity exists. If the benefit is “future devs,” the pump can still happen—but it’s more fragile. - Is there an ecosystem ready to use the extra capacity?

Capacity without demand is just a chart story. I look for rollups shipping, appchains launching, dev tooling, and real apps with users. - What bottleneck moves next?

If DA gets cheap, I start watching sequencing, MEV extraction, bridge UX, and liquidity fragmentation. The money usually rotates to the next bottleneck narrative fast.

One extra point that matters: thin liquidity makes narratives look stronger than they are. Makarov & Schoar (published research often cited in crypto market structure discussions) showed how fragmented liquidity across venues can create dislocations; in plain terms, when liquidity is scattered or thin, price can move harder than it “should.” That’s bullish in the moment—and dangerous later.

If you only watch spot price, you’re always late. The “engine sound” is usually in derivatives.

When perps heat up, three things happen:

- Open interest climbs → more traders are in the arena, and forced liquidations become a real accelerant.

- Funding flips aggressive → the crowd is leaning one direction, which can power the trend… until it becomes the reason for the reversal.

- Liquidation clusters build → price gets magnetized to levels where the most pain is.

This isn’t just “CT vibes.” Traditional and crypto-focused market microstructure research has consistently shown that leverage and positioning amplify volatility. In crypto specifically, the reflexive loop is brutal: price goes up → leverage piles in → price goes up faster → one sweep liquidates late longs → the chart nukes → people call it manipulation. Most of the time it’s just crowded positioning meeting thin liquidity.

So when I see a narrative catch fire, I immediately ask: Is this spot-led or perp-led? Spot-led moves tend to be steadier. Perp-led moves are where you get those violent “up only” candles… and the equally violent erases.

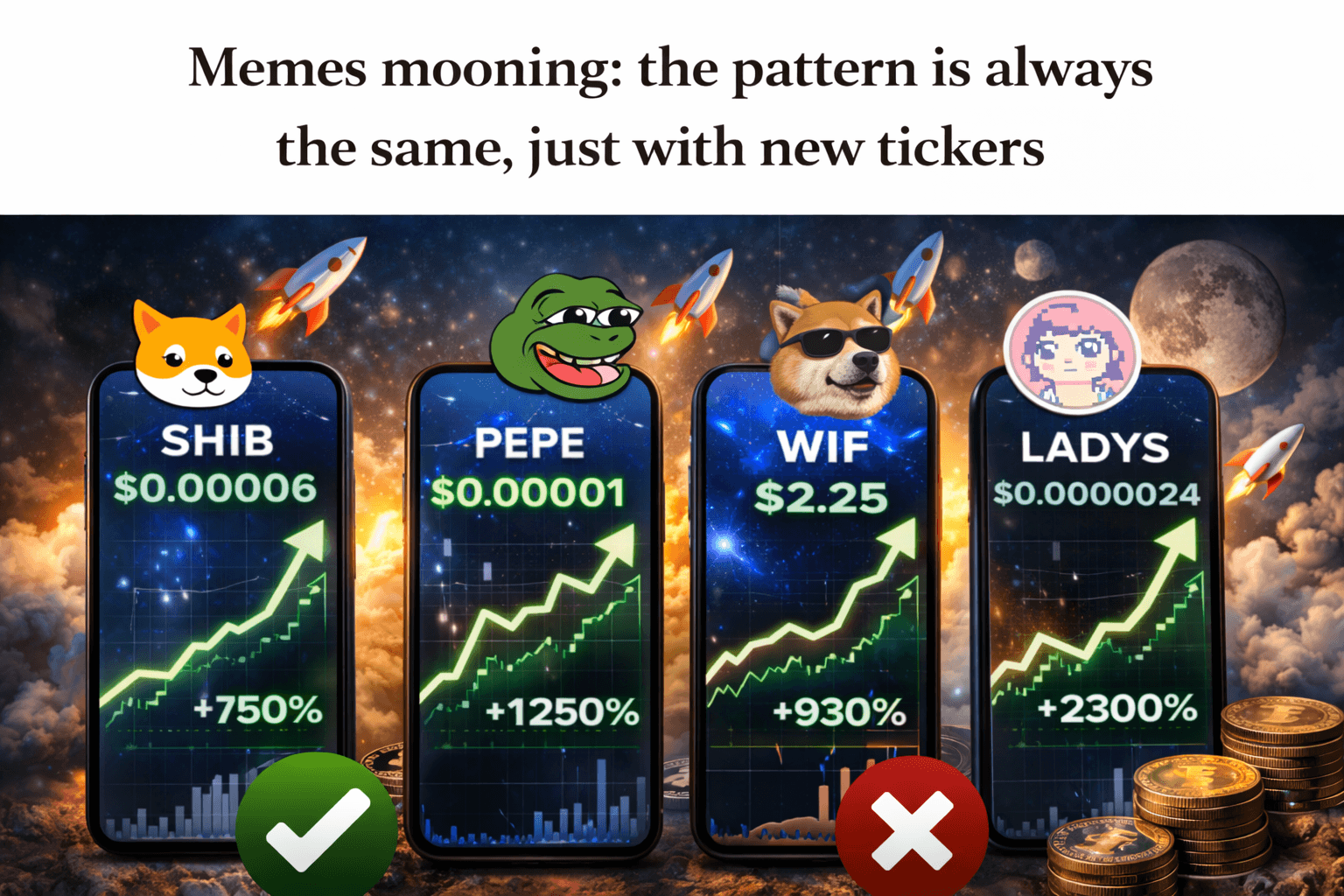

Memes mooning: the pattern is always the same, just with new tickers

Meme season isn’t random. It’s a social/liquidity machine with a repeating script. The characters change; the plot doesn’t.

Here’s the cycle as I’ve watched it play out again and again:

- Stealth: A token launches quietly, early holders accumulate, liquidity is thin.

- Discovery on X: A few accounts post PnL screenshots, “community” memes, and “it’s still early.”

- Liquidity rush: More pools, more volume, easier entry. This is where most people first notice it.

- Leverage/derivatives: If perps appear (or leverage routes become popular), the volatility multiplies.

- Top signal phase: Endless “community” posts, hero worship, timelines turn into copy-paste slogans, and anyone asking about risk gets called a boomer.

- Brutal retrace: The chart gives back weeks of gains in hours. The “community” becomes a support group.

The only real edge in memes is not “finding the best meme.” It’s managing your entry, sizing, and exits so you don’t become someone else’s exit liquidity.

My “don’t get farmed” rules for meme season (simple, boring, effective)

I trade memes like they’re fireworks: beautiful, exciting, and not something I hold in my pocket.

- Position size like it can go to zero.

If losing it would change my mood for the day, it’s too big. - Only trade liquid pairs.

If I can’t exit without donating a chunk to slippage, it’s not a “trade,” it’s a prayer. - I don’t buy after vertical candles.

If it’s gone straight up, I wait for a pullback or I skip. Missing a trade is cheaper than chasing one. - I take profit in chunks.

Partial sells pay for the risk and stop me from round-tripping a winner into a lesson. - I never marry a meme.

Memes don’t love you back. They just redistribute liquidity. - I assume influencer posts are distribution.

Not always, but as a default assumption it keeps me alive. - I keep a hard invalidation level.

If it hits, I’m out. No debate, no coping, no “it’ll bounce.”

My rule of thumb: If the main reason you’re bullish is “everyone is talking about it,” you’re not early—you’re marketing.

People also ask

Why is Polygon acquiring projects?

Acquisitions are usually about speeding up execution: buying a shipping team, filling a tooling gap, or absorbing a product with users. In crypto, it can also be about narrative—signaling “we’re consolidating and building a full stack,” which markets often reward quickly. The key question is whether the acquisition turns into integration (product + usage), not just announcements. I watch for timelines, shipping milestones, and whether developers actually adopt what was acquired.

Is Celestia really doing 1TB/s?

That number is best understood as a DA-layer throughput claim under certain assumptions, not “1TB/s of real user transactions.” DA throughput, execution throughput, and real TPS are different things. It can still be meaningful—especially for rollups that need cheap, scalable data posting—but it’s not a guarantee of mainnet sustained performance. When you see a number that big, treat it as a signal to check the conditions: hardware, networking, sustained vs burst, and what exactly is being measured.

What is data availability and why does it matter?

Data availability means the data behind blocks is actually accessible to the network so others can verify what happened. In modular designs, execution can happen elsewhere (like rollups), but they still need a reliable place to publish data so the system stays verifiable. If DA is expensive or limited, rollups get bottlenecked and users feel it via fees or congestion. If DA becomes cheaper and more scalable, it can unlock more appchains/rollups—but other bottlenecks usually show up next (latency, bridging UX, sequencing, MEV).

Why do meme coins pump so hard?

They’re pure attention vehicles, and attention is liquid in crypto. Memes also benefit from simple narratives: no roadmap to debate, no valuation model to argue over—just “line goes up.” When leverage and thin liquidity join the party, price can move violently fast. The same mechanics that create huge upside also create the brutal retraces.

How do I spot a meme coin top?

I watch for a shift from discovery to performance marketing: nonstop “community” posts, recycled slogans, and timelines filled with people trying to recruit buyers instead of sharing information. Another tell is when every dip is instantly framed as “free money” and risk management becomes socially unpopular. If perps are live, I also watch funding and OI for crowded positioning—tops often form when the trade becomes consensus. It’s not perfect, but it keeps me from getting hypnotized by green candles.

What should I check before aping into an altcoin pump?

First: liquidity—can you exit cleanly, or will slippage eat you alive? Second: token mechanics—unlocks, emissions, and who might be sitting on a big bag waiting for your buy pressure. Third: onchain reality—are users and fees growing, or is it just noisy volume? And finally: leverage signals—if the move is perp-led with frothy funding, you’re often one wick away from regret.

Where I’m tracking this (quick sources I used)

I’m not treating any single post like gospel, but these are the threads I’ve been cross-checking as the story develops:

- https://x.com/nifty0x/status/2011823627780460929

- https://x.com/efipm/status/2011439915033096269

- https://x.com/Adanigj/status/2011608554738684270

- https://x.com/cryptotalemedia/status/2011303706533511299

- https://x.com/bitcns/status/2011604918788866076

- https://x.com/DeFi_Scope/status/2011496221488157000

- https://x.com/Alaouicapital/status/2011358471669821594

- https://x.com/Oleribeweb30/status/2011347372908183979

- https://x.com/oTTeuMsTudio/status/2011277190038745493

- https://x.com/NodeStake_top/status/2011238582611296625

- https://x.com/Hyperliquid_Hub/status/2011257994236019127

- https://x.com/stakeingermany/status/2011886108901028327

- https://x.com/stakeingermany/status/2011438158919909586

- https://x.com/BSCNews/status/2011407705194315965

- https://x.com/HenryVo_TTT/status/2011294092270191052

- https://x.com/spaceagente/status/2011272538287149195

- https://x.com/truongson/status/2011400323982860360

- https://x.com/leelucky2021/status/2011270490955059651

- https://x.com/My_CryptoNews/status/2011483844617084931

- https://x.com/stitchdegen/status/2011844024332927408

- https://x.com/YZfinance/status/2011541196712050914

- https://x.com/criptonemo44/status/2011597696189284767

- https://x.com/criptonemo44/status/2011597257393783046

- https://x.com/criptonemo44/status/2011596933232804088

- https://x.com/criptonemo44/status/2011597099457266038

- https://x.com/criptonemo44/status/2011597405016474054

- https://x.com/criptonemo44/status/2011597197465567266

- https://x.com/criptonemo44/status/2011597338490650848

Now the real question: with acquisitions, modular hype, perps leverage, and memes sucking up oxygen… how do I decide what’s actually worth holding through the noise, and what’s just a two-day story?

I’ve got a dead-simple checklist I use before I chase anything—especially when the candles are loud. Keep reading.

What I’m watching before the next pump (my personal checklist)

When crypto gets loud, I stop looking for “the next coin” and start checking the conditions. Most pumps look obvious in hindsight, but in real time they’re messy: half-truths, leverage, thin liquidity, and people confusing marketing with adoption.

Here’s the checklist I’m using right now before I touch anything that’s already moving.

1) Narrative strength: is it everywhere and are builders actually shipping?

- What I look for: consistent chatter across X/Telegram/Discord plus a steady stream of commits, releases, or integrations.

- What “shipping” looks like: mainnet launches, real partnerships with code in production (not just a logo), docs that are updated weekly, and teams responding to issues publicly.

- Quick sanity check: open the project’s GitHub (or the core repos it depends on). If the last meaningful activity is months ago, the “narrative” is often just a trading campaign.

I’ve learned this the hard way: narratives can carry price for a while, but they don’t carry it through unlocks, copycats, or the first big market red candle. Shipping does.

2) Liquidity: can I exit without donating 15% to slippage?

- On-chain: I check DEX liquidity depth and the biggest LP wallets. If two wallets control most of the pool, I treat it like a trap until proven otherwise.

- Order books: if it’s listed on a CEX, I look at the spread and how thick the book is a few % above/below price.

- Reality test: I ask, “If I had to sell this position in 60 seconds, how bad would it hurt?” If the answer is “very,” I size it like a meme—tiny.

Liquidity is the boring edge. In fast rotations, the difference between “nice trade” and “why am I stuck” is usually just market depth.

3) Token mechanics: unlocks, emissions, incentives, and ‘who can dump on me?’

- Unlock schedule: I check the next 30/60/90 days. If a big unlock is coming, I want a very good reason to be early.

- Emissions: high emissions aren’t always bad, but they have to be matched by sticky demand. If the only demand is “points” or “temporary APR,” I assume selling pressure is baked in.

- Holder concentration: I look for top holder distribution and any weird “team treasury” wallets that can quietly drip supply.

If you want a simple rule: when supply is guaranteed and demand is optional, price usually loses. Not always immediately, but often right when the chart looks the prettiest.

4) On-chain reality check: users, fees, TVL quality, and volume sources

- Users: daily active addresses can be misleading (Sybil farms are real), so I compare it with transaction count, retention, and whether activity looks organic.

- Fees: I like seeing real fee generation because it’s harder to fake than “transactions.” Even if fees are low, a consistent trend matters.

- TVL quality: not all TVL is equal. I ask, “Is it mercenary yield money?” If incentives end tomorrow and TVL vanishes, that’s not strength—that’s rented liquidity.

- Volume: I’m cautious with “record volume” headlines. Wash-y volume is a thing, especially on thin pairs. I look for multiple independent sources confirming it.

There’s a decent body of research suggesting that organic activity and fee signals tend to be more durable than pure social hype. For example, several academic and industry studies on crypto networks and DeFi point to usage/fees/liquidity being stronger long-run indicators than raw follower growth or short bursts of volume. I don’t treat any single metric as truth—but I do treat consistent fee + user growth as the closest thing we get to fundamentals in this casino.

5) Leverage signals: funding spikes, OI jumps, liquidation clusters

- Funding: if funding flips aggressively positive and stays there, I assume crowded longs.

- Open interest (OI): if OI explodes while spot volume doesn’t, I treat it like a leverage bubble.

- Liquidation levels: when everyone is positioned the same way, the market loves to sweep them. I’d rather enter after the sweep than before it.

Real example behavior I watch for: a token trends hard, perp OI rips, funding goes silly, and then price “randomly” wicks down 8–15% in minutes. That wick isn’t random. It’s the market collecting overconfident leverage.

The “3-lane” playbook: safe, medium, degen

I don’t like pretending every trade deserves the same risk. When the market is rotating this fast, I keep three lanes and I don’t mix them.

- Safe lane: majors + ecosystem leaders that can survive narrative changes.

How I treat it: slower entries, wider stops (or none if it’s long-term), and I’m fine holding through noise. - Medium lane: strong infra/app tokens with clear catalysts.

What qualifies: upcoming launches, integrations, revenue/fees trending up, meaningful governance changes, or a product that’s obviously getting used. - Degen lane: memes/low caps with strict sizing + fast profit-taking.

My rule: if it can -40% in a day (and memes can), I size it so that -40% doesn’t change my mood.

The point is simple: I want upside without risking my whole week on one chart. A lot of people “diversify” by buying 12 illiquid coins that all dump together. That’s not diversification. That’s just 12 ways to panic.

Personal rule: If I can’t explain why I’m in a position in one sentence, I’m probably in it because I’m bored or jealous of someone else’s screenshot.

Red flags I’m not ignoring this week

These are the signals that show up right before people start asking, “How did this rug so fast?” If I see two or three of these together, I slow down or I skip entirely.

- Fake partnerships: a project “partners” with 20 brands but there’s no product integration, no contract deployment, no joint announcement from the partner.

- Anonymous team + huge premine: I’m not anti-anon, but anon plus heavy insider allocation plus aggressive marketing is a classic combo.

- Thin LPs: chart looks amazing because $20k moves it. That’s not strength—it’s fragility.

- Sudden CEX listing after a vertical move: the listing becomes exit liquidity. Not always, but enough that I treat it carefully.

- Influencer spam cycles: when every post looks like a template—same catchphrases, same images, same “community” lines—someone is distributing.

- “Community takeover” stories masking abandonment: sometimes CTOs are real. A lot of times it’s just a new narrative to restart the pump after the original team checked out.

If you want a quick filter: when the marketing is professional but the product is fuzzy, I get suspicious.

The takeaway: catch narratives early, but don’t marry them

The last couple days were the perfect reminder that crypto doesn’t wait for anyone. Narratives form fast, liquidity moves faster, and leverage turns everything into a rocket ship or a trap door.

My edge isn’t predicting the future. It’s staying calm while everyone else is speed-running bad decisions. I’m watching narrative + shipping, liquidity, token mechanics, on-chain reality, and leverage—every time—before I chase anything.

If you want to keep up with what I’m tracking as this rotation develops, bookmark https://cryptolinks.com/news/ and share this post with your DeFi group. And if you’re seeing a new narrative form (before it hits the “everyone is posting” stage), tell me what it is—I’m always looking for the next clean setup.