Coinbase Many Wins in The Mainstream Race and Other Developments Molding the Stance of Crypto In 2020

There are lots of factors limiting crypto’s mainstream movement. One of such is the apparent complexities associated with the technology, particularly when it comes to owning, storing, and transacting digital assets. New entrants have to get acquainted with a lot of terminologies and strange systems before they can start enjoying the benefits of participating in the crypto market. The crypto space must look for ways to simplify the processes involved in owning and spending crypto before the technology can attain mainstream adoption, which is why Coinbase’s announcement regarding its partnership with VISA is a great development for the crypto world as a whole.

In this article, I will explore Coinbase’s latest milestone, its potential effect on crypto’s mainstream growth, and other new developments molding the future of cryptocurrency technology.

Why Is Coinbase’s Partnership with Visa A Big Deal?

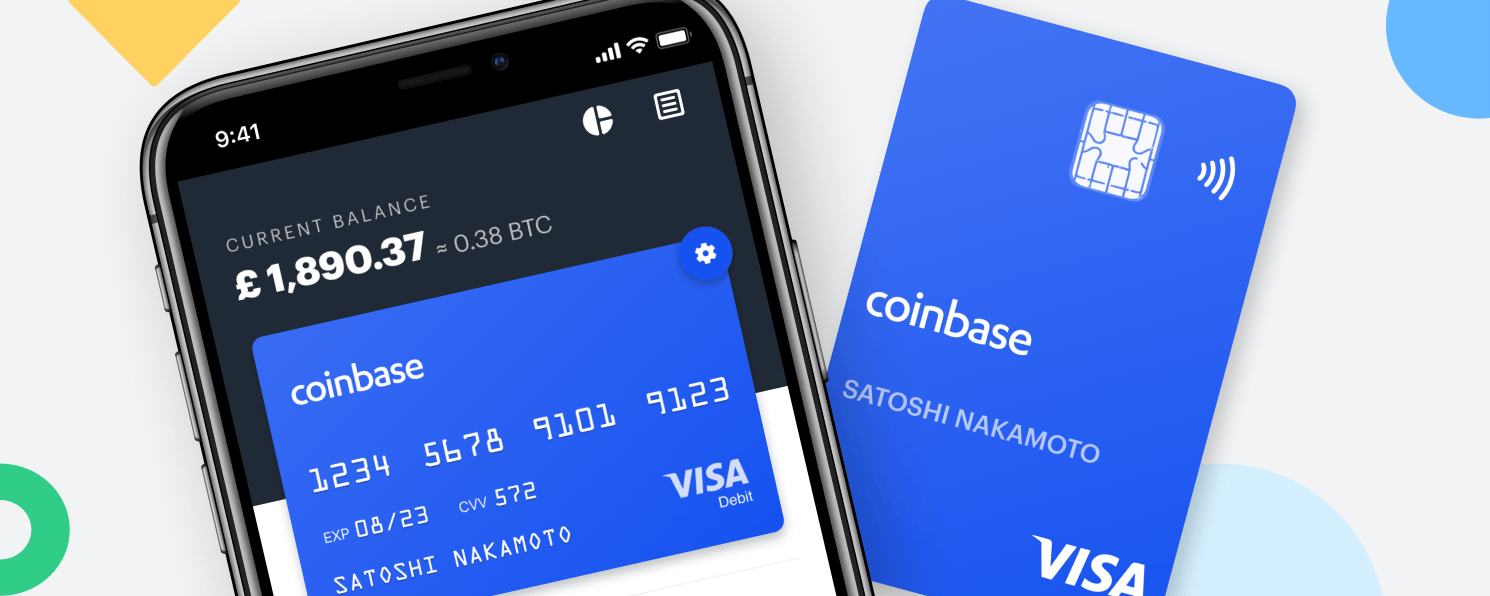

Coinbase Visa Credit Card

On the 19th of February, Coinbase officially announced that it has struck a deal with Visa, which affirms its status as the “first pure-play cryptocurrency company to receive Visa membership.” In essence, Coinbase has become the first crypto debit card service provider to earn the status of a principal member of Visa. Henceforth, Coinbase does not need to go through third-parties before it issues Visa-backed crypto debit cards. One of the perks of receiving a Visa membership is that it allows Coinbase to stand as an intermediary between Visa and other crypto firms looking to issue crypto debit cards based on Visa’s infrastructure.

In the statement released via its blog, Coinbase mentioned that the partnership will improve its crypto card services and expand its global reach. The document reads:

“From funding holidays abroad to trips on public transport, Coinbase Card customers are making their crypto work for them in everyday situations. Over half of customers who’ve signed up to Coinbase Card use it regularly, with its usage peaking in the UK, followed closely by Italy, Spain, and France. Following the success of Coinbase Card, we are proud to be the first company in the crypto ecosystem to be granted Visa principal membership. This membership will enable us to offer more features for Coinbase Card customers; from additional services to support in more markets — all elements that will help to evolve and enrich the cryptocurrency payment experience.”

Coinbase’s latest exploit has reiterated its prominence in the emerging crypto debit card market. However, it is impossible to appreciate the importance of this event without first discussing the state of the crypto payment sector.

A crypto card system is one of the viable ways of spending cryptocurrencies, as it offers similar payment features found on conventional bank cards. The only difference is that while conventional bank cards enable fiat transactions, crypto cards, on the other hand, provide instant crypto payment services. Thus, crypto holders, with the help of crypto debit cards, can make crypto payments in online or physical stores.

Nonetheless, there is one factor that makes the entire process possible and reliable. Every crypto debit card provider must integrate with one of the leading card infrastructures licensed to offer payment services to multiple regions. At the moment, the two card payment network processors that fit this description are Mastercard and Visa, as the majority of crypto card issuers have pitched their tent with either of them to capitalize on their sophisticated payment network and security.

While this is a given, not until recently have any of the active crypto debit card providers had direct dealings with Visa. Instead, these entities had to go through intermediaries, called Bin sponsors, licensed as principal members of Visa, before they can leverage the infrastructures of the card payment processor. As it is with every system involving middlemen, this business model comes with uncertainties that stifle the crypto debit card market. For one, Visa can decide to cut ties with a Bin sponsor, which will indirectly cripple the services of all the crypto card providers it oversees. Also, opting for an intermediary-based model will increase the amount paid to access the payment network.

We have seen this narrative play out in 2018 when Visa suddenly cut ties with WaveCrest, a Gibraltar-based bin sponsor. Visa stated that “noncompliance with operational rules” on the part of WaveCrest had forced it to take this action. Unfortunately, this event had a damning effect on prominent crypto card providers, which have adopted the bin sponsor as their access point to the Visa payment network. Crypto debit cards marketed to Europe-based crypto holders like Xapo, Wirex, Bitpay, Cryptopay, and Bitwala became redundant overnight.

Following these events, the crypto debit card industry hit a roadblock, as some card providers had to streamline the scope of their businesses to regions where they still had access to Visa’s payment infrastructure. Others were not as fortunate since they had to suspend operations altogether. Therefore, it comes as a bit of relief to discover that crypto card providers have begun to find a way around bin sponsors and facilitate a more reliable and less expensive way to offer their users Visa-enabled crypto payment services.

On the contrary, some crypto card providers have opted for a less volatile option, which is China-based financial service corporation, Unionpay. One of the COOs of the platforms using Unionpay as an alternative to a Mastercard/Visa-centric landscape noted that it is easier to avail payment services because all parties rely on a simple model. Crypterium’s Chief Operating Officer, Austin Kim, explained:

Crypterium’s Chief Operating Officer, Austin Kim

“Both Visa and Mastercard allow you to develop cards for particular regions like the United States, South America, Europe, etc. UnionPay, on the contrary, divides the world into two regions: China and the rest of the world. This model is aligned with our commitment to serve clients from every corner of the world.”

How Does Coinbase’s New Milestone Affect the Crypto Space as A Whole?

Apart from being an unprecedented feat, Coinbase’s status as a principal member of the network bodes well for the crypto space. First and foremost, this achievement elevates Coinbase to the position of a bin sponsor. Hence, emerging crypto debit card providers can partner with Coinbase to access Visa payment infrastructures, instead of relying on intermediaries with little or no knowledge whatsoever of crypto technology. Juan Villaverde of Weiss Ratings echoed this sentiment when speaking to Cointelegraph. He explained:

Juan Villaverde of Weiss Ratings

“Other crypto companies could potentially go to Coinbase to issue their own cards, rather than having to rely on more traditional financial companies. Typically, the latter are much more reluctant to deal with crypto companies. This would create new opportunities for many other assets.”

It remains to be seen if Coinbase will capitalize on this potential source of revenue, as reports allege that the crypto firm is showing no interest in operating as a bin sponsor “anytime soon.” Nevertheless, for every crypto debit card provider out there, there is nothing as satisfying as bypassing intermediate entities required to access payment networks. These services will rather become principal members themselves. Fortunately, Coinbase has provided a template to achieve this. Crypto debit card providers are now aware of the possibility of attaining Visa membership. I believe that a majority of them have already implemented plans to rid themselves of third-party entities.

Furthermore, Coinbase’s achievement is a strong indicator that the crypto space is heading in the right direction. If simpler and faster means of transacting crypto is the goal, what better way to establish this than to make crypto debit cards way more efficient. Debit cards are vital to the crypto mainstream adoption mantra because they offer a medium to use digital currencies to pay in conventional stores or websites.

One of the reasons why merchants and crypto holders are not too keen on adopting crypto cards is because it is expensive, which can be credited to the intermediate processes involved in executing a crypto card-enabled transaction. And now that Coinbase has successfully bypassed one of these intermediaries, it is safe to say that things are looking up for the crypto community. It is feasible that the reduction in transaction fees would trigger an influx of crypto debit card users in the long run.

Coinbase Implements Username-Enabled Crypto Transactions

Following the announcement of its Visa membership, Coinbase revealed days later that it has initiated new features on its wallet that allow users to send crypto to usernames instead of wallet addresses. This development conforms with the ongoing push for simpler crypto-enabled systems that will appeal to a mainstream audience.

While explaining the reasons for implementing this feature, Coinbase revealed that its users often encounter snags when sending crypto via wallet addresses. It argued that availing an easier mode of identifying crypto transaction recipients would eradicate the challenges associated with long and completely random wallet addresses.

The document reads:

“Human-readable addresses help fix these problems. There are now services that let you associate a short human-readable name with your crypto addresses. […] We believe these improvements will make cryptocurrency much easier to use and help drive adoption with a more mainstream audience.”

Crypto in mainstream TV

Crypto in mainstream TV

Talking of adoption and mainstream relevance, popular TV show, The Simpsons, put the spotlight on crypto in one of its latest episodes. The episode had Jim Parsons of Big Bang Theory explain the workings of cryptocurrency and blockchain technology. Later in the show, a message appeared on screen explaining the perceived intricacies of cryptocurrency and the conundrum arising from the unavailability of means of simplifying the concept. The message reads:

“Using the word “cryptocurrency” repeatedly while defining cryptocurrency makes it seem like we have a novice’s understanding of cryptocurrency. Well, that is a total pile of cryptocurrency. In this system, rules are defined for the creation of additional units of cryptocurrency. They can be generated by fiat like traditional currency or just thrown around randomly or all given to LeBron.”

Wikipedia Is Not Considering Crypto

In a separate report that betrayed the compatibility of crypto to mainstream systems, Jimmy wales, the co-founder of Wikipedia, revealed that it is unproductive to introduce cryptocurrency technology to the Wikipedia ecosystem. When asked if a crypto-enabled system could help Wikipedia reward the platform’s contributors, Wales emphasized that it was unproductive to do such.

Wales explained:

Jimmy wales, the co-founder of Wikipedia

“This is a really bad idea. It’s an idea that doesn’t actually work. If you take something that is a bad idea and put it on the blockchain, that doesn’t necessarily make it a good idea. Creating a mechanism where you effectively authenticate that type of behavior … isn’t going to help with the quality of Wikipedia at all. […] To say to them, you’re going to have to pay or put money at risk in order to edit Wikipedia is completely insane,”

However, he did mention that he is not opposed to receiving crypto as donations, as Wikipedia is a platform invested in disseminating knowledge, and it has accepted crypto donation since 2014.

The Bank of Canada Unimpressed with State-Backed Crypto

Another interesting report that could set the tone for crypto’s emergence in the global economy highlighted the reluctance of some central banks to join the race for a state-backed cryptocurrency. Timothy Lane, Deputy Governor of the Bank of Canada, mentioned in a recent speech that Canada is not interested in issuing a central bank digital currency any time soon.

Lane stated:

Timothy Lane, Deputy Governor of the Bank of Canada

“We have concluded that there is not a compelling case to issue a CBDC at this time. Canadians will continue to be well-served by the existing payment ecosystem, provided it is modernized and remains fit for purpose.”

This revelation comes as a surprise, as Canada was one of the few nations that had researched the concept heavily and even initiated and live-tested a similar project on Corda. Judging by Lane’s assertion, it is safe to say that regulators and the Bank of Canada were not impressed with the results.

Nonetheless, Lane added that Canada will have no other choice but to join the bandwagon if private cryptocurrencies threaten the efficacy of fiat currencies. It would appear that he is referring to crypto initiatives like Libra, which could replace fiat money. While discussing the reason why the Bank Of Canada considers the influx of these cryptocurrencies a threat, Lane explained that they are “a monopoly that would erode competition and privacy and pose an unacceptable challenge to Canadian monetary sovereignty.”

He added:

“It’s tough to predict if Libra will ever live up to its promises or even come into existence. But it is a good example of a transformative technology that affects how the bank needs to respond to the future of money,”