Are Centralized Exchanges Hurting the Efficacy of Crypto?

From the looks of things, the travails of crypto are one way or the other tied to the operations of crypto exchanges. This assertion holds, considering the array of controversies these entities attract, and its effects on the image of crypto as a viable asset class. For one, recent news relating to crypto exchanges highlights the growing number of sudden closures, high profile hacks, and troubling lawsuits. The apparent lack of standards in the crypto exchange market is one of the major causes of concern in the industry.

As such, it has become necessary to explore the workings of exchanges and how their frailties tend to stifle the establishment of crypto in the capital market.

What Exactly Are the Roles Crypto Exchanges, And Why Are They So Important?

Very much like the workings of their traditional counterpart, a crypto exchange’s primary role is to allow users to trade assets. However, in the case of crypto exchanges, they only facilitate trades between two crypto assets, or between digital assets and fiat currencies. Over the years, we have witnessed how these entities have taken up more functionalities in the space. The growing influence of crypto exchanges has seen them explore the crypto futures market and introduce a new breed of crowdfunding mechanisms – the initial exchange offering (IEO). On the other hand, the explosion of centralization in this market is causing individuals who lean towards a purist notion of crypto to panic.

This set of crypto enthusiasts value the decentralization concept that crypto promotes. They hate to see centralized firms at the pinnacle of the market, with little or no place left for the autonomy that crypto avails. If you will recall, this issue had sparked tension between crypto exchanges and tokens developers. While a Vitalik Buterin outburst last year gave the community a fresh outlook into this issue, yet, little has changed as regards to the established pecking order in the crypto space. Why then has centralized crypto exchange continue to flourish, regardless of the explosion of scandals that taint its efficacy?

Crypto exchanges act as the middlemen between traders and the crypto market. As such, they are the de facto gateway through which individuals can access crypto. In light of this, they will continue to play vital roles in the development of cryptocurrency. Apart from creating an avenue for the average crypto enthusiast to access digital assets, these entities – to an extent – have a say in the success or failure of a token. This assertion holds since startups have to ensure that their tokens trade on exchanges to give their project a fighting chance at survival.

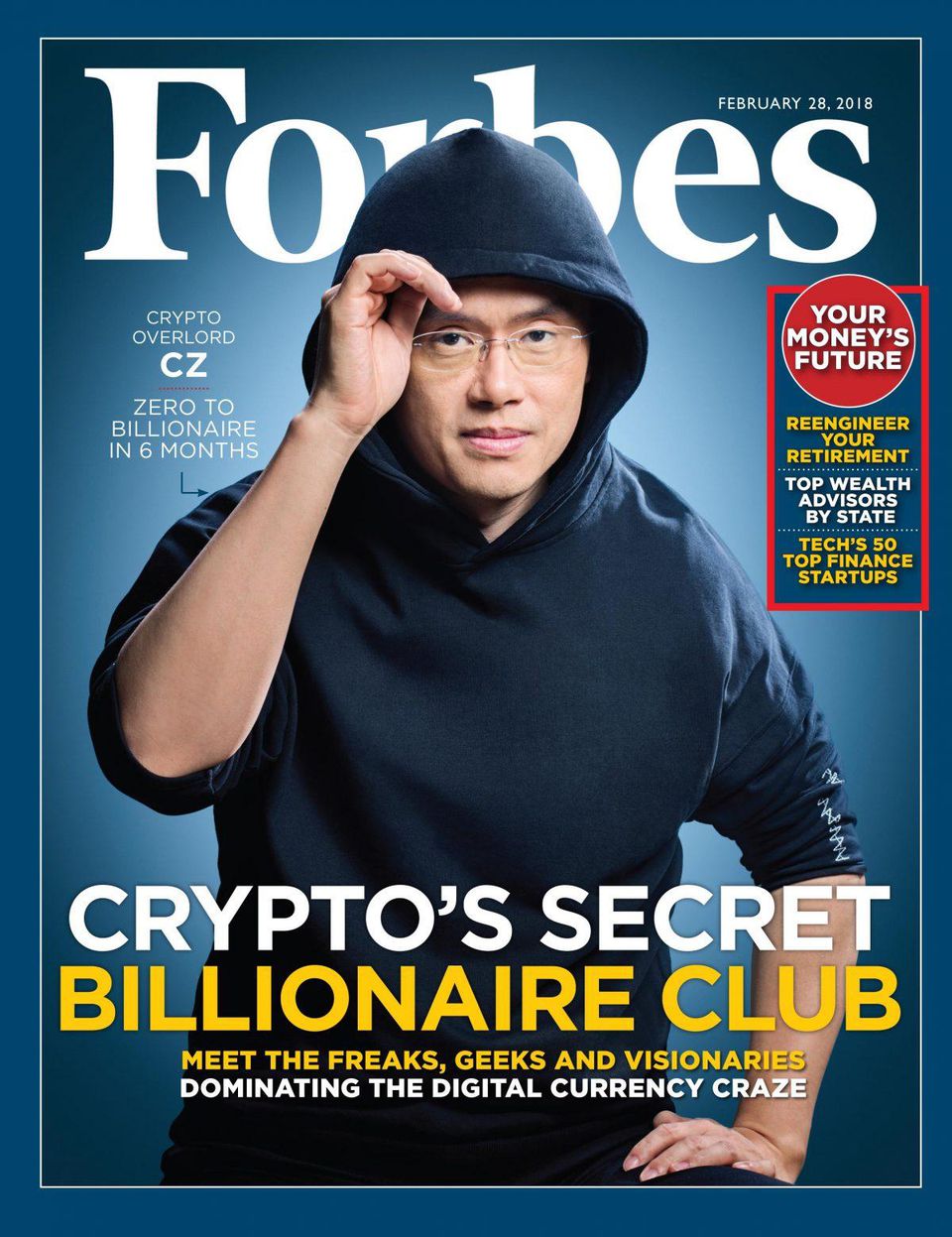

To this end, there have been allegations and counter-allegations relating to the exorbitant fees charged for listing coins, particularly on popular crypto exchanges. On October 28, Cointelegraph revealed how Blockstack paid Binance $250,000 to list its STX coin. Although both parties have since explained that the payment was a voluntary long-term payment, which will ensure that STX remains listed on Binance in the future, still the whole deal connotes the disparity between startups with unlimited resources and those that can barely afford the premium services on exchanges.

According to Blockstack’s CEO,

“This long-term payment is meant to watch out for the Blockstack ecosystem by incentivizing Binance to list Stacks over many years and aligns well with our long-term focus. The marketing fee is a joint marketing campaign that we plan to run later on, again that is not a ‘listing fee’ but a marketing campaign that we plan to launch in the near future.”

Truth be told, it is still unclear why an exchange – whose CEO had previously stated would never consider money as a criterion for listing tokens – will backtrack and accept payment from a startup to guarantee long-term listing benefits. This action betrays “the money is not relevant” image that Binance is trying to project. There are reasons to believe that the same technicalities apply to exchanges that claim to charge zero listing fees. One of such platforms is OKex, as its head of operations, Andy Cheung, allegedly wrote that:

“We don’t have a standard listing fee. Some 3rd party cost could incur such as compliance, legal and due diligence of the project when it comes to listing, depending on the complexity of the token structure and design.”

If this is the case, then controversies relating to listing fees will not end anytime soon, as long as exchanges choose not to make the conditions for enlisting tokens public.

Away from fees, it has become rampant for crypto exchanges to fall victim of one form of attack or the other. As mentioned earlier, centralized crypto exchanges are middlemen. Therefore, whosoever chooses to utilize their platforms must hand over his or her assets to them before executing trades. Hence, crypto exchanges are also a form of custodial solutions, as they are charged with the responsibility of safekeeping the assets users leave in their care.

However, considering the alarming rate of crypto hacks and thefts, it is clear that the majority of these exchanges are not doing enough to ensure the safety of their wallets. More pressing is the increase in cases where crypto exchanges blame the inaccessibility of users’ crypto assets on the loss of private keys. A first of such a case was reported earlier this year when it was revealed that the passwords to QuadrigaCX’s wallet were lost, following the death of the crypto exchange’s CEO.

Interestingly, similar news has emerged with a bit of a twist. On November 1, a local newspaper stated that the founder and CEO of Zimbabwe-based crypto exchange, Golix, had lost the password of the exchange’s cold wallet containing bitcoin that worth over $300,000. This report raises some serious questions, as regulators in Zimbabwe had ordered the shutdown of the crypto exchange due to incompliance with regulatory standards. Note that regulators had given this order way before news of the lost password broke. Hence, one could assume that there is more to this story, especially now that exit scams are becoming prevalent in the space.

In another news, Canadian regulator – the British Columbia Securities Commission BCSC – has taken control of Einstein Exchanges. This development came after multiple complaints claimed that it had barred users from accessing their assets. According to the report, the legal travails of the crypto exchange, its $12 million debt, and its plan to shut down spurred the watchdog to take swift action.

It also does not help that the actions of unregulated crypto exchanges play a major role in the US Securities and Exchange Commission’s reluctance to approve a crypto ETF. Note that the SEC has highlighted price manipulations, which some unregulated exchanges practice, as one of the reasons why it has not changed its stance.

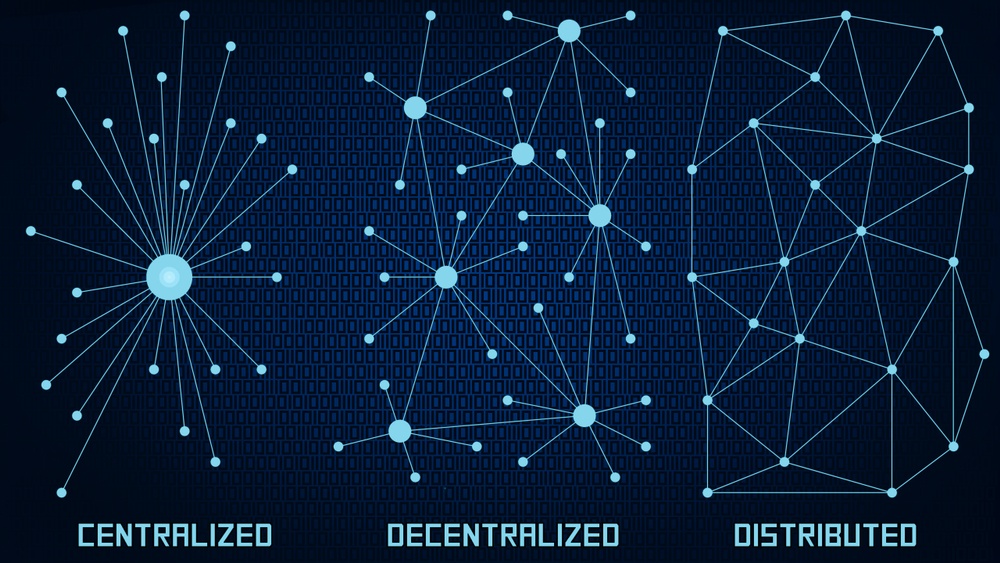

Having examined the drawbacks of centralized crypto exchanges, there are enough reasons why users and startups should look for alternatives. The apparent alternatives are decentralized exchanges DEX. Unlike the centralized ones, DEX gives users a level of autonomy over their activities, as there is no need to transfer assets into the exchange’s wallet before executing trades. Instead, decentralized exchanges rely on smart contracts that automatically credit or debit users’ wallets, whenever they agree to a trade. In other words, a decentralized exchange is a P2P network that gives users full autonomy over their assets and permits direct transactions.

Also, the issue of listing fees is absent in a DEX since the platform eliminates all middleman factor. Likewise, security and anonymity are other benefits of using these solutions as KYC does not apply to a typical decentralized exchange. That said, one will expect that the above-mentioned benefits would have sparked the emergence of decentralized exchanges to the top of the market. However, this is not the case. Instead, centralized ones continue to dominate.

Why Is This the Case?

Decentralized exchanges have struggled to record the same level of liquidity that the centralized exchanges command. According to experts, centralized exchanges have had enough time to win the trust of crypto holders. They also have an edge over DEX when it comes to speed and user experience. To make matters worse, alterations in the attributes of decentralization, as influenced by the influx of hybrid decentralized exchanges, have put a dent on the prospect of trustless networks in the crypto exchange market.

In its true sense, a fully decentralized exchange should bypass any form of central authority. From the workings of the new breeds of DEX popping up in the space, it is clear that this requirement is becoming obsolete. For instance, the structure of Binance DEX suggests that Changpeng Zhao still has significant input in the governance of the exchange. The same is true for Huobi, which has capitalized on its influence to launch a decentralized marketplace.

Hence, KYC and AML still feature in many of these platforms, and the main aim of the governing team is to make profits. This has led some experts to refer to these exchanges as non-custodial exchanges, as their capacity to offer direct trades is the unique feature, setting them apart from centralized platforms.

Since we are more or less stuck with having centralized entities dominate the crypto market, are there ways to mitigate the shortcomings of an overly centralized market?

Global Standards Will Change the Terrain

The lack of standards in the crypto space has always been a limiting factor for cryptocurrency. Experts have blamed the recurrence of security scandals in the industry on the unavailability of global standards that would govern the operations of crypto exchanges. For a while, anyone with the right resources could startup an exchange. It wasn’t until the proliferation of regulations that we began to see a more structured market emerge.

As such, some of the global regulatory standards becoming the norm is the requirement that crypto exchanges must introduce KYC and AML procedures for their users. Although this has helped users identify the legal standing of exchanges, yet, there is a lingering notion that regulators must enforce more standards to establish their credibility.

Owing to the importance of tailored regulatory frameworks, regulators around the world have shown a spirited response to the threats unregulated exchanges pose. And they have begun to implement regulations, which will guide the operations of such platforms within their jurisdiction. This is evident in the number of crypto exchange-related reforms enacted around the globe, with Hong Kong’s regulatory framework coming in as the latest.

While it is common for exchanges to complain about the stiff requirements imposed on them, they must, however, realize that they are the first point of access for new entrants in the crypto space. Therefore, they must do everything within their capacity to protect the interest of their customers. Judging by the increase of legal actions taken against defaulting exchanges, these entities are seemingly doing more to stay within the confines of the law.

Take, for instance, the decision of certain exchanges to stop rendering services to US traders. This development stems from the fact that exchanges are coming to terms with the consequences of allowing users – regardless of the crypto regulations of their home country – to access their infrastructures indiscriminately.

As for the clamor from some quarters that middlemen should have no place in the crypto market, it is crucial to note that there was no way the crypto industry would have experienced this much development – in so little time – without the help of centralized crypto exchanges. These platforms maintain a familiar structure to those existing in traditional markets. Hence, new entrants do not have to start from scratch, in their quest to adopt crypto.

Nonetheless, there is a place for decentralization in this conversation, as it further establishes the essence of cryptocurrency. If crypto and blockchain technologies – with all of their disruptive capacity – finds it difficult to make an impact in one of its primary sectors, then its viability in less receptive industries is uncertain. Therefore, the onus falls on stakeholders to ensure that decentralization – at its purest form – strives in the crypto exchange market.