All You Need To Know About Cardano And Its Upcoming Upgrade

Those familiar with the crypto industry will agree that Cardano is one of the most promising and ambitious digital asset projects presently under development. For one, Cardano always features prominently in the list of blockchain projects that are innovative and robust enough to challenge the dominance of Ethereum in the smart contract and decentralized application market. Also, its native token, ADA, is one of the top five digital assets by market capitalization.

And so, it has become necessary to unravel the factors propelling the growth of both the Cardano ecosystem and its native crypto economy. Here, I will discuss everything you need to know about Cardano, including its upcoming upgrade.

What is Cardano?

Cardano describes itself as a third-generation blockchain that expands on the functionalities available on legacy blockchains like Bitcoin and Ethereum. The goal is to solve some of the persisting issues of blockchain technology, particularly scalability and interoperability. And so, it has opted for a unique blockchain infrastructure that allows more room for development and functionalities.

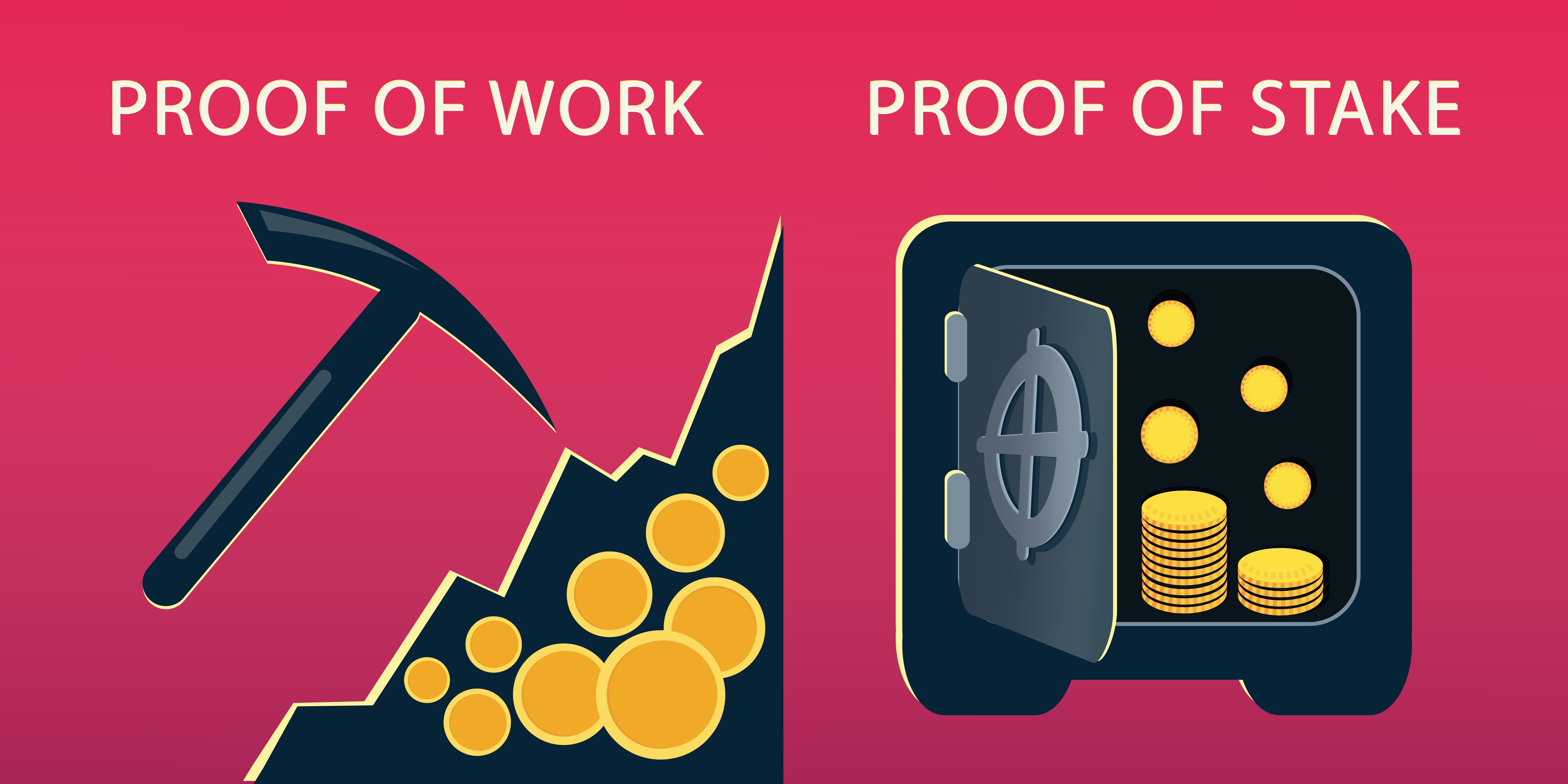

It is worth mentioning that Cardano is the first blockchain to rely on a proof-of-stake (PoS) consensus system for validating transactions. According to the team, PoS was chosen because of the added flexibility it offers. On the contrary, Proof-of-Work is considered environmentally unfriendly and somewhat limited when it comes to network throughput.

Another unique thing about Cardano is that the entire project relies on a peer-reviewed and academic approach to development. In other words, the team comprises blockchain experts who would preferably take the long route of carefully researching and academically developing Cardano. While it is commendable, the academic approach of the Cardano team has often been highlighted by critics as an inefficient strategy. More specifically, many believe that the peer-review system that the Cardano team operates has contributed to some of the development delays experienced since the project was first introduced in 2015.

Notably, the entirety of the project is open source. Likewise, the ecosystem will eventually be governed by users. In essence, Cardano is a public and decentralized blockchain. All in all, Cardano hopes to deliver an intermediate-free peer-to-peer network where users can access sustainable and inclusive blockchain solutions.

Who founded Cardano?

Charles Hoskinson, one of the co-founders of Ethereum, founded Cardano in 2015 after he left the Ethereum team. He has since focused on developing an advanced smart contract blockchain that is free from some of the limitations associated with Ethereum. Hence, you can see why Cardano is one of the blockchains marketed as the “Ethereum Killer.” Notably, Cardano is not a fork of Ethereum. Instead, Hoskinson opted to build the blockchain from scratch.

Today, Hoskinson is the lead developer in the Cardano ecosystem and is understandably the face of the project. In 2017, Cardano was officially launched, and its native cryptocurrency, ADA, debuted via an initial coin offering (ICO) fundraising campaign.

Why was the project named Cardano?

Cardano was named after Gerolamo Cardano, who was an Italian polymath and mathematician. On the other hand, ADA’s name was inspired by Ada King, a British mathematician and the Countess of Lovelace. Ada is widely recognized as the pioneer in computer programming. She discovered how mathematics could expand the potential of computers and then went ahead to publish the first computer algorithm in 1843. Fittingly, the smallest unit of ADA — that is 0.000001 ADA — was also named Lovelace. As you would notice later in this guide, the Cardano team has a thing for naming key components of the project after individuals that had contributed to the development of various fields.

What are the organizations behind Cardano?

Most Blockchain projects are actively developed and maintained by a single team. However, in the case of Cardano, the project is being manned by three organizations with unique responsibilities. These organizations include Cardano Foundation, IOHK, and Emurgo.

Cardano Foundation

Cardano Foundation is based in Switzerland, and it aims to “standardize, protect and promote” the technology and protocol powering the Cardano ecosystem. It is in charge of outsourcing the development of marketing of the Cardano project.

IOHK

Input-Output Hong Kong is a for-profit organization that is actively developing the Cardano blockchain. Interestingly, this company is headed by Charles Hoskinson. IOHK claims to create financially inclusive technologies.

Emurgo

Emurgo is the sister company of IOHK, and it supports startups, developers, and entrepreneurs in building solutions that align with the ethos of blockchain technology.

Cardano’s smart contract functionality

Perhaps, the most exciting thing about Cardano is the fact that it supports smart contracts. In essence, the blockchain will eventually provide all the smart contract supports that Ethereum currently delivers. As such, I expect a non-fungible token (NFT) economy and a decentralized finance (DeFi) market to launch on Cardano sometime in the future. What makes Cardano’s smart contract blockchain unique is its layered architecture that provides added flexibility and throughput.

Cardano’s blockchain architecture

As mentioned earlier, Cardano features a layered architecture that separates that transactional infrastructure from the smart contract system for more speed and functionalities. In contrast, most blockchains rely on a single-layered system, which often results in network congestion, slow transaction speed, and high fees. Below I have explained the two-layer design of Cardano.

Cardano Settlement Layer (CSL)

As its name implies, CSL is the settlement system of Cardano. In other words, this is the layer where peer-to-peer transactions are executed. With this, Cardano allows users to transfer the ownership of tokens.

Cardano Computing Layer (CCL)

The second layer of the Cardano blockchain governs smart contract deployment and operations. Also, CCL is critical to the security of the entire network, and it offers an adaptive regulatory system that is compatible with various jurisdictions. Judging by the massive impact of this layer, it is safe to say that CSL is the heart of the Cardano blockchain.

How fast is Cardano?

Although Cardano is yet to launch its scaling solution, its blockchain performance is still somewhat impressive compared to what we have come to expect from Bitcoin and Ethereum. In the first test carried out in 2017, Cardano processed 257 transactions in one second. To put this in perspective, Bitcoin can only process 5 transactions per second, while Ethereum can only go as high as 20 transactions per second. In light of this, it is safe to say that Cardano is much more efficient when it comes to speed, especially when compared to first and second-generation blockchains. However, it is worth mentioning that the transaction processing capability of Cardano will increase exponentially once its scaling solution comes online.

How are blocks produced on Cardano?

Like other blockchains, Cardano has a network of block producers and validators who are responsible for verifying and adding new transactions to the blockchain. Since the blockchain uses the proof-of-stake consensus protocol, the transaction validation process relies on the proactiveness of validator nodes — which are indirectly network participants that have staked ADA on the blockchain as a show of financial commitment to the wellbeing of Cardano.

More specifically, Cardano uses Ouroboros Protocol, which is one of the iterations of PoS. Ouroboros Protocol enables a cycle for block creation. This starts by dividing physical time into what we call epochs, which are divided further into slots. Think of slots as working shifts at a manufacturing plant. At the time of writing, an epoch lasts for five days, while a slot lasts for a second. Both are cyclical — that is, once an epoch or slot expires, another starts immediately.

For each slot, the protocol randomly picks a slot leader via a lottery system. Nodes with the highest staked ADA have a higher chance of emerging as slot leaders. The responsibility of a lot leader include:

- Transaction validation

- Block creation

- Adding the created blocks to the blockchain

Interestingly, Cardano allows small ADA stakers to join or delegate their stakes to a staking pool. This design allows more network participants to partake in the staking and validation process even when they cannot compete financially with large staking nodes.

Proof of Stake Vs. Proof of work

Proof of Stake Vs. Proof of work

It is common knowledge that Ethereum 1.0 and Bitcoin are PoW-based blockchains that require the users to solve computer-intensive mathematical problems. While this approach is recognized as a highly secure and decentralized consensus methodology, it is environmentally unfriendly and slow. In most cases, individuals or companies need to invest a significant sum in electricity and special mining rigs in order to play vital roles in the validation process and get rewarded for their efforts.

To mitigate these limitations, new generation blockchains are increasingly developing and adopting alternative blockchain consensus protocols that will enable a more inclusive ecosystem, where anyone can become validators without having to use sophisticated hardware or pay exorbitant utility bills.

A prime example of such a flexible consensus mechanism is Proof of stake. Unlike PoW, PoS focuses on creating a flexible ecosystem where users can simply stake the blockchain’s native digital assets to show their intent to become validators. It is from this pool of stakers that the protocol picks validators. Note that the method used by the PoS protocol depends on the set rules written into its code.

From all indications, the possibility of an energy-efficient consensus methodology had informed Cardano’s decision to opt for PoS. Notably, a similar design is being incorporated in the Ethereum ecosystem for ETH 2.0. Arthur Breitman, one of the architects of Tezos, explained this aptly during an interview with Cointelegraph:

“Proof-of-stake has gone from a fringe idea in cryptocurrency circles, to completely mainstream with the launch of Tezos in 2018, and with large institutions like Coinbase participating in staking. In the meantime, consensus attacks on smaller proof-of-work chains and the high amount of inflation associated with new proof-of-work chains have made it clear that proof-of-work is no longer viable for launching cryptocurrencies.”

Another core factor propelling the adoption of PoS is its compatibility with sharding — a scaling mechanism for sharing transaction loads across multiple parallel chains. Unlike PoW, staking-powered consensus mechanisms offer the level of flexibility needed to validate transactions simultaneously on interoperable sidechains.

Decentralized applications (Dapps)

Dapps are applications that run on public and decentralized blockchains. More specifically, they capitalize on smart contract functionalities for delivering autonomous and automated solutions. Note that smart contracts are basically self-executing programs. Smart contracts allow users to execute activities or perform tasks as long as they meet the terms and conditions governing their operations. In other words, dapps predominantly thrives on smart contract-enabled blockchains.

Considering that Cardano is expected to launch smart contract support on September 12, it is safe to say that we will begin to see more blockchain applications run on this network in the coming months. If all goes as planned, Cardano would increasingly appeal to blockchain developers. In time, it may become the ideal hub for NFTs and DeFi applications, depending on the outcome of the ongoing Ethereum 2.0 rollout.

Cardano’s development roadmap

As mentioned earlier, Cardano has opted for a peer-reviewed approach to development. Therefore, it is no surprise that the blockchain is still undergoing core upgrades four years after it launched. Some critics argue that the slow rollout of updates is a dealbreaker. In contrast, proponents believe that it helps the development team deliver concrete infrastructures that are insusceptible to errors and bugs.

When discussing the track record of Cardano’s development team, it is imperative to highlight the different stages of upgrades initially introduced to steer the team’s operation. These stages were uniquely named after individuals that have excelled in various fields. Below I have highlighted each phase and discussed improvements they bring to the Cardano network:

Byron Era

This era was named after Lord Byron, a famous poet and the father of Ada Lovelace. It officially kicked off in 2017 when Cardano launched. In this era, it became possible to transfer ADA tokens via a federated network. The core objective was to build a sound foundation for the Cardano network.

Thus, part of the upgrades executed during this era involved the creation and implementation of native wallet infrastructures for ADA. These wallets include IOHK’s Daedalus desktop wallet and the lightweight version Emurgo built, called Yoroi wallet. There were also campaigns to have Cardano listed on major exchanges. This era came to an end in 2020, and the Shelley era officially began.

Shelley Era

This phase was named after Mary Shelley, the author of Frankenstein, to illustrate the network’s goal to become autonomous. The Shelley Era began in 2020. Throughout this period, the development focused on implementing features and upgrades that would help Cardano transition from a federated network to a decentralized ecosystem. Hence, decentralization was the main focus in the Shelley era.

To achieve this, the developers activated staking such that users can proactively participate in the validation process of the network. The success of this era would go on to determine the network’s insusceptibility to attacks. Since validation duties have been distributed across several validator nodes, the network was able to eliminate a central point of attack. To successfully attack Cardano, the attacker must control a large share of funds staked on the blockchain. Fortunately, the Cardano staking nodes are well distributed. Hence, chances that a single entity would own over 50% of the staked funds are significantly low.

Goguen Era

The Goguen era, which was named after Joseph Goguen, a U.S. computer scientist, would mark the launch of smart contract support on the Cardano blockchain. This is perhaps the most anticipated development phase because it unlocks extra blockchain functionalities critical for running and engaging with smart contracts. As discussed earlier, once smart contract features go live on Cardano, it will automatically unlock the opportunity to develop and operate dapps on the network. In turn, we will begin to see a steady rise in the number of NFT and DeFi platforms available to Cardano users.

One of the series of updates planned for this era would see the launch of Plutus, the platform that provides all the tools and resources necessary for creating smart contracts on Cardano. This platform supports smart contracts written in the Haskell programming language. Then there is Marlowe Playground, a purpose-built platform where non-technical users can write financial smart contracts via Marlowe, a domain-specific language. The goal is to design the Cardano smart contract layer in such a way that users do not have to hone programming skills to create and launch smart contracts. Also, the Cardano will become a multi-asset blockchain. In other words, it will support the minting of tokens, much like how Ethereum houses thousands of digital assets.

Basho Era

Once the Goguen mainnet goes live, the next series of updates and testing will usher in the Basho Era. This era got its name from the famous Japanese poet and haiku master, Matsuo Bashõ. During this era, the core objective is to optimize the scalability and interoperability of the Cardano blockchain. Here, the developers will introduce side chains to share transaction loads and increase the network’s speed. Importantly, these side chains would be interoperable with the primary chain so that the activities executed on each will eventually be logged on the mainnet.

Once these updates are successfully implemented, Cardano’s transaction speed will improve exponentially. Thereby, the success of the Basho Era could potentially spur mainstream adoption of Cardano since its network would be flexible and resilient enough to meet the requirements of offering blockchain solutions to a global market.

Voltaire Era

At the latter stage of development, the Cardano team will look to transfer the governance of the network to participants. When this happens, there would be no need for Cardano foundation, nor would IOHK have the final say on future developments. Instead, the platform will rely on a voting governance system that will allow the average ADA holder to have a say over the implementation of critical and minor updates.

Which of these eras is the current Cardano mainnet?

Recall that the Shelley mainnet launched in 2020. And ever since it launched, the development team has been putting plans in place to move to the next era, named Goguen. Part of these plans involves stress testing upgrades on the testnet before making them available to the public.

Currently, we are in that testing phase as the Cardano testament has been hard forked no less than three times to see how the smart contract features will respond, albeit in a controlled environment. This testing phase has been named after Alonzo Church, a mathematician credited for discovering lambda calculus, which is considered the building block for the Haskell programming language.

The Alonzo testnet focuses on deploying the Plutus platform and enabling features that would optimize Cardano’s smart contracts. This testnet has been divided into three phases:

Alonzo Blue: Launched in Mar 2021, Alonzo Blue introduced the Plutus platform and allowed a handful of network participants, specifically staking pool operators and network pioneers, to test the implementations.

Alonzo White: In mid-July, the team upgraded the testnet to onboard an NFT minting infrastructure and expanded the number of participants allowed to test the upgrades. During Alonzo White, a total of 500 participants, including developers, validators, and stake pool operators could contribute to the testing process.

Alonzo Purple: The last testing phase introduces an ERC20 converter that will make Cardano more or less compatible with ERC20 tokens. Also, it is the first time the entire Cardano community can test smart contract implementations on the testnet. The outcome of these tests will determine the readiness of the Cardano blockchain to launch the Goguen mainnet. If all goes as planned, expect the Cardano blockchain to support smart contracts, starting from September 12, 2021.

What are experts saying about this development?

On August 13, 2021, Nigel Hemsley, the head of delivery and projects at IOHK, revealed that the official launch date for the Alonzo mainnet hard fork is September 12, 2021. He stated:

“Once we hard fork the testnet it gives us this period of stability where we can test it and so can exchanges… We will submit a proposal for a mainnet hard fork and also patch you with our Plutus application backend so we can have a complete smart contract release ready for people to use, ready for the Alonzo hard fork on Monday, September 12.”

However, knowing fully well that the IOHK had a knack for pushing planned updates forward, some crypto proponents were not particularly convinced of the readiness of the team to initiate this vital upgrade at this said date. As for Ben Armstrong, a YouTuber and the creator of BitBoyCrypto, the only reason why IOHK may push its launch date forward is to ensure that everything goes as planned. He stated that the academic approach of IOHK to Cardano’s development might determine its decision in the coming weeks:

“The Cardano team hasn’t backed away from their smart contract launch period starting in September. Considering how well the Alonzo White hard fork has gone, I don’t expect any further delays. That said, Cardano’s methodical approach means they’ll push a deadline before the possibility of taking a step back on a bad launch.”

While referencing Hoskinson’s claim that some of his engineers were poached, Armstrong added that the demand for blockchain engineers might have caused some of the delays in the Cardano development:

“When ICP hit Coinbase this year, Charles was open about how DFinity poached several of his top engineers. I imagine that has caused some delays in Cardano-specific development across the industry.”

Armstrong also spoke on the level of growth that awaits Cardano following the implementation of smart contracts. He said:

“It’s a chicken and egg situation. You need smart contracts to really get DApp development going, but you also need killer DApps to draw more development to the space. There are a lot of DApps that are on Ethereum and waiting in the wings for Cardano.”

Duc Luu, the executive chairman of Spores Network, an NFT and DeFi marketplace on Cardano, said that the potential launch of smart contract support on Cardano could improve its appeal to institutional investors:

“Cardano promises the possibility of greener blockchain footprint, lower gas fees and higher throughput which we believe makes it a prominent venue for NFTs, as well as DeFi mainstream adoption, which are the two areas that institutional investors are very much interested in.”

Notably, Cardano has dominated the crypto staking economy due to the flexibility of the staking requirements of the blockchain and the possibility of contributing to the network’s governance. While speaking on this topic, Armstrong said:

“They are hodling onto their stack of ADA, not just to use it for gains down the road but also to have a say in the eventual governance coming in Voltaire. Even with the current state of smart contracts, there are already NFTs you can buy and games to play. But once ADA asserts itself in smart contracts, you’re going to see that staking figure drop significantly.”

Another major talking point centers around the necessity of the ERC-20 converter highlighted earlier. The inclusion of this feature suggests that Cardano hopes to attract some of Ethereum’s users and developers. The ecosystem boasts a more scalable network. Hence, congestions are not frequent occurrences on the Cardano network, and the transaction fees are somewhat affordable. Francisco Landino, project manager at IOHK, spoke on Cardano’s chances of cornering some of the Ethereum market shares. He noted:

“Once deployed, users of supported Ethereum tokens will be able to bring them over from Ethereum’s congested network and take advantage of Cardano’s transaction capacity and lower fees, while enjoying enhanced security, reduced cost, and interoperability.”

Staking on Cardano

As mentioned earlier, Cardano is a staking-powered blockchain. Hence, you can stake ADA on the blockchain and join the budding staking economy. On the one hand, Cardano’s primary motive for enabling a staking economy is to ensure that the blockchain remains decentralized and secure. On the other hand, stakers are majorly motivated by the incentives that such opportunities provide.

As such, Cardano had to make staking appealing by distributing rewards to users that have decided to stake their funds and participate in the transaction validation process of the network. The higher the number of nodes that actively participate in this process, the more secure Cardano becomes.

Another reason ADA staking is in high demand is that it comes with a level of flexibility that is absent in most competing staking-enabled blockchains. Rather than impose lock periods on stakers, Cardano lets users withdraw their staked funds at any point in time. Also, the staked funds remain in users’ wallets.

This is unlike what we have in the Ethereum 2.0 ecosystem, where users have to lock their funds in the staking pool until the final stage of the upgrade is implemented in 2022. Thanks to the autonomy that Cardano offers stakers, they can rest assured that some of the risks associated with other blockchains do not apply to them.

Bakyt Azimkanov, director of global PR and communications at the Cardano Foundation, explained the advantages that Cardano has over competitors in an interview with Cointelegraph:

“Users simply have to deposit ADA into a wallet that supports delegation and choose a stake pool to delegate to. The process is then hands-off until the user wishes to withdraw or change pools. Users retain their staked ADA in their wallets at all times, so it’s an incredibly safe way to generate delegation rewards without heavy user interaction or risking loss of funds.”

How does staking work on Cardano?

As already mentioned, stakers are randomly picked to take up the role of validators for the opportunity of receiving rewards. You could operate a node or delegate your stake to other stakers. All this can be done through the Yoroi and Daedalus wallets. In essence, you may have to take up the technical requirements of staking.

Alternatively, you could delegate your ADA tokens to a stake pool and have an operator take up the technical aspect of staking and validation on your behalf. In return, you will receive a reward proportionate to your share of the funds delegated to the stake pool. With this system, you can earn passive income by delegating your idle ADA tokens to a staking pool. You can find a step-by-step guide on how to stake or delegate your ADA here.

What are the staking rewards on Cardano?

According to data from StakingRewards, if you set up a staking node and decide to do the whole thing yourself, you might earn a 6.59% interest on your staked funds. Alternatively, you could delegate your coin to a stake pool and generate a 6.32% return. Remember that when you delegate your coin, you can withdraw your token whenever you want. Also, popular exchanges offer special ADA staking services. In such cases, you may have to deposit your funds into the exchange’s wallet to start earning interest. As you must know, depositing your coins on exchanges comes with its own sets of risks. Therefore, while this may seem like an easy option, it is not as risk-free as a self-staking approach.

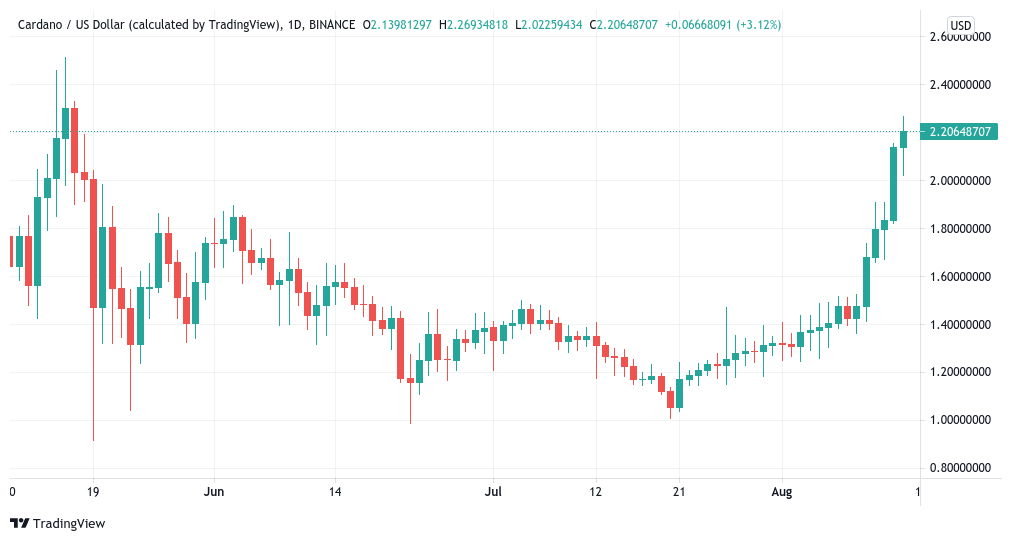

The price-performance of ADA

ADA/USD 1-day candle chart (Binance). Source: TradingView

ADA has consistently featured among the top 10 cryptocurrencies by market cap. At the time of writing, it was selling for $2.10, which is over 1,400% higher than its valuation a year ago. With a market cap of $60 billion, the token seems to be on track to break the $2.46 price record it set back in May 2021.

Notably, the impressive price performance of ADA is strongly tied to the buzz surrounding the launch of smart contracts on the Cardano blockchain. The success of the launch would determine whether Cardano will experience an increase in the adoption rate. Therefore, the chances that ADA would continue on this run, at least in the short term, is high. If the September 12 date holds, there are reasons to believe that the hype would reflect in the price performance of the digital asset since more users will start utilizing it on decentralized applications.

Amy Arnott, a portfolio strategist at Morningstar, agreed with this logic and added that Cardano could potentially join bitcoin and ether and become a top three cryptocurrency. She explained:

“Cardano is similar to ethereum in that it’s a protocol that has a lot of potential technical applications. There’s a lot of enthusiasm about cardano, and also various stablecoins.”

Another positive sign that Cardano has a strong following is that, up until now, the core application of ADA is staking. And yet, it has retained its position on the top tier of the crypto market. Marie Tatibouet, chief marketing officer of Gate.io, highlighted this point while discussing the anticipated Alonzo upgrade slated for September:

“As of now, the two main functions of the ADA tokens are staking and governance. In that regard, it is a very good sign that so many holders have faith in the network and have staked their tokens in the ecosystem.”

However, there is no guarantee that the launch of smart contracts on Cardano would have an immediate impact on its price. Much like most things in the crypto industry, nothing is set in stone.

Conclusion

Cardano has all it takes to become the go-to blockchain for developers and dapp users. The planned launch of smart contracts on the ecosystem presents ample opportunity to eliminate the doubts that have trailed its every step since it launched in 2017.