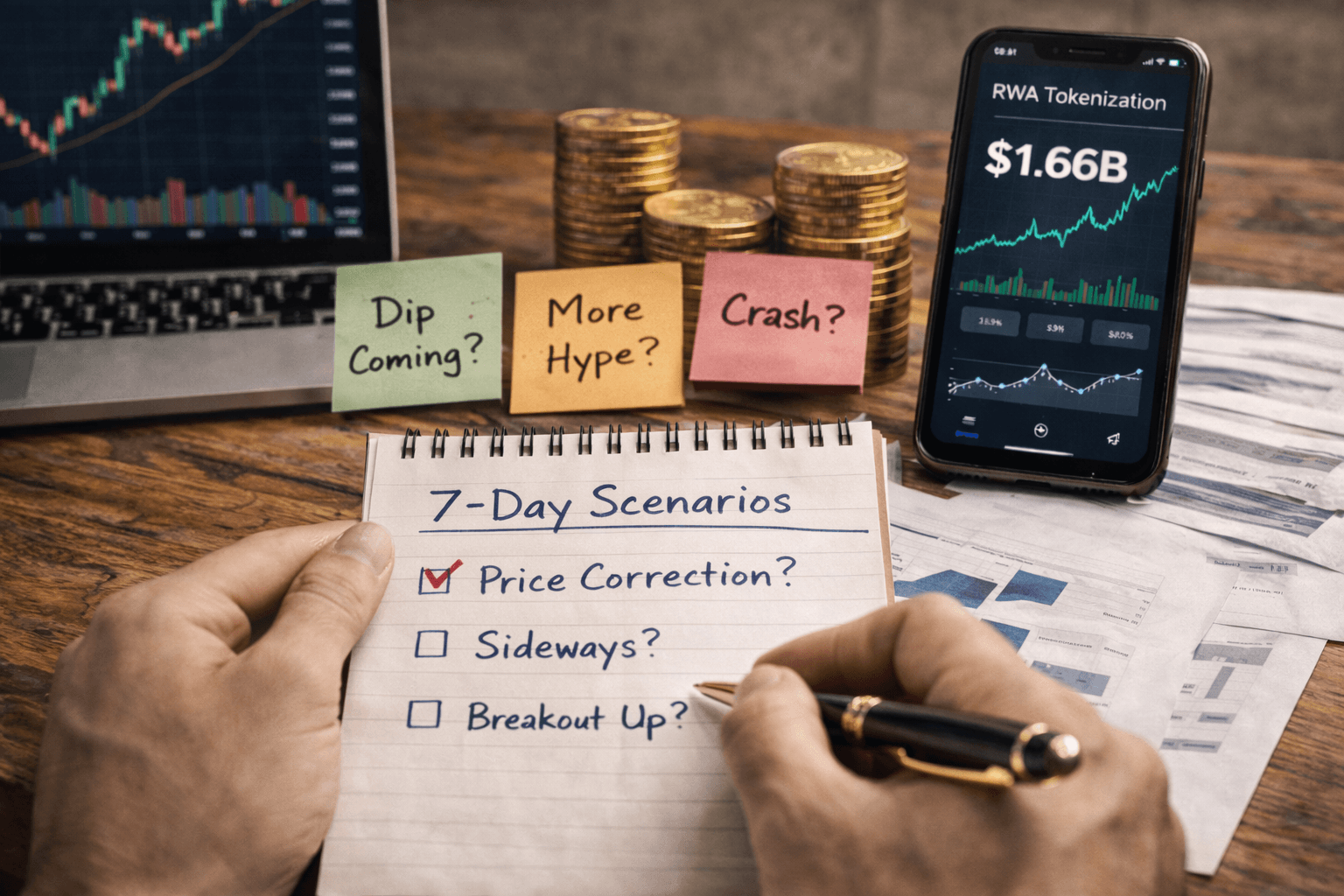

Solana RWAs Just Hit a $1.66B All‑Time High — What It Means for Tokenization in the Next 7 Days

Is Solana quietly becoming the place where “real-world stuff” actually lives onchain… or are we just watching another weekend headline that fades by Friday?

Solana RWAs just printed a reported $1.66B all-time high, and I’m not treating that like an automatic green light—I’m treating it like a stress test. These “ATH” moments are where people get hurt: the number goes up, the narrative gets loud, and most traders are left guessing what’s actually inside the figure, where the new value came from, and whether you could exit without getting wrecked by thin liquidity, weird redemption rules, or a “backing” story that sounds solid until you read the fine print. Over the next 7 days, I’m watching for the telltale signs that separate real tokenization growth from dashboard optics—issuer concentration, net inflows vs reclassification, liquidity depth, redemption friction, and whether the onchain activity matches the headline—so you can move based on signals, not vibes.

Listen to this article:

Solana’s RWA narrative snapped back into focus after the ecosystem reportedly pushed to $1.66B in tokenized value (an all-time high). If you’ve been around crypto long enough, you already know what happens next: timelines fill up with victory laps, people FOMO into the loudest ticker, and a week later everyone argues whether it was “real” growth or just optics.

I don’t like guessing. I like tracking. So in this post, I’m turning that $1.66B number into something useful: what it likely represents, what usually pushes it up (or pulls it back down), and the exact signals I’m watching over the next 7 days so you can react early instead of chasing late.

The pain: RWA hype moves fast, but most people don’t know what to track

RWAs (real-world assets) are one of those sectors where the headline travels faster than the facts.

When people see “ATH,” they tend to do one of two things:

- Ape in because “institutions are coming” and they don’t want to miss the next leg.

- Write it off as marketing because “tokenization is just a new label for old TVL games.”

The real problem is simpler (and more frustrating): most traders and even many DeFi users don’t know what counts as RWA value, where it’s coming from, or what would actually make that number keep climbing this week versus snapping back.

And with RWAs, the usual crypto instincts can betray you. A memecoin can be pure vibes and still be tradable. RWAs can look “safe” on a dashboard and still have issues like:

- Thin liquidity (you can buy it, but exiting size hurts)

- Redemption friction (rules, windows, fees, or KYC you didn’t expect)

- Backing ambiguity (“proof” that sounds legit until you read the fine print)

If you’ve ever watched a tokenized-asset narrative spike, you’ve seen the pattern: numbers pump first, questions come later. I’d rather flip that.

Promise solution

I’m going to turn this ATH into a simple framework you can actually use:

- What the $1.66B likely represents (and what it might be lumping together)

- The growth triggers that usually cause sudden jumps

- The risks that tend to surface right after ATH weeks

- A clean 7‑day watchlist (metrics + catalysts) so you can judge momentum vs fade with your eyes open

RWAs are not just “TVL, but boring.” They mix markets, custody, legal structures, and onchain composability. If you don’t have a scoreboard, you’re basically trading vibes.

What this article will help you do in 10 minutes

Here’s exactly what you’ll walk away with:

- Understand what Solana’s RWA “ATH” is actually measuring (and what it isn’t)

- Spot the difference between sustainable tokenization growth and a short-term narrative pump

- Identify the most likely 7-day catalysts (liquidity, integrations, incentives, listings, partnerships)

- Avoid the classic traps: thin liquidity, unclear backing, redemption issues, and “TVL optics”

Also, one quick reality check: the reason RWAs are so magnetic is that they promise something crypto has struggled with for years — stable yield that doesn’t rely on reflexive token pumps.

And this isn’t just a Solana thing. Over the last couple of years, major research firms and industry reports have repeatedly called tokenization one of the most credible “bridge” narratives between traditional finance and onchain markets. For example, a widely cited note from Boston Consulting Group framed tokenization as a potential structural shift in how assets are issued and managed over time. That doesn’t guarantee this $1.66B is sticky — but it does explain why the market reacts so fast when these numbers print new highs.

Quick definitions (so we don’t talk past each other)

Before we go any further, let’s lock in the meanings. These sound basic, but most confusion (and most bad trades) start right here.

- RWAs (Real-World Assets): onchain tokens that represent claims on something offchain — like treasuries, credit, commodities, or real estate exposure.

- Tokenized value: the reported dollar value of those onchain tokens tied to real-world assets. Depending on the dashboard, this can mean different things (and sometimes mixes categories).

- Onchain proof: evidence you can verify via blockchain data (supply, holders, transfers) plus whatever reporting the issuer provides.

- Redemption: the process of turning the token back into the underlying asset or cash equivalent (this is where “it’s backed” becomes real or falls apart).

- Liquidity: how easily you can buy or sell without moving the price. A token can be “worth” $100M on paper and still be painful to exit.

- Permissioned RWAs: access and transfers may require KYC, whitelisting, or compliance checks. This can be fine — but it changes your exit assumptions.

- Permissionless RWAs: tokens can usually move freely onchain. Sounds great, but you still have to check how redemption and backing work behind the scenes.

The uncomfortable truth: “Tokenized value” can rise even when liquidity gets worse, redemption becomes harder, or the ecosystem becomes dependent on one issuer. That’s why I don’t treat ATH screenshots as a green light by default.

So here’s the question I want you to keep in mind as we move forward:

Is Solana’s $1.66B RWA ATH coming from real net inflows and real usage… or from reclassification, incentives, and thin markets that look good on a chart?

Next, I’m going to show you how I sanity-check the $1.66B number in practice — the same checklist I use to figure out whether an RWA “ATH” is a genuine expansion or just a temporary dashboard win.

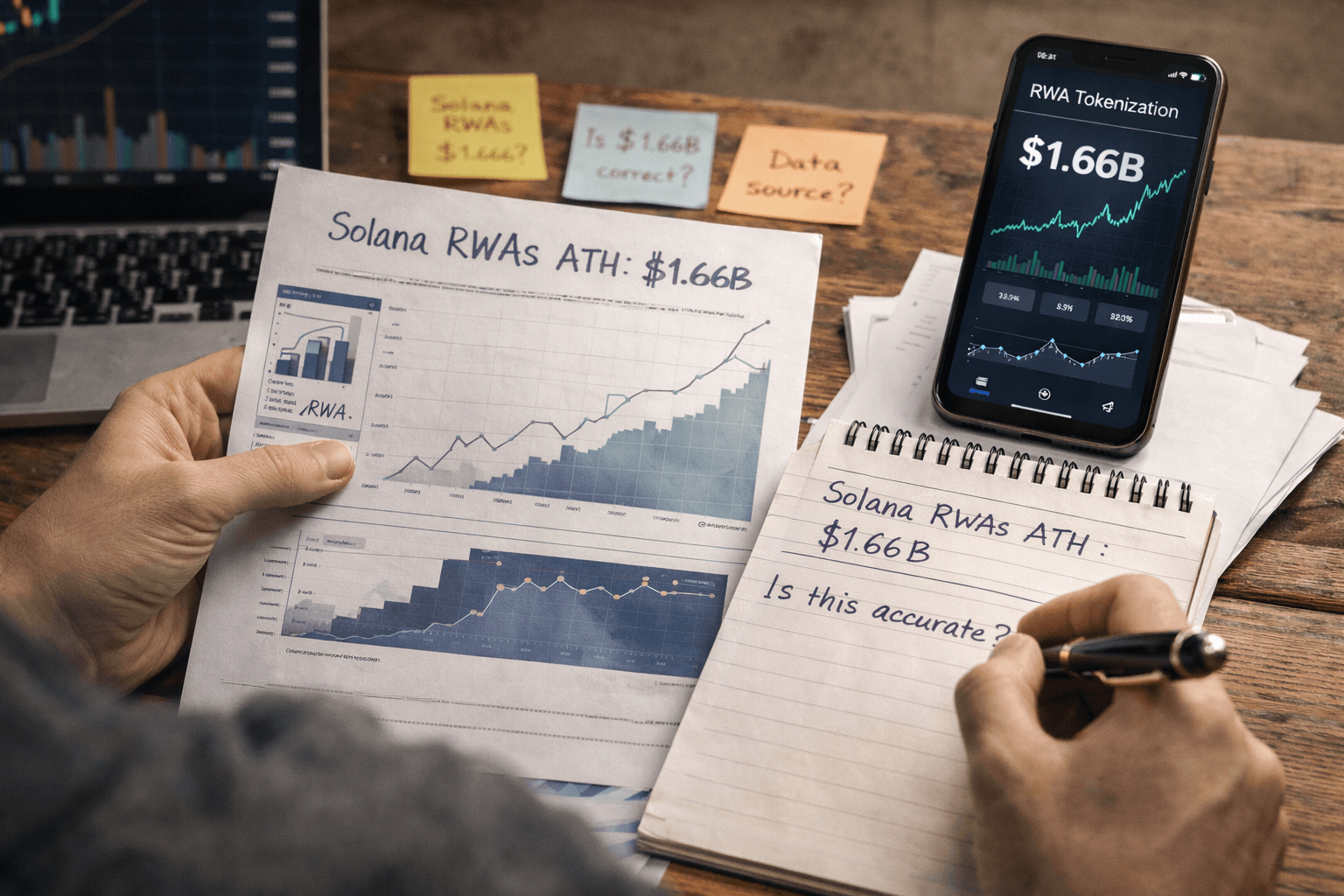

What “Solana RWAs hit $1.66B ATH” really means (and how I sanity-check it)

When I see a headline like “Solana RWAs hit $1.66B (ATH)”, I don’t treat it like price action. I treat it like accounting.

In most dashboards, “tokenized value” is basically:

- (Circulating supply) × (reference price per token)

- summed across a set of tokens the tracker labels as RWA (treasuries, credit, commodities, real estate proxies, receivables, etc.)

That sounds clean, but here’s the catch: the quality of the number depends on the quality of the inputs. And RWAs are where inputs get… flexible.

So this is the quick “is this real?” framework I run every time an ATH prints.

My RWA ATH sanity-check checklist (the stuff that separates “real inflows” from “optics”)

- 1) Issuer transparency (who is responsible if something breaks?)

I want to see a clear issuer entity, clear terms, and clear jurisdiction. If the project page is vibes + memes but the legal structure is foggy, I size it like a speculative altcoin, not like “cash equivalents.”

- 2) Reserve attestations and reporting cadence

For treasuries/cash-like RWAs, the gold standard is frequent, third-party reporting. In traditional finance, reserve-style reporting is normal; in crypto, it’s a competitive advantage.Study breadcrumb: The BIS has repeatedly emphasized that tokenization only scales sustainably when claims, governance, and settlement finality are clear—not just “onchain tokens exist.” That’s basically the grown-up version of “show me the backing and the rules.”

- 3) Oracle pricing (what price is the dashboard using?)

If a token tracks a treasury fund, is it priced off NAV? A DEX pool? A stale oracle? A “mark” from the issuer? A lot of ATH weeks quietly rely on the most flattering pricing source available.My rule: if the underlying is stable and the onchain price is jumpy, I assume the issue is liquidity or pricing, not “suddenly the T-bill market pumped.”

- 4) Circulating supply vs. fully diluted (are we counting tokens that can’t actually trade?)

Some structures mint tokens that are technically “issued” but not freely transferable, not broadly redeemable, or locked behind permissioning. If the tracker uses a supply number that includes semi-frozen inventory, the “tokenized value” can look bigger than the value that can actually move.

- 5) Double counting across wrappers (the silent ATH inflation trick)

This one is huge on fast chains: the same economic exposure can show up multiple times.

- Base RWA token exists (say, a treasury token)

- Wrapped version appears (bridge/wrapper)

- Receipt token appears (vault share token)

- LP tokens appear (pool shares)

If dashboards aren’t careful, you can end up with one underlying dollar getting counted as $1 + $1 + $1 across representations. The chain didn’t attract $3—your accounting did.

My quick test: if the “ATH” is real, I should be able to identify which specific tokens grew supply, where that supply came from, and where it sits now (wallet concentration + venues). If I can’t, it’s probably an optics ATH.

And yes—this matters even if you’re not buying these tokens. Because if the $1.66B is mostly real, Solana just gained a serious new pillar of liquidity and collateral. If it’s mostly wrappers + incentives, it can unwind fast.

Where the growth likely came from: the 3–5 biggest buckets

I don’t need insider info to map most RWA spikes. They usually come from a few repeatable sources—here’s how that typically looks on Solana right now.

- 1) Tokenized treasuries / yield-bearing cash equivalents

This is the easiest on-ramp because it matches what DeFi users already want: park funds, earn yield, keep liquidity (mostly).In the broader market, products like BlackRock’s BUIDL and Ondo-style treasury tokens trained people to think “onchain T-bills” is normal. When Solana gets native versions or credible wrappers, value can ramp quickly because it’s not a weird new trade—it’s a familiar cash-management move.

What makes this bucket jump: big mints, new distribution via wallets, or a new venue accepting it as collateral.

- 2) Onchain credit / private credit wrappers

Private credit can print big numbers fast because the underlying market is massive and the yields are attractive. But it also demands the most trust: underwriting, servicing, default handling, recovery… all the stuff crypto people don’t like thinking about until the first missed payment.What makes this bucket jump: a single fund allocation, a new credit line, or “vault deposits” from a few large wallets.

- 3) Commodity or real estate representations (often narrative-driven)

This bucket can pump attention even when it’s small in real usage. Why? Because it’s a strong story: “gold on Solana,” “real estate on Solana,” “invoices on Solana.”But I’m stricter here: redemption terms, fees, custody, and legal enforceability matter more than the ticker symbol. If redemption is hard, the token can trade like a meme during hype weeks—then gap down when the vibe changes.

- 4) New wrappers, bridges, or integrations that reclassify existing value into “RWA”

This is the sneaky one. Sometimes the underlying exposure already existed, but a new wrapper makes dashboards categorize it differently, so the “RWA total” jumps overnight without the ecosystem actually attracting new external capital.It’s not automatically bad—wrappers can improve access—but it can create an ATH that’s more taxonomy than adoption.

- 5) Incentive-driven deposits (points, boosted yield, partner campaigns)

This is where ATH weeks get dangerous. If deposits are motivated by short-lived incentives, TVL can look sticky… right until incentives end and the exit door gets crowded.

If you want to see what the community is highlighting right now (as breadcrumbs, not gospel), these are some of the threads and project mentions I’m tracking:

https://x.com/solana/status/2022947927413686542

https://x.com/levelz/status/2023091239948783704

https://x.com/tokencycle/status/2022956000639353081

https://x.com/AgabeyovRa10201/status/2022974175816958141

https://x.com/ValeoCash/status/2022948030400315877

https://x.com/SplyceFi/status/2022948234008867150

https://x.com/mosoppiiee/status/2023001989857345727

https://x.com/GordonGekko/status/2022948105797407021

https://x.com/KaiGonnaMakeIt/status/2022962207919874423

https://x.com/TrendChad/status/2022960754282889591

https://x.com/ZeusRWA/status/2023331461416239332

https://x.com/MarshmallowWeb3/status/2023086308231664082

https://x.com/_theonlyplanet/status/2022950690910359605

https://x.com/Girl_SunLumi/status/2022957305122132234

https://x.com/owoweb3/status/2023018346745377220

https://x.com/Lona74919132/status/2023029048772010115

https://x.com/Azharthegreat/status/2023123009863667881

https://x.com/greenwhite28169/status/2022975476420235272

https://x.com/Ryumeta/status/2022948363331850441

https://x.com/BARONMOND_1/status/2023072869287329887

https://x.com/luxurycryp24732/status/2022997997739712716

Why this ATH matters for Solana DeFi (even if you don’t hold RWAs)

Here’s the part people miss: RWAs don’t have to be your trade to change your DeFi experience.

- RWAs can become higher-quality collateralIf lending markets accept a credible treasury/cash-equivalent token, collateral gets less volatile than SOL/ETH/memecoins. That can mean higher borrow capacity, lower liquidation risk, and generally a less chaotic credit layer.

- Stable yield options reduce “mercenary TVL” behaviorWhen the only yield is incentive emissions, liquidity behaves like a tourist. Cash-like yield gives protocols something closer to “savings behavior.” It doesn’t fix everything, but it helps.

- RWAs attract different capital profilesFunds, DAOs managing treasuries, and fintech-style users don’t necessarily want 10x volatility. They want predictable yield, reporting, and exits. That capital base tends to be stickier when the product is real.Study breadcrumb: One reason tokenization keeps growing is simple: major research shops (BCG is a famous example) have projected tokenized assets could reach trillions over the coming years. Whether you love or hate those forecasts, the direction of interest is clear: traditional balance sheets want onchain rails.

- Second-order effects: tighter spreads and deeper liquidityMore credible collateral + more stable capital can tighten borrowing spreads and deepen liquidity in places you actually trade. It’s not instant, but it’s how a DeFi ecosystem “levels up” quietly.

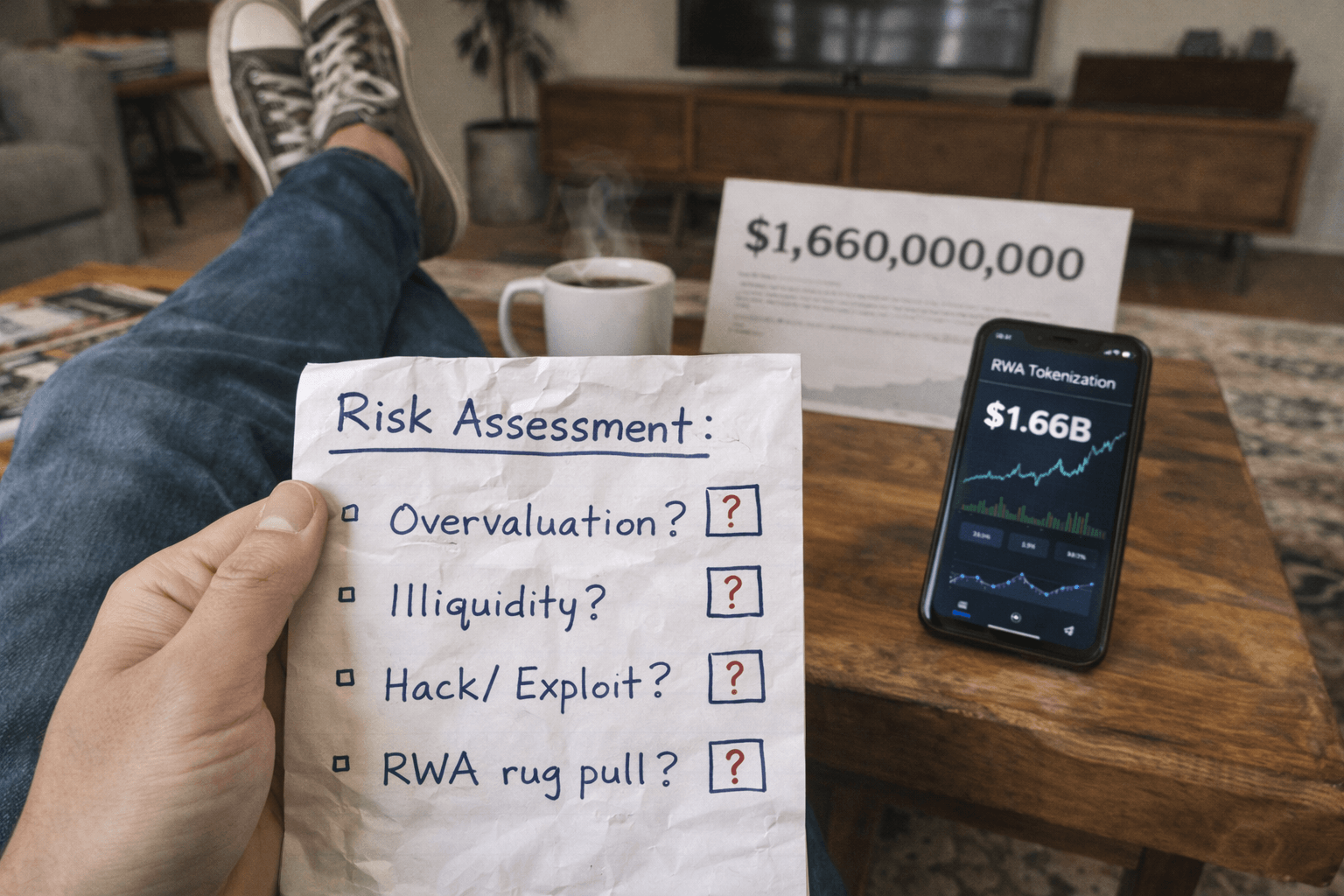

Every time RWAs get hot, I see the same blind spots. The problem is that these aren’t “maybe” risks—these are structural risks.

- Liquidity mismatchYour token trades 24/7. The underlying asset often doesn’t. If redemptions depend on banking hours, settlement windows, or offchain market liquidity, you can get a nasty gap between “chart liquidity” and “exit liquidity.”

- Redemption gates + KYC surprises Some RWAs are effectively permissioned. That might be fine—until you realize you can buy the token permissionlessly but can’t redeem without extra steps (or at all). I always read redemption terms like I’m trying to break them.

- Issuer concentration riskIf one or two issuers represent most of the $1.66B, the whole “Solana RWA” story can hinge on a single set of decisions: pausing mints, changing fees, tightening access, switching custodians, changing attestation cadence.

- Oracle / pricing assumptions that don’t survive volatility During hype, people trust the peg because it’s convenient. During stress, everyone suddenly cares about how pricing is computed. If the pricing stack is weak, the first wobble can cascade through lending markets fast.

- Regulatory headlines that freeze growth RWAs sit closer to the regulated world by nature. That means a single headline can change access, distribution, or redemption expectations overnight. You don’t have to predict regulation—you just need to size positions like regulation exists.

What I’m watching over the next 7 days (the “momentum vs fade” checklist)

If you want to track whether this ATH is real momentum or just a weekend number, this is my daily scoreboard. No drama—just signals.

- Net new tokenized value (supply-driven), not price-driven I want to see fresh mints and sustained issuance—not just tokens repricing on thin liquidity.

- Holder count + distribution Is adoption spreading, or is the ATH basically five wallets and a dream? Concentration isn’t always bad, but it changes the risk profile massively.

- Liquidity depth and slippage on key pairs I check: what happens if someone hits the pool with a normal order size? If slippage is ugly, the “market cap” is a poster, not a price.

- Collateral adoption (the real DeFi integration test) Are lending/borrow markets accepting these assets? Are LTVs conservative? Are liquidations well-designed? This is where RWAs go from “token” to “infrastructure.”

- Integrations that create real distributionWallet visibility, aggregator routing, money market listings, and collateral eligibility matter more than announcements. I’m watching for integrations that put RWAs in front of normal users without friction.

- Incentives that might be inflating the number If a points campaign is doing the heavy lifting, I assume churn is coming. I don’t panic—I just plan exits and entry sizes around incentive cliffs.

- Proof upgrades: attestations, audits, reporting cadence The fastest way for RWAs to go from “hot narrative” to “serious capital” is boring: better proof, more frequent reporting, cleaner disclosures.

People also ask (the fast, practical answers)

- What are RWAs in crypto and why are they growing? RWAs are tokens that represent claims on offchain assets (like treasuries, credit, commodities). They’re growing because people want onchain settlement + programmable ownership while still holding assets the real world recognizes.

- Is RWA tokenization actually backed 1:1? Sometimes yes, sometimes “sort of,” and sometimes it’s effectively synthetic exposure. I treat “1:1 backed” as a claim that must be verified with attestations, legal structure, custody details, and redemption terms.

- Why is Solana attracting RWAs vs Ethereum/L2s? Cost and speed help, but the bigger draw is composability with a large retail DeFi user base. If distribution (wallets/DEXs/lending) gets smoother, RWAs can scale faster because users can actually use them without paying painful fees.

- What can go wrong with tokenized treasuries/credit? Liquidity mismatch, redemption gates, issuer risk, pricing/oracle failures, and regulatory changes. The “asset” might be safe while the token wrapper is fragile.

- How do I evaluate an RWA project safely? I start with: who issues it, how reserves are proven, how redemption works, where it trades, and how concentrated holders are. If any of those are unclear, I size down until they aren’t.

Now the real question: what happens next?

If this $1.66B is being driven by real issuance + real integrations, the next week can look very different than if it’s mostly wrappers + incentives. I’ve got a simple set of scenarios I use to call momentum vs fade—and the confirms for each are not what most people think.

What this ATH could trigger next (realistic 7‑day scenarios)

$1.66B is a loud number, but the market only cares about one thing now: does it compound… or does it mean-revert the second attention moves on?

Here are the three paths I think are realistic over the next week, and the exact “tells” I’d look for to confirm which one we’re in.

Scenario 1 (Bull case): integrations + deeper liquidity + real collateral demand

In the bull case, this isn’t just “RWA season.” It becomes RWA utility week — where tokenized assets start behaving like first-class DeFi building blocks on Solana.

What would confirm it (in the next 7 days):

- At least one major venue adds/expands RWA collateral (or raises caps) in a way that actually increases borrow demand, not just TVL optics.

- Liquidity tightens instead of thinning: spreads get better, and you can move meaningful size without a nasty slip.

- Net new supply shows up (fresh minting / issuance), not just price changes. This is the cleanest proof that real money is choosing the product.

- Integrations land where users already live (wallet/aggregator routing, lending UI defaults, “earn” tabs). If it becomes one tap in a mainstream Solana wallet, the flow can change fast.

A simple real-world example: if a cash‑equivalent/tokenized treasury product gets integrated so it can be used as collateral for a stablecoin loan, users suddenly have a clean loop: park idle funds → borrow against it → deploy elsewhere. That kind of loop is how sticky DeFi liquidity gets created.

Also worth remembering: tokenization isn’t a meme. Traditional finance has been working toward it for years. BCG has projected tokenized assets could reach $16T by 2030 (big number, but the direction matters). If Solana captures even a sliver of that, weeks like this start to look like early innings, not late-cycle noise.

Scenario 2 (Base case): the number holds, the narrative cools, quality keeps flowing in

This is the most common outcome after an ATH headline: people stop tweeting, but the builders keep shipping and the best products keep collecting steady deposits.

What would confirm it:

- Tokenized value flattens (small up/down days), but doesn’t give back the whole move.

- Holder counts keep inching up even if price action is boring. That’s usually real adoption, not mercenary capital.

- One or two legit announcements (attestation cadence, new market, new integration) but nothing that screams “mania.”

- Rotation inside the category: users shift from the sketchier wrappers into the transparent ones, rather than leaving RWAs entirely.

If we get this base case, I actually like it. Quiet growth beats noisy spikes because it gives the ecosystem time to standardize reporting, improve liquidity routing, and tighten risk parameters without everyone trying to sprint at once.

Scenario 3 (Bear case): incentive spike fades, liquidity thins, outflows hit the biggest product

The bear case isn’t “RWAs are dead.” It’s simpler: the ATH was partly campaign-driven, and when the incentives stop pulling, the capital slides right back out.

What would confirm it:

- Liquidity gets fragile: you see widening spreads, shallow order books, and bigger slippage on normal-sized trades.

- Outflows cluster in one place: a single large product (or issuer) starts bleeding, and the whole ecosystem number drops with it.

- Redemption friction shows up in public: users suddenly realize exits aren’t instant, or they run into gating/KYC surprises they didn’t price in.

- Short-term points end and the TVL chart looks like it stepped off a cliff within 48–72 hours.

Tokenized assets have a built-in structural issue that can amplify this: the token trades 24/7, but many underlying real-world markets don’t. When panic hits at 2 a.m. on a Sunday, the chain can move faster than the offchain plumbing. That mismatch is exactly where “safe yield” narratives get stress-tested.

If you’re a DeFi user: how I’d approach RWAs this week (without getting wrecked)

If you’ve never used RWAs on Solana before, this is not the week to go max size on day one. It’s the week to act like a skeptical power user and make the products prove themselves.

- Start small and do a full round trip (buy → hold → sell / redeem if available). I want to see the “exit path” with my own eyes, not just read marketing copy.

- Pay for transparency, not APR. If two products look similar but one has cleaner reserve reporting (and updates it often), I’ll take the slightly lower yield every time. In RWAs, information quality is part of the return.

- Check liquidity before you check APY. If I can’t exit without moving the price, the yield isn’t yield — it’s a lockup with extra steps.

- Assume “tokenized value” is not “instant liquidity”. A big TVL/RWA number can be real while the market is still thin. Those aren’t contradictions.

- Size like a risk manager. I treat early RWA positions like I’d treat a new stablecoin: small until it survives volatility and a few messy news days.

A quick practical test I like: before buying size, I’ll simulate selling the same size (or close) and look at the expected slippage. If it’s ugly in calm conditions, it’ll be worse when things get noisy.

If you’re a builder/investor: signals that tokenization on Solana is maturing

An ATH is a headline. Maturity is a checklist of boring things that keep working even when nobody’s tweeting.

These are the signals that make me think “okay, this is becoming real infrastructure,” not just a category pump:

- Multiple issuers are growing at the same time. When the chart depends on one product, it’s fragile. When growth is spread across issuers and structures, it’s a market.

- RWAs are accepted as collateral in more than one meaningful venue (and actually used). One listing is marketing. Multiple venues with real borrow demand is adoption.

- Attestations become routine: same format, predictable cadence, easy to verify. In traditional finance, standardized reporting is how markets scale. Onchain markets won’t be different — just faster.

- Institution-friendly rails improve without killing composability. The best outcome is: compliant entry paths exist, but the onchain asset still plugs into lending, routing, and collateral systems cleanly.

- Risk parameters evolve like grown-ups: conservative LTVs, clear caps, stress-tested oracles, and transparent incident response when something breaks.

If you want a “bigger picture” anchor here, the Bank for International Settlements has been consistently pointing toward tokenization as a structural shift in market plumbing (settlement, collateral mobility, and operational efficiency). The direction of travel is clear even if the timeline is messy.

So what now?

$1.66B is a big headline — but the next 7 days will tell us if this move has legs or if it was just a clean weekend milestone.

If you only track five things this week, I’d make it these:

- Net new tokenized value (fresh issuance/mints, not price effects)

- Liquidity depth + spreads on the main RWA pairs (and slippage at your typical trade size)

- Collateral adoption (new markets, higher caps, actual borrow demand)

- Holder growth + distribution (are new users coming in, or is it a whale-only game?)

- Proof quality (attestation updates, audits, reserve reporting cadence)

My rule of thumb: the best RWA opportunities usually sit where transparency + liquidity + real utility overlap — not where the chart looks the loudest.

If we get the bull-case confirmations, I’ll lean in. If it’s base-case, I’ll stay patient and picky. If the bear-case signals show up (thin liquidity, clustered outflows, redemption surprises), I’d rather be early in stepping back than late in explaining why “TVL” didn’t equal “exit.”