Understanding Real-World Asset Tokenization

Have you ever wondered why suddenly everyone—from big banks to crypto enthusiasts—is raving about tokenizing real-world assets? What exactly does this trendy phrase mean, and should it really matter to you personally?

If you’re scratching your head, feeling slightly left behind, relax—you’re precisely in the right place. Today, I’m going to break down this buzzworthy crypto development in a clear, straightforward way, without the confusing buzzwords or tech talk that can often leave us overwhelmed.

After reading this guide, you’ll have a clear grasp on why tokenizing physical assets is capturing so much attention, how it practically works in the blockchain world, and importantly—what it could mean for you, your investments, and the wider crypto landscape.

What Makes Real-World Assets So Complicated to Handle?

Let’s first talk plainly about why managing ‘real-world’ physical assets—like real estate, artworks, gold bars, or commodities—is usually such a headache. It’s not just you; traditional asset management has always been more cumbersome and costly than you’d like it to be.

Here are just some of the complications investors frequently encounter:

- Expensive Fees: High administrative costs, management fees, and hefty transaction charges often chip away at returns.

- Slow Transactions: Buying, selling, or trading physical assets like real estate often takes weeks—or even months—to complete.

- Complex and Rigid Regulations: Government and financial regulations can mean heavy paperwork, legal hurdles, and compliance headaches.

- Limited Accessibility: Let’s face it—valuable physical assets like luxury properties or rare artworks generally require substantial investment upfront, limiting them largely to wealthy clients.

Tokenization Can Solve These Problems

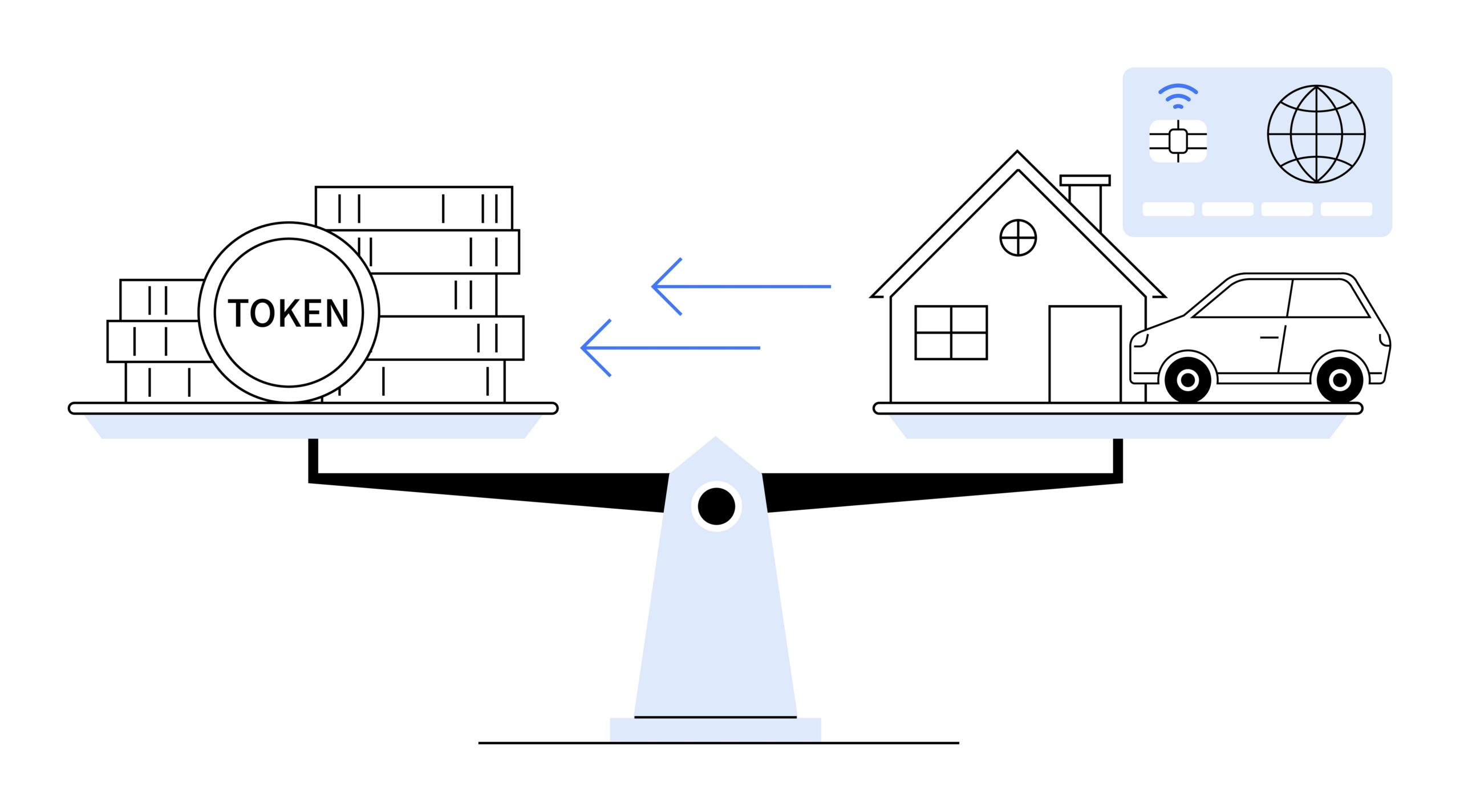

The good news is that blockchain technology isn’t just great for cryptocurrencies like Bitcoin or Ethereum—it can remove many of these frustrations by redefining how we own and trade real-world assets.

By turning these assets into digital tokens stored securely on blockchain networks, many of the traditional roadblocks begin to fall away. Suddenly, ownership is simpler, trades become faster, fees drop significantly, and financial barriers tumble for regular folks like you and me.

But exactly how does putting real-world assets on the blockchain via tokenization actually work in practice—without being overly technical? Stick with me, and I’ll explain exactly what tokenization means in everyday terms and give you a clear-cut example that will quickly click.

What Exactly is Real-World Asset Tokenization?

Before we move forward, let’s clear away all the crypto buzzwords and simply answer the question we all secretly have: “What on Earth is real-world asset tokenization anyway?”

Real-World Asset Tokenization Explained Simply

In plain English: Tokenizing real-world assets means converting them into digital tokens stored safely and transparently on a blockchain. Think of the blockchain as a secure digital ledger—tamper-proof and available for everyone to view—holding clear, indisputable records about ownership.

These digital tokens aren’t just fancy placeholders—they legally represent actual ownership stakes in physical assets. So when you hold a token, you’re genuinely co-owning something tangible, be it precious art, gold bullion, farmland, or luxury real estate.

“Tokenization is not just digitizing assets; it’s democratising access to opportunities previously exclusive to a wealthy elite.” – Blythe Masters, CEO of Digital Asset Holdings.

Pretty exciting, right? But maybe you’re thinking, “Okay, cool—but how exactly does this work in real life?”

Quick Example of Tokenization

Imagine a gorgeous luxury hotel in downtown Manhattan worth millions. Under traditional circumstances, owning a slice would be nearly impossible for regular people due to massive capital barriers and complex legal paperwork.

- With tokenization, the building can now be divided into, say, ten thousand digital tokens.

- Each token represents equal ownership of 1/10,000th of the hotel.

- Instead of needing millions upfront, you could purchase just a few tokens for a small, manageable sum. Congratulations—you’re now officially part-owner of premium real estate in NYC!

This isn’t some hypothetical scenario. In 2020, a luxury hotel in Aspen actually got tokenized: investors grabbed tiny slices of the property swiftly via blockchain technology.

Tokenization isn’t reserved for real estate either—fine art is also feeling the blockchain love. In 2018, ownership of Andy Warhol’s iconic painting was converted into thousands of tokens on Ethereum blockchain, letting people buy fractional digital stakes in legendary art previously reserved only for ultra-wealthy collectors.

Don’t you find business stories involving fine art or skyscrapers suddenly becoming achievable investments incredibly fascinating? But tokenizing real-world assets isn’t just about interesting anecdotes—it’s shaking up how we view investing entirely.

Intrigued yet? Great, because now you might wonder: “Exactly why should I care about tokenization personally?” Stay with me—the answer comes right next, revealing why this blockchain-powered change could genuinely transform your financial future.

Why Should You Care About Asset Tokenization?

Let’s be completely real here—blockchain and tokenization sound techy and complex. I get that. But why exactly does real-world asset tokenization matter for regular folks like you and me? Well, the truth is that this technology could totally change how you can invest, grow your wealth, and even how accessible opportunities become for you. Let me explain.

Fractional Ownership Opens the Door for Everyone

Ever dreamt of owning a slice of prime Manhattan real estate or a rare Picasso painting, but thought you’d need to win the lottery first? Fractional tokenization breaks these huge assets into digital pieces, allowing you to buy just a tiny, affordable share.

For example, look at luxury properties like St. Regis Hotel in Aspen. In 2018, they tokenized their entire property—worth millions—in the famous “Aspen Coin” project, letting people just like us own fractions of this high-value asset. Without tokenization, most of us would find this property totally unreachable, reserved only for the ultra-wealthy.

“Fractional ownership democratizes investment opportunities, transforming exclusive assets accessible only to elites into inclusive ones available to everyone.” – Deloitte Blockchain Lab Report

This means you aren’t limited by a massive budget. Whether it’s a piece of fine art, a high-grade gold bar held across the globe, or part-ownership of a stable commercial building downtown, fractional tokenization opens previously closed doors for the average investor.

Increasing Liquidity Just Got Easier

Here’s another big win. Usually, physical assets can take weeks, months, or longer to sell. With tokenization, that same asset can potentially be traded 24/7 on global blockchain marketplaces, allowing fast transactions—even instantaneous trades—instead of endless paperwork.

- A recent World Economic Forum report found assets tokenized on blockchain saw an average transaction processing time drop from days down to mere minutes or even seconds.

- Real-world example: The Australian Securities Exchange (ASX) has been experimenting successfully in tokenizing real-world assets, dramatically shortening settlement times and boosting liquidity across markets they’ve tested.

Lowering Investment Barriers Creates New Opportunities

Imagine being able to diversify your investments beyond just traditional stocks, bonds, or crypto without having millions in your pocket. Tokenization breaks down barriers like complex paperwork, legal hurdles, and huge required investment minimums.

For instance, investment platforms like RealT.io have already turned residential properties in the U.S. into tokenized fractional assets. This lets anyone invest in rental properties from as little as $50, opening huge doors for everyday investors.

Think about the possibilities—what if you could securely own fractions in different locations and asset types effortlessly? Where would you invest if those barriers disappeared?

Now, I know what you might be thinking—how exactly do these real-world assets get tokenized in practice? What’s happening behind the scenes to make this possible?

Ready to find out exactly how it works step-by-step, in simple terms anyone can understand? Let’s explore that now.

How Does Real-World Asset Tokenization Actually Work?

You’ve gotten excited about tokenizing real-world assets and maybe you’re wondering, “How does this thing actually happen in practice?” Great question—let’s quickly walk through the simple steps behind the scenes so you can clearly see how physical stuff like luxury apartments or precious gold bars become accessible investments.

“Simplicity is the ultimate sophistication.” — Leonardo da Vinci

Step 1: Choosing & Assessing the Asset

First, experts carefully pick and evaluate physical assets. This step is crucial because not just any asset qualifies. It needs clear legal ownership, stable value, and some demand from people who want to buy and trade the tokens later. For instance, that gorgeous commercial building in downtown New York or a collection of valuable artwork—these certainly check the boxes. After identification, experts verify physical condition, market value, documentation, and ownership legitimacy to ensure everything’s clean and above board.

- Real estate properties (commercial buildings, luxury houses)

- Gold, silver, or commodities

- Artwork and collectible items

- Even certain rare vintages of wine!

As you can see, possibilities are excitingly broad. A study from Boston Consulting Group noted that tokenizing illiquid assets—like real estate and collectibles—could unlock trillions of dollars in opportunities in the coming decade. That’s not just hype—it’s real financial potential you could tap into.

Step 2: Creating Digital Tokens Representing Ownership Rights

Once an asset passes the verification test, let’s talk digital tokens! Blockchain platforms securely generate unique digital tokens, clearly representing either partial or complete ownership rights in the asset. A single building, for instance, could be divided into thousands of tokens, each representing a tiny part of ownership.

Typically, Ethereum, Binance Smart Chain, or other top-tier blockchains power this digital token creation. They establish authenticity, security, and proof of ownership thanks to the blockchain ledger. Remember: everything is transparent and traceable, meaning your digital share is legally verifiable on the blockchain.

Step 3: Selling & Trading the Tokens

Now that we have our tokens ready, the fun part kicks off! Tokens become available to buy, hold, and sell easily on blockchain marketplaces or crypto exchanges like OpenSea or Realty marketplace. Imagine logging into a marketplace, finding your dream investment—a piece of luxury real estate—and buying it in minutes without all the usual headaches or paperwork. Trading tokens later becomes just as straightforward; they typically become easy-to-buy-and-sell digital assets available day or night.

This trading convenience dramatically boosts liquidity, provides price discovery, and breaks down old barriers, letting anyone join the investment market effortlessly.

But here’s a question you might be thinking: If tokenization makes investing so simple and appealing, why are big-name banks even interested? After all, you’d assume they’re quite comfortable keeping things as complicated as possible, right? You’ll be surprised to learn why they’re all-in on this new revolution. Answers coming up next—keep reading!

Why Are Banks and Major Financial Institutions Jumping Into Real-World Asset Tokenization?

You’ve probably wondered why big banks and major investment firms, typically known to move cautiously, suddenly seem obsessed with tokenizing real-world assets. I can tell you from years of watching crypto trends closely—when mega-institutions like JPMorgan, Goldman Sachs, and BlackRock start buzzing enthusiastically about something, it’s almost guaranteed to be hugely influential.

But what’s driving these financial giants to embrace asset tokenization so eagerly? Let’s explore the main reasons together, without complicated buzzwords or financial jargon.

Operational Efficiency: Saving Millions by Streamlining Transactions

Plain and simple: financial institutions stand to save millions by switching to blockchain-based tokenization. Traditional methods of moving real-world assets are slow and costly, riddled with intermediaries who each take their slice of the pie. Blockchain tokenization cuts out many unnecessary steps, making everything quicker, smoother, and cheaper.

For instance, JPMorgan’s blockchain-enabled platform called Onyx already helped streamline repo market transactions—short-term lending between banks. By tokenizing cash and securities, JPMorgan managed to slash trade settlement to hours instead of days, saving significant costs and reducing risks.

“With blockchain, certain transactions can be settled immediately rather than going through traditional clearinghouses, saving significant amounts in costs.” – Umar Farooq, CEO of JPMorgan’s Onyx.

This speed and efficiency translate directly to tangible benefits for banks: lower operating costs, fewer employees bogged down with paperwork, and substantially reduced overhead.

Reducing Financial Risks and Errors: A Clearer Path Ahead

Another huge motivating factor? Transparency and traceability. Tokenization on blockchain means every transaction gets recorded immutably and transparently. Banks can quickly and confidently verify asset ownership and reduce human error dramatically.

- Immediate Traceability: Transactions are publicly recorded on blockchain ledgers, ensuring easy verification and reduced discrepancies.

- Reduced Fraud Probability: Tokenization inherently secures asset titles, making attempts at fraud or manipulation harder, potentially saving institutions millions annually.

- Enhanced Compliance: Regulatory reporting becomes easier with instantly verifiable ownership records, reducing hefty compliance-related fees.

Real Examples Speak Louder Than Words

Look at BlackRock, the world’s largest asset manager, partnering closely with blockchain platforms to test asset tokenization. Or HSBC, successfully conducting blockchain-based transactions in real estate finance. These respected institutions wouldn’t participate without serious underlying benefits.

A major report from Boston Consulting Group (BCG) estimated that tokenization could grow rapidly to represent up to 10% of global GDP (that’s trillions!) by 2030. With numbers like these, you better believe banks simply can’t afford to miss out.

Still curious about the other major benefits banks and institutions see? Just wait till you learn what’s next—in fact, did you know the benefits of asset tokenization can impact you directly? Keep scrolling; it’s going to surprise you how much this trend matters personally.

The Primary Benefits of Asset Tokenization You Should Know

Imagine finally having the chance to own a slice of something big—something you’ve only admired from afar. Have you ever dreamt of telling your friends: “Yeah, I own a piece of that luxury Manhattan apartment building,” or maybe, “That Warhol in the gallery downtown? I own a fraction!” Well, tokenization just might make your dreams come true. So let’s quickly look at the standout perks of turning traditional assets into digital tokens:

Accessibility: Opening Up Investments for Everybody

Traditionally, big-shot investments like real estate, fine arts, or even rare commodities have been reserved only for the wealthiest among us. Asset tokenization completely flips the script by offering fractional ownership.

- No more needing millions upfront—invest with whatever amount you have, even if it’s modest.

- Real-life best example: Aspen Coin, where investors were able to buy pieces of the upscale St. Regis Aspen Resort through tokenization (backed by Forbes).

- Suddenly, anyone with a few hundred bucks gets the chance to participate with big players.

Liquidity Boost: Trading Becomes Easier Than Ever

You may have noticed that selling off certain traditional investments (think of properties or artworks) can take forever, right? With asset tokenization, your holdings become instantly more fluid:

- Sell, trade, or transfer asset-backed tokens rapidly, exchanging complex paperwork for a few simple clicks.

- A real-world example—Pax Gold (PAXG), a digital token representing gold, makes trading in gold 24/7 as easy as trading crypto (source).

- Improved liquidity also means you quickly access cash without typical hassles and lengthy waits.

Transparency Means Trust

“Trust is the glue of life. It’s the most essential ingredient in effective communication. It’s the foundational principle that holds all relationships.” – Stephen R. Covey

This quote speaks volumes. What’s so amazing about tokenization is the blockchain itself—a fully transparent, immutable ledger. It’s a record of each transaction that anyone can access, audit, or verify at any time.

Think about that for a moment—increased trust means:

- Less chance of fraud or disputes, as blockchain transactions can’t be easily manipulated.

- A clear, traceable ownership history enhancing buyer security and confidence.

- Ultimately, a safer investment environment for you and all players involved.

If these benefits excite or intrigue you, just wait till you see the incredible resources I’ve gathered to help you easily and confidently navigate your tokenization journey.

Ready to find out what’s next? Keep reading, and I’ll reveal some of the most helpful, user-friendly resources I’ve personally selected for exploring tokenization deeper—you’re really going to love what’s coming up!

Important Resources to Check Before You Begin Your Tokenization Journey

Okay, so tokenizing real-world assets sounds amazing, right? You’re ready to enter the fascinating new era of investments—owning tiny parts of real estate, gold, or art digitally sounds exciting. But before you get too eager and dive in wallet-first, let me share two excellent reads that’ll ensure you’re truly prepared and informed.

I get it—there’s a lot of stuff out there, and knowing which resource to trust can be overwhelming. I’ve already sorted through the clutter for you, picking only straightforward, credible, and practical guides you’ll genuinely enjoy.

- Chainlink’s beginner-friendly breakdown on RWAs

Here’s a fantastic starting point. No complicated tech-speak—just simple explanations, clear steps, and practical advice. Chainlink is trusted across blockchain circles, and their piece on Real-World Assets offers transparent and digestible insights on tokenization fundamentals. Perfect for beginners. - Coinspeaker’s concise but interesting guide about RWAs

If you enjoy clear language along with relatable, real-world examples, Coinspeaker does an excellent job. Each concept is explained quickly, in ways that make sense instantly. They’ll equip you with relatable examples you’ll easily connect with and remember. Highly recommended as your second stop.

“An investment in knowledge pays the best interest.” — Benjamin Franklin

Look, tokenization is set to become a financial powerhouse. There’s no better feeling than understanding something yourself, rather than relying on uninformed opinions. Before you move any further, give these resources a look—you won’t regret it.

Now, I bet you‘re wondering what questions people most commonly ask about Real-World Assets tokenization? Curious about whether it fits your personal investing strategy? Let’s quickly address those burning questions next.

Real-World Asset Tokenization FAQ: Answers to Your Most Common Questions

If you’re like most crypto followers out there, you’ve probably got tons of burning questions running through your mind about real-world asset tokenization. I feel your curiosity—so I’ve gathered the most frequently asked questions readers send my way, providing quick, no-nonsense answers for your peace of mind.

How Does Real-World Asset Tokenization Actually Work?

You can picture tokenization as simply translating traditional, physical assets into digital tokens on a blockchain. Each token clearly and securely represents your share of ownership. Let’s say you’d love to own a piece of a rare classic car, but you don’t have six figures sitting in a bank—who does, right? Tokenizing this asset means this fancy ride could actually become affordable to everyday investors through fractional ownership tokens.

“Imagine buying a few tokens, each one giving you the precise legal right to own a small percentage of that incredible classic vehicle. That’s exactly what real-world asset tokenization achieves.”

Why Do Big Banks Care About Tokenizing Assets?

Banks are always on the hunt for ways to trim costly overheads and speeding up notoriously slow processes. Honestly, outdated financial transactions are expensive, inefficient, and full of headaches. Tokenization solves such problems, shaving billions off their annual costs. By digitizing real-world assets, banks cut settlement time drastically, smooth out risks, and eliminate costly third-party middlemen. It’s no wonder institutions like J.P. Morgan, Citi, and HSBC have all started exploring blockchain-based tokenization.

What Is the Biggest Benefit of Real-World Asset Tokenization?

The hands-down greatest bonus I’ve discovered is fractionalization. By tokenizing assets, we remove barriers that once locked out everyday investors and made many forms of investment exclusively for the very wealthy. Tokenization democratizes financial opportunities, letting anyone buy, sell, or trade tokens representing fractions of valuable assets.

You’d never imagine investing in Picasso’s art unless you’re ultra-rich, am I right? But through fractional tokenization, suddenly owning part of classic masterpieces becomes shockingly easy and within reach for all budgets.

Is Asset Tokenization Different from “Tokenization” in AI and Machine Learning?

Absolutely—these are completely different things. The confusion is understandable, given that both concepts use the same word. But in AI and machine learning, “tokenization” merely means breaking down sentences and words into smaller parts for computer understanding.

- Blockchain Asset Tokenization: Digitizes real-world assets, representing secure ownership rights.

- AI Tokenization: Breaks down text data into simpler chunks that algorithms can understand.

See how drastically different they are? Now you’ll never mix them up again!

Ready to find out if this is really something worth diving deeper into? Is real-world asset tokenization just hype or a real-deal investment revolution you’d regret ignoring? The answer could seriously impact your financial future—grab your favorite drink and keep rolling as you click into the next section!

Is Asset Tokenization Worth Your Attention?

With all we’ve explored, here’s the question I’m sure is burning in your mind right now—should you really be paying attention to real-world asset tokenization? Is it just another flashy crypto trend, or something with the staying power to genuinely change how we invest?

Understanding the Impact on Future Investments

Let’s cut straight to the chase—this isn’t simply another passing fad. Asset tokenization represents a fundamental shift. It’s already shifting gears on how we approach investing, opening doors that traditional finance never could.

Take real estate, for instance. Typically an industry known for tedious paperwork, large sums upfront, and limited accessibility. Tokenization has already allowed regular investors to securely buy fractions of luxury apartments worldwide in a click. Platforms like RealT let you own shares of real-world properties as easily as trading crypto, with some tokens priced as low as $50 per share. If this isn’t truly democratized investing, what is?

And it’s not just hype—big institutions are taking real notice. According to a 2023 report from Citi, tokenization is expected to grow to a market worth over $4 trillion by 2030. When industry giants predict numbers like these, I always pay close attention.

Before Jumping In, Do Your Own Homework

But hold your horses—it wouldn’t be responsible to jump headfirst without careful consideration. As with any emerging trend, there’s still volatility and regulatory dust floating in the air. You absolutely need to do your own research first.

Read deeply about whichever asset you’re considering tokenizing or investing in. Make sure you trust and fully understand the platform. Ask smart questions: Is this asset properly authorized and regulated? Who’s doing the auditing? What legal protections do you have? I personally always look for transparency, reputable entities backing the asset, and clear legal structures before getting involved.

What’s Next in Real-World Asset Tokenization?

So, what should you watch out for next? Keep your attention focused on several key areas:

- Increasing institutional adoption: Major banks and asset managers adopting tokenization will further legitimize and stabilize the market. Already, names like JPMorgan, Goldman Sachs, and HSBC are actively exploring tokenized bond markets and other assets.

- Regulatory developments: Keep a close eye on how regulators globally adjust to tokenization. Favorable regulatory movements, such as clear guidelines from the SEC or the European Union’s MiCA regulation, could rapidly accelerate mainstream adoption.

- Innovations & new asset types: Expect to see tokenization expanding beyond property and commodities. Art, patents, private equity—almost any valuable item holding tangible or intangible worth—could soon become equally tokenizable.

Personally speaking, I’m excited about tokenizing art. Platforms like Masterworks have already opened art investments to everyday people, allowing fractional ownership of blue-chip pieces from artists like Banksy or Basquiat. If tokenization takes this further, we could all hold fractional shares of historical masterpieces that were once accessible only to ultra-rich collectors.

Wrapping It Up: The Big Picture, Simply Put

At the end of the day, real-world asset tokenization is a transformative development in the investment world. By simplifying investment barriers, multiplying liquidity, and increasing transparency, tokenization is changing the investing landscape forever.

But remember—like any promising space, thoughtful due diligence isn’t optional; it’s essential. Stay curious, follow reputable news (like what you’re doing right now!), and keep learning. This is one wave you won’t regret riding if you prepare wisely and understand clearly.

In short, asset tokenization isn’t just worth your attention—it should firmly hold your curiosity and investment radar from here on out.