Will Concentration of Wealth Hold Bitcoin Back?

It’s been debated in economics for decades; does wealth inequality matter?, How is inequality best addressed? Now the debate comes to crypto, with enthusiasts questioning whether a fair distribution is possible or even desirable in the Bitcoin ecosystem.

Is Bitcoin Wealth Too Concentrated?

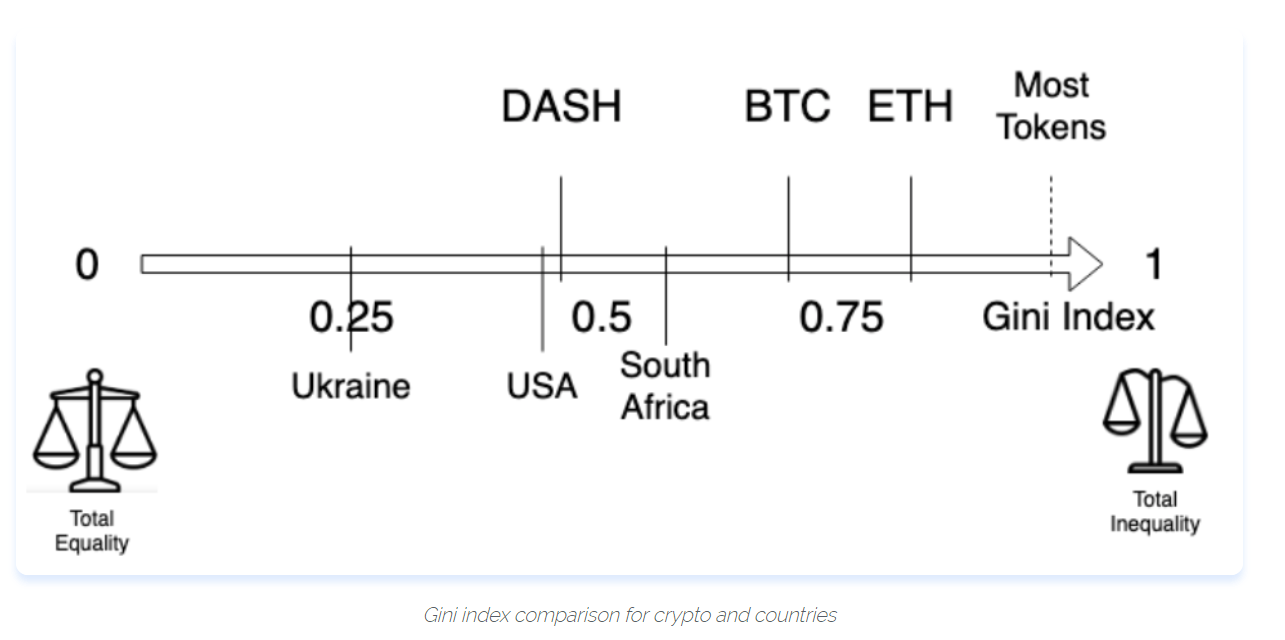

The wealth distribution is highly uneven in the world today and has been rising over the course of the 20th century, as outlined in Thomas Pikkety’s famous book Capital in the 21st Century. Recent research from PARSIQ shows that the GINI measure for Bitcoin is higher than South Africa’s, where the GINI measure indicates how far a country’s wealth is from a totally equal distribution. This data point has caused people to ask if the wealth disparities in Bitcoin, which seem to be worse than in the legacy financial system, are holding bitcoin back.

As a result, the distribution of wealth amongst crypto-assets has become a topic of lively discussion, with the motion debated by Vinny Lingham and Dan Held on a TruStory podcast. On-chain data shows that around 2 percent of bitcoin wallets own just over 80 percent of all circulating bitcoin, leading critics to argue that wealth concentration is preventing the crypto-asset from becoming sound money.

However, Bitcoin advocates argue that on-chain data is misleading, since wallets are not analogous with individuals. A person can own more than one wallet, or one wallet could represent more than one person. For instance, it is well known that bitcoin whales, who hold large amounts of the cryptocurrency, often break their holdings up into multiple addresses. Also, we know that some bitcoin addresses belong to exchanges and these addresses represent all of the individuals who are actively trading at that exchange.

The topic of Bitcoin’s wealth distribution ignited a lively discussion on Twitter following a live debate between Vinny Lingham of Civic and Dan Held, the creator of ZeroBlock and co-founder of Interchange – which was acquired by the crypto exchange Kraken. Lingham kicked off the debate by postulating if bitcoin rose to $10 million dollars, would it be a problem for society if less than 1 percent of the population owned a large majority of the world’s wealth?

Held argued that bitcoin’s launch was the fairest that could be possibly be conceived, since Satoshi released the whitepaper two months before the project started and published the code publicly for everyone to start mining on January 3, 2009. While some may argue that Satoshi has somewhere close to 1 million coins and could amass a lot of wealth and power, Held argues that after ten years, the enigmatic creator of Bitcoin has not touched those coins and it is expected Satoshi will never move them, since he has indicated in the past he does not care about money.

Held also noted that every bitcoin gained by an individual was earned, either through buying or mining it, and it was not acquired through force or it was not reappropriated, which makes it different from other asset classes. Held also questioned the use of the GINI measure to look at the wealth disparity in bitcoin, as it is used to measure wealth inequality within a country, and there is no use of GINI for assets like gold. On top of that, it is difficult to get the data needed to assess wealth concentration not just for Bitcoin but for assets like gold.

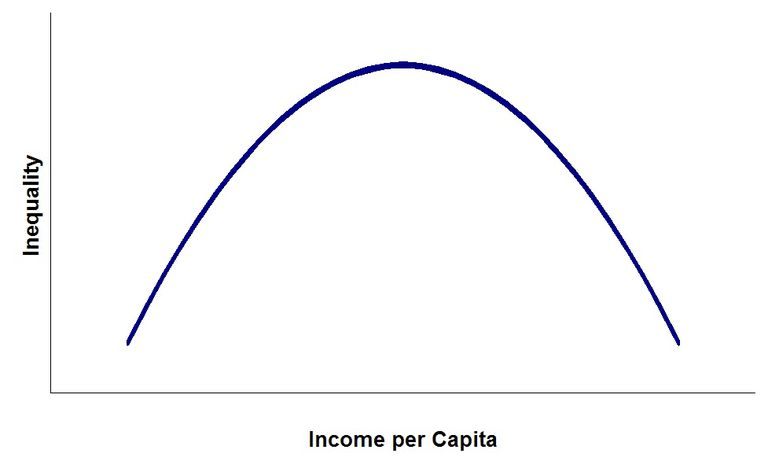

Another important point to consider is that Bitcoin is still a very young ecosystem. Economic theory suggests that economies experience rising inequality over time as the system grows and efficiency is achieved. A few people get wealthy as the economy developed but then a point is reached where more resources are exploited and inequality starts to decline as participation in productive activity increases.

The relationship between economic activity and inequality is known as the Kuznets curve, illustrated below.

So the debate around the wealth concentration of bitcoin could be premature. The system is still developing and is just over ten years old. As more and more participants join the Bitcoin ecosystem, we can reasonably expect that inequality follows the pattern outlined above.

For instance, large bitcoin holders start businesses and employ people from outside the Bitcoin ecosystem, with bitcoin news organisations serving as a good example of this. As large bitcoin holders start businesses or spend their gains, there is a trickle down effect that helps to reduce inequality.

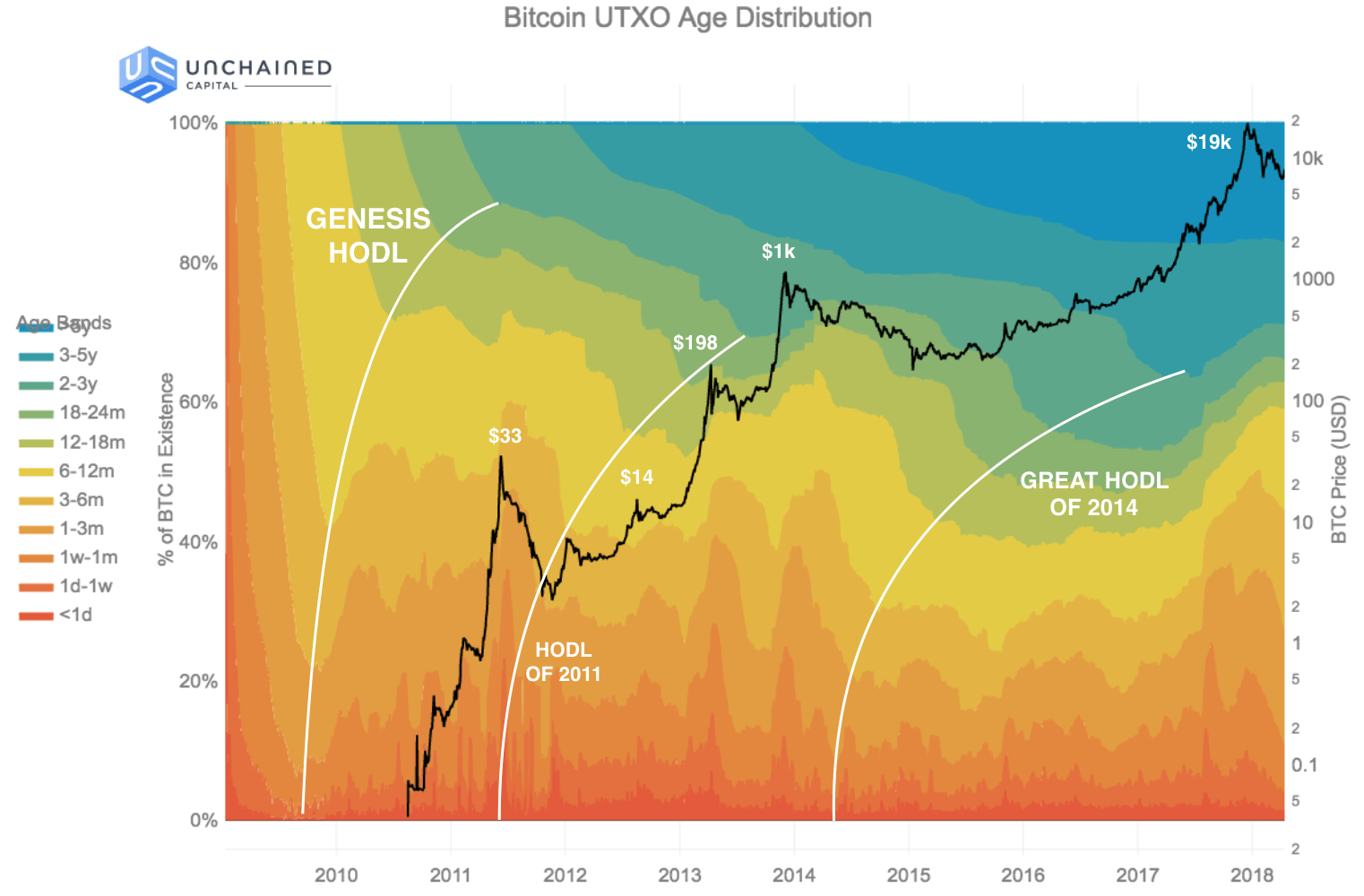

HODL Waves Show that Bitcoin Distribution has Improved

Arguing in favour of the motion that the distribution of bitcoin will improve over time, Held pointed to HODL waves, illustrated below. The HOLD waves analysis published by Unchained Capital that shows as the price of bitcoin rises, a large number of bitcoins are transacted – suggesting the ownership of those bitcoins are changing hands. As people feel more wealthy, they cash out their bitcoin gains to buy something and a new holder buys those coins, acting as an equalizing mechanism over time.

An important point raised in the TruStory debate is that Bitcoin circulated freely for a year and a half with no value attached to them. Early adopters took a massive risk by holding onto bitcoins from the early days and there were no guarantees that it would ever become valuable. Critics of bitcoin’s wealth distribution seem to go against the mechanics of capitalism itself, with the large bitcoin wealth a reward for early adoption.

Compared to other asset classes, you generally need permission of some sort, think VC’s and trading commodities. However, with Bitcoin, anyone can run the software, so while the equality of outcome may not be perceived as desirable, it is hard to argue that the equality of opportunity was not present for Bitcoin.

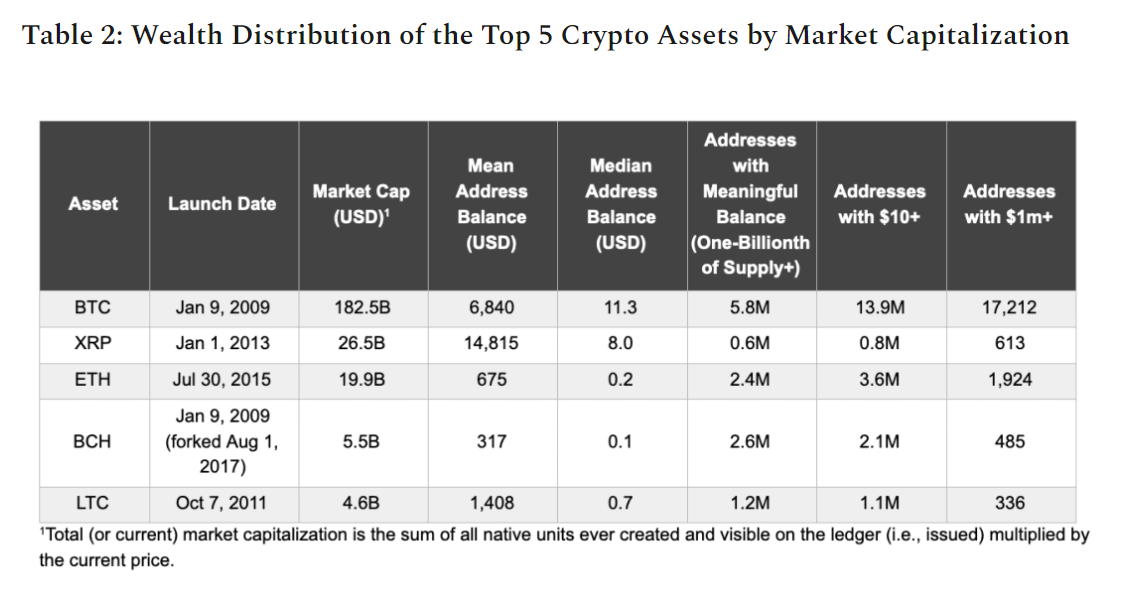

While a lot of commentators focus on using the GINI measure of inequality, a post from Coinmetrics analysed other measures for the top crypto-assets to provide a comparison. The results show that 5.8 million bitcoin addresses have a meaningful balance, which is defined as one billionth of the total supply. The number of addresses with more than $10 is also way higher in Bitcoin (13.9 million) as compared to the other top crypto-assets, such as 3.6 million for Ethereum.

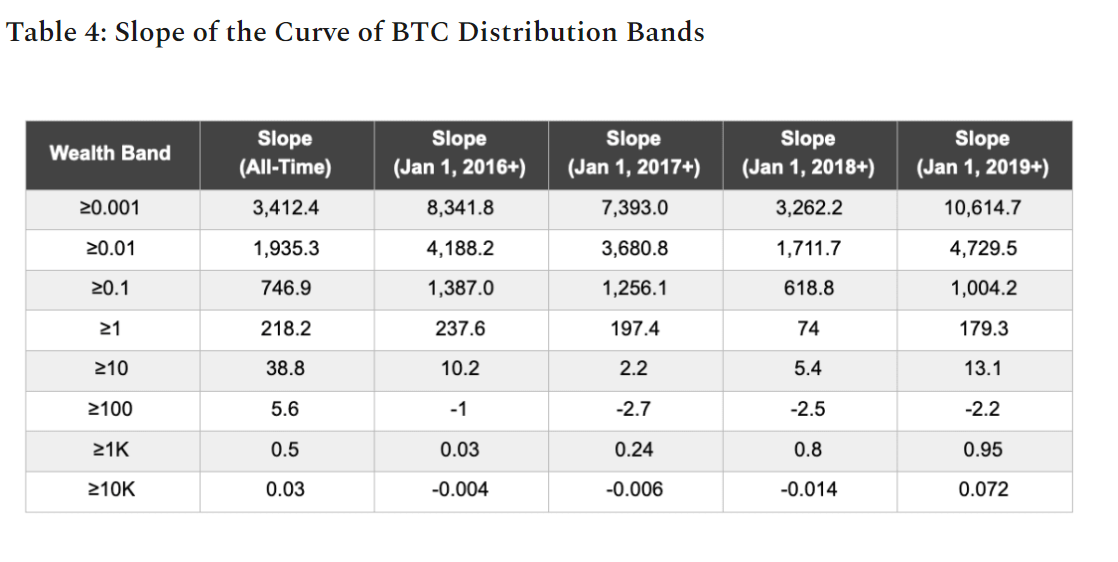

Coinmetrics also looked at the wealth distribution over time, illustrating the current rate of distribution using the number of addresses with X amount of Bitcoin. The table below shows how the distribution has changed over time and suggests that every day, we expect 179 new addresses to hold at least one bitcoin, according to the slope from January 2019.

As the numbers above show, 2019 shows the highest rate of new addresses holding at least 0.001 bitcoin, suggesting that 10,614 new addresses will hold at least this amount every day. The number of addresses holding at least one bitcoin has fallen over time, but has increased for most other wealth bands, showing positive progress over the past three years or so.

Bitcoin Inequality as a Function of Existing Inequality

Another way of looking at inequality in Bitcoin removes the need to look at data on addresses. Bitcoin analyst and derivatives trader Bambou Club looked at the distribution of bitcoin a few in September 2017 using a unique method.

Making the assumption that a power law applies to the distribution of bitcoin and that it very much mirrors the distribution of global wealth is not too far fetched, as resources are required to mine and purchase bitcoin. While you could mine bitcoin on your laptop with ease in the early stages, as the ecosystem evolved so did the requirement to mine a block and be rewarded with the block reward.

The power law applies to a lot of natural phenomena but one adjustment was made to the model to account for early miners who control a lot of bitcoin – as there is no parallel concept for global wealth. Bambou Club also used traffic statistics to bitcoin sites to arrive at an estimate of 25 million bitcoin holders.

Combining these assumptions, the results show that the richest 30 percent of bitcoin owners control almost 99 percent of the supply – of course, these assumptions are from September 2017 and may have changed significantly since then.

What Can be Done About Inequality in Bitcoin?

Whether or not inequality is a problem worthy of attention is as much as a philosophical question than it is an economic one. To those who believe in free markets and capitalism, inequality does not matter much as the capitalist system rewards those who risk their capital. Either you take the risks or you don’t, and the choices of different individuals produces these inequalities we observe.

For those more leaning towards socialism or democratic socialism, inequality is important as it affects people’s quality of life and our wellbeing is largely determined by how well we are doing as compared to those around us.

Some people buy bitcoin not to be rich, but because they want to avoid being poor. As a fascinating experiment in monetary economics, Bitcoin is still very young and has a lot of room to develop. It could be the case that Bitcoin revolutionizes the financial system and hyperbitcoinization pushes a lot of people out of poverty, to such an effect that inequality may not matter as much if everyone can meet their basic needs since the purchasing power of bitcoin is designed to increase, not decrease as with fiat money, over time. Also, by destroying the government’s ability to inflate bitcoin, using bitcoin as a reserve currency would no doubt have a positive impact on income inequality, which has soared since the end of the gold standard in 1971.

However, the flip side is that we replace our current system with a similar system, but with a new aristocracy instead and it is hard to say whether that would be more desirable than the system we have now.

But one thing that affects inequality is education. As people become more educated, the opportunities available to them increases. Similarly, the more people that are educated about Bitcoin, the more buyers there will be and will speed up the process of the HOLD waves. Therefore, one way to decrease inequality in Bitcoin is to educate people about how money really works and what Bitcoin does to solve the issues with the legacy financial system.

Since there is no government or central entity in bitcoin, there are no redistributive processes for bitcoin holders to tax wealthy holders and transfer benefits to poorer holders. All solutions to Bitcoin’s wealth concentration will be market-based solutions. Since financial inclusion is another key determinant of inequality, a suggested market solution for Bitcoin’s wealth concentration is to build services that allow individuals in developing countries with no access to financial services to access, and gain a stake in, Bitcoin.

For instance, the Lolli service provides cashback in the form of bitcoin when buying goods from one of their partners – giving people an easy way to be included in the Bitcoin ecosystem. The problem is, this service is limited to the US, and a similar service targeted at countries with low financial inclusion could help reduce inequality within Bitcoin, by giving more people a chance to earn bitcoin.

As for whether it is an urgent problem for Bitcoin, it is probably too early to worry about inequality now since the ecosystem is still developing. No one would consider inequality an issue for developing countries like China or India yet, as they are still going through the process of economic development. Once Bitcoin reaches critical mass and proves itself as a form of sound money and alternative to fiat, then maybe the issue of inequality deserves more attention.