The Key Cryptocurrency Talking Points so Far in 2019?

Despite prices being down, there is no shortage of discussion taking place on key topics in the blockchain and cryptocurrency industry. We have already seen a lot of major movements taking place in 2019 already. New cryptocurrencies have been launched and existing technologies are continuing to be developed. In this latest Cryptolinks update, we take a delve into the key talking points surrounding cryptocurrencies and blockchain so far in 2019.

Security token offerings (STOs) versus initial coin offerings (ICOs)

The last two years have been huge for ICO’s. Over $6 billion was raised in 2017 and over $7 billion was raised in 2018. After numerous exit scams and poor projects raising funds over these past two years, there is now an increasing move towards STOs. The key difference here is that the token registers as a security and will be subject to regulations. It will cost the founding team more money but will provide more protection to investors. A number of STO marketplaces have been launched to facilitate this increased move towards STOs such as tokenget.com.

Block Size Debate

The block size limit in the bitcoin protocol has been a point of debate as far back as 2010. The debate particularly intensified from 2015 to 2017 and ultimately resulted in Bitcoin Cash forking the code to increase the block size limit. The debate has been reignited again recently but in the opposite direction. Bitcoin core Luke Dash Jr has been proposing to decrease the block size limit via a soft fork and the community is relatively split over whether this is a good idea. Many view it as unnecessary. The main reason for decreasing the block size limit would be allowing more users of the network to run their own full node. This debate is still very much ongoing and it will be interesting to see how it plays out in 2019.

Lightning Network

The lightning network is a payment channel built on top of the bitcoin blockchain which has been proposed as a potential solution to Bitcoin’s scalability issues. The whitepaper for the idea was published back in 2016 but the project is starting to pick up more momentum and adoption recently. The lightning network still remains very much in the phase where development is still ongoing and improvements need to be made before it can be widely used. We are nonetheless seeing significant developments for this second-layer solution. For those who wish to run their own lightning network node, the Casa node is an option to easily set up both a bitcoin full node and a lightning network node.

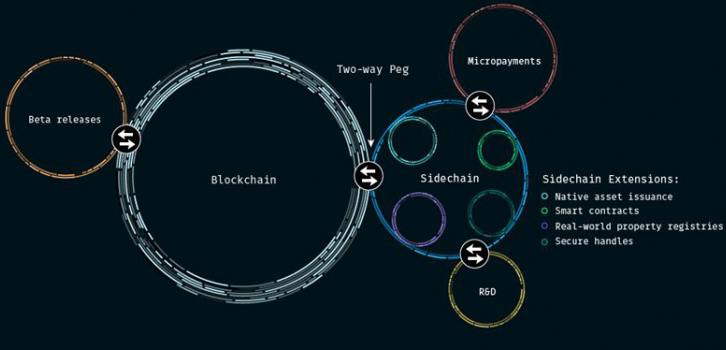

Sidechains

On a similar note, sidechains are another second-layer solution which is seeing increased interest and some increased adoption. Sidechains function similar to payment channels like the lightning network and are essentially chains which are built on top of the blockchain. Blockstream, a company that focuses on developing products on the Bitcoin blockchain, has launched their sidechain liquid.

Privacy & Fungibility

Privacy has been a prime topic at the start of 2019. It has been a topic of much discussion before with heated debates taking place around the technological approaches of cryptocurrencies such as Zcash and Monero. We are seeing different approaches being applied in 2019 with a number of cryptocurrencies launching that have implemented the MimbleWimble blockchain that emphasizes privacy. These cryptocurrencies include Grin and Beam and it is likely that they will become even more widely known and discussed as the year progresses. This also ties in with the topic of fungibility in cryptocurrencies. Protocols which protect privacy such as projects using the MimbleWimble blockchain have complete fungibility for their cryptocurrencies. However, the creation of blockchain companies such as Chainalysis means that bitcoin may not be fungible and some bitcoins may be treated differently due to being involved with illegal activities in the past. Fungibility remains very much an uncertain issue and 2019 may shed some more light on this topic.

Commercialized Options versus Free Alternatives

As the cryptocurrency ecosystem continues to develop and people become more familiar with products and how to use them it is likely that we will see businesses such as BitPay struggle as their potential customers decide to go with cheaper alternatives. For example, BTCPay server provides a free and open-source alternative which allows merchants to manage their own nodes and channels. While this process may take a while as many merchants will still pay fees to businesses such as BitPay to manage their payments and act as their custodial, we may see an increasing move to alternatives take place throughout 2019.

Regulation and Institutions Arriving

Talk of regulation and institutional capital has been a big topic of interest since 2017. With exchanges such as Bakkt and ErisX waiting for CFTC approval prior to launching, it remains a more relevant topic than ever. Some shuffles to the regulatory landscape were made in 2018. Binance moved operations to Malta in response to Malta passing through legislation to provide regulatory oversight to businesses operating with cryptocurrencies and blockchain. Bittrex also plans to launch Bittrex International in Malta which will have a streamlined process for listing tokens. 2019 is bound to have more talks in relation to regulation and