New Research Highlights Volume Manipulation From Top Cryptocurrency Exchanges!

Recently released research by CoVenture, an alternative asset manager with a division dedicated to cryptocurrencies, has highlighted that we cannot trust the volume figures we see for exchanges in a lot of cases. The report delved into different ways that exchanges artificially pump up their transaction volumes. The report was generated using data and research compiled from CryptoCompare, CoinOne, and the Blockchain Transparency Institute.

Who are the main culprits?

Several exchanges which are commonly among the top exchanges by trading volumes on CoinMarketCap have been identified as having as little as 1% of their reported volume as being actual volume. Some of the exchanges highlighted in the report for having questionable volume are the following:

- Bithumb

- ZB

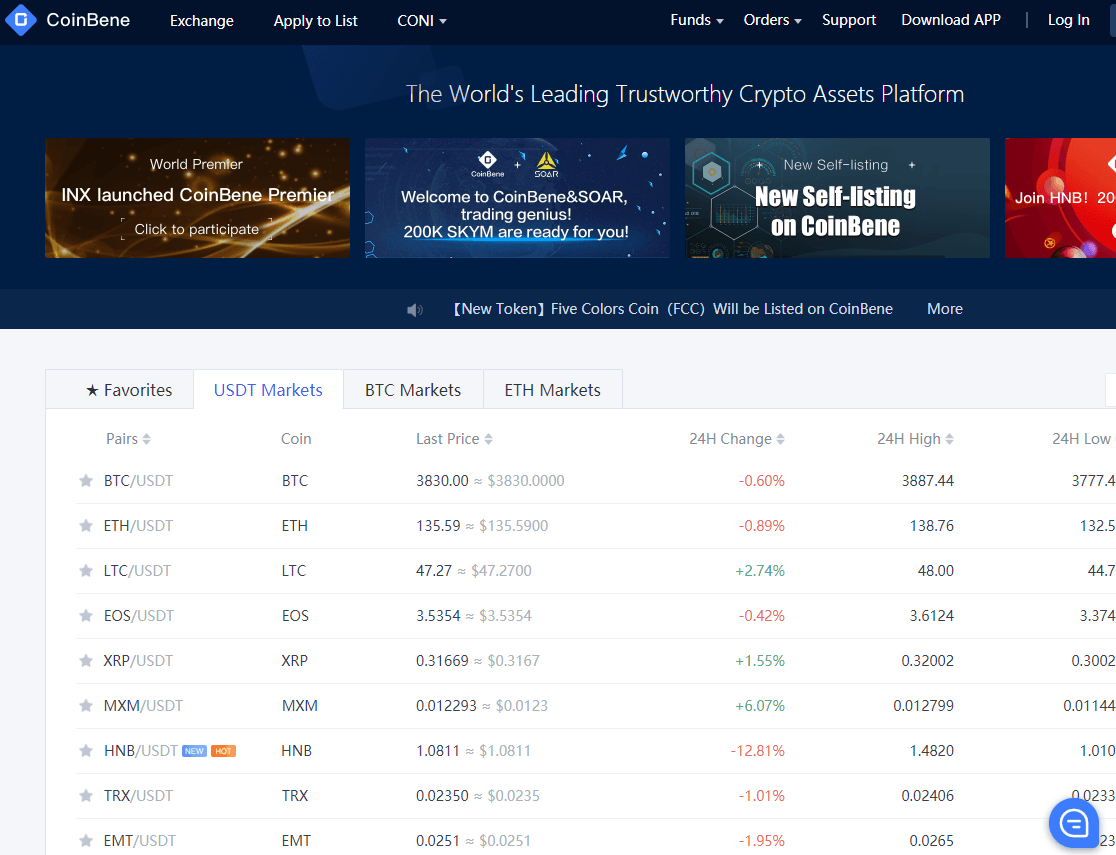

- CoinBene

- EXX

- Fcoin

- OKEx

- OEX

What are the ways that the exchanges manipulate their volume?

The main way that exchanges can artificially inflate their volume is through wash trading. Wash trading is effectively the exchange buying and selling their own products serving to pump up their volume figures. Wash trading is an illegal practice in the traditional markets but the lack of regulation for cryptocurrency businesses has made it possible for exchanges to conduct this practice without any repercussions. It is difficult to prove wash trading exists but a number of factors can make a strong case for showing exchanges conduct this practice. Factors such as a high number of API trades taking place, lack of volatility despite a high number of trades, and repeated trades taking place at the same price are all indicative of wash trading.

The second way that cryptocurrency exchanges are artificially inflating their volume is a relatively recent phenomenon known as transaction fee mining. Typically, exchanges make money from taking a fee from traders when they place trades. Transaction fee mining has flipped this model on its head and has actually compensated traders in the exchanges native token for making trades. The regular trading fees are collected in crypto or fiat but the traders are afterwards reimbursed in the native token of the exchange. Traders are often reimbursed in excess. For example, a trader may be reimbursed 120% of what they paid in trading fees. This provides traders with a greater incentive to make a high number of trades. The report noted that 12% of cryptocurrency exchanges had a transaction fee mining model. Some examples of exchanges that apply this model are CoinBene and Bit-Z.

It is also worth noting that exchanges will often have their own proprietary trading desk where they can profit from the movements that take place on the exchange. Exchanges often claim the reason for the existence of these proprietary trading desks is to add liquidity to the exchange. However, the proprietary trading desks can often make large amounts of profit and have the advantage of being able to benefit from data not accessible to normal users of the exchange.

What are some alternatives that can be used?

CoinMarketCap remains the most popular source of information and data on cryptocurrencies. However, CoinMarketCap includes exchanges that conduct wash trading and transaction fee mining in their rankings. CoinMarketCap makes no adjustments for the reported figures and does not mark the exchanges which use the transaction fee mining model.

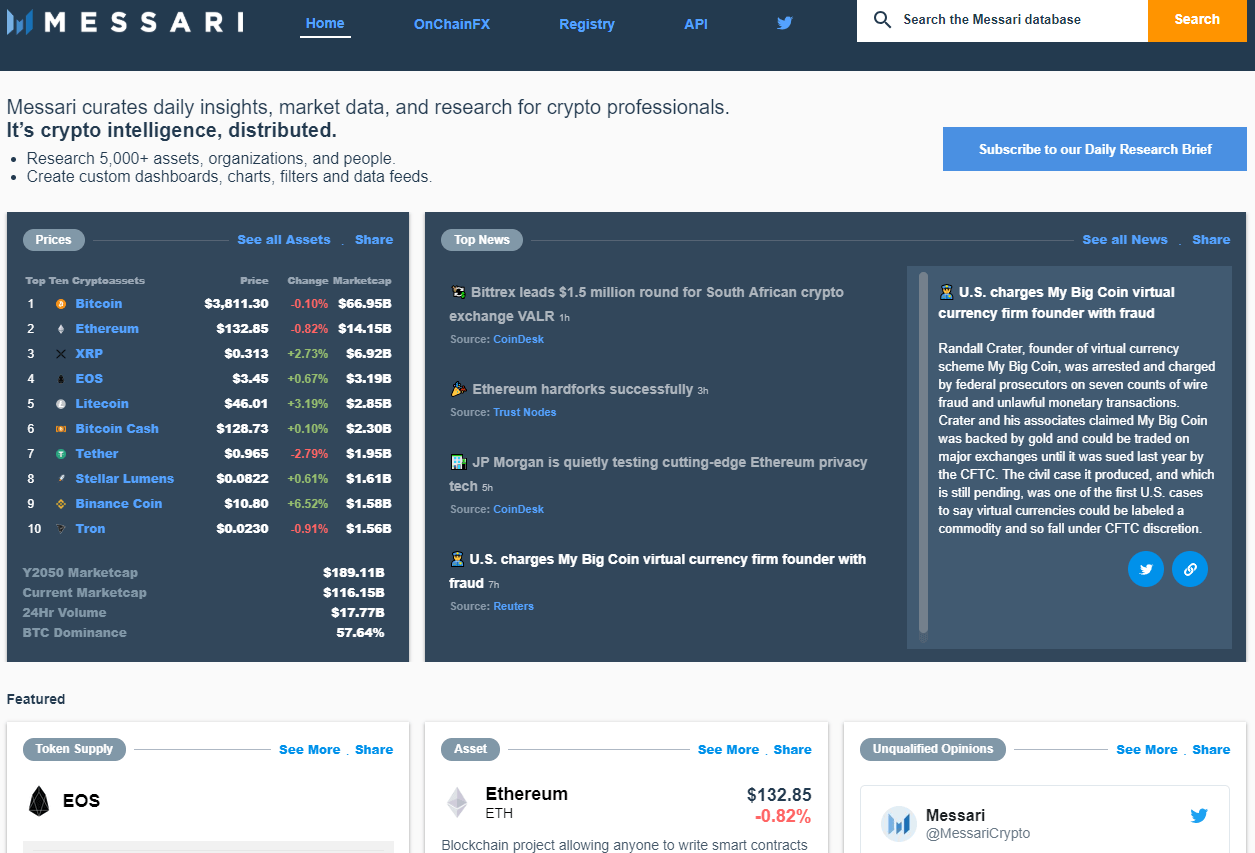

There are many alternatives that can be considered apart from CoinMarketCap. Some data providers clearly note the exchanges which have transaction fee mining. Others such as Messari have made adjustments to some of their trading figures.

There were also a number of exchanges which were noted to have high amounts of liquidity. The exchanges to have been noted to be the most stable from the report with most accurate volume figures were the following:

- Bitstamp

- Kraken

- Bitfinex

Anything else interesting from the report?

The report also mentioned research spanning from December 2011 to April 2016 that found a statistical tie between bitcoin returns and volume figures. However, more recent figures from research spanning from December 2016 to March 2018 shows that the statistical tie has broken down. The recent research also analysed whether there was a link between USD Tether issuance and bitcoin returns. Although it was found that the issuance of tether has a small impact on trading volumes in bitcoin and tether itself, the effect is short-lived and has no link to bitcoin returns. This was an interesting finding of the research as many analysts have referred to the issuance of tether as a key factor impacting price performance.

What can I do?

Practically, there are a number of good takeaways which can be taken from the research. It proves that any volume figures should be taken with a grain of salt. The bitcoin mantra of “don’t trust, verify” stands strong in light of this research. One of the most important considerations to take into account when choosing an exchange is liquidity. Trading on an illiquid exchange poses a high risk of volatile price movements. For this reason, the most practical piece of advice that can be taken from the research is to pick the exchanges that have built up a considerable reputation over the years. The research noted that four of the five exchanges that are likely to be reporting actual volume were in existence since 2014 at the latest. The fifth was Binance.