Breaking Down Coinbase Pro Listing XRP

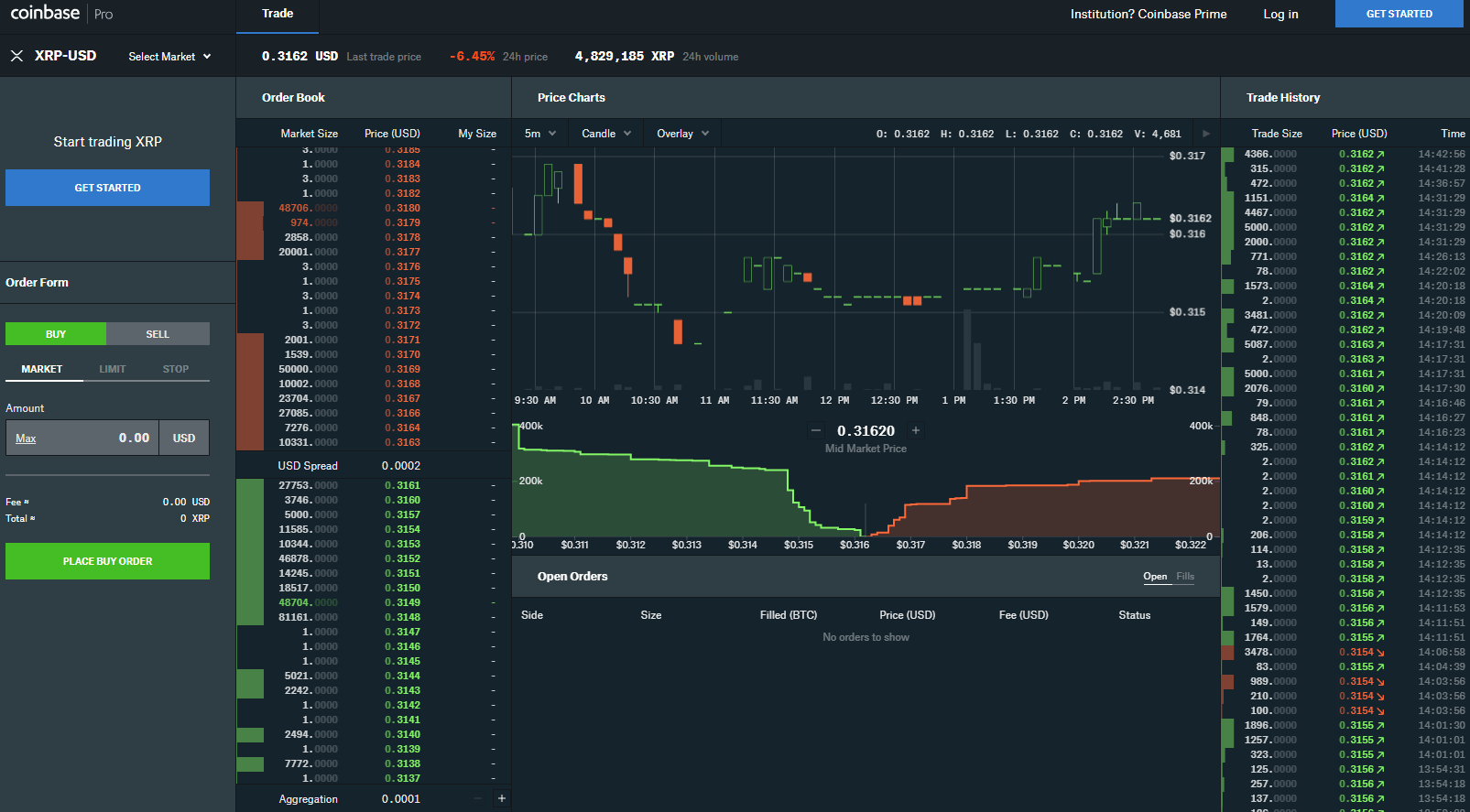

Traders and XRP enthusiasts alike have long been anticipating the listing of the third largest cryptocurrency by market cap – Ripple’s XRP – to Coinbase. Coinbase, one of the first and largest cryptocurrency exchanges, announced that they are adding support for XRP. The listing will take place in several phases which will progress from the exchange initially only accepting deposits to finally facilitating both limit and market orders. This several step rollout will be done to ensure sufficient amounts of liquidity. Coinbase has been operating since 2012 and has built up a reputation as one of the most liquid and trusted cryptocurrency exchanges.

When XRP?? Now! XRP/USD, XRP/EUR, and XRP/BTC order books will soon enter transfer-only mode, accepting inbound transfers of XRP in supported regions. Orders cannot be placed or filled. Order books will be in transfer-only mode for a minimum of 12 hours. https://t.co/MWUtUm4wRh

— Coinbase Exchange 🛡️ (@CoinbaseExch) February 25, 2019

XRP will initially only be available for Coinbase Pro users which is Coinbase’s service tailored for advanced and professional traders. It is expected that Coinbase will progress to adding the asset for non-pro users. Coinbase has generally added new assets for general users within weeks of listing on Coinbase Pro.

To List or Not to List? – A History of the Lead Up to Coinbase Listing XRP

It is a significant event for a coin to be listed on Coinbase due to its large user base. As of May 2017, Coinbase had over 20 million users, as many as Fidelity Investments. To assess the significance of Coinbase listing XRP, it’s worthwhile to take a look at the history leading up to the event.

In January of 2017, Coinbase and Coinbase Pro (formerly known as GDAX) only had bitcoin, ether, and litecoin available for trading on its exchange. It has long been a topic of heated discussion among cryptocurrency enthusiasts and especially XRP fanatics whether or not Coinbase should list XRP to its platform.

While many pointed to the large market cap of XRP has a clear reason for Coinbase to list XRP, there remained some solid reasons not to list. XRP’s questionable status in terms of whether it is a security along with its distinctly different node structure than blockchains such as bitcoin acted as key barriers to XRP being listed to Coinbase.

XRP started 2017 trading on exchanges such as Bitstamp at less than $.01. XRP saw a rapid rise to its value during the euphoric price increases of 2017, closing the year at $2.30. Rumours of a Coinbase listing drove the price up even further at the start of 2018 with price reaching an all-time high around the $3.50 mark. Altcoins such as ether, litecoin, and bitcoin cash all saw meteoric rises after being listed on Coinbase. This likely played a large role in the price increases with many speculators believing the price will increase even further upon listing. Months came and went without any sign of Coinbase listing XRP. Many gave up hope of Coinbase ever listing XRP.

In September of 2018, Coinbase announced changes to its listing process. The new listing process would enable a more streamlined process for listing cryptocurrencies and Coinbase also mentioned several cryptocurrencies it was considering listing. XRP failed to make the list of cryptocurrencies Coinbase was considering.

Coinbase proceeded to list several cryptocurrencies including 0x Project, Basic Attention Token, and Zcash. Many reacted in a similar way to early cryptocurrencies listed to Coinbase and underwent quick price increases upon listing. Somewhat shockingly, Coinbase did not list XRP in 2018. Many viewed barriers such as the more centralized node structure and questionable legal standing as insurmountable objects to a listing taking place on Coinbase. However, with all other major exchanges listing XRP, Coinbase may have been afraid of losing their dominance in the exchange business.

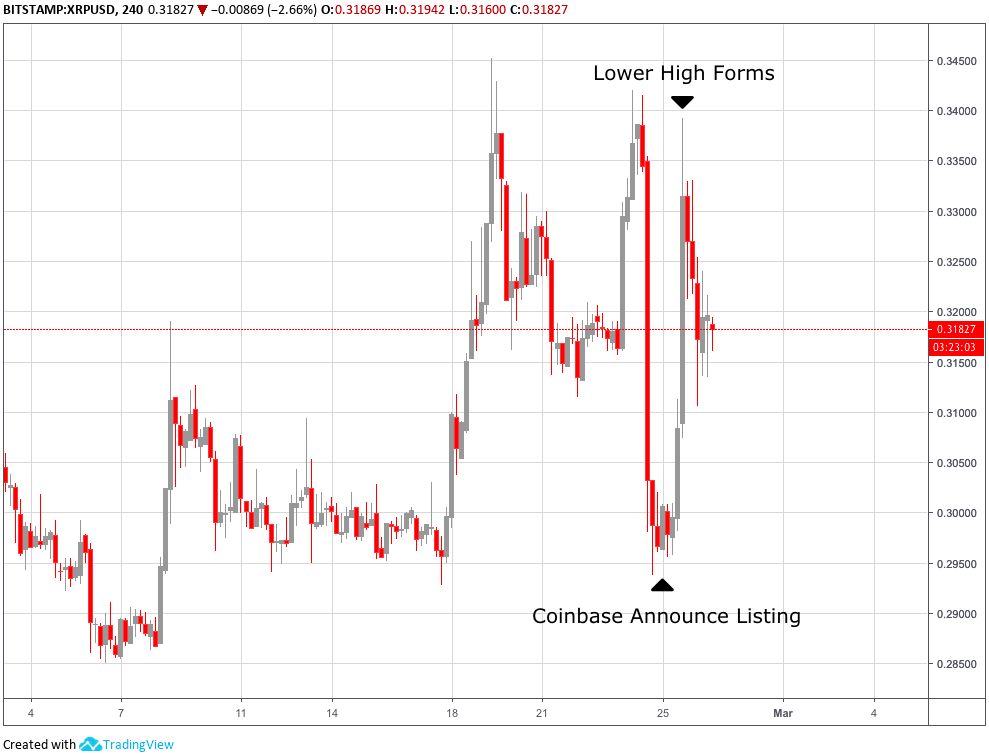

How has the Price Reacted?

XRP fanatics and hodlers have long been anticipating XRP listing to Coinbase Pro. Many believed a listing would spark huge amounts of fiat investment into XRP resulting in a significant price increase. While the price has increased upon listing, it has not undergone an extraordinary appreciation. Price failed to form a higher high on its initial increase and has since started to reverse at the time or writing. It has yet to be seen whether this will be followed up with another wave of buying. So far, XRP has underperformed in relation to the high expectations set by XRP fanatics.

What’s Next for XRP and how will the Coinbase Listing Affect it?

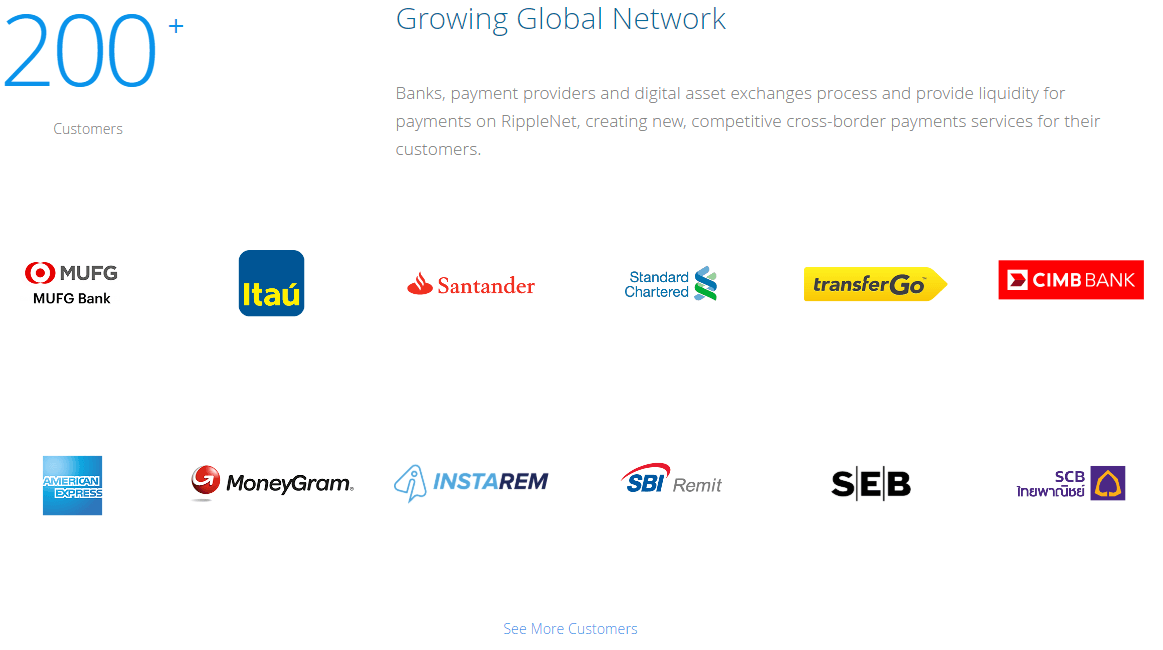

Ripple has also continued to build on its network of 200+ payment customers including adding customers such as Santander, Standard Chartered, American Express, and MoneyGram. Although these payment customers are not directly linked to the XRP cryptocurrency, these developments along with listing to Coinbase mark increased progression in Ripple working towards its aim. Ripple’s goal is to create the internet of value where money can move as quickly and as freely as information.

Nonetheless, big question marks still remain about XRP. Where will it stand with securities regulators such as the Securities and Exchange Commission? Is it’s node structure suitable for blockchain technology or is it giving up the key benefits of decentralization? Does the company Ripple have too big of a role to play in the operation of the XRP blockchain and the cryptocurrency XRP? There is also the matter that 55 billion of the 100 billion XRP are held by the Ripple company.

While XRP listing to Coinbase Pro is a big development that speculators have been anticipating since 2017, it remains to be seen whether it will have a big impact on the long-term value and viability of the XRP project. For the moment, it is just serving to add further volatility.

What’s Next for XRP and how will the Coinbase Listing Affect it?

Ripple has also continued to build on its network of 200+ payment customers including adding customers such as Santander, Standard Chartered, American Express, and MoneyGram. Although these payment customers are not directly linked to the XRP cryptocurrency, these developments along with listing to Coinbase mark increased progression in Ripple working towards its aim. Ripple’s goal is to create the internet of value where money can move as quickly and as freely as information.

Nonetheless, big question marks still remain about XRP. Where will it stand with securities regulators such as the Securities and Exchange Commission? Is it’s node structure suitable for blockchain technology or is it giving up the key benefits of decentralization? Does the company Ripple have too big of a role to play in the operation of the XRP blockchain and the cryptocurrency XRP? There is also the matter that 55 billion of the 100 billion XRP are held by the Ripple company.

While XRP listing to Coinbase Pro is a big development that speculators have been anticipating since 2017, it remains to be seen whether it will have a big impact on the long-term value and viability of the XRP project. For the moment, it is just serving to add further volatility.