Solana’s SKR Token Launch: The Mobile-Crypto Boost Nobody Should Ignore — And What DeFi Users Need To Know

Have you ever tried to swap $10 on your phone and somehow ended up asking yourself: “Why did this cost that much?”, “Did I approve the right thing?”, or “Wait… is this the real token?”

That’s the real fight right now: not “chain vs chain,” but crypto vs everyday convenience.

So I’m looking at Solana’s SKR token launch through one lens only: does it actually make mobile crypto easier? And if it does, what changes for DeFi users in 2026—fees, liquidity, incentives, security, and how people really behave when crypto finally feels “phone-native.”

If SKR is just hype, it’ll show up as a short spike in claims and a fast drop-off. If it’s real, we’ll see retained mobile users doing real transactions.

Listen to this article:

The pain: mobile crypto still feels harder than it should

Mobile is where the next wave of users lives. That’s not a “crypto opinion,” it’s just how the internet works now. The GSMA Mobile Economy reports have been beating this drum for years: more people are online because they have a phone, not because they bought a laptop.

And yet… a lot of “mobile crypto” still feels like someone squeezed a desktop finance dashboard into a 6-inch screen.

Here’s what I see over and over (and I’m betting you’ve felt at least two of these):

- Clunky onboarding (seed phrases, confusing backups, “where do I even start?”)

- Fees that feel random (network fee vs priority fee vs swap fee vs “why is it higher now?”)

- Risky signing flows (tiny popups, scary permissions, and zero plain-English context)

- Fragmented wallets (one app for swaps, one for NFTs, one for staking, and none of them agree)

- DeFi UIs built for desktops (you can do it on mobile… but it’s like doing taxes in a ride-share)

That’s why a mobile-friendly token launch matters. Not because “tokens are exciting,” but because distribution and incentives are the only things that reliably push users through friction—especially on a phone, where attention is short and trust is fragile.

Onboarding is the real bottleneck (not TPS)

People love arguing about TPS. Meanwhile, the average new user gets stuck way earlier:

- Seed phrases: writing down 12–24 words is simple… until you’re doing it in a noisy room, on a tiny screen, while hoping you don’t lose the paper.

- Bridges and funding: “Just bridge assets” is easy advice if you’ve done it 50 times. For everyone else, it’s the moment they bounce.

- KYC friction: sometimes required, sometimes not, sometimes “fast,” sometimes a weekend-killer.

- The ‘what now?’ gap: wallet installed… and then what? Which token? Which app? Which network? Which link is safe?

This is why tokens tied to mobile distribution can outperform “regular” launches. If SKR is designed to reduce those early drop-offs—by nudging users into a first successful action—then it’s not just another ticker symbol. It becomes a behavior-shaping tool.

And there’s a psychology angle here that’s been proven outside of crypto: reduce steps, reduce confusion, increase completion. The Baymard Institute’s long-running research on checkout UX consistently shows that complexity and friction crush conversions. DeFi onboarding is basically “checkout UX” with higher stakes and worse language.

If SKR helps simplify that first successful “I did it” moment on mobile, that’s the difference between:

- a user (they come back), and

- a tourist (they leave and tell friends crypto is annoying).

Micro-transactions + stablecoins demand cheap, instant settlement

Here’s the thing: the most common “real-life” mobile payments aren’t $5,000 buys. They’re small. Frequent. Sometimes impulsive. Sometimes social.

Think:

- Tipping a creator

- Mini-payments in communities

- In-game items that cost less than a coffee

- Subscriptions that renew automatically

- Sending stablecoins to family or friends (fast, low drama)

On mobile, a “transaction” competes with instant alternatives. If it takes too long, costs too much, or asks too many questions, people close the app. That’s why cheap fees + fast confirmations aren’t just marketing points—they’re required if you want crypto to behave like a modern phone payment experience.

Solana’s design has always aimed at that “it just works” feel: low-cost interactions and quick settlement. If SKR is built to push more mobile-native activity (instead of just rewarding screenshots and hype), it could amplify what Solana is already good at: making frequent actions economically sane.

And yes, DeFi users should care about this even if you personally never “tip.” Because micro-activity scales into:

- more swaps

- more stablecoin velocity

- more liquidity competition

- more incentive wars (the good kind and the messy kind)

Promise solution: what SKR changes (and what I’ll verify in this article)

I’m not here to sell you a dream or slap “bullish” on a headline. What I care about is what shows up in real usage.

So here’s what I’m going to check and translate into plain English as this unfolds:

- What SKR actually is (not vibes—real function and real constraints)

- How the launch is structured (distribution, incentives, and what behaviors it’s trying to create)

- How SKR is being used on mobile (is it reducing friction or adding another thing to manage?)

- What on-chain signals matter (the kind that reveal real adoption vs one-time farming)

- How DeFi users can position without becoming exit liquidity for the loudest posts

Now the big question: is SKR going to be a real mobile adoption engine… or just another “claim, dump, forget” token event?

Next, I’m going to lay out SKR + Solana in plain English—what’s launching, who it’s for, and why this timing matters—so you can judge it without guessing.

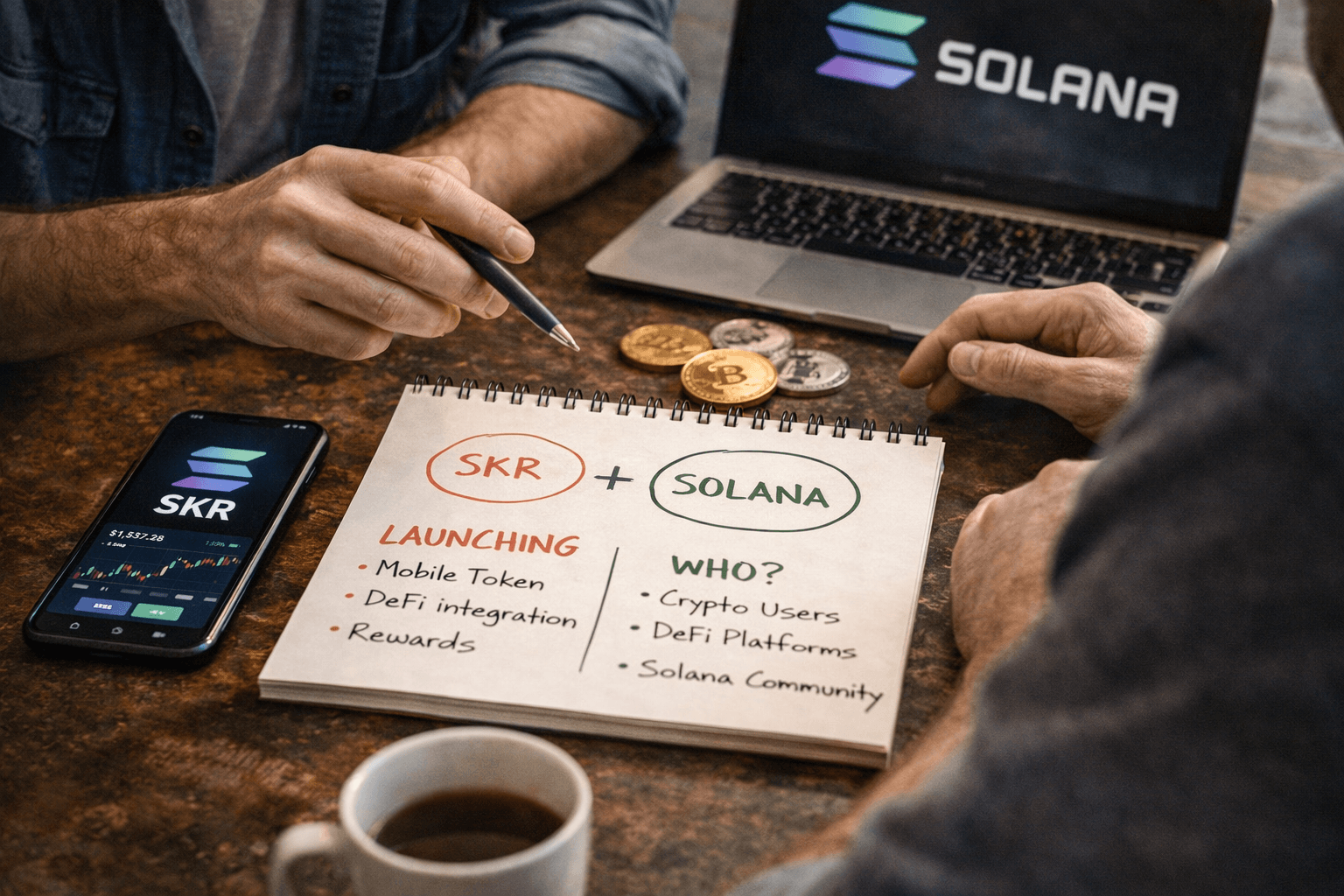

SKR + Solana in plain English: what’s launching, who it’s for, and why now

When people hear “new token launch,” their brain goes straight to price charts. I get it. But with SKR, the interesting angle (at least for me) isn’t the first candle. It’s the distribution + behavior design behind it.

Here’s the cleanest way I can explain SKR without the marketing fog:

SKR looks like a mobile growth token: it’s designed to push real on-chain actions from phone users (payments, swaps, staking, lending, LP), using incentives that are cheap enough to run at scale on Solana.

That “cheap enough to run at scale” part matters. A reward system that costs $0.40 per action dies fast. One that costs fractions of a cent can actually stay alive long enough to change habits.

What SKR is not (and I’m saying this bluntly because it saves people money):

- Not guaranteed profit just because it’s new.

- Not automatic “free money” because incentives always come with rules, caps, timelines, and competition.

- Not a substitute for due diligence on token address, app authenticity, unlocks, and farming dynamics.

The mental model I’m using while tracking this launch is simple:

Mobile growth token + ecosystem incentives + user acquisition loop.

Incentives bring users in → users do actions → apps/DEXs get volume → liquidity deepens (sometimes) → experience improves → retention rises (if the product is real).

The big “if” is retention. Anyone can buy attention for a week. The question is whether SKR helps build repeat behavior instead of one-time airdrop tourism.

Quick Solana summary (for anyone new)

Solana is a Layer-1 blockchain optimized for fast confirmations and low transaction fees. In normal-person terms: it’s one of the few chains where doing lots of small things—swaps, transfers, game actions, NFT mints, limit orders—doesn’t feel like you’re paying rent every time you tap a button.

That’s why it’s been popular for:

- DeFi (DEX trading, perps, lending)

- NFTs (lower-cost minting and trading)

- Payments and stablecoin transfers

- Mobile-first apps where people expect “tap → done”

If you want the baseline overview and market data, I still point people to CoinMarketCap’s Solana page because it’s quick and neutral:

https://coinmarketcap.com/currencies/solana/

One note I always add: you’ll see a lot of “theoretical TPS” talk online. What matters to users is real-world throughput under load, uptime, fees, and how often an app flow fails. In 2026, the chain that wins mobile isn’t the chain with the best slogan—it’s the chain where a normal person can complete a transaction without sweating.

Why Solana has been moving up recently (the demand story)

When SOL trends up, people love to argue narratives. I prefer checking measurable demand signals first, then matching the story to the data.

Here are the signals I watch because they’re harder to fake than vibes:

- On-chain activity: more signers, more transactions that represent real app usage.

- Fee revenue patterns: not just “fees high,” but “fees consistently paid because people are doing stuff.”

- Stablecoin settlement growth: if users are moving stablecoins, something real is happening (trading, payroll, payments, remittances).

- Developers shipping: new products, updates, integrations—especially wallets and UX improvements.

- Derivatives positioning: useful as a temperature check, not a crystal ball.

This MEXC piece is a decent example of how exchanges frame the “why is Solana moving” question (use it as one input, not gospel):

https://www.mexc.co/en-PH/news/504348

The short version: Solana doesn’t need everyone to love it. It needs enough users doing enough transactions that the network becomes the default for certain behaviors (especially the ones that happen on a phone).

Why Solana keeps growing in 2025 → 2026: stablecoins + real usage

Stablecoins are the most “boring” part of crypto—and that’s exactly why they’re powerful.

If you see stablecoin usage climbing on a chain, you’re often seeing one (or more) of these realities:

- People are using it as a payments rail (send money like a message).

- Traders are rotating capital faster, which increases DeFi velocity (swap → LP → lend → repay → swap).

- Apps are quietly building retention because stablecoins reduce friction: users understand “$10” better than “0.0062 SOL.”

DL News covered this stablecoin angle around Solana’s momentum, and it matches the framework I use when judging “real usage vs hype”:

https://www.dlnews.com/articles/markets/why-solana-stablecoin-action-boomed-over-2025/

Now connect this back to SKR: if SKR incentives nudge more mobile users into stablecoin transfers and routine DeFi actions, that’s not just “engagement.” That’s habit formation. And habits are what make liquidity sticky.

What “mobile crypto adoption” actually means (metrics I care about)

“Mobile adoption” is one of those phrases that sounds good and explains nothing. So I track it like a product manager, not a meme account.

If SKR is supposed to boost mobile usage, these are the KPIs that should move (and stay moved):

- New wallets created (but filtered for quality—see retention below).

- Retention: 7-day, 30-day, 90-day return behavior.

- Daily active signers: how many unique wallets are signing transactions daily.

- Stablecoin transfer count: boring, consistent, meaningful.

- Swap volume from mobile dApps: not just total volume, but volume that starts on phone-native interfaces.

- Average transaction size: are people doing $2–$20 actions (true mobile behavior) or just whales moving size?

- Repeat behavior: does the same user swap again next week without needing a reward?

A launch that produces a million “claims” and no retention is not adoption. It’s a one-time marketing event with gas fees.

How SKR could boost mobile adoption (the playbook)

I’ve reviewed enough crypto products to notice patterns that actually work—especially in 2026, when users are allergic to anything that feels like homework.

Here’s the playbook that tends to create real behavior change, and how SKR could fit into it:

- Subsidized fees / fee credits onboardingIf a new user’s first experience is “why did it cost money to try this,” you lose them. Fee credits (done transparently) can turn the first week into smooth onboarding.

- Rewards for real actions (not vanity tasks)I’m talking about: swap a small amount, send a stablecoin, stake, lend, provide liquidity, repay—things that prove the user learned the flow. “Follow us + like + join Discord” doesn’t build on-chain fluency.

- Partnership railsWallets, phone-native apps, merchants, gaming studios—partners that already have distribution. This is where mobile wins are made, because users don’t want 12 installs and 4 seed phrases.

- Referral loops that don’t feel scammyThe referral system should reward successful onboarding and safe behavior, not spam. In other words: reward “my friend made their first swap and used a passkey,” not “my friend clicked my link.”

This is where Solana’s strengths matter: low-cost interactions allow incentive-heavy growth without the whole thing collapsing under fee overhead.

A practical example of what I mean: imagine SKR rewards users for making three stablecoin payments under $5 in a week (coffee, subscription, tipping). That sounds small, but it creates the “I can use this like an app” moment—and those moments compound.

What it means for DeFi users in 2026 (the real implications)

If SKR does its job and pulls more mobile users on-chain, DeFi doesn’t stay the same. It shifts—sometimes in your favor, sometimes not.

Here’s how I see the knock-on effects:

- More users → more swaps → deeper liquidity (sometimes)More flow can tighten spreads and reduce slippage on majors. But it can also concentrate liquidity in whatever pools incentives push, leaving other pairs thin.

- Incentive wars → short-term APR spikes, then normalizationWhen rewards go live, APRs can look ridiculous. Then emissions taper, farmers rotate out, and “permanent” yields settle closer to fee-driven reality.

- More retail flows → more memecoin volatilityMobile-first users love simple narratives and fast trades. That can create opportunity, but it also amplifies wick games, fakeouts, and liquidity traps.

- Bigger attack surface → scams shift to mobileAs soon as mobile grows, scammers follow the path of least resistance: fake apps, spoofed token tickers, “support DMs,” poisoned search ads, and malicious signing requests designed for small screens.

The DeFi mindset I use here is:

Where will liquidity rotate if SKR incentives reward specific actions?

And: which user behaviors change when the average user is mobile-first?

Risks I’m watching (so we don’t get blinded by a hot launch)

I like growth launches. I also like keeping my readers out of avoidable messes. Here are the risks I watch every single time a token is tied to onboarding incentives:

- Unlock schedules: sudden supply hitting the market changes everything.

- Concentration / whales: if a few wallets control a huge chunk, volatility gets nasty.

- Fake apps: clones in app stores, and worse—APK sideload traps.

- Phishing + spoofed tokens: same ticker, wrong address. Happens daily.

- Reward farming: bots and sybil clusters draining incentives meant for real users.

- “Incentives drop → users vanish”: the classic retention cliff.

My quick safety checklist (especially for mobile):

- Verify the official token address from official sources before interacting.

- Use official app stores only (no sideload APKs, no random “beta builds”).

- Don’t sign mystery messages—read the prompt, even on a tiny screen.

- Regularly revoke permissions you don’t need anymore.

- Keep an airdrop wallet separate from your main funds.

- Use hardware and/or passkeys where possible for your serious wallet.

What people on X are saying (resources to cross-check sentiment fast)

I use X the same way I use a loud trading floor: it’s great for spotting narratives early, and terrible as “proof.” So I treat posts as a sentiment + claims map, then I verify anything important on-chain or via official announcements.

Here are the threads/posts I’m tracking to see which claims keep repeating (and which ones look suspiciously coordinated):

- Mag_gems

- Azharthegreat

- Nickmeta

- 0xDavecryps

- BaseltoGil69074

- JohnFri04358500

- MOEW_Agent

- Kai95x

- ismeidyfinanzas

- JWanderKing

- topsolxyz

- montaspavel

- VladoneDificile

- yusuf_sdev

- BillyGoatTales

- stitchdegen

- hackapreneur

- wiseadvicesumit

- Cryptoiconn

- JulesNetX

- 36Crypto2

- MastrXYZ

- PlayToEarn

- Jack_jansonWeb

While you skim those, pay attention to what’s being claimed (token utility, eligibility, reward mechanics, “official links,” unlock timelines). Then ask the only question that matters:

If I had to verify this claim without trusting anyone—what would I check on-chain, and what would I check inside the app?

Because that’s where this gets practical. In the next section, I’m going to lay out the exact game plan I use in 2026 to react to launches like this—without getting farmed by hype, APR traps, or mobile-first scams.

Quick question before you move on: if SKR triggers a wave of new mobile users, are you positioned to benefit from the liquidity shift… or are you the exit liquidity for the first rotation?

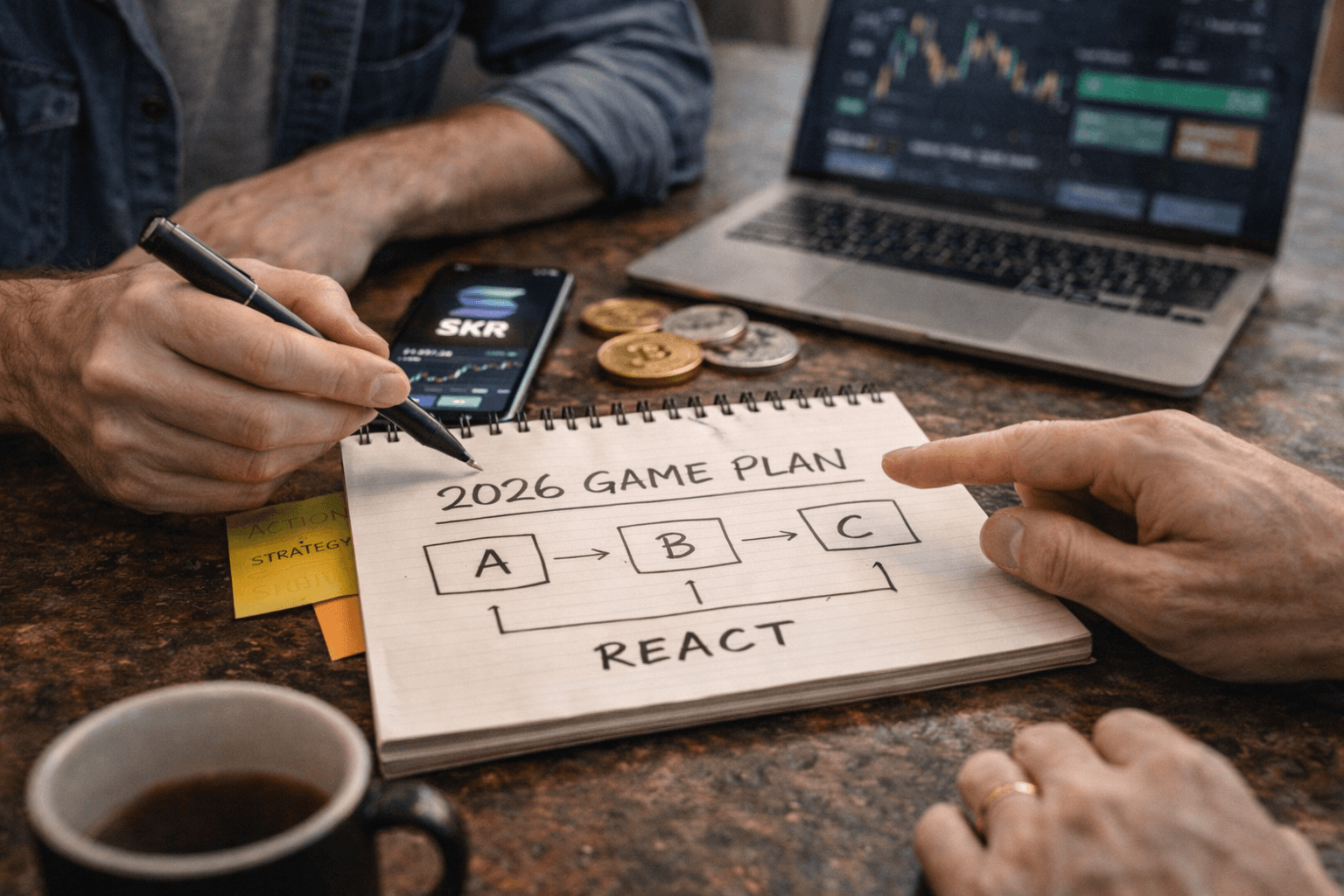

How DeFi users can react in 2026: a practical game plan (without getting farmed)

Whenever a token launch is tied to “new users” (especially mobile users), I don’t start by asking “how high can it go?”

I start by asking: where does the new activity actually hit the chain—and what’s the cleanest way to respond without becoming exit liquidity for incentives, whales, or outright scams.

Here’s the playbook I’m using around SKR, and the same one I recommend to anyone trying to survive (and win) in DeFi 2026.

If you’re a DeFi user: where SKR could matter first

Mobile-first growth doesn’t change DeFi everywhere at once. It usually shows up in a few “impact zones” first—places where friction is low and repeat actions are easy.

These are the zones I’m watching, in order:

- DEX routing + swap volumeIf SKR actually brings retained mobile users, the first visible signal is usually more small swaps, more stablecoin-to-token churn, and better routing liquidity.What I check: average slippage on common pairs (like SOL/USDC), depth around mid-price, and whether volume stays elevated after the initial incentive rush.Practical example: If you’re swapping $20–$200 chunks on mobile and you notice slippage dropping from “annoying” to “barely there,” that’s real improvement. It means liquidity isn’t just hype; it’s usable.

- Lending demand (and the “borrow to loop” reflex)When incentives hit, people borrow against majors to chase yields or points. That can tighten utilization fast.What I check: utilization rates, borrow APR spikes, and whether deposits are sticky after rewards cool down. If the borrow market heats up while DEX volume also rises, that’s a healthier sign than “APR up because everyone is farming and leaving.”

- Staking/locking behavior (real or cosmetic?)Mobile users are far more likely to click “stake” than to LP a volatile pool. That’s not a joke—it’s just simpler UX.What I check: how many unique wallets stake, average stake size, and how quickly stake leaves when rewards change.

- Payments rails + stablecoin velocityIf SKR is truly “mobile crypto boost,” the most honest metric is stablecoin movement: lots of small transfers that repeat.What I check: stablecoin transfer counts, median transfer size, and repeat senders. If you see many new wallets, but no repeated stablecoin usage, it’s likely a claim-and-dump crowd.

- Mobile-first appsThis is where it gets interesting. If a wallet or mobile dApp makes SKR “feel like credits” (fee rebates, rewards for real usage), you’ll see it in on-chain behavior: more signatures per wallet, more consecutive active days, and fewer one-and-done addresses.

What I use to verify this (quickly):

- DeFiLlama for TVL trends and protocol flows (great for “is liquidity rotating?”)

- Solscan for checking token addresses, holders, transfers, and program interactions

- Dune dashboards (when available) for retention-style analytics and wallet cohorts

My rule: I don’t trust “engagement” until I see repeat behavior. A spike is a headline. Retention is the business.

If you provide liquidity: how to avoid APR traps

LPs get marketed to like they’re being offered a “yield.” In reality, you’re being offered a mix of:

- real trading fees

- token emissions (temporary)

- inventory risk (impermanent loss)

- exit liquidity risk (everyone leaving at once)

Here’s my simple framework before I LP anything around a hot launch:

1) Separate real fees from rewards

If a pool shows 200% APR, I want to know how much is actual trading fees versus emissions. Fees tend to persist if volume is real; emissions disappear on a schedule.

2) Check the emissions schedule like you’re reading a lockup

If incentives are front-loaded, the pool often becomes a musical chairs game. When emissions drop, liquidity vanishes, slippage rises, and late LPs eat the volatility.

3) Avoid thin pools during hype

Thin liquidity + mobile hype is how you get wicked candles and “it looked safe until it wasn’t.” If you’re seeing huge APR on a small TVL pool, that’s not a gift—it’s a warning label.

4) Define exit rules before you enter

- “If emissions drop by X%, I’m out.”

- “If price moves Y% against the range, I’m out.”

- “If daily fees fall below Z, I’m out.”

5) Track impermanent loss like it’s a fee you pay

During launch weeks, IL is usually the biggest hidden cost. If you can’t explain how your position behaves when price moves fast, you’re not LPing—you’re guessing.

LP reality check: the best-looking APR screenshot is often taken right before everyone rushes in and compresses it.

If you want a sanity anchor here, it’s worth reading up on how liquidity mining often bootstraps activity short-term but doesn’t guarantee long-term stickiness. This pattern has been studied repeatedly across DeFi cycles (reward-on, reward-off behavior), and you can see it yourself by comparing incentive periods vs post-incentive volume across major protocols on DeFiLlama.

If you trade: a cleaner way to think about volatility

Mobile inflows can move fast because the UX is fast. That sounds obvious, but the market effect is huge: lots of smaller buys, lots of copy-trading behavior, and sharp rotations when “what’s trending” changes.

So I trade launches like SKR with one goal: avoid getting dragged into noise.

My guardrails:

- Position size first, thesis secondIf you can’t hold through a 30–50% wick (either direction) without panicking, your size is too big for a launch environment.

- No leverage during unlock rumorsLaunch season is when timelines, screenshots, and “insider unlock charts” spread the fastest—especially on mobile feeds. Even when they’re wrong, they move price because people react to them.

- Confirmation > viralityI want to see volume + liquidity + sustained users, not just one of them.

- Volume without liquidity = easy manipulation

- Liquidity without users = mercenary capital waiting to leave

- Users without repeat usage = claim-and-churn

- I treat “mobile-friendly” narratives as a timing acceleratorIt can compress the cycle. What used to take weeks can happen in days because distribution is faster and attention is constant.

A clean example of “confirmation thinking”:

If SKR is supposed to boost mobile DeFi, I expect to see stablecoin transfer counts rising alongside higher DEX volume, and not just for 24 hours. If I only see price pumping with no meaningful change in usage metrics, I assume it’s mainly speculative flow.

Security checklist for mobile-first crypto (non-negotiables)

Mobile is the new battlefield. The scams are tailored for small screens, fast taps, and people signing without reading.

And the data backs the general direction: blockchain crime reports like Chainalysis’ annual research consistently show social engineering and theft remain major drivers of losses, and the delivery has increasingly moved to where users live—messaging apps, fake sites, and mobile UX tricks. (If you want a baseline read, start here: Chainalysis blog/reports.)

My checklist (I actually follow this):

- Use official app stores onlyNo sideloaded APKs. No “beta wallet” links from DMs. If an app isn’t in the official store or on the project’s verified site, I treat it as hostile.

- Verify token addresses every timeI don’t trust tickers. I check the official address from a verified source, then confirm it on Solscan. Spoofed tokens are cheap to mint and expensive to learn about the hard way.

- I don’t sign mystery messagesOn mobile, signature prompts are easy to rush through. If I don’t understand what I’m approving, I reject it. Period.

- Revoke permissions regularlyIf I’ve interacted with random dApps during a hype week, I assume something I approved will be used against me later. I revoke and clean up.

- Separate wallets by purposeI keep an “airdrop/experiment wallet” with small funds and a separate main wallet for anything meaningful. This one habit saves people over and over.

- Use strong device security + modern authPasscodes, biometrics, and (when available) passkeys/hardware-backed signing matter. The weakest link is usually not the chain—it’s the device and the human.

- Assume links are trapsIf someone sends me a “claim now” link, I don’t click it. I navigate manually through official pages and compare URLs carefully.

If you remember one thing: mobile convenience cuts both ways. It makes good UX easier—and bad decisions faster.

My take: SKR is a mobile adoption test for Solana in 2026

I’m not treating SKR as a “price event.” I’m treating it as a behavior test.

If it works, I expect to see retained mobile users doing boring, repeatable things:

- stablecoin transfers that happen daily, not once

- small swaps that stack up into real volume

- lending/borrowing that doesn’t evaporate the moment rewards change

- less friction on mobile flows (fewer failed transactions, fewer confusing prompts)

If it doesn’t work, we’ll still get volatility, loud timelines, and a short-lived incentive bloom—but the on-chain footprint will look like the usual pattern: lots of new wallets, low retention, and liquidity that rotates out as soon as emissions cool.

What I’ll keep tracking after launch:

- 7/30/90-day active signers (not just new wallets)

- stablecoin transfer counts and repeat senders

- DEX liquidity depth and slippage on common pairs

- protocol flows (TVL up is nice; TVL that stays is the signal)

- scam patterns targeting mobile users (fake apps, spoofed tokens, malicious approvals)

If you’re watching the chain too, tell me what you’re seeing—especially anything that looks like real mobile retention (or anything that smells like mercenary farming). That’s the difference between a launch that matters and a launch that just trends.