Exploring Cross-Chain Compatibility in Blockchain

Ever tried to move assets from one chain to another and thought, “Why is this so complicated?” Same. Whether it’s getting USDC from Ethereum to Arbitrum (USDC vs USDC.e), or swapping BTC straight into ETH without touching a centralized exchange, cross-chain often feels like a maze of fees, wait times, and “is this the right bridge?” anxiety.

What’s broken right now

Most blockchains are still isolated islands. Your assets, data, and activity don’t travel well between them, so you’re stuck using tools that add friction and risk. Here’s what that looks like in the real world:

- Siloed liquidity and UX headaches. You bridge USDC from Ethereum to Arbitrum and get a different contract (USDC.e). Then some dApps support one version, some the other, and your “simple” transfer turns into support docs and Discord threads.

- Finality and timing aren’t consistent. Bitcoin users talk in “blocks” (6 confirmations can be ~60 minutes), Ethereum finality targets ~2 epochs (~12 minutes), Cosmos chains often finalize in seconds, and optimistic L2 withdrawals can take ~7 days. Those differences affect how safe and fast cross-chain moves feel. Sources: Bitcoin dev guide, Ethereum docs, Cosmos docs, Optimism, Arbitrum, Polkadot.

- Security incidents are real and expensive. Cross-chain bridges have been prime targets:

- Chainalysis reported bridges accounted for roughly $2B stolen in 2022, ~69% of funds lost in that year’s hacks.

- Notorious cases include Ronin’s $625M exploit, Wormhole’s $325M exploit, Nomad’s $190M incident, and Poly Network’s $600M+ breach.

- Phishing and fake UIs. Lookalike bridge sites, malicious “bridge aggregators,” and wallet-drainer scripts are everywhere. One wrong click and you’re authorizing a transfer you didn’t mean to make.

- Builder pain is just as bad. Different consensus rules, finality, and security models make cross-chain messaging tricky. You need to handle reorgs, retries, idempotency, rate limits, and governance upgrades—while keeping UX smooth and fees sane.

Bottom line: cross-chain is powerful, but today it can feel like flying with three layovers and a surprise luggage fee.

What I’m going to make easy for you

I’ll cut through the noise and show you—plainly—how cross-chain actually works and how to use it safely:

- How the tech works without jargon: atomic swaps, bridges (lock-and-mint vs burn-and-release), and true interoperability protocols.

- Who’s doing it right: Cosmos IBC, Polkadot’s XCM/XCMP, and cross-chain middleware like Axelar, LayerZero, Chainlink CCIP, and Wormhole.

- What’s safe vs risky: trust models, on-chain verification, audits, bounties, and incident transparency—so you can spot red flags.

- Step-by-step checklists for users and builders: start small, verify on explorers, handle finality, avoid gotchas, and choose the right stack.

I’ll also point to tools and resources I actually use and track on cryptolinks.com/news/, so you can see what’s working right now and what to avoid.

Who should keep reading

- DeFi users trying to route to lower fees, tap deeper liquidity, or net better yields across chains.

- NFT collectors who want broader markets and cheaper listing/minting options without wrapping nightmares.

- Builders planning multi-chain apps who need sane finality handling, safer message passing, and fewer sleepless nights.

- Security-minded users who want a pragmatic framework to evaluate bridges, routers, and middleware before clicking “Bridge.”

If you’re thinking, “okay, but what exactly is cross-chain—like, in one sentence?” you’re going to like what’s next. In the next section, I’ll explain cross-chain basics in plain English and show why it matters to your wallet and your apps. Ready for a clean, no-fluff definition and a couple of quick examples you can use today?

Cross-chain basics: what it is and why it matters

“The future of crypto isn’t one chain winning; it’s many chains working like one.”

Plain-English definition

Cross-chain means two or more separate blockchains can exchange assets, messages, or data. It turns isolated networks into a connected web so your value and info don’t get stuck on a single island. Think: sending instructions from Ethereum to Cosmos, moving USDC from Arbitrum to Avalanche, or triggering an action on Solana from an app on Base.

In practice, cross-chain is what lets you route value to where it’s cheapest, fastest, or most useful—without rebuilding your life on every new chain that pops up.

Interoperability vs portability vs composability

- Interoperability = chains can communicate. Example: Cosmos chains using IBC to acknowledge and act on each other’s messages natively.

- Portability = assets can move. Example: Circle’s CCTP lets you move native USDC between Ethereum, Arbitrum, Avalanche, and more—without sketchy wrapped IOUs.

- Composability = apps can plug into each other across chains like Lego. Example: a swap+bridge in one click using a router (e.g., LI.FI) so you don’t manually juggle three tools to get from token A on chain X to token B on chain Y.

Put simply: interoperability is the conversation, portability is the travel, composability is the teamwork.

Why you should care

- Lower fees: Route to cheaper networks for the same outcome. A simple token swap that costs dollars on Ethereum mainnet can be cents on an L2 like Base or Arbitrum. You can check current averages on l2fees.info.

- More liquidity: Better prices when you aren’t stuck on a thin pool. If the deepest USDC liquidity is on Ethereum but you’re on Optimism, cross-chain tools can route your trade to where slippage is lower and settle back where you started.

- Better yields: Stablecoin APYs move. Being cross-chain means you can rebalance from a quiet market on Polygon to a hotter vault on Arbitrum—or into Cosmos DeFi on Osmosis—without a headache.

- Wider NFT markets: If the collection you want lives on Solana or a new L2, you can move value there, mint or buy, and get back—all in a single guided flow using modern routers and wallets.

- Flexible dApps: Apps can orchestrate actions across chains in the background. You click once; behind the scenes it swaps, bridges, and executes where it’s best for you.

Quick FAQ: What is cross-chain in blockchain?

It’s the tech that lets different blockchains talk and transfer value safely, instead of staying siloed. Sometimes that’s pure messaging (send instructions), sometimes it’s asset movement (send tokens), and often it’s both—stitched together so it feels like one experience even when multiple chains are involved.

Here’s the catch: not all blockchains behave the same. Finality times, permissions, and governance vary a lot—and that changes which cross-chain paths are even possible. Want to know which types of chains make cross-chain simple, and which ones demand extra guardrails? Let’s break that down next.

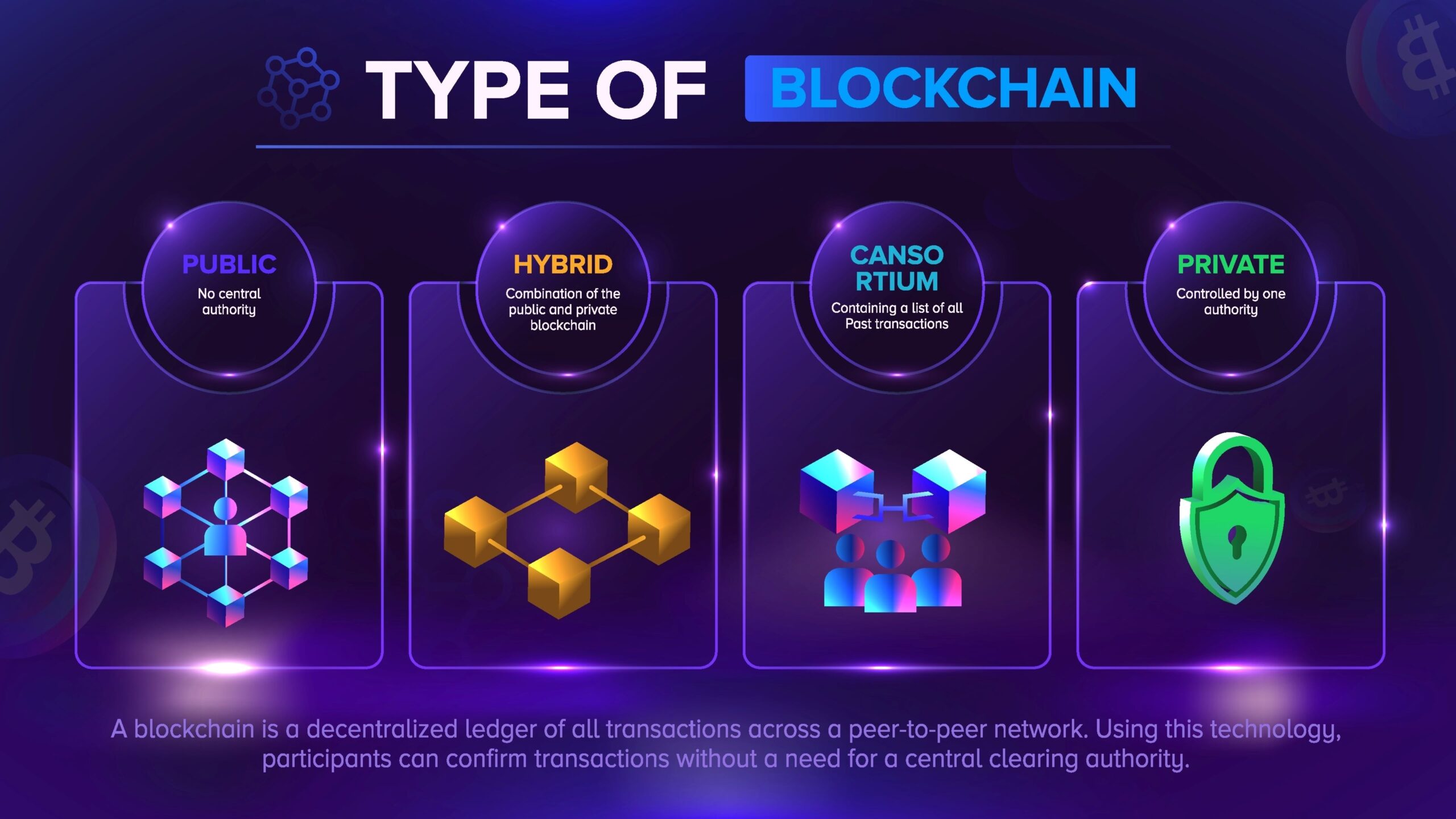

The 4 types of blockchains and why that matters for cross‑chain

Public blockchains

These are open networks anyone can read, write, and build on—think Ethereum, Bitcoin, and Solana. For cross‑chain moves, their main variables are security assumptions and how fast transactions become final.

- Finality reality check

- Bitcoin: probabilistic; many bridges wait ~6 blocks (~60 min) before acting.

- Ethereum: economic finality after ~2 epochs (~12–13 min); most apps accept fewer confirmations and absorb small reorg risk.

- Solana: fast (~seconds) with optimistic finality; systems need rollback handling during network incidents.

- What this means for cross‑chain

- Public↔Public is the most permissionless. You’ll see native swaps (e.g., BTC↔ETH via Thorchain), trusted bridges (guardians/oracles), and trust‑minimized designs when light clients are feasible.

- Fast-finality chains (Cosmos zones, Solana) are friendlier to message passing. Slow/probabilistic chains (Bitcoin) lean toward HTLC/atomic‑swap patterns or inventory‑based liquidity.

“Compatibility isn’t a feature—it’s a promise. Break it, and users don’t cross back.”

Private blockchains

Closed, permissioned networks run by a single organization or a defined group—common in finance, supply chains, and internal ledgers. Examples include Hyperledger Fabric deployments (e.g., IBM Food Trust) and bank-operated Ethereum variants (e.g., JPM’s Onyx platforms).

- Cross‑chain in practice

- Strict access control, identity, and audit trails are non‑negotiable.

- Gateways/oracles relay messages with governance checks; logs must stand up to compliance reviews.

- Real‑world signals

- SWIFT x Chainlink CCIP experiments showed how banks can instruct token movements across public and private chains with bank‑grade controls.

- Hyperledger Cacti (formerly Cactus) focuses on connectors, receipts, and secure auditability between permissioned and public stacks.

Consortium blockchains

Multiple organizations run and govern the network together. The tech might be public or permissioned, but governance is formalized. Think of Energy Web Chain (validators from energy companies) or public networks governed by councils like Hedera.

- Interop is policy‑driven

- Bridges often require whitelisting, multi‑party approvals, or council‑operated validators.

- Example: Hashport connects Hedera to EVM chains using a committee of operators and risk controls aligned with council governance.

- Why this matters

- Great for predictable operations and audits, less ideal for “permissionless everything.”

- Upgrades and incident responses can be fast because decision‑makers are known and organized.

Hybrid blockchains

These blend public transparency with private data or access. The pattern is simple: keep sensitive business data private, anchor proofs or settle value on a public chain.

- Where you’ll see it

- Baseline Protocol: companies keep records in private systems but use Ethereum for coordination with zero‑knowledge proofs. Data stays private; state integrity stays public.

- Avalanche Subnets: permissioned app‑specific chains that can route value to/from the public C‑Chain via native tooling.

- XDC Network: a hybrid EVM chain used in trade finance, with bridges and adapters aimed at connecting to permissioned systems.

- Cross‑chain shape

- Often message‑first (commitments, receipts, proofs) rather than raw asset moves.

- Strong separation of concerns: public chain for settlement/attestation, private domain for business logic and PII.

Why type matters

The chain’s governance, finality, and permissioning decide which cross‑chain method actually fits—and what risk you’re taking on.

- Public ↔ Public

- Use cases: DeFi transfers, NFT moves, multi‑chain dApps.

- Best fits: light‑client bridges where available, IBC‑style protocols on fast‑finality networks, atomic swaps for UTXO pairs, or well‑known middleware with transparent security models.

- Private ↔ Public

- Use cases: tokenized deposits, on‑chain settlement of off‑chain agreements.

- Best fits: gateway/oracle frameworks with audit trails, access control, and deterministic replay. Expect allowlists, KYC, and signed receipts.

- Consortium ↔ Anything

- Use cases: industry networks exchanging standardized assets or credentials.

- Best fits: bridges governed by the consortium (committees, slashing, published incident runbooks). Upgrades and pauses are policy events, not ad‑hoc calls.

- Hybrid ↔ Public

- Use cases: privacy‑preserving workflows, enterprise settlement, proofs of compliance.

- Best fits: message passing with zk‑proofs/commitments; anchor hashes on public chains, move assets only when necessary.

Finality dictates caution: the slower or more probabilistic the finality, the longer a bridge or protocol must wait—or the more it must hedge. Permissioning dictates process: the more closed the network, the more you’ll see governance checks, receipts, and audits built into the interop path.

If you match the method to the chain type, cross‑chain stops feeling like a gamble and starts feeling like infrastructure. So how do atomic swaps, bridges, and interoperability protocols actually pass messages and value across these very different worlds? That’s exactly what we’re going to unpack next.

How cross-chain communication works (without the jargon)

Cross-chain tech sounds mystical until you watch it in action. Under the hood, it’s just one chain proving “something happened” so another chain can safely react. The big differences come from how that proof is verified and who you’re trusting along the way. Here’s how I think about it when I’m about to move value across chains.

“In crypto, trust is a cost. Reduce it, and you often reduce risk.”

Atomic swaps: peer-to-peer, no middleman (when it fits)

Atomic swaps let two people trade assets across different chains directly using a cryptographic mechanic called an HTLC (Hashed Time-Locked Contract). If one side completes, the other must complete—otherwise both sides get their money back. No custodians. No wrappers.

- How it works in plain English: We both lock our coins with the same secret. If I reveal the secret to claim yours, you automatically get mine. If anything goes wrong, the lock times out and funds return.

- Where it’s used: Projects like THORChain enable swaps between native assets (e.g., BTC ↔ ETH) without wrapped tokens. Lightning-based “submarine swaps” also follow similar ideas for BTC.

- Trade-offs: You’re limited by which chains support compatible scripts and liquidity; UX can feel technical and slower than AMM-style bridges.

Reality check: Atomic swaps are beautifully trustless, but not every pair is supported and the flow isn’t always newbie-friendly. When I want pure native-to-native swaps, I look here first—otherwise I consider a bridge or a protocol below.

Bridges: lock-and-mint, burn-and-release, and message relays

Most people use a “bridge” without thinking twice. The typical model: lock your tokens on Chain A, mint a wrapped version on Chain B. Later, burn the wrapped version on B to release the originals on A. Some bridges also pass messages (not just tokens) so apps can do cross-chain actions.

- Lock-and-mint: Your asset is escrowed on the source chain; a wrapped representation is minted on the destination. Example: many multi-chain “BTC on X chain” tokens.

- Burn-and-release: When you’re done, the wrapped token is burned, and the escrowed original is released.

- Message passing: Bridges can send instructions, not just assets—think “mint this NFT over there” or “trigger this claim on that chain.”

Security note worth your time: Bridge exploits have cost users billions. Notable incidents include Ronin (~$624M), Wormhole (~$325M), and Nomad (~$190M). Chainalysis tracked how bridge attacks became a major share of total crypto hacks in 2022, and risks haven’t vanished. A great resource to judge risk is the L2Beat bridge risk framework.

When I use bridges: Inside the Ethereum family (L1 ↔ L2), I prefer official bridges first; for multi-ecosystem hops, I compare trust models and check audit/monitoring details before pushing size.

Interoperability protocols: standard rails for cross-chain

Instead of one-off bridges, interoperability protocols build a standard way for chains to talk, verify, and transfer. Think of them as multi-chain “internet protocols” for blockchains.

- Cosmos IBC: Chains with fast finality in the Cosmos ecosystem exchange authenticated packets via on-chain light clients. It’s battle-tested and open-source. Learn more at IBC docs.

- Polkadot XCM/XCMP: Parachains use shared security and a common messaging format to coordinate safely. Docs: Polkadot XCM.

- Cross-chain middleware: Networks like Axelar, LayerZero, Chainlink CCIP, and Wormhole provide message passing and token transfers across many chains with different validation models.

Why I care: Standardization means fewer bespoke contracts to audit and better tooling for builders. For users, it often translates to cleaner UX and clearer guarantees—especially when events are verified on-chain via light clients.

Message passing vs asset transfer (same highway, different cargo)

Sometimes you don’t need to “move” the asset—you just need another chain to do something.

- Message passing: Send instructions or proofs. Examples:

- Cosmos Interchain Accounts: control an account on Chain B from Chain A.

- Cross-chain governance: cast a vote once and fan it out to linked chains.

- Risk controls: tell a lending app on another chain to adjust a position without bridging funds.

- Asset transfer: You need liquidity on the other side. Examples:

- Move stablecoins to a cheaper chain for trading.

- Bridge collateral to post margin in a derivatives app.

Costs and risks differ: Message passing can be cheaper and safer if verification is strong and you avoid wrapped tokens entirely. Asset transfers add liquidity and custody assumptions you’ll want to understand.

Trust models: where your risk actually lives

Every cross-chain action boils down to who or what verifies that “Chain A event X is real” before Chain B acts. Here’s the spectrum I watch:

- Trusted: A multisig or a set of operators attest to events.

- Pros: Fast, flexible, broad chain coverage.

- Cons: Key compromise or collusion can be catastrophic.

- Trust-minimized: On-chain light clients verify proofs of the source chain’s state (e.g., IBC between Tendermint-family chains).

- Pros: Strong security assumptions anchored in the source chain.

- Cons: Harder to implement across heterogeneous chains; may be costlier.

- Hybrid: Mixes oracles/relayers, economic security, and on-chain checks (common in modern middleware).

- Pros: Practical coverage with layered defense.

- Cons: You must understand each layer’s failure mode.

Personal rule of thumb: If there’s a trust-minimized path (light clients, native protocols), that’s my default. If I’m using a trusted or hybrid system, I check validator distribution, audits, bounties, incident history, and live monitors before size.

Quick FAQ: How does cross-chain communication work?

It works by verifying an event on one chain and executing a corresponding action on another—using atomic swaps, bridges, or interoperability protocols. The key difference is how that event is verified (multisig operators, light clients, or hybrid models) and whether you’re sending messages or assets.

So which ecosystems actually pull this off well—and when do I use each one? Up next, I’ll show real networks in the wild, the trade-offs they choose, and the routes I prefer when fees, speed, and safety all matter. Which one do you think tops my list this month?

Ecosystem examples you’ll actually see in the wild

“The best bridge is the one you stop thinking about right after you click confirm.”

Cosmos + IBC: chains that speak the same language

Cosmos is what cross-chain looks like when it’s baked in from day one. Networks like Cosmos Hub, Osmosis, dYdX Chain, Evmos, and others ship with fast-finality consensus and use IBC (Inter-Blockchain Communication) to send tokens and messages trust-minimally. No custodial multisigs guarding your funds—each chain verifies the other with light clients.

Real example you can try today: move ATOM from Cosmos Hub to Osmosis via IBC, then swap into OSMO or bridged assets like axlUSDC on Osmosis. Traders move funds to dYdX Chain for perps and back again—all via IBC. You can monitor live IBC flows on Map of Zones and channel health on Mintscan.

- Why it works: standardized packets, fast finality (seconds), and a strong record of transparent fixes (see the Dragonberry patch in 2022).

- Good to know: assets often use the ICS-20 standard; you’ll see token prefixes like ibc/… in wallets—normal for IBC.

- Docs:ibc.cosmos.network

On Polkadot, parachains connect to the Relay Chain and communicate through XCM (Cross-Consensus Messaging). It’s not just token transfers—apps pass instructions, NFTs, and configuration messages using a common standard. Security is pooled at the Relay Chain, so parachains like Moonbeam, Astar, and Acala get a robust base.

A practical flow: send DOT from the Relay Chain to a DeFi parachain, mint a stablecoin on Acala, then route assets to Moonbeam to use EVM tooling—all via XCM. Track messages and channels with Subscan XCM.

- Why it works: standardized messaging, HRMP channels, and upgrades like XCM v3 that add features and safety rails.

- Docs:Polkadot XCM

Cross-chain middleware many apps rely on

Not every chain pair has native compatibility. That’s where middleware steps in—powering multi-chain apps you use without you noticing. Each option has a different trust model, coverage, and tooling.

- Axelar — a proof-of-stake validator network with General Message Passing (GMP). Popular for EVM ⇄ Cosmos connectivity. You’ll see Axelar-wrapped assets (like axlUSDC) on Cosmos DEXs, and apps route through Squid for one-click swaps/bridges.

Use case: swap USDC on Ethereum to OSMO on Osmosis in one flow via Squid + Axelar.

axelar.network - LayerZero — “ultra-light node” design that splits verification between an oracle and a relayer (configurable). Known for Stargate (liquidity layer) and widely used cross-chain messaging in DeFi and gaming.

Use case: move stablecoin liquidity between EVM chains with Stargate or trigger a cross-chain claim in a game.

layerzero.network - Chainlink CCIP — built on decentralized oracle networks with additional risk management and rate limits. Favored by enterprises and protocols that want conservative controls. Used in bank-grade experiments with SWIFT and by DeFi protocols for governance and token actions across chains.

Use case: cross-chain governance calls and token mints with circuit breakers and monitoring.

chain.link/cross-chain - Wormhole — a guardian set attests events and relays messages across many chains (EVM, Solana, Aptos, Sui, and more). Powers the Portal Token Bridge and supports arbitrary messaging used by data networks like Pyth.

Use case: send tokens to Solana or trigger cross-chain actions for apps in new ecosystems.

wormhole.com

If you want to compare routes and fees across these networks in one place, tools like LI.FI show multiple options side-by-side.

Thorchain for swaps: native BTC ↔ native ETH, no wrapping

If you want to swap Bitcoin to Ether without wrapped tokens, THORChain is the battle-tested path. Its nodes manage cross-chain vaults and use bonding economics to align incentives. You pay network fees plus a slip-based fee, and you end up with native assets on each chain—not synthetic IOUs.

- Typical flow: send BTC in, receive ETH out to your wallet. Frontends include THORSwap, Rango, and integrations in wallets like Trust Wallet.

- Why it’s compelling: no custodial bridge risk and no wrapped-assets depeg risk for the main leg of the trade.

- thorchain.org

EVM L2s and their official bridges: the steady route inside Ethereum land

Staying within the Ethereum family? The canonical bridges for rollups are usually the safest option:

- Arbitrum:bridge.arbitrum.io

- Optimism (OP Mainnet):app.optimism.io/bridge

- Base:bridge.base.org

Heads-up: optimistic rollups use a challenge window (about 7 days) for withdrawals to L1. “Fast” bridges can front you liquidity to skip the wait, but they add extra trust or economic assumptions. Great for UX—just understand the trade-offs.

Older/legacy context worth knowing

Projects like Aion helped popularize the idea of blockchain interoperability years ago, alongside efforts like Interledger. They’re part of the story that led to today’s more mature choices (IBC, XCM, modern middleware). Even if usage shifted, the early research shaped the standards we now take for granted.

Quick FAQ hit: what’s an example of cross-chain interoperability?

Cosmos IBC and Polkadot’s XCM are the cleanest “native” examples you can use today. For broader coverage across many chains, middleware like Axelar, LayerZero, Chainlink CCIP, and Wormhole invisibly power the multi-chain apps you click every day.

I’ve shown you where the action is. But which paths are truly safe to use, and what red flags do I check before I press “Bridge”? Let’s look at that next—because one overlooked detail can be the difference between smooth sailing and a sleepless night. Ready to see the checklist I actually use?

Security and risk: what I look for before I click “Bridge”

I love the promise of a connected crypto world—but I respect the risks more. Cross-chain is where some of the biggest wins happen, and where the biggest losses have happened too. Here’s exactly what I look at before I send a single token across.

Common failure points

Bridges fail in predictable ways. Knowing these patterns is your shield.

- Compromised keys or validator sets

When a few keys control a bridge, a single breach can drain it.- Ronin (2022): attacker compromised validator keys controlling the bridge and stole over $600M.

- Harmony Horizon (2022): a multi-sig design with a small signer set led to a ~$100M loss.

- Multichain (2023): centralized operational risk left funds stuck, then mysteriously drained—governance and custody risk, not just code.

- Smart contract verification bugs

One missed check can turn “trust-minimized” into “trust-me.”- Wormhole (2022): a signature verification bug on Solana let an attacker mint wrapped ETH; funds were later backstopped.

- Nomad (2022): an initialization error allowed anyone to “copy-paste” the exploit and withdraw funds—about $190M in a crowd-sourced drain.

- BNB Chain Token Hub (2022): a proof verification issue enabled forged messages and massive unauthorized minting.

- Relayer/oracle manipulation

If a small set of relayers sign off on messages, compromised nodes can approve fake events. Robust quorum and independent verification are critical. - Replay and nonce mishandling

Cross-chain systems that don’t track nonces and channel state correctly can execute the same message twice. This is rare but devastating. - Governance and upgrade risk

Proxies, upgradable contracts, and emergency admin keys are useful—but if governance is opaque, those same tools are an attack surface.

Context: Chainalysis estimated that as of August 2022, cross-chain bridge hacks accounted for roughly 69% of total crypto stolen that year. In 2024, the new year started with Orbit Bridge losing ~$80M. The lesson hasn’t changed: cross-chain is powerful, but unforgiving.

“Don’t bridge more than you’re willing to see stuck for a while.” Even good protocols pause to protect users. Assume friction; plan for it.

Signals of quality

When I vet a bridge or cross-chain app, I look for these green flags:

- Audits by known firms—and multiple passes

Names like Trail of Bits, OpenZeppelin, NCC Group, Zellic, Halborn don’t guarantee safety, but they help. I prefer projects with repeat audits and public reports. - Serious bug bounties

Live programs on Immunefi or similar, ideally in the seven-figure range. Wormhole’s $10M bounty set a strong bar. - Trust-minimized verification

Light clients and on-chain proof verification (e.g., IBC-style) beat trusting a handful of operators. If it’s trusted, I want to understand the quorum, slashing, and incentives. - Distributed validator/guardian sets

Diverse operators, ideally public identities, with measurable liveness and safety assumptions. Optional independent risk networks (like Chainlink CCIP’s separate risk layer) are a plus. - Open-source repos and reproducible builds

I want code, specs, and versioning in the open. Bonus points for formal verification on critical components. - Transparent incident reports and status pages

Post-mortems, public war rooms, and dedicated explorers (e.g., Wormholescan, Mintscan) help me verify exactly what happened and when. - Conservative defaults

Pausable contracts, rate limits, bounded execution, and allowlists for high-risk flows. If a team says “we’ll never pause,” that’s a red flag.

User safety checklist

My personal routine before any cross-chain move:

- Confirm the official URL

Use bookmarks. Cross-check from official docs/Twitter/Discord. Phishing is still the most boring, most effective attack. - Start with a tiny test

Send a dust amount first. Confirm on both explorers before scaling. For Cosmos, check Mintscan; for EVM, use Etherscan/Arbiscan/BaseScan; for bridge-specific, use their explorer. - Verify chain IDs and token contracts

Match the contract on the destination chain. Wrapped assets often have different addresses—don’t assume ticker equals token. - Watch slippage, fees, and deadlines

Bridges and routers layer fees. Routers like LI.FI help compare, but I’ll pay a bit more for a safer route (e.g., official L2 bridges for ETH L2s, IBC for Cosmos). - Check finality assumptions

Some routes need more confirmations. If your source chain has probabilistic finality, wait longer. Don’t rush large transfers into volatile markets. - Avoid blind signing

Read EIP-712 messages. Wallets like Rabby simulate transactions—use that. If the message looks weird, stop. - Keep gas on both chains

Getting stuck without gas on the destination is the classic rookie mistake. I keep a small buffer on every chain I touch. - Track status in real-time

Keep the bridge UI open, confirm with its explorer, and verify the destination tx. Screenshots and tx hashes help if you need support later.

Insurance and fallbacks

Hope for smooth transfers; plan for pauses.

- Coverage options

Third-party cover (e.g., Nexus Mutual, InsurAce) can offset risk, but read exclusions—some don’t cover bridge-specific failures or require whitelisted protocols. - Protocol backstops

Some teams maintain insurance funds or treasuries. THORChain historically reimbursed users after incidents using its treasury. This is not guaranteed—verify the policy, not the promise. - Diversify routes and timing

Don’t send everything in one transfer. Split across time and, if you must, across reputable routes. Prefer trust-minimized paths when available. - Know your exit plan

If a bridge pauses, how do you unwind LPs or hedges? Can you source the asset locally, or hedge exposure on a perp market while you wait? Write this down before you bridge. - Keep records

Tx hashes, screenshots, and timestamps make support and claims easier—and keep your accountant happy.

One last habit that’s saved me headaches: I treat bridged assets like I would a wrapped token—useful, but not the same as native. If I can route via a native path (IBC in Cosmos, official L2 bridges on Ethereum, or a battle-tested native swap like THORChain), I do that first.

I’ve shown you how I assess risk and stay safe as a user. But what if you’re building the bridge—or the app that depends on one? Up next, I’m sharing the exact guardrails I expect builders to ship with: from finality handling and idempotency to rate limits and circuit breakers. Want the checklist I use when I review cross-chain apps—and the mistakes that get an instant “nope” from me?

For builders: shipping cross-chain without shooting yourself in the foot

Shipping cross-chain is like performing surgery between two moving trains. The upside is massive—reach, liquidity, new users—but the blast radius when something goes wrong is bigger than most single-chain features. I’ve shipped and reviewed enough multi-chain systems to know this: the decisions you make before you write a line of code usually decide whether you sleep well.

“Slow is smooth, smooth is fast.” Move carefully now, move confidently later.

Pick your stack wisely

Every stack carries a tradeoff triangle: reach, latency, and trust. Match the stack to your use case—not the other way around.

- Native interop (Cosmos IBC, Polkadot XCM)

- Best for: ecosystems that already speak the same language.

- Why: standardized messaging, fast finality, battle-tested paths.

- Notes: If you’re building on Cosmos, start with IBC. On Polkadot, XCM/XCMP is the default. dYdX v4 is a good example of leaning into IBC for native liquidity flows.

- Official/canonical bridges (within an L2 family)

- Best for: L1↔L2 and L2↔L2 inside the same rollup family (Arbitrum, Optimism, Base).

- Why: Usually the safest path for that ecosystem; fewer moving parts.

- Notes: You will trade some speed for security and predictability.

- Cross-chain middleware (Axelar, LayerZero, Chainlink CCIP, Wormhole)

- Best for: apps that need to reach many chains with one integration.

- Why: Broad coverage, SDKs, and patterns for message passing + asset flows.

- Notes: Compare trust models:

- Axelar: proof-of-stake validator set verifying messages.

- LayerZero: oracle + relayer separation (configurable parties), “Ultra Light Node.”

- Chainlink CCIP: decentralized oracle network + separate risk management network.

- Wormhole: guardian set attestation with evolving security modules.

Sanity filter: Chainalysis and Immunefi have repeatedly highlighted that bridges are prime targets for exploits; misconfigured verification and access control are common root causes. See examples from 2022–2024 reports and incidents: Chainalysis on bridge hacks, Immunefi’s loss reports.

Finality and reorgs

If you don’t respect finality, you’ll eventually ship a double execution. Different chains finalize differently—and sometimes stall. In May 2023, Ethereum’s beacon chain experienced finality hiccups; if you assumed “2 blocks = final,” you had a bad day. Reference.

- Per-chain confirmation rules: Configure per-chain thresholds (e.g., Ethereum: finalized checkpoint; Solana: N slots + finalized commitment; Bitcoin: 6+ confs by value band).

- Idempotency keys: Attach a message nonce or GUID and store it on the destination. If you see it again, no-op. This alone kills a whole class of double-exec bugs.

- Replay protection: Include domain separators (chainId, appId, version). Use EIP-155/EIP-712 style domain separation for signatures and message hashes.

- Retries with backoff: Networks get congested. Exponential backoff + jitter avoids thundering herds when a chain comes back.

- Poison pill on ambiguity: If the source chain reorgs past your observation point, mark the message “ambiguous,” alert, and require human review or a later finalized proof.

Security by design

Most cross-chain blowups weren’t “black swans.” They were missing guardrails. A few to bake in from day one:

- Threat model first: Map actors (validators, relayers, guardians, oracles, signers, operators). Define what each can do if compromised. Plan controls for each.

- Bound execution: Hard-cap gas, external calls, and token amounts per message. No unbounded loops. No “call arbitrary target” without an allowlist.

- Allowlists and roles: Routes, tokens, and contracts should be explicitly allowed. Use least privilege, timelocked upgrades, and multisig with signer diversity.

- Rate limits and circuit breakers: Per-asset daily caps and velocity limits. Automated pauses on anomaly (e.g., failed-proof spike, latency spike, signature mismatch).

- Upgrades with sunlight: Timelock + on-chain notice + emergency pause that can only reduce capability, not expand it.

- Kill “god mode” keys: If you must have admin keys, shard them, rotate often, and gate sensitive ops behind multi-party workflows.

- Independent verifiers: Where possible, use on-chain light clients or multiple independent attesters. Avoid single-source attestations.

Reality check: Read incident reports. The 2022 Wormhole bug and Nomad misconfiguration were both avoidable classes of failures (signature verification and initialization/validation). Postmortems: Chainalysis overview with Wormhole/Nomad, Nomad’s updates (archived across community summaries).

Gas, fees, and UX

Users don’t want to think in twelve gas tokens or which chain they’re on. If you make them, they churn.

- Meta-transactions / account abstraction: Sponsor destination gas via ERC-4337 paymasters so users pay once in the source token. Spec.

- Fee transparency: Break down all costs: execution, relayer/oracle, bridge fee, slippage. Show “estimate now” and “upper bound.”

- Batching and delayed settlement: Batch low-value messages, settle during cheaper blocks. Offer “fast” vs “economy” lanes.

- Destination readiness checks: Before sending, ensure user has (or you sponsor) minimal destination gas, correct token decimals, and an allowance plan.

- Clear states: Pending on source, finalized on source, in transit, executed on destination. Link both explorers and your own tracker.

Testing and monitoring

Cross-chain failures often come from assumptions. Kill assumptions in staging before they kill you in production.

- Staging that mirrors prod: Spin up test environments with the same relayers/oracles/guardians you’ll use in prod. Fork mainnet states with Foundry or Hardhat; simulate end-to-end on Tenderly.

- Property-based tests: Fuzz message ordering, duplication, delay, and partial failures (source success + destination revert).

- Chaos drills: Drop 10% of messages. Introduce random reorgs. Yank a validator/guardian for an hour. Prove your system degrades safely.

- Observability across chains: Emit consistent events with message IDs on both sides. Correlate with OpenTelemetry. Dashboards: latency, success rate, retry distribution, amount-in-flight, anomalous flows.

- Runbooks and on-call: Who pauses? Who unpauses? What’s the threshold? How do you message users? Practice the drill.

- Bounties and audits: Favor firms with cross-chain chops (re-entrancy across chains, signature domains, proof systems). Add public bounties before TVL grows.

Compliance and data

I’m not a lawyer, but I am a fan of sleeping well. Know what crosses the boundary.

- Data minimization: Don’t ship personal data across chains. If you must pass metadata, encrypt it and avoid anything regulated (PII, health, etc.).

- Sanctions/KYT tooling: If you’re custody-adjacent or operating relayers with discretion, consider screens from vendors like Chainalysis or TRM.

- Jurisdiction triggers: Cross-chain staking rewards, fee-sharing, or revenue splits can create tax/reporting duties. Document flows clearly.

- User messaging: Tell users what’s on-chain, what’s off-chain, and what happens if a chain pauses. Clarity reduces support load when markets are red.

One last thing: if you wouldn’t be comfortable pausing your bridge on a Friday night and explaining why on Monday, you haven’t prepared enough. The good news? In the next part I’ll share the exact wallets, bridges, dashboards, and research I lean on daily to make all of this easier. Want the short list I actually use—and why?

Tools, wallets, and research I actually use

I keep a standing toolkit for moving value and messages across chains without losing sleep. These are the specific wallets, bridges, routers, and explorers I rely on—and the “why” behind each pick. Wherever possible, I’ll point to real behaviors and track records that have earned my trust.

Wallets with cross-chain chops I actually trust

- MetaMask (with Snaps) — My default for EVM. Snaps let me extend MetaMask with support and security tooling beyond vanilla Ethereum (think: non-EVM networks or enhanced transaction warnings). I like that I can use the built-in Portfolio “Bridge” to compare routes for L2s, and I always check the simulation preview before signing. Tip: I only enable Snaps that are open-source and have clear docs, and I revoke any I stop using.

- Rabby (EVM) — The pre-transaction simulation, clear risk flags, and automatic network switching are worth their weight in gas. Rabby also warns on approvals, shows permit signatures, and highlights address poisoning. If I’m testing a new bridge UI or a fresh token, Rabby’s preview catches mistakes that could cost me. It’s become my “safety-first” EVM wallet.

- Keplr (Cosmos) — For IBC-native moves, Keplr’s “IBC Transfer” and channel visibility are clutch. I can see the exact channel path and denom, verify the counterparty chain, and track finality in minutes. When I’m moving USDC via Noble across Cosmos, Keplr keeps the flow simple and transparent.

- Phantom (Solana + EVM) — Great UX, solid phishing protections, and helpful transaction simulations. I keep it as my Solana daily driver, and the EVM support makes it easier to keep one mnemonic for more of my day-to-day. For actual bridging between Solana and EVM, I still use specialized bridges (below), but Phantom’s security prompts help me avoid drainer signatures.

Why these? I want three things: native chain support, honest pre-sign simulations, and built-in guardrails (approval warnings, contract risk signals, verified token lists). Those features have saved me from bad routes and fake UIs more times than I can count.

Bridges and routers I monitor (and how I choose)

- Official L2 bridges (Arbitrum, Optimism, Base) — When staying in the Ethereum family, I default to the official bridges for safety. Withdrawals from optimistic rollups take time by design (challenge periods), but I prefer that honesty to opaque “fast” exits. If I need speed, I’ll compare reputable fast-withdrawal providers via an aggregator.

- Axelar — Generalized messaging plus widespread app integrations. I’ve had smooth experiences with Squid (Axelar-powered) for route discovery, and I like that Axelar publishes validator sets and incident reports. When I need to span EVM, Cosmos (via Noble/IBC), and more, Axelar is often on my shortlist.

- Wormhole — Huge multi-chain footprint and strong tooling. They had a major exploit in 2022 and covered users, then hardened their process. I use Wormholescan to verify message status on both sides and appreciate that many wallets and apps integrate their SDKs cleanly.

- LayerZero-connected apps — The modular “oracle + relayer” model (with OFT for tokens) gives teams flexibility, but trust depends on who’s running those components. I only use apps that disclose their providers, offer independent verification options, and show clear execution status. Transparency is everything here.

- Thorchain — For native asset-to-asset swaps (e.g., BTC ↔ ETH) without wrapping. It’s my pick when I want to avoid synthetic or wrapped representations. Thorchain has had incidents in the past and learned from them; I watch pool health and slip-based fees, and I double-check the swap preview before confirming.

- Aggregators I actually use: LI.FI, Rango, Socket (Bungee) — I rarely bridge blind. Aggregators compare time, cost, and route risk across multiple bridges and DEX legs in one view. I still click through to each route’s explorer links and confirm contract addresses, but these tools save hours and reduce guesswork.

- Bonus: Circle CCTP for USDC — If I’m moving native USDC between supported chains, CCTP is my go-to because it burns and mints instead of wrapping. Many routers (e.g., LI.FI, Squid) surface CCTP routes automatically. Wherever native USDC is available (including via Noble in Cosmos), I prefer it to wrapped lookalikes.

Reality check: According to Chainalysis, cross-chain bridges were a disproportionate target in 2022, accounting for billions in stolen funds. That stat alone is why I prioritize official bridges, native protocols, and tools with public audits and aggressive bug bounties.

Explorers and trackers that save me from headaches

- DeFiLlama — Bridges dashboard: A snapshot of bridge TVL and usage. I use it to sanity-check whether a route is battle-tested or barely used.

- L2Beat (bridges + L2 risk): Clean, sober detail on trust assumptions and upgrade keys for L2s and their canonical bridges. When in doubt, I read the risk section here.

- Wormholescan: Message-level transparency for Wormhole transfers. If a UI hangs, I can still trace sequence numbers and finality.

- Axelarscan: Track Axelar cross-chain messages, fees, and status. Great for debugging app-level flows that use Axelar under the hood.

- Mintscan (Cosmos): IBC channel info, denoms, and chain pages. If I’m moving assets to/from Osmosis, Cosmos Hub, or dYdX (app-chain), this is open in a tab.

- Map of Zones: Visualizes IBC throughput and latency between Cosmos zones. Handy to see if a channel looks congested or if a chain is experiencing delays.

- Subscan (Polkadot): Parachain activity and XCM tracking. When I send assets/messages across parachains, Subscan gives me the breadcrumb trail.

- Etherscan, Solscan, Basescan, Arbiscan: Chain-native explorers to confirm finality, token contracts, and logs. I always verify the exact token contract on the destination chain before celebrating.

- Chainlist: For EVM chain IDs and RPCs from verified sources. One click to add the right network beats copy-paste errors.

How I actually use this stack (2 quick plays)

- ETH → Base (USDC): I check LI.FI for routes. If native USDC (CCTP) is available, I choose that. I confirm the route’s contracts on Etherscan and Basescan, simulate in Rabby, and keep a tiny ETH and a tiny ETH on Base for gas both sides. If I don’t need speed, I consider the official Base bridge for maximum trust.

- Ethereum → Cosmos (Osmosis) for USDC liquidity: I prefer native USDC via Noble. I’ll use Squid (Axelar-powered) or any router that shows a CCTP+migration path, then confirm on Axelarscan and Mintscan. In Keplr, I verify the IBC denom and channel before I touch the asset.

Want a dead-simple, repeatable game plan you can follow for any cross-chain move—plus a lightweight checklist you can save? That’s up next. What’s the one step you always forget when bridging?

Putting it all together: a simple cross-chain game plan

Let’s wrap this up with a dead-simple plan you can use right now. No fluff—just what works, what to avoid, and how I personally keep my assets (and sanity) intact when moving across chains.

Quick checklist for users

- Confirm you’re using the official bridge or protocol site.

Don’t trust random search results. Follow links from official docs or GitHub. Examples:

– Arbitrum Bridge, Optimism Bridge, Base Bridge

– For Cosmos, use IBC via wallets like Keplr and verify channels/txs on Mintscan

– For USDC, consider Circle’s CCTP when supported. - Start small, verify on both explorers, then scale up.

Send a tiny test (even $5–$20). Confirm on both chain explorers (e.g., Etherscan, Arbiscan, Mintscan, Subscan) before moving size. - Compare routes with a router; sometimes the “cheapest” is not the safest.

I use aggregators like LI.FI (and sometimes Rango) to price routes—but I still prefer native/official routes when risk is higher. Safety > 3 extra dollars saved. - Prefer native protocols (IBC/XCM/official bridges) when available.

IBC for Cosmos zones, XCM for Polkadot parachains, and official L2 bridges in the Ethereum family tend to be the most predictable for core transfers. - Keep gas on both chains to avoid getting stuck.

Always keep a little ETH on the destination if you’re moving to an EVM chain (or the native token for non-EVM). I also stash a small buffer on the origin chain in case I need to retry.

Why so picky? Because the data backs it up. Reports from sources like Chainalysis and Immunefi have repeatedly shown cross-chain bridges are prime targets during exploit cycles—some years representing the largest chunk of total funds stolen. The right habits cut a lot of that risk down.

Pro tip: When in doubt, sanity-check the bridge’s risk profile on independent trackers like L2BEAT Bridges, and scan recent incident reports or disclosures.

Quick checklist for builders

- Choose a trust model that matches your risk tolerance and users.

If you’re moving mission-critical value, lean toward trust-minimized verification (light clients, on-chain proofs) or native protocols. If you need broader reach fast, middleware is fine—just be honest about assumptions and add circuit breakers. - Handle finality, retries, and idempotency cleanly.

Normalize per-chain confirmations, use unique nonces/message IDs, and make execution idempotent. Re-orgs and timeouts happen; a “retry without double-execute” pattern saves you from support nightmares. - Add clear UX states for pending, confirmed, and failed cross-chain actions.

Show explorer links for both chains, include ETA ranges per route, and surface errors with next steps. Users forgive slow; they don’t forgive silence. - Monitor everything and plan for pauses, rollbacks, and upgrades.

Wire up alerts for message delays, validator set health, and liquidity shortfalls. Keep a runbook for pausing, draining queues, and resuming safely. Public postmortems build trust when things go sideways.

If you want a sanity checklist to keep in your repo’s README: list your trust assumptions; define confirmation thresholds per chain; document failure modes and who can pause/unpause; and link audits, bounties, and incident logs. It’s not just good hygiene—it’s a conversion booster.

Rapid FAQ recap

- What is cross-chain in blockchain? It’s how separate blockchains exchange assets or messages so value isn’t siloed.

- What are the 4 types of blockchain? Public, private, consortium, and hybrid.

- How does cross-chain communication work? Through atomic swaps, bridges, or interoperability protocols that verify events across chains.

- What’s an example of cross-chain interoperability? Cosmos IBC and Polkadot’s XCM are leading examples; Axelar, LayerZero, CCIP, and Wormhole power many multi-chain apps.

Final word: move smart, not scared

Cross-chain isn’t a stunt—it’s how you unlock better markets, fees, and apps. Stick to official routes when you can, test with small amounts, and always keep explorer tabs open. When I’m moving ATOM to OSMO, I use IBC in Keplr and confirm on Mintscan. When I’m sending ETH to Arbitrum, I use the official bridge, then check Arbiscan and Etherscan before doing anything else. For USDC, CCTP has been solid where supported, and I still price-check with an aggregator to weigh speed vs. risk.

I’ll keep testing wallets, bridges, and protocols and post updates on Cryptolinks.com/news/. If you’ve got a setup you swear by—or a hard lesson from a failed transfer—share it in the comments. Real stories (good and bad) help everyone move smarter.