Are We on The Verge of an Epic Crypto Bull Run?

There is some level of assuredness trailing the recent spike in the prices of cryptocurrencies. Market indicators continue to forecast even more impressive price performances ahead of a full-blown bull market. You will agree that despite the outrageous price predictions trending in the last couple of weeks, compelling arguments are backing optimistic projections for the crypto market as a whole. In light of this, I have decided to weigh in on this discussion. Here, I will explore the current state of the crypto market and compare present market conditions to 2017’s bull run.

The Bullish State of The Crypto Market

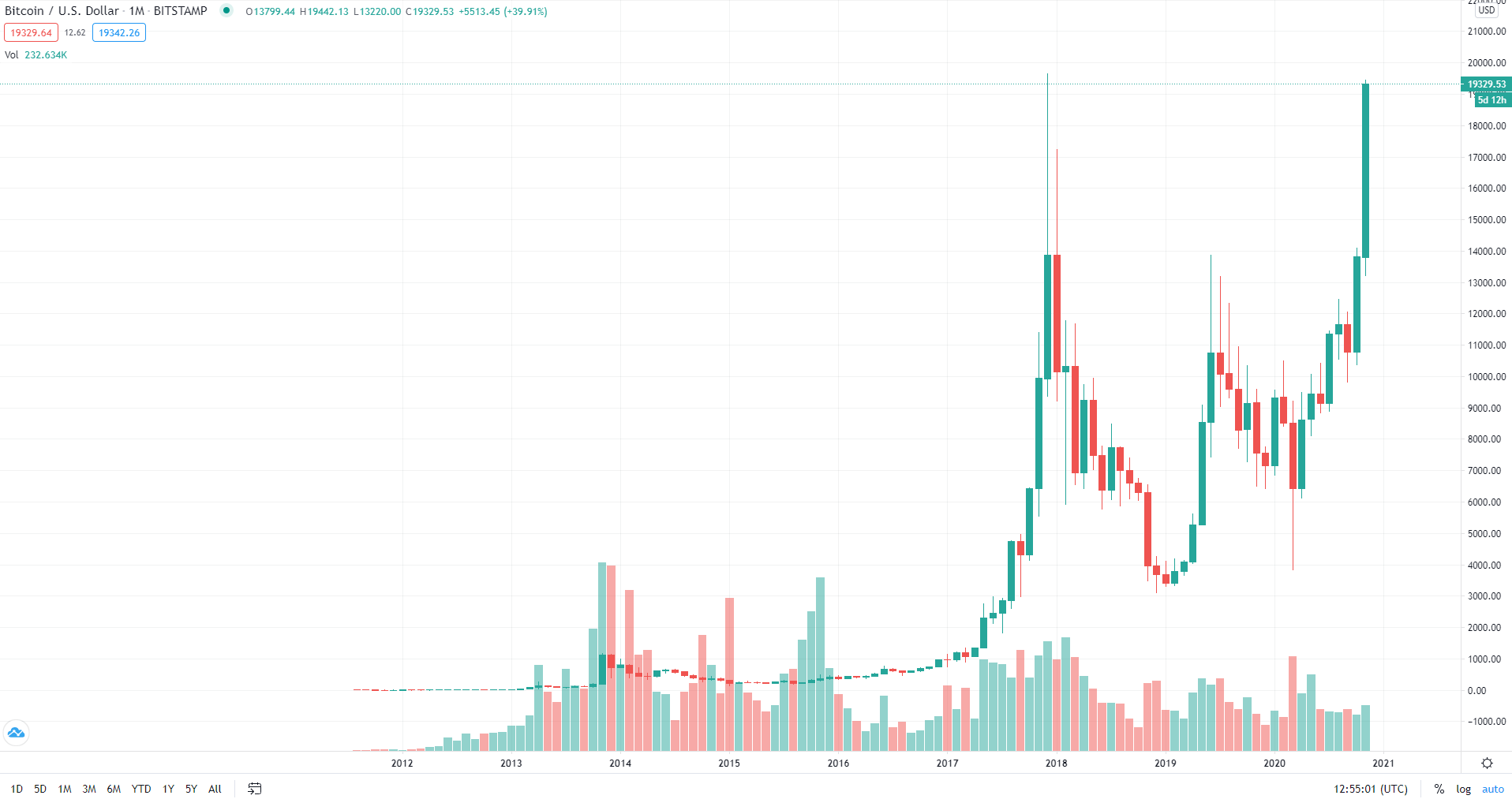

Some argue that the crypto market, following the $3,000 price registered by Bitcoin in December 2018, had kicked off a bull run since the start of the first quarter of 2019. While it is true that the market had recovered steadily, it is a long way from reenacting the level of volatility associated with a bull market. Even though Bitcoin is fast approaching its 2017 peak performance, the prices of the majority of cryptocurrencies, on the other hand, are nothing near what we witnessed at the height of the Alt season of January 2018. Hence, it is safe to say that we are still at the early stages of a bull movement as experts are not expecting Bitcoin to peak anytime soon.

If this projection is anything to go by, then there is every possibility that digital assets, including Bitcoin, would surpass previous price records and set new ones in the coming months. Much of this forecast hinges on the following factors.

The Institutional Interest in Cryptocurrency

All through 2020, institutional investors have shifted their attention to the crypto market due to inflation arising from the pandemic-induced economic crisis. Now more than ever, investors are coming to terms with the potential of cryptocurrencies, particularly Bitcoin, and its inflation-hedging attributes. Sam Trabucco, a quantitative trader at Alameda Research, made this known in a recent tweet where he explained the core reasons for the upsurge of the value of Bitcoin. He wrote:

“My take would be: eh probably a combination. I do think that Biden’s victory and the vaccines were net good for e.g. SPY which has both short- and long-term correlation to BTC in the COVID era, which contributed. And there are also legit a lot of traditional companies / entities — banks, hedge funds, random rich people, thought leaders, tech companies, Wyoming senators, etc. — signaling support for BTC, which both directly (buying) and indirectly (sentiment) influences its price up.”

In the last few months, a growing number of high-profile individuals and entities have publicly endorsed crypto by disclosing that they had allocated a percentage of their assets to one or more coins. For instance, Square purchased over $50 million worth of Bitcoin to store as a reverse asset. Developments such as this give the average investor a little more confidence to explore the opportunities prevalent in the crypto industry.

True to this observation, a survey by financial advisory organization deVere Group has revealed that more high net worth individuals are either planning on investing in crypto, or they already do. The survey interviewed around 700 millionaires from a wide variety of regions and found that 73% (an increase of 5%) maintained a crypto bullish stance. According to the CEO and founder of deVere Group, Nigel Green, Bitcoin’s sterling year-to-date performance has attracted the attention of wealthy investors:

“As the survey shows, this impressive performance is drawing the attention of wealthy investors who increasingly understand that digital currencies are the future of money and they don’t want to be left in the past.”

Furthermore, he added that the surge in interest, as seen in the survey, can be linked to the growing acceptance of bitcoin by institutional investors. Green wrote:

“No doubt that many of these HNWs who were polled have seen that a major driver of the price surge is the growing interest being expressed by institutional investors who are capitalizing on the high returns that the digital asset class is currently offering.”

Crypto Whales Continue to Hodl

Experts believe that crypto whales are in no rush to cash out and take profits. Instead, they continue to accumulate and hold. According to market metrics, there has been a shortage of sellers as a result of this unprecedented level of accumulation. Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, echoed this revelation while noting that such a market trend creates the right condition for a bullish run. He tweeted:

“To be honest, more and more $BTC going from exchanges towards cold wallet storage. Big listed companies allocating cash reserves to $BTC. Is incredibly bullish.”

Also, Glassnode revealed that accumulation addresses account for a large percentage of bitcoin supply. Hence, there is a rise in hodling activity, even though the digital asset has risen in value steadily for the last few weeks. Glassnode wrote:

“Bitcoin accumulation has been on a constant upwards trend for months. 2.6M $BTC (14% of supply) are currently held in accumulation addresses. Accumulation addresses are defined as addresses that have at least 2 incoming transactions and have never spent BTC.”

This Bull Run Is A Bit Different

There is a striking semblance between this current bull run and 2017’s. In the previous bull market, Bitcoin led the way in price performance, only for altcoins to hit their peak roughly a month later. From what we have witnessed so far, it seems that a recurring trend is unraveling. As indicated earlier, bitcoin is nearing its peak price while altcoins are yet to achieve a similar feat. That said, this current market movement has some peculiarities, unlike the previous one. The most potent is that investors and not retail traders are at the helm of this resurgence.

What this means is that the tendency for a price dump is very low. Investors are looking to ride out the ongoing economic crisis. Therefore, they are not in a hurry to sell their digital assets. In turn, this ensures that the supply of bitcoin remains low compared to the demand. Galen Moore, in a recent piece on Coindesk, explored these findings, and explained that it bodes well for the current bull run. He stated:

“The number of addresses holding at least 1 bitcoin increased at an unrelenting pace from the end of 2013 to the 2018 crash. It picked up again in 2019, then leveled off again this spring. This is different from the end of 2017, when it soared to a peak with the bitcoin price. Compare that to the number of what we could call bitcoin “billionaires,” addresses holding at least 1,000 BTC. These whales were selling into the run-up in 2017. This time, the Bitcoin blockchain’s Forbes List is growing, not shrinking.”

What Do Experts Think of This New Wave of Crypto Adoption?

Asheesh Birla, general manager of RippleNet, highlighted this emerging trend in a recent interview where he explored the damaging effects of Covid 19 and how the crypto industry has benefited from them:

“In tandem, there’s more interest in the space than ever before with major companies like PayPal and Square placing their bets on crypto, pushing it to the mainstream. Validation from these companies has contributed to more interest in the utility of cryptocurrencies, and their ability to better serve their businesses and customers.”

Apart from these endorsements, the sheer tendency of traditional investors to adopt cryptocurrency stems from the increased pressure on governments and their central banks to take action against an imminent global economic meltdown. As explained by Mike Belshe, CEO at BitGo, the inflationary approach of governments to the aftermath of the Coronavirus gave investors a fresh take on Bitcoin and its deflationary infrastructure:

“Prior to COVID-19, most people weren’t paying as much attention to the economic factors that make Bitcoin relevant. Frankly, they didn’t need to. If you’re generating a return from the stock market, you stay with what you know, and you don’t have to worry about learning something new. But now that’s all changed with the pandemic — fiscal policy around the globe is causing governments to wildly print money, reducing its value and causing inflation. Investors now understand they have to get ahead of this.”

Belshe added that investors have begun to enlighten themselves in the rudimentary of the crypto market, and this has resulted in its growing acceptance among investment leaders. He explained:

“They are asking a lot more questions and are grasping the underpinning of Bitcoin’s thesis — that an asset’s scarcity matters. Digital assets are a hedge against inflation and a safe store of value. Investment leaders such as Paul Tudor Jones, Stanley Druckemiller and Bill Miller are demonstrating that Bitcoin is now an important part of any portfolio. This year has brought so much uncertainty but people are feeling empowered to educate themselves on what they need to do to get involved with crypto. All the building blocks are in place — compliance, custody, liquidity, portfolio management and wallet technology, as well as tax tools — giving investors the tools they need to invest in digital assets.”

Likewise, Tim Draper, Venture Capitalist and Bitcoin investor, echoed this sentiment and projected that it would become fashionable to own Bitcoin due to the gross incompetence of governments as regards economic policies:

“A lot of people, stuck in their homes finally made the time to set up a Bitcoin wallet, but the real impact of Covid was that the lockdown was devastating for many families, and when the government printed $13 trillion to try to put a bandaid on it, it made it clear that you would rather be holding Bitcoin than these diluted and dilutable dollars. I expect ‘fiduciary duty’ to now include owning some Bitcoin as a hedge against government currency flooding and manipulation.”

While sharing his view, Preston Byrne, Partner at Anderson Kill, P.C., opined that the emerging perception that dollars and other fiat currencies are weakening due to a combination of factors has helped crypto present its case. He noted:

“The COVID-19 outbreak’s most tangible impact on crypto was validation of crypto’s core thesis that our societies are brittle and math, not men, is likely to form a sounder basis for future social organization. The reliance of practically every major economy on fiscal and monetary stimulus to stay afloat reinforced and widened public perception of the weakness of fiat money and institutions. ‘Crypto,’ so-called, is a diverse array of beliefs and areas of interest ranging from hard money, to censorship-resistance, to secure communications. These technologies are uniquely responsive to social and enterprise adaptation to stressors that have dominated headlines in the last year, whether we’re talking about ‘Money printers go brr,’ the ongoing exodus from big tech, or widespread social unrest in the cities.”

Traditional Assets More Volatile Than Bitcoin

Amidst this exciting string of events, research carried out by Van Eck revealed that, contrary to popular opinion, bitcoin is a more stable asset than a significant percentage of S&P 500 stocks. Through its analysis, the exchange product issuer discovered that 29% of S&P 500 stocks had registered more volatility than bitcoin when analyzing the year-to-date performance. This figure dropped to 22% if fluctuations for a 90 days basis is used. The report reads:

“In our long-term study of bitcoin, we had compared bitcoin correlations to traditional asset classes and now see another interesting recent trend with its volatility. In our current volatility research, we compared the 90 day and year to date volatility—as measured by their daily standard deviation1 as of November 13, 2020—of bitcoin against the constituents of the S&P 500 Index. We found that bitcoin has exhibited lower volatility than 112 stocks of the S&P 500 in a 90 day period and 145 stocks YTD.”

Van Eck, in what seems like an attempt to reassure regulators of Bitcoin’s maturity, stated that a U.S. bitcoin exchange-traded fund (ETF) would inherit a similar level of stability. It added:

“While there are no U.S. bitcoin exchange traded funds (ETFs) available today, we believe such products may show similar volatility characteristics—based on the comparison above—as many stocks in well-known indices and ETFs, such as the S&P 500 and related products.”