Understanding the FTX Collapse: Key Takeaways for Crypto Investors

When the stalwart of the cryptocurrency sphere, FTX, crumbled, it sent shockwaves through the community—it’s a scenario that seemed unfathomable until it wasn’t. The unraveling of this behemoth offers us a masterclass in the fragility of digital financial systems and the unforeseen dangers that lurk within them. Reflecting on the collapse of FTX is not just about understanding a singular event but a wake-up call to the inherent risks and necessary precautions in . Piecing together the series of missteps that led to their downfall highlights the critical need for due diligence and financial acumen. It’s a tough lesson, but one that equips us with the knowledge to fortify our own investment strategies against similar calamities and propels us towards a more secure crypto investment future. Keep an eye on the horizon, because learning from these events is your first step in navigating the unpredictable seas of cryptocurrency investing.

Have you ever paused to consider how a towering giant in the cryptocurrency market like FTX could stumble so catastrophically, virtually overnight? As someone deeply immersed in the complexities of cryptocurrency investments, it’s vital we crack open the case of FTX’s downfall and investigate what this means for our future moves in this volatile market.

The Unpacking of FTX Meltdown

Newcomers and veterans alike were taken aback as FTX, a seemingly secure crypto exchange, plummeted from grace. The series of events that led to its demise are both intriguing and alarming. You might be asking, what exactly instigated such a rapid unraveling?

Learning from the FTX Scandal

- Understanding that crypto assets are highly volatile and can devalue rapidly, sometimes without warning.

- Acknowledging the ever-present risk of cutting-edge tech paired with emerging financial services.

- Realizing the importance of transparency and regulatory compliance in financial operations.

These are not mere bullet points to gloss over but critical alerts that must be etched in the mind of every savvy investor.

The Reasons behind FTX’s Downfall

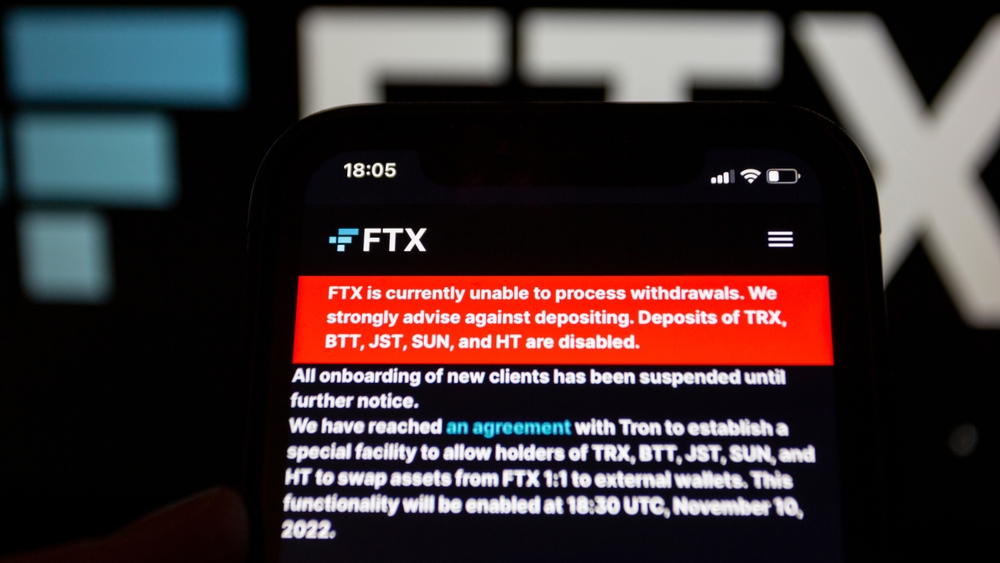

At the core of the FTX scandal was a fundamental flaw that is often a harbinger of disaster in the financial world: mismanagement of funds and a subsequent liquidity crisis. This isn’t just conjecture; it’s supported by reporting from reputable sources that detail how intertwined the exchange and its sister trading firm became, leading to an untenable situation.

- A reckless co-mingling of customer funds with corporate expenses.

- An opaque structure that concealed the fragility of FTX’s financial stability.

- The rapid unraveling of trust once the precarious nature of FTX’s operations came to light.

These missteps serve as a stark reminder that, in the digital realm of crypto, the foundations upon which platforms stand can be as volatile as the currencies they trade. So, what does this mean for our investment strategies going forward? And, more importantly, how can we safeguard ourselves from similar fiascos?

Stay tuned. In our next exploration, we’ll delve into the swift and significant impact the FTX collapse imparted upon the global crypto market. Have the recent events made you reconsider your strategy in cryptocurrency? Stick with us as we uncover more insights into building a more resilient investment future.

The Impact of FTX’s Downfall on Crypto Market

When FTX’s bright beacon of hope turned into a cautionary flare, the ripples were felt far and wide. Let’s talk about the tsunami it caused in the crypto ocean.

Ripple Effect on the Overall Crypto Market

Imagine a stone dropped into water, creating ripples that spread across the entire surface. FTX’s collapse was that stone—the impact resonated through the whole crypto universe, causing immense value dips for a vast array of cryptocurrencies. It’s a stark reminder for us to stay vigilant of these market shifts that can happen at the drop of a dime—or coin, in our case.

Exchange Reserves Depletion

In the wake of FTX’s demise, other exchanges felt the shivers too. Exchange reserves—a critical backbone for fluidity and user assurance—took a hit. Think of it as a run on the crypto banks; the trust meltdown led to a freeze-up in assets and increased insolvency fear. Always keep an eye out on the health of your chosen exchanges; it’s your financial heartbeat in the digital world.

Implications for Crypto Trading Platforms

FTX didn’t just fall on its own; it dragged down other platforms in its wake. Some suffered reputation damage by association, others faced a crisis of confidence from skittish investors. When you next choose where to trade, remember these implications. It’s not just about features and fees, but trust and stability, too.

“The markets can stay irrational longer than you can stay solvent.” This quote by legendary economist John Maynard Keynes speaks volumes in light of the FTX fall. Emotions stirred, portfolios shaken, but have you found the silver lining? Here’s the teaser: what can we uncover from these tremors about safeguarding our digital treasuries? Up next, we decode the missteps that led to billions vanishing into thin air. Stay tuned, because what happened to those funds? That answer might just be your crypto compass for safer navigation.

The Anatomy of FTX’s Collapse

Understanding the full scope of FTX’s collapse is akin to piecing together a complex puzzle. It’s essential to look not only at the events that unfolded but also the underlying factors that led to such a catastrophic outcome for the once-celebrated crypto exchange. Let’s probe into the critical elements that constituted the downfall of a giant.

Misappropriation of Funds

It’s been reported that FTX management allegedly redirected a staggering $8 billion in customer deposits, funds that were supposed to be sacrosanct, for their own ventures. This startling revelation serves as a stark alarm bell. Imagine logging into your account only to find your crypto stash—your hard-earned assets—essentially vaporized. This misuse of funds is not just a breach of trust; it’s an outright heist under the guise of sophisticated financial maneuvering.

Ill-Advised Investments

Where did all the money go? A portion of FTX’s funds were allegedly channeled into extravagant real estate and other high-risk endeavors. It’s a classic tale of hubris meeting naivety, resulting in a meltdown that affected thousands. These ill-advised financial decisions demonstrate the peril of straying far away from the conservative principles of asset management, morphing a platform of promise into a byword for imprudence.

Break-down of Trust

“Trust takes years to build, seconds to break, and forever to repair,” goes the saying. FTX’s misuse and mismanagement of investor funds have led to a severe erosion of trust—a commodity that’s as precious in the crypto world as the cryptocurrencies themselves. The repercussions of this break in trust ripple through our community, prompting us to question: How can we safeguard against such betrayals in the future?

- Did you know? A study from the University of Cambridge found that trust in financial institutions heavily influences market stability and consumer behavior. FTX’s collapse is a real-world endorsement of this study, as we’ve witnessed trust evaporate and market stability wobble.

In the aftermath of such a debacle, one cannot help but ponder what measures we could have taken to avert this disastrous outcome. Could a more informed and vigilant community have foreseen the signs? Stick around as we navigate the crucial lessons this scandal has etched in the annals of crypto history.

“The wise learn many things from their enemies.” – Aristophanes

Adversity often teaches us more than prosperity. As we peel layer after layer of the FTX incident, it’s not the blaring headlines we should focus on, but the tacit lessons beneath. How can we apply this hard-won knowledge to fortify our future investments?

Are you prepared to discover how you can equip yourself against such financial calamities? Continue reading and transform adversity into your steadfast ally.

Lessons to Learn for Crypto Investors

The abrupt collapse of FTX wasn’t just a wake-up call—it was a blaring siren that echoed across the entire crypto landscape. It left us wondering, how can we sail safely in these turbulent market waters?

Importance of Risk Management

In the face of FTX’s downslide, one undeniable truth remains: risk management is not optional; it’s absolutely critical. Say you’ve got a digital wallet bursting at the seams—ask yourself, are you overexposed to a single asset? Are stop-loss orders part of your strategy? Remember, it’s not about avoiding the storm but learning to thrive within it.

Need for Better Security

FTX’s fall from grace also shone a glaring spotlight on security—or the lack thereof. It’s not just about choosing strong passwords or enabling two-factor authentication. It’s about asking the hard questions. Is your exchange audited? What’s their cold storage policy? It’s time to put the security of your investments under the microscope.

Resources to Arm Ourselves

To forge our shields and sharpen our spears, we need the right resources. Here’s a start:

- Get insights from Simon Business School on the five golden lessons from the FTX debacle.

- Dive deep into Investopedia’s article about what the heck went wrong with FTX.

- Expand your understanding with CNBC’s take on four cryptocurrency investor lessons post-FTX.

Warren Buffett once said, “It’s only when the tide goes out that you learn who has been swimming naked.” This quote couldn’t be more apt now, as we see which investors were prepared for volatility and which weren’t.

So, fellow crypto enthusiasts, have you assessed the risks and reinforced your security? We’ve talked about protecting ourselves, but how do we build resilience for the long haul? Stay tuned—up next, we’ll explore how diligence and diversification can become your stalwarts in the aftermath of such a monumental industry shakeup.

The Way Forward for Crypto Investors

In light of the FTX implosion, what steps can we take to secure our crypto journey? The fallout from this episode has shone a harsh light on the fragility of what we may have once considered impervious. As we look ahead, our primary goal should be to sharpen our approach to investing. Be it the seasoned trader or newbie entering the market, the wake-up call is universal: due diligence is no longer optional; it’s imperative.

Need for Greater Diligence

FTX’s tale of woe reminds us that rigorous research can make or break our investments. But what does due diligence truly entail for a crypto investor? It’s about diving deep into the whitepapers, yes, but it’s also about tracking the operational integrity of the platforms we trust. They’re the custodians of our digital assets, after all. Have we looked into their security protocols? Their track records? Let this be a lesson that a platform’s flashy features should never overshadow the foundational need for reliability and regulatory compliance.

Importance of Diversification

The old adage “don’t put all your eggs in one basket” couldn’t resonate more within the context of cryptocurrency. Diversification is the bulwark against the unpredictable tides of this market. By spreading investments across various assets, sectors, and even geographical locations, we stand a better chance of weathering storms such as FTX’s demise. Studies have shown that portfolios with a mix of uncorrelated investments generally perform better over the long term, minimizing risk while potentially maximizing returns.

Building a Robust Investment Strategy

An invincible investment strategy doesn’t exist, but a robust one does. It involves not just diversification, but also understanding our risk tolerance and exit strategies. From the wreckage of FTX, one thing is crystal clear: always know your exit before you enter. And if you’re looking for resources to bolster your strategy with insights from the FTX downfall, check out Simon Business School’s “5 lessons from the collapse of FTX”, Investopedia’s detailed analysis “What Went Wrong With FTX”, and CNBC’s “4 Lessons for Cryptocurrency Investors from the FTX Collapse.” These are excellent starting points for building that durable strategy we so desperately need.

Of course, the journey doesn’t end here. As we absorb these insights, we are preparing for another leap — the practical application of these strategies. But are we truly ready to test these strategies against the uncertainty of the markets? Stay tuned as we delve into how to apply the wisdom we’ve gathered to protect and grow our investments in the final part of our discussion.

Summing It Up: Lessons from the FTX Debacle

The FTX collapse has been nothing short of a seismic shift for the crypto universe, sending waves of caution to every corner of the market. It’s like navigating through a storm, and now that we’re in calmer waters, it’s time for us to reflect on what this means for our future investments. In the deep ocean of crypto, it’s crucial to remember that without proper navigation, there’s always a risk of hitting an iceberg, just like FTX did.

A Case Study in Mismanagement

The catastrophic ending of FTX isn’t just about a company failing; it’s a vivid highlight reel on the dangers of impulsive and uncalculated decisions within the crypto space. Picture this: a seasoned trader who senses an opportunity in the volatility of cryptocurrencies and leaps without checking if there’s a net. The consequences? Catastrophic losses when the market swings the other way — a reality too many faced during FTX’s downfall. We’re not just observers; we’re students in this evolving course on digital currency investments, picking up lessons on caution, strategy, and the price of negligence.

Importance of Transparency

Imagine for a moment that you’re playing a high-stakes poker game, but in this game, not everyone’s cards are on the table. That hidden information could turn a winning hand into a devastating loss. This scenario mirrors the lack of transparency that plagued FTX, highlighting the importance of clear-cut and honest dealings. In practice, transparency means granting investors access to verifiable information and not leaving them in the dark about where their funds are going. It’s about being able to peek behind the curtain and know that your investments aren’t part of a vanishing act.

Conclusion: Protecting Our Investments

As we gather up the lessons scattered in the wake of FTX’s implosion, we’re reminded of the quintessential principle: protecting our investments is paramount. This means more than just safeguarding our assets; it’s about armoring our strategies with diligence, spreading our risks across a diversified portfolio, and remaining perpetually vigilant. The adage “don’t put all your eggs in one basket” resonates more than ever, emphasizing a strategy that is as much about what to include as it is about what to exclude.

The FTX narrative serves as a stark anamnesis, pressing us to be meticulous in our investment approaches and urging us to seek not just profit, but also protection in an ecosystem that can be as volatile as it is enticing. By embracing the lessons FTX unwittingly imparted, we’re now equipped to venture forth with a blend of wisdom, caution, and an ever-watchful eye on the horizon of the crypto world. Let’s move forward, making informed decisions that steer us clear from repeating history and toward a sustainable and profitable future in investing.