How To Survive The Crypto Crash And Induce Long-term Profits

Volatility is perhaps the most appealing attribute of the crypto market to new investors. The prices of digital assets have recorded unprecedented uptrends since the year began. In turn, this has spurred the influx of investors looking to generate high profits amidst the institutional adoption of cryptocurrency.

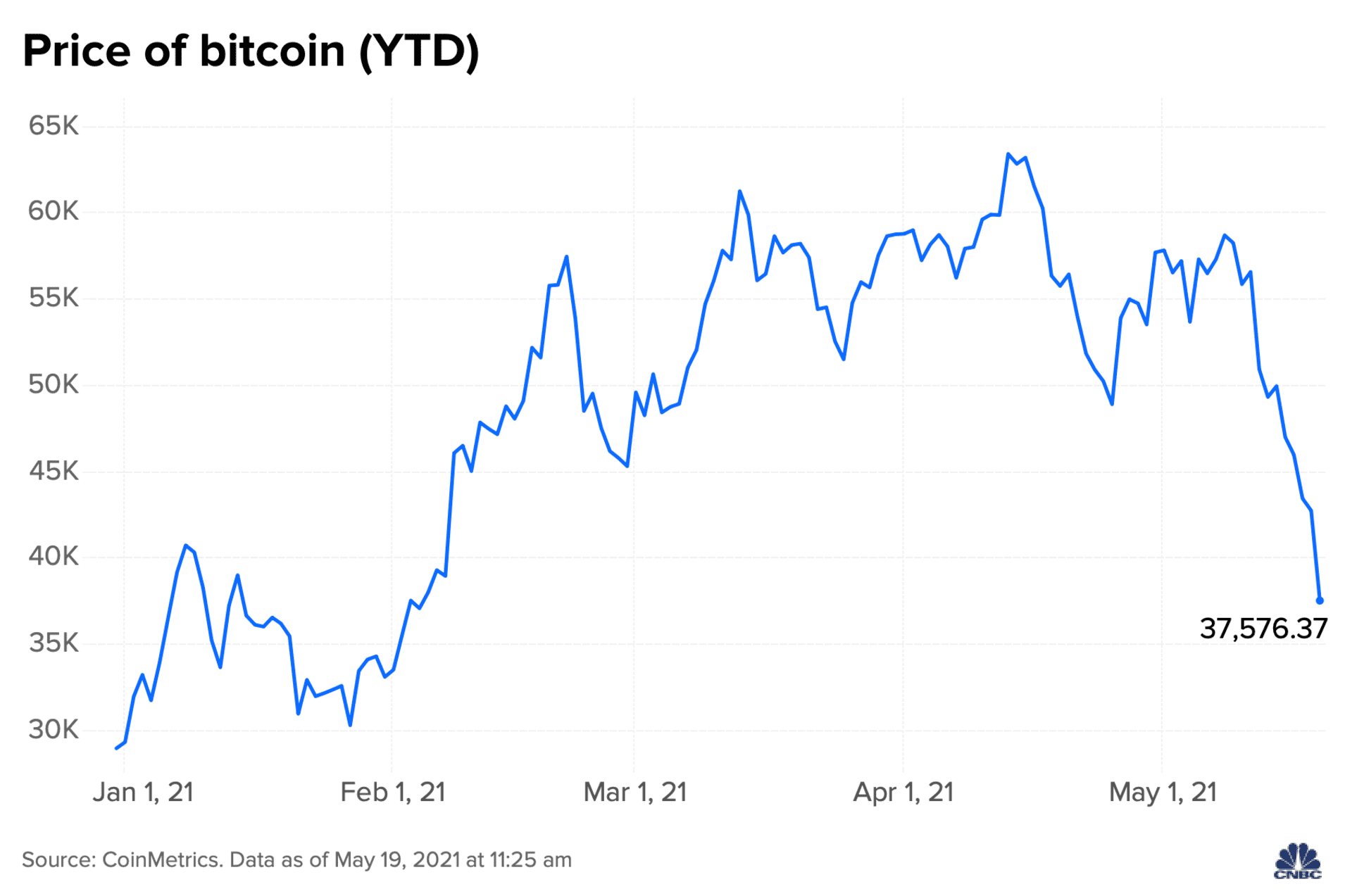

However, all this changed when the crypto market responded negatively to a series of events. At the time of writing, Bitcoin, the world’s most popular cryptocurrency, had fallen by 47% in the space of 4 weeks. For many experienced crypto investors, this is a common occurrence in the crypto market. Therefore, the latest crypto crash might not come as a surprise nor will its effects cause them to panic. In contrast, it must be difficult for new investors to process the recent price collapse and set up the appropriate strategies to negate its effects.

In light of this, I have decided to discuss this crypto crash at length, identify the causative factors, compare it with past market collapse, and explore the ideal response to reduce its impacts.

What Caused The Crypto Crash?

Everything was all rosy in the crypto sphere until May 12 when Elon Musk tweeted that Tesla would no longer be accepting Bitcoin due to environmental concerns. This announcement changed the tides drastically such that the price of Bitcoin fell below the $50,000 mark for the first time in over 18 days. While many believed that this was a mere setback and an opportunity for the crypto market to gain more momentum, a barrage of other negative news forced the price even lower. Chief among them is China’s decision to ban crypto mining and trading within its territory.

Another contributing factor is the rehashing of crypto regulations in light of the mass adoption of digital assets-based investment products. Countries like the United States are looking to capitalize on the crypto craze to generate more tax revenues. Regulators also seem to have intensified efforts to protect investors against the influx of “shit coins.”

Likewise, a shift in investment trend may have played into the market crash. JPMorgan believes that institutional investors are shifting their attention from speculative markets to the established investment opportunities like Gold. The firm wrote:

“The Bitcoin flow picture continues to deteriorate and is pointing to continued retrenchment by institutional investors… Over the past month, Bitcoin futures markets experienced their steepest and more sustained liquidation since the Bitcoin ascent started last October.”

This also coincided with the reopening of economies across the globe. There is every reason to believe that investors are looking to take advantage of the economic boom poised to accompany the ease of lockdown policies. Mike Novogratz aptly summarizes the crypto dilemma during an interview with CNBC. He said:

“A lot more people own crypto. Crypto has seeped into pockets all over our society and you had a confluence of events — a combination of Tax Day, Elon Musk tweets, whatnot, where you started breaking down the positivity in the price action, and now we’ve got a liquidation event.”

While these factors seem to be the obvious culprits, the unprecedented sell-off shows why Bitcoin and other cryptocurrencies are considered to be highly volatile. Not many asset classes out there can outlive the level of bloodbath witnessed in the past month. And yet, to long-term crypto proponents, this is nothing out of the ordinary. Many believe that this is just a temporary setback for crypto on its way to new all-time highs. Nonetheless, it is important to ascertain the difference between a correction and a bearish crash.

A Crypto Correction Or A Bear Market?

A Crypto Correction Or A Bear Market

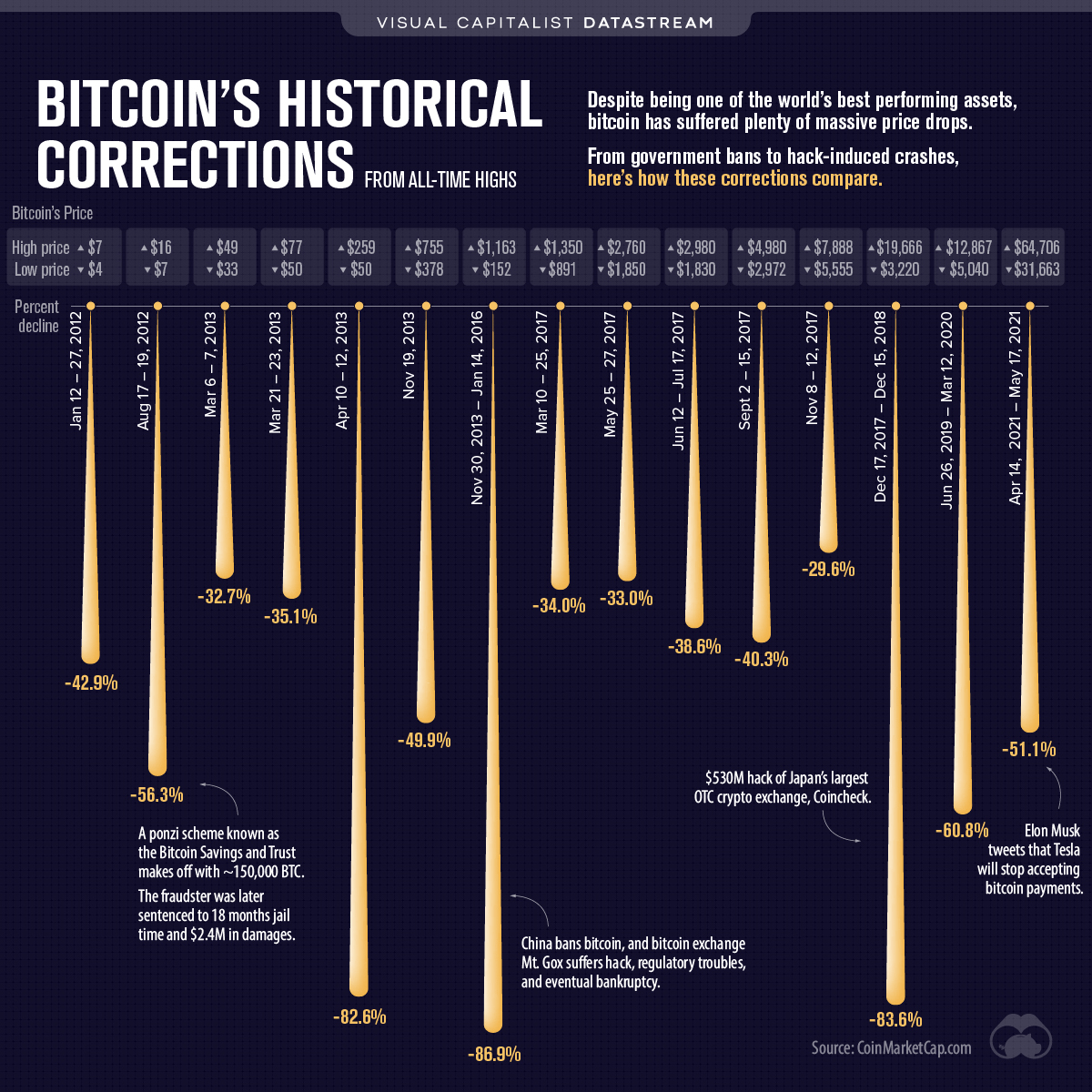

Bitcoin’s historical corrections (source:Visual Capitalist)

As defined by Ollie Leech on Condesk, a correction occurs as a result of a buying exhaustion on the part of bullish investors:

“These (price correction) usually indicate bullish traders have become exhausted and need time to consolidate and recover. Exhaustion occurs when a majority of buyers has bought the underlying asset and there are no more new buyers appearing to support the uptrend. If sell orders continue to pile in without anyone on the other side of the order book buying them, prices start to fall.”

In contrast, a price crash somewhat foreshadows extended periods of market downturns. Leech also added that other technical factors and minor events could also spur the occurrences of price corrections:

“Corrections can be influenced by minor events but tend to be initiated by technical factors such as buyers running into strong resistance levels, depleting trading volume and negative discrepancies between Bitcoin’s price and indicators that measure its momentum like the Relative Strength Index (RSI).”

Due to the unprecedented volatility of the prices of digital assets, It is difficult to distinguish between a crypto price correction and a crash. In traditional markets, a 20% price downturn is enough reason to anticipate a bear market. Conversely, Bitcoin, the most popular coin, has recorded wild price swings on its way to the $64,000 peak price set in April.

This is not the first time that the price has dipped by over 20%. However, the difference between this current market condition and previous corrections is the time it took to register a consistent dip in price. At one point, the price fell by 33% in the space of 24 hours. In the traditional investment landscape, such a steep and extended price movement are deemed tell-tale signs of an impending bearish run.

However, as explained earlier, this current market trend is a result of a slew of events perceived to have negative impacts on the global acceptance of cryptocurrencies. Hence, we are witnessing a unique situation where it is difficult to gauge the probability of a long-term uptrend or the start of a bearish run. Notably, Bitcoin and a majority of altcoins have recovered momentarily from the lows recorded at the height of the recent crypto sell-off. Is this a sign of good things to come, or just a momentary cease-fire before the onslaught resume?

What Do Experts Think?

What Do Experts Think

Unsurprisingly, most long-term crypto proponents believe that the bull cycle, which kicked off in March 2020, is far from over. Bobby Lee, founder and CEO of Ballet, a crypto wallet service, argued that the apparent rift that exists between the crypto community and China’s government has no lasting impact on the price trajectory of Bitcoin. Lee explained:

“China will ban Bitcoin again and again. By some future date, Bitcoin will be over $100,000 and [China will] have more regulatory agencies [looking at it], and the question is, what more can China do to ban Bitcoin and cryptocurrencies? It hasn’t already banned everything. Now they’re going to go after mining, apparently.”

Lee further highlighted the recurring approach of China to regulation, noting that we should not expect the country to change its stance on cryptocurrency in the foreseeable future:

“China operates in a way where they rarely change the rules. Changing the rules can be very controversial. What they do is they change enforcement. That’s why these verbal announcements are just a signal to the market, that they’re going to step up the enforcement again.”

And since China has been at loggerheads with the crypto industry for years now, its newly proposed policies should not drastically alter market conditions. In other words, if China’s regulatory stance is the main reason for the latest correction, then expect the market to rebound in no time at all.

CNBC’s Kelly Evans lent her voice to this topic in an article titled: The Crypto Crash. Here, Kelly emphasizes that the current crash does not dilute the potency of cryptocurrency:

“The biggest difference between now and the Bitcoin bust of 2017 is that Bitcoin barely encapsulates the world of crypto anymore. It’s just one piece of it. Meanwhile the crypto world is off to the races creating new payment tools and asset classes… There’s no putting the genie back in that bottle.”

She added that it is also looking less likely that regulators would bar us from owning or using digital assets:

“Will regulators end the whole experiment? I doubt it. Yes, our Fed is looking into its own digital currency, which could undermine the appeal of a lot of stablecoins today. But that will take awhile. Yes, the IRS is cracking down on unreported gains from owning or using crypto, as they should–it’s property, after all, not money. (Similarly, they may restrict the ability to use crypto as payment.) But I don’t see how or why they would decide “no one can invest in (a.k.a. own) crypto.” It would be like saying “you can’t own the new mini oil contracts” because they’re not physically deliverable. If anything, the feds seem to be tiptoeing towards codifying crypto as a permanent part of the asset landscape.”

Crypto analyst, Benjamin Cowen, believes that even though a rebound is imminent, it would take a lot more time for the digital asset to regain its already lost momentum. He explained:

“I would be more inclined to think that it’s more likely that we spend a little bit more time going down before we come back up. If you think it’s going to bounce and go up and put in a $200,000 Bitcoin within the next few months, you basically, at this point from where the price currently is, you need to see an immediate rebound otherwise I don’t think we can make it. But if we get that immediate rebound and we start moving back up then maybe it’s a possibility. Again, I’m just a little more pessimistic about it rebounding that quickly.”

As for Peter Berezin, chief global strategist at BCA Research, the crypto crash is far from over. He noted that the influx of strict regulations would force the price of digital assets even lower. Berezin stated:

“The drubbing that cryptocurrencies have received over the past two weeks is just a taste of things to come. Crypto markets will continue to face tighter regulation. … In the near term, the pain in crypto markets could drag down other speculative assets such as tech stocks.”

Nikolaos Panigirtzoglou, a managing director at JPMorgan, also shared a similar view, noting that the recent price recovery may not mark the end of the market crash:

“Despite the recovery in prices to around $40k, the momentum signals, and in particular the longer lookback period one, remain problematic as a signal. It is too early to call the end of the recent Bitcoin downtrend.”

Bearing these views in mind, it is safe to say that no one knows for sure whether the crypto market would recover or go downslope from here. Therefore, it is up to you as an investor to identify a strategy that works best for you and stick with it.

How Does The Four-year Cycle Come To Play?

How Does The Four-year Cycle Come To Play

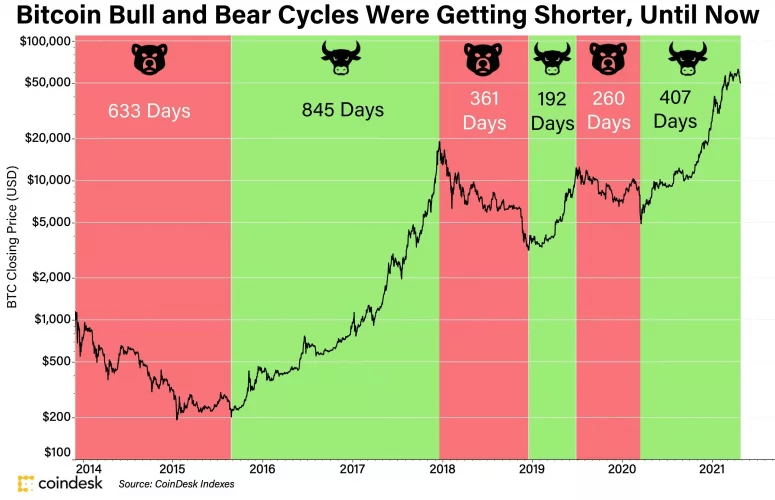

Historical Bitcoin bull and bear cycles (Source: Coindex Index)

Looking at the historical price trend of Bitcoin, it is easy to identify a recurring pattern. There is always a four-year build-up to a new price peak. Following the bear market of 2018, avid Bitcoin proponents expect the price of the digital asset to peak in the closing months of 2021 or early 2022. The current market condition does not resonate with historical price patterns. And so, it is easy to see why some believe that the price of Bitcoin would rebound quickly and set up unprecedented price movements for the rest of 2021.

Cowen captured this train of thought while discussing the two possible scenarios that could trail present market conditions:

“What I would say to you is I think there are two main trains of thought here. The first one being the four-year cycle. And in that scenario, if you’re expecting the four-year cycle to play out, then you would probably expect a pretty big bounce so that we get back on track. In order for us to put in those pretty high numbers by the third quarter or fourth quarter we need to get a bounce relatively soon so that we get back on track. So that would be if you think it’s going to peak this year. And the other one of course would be the lengthening cycles. And this one would be more along the lines of thinking that it’s going to take a little bit longer and that a reaccumulation phase is not the worst thing in the world for Bitcoin.”

Although the four-year cycle has been a recurring theme in the crypto market, the market has changed dramatically since the last bear market. For one, institutional investors have entered the market en masse. Hence, there is no saying if the four-year cycle still holds.

How To Approach The Current Crypto Market

There are several ways to cope with the volatility of the prices of digital assets. These measures are critical in a market cycle such as this. Below are some of the strategies you can adopt as a coping mechanism.

Buy The Dip

Buy The Dip

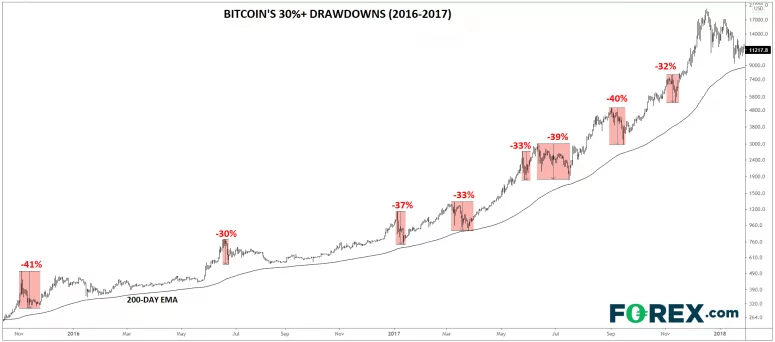

Bitcoin’s 30%+ price dips (Source: Forex.com)

The sudden fall in prices may be a blessing in disguise to those interested in buying more cryptocurrencies. Buying the dip entails calculated moves to purchase digital assets when they are experiencing corrections. Hence, the $30,000 Bitcoin price low recorded recently might have been the best entry point for buying the dip. If the value of Bitcoin recovers and subsequently exceeds its $64,000 all-time high, then those who bought the dip would emerge as some of the most profitable investors.

Benjamin Cowen shares a similar sentiment as he believes that the present market condition provides ample opportunity to reaccumulate Bitcoin:

“What I would say for this cycle is that Bitcoin is being very gracious. And what it’s potentially allowing people to do is reaccumulate before a move up later on this cycle to that six-figure mark… It allows these [new] guys to get it at a discount… In the grand scheme, if you’re operating somewhat deterministically like me on a six-figure Bitcoin later this cycle, something below $40,000 isn’t the worst price in the world. It also depends on your risk tolerance. It could easily continue to drop. And that’s why I think a DCA (dollar-cost average) strategy is the most appropriate strategy for Bitcoin.”

Before you start buying the dip, you should however ascertain the best entry point. As stated earlier, it is too early to determine the long-term price movement of crypto assets following the sustained downtrends. Therefore, buying Bitcoin at $40,000 may prove to be either a wise or foolish decision in the long run. A more cautious approach to this dilemma is the dollar-cost average strategy.

What is dollar-cost averaging?

Dollar-cost averaging is a measured attempt to make periodic and fixed purchases of an asset to negate the impact of volatility. In essence, you invest a specific amount in a digital asset at fixed intervals. This eliminates the need for investing at the best entry point. Also, spreading your investment across fixed intervals reduces the risks associated with lump-sum purchases.

For instance, if you plan on investing $1,000 in Bitcoin, you can spread your investment across 4 weeks. In each week, you will invest $250 regardless of the changes in the price of Bitcoin. With this, it is possible to take advantage of price dips. The more the price of Bitcoin dips, the more profit your dollar-cost average strategy generates. In essence, dollar-cost averaging is the ideal investment model for bear markets or extended periods of price corrections.

Conversely, it quickly loses its potency if the price of the asset is recovering or exhibiting signs of a bull cycle. With each purchase, you tend to buy the asset at a slightly higher rate. In the end, you will discover the potential profit is lower than what you could have made if you had invested a lump sum in the digital asset.

Hodl

For those that do not have extra funds to throw at the crypto market, the next logical step is to hold their positions until prices recover. Although this is not as easy as it sounds, it is the only way you can protect yourself from permanent losses. There is a strong possibility that the crypto assets would recover and even outperform their current peak prices. As such, it is common sense to weather the price corrections and sell only when the value of the asset has recovered. Losses become irreversible when you opt to sell your holdings below your purchase price.

However, note that there is no way to accurately predict how long it would take for the market to rebound and start yielding profits. For example, it took roughly 2 years for investors that had bought Bitcoin at $18,000 in 2017 to recoup their investments. Hence, it could take weeks, months or years, for Bitcoin to retest the $60,000 mark. So, if you are opting for the hodl option, then be prepared to maintain your position for the long haul.

While you are at it, ensure that the digital assets you are invested in are poised for long-term viability. Not all cryptocurrencies that made a splash in the bull cycle of 2017 are still relevant today. If you had at one point or the other invested in a coin with weak fundamentals, then you may not likely recoup your investment. This is true in a scenario where you might have to wait for years for the crypto market to recover. Therefore, before you decide to hodl, ensure that the cryptocurrencies that make up your portfolio are viable enough to outlive a sustained bearish run.

Switch To Stablecoins

Stablecoins are the major source of stability in the traditionally volatile crypto market. These coins are pegged to traditional assets or fiat currencies and are unsusceptible to volatile price movements like the one experienced recently. As such, it comes as no surprise that there is always an uptick in the demand for stablecoins during periods of high price fluctuations. Paolo Ardoino, CTO of Tether, emphasized that excessive volatility often forces investors to move their funds to the stablecoin market:

“During these extreme episodes, we’ve historically seen an uptick in stablecoin activity, made evident by Tether’s recent US$60 billion milestone as demand continues to grow. Events like these even support the ecosystem’s strength and help everyone refocus back to building rather than the distraction of token price gains.”

Thus, it is okay to exchange your volatile coins for stablecoins and wait out the storm. You can switch back when there is some level of clarity regarding the short-term and long-term movement of crypto prices.

While stablecoins are proven shields against unprecedented volatility, they also have their own sets of drawbacks. The most prominent is the increased regulatory scrutiny of stablecoin activities. Using regulated fiat currencies as the underlying peg for a stablecoin is bound to attract the attention of regulators. Also, not all issuers are transparent about their operations.

To avoid all the governance and operational controversies associated with centralized stablecoins, you should go for established decentralized stablecoins like DAI.

Isolate Promising Digital Assets

Isolate Promising Digital Assets

More often than not, it is time and resource-intensive to separate viable crypto projects from mediocre ones, especially in a bull market. Entrepreneurs and developers are constantly capitalizing on various crypto trends to market their products. This is more evident during bull cycles as investors are more prone to pour funds into the crypto market indiscriminately. It goes without saying that such an undisciplined investment strategy influenced the bull market in 2017 and resulted in the explosion of initial coin offerings (ICOs).

In the aftermath of the market crash at the beginning of 2018, we began to witness the extent to which scammers and incompetent entrepreneurs or developers had profited off the ICO boom at the expense of investors. Only a handful of the crypto projects that emerged during the heights of this investment frenzy are still operational. And so, it is a lot easier to differentiate between poorly conceived crypto projects and viable ones when the market is relatively quiet.

Hence, this market crash provides a window to reassess the market, identify hidden gems, and invest at their early stage of development. The goal is to see beyond the hype and accumulate as many crypto assets as you possibly can. Note that this requires a long-term investment strategy. It is almost impossible to predict how long it would take for these tokens or coins to generate impressive returns on investments. So, once you have carried out due diligence and confirmed the long-term viability of the digital asset, you may have to patiently wait for it to generate significant yields. You may be wondering: How then can I know for sure that a crypto token is viable?

How to identify viable crypto projects

Understand the utility of the product

It is common for crypto startups to jump at trends without really developing new paradigms that could set their products apart or appeal to a broad audience. The quality of the utility of a crypto product has a strong bearing on its long-term valuation. Hence, invest responsibly by taking the time to understand the workings of the project, what it brings to the table, and how it can improve existing systems.

Luckily, a majority of crypto projects are open source. In essence, you can audit the protocol independently to confirm that there are no bugs or other technical issues that could undermine the viability of the product. While researching new crypto projects, you should go as far as comparing them with existing solutions or other competitions. If there is no obvious advantage that this new product offers, then there is a zero chance that it will make a splash in an already saturated sector.

Also, confirm that the lofty goals set by the development team are achievable. It is better to opt for projects with practical solutions than to go for those with unproven and bogus architectures.

Verify the development team’s reputation

After you must have ascertained the utility of the product, the next step involves the thorough research of the development team. Not only is it advisable to choose projects headed by reputable figures, but it is also important to identify how their experience and expertise influence the growth potential of the project. You must ensure that the individuals that make up the development team are versed in the realities of the targeted industry.

There is a limit to the impact a product can make when those in charge of steering its development lack the experience and skills required to maneuver recurring limitations.

Opt for functioning products

As stated earlier, do not just base your decision on the appeal of the solution. You should go a step further to confirm that it is not just wishful thinking. The best way to avoid projects that would later linger in the development stage is to opt for startups that already have working products. It is easier to gauge the viability of a project if its product has already scaled the early stages of development. With this, you are not basing your decision on promised deliverables but functioning systems.

Earn Crypto Passively

During a prolonged price correction, it is best to accumulate cryptocurrencies by buying the dip. However, if buying is not on the cards, you can as well find means of generating crypto income. For example, you can apply for positions in companies that pay their employees in cryptocurrencies. With this, you must have accumulated enough digital assets by the time the next bull cycle begins.

Another possible income-generating opportunity peculiar to the crypto sphere is staking. Here, you lock or commit your crypto holdings on blockchains to become a validator and earn newly minted coins as rewards. Then there is the option of lending out your crypto for the chance of earning interest. This approach has become popular in the last couple of years, thanks to the emergence of both centralized and decentralized lending platforms.

Lastly, you can partake in bounty promotions, referral programs, and airdrops. All three options are avenues by which you can earn cryptocurrencies for free. You only need to complete specific tasks like referring a product to your family and friends, following an account across social media selected platforms, retweeting posts, and so on.

However, while hunting for ways to earn passive crypto income, do not forget that there are several illicit entities out there trying to defraud you of your money or steal your data. Hence, if it is too good to be true, then it is most likely a ploy to defraud you. As appealing as crypto is, it is not a get-rich-quick scheme. Anyone that promises you anything different is probably looking to steal from you. As such, it is advisable to put your greed in check when dealing with cryptocurrencies.

Get Involved In Crypto’s Development

Whenever the value of crypto assets is no more the talking points, developers and the crypto community team tend to focus more on its technical developments. Hence, a sustained price downtrend offers crypto participants the opportunity of getting more involved in the industry. You can start by expanding your knowledge of the crypto landscape. Learn about newly introduced concepts and how they can improve our everyday lives.

You can as well contribute to the governance of decentralized protocols. This requires the acquisition of voting rights in the form of governance tokens. In addition to buying these tokens, you can partake in governance distribution programs to earn a share of the token and in turn have a say on the future of the project. Note that the more people are involved in the governance of such protocols, the more decentralized they become.

Try The Traditional Asset Markets

The truth is that not everyone is cut out for the wild price swings associated with digital assets. Some do not just have the appetite for risks required to outlive a 60% price crash. And so, for this set of people, the only logical way of approaching a market correction of this magnitude is to pull out of the crypto market and stick to asset markets that are not prone to excessive volatility.

Experts believe that the stock market would likely benefit from the recent price crash as investors are likely switching their attention from speculative assets to traditional assets or stocks poised to experience price boost due to the lifting of lockdown restrictions. Therefore, if it is traditional asset markets that best suit your risk appetite, go for it.

Conclusion

As highlighted in this guide, the possible long-term effects of the recent crypto crash are not set in stone. Expect the market to either recover and continue from where it stopped or trade sideways for a while before testing new lows. Depending on the eventualities, it is advisable to come to terms with the volatility of the crypto market and set up viable strategies for coping with unexpected crypt crashes.

This entails the reassessment of one’s risk appetite and the adoption of investment strategies designed to help reduce and cope with the impact of unprecedented downtrends.