Do Pump and Dumps Actually Happen in Cryptocurrency? The Biggest Scam Schemes Taking Place Now.

Many of us have seen the film “The Wolf of Wall Street”. The film was filled with scenes of drugs, parties, and curse words. But how did the firm in The Wolf of Wall Street – Stratton Oakmont – actually make their money. A lot of the money the partners in the firm made was through the operation of a pump and dump scheme.

What is a pump and dump scheme?

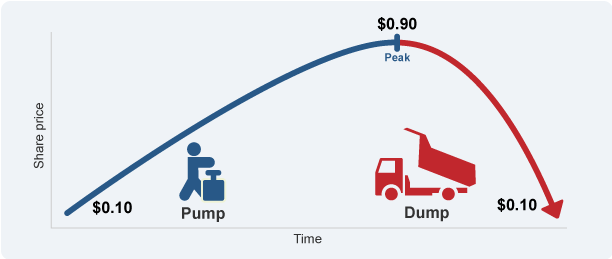

A pump and dump scheme is organized by a group that orchestrate the collective buying of an instrument. This pumps up the price with the idea being that other traders will take note and get involved. As well as the traders in a pump and dump group collectively buying, the group members typically organise to spread misinformation regarding the instrument so that others are enticed to buy. Once the price has risen significantly, the members of the pump and dump exit leaving the instrument with those who entered late. This spurs on more selling and the price will typically dump. In “The Wolf of Wall Street”, the main organiser Jordan Belfort and his partners would hold significant holdings in questionable companies and hire brokers to sell the shares to the public. Once the price had risen significantly, Belfort and his partners would exit their sizeable positions.

Do pump and dumps exist in cryptocurrencies?

Pump and dumps are an illegal practice in the regulated securities market. They are also almost impossible to execute in the securities markets due to the huge amounts of capital which would be required to significantly move price. The unregulated nature of the cryptocurrency market combined with the low market cap of many of the cryptocurrencies that make up the market makes it an attractive target for those who wish to run pump and dump schemes. Recent research shows that there are over 3,700 of these groups operating on Telegram and over 1,000 operating on Discord. The results also show that the groups are reasonably successful at manipulating cryptocurrency prices. The biggest factor which contributes to the success of a pump and dump was shown to be the market cap of the cryptocurrency being targeted with lower market cap cryptocurrencies being more suitable for pump and dumps.

What are the risks?

Despite the groups being reasonably successful, pump and dumps are highly risky for users to get involved in. There is no certainty involved when buying into one of these schemes and members of the groups could easily be buying at the point where the price is about to dump. The success also depends on the ability of the group to attract other traders outside of the group to participate which is not always guaranteed. Members of the group can often just be buying and selling to one another with those who enter early profiting and the late entrants losing significant amounts.

The Biggest Groups

With a huge amount of these groups operating on both Telegram and Discord, we present the biggest and most significant pump and dump schemes operating in the cryptocurrency space today. As the market becomes more regulated and more institutional capital enters the industry, these groups will likely gradually start becoming extinct. For the moment, they are a very much a reality and it is important for those who participate in the cryptocurrency markets to be aware of their role.

Big Pump Signal

Big Pump Signal is the largest pump and dump group with over 100,000 members on Discord and over 50,000 on Telegram. The group orchestrates pump and dumps to take place on Binance exchange. The group has an affiliate programme whereby members that refer other group members get information on the cryptocurrency being pumped prior to other members. The affiliate programme is a progressive system where the member gets the information earlier when they have invited more members. The maximum time advantage is 3 seconds which is achieved by inviting 250 other members.

Big Pump Group

Big Pump Group is a highly similar group that also operate on Binance exchange. The group has over 24,000 members on Telegram. There is also a similar affiliate system. The Big Pump Group affiliate system allows the members to achieve up to a 3 seconds advantage by inviting 500 members. Big Pump Groups also have plans to launch a group that orchestrates pump and dumps on Bittrex exchange.

Mega Pump Group

Mega Pump Group is another similar group that organises pump and dumps on Binance exchange. The group has over 28,000 members in their Telegram channel. Big Pump Group and Big Pump Signal both have websites but Mega Pump Group does not. This group is currently taken a break due to the bearish market conditions.

Other Groups

There are a number of other groups which operate on other exchanges. Crypto Family Pumps, Hit Pump Signals and Strategies, and Cryptocurrency Analysis and Market Predictions all operate on Cryptopia. Cryptopia is a New-Zealand based exchanges which have lower trading volume meaning that it may be more suitable for organising pump and dumps.