Analyzing Cryptocurrency Performance: Past and Future

Embarking on the cryptocurrency investment odyssey calls for more than just a leap of faith; it’s a strategic march into a battlefield where the cleverest maneuvers are born from understanding the ebbs and flows of this digital asset’s past performance. While stories of jaw-dropping wealth and crushing losses circulate with each market cycle, critical insights await those willing to sift through the chaos. It’s about identifying patterns in the historical tumult, predicting market movements with calculated precision, and setting sail with an informed compass charting towards the future fortunes of . Let’s peel back the layers of mystique and arm ourselves with knowledge, for in the pulse of past market rhythms lies the foresight to anticipate the next big wave in the cryptosphere.

Fear and Uncertainty of Cryptocurrency Investment

Fear and uncertainty often grip the hearts of potential investors regarding cryptocurrencies. But what exactly stirs these feelings?

- Extreme Volatility: The wild price swings can make even the bravest investor’s pulse race.

- Lack of Historical Data: With traditional investments, years or even decades of ; cryptos, being relatively new, lack this depth of information.

- Underlying Technology: The complex technology behind cryptocurrencies can be intimidating for many.

Despite these concerns, a burgeoning number of investors are attracted to the potential rewards that offer. But how can one separate the wheat from the chaff and discern whether these digital assets are suitable for long-haul investment?

Unlocking The Future

Understanding the historical performance of cryptocurrencies provides a foundation upon which predictions of future trends can be made. It’s a narrative marked by:

- Historic Bull Runs: Moments where the cryptocurrency market skyrocketed, captivating the attention of mainstream media and the public.

- Abrupt Corrections: Times when the market corrected itself, often resulting in significant price drops, leaving investors reeling.

- Changes in Regulations: How governmental stances worldwide have influenced investments and market stability.

By scrutinizing the performance timeline of digital currencies, we catch a glimpse of the potential that lies ahead. With each cycle, lessons are learned, and investment strategies are refined. Now, equipped with this insight, the question remains—how will these factors shape the future of cryptocurrency?

Stay tuned; more revelations are on the horizon. What can historical parallels between and conventional assets like gold tell us? As we pave the way to part two, anticipate a compelling examination of Bitcoin’s storied journey and its juxtaposition with traditional market stalwarts. Will hist ory repeat itself, or is the digital currency realm charting an entirely new course?

Tracing the Lines of Historical Performance

“History is a guide to navigation in perilous times. History is who we are and why we are the way we are.” These words by David McCullough aren’t just relevant to the broader strokes of human history but resonate deeply with the volatile journey of cryptocurrencies. When stepping into the world of Bitcoin, one stands on the precipice of the digital age’s most significant financial revolution. But before we dive into the future, let’s take a moment to analyze Bitcoin’s awe-inspiring ascent and how it stacks up against traditional assets like the SPDR Gold Shares.

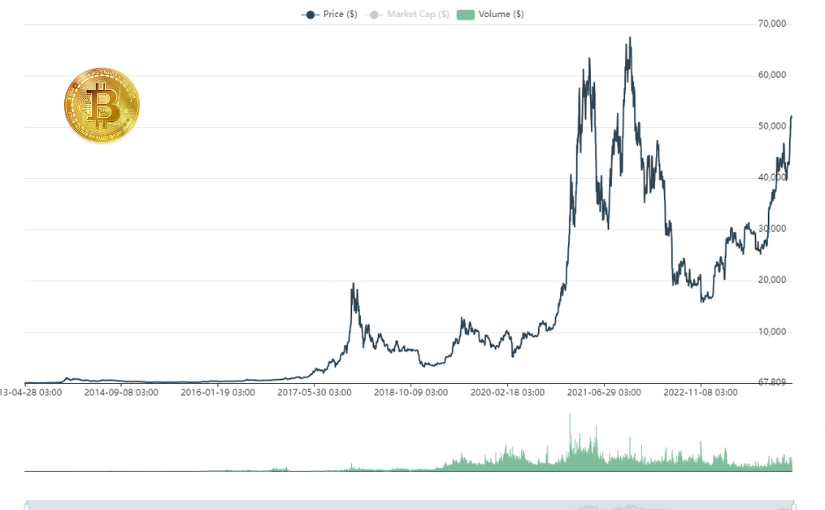

The Bitcoin Rollercoaster

Since its inception in 2009, Bitcoin has been a whirlwind of ups and downs. But it’s not just the price fluctuations that make this digital asset so intriguing; it’s the narratives that surround its growth. From its humble beginnings when the price of one Bitcoin was mere cents, to the dizzying heights of its 2017 peak and subsequent corrections over the years, the Bitcoin story is one of meteoric rises and heart-stopping drops. Let’s break down some notable moments in Bitcoin’s history:

- 2010: Bitcoin is used to buy a pizza, famously known as the first real-world transaction.

- 2013: Bitcoin surpasses $1,000, firmly marking its arrival on the global stage.

- 2017: The peak of nearly $20,000 per Bitcoin that created a frenzy among investors before the inevitable correction.

- 2020: Institutional adoption begins to ramp up as the world grapples with economic uncertainties, reinforcing Bitcoin’s stature.

As I dissect these major milestones, they showcase not just an asset’s performance but also the growing trust and belief in a decentralized future.

Comparing Apples to Oranges

When it comes to investment performance, comparing Bitcoin to traditional assets is like juxtaposing daring innovation with time-honored stability. Consider the gold market, represented by SPDR Gold Shares—a stalwart of security for many investors. Over the same period that Bitcoin has existed, gold has had its share of fluctuations but with nowhere near the same volatility or return potential that Bitcoin has exhibited. While gold’s stability is its charm, Bitcoin’s explosive potential is what captivates the adventurous investor.

Here are a few thought-provoking comparisons that highlight the contrast:

- While gold has seen a relatively steady appreciation over the past decade, Bitcoin has experienced exponential growth, outpacing virtually every traditional asset class.

- Gold’s market cap remains significantly higher than Bitcoin’s, suggesting widespread acceptance and stability. However, Bitcoin’s market cap growth percentage tells a story of rapid adoption and high reward potential.

- The liquidity of both assets varies greatly, with gold offering more traditionally accessible means of trade, while Bitcoin facilitates swift digital transactions, bypassing conventional financial systems.

Now, does this mean Bitcoin’s trailblazing performance overshadows the assuredness of gold? Or do these comparisons open up new avenues to blend the new-age digital asset with the old guard of investment? These questions pave the way for a deeper understanding and anticipation of the future that lies ahead.

When considering where our monetary system is heading, will modern digital currencies phase out their tangible counterparts, or will gold continue to hold the fort as a haven in uncertain times? Stay tuned, as we delve into more insights that will help you navigate this dynamic landscape in the next part of our series.

Diving into Cryptocurrency Trend Analysis

When it comes to understanding the ever-evolving world of digital currencies, isn’t it like trying to catch ripples in the water with your bare hands? Sometimes, indicators and patterns in the crypto market can be fleeting, but with the right tools and know-how, predicting trends doesn’t have to be a wild guess.

A Lesson on White Papers

Consider the white paper as the cryptographer’s map, the document that can either make or break a currency. They are more than just technical manuals; they paint a vision for the future of the coin. For instance, Bitcoin’s white paper was not just about the technology but a whole new philosophy of decentralization. But, how accurately do these documents translate to success in the actual market?

- Examine the problem the cryptocurrency is trying to solve.

- Scrutinize the proposed solution’s feasibility and the technology behind it.

- Check the milestones and timeline; are they realistic and being met?

The Importance of Team Research

Have you ever wondered why some coins soar while others flop? Often, it’s the team that makes all the difference. Case in point, Ethereum’s resilience and continued innovation can be traced back to its founder, Vitalik Buterin, and his team’s expertise. But what should we look for in a team to determine a cryptocurrency’s potential?

- Expertise and track record of the development team.

- The advisory board’s credentials and their influence in the blockchain community.

- Transparency in communication and regular updates from the team.

Crypto Leadership, Community, and Technology

Imagine a cryptocurrency as a ship – the leadership steers it, the community powers the sails, and technology is the vessel itself. A prosperous currency needs all three. Take Bitcoin again; it’s not just the groundbreaking technology but its robust community and leadership that challenge norms and push boundaries. Here’s a breakdown:

- Leadership: Visionaries who champion the project. Are they the lighthouse guiding the ship to new horizons?

- Community: A dedicated user base that believes in the currency. Is the community engaged and thriving?

- Technology: Innovative and scalable tech solutions. Does the technology have the potential to outlive the hype?

“Investing in cryptocurrencies is a blend of both science and art, where numbers meet human behavior.” – Anonymous

As we trace these digital footprints, we are not simply watching numbers go up and down. We’re part of an intricate dance of market sentiment, innovation, and the human element behind it all.

Now, you might be pondering over what this means for the future. Will the information extracted from white papers and team research be enough to guarantee a good investment? Well, one thing’s for sure – the anticipation surrounding cryptocurrencies is palpable. It’s the reason I’m here, tirelessly exploring and informing you, so you can navigate these waters with confidence.

Are you ready to discover how these insights can carve the path for the next big investment? Hold tight, because the next segment will unravel the mysteries awaiting in the future of cryptocurrencies.

Deciphering the Future of Cryptocurrencies

When you think about the evolution of cryptocurrencies, there’s a distinct buzz in the air – it’s the sound of change, of digital transactions becoming as commonplace as cash. As an enthusiast of the crypto-wave, I’ve seen firsthand how early indications are painting a bright future for these digital assets. But what does this shift towards mainstream acceptance really mean for you, the investor?

The Rise of Digital Transactions

Imagine a world where buying your morning coffee or paying for a ride is a simple swipe away – not with a credit card, but with your cryptocurrency wallet. We’re inching closer to this reality every day. Businesses around the globe are starting to welcome crypto-based transactions with open arms. This could revolutionize not only our daily lives but also the potential of your investment portfolio.

- Accessibility: As crypto payments become more user-friendly, expect a surge in their adoption rate.

- Speed and Efficiency: With blockchain technology streamlining transactions, say goodbye to long processing times.

- Reduction of Fees: Traditional banking fees could soon be a relic of the past, thanks to the minimal costs associated with crypto transactions.

“The future of money is digital currency.” – Bill Gates. This isn’t just a passing thought; it’s the writing on the wall, and it holds great promise for your investment’s growth.

The Intersection of Crypto and Global Finance

But there’s more. Cryptocurrencies are not just cozying up to traditional forms of payments; they are beginning to intertwine with the very fabric of global finance. Major financial institutions have started to recognize the potential, with some even creating their own digital currencies or integrating blockchain into their existing infrastructure.

- Banking Integration: Banks are exploring blockchain for secure and efficient transactions, heralding a new era of fintech.

- Regulatory Advances: With proper regulations in place, crypto will gain further legitimacy, trust, and stability – key factors for any investment.

- Institutional Investment: The entry of institutional investors brings with it a wave of resources and expertise, potentially boosting market stability and growth.

As these groundbreaking developments continue to unfold, your foresight as an investor could be greatly rewarded. However, with every opportunity comes questions:

How can you navigate this melding of the old and new financial paradigms? What tools and strategies will you need to maximize your returns in this brave new world of finance?

Hold onto these thoughts as we prepare to explore the crystal ball of cryptocurrency indicators. Are they your ally in carving out a successful future in this digital gold rush? Stay tuned – the answer might just surprise you.

Cryptocurrency Indicators: Friend or Foe?

Hello, fellow crypto enthusiasts! In our journey through the complex web of cryptocurrency, we often find ourselves at a crossroads, where numbers and charts either pave the way to our success or become an enigmatic puzzle. Let’s illuminate the significance of technical indicators in crypto trading and untangle what they portend for the future.

The Game of Numbers

When trading cryptocurrencies, there’s a secret arsenal that traders swear by – technical indicators. These are not just mere numbers; they’re like the pulse of the market’s beating heart, signaling its next move. Here are the top 10 technical indicators that every trader worth their salt keeps an eye on:

- Relative Strength Index (RSI) – Is the market overbought or oversold? RSI holds the answer.

- Moving Average Convergence Divergence (MACD) – The trend-follower’s compass, highlighting momentum shifts.

- Bollinger Bands – These bands don’t play music, but they sure can signify market volatility.

- Fibonacci Retracement – Finding support and resistance levels has a mathematical touch with the Fibonacci sequence.

- Volume – The unsung hero, sometimes loud, sometimes soft, revealing the strength of a price move.

- Stochastic Oscillator – Just how strong is your crypto’s current trend? This guy can give some hints.

- Ichimoku Cloud – With a name as mystical as its predictions, this indicator gives an all-in-one market view.

- Candlestick Patterns – These aren’t just pretty shapes. They tell a story of market sentiment and potential reversals.

- Parabolic Stop and Reverse (Parabolic SAR) – A mouthful to say, but it’s a straightforward way of spotting potential reversals.

- Average Directional Index (ADX) – Measuring the strength of a trend is its game, helping you gauge your next move.

Imagine harnessing this powerful line-up to peek into the crystal ball of cryptocurrency trading. It’s like using the stars to navigate the high seas of investment.

Using Tech Indicators for Future Analysis

But if truth be told, becoming a seer of cryptocurrency doesn’t just happen by staring at numbers. Knowing how to interpret these indicators is where the real magic lies. Let’s picture the RSI soaring above 70 – that’s not just a number, it’s a siren’s song, often warning of an overbought market. On the flip side, if it’s dipping below 30, you might be looking at a robust buy signal – a gem hidden among the stones.

“The trend is your friend until it ends,” as the seasoned traders say. Indicators like the MACD and Bollinger Bands help us ride the waves of market trends, ensuring we don’t find ourselves swimming against the tide. And when Fibonacci retracement levels align with support or resistance markers, it’s as if the ancient mathematicians themselves are pointing out the golden spots for potential buy or sell orders.

It’s about painting a bigger picture from small strokes – each indicator adds a hue, a shadow, a highlight, providing a multi-dimensional perspective of the market’s potential next moves.

Savvy trading springs from the confluence of indicators, not the reliance on a singular metric.

Remember, these indicators are tools, not oracles. What they predict could well be overturned by a sudden regulatory announcement or an unexpected market event not even Nostradamus would see coming. Yet, their calculated insights are invaluable, offering a semblance of order in what can be a chaotic marketplace.

With these indicators as your cryptic cipher, can you decode the patterns to reveal the market’s future choreography? Stay tuned as we next navigate the vast ocean of resources that every crypto analyst should have in their treasure chest – perhaps therein lies your map to untold wealth. What indicators have you plied in your own trading voyages?

Valuable Resources for Crypto Analysis

Hey there, savvy investor! When it comes to staying ahead of the cryptocurrency game, the right tools can make all the difference. You want resources that not only depict the journey of cryptos up till now but also unblur that crystal ball of future trends. So, let’s get laser-focused on some of the most reliable beacons in the vast ocean of crypto analysis.

Reflecting on the Past

Ever wondered how deep the roots of Bitcoin’s volatility go? A visit to Doubloin could be illuminating! Here’s a treasure chest that maps Bitcoin’s fluctuating fortunes over the years. With Doubloin, you’re looking at comprehensive graphs that paint the full picture—from striking peaks to sobering troughs. A real-time journey that showcases how events, market sentiments, and even tweets have nudged the crypto giant, Bitcoin, in different directions.

Glimpsing into the Future

But what about the days ahead? That’s where Morning Star’s charts come in. Morning Star doesn’t just give you the numbers; it gives you the story those numbers tell about what’s to come. Understanding their in-depth analysis could be your edge in making predictions. They are like the soothsayer that whispers secrets about possible futuristic scenarios in the crypto-verse, and trust me, you want to listen.

The Art of Analysis

But let’s not stop there! For the tactical minds yearning for top-notch technical analysis, OANDA stands out as a maestro in interpreting the market’s ebb and flow through a series of insights and tools. OANDA shows you how to read the market’s pulse and potentially predict its next palpitation. It’s like having an oracle in your browser, offering guidance through the complex dance of numbers and trends.

And now, with these tools at your fingertips, how will you leverage them to carve out your niche in the crypto landscape? Have we sparked a sense of confidence to predict crypto shifts smarter and possibly sooner? In the upcoming finale of our exploration into cryptocurrency performances, expect to lock the final piece of this puzzle into place. Are you ready to claim your position on the frontlines of crypto investment? Stay tuned.

The Road Ahead

As we stand at the precipice of a new era in investment, the buzz and whirl of cryptocurrency are louder than ever. The journey thus far may have been speckled with uncertainty and exhilarating returns, but what lies ahead is even more promising. With every stride taken in the crypto world, we trailblaze paths into an investment landscape ripe with opportunities, aiming to maximize the potential that digital currencies offer.

Cryptocurrency: A New Investment Frontier

The lure of cryptocurrencies goes beyond their novelty; it’s their potential to redefine wealth and investment for generations to come. Consider how Bitcoin, a name now synonymous with digital gold, has made millionaires out of early adopters. Or ponder over Ethereum, a platform that’s not just a currency but an innovation hub. The value extends past mere currency – it’s in the blockchain, in smart contracts, in decentralized finance. Studies into blockchain’s market size project a snowballing trajectory, set to expand exponentially in the coming years. This isn’t just a trend; it’s the future unfolding before our very eyes.

Making Smart Investment Choices

Information, they say, is power, and with the insights shared through various analyses, you’re now equipped to make informed decisions in the cryptosphere. Remember the flash crashes and the spikes – they tell tales of volatility but also of remarkable recoveries. Real cases, like the bull run of 2017 or the swift adoption by corporations as seen with Tesla’s $1.5 billion Bitcoin buy-in, serve as tangible lessons. Such strategic moves are based on careful study and a deep understanding of market dynamics, exactly the kind of smarts that will bolster your investment decisions.

Conclusion

In recapping our journey, we’ve seen the silhouettes of the past and the outlines of what’s to come. The historical dance of cryptocurrencies has been one of high risk but also high reward. Looking forward, the integration with global financial systems, the advent of institutional investments, and the rise of decentralized finance lay the groundwork for a new chapter. As expert testimonies predict, the era of digital currency is just at its dawn. But remember, like all frontiers, it demands respect, a keen eye, and a penchant for continuous learning. So take these lessons, insights, and revelations with you as you venture into the terrain of crypto investing. The road ahead is bright, and it’s yours to claim.