Coinbase vs. the White House: Is Washington About to Kill the Crypto Bill—and Freeze DeFi Innovation?

If you’ve felt that weird mix of hope and dread watching the Coinbase–White House tension hit the timeline, you’re not alone. This isn’t just another “crypto vs. government” headline—it’s a real stress test for whether the U.S. can pass a workable market-structure bill without kneecapping the very parts of crypto that actually work: stablecoins, open networks, and DeFi.

I’m writing this for investors, builders, and everyday users who want a straight answer: does this clash threaten the Senate crypto bill, and what happens to DeFi if it stalls—or flips in a bad direction?

Markets can price risk. What they can’t price is “we’ll see” enforcement.

The pain right now: regulation by conflict, not by rules

Right now, U.S. crypto policy feels less like a rulebook and more like a series of public battles—agency statements, lawsuits, “guidance” that reads like threats, and companies guessing what the government will decide after they ship.

That matters today because uncertainty isn’t just annoying—it’s expensive:

- Investors widen their risk premiums when rules can change mid-flight (that usually means lower valuations and thinner liquidity).

- Builders avoid shipping features that might become liabilities—especially anything touching staking, stablecoins, or DeFi interfaces.

- Users get pushed into worse outcomes: fewer regulated on-ramps, more fragmented access, and “shadow” alternatives that are harder to monitor and protect.

This isn’t theoretical. Research has repeatedly shown that regulatory uncertainty changes where activity goes. For example, the Bank for International Settlements (BIS) has documented how crypto activity shifts across jurisdictions as rules tighten or loosen, and the IMF has warned that inconsistent frameworks encourage regulatory arbitrage (translation: activity migrates to wherever the rules are clearer or the enforcement is lighter).

And DeFi? DeFi hates vague enforcement even more than markets do, because it’s built on software distribution. When the rules aren’t explicit, people don’t just “comply”—they stop building, block U.S. IPs, or move teams offshore.

What people are actually scared of (and it’s not just Coinbase)

Coinbase makes a great headline, but the anxiety underneath is broader. Here’s what I’m seeing investors and founders actually worry about—especially in the U.S.:

- Exchanges getting squeezed into listing fewer tokens, restricting features, or charging higher fees because compliance becomes heavier and less predictable.

- DeFi front-ends becoming the enforcement target (not the protocol contracts themselves, but the websites and teams people use to access them).

- Stablecoins getting boxed in—either through issuer-only rules that reduce competition, or restrictions that make “dollars on-chain” harder to use in DeFi.

- Liquidity moving abroad as market makers, token teams, and even app developers decide it’s safer to serve non-U.S. users first.

- A “permissioned internet” precedent for finance—where publishing code is treated like operating a bank, and access becomes gatekept by a handful of approved intermediaries.

That last one is the sleeper issue. If the U.S. sets a norm that open-source financial software needs centralized permission to exist, other countries copy it. That’s how innovation slows down globally, not just locally.

Quick definitions so nobody gets lost

What is Coinbase used for? In normal-person terms, Coinbase is mainly:

- An on/off-ramp: a place to connect your bank and move between dollars and crypto.

- A trading venue: spot markets for buying/selling assets.

- Custody: holding crypto for users and institutions (including more formal custody services for large clients).

- Staking/services (where allowed): helping users participate in network security/validation programs, depending on the asset and jurisdiction.

- Institutional rails: APIs, prime-style services, and workflows that funds and larger players rely on.

And that’s exactly why it becomes a regulatory lightning rod: it sits where crypto touches the traditional system—banks, payments, consumer protection, tax reporting, and market integrity. If policymakers want leverage over crypto adoption, centralized on-ramps are where they push.

Why “Coinbase vs. White House” is bigger than one company: because it signals how the administration wants crypto regulated in practice. Not in speeches. Not in campaign lines. In day-to-day reality: who gets pressured, what gets labeled risky, what gets tolerated, and what gets quietly squeezed out.

If the posture is “we’ll keep flexibility and enforce as we go,” then even a good-looking bill can become a battleground. If the posture is “we want a predictable lane system,” then the same bill can actually reduce friction and keep innovation onshore.

Promise: what I’m going to do next (so you can stop guessing)

Here’s what I’m going to lay out next, in plain English, without the Twitter fog:

- What the Senate bill is trying to do (and what parts matter most for real users, not just lobbyists).

- Who the power players are—and what each side actually wants when cameras aren’t rolling.

- The likely outcomes and what each one means for DeFi access, stablecoins, and U.S. market liquidity.

- A practical checklist to reduce policy risk in your portfolio and your DeFi usage without panic-selling headlines.

So here’s the big question I want you thinking about as we move on: is this bill headed toward real “lane clarity”… or a version of clarity that quietly makes DeFi impossible to use? I’m going to map that out next.

What the Senate crypto bill is trying to do—and why the White House fight could derail it

Here’s the clean way to think about the Senate’s “market structure / CLARITY-style” push: it’s trying to stop the U.S. from regulating crypto by headline, lawsuit, and surprise enforcement.

The core goal is simple (and overdue): draw lanes. Who regulates what, what disclosures are required, what stablecoins must prove, and whether DeFi is treated like software or like a financial intermediary.

That’s exactly why this Coinbase–White House clash matters. Coinbase isn’t fighting because it loves politics. It’s fighting because clear rules scale a business, and unclear rules turn every product decision into a legal coin flip. If the executive branch signals “we want maximum flexibility,” it raises the odds that the bill gets rewritten into something that looks like clarity on paper—but functions like a leash in practice.

And yes, investors feel this immediately: it changes which tokens get listed, which yields survive, which stablecoins stay liquid, and whether U.S. users can even access certain DeFi front-ends without jumping through hoops.

One quick reality check: multiple industry studies keep pointing to the same macro effect—regulatory uncertainty pushes activity elsewhere. Electric Capital’s developer reports (year after year) have shown that builders are globally mobile; when policy gets hostile, talent spreads out rather than waits around. Chainalysis’ adoption reporting also consistently shows how quickly usage routes around restrictions. That’s not ideology—it’s incentives.

“What is the Senate crypto bill?” (answer it like a normal person)

Most Senate drafts being discussed publicly have the same “big rocks,” even if the exact wording changes week to week. Here’s what it’s trying to accomplish, in human language.

1) Split oversight: SEC lane vs. CFTC lane

Right now, one of the biggest problems is that the SEC can argue a lot of tokens are securities, while the CFTC argues some are commodities, and projects/exchanges get stuck playing defense. The bill’s direction is typically:

- SEC for securities-like crypto activity (investment-contract behavior, capital formation, issuer-driven promises).

- CFTC for commodity-like crypto spot markets and trading oversight (think: market integrity rules where there’s no “issuer-like” entity controlling the asset).

Why you should care: if a token can plausibly qualify for the “commodity lane,” that changes what an exchange can list, what disclosures are required, and how market surveillance is handled. It also changes whether a project’s U.S. strategy is “build” or “geo-block.”

2) Registration/disclosure expectations for intermediaries

The most realistic version of “clarity” doesn’t mean “no regulation.” It means predictable paperwork for the businesses that touch users:

- Exchanges (order books, custody, surveillance, conflicts of interest)

- Brokers/dealers (how they route, how they disclose fees)

- Custodians (segregation, attestations, bankruptcy treatment)

- Staking-as-a-service / yield programs (what is “service,” what is “product,” what is “security”)

Real-world example: if you’ve ever watched U.S. platforms quietly remove or restrict certain products while they remain available offshore, that’s not “tech.” That’s compliance uncertainty. The bill is trying to replace that uncertainty with defined categories and defined obligations.

3) Stablecoin standards (the part Washington can’t stop staring at)

Stablecoins are where “consumer protection” and “systemic risk” narratives collide. A typical Senate approach being floated includes:

- Reserve requirements (what backing is allowed, how liquid it must be)

- Redemption rules (how quickly users can cash out at par)

- Audits/attestations (proof that reserves are real and appropriately held)

- Issuer supervision (who can issue, and under what charter or regime)

This is one of the few areas where I actually see bipartisan instincts: even many pro-crypto lawmakers don’t want a repeat of large-scale stablecoin failures.

And there’s data behind why lawmakers focus here. The BIS has repeatedly highlighted stablecoins as a potential channel for run-risk if reserves aren’t solid and redemption isn’t reliable. Whether you agree with the framing or not, that’s the policy logic that keeps stablecoins in the crosshairs.

4) DeFi and developer treatment (the “don’t accidentally kill software” section)

This is where one sentence can change everything.

There’s a world of difference between:

- Regulating a company that custody-holds user funds and actively markets financial products,

- vs.

- Regulating open-source developers who publish code, or wallet teams that provide self-custody tools.

We’ve already seen how pressure travels “upstream”:

- Front-end restrictions (web interfaces geo-blocking regions, adding friction, or removing token access)

- Wallet/provider pressure (risk teams adding blacklists, RPC endpoints filtering requests)

- Infrastructure chokepoints (hosting, analytics, fiat ramps becoming de facto gatekeepers)

Real-world reminder: the Tornado Cash sanctions era made it painfully obvious that even if a protocol is “on-chain,” the user experience often depends on off-chain components that can be pressured. That’s why DeFi folks are nervous about vague “facilitating” language that could be stretched into developer liability.

5) What changes for regular users

If this bill moves, most users won’t “feel” SEC vs. CFTC in daily life. They’ll feel it here:

- KYC touchpoints at on/off-ramps (and potentially more identity checks around certain services)

- App access (what U.S. platforms list, what they block, what they require extra disclosures for)

- Stablecoin availability (which coins remain supported on regulated rails)

- Yield/staking UX (what stays simple, what becomes “for accredited only,” what disappears)

Coinbase cares because it’s sitting at the intersection of all of this: listings, custody, staking, institutions, compliance, and the public markets. For Coinbase, “clarity” isn’t a slogan—it’s a business model requirement.

The political bottleneck: how a bill dies even when “everyone wants clarity”

I’ve watched enough regulation attempts to tell you this: bills rarely die because nobody wants the headline goal. They die because the details create enemies.

Here are the common failure points I’m watching in this fight:

- Committee edits that look small but change scope (a definition expands, an exemption shrinks, a reporting requirement becomes impossible for startups).

- Poison-pill amendments that force senators to choose between “vote yes and anger your base” or “vote no and look anti-consumer.”

- Agency turf wars (SEC vs. CFTC influence isn’t theoretical—it’s budget, authority, and future enforcement leverage).

- Executive pressure framing the bill as “weakening protections” even if it’s mainly allocating jurisdiction.

- Election-year messaging where nuance dies and everyone races to sound toughest on scams.

- Lobbying narratives that turn complex market plumbing into a simple story: “innovation” vs. “consumer protection.”

That last one matters because it’s emotionally powerful. Nobody wants to defend “crypto” if the public conversation gets dominated by hacks, rug pulls, and meme-coin blowups. Even if the bill is really about spot market structure, the messaging war will try to turn it into a referendum on everything people hate about crypto.

The Coinbase–White House clash: what each side wants (and what they’ll trade)

When I strip the drama out and just look at incentives, the conflict becomes easier to predict.

What Coinbase likely wants

- A predictable rulebook for listing, custody, and staking services.

- A workable compliance path that doesn’t require guessing what a regulator “might” decide later.

- Limits on regulation-by-enforcement, so innovation doesn’t happen only after a subpoena.

- Clear token classification process so a project can graduate from “issuer-controlled” to “sufficiently decentralized” (or similar concept) without living in legal limbo forever.

What the White House posture usually signals

- Consumer protection optics (visible toughness plays well politically).

- Systemic risk control, especially around stablecoins and anything that smells like shadow banking.

- Keeping agency power flexible so regulators can adapt without Congress boxing them in.

Where compromise could realistically happen

- Stablecoin rules: stricter reserve/redeem standards in exchange for clearer permissions to operate.

- Disclosure regimes: more standardized disclosures for token issuers/intermediaries, but with sane thresholds so small teams aren’t buried.

- Phased compliance: longer transition windows so platforms can implement controls without shutting products overnight.

- DeFi carve-outs / safe harbors: language that protects open-source developers and non-custodial software, while still targeting custodial intermediaries that look like banks/brokers.

If you want one “tell” for how serious this fight is: listen for whether the conversation shifts from “crypto bad/good” to specific legal definitions. The moment the public messaging starts arguing over definitions, it means real power is being negotiated.

What this means for DeFi specifically (the part TradFi headlines miss)

Most TradFi coverage frames this like it’s only about Coinbase and “exchanges.” That’s lazy framing.

Even if the bill is aimed at centralized intermediaries, the shockwaves hit DeFi through second-order effects:

- Front-end access becomes the battlefield: If policymakers can’t control smart contracts, they pressure websites, app stores, hosting, and DNS.

- Wallet/provider pressure increases: Wallet teams may be nudged toward screening, blacklists, or “compliance modes,” especially for U.S. distribution.

- Liquidity fragments: If U.S. participants lose easy access, depth migrates to offshore venues, and pricing/MEV dynamics change across chains.

- RWA/tokenization slows: Real-world asset teams hate uncertainty. If the bill stalls or gets hostile, pilots get paused, partners back away, and legal budgets explode.

- Developer liability chills open-source: The fastest way to kill innovation is to make builders personally liable for how strangers use code they published.

And there’s a measurable “chill” effect. Academic work around regulatory uncertainty (across tech sectors, not just crypto) repeatedly shows reduced investment and slower product rollout when compliance cost is unpredictable. Crypto just experiences it in fast-forward because capital and teams can relocate quickly.

If the final language treats DeFi UI operators like brokers, you’ll see more geofencing and more “not available in your region” banners. If it treats developers like money transmitters, you’ll see fewer public repos, more closed-source “compliant DeFi,” and more building outside the U.S.

Neither of those outcomes is inevitable—but both are on the table depending on wording.

Signals I’m watching this week (so you don’t have to)

I don’t trade my portfolio on hot takes. I watch signals. Here’s my current radar:

- Committee calendars and markups: Are there scheduled hearings/markups, and do amendments leak early?

- Agency statements: Any shift in tone from SEC/CFTC leadership is a clue about behind-the-scenes alignment or friction.

- Big exchange compliance moves: Sudden product restrictions, disclosure updates, or revamped terms often front-run policy changes.

- Stablecoin issuer announcements: Attestation cadence, reserve policy changes, new U.S. partnerships, or talk of new charters.

- On-chain behavior: Bridge volumes, DEX flows, and stablecoin velocity can hint at U.S. participants repositioning.

These are useful as temperature checks while I verify details against primary sources and the actual bill text. I’m linking them so you can see what narratives are spreading in real time:

- center_forex thread

- jeff58409144 post

- byul_finance post

- AboutRWAs post

- jbrito93 post

- CoinbaseDuck post

- AndroOxinu post

- MotiveXRP post

- leviathan_news post

- lanzilli post

- adrianwuong post

- niftymfer post

- nunniabuzzzz post

- 997_Carrera post

- Confident_dev post

- CAn0nBull post

- Cryptodefiguide post

- TronWeekly post

- Famacrypt post

- realMaxAvery post

- unusual_whales post

- stockmom post

- BaapsOfCrypto post

- VincentBuLu1 post

- ahmedzein12 post

Here’s the question I want you to keep in your head as you read on: if Washington “compromises,” is it the kind that unlocks growth… or the kind that quietly makes DeFi unusable for U.S. users?

Because the next step isn’t debating who’s right on TV—it’s mapping the few realistic outcomes and what each one does to exchanges, stablecoins, DeFi access, and your portfolio decisions in the real world.

Outcomes that matter: will this kill the bill, and does DeFi get tanked?

Headlines make this feel binary: “bill passes = good” or “bill fails = bad.” Real life is messier. What matters is what kind of bill comes out the other side, and how agencies interpret it once it’s signed (or weaponize the vacuum if it’s not).

So here’s how I’m framing it right now—probability-based, not doom-based. These are the scenarios I’m watching, what they mean for markets/builders/users, and what I’m actually doing about it.

My rough probabilities today:

- Scenario A (passes with real pro-innovation clarity): 30%

- Scenario B (passes but boxed-in / restrictive): 45%

- Scenario C (stalls/collapses = uncertainty wins): 25%

These numbers can change fast with one committee rewrite or one “consumer protection” amendment that sounds harmless but breaks everything in practice.

Scenario A: Bill passes with pro-innovation clarity (best case)

This is the version where Congress actually gives the market a usable rulebook:

- Exchanges get a clean compliance path (registration that’s possible without sacrificing every asset listing).

- Institutions finally get defensible frameworks for custody, disclosures, and market structure—so they don’t have to treat every token like a legal grenade.

- DeFi gets language that recognizes a basic truth: publishing code isn’t the same thing as running a financial intermediary.

- Stablecoins get standards that are strict enough to build trust, but not so strict they kill competition.

What improves fast if this happens:

- Listings and liquidity improve because platforms can make decisions with less “will we be sued for this next month?” anxiety.

- US-based teams stop geo-fencing as aggressively, especially at the UI level.

- On-chain stablecoin velocity increases because large firms can use stablecoins without feeling like they’re stepping into regulatory quicksand.

Real-world sample of what “clarity” changes: look at what happened in Europe after MiCA was finalized. Even before full implementation, you could see platforms and issuers adjust behavior to match the upcoming regime—announcing compliance plans, changing product availability, and shifting marketing. I don’t need the US to copy MiCA; I just want that same “we know what the rules are” effect.

Studies worth knowing (because this isn’t just vibes): research across finance consistently shows that policy uncertainty reduces investment and risk-taking. One widely cited measure is the Economic Policy Uncertainty (EPU) work by Baker, Bloom, and Davis; the punchline is simple—when rules feel unstable, businesses slow down. Crypto is basically that effect on steroids because the product itself is financial and global.

What still doesn’t magically disappear:

- State-level friction (money transmission, BitLicense-style burdens, and inconsistent interpretations).

- Banking chokepoints (even with a good bill, banks may remain conservative until regulators signal comfort).

- Implementation lag (rulemaking takes time; expect a messy transition period where “clear” becomes “clear-ish”).

If we get Scenario A, I expect the market reaction to be loud, but the bigger impact is quieter: the US stops acting like it’s trying to regulate crypto through fear.

Scenario B: Bill passes but with heavy restrictions (mixed case)

This is the one I’m most worried about—not because it’s a total shutdown, but because it can sound like progress while quietly boxing DeFi into a corner.

Here’s what “allowed but boxed in” looks like:

- Front-end obligations that effectively turn websites into regulated gatekeepers. DeFi might exist on-chain, but if UIs become compliance choke points, most normal users never reach it.

- Stablecoin rules that centralize power—for example, requirements that only a narrow set of issuers/banks can realistically meet, or redemption/permissioning language that pushes everything toward a walled garden.

- Over-broad definitions that catch the wrong people: open-source maintainers, node operators, wallet providers, or “service providers” defined so widely that you can drive enforcement through it later.

What this does to the market:

- Big players adapt; small players die. Compliance becomes a fixed cost that only giants can afford.

- Liquidity stays, but it concentrates. You get a “crypto mall” instead of an open ecosystem.

- Builders move the real innovation offshore while keeping a sanitized version in the US.

Real sample you’ve already seen in crypto: when certain jurisdictions tightened access, the chain didn’t stop, it just rerouted. UIs started blocking IPs, front-ends became more cautious, and users either moved to alternative interfaces, used VPNs, or shifted activity elsewhere. The market doesn’t die—it fragments.

Why this scenario is so tricky: politicians can claim victory (“we regulated crypto!”), agencies keep leverage, and the average person doesn’t notice the cost until they try to use a wallet or a DeFi app and hit a wall.

My rule of thumb: if the bill’s compliance burden lands primarily on interfaces and tooling rather than on custodians and true intermediaries, DeFi gets “regulated” by being made inconvenient and risky to operate.

Scenario C: Bill stalls or collapses (worst case for uncertainty)

This is the slow-burn pain scenario. No big “crypto ban” moment. Just a continuation of the current dynamic: uncertainty plus selective enforcement plus rumor-driven volatility.

What happens when nothing passes:

- Enforcement pressure stays unpredictable, which makes US-facing businesses operate defensively.

- Token listings get tighter because platforms won’t take risks without clearer lines.

- DeFi access becomes patchy as UIs and infrastructure providers limit exposure.

- Liquidity and teams migrate to jurisdictions with clearer frameworks (even if those frameworks aren’t perfect).

You can actually see a version of this in historical on-chain behavior: when regulatory heat rises, activity doesn’t vanish, it shifts. DEX volumes, bridge flows, and stablecoin mixes tend to react to access and perceived risk. I’m not going to pretend one metric tells the whole story—but migration is a real pattern.

The sneaky cost in Scenario C: it’s not just market chop. It’s the US losing its chance to shape standards. When innovation relocates, so does influence. That’s how you end up importing rules later instead of writing them.

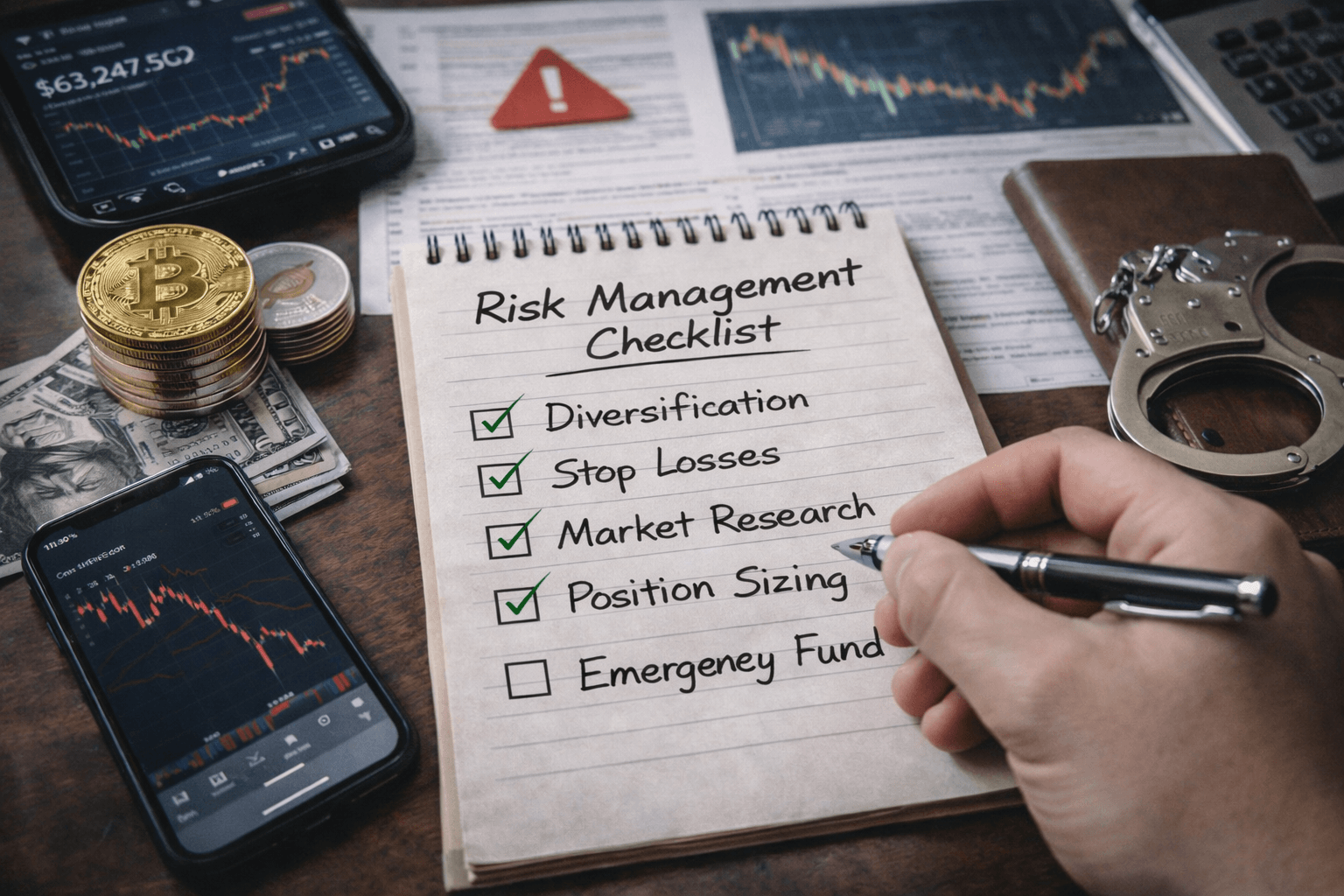

What I’m doing with my own risk management (practical checklist)

I’m not trading this story based on who “won” a news cycle. I’m running a risk checklist that assumes uncertainty is the base case and clarity is the upside.

Here’s the checklist I’m using (copy it):

- Position sizing: I keep any single token position small enough that a surprise delisting or access restriction doesn’t wreck my month.

- Jurisdiction risk: I ask: “If US access tightens overnight, can I still manage this position safely?” If the answer is no, I size down.

- Counterparty risk: I avoid keeping long-term funds on any one exchange. I treat exchanges as transaction venues, not banks.

- Stablecoin diversification: I don’t pretend one stablecoin is “the safe one.” I spread exposure and I track issuer attestations, redemption policies, and regulatory posture. If a bill targets one class of issuer, concentration becomes a real risk.

- Self-custody basics:

- Hardware wallet for long-term holdings.

- Backups stored offline in more than one physical location.

- Separate “spending” wallet from “vault” wallet.

- DeFi smart-contract risk: I treat DeFi like early-stage software:

- I prefer protocols with long uptime, public audits, bug bounty programs, and conservative parameters.

- I avoid chasing yield that only exists because risk is being hidden.

- I limit approvals, revoke allowances, and don’t leave infinite permissions lying around.

- UI/front-end dependency: I assume front-ends can disappear or geo-block. If I use a protocol seriously, I make sure I know alternative access methods (read-only explorers, alternative interfaces, or fallback routes).

- Policy milestones (the only headlines I care about): committee markups, published bill text changes, agency guidance memos, and stablecoin issuer compliance announcements. I don’t trade “anonymous staffer says…” posts.

If you’re a builder reading this, my version of the checklist is simple: don’t build a business that only survives if regulators stay confused. Confusion is not a moat. It’s quicksand.

Conclusion (My take: don’t trade the drama—track the rules)

This Coinbase–White House clash is loud, and it’s designed to be. But the real edge isn’t picking sides—it’s tracking what the bill actually turns into: definitions, carve-outs, compliance triggers, and what counts as “operating” versus “publishing.”

I’m staying flexible. If we get a clean, workable framework, I expect US liquidity and building to accelerate. If we get a restrictive framework, I expect “allowed but painful” DeFi and more fragmentation. If the bill dies, I expect the uncertainty tax to keep compounding.

I’ll keep updates and source links flowing as this moves at Cryptolinks.com/news. The goal isn’t to panic with the timeline—it’s to be positioned for whichever version of reality shows up.