What are Cryptocurrency Derivatives and Where to Trade Them?

Cryptocurrency derivatives sound like some sort of exotic term. There can be a fair amount of both misunderstandings and taboo surrounding derivatives and cryptocurrencies separately. Put them together and you have a whole other ball game. We are here to clear up what exactly derivatives even are and why they might be useful in cryptocurrencies. We are also going to present the key places where they can be traded.

What even are derivatives?

The key is in the name really. Derivatives are something which is derived from something else. In financial terms, this simply means they are a form of contract that has a value derived from some asset. For example, a Bitcoin USD derivative would have its value derived from the actual market of Bitcoin versus USD.

There are a number of different types of derivatives. The main types are options and futures. Explaining the ins and outs of each of these can get really technical but the key thing to note is the value of the derivative will vary based on how it is structured. For example, futures expire at a date in the future so the market takes this into account when the contracts are being traded.

Why cryptocurrency derivatives?

By being simply a contract and not an actual asset, derivatives allow traders and investors to do things which would be extremely difficult to do in the actual market for the asset – also known as the spot market. For example, traders can use enormous amounts of leverage which is essentially using borrowed funds with the aim of getting a greater return on the amounts they invest. This also provides a higher risk. Although this is possible in the spot market, it is greater to a much larger extent in the derivatives market due to the exchanges being able to liquidate the derivatives immediately if the trader loses the money they have put into the position. Derivatives also enable traders to take short positions easily which is another difficult task in the spot market.

The top places to trade them

Bitmex

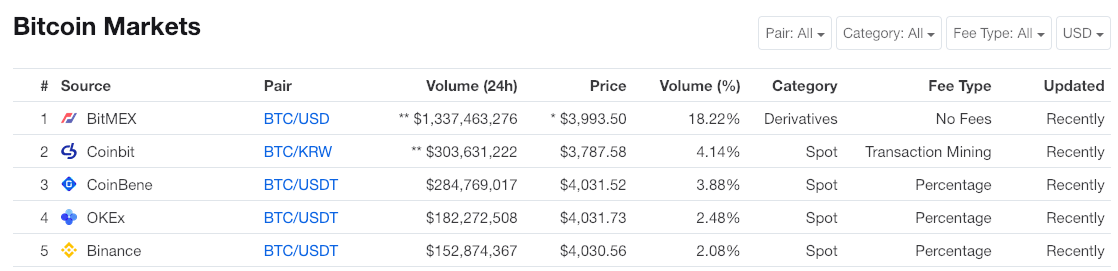

Bitmex is the king of cryptocurrency derivatives. Their flagship product is the XBTUSD perpetual swap which is a derivative that tracks the price of bitcoin versus USD and never expires. This product often accounts for the most amount of volume of the markets that trade Bitcoin versus USD as seen below in data from CoinMarketCap. Bitmex is a bitcoin-only exchange. Users deposit bitcoin and if they take correct trading positions, their balance of bitcoin will increase. If they take incorrect trading positions, their balance of bitcoin will decrease.

Users can leverage up to 100 times their equity when trading the XBTUSD product. Other products have less leverage offered but users can still leverage up to at least 20x in other products. Bitmex also offers a contract for ether priced against USD. They offer a number of altcoin contracts also but these are priced against bitcoin instead of USD. The altcoin contracts which are priced against bitcoin include ether, litecoin, tron, EOS, cardano, bitcoin cash, and ripple. The fees are low on Bitmex ranging from 0.075% to 0.25% for market takers and market makers actually receive a rebate

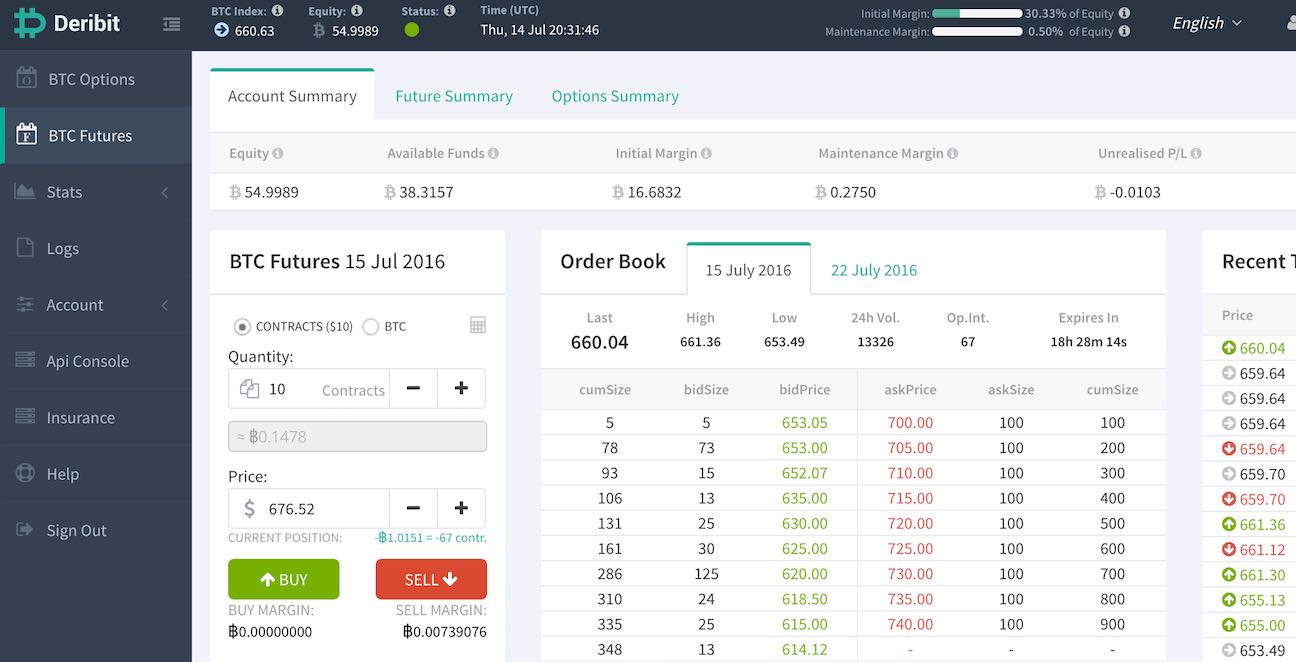

Deribit

Deribit is the closest competitor to Bitmex. Deribit is also a bitcoin-only exchange. While Bitmex provides futures contracts, Deribit provides both futures and options contracts. Options are a different type of derivative too and allow traders to speculate in the markets in a different manner. This is one advantage which Deribit has over Bitmex. However, Deribit only provides products which allow users to speculate in bitcoin which is a major disadvantage for Deribit. Deribit does also offer a perpetual futures contract that enables traders to speculate on bitcoin priced against USD. This product can be leveraged up to 100x. The fees range from 0.05% to 0.075% for market makers and a 0.02% to 0.025% rebate for market makers.

OKEx

OKEx is an exchange which has both spot and derivatives contracts. The exchange is owned by parent company OKCoin. The exchange which launched in 2017 offers futures contracts in both bitcoin and altcoins. OKEx enables traders to speculate with fiat currency which is one advantage which it has over Bitmex and Deribit. Users can apply up to 20x leverage on some contracts. The fees start at 0.01% for market makers and 0.03% for market takers. This progressively drops based on the amount of volume traded.

An Up & Comer? – Delta Exchange

Delta exchange is a new derivatives exchange which launched in 2018. Similar to Bitmex and Deribit, Delta is a bitcoin-only exchange. However, Delta does offer some products which are not available on either Bitmex or Deribit. Bitcoin versus USD and ether versus USD products are available on Bitmex. Deribit offers a wider range of futures products priced against USD. Delta facilitates ripple and stellar lumens futures trading against USD as well as bitcoin and ether. The bitcoin product can be traded with up to 100x leverage while the other products can be traded with up to 20x leverage. The fees are also competitive. Market makers receive a rebate of 0.005% to 0.025%. Market takers are charged 0.025% to 0.075%. Delta exchange has only been operating for a short while so it has not built up the same level of trustworthiness and reputation as the others. However, it could be a key player moving forward.