Six Cryptocurrency Exchanges to Keep an Eye on in 2019 ?

Many will be glad to see the back of 2018. 2019 has officially arrived and investors and traders alike have new price predictions, hopes, and dreams. Prices always steal the show but the exchanges play an important role in bringing that show to us. There are some big developments scheduled to take place in the exchange ecosystem in 2019. We present the key players to keep an eye on and the key dates to take note of in your diary ?…

1. Bring on Bakkt

The highly anticipated Bakkt exchange is set to launch in 2019. The exchange was originally scheduled to launch in 2018 before being pushed back to January 24th. It has now been further delayed and currently has an uncertain launch date. One of the main reasons that Bakkt is generating so much hype is due to it being backed by the Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange. The first product planned to be launched on Bakkt is the first ever physically delivered bitcoin futures contracts. This means that when the financial futures contract expires, holders will receive their payment in bitcoin instead of USD. The eventual arrival of Bakkt – whenever that may be – may mark the arrival of a considerable amount of institutional investors to cryptocurrencies. The steps that Bakkt are taking – such as awaiting approval from the CFTC (a regulatory body for futures) for the products it plans to launch. – will build a more regulated ecosystem far more attractive to institutional investors.

2. Enter ErisX

Another highly anticipated exchange setting up to attract institutional investors is ErisX. ErisX is being launched by Eris Exchange, an exchange operating since 2010. ErisX plans to launch both spot and futures products for cryptocurrencies. Similar to Bakkt, ErisX is also awaiting approval from the CFTC before launching their products so to build a regulated trading environment. ErisX has formed significant partnerships with already regulated entities including TD Ameritrade and the Chicago Board Options Exchange. The spot products are planned to be launched in Q2 of 2019 while the futures products are planned to be launched in the second half of 2019.

3. What about Binance?

Binance only launched in 2017 and quickly became the largest exchange by trading volume. 2018 was a big year for Binance. The headquarters for the company moved to Malta. The main driver for this move was the Maltese government creating a regulatory framework for businesses operating in the cryptocurrency and blockchain space.

Binance also launched their first crypto-to-fiat exchange during 2018. The exchange was launched in Uganda and facilitates trading between the Ugandan Shilling and bitcoin or ether. There are also plans to launch an exchange which will facilitate trading between the Euro and Swiss Franc with major cryptocurrencies. A fiat exchange in Singapore has also been undergoing testing. All this activity in the fiat-to-crypto space gives rise to a strong possibility that Binance may claim a significant share of the fiat-to-crypto market in 2019 and take on major exchanges such as Coinbase.

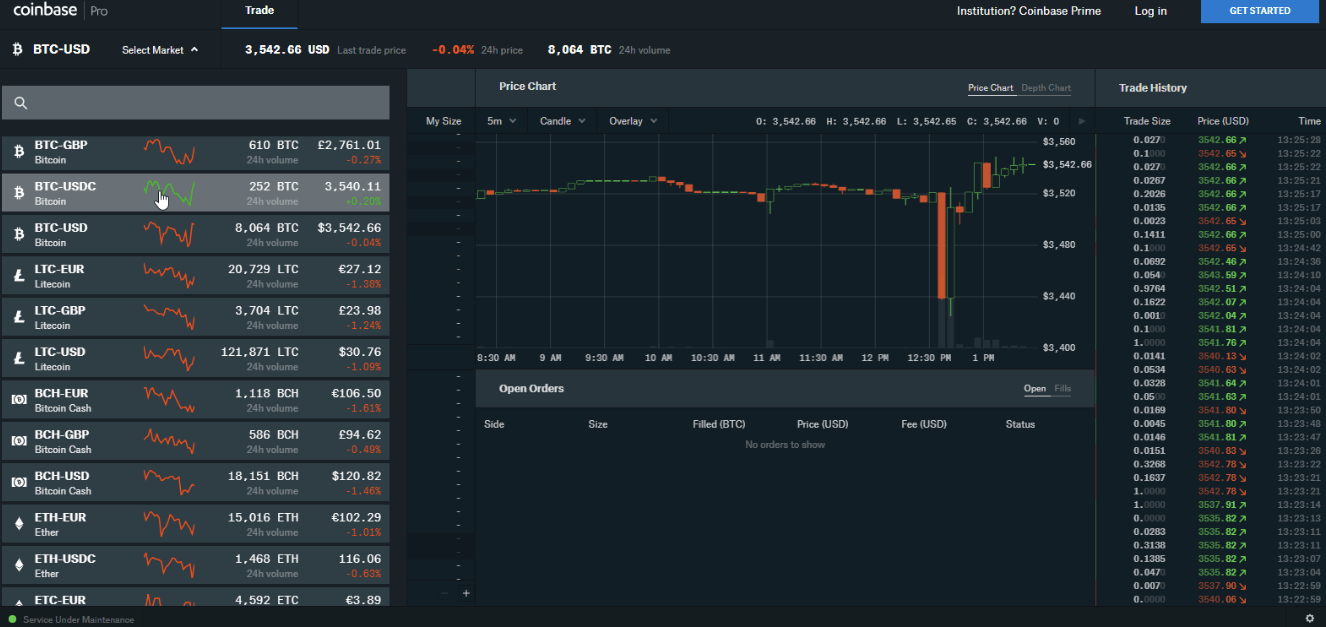

4. More Cryptocurrencies for Coinbase?

Speaking of Coinbase, their policy for listing cryptocurrencies changed approaching the end of 2018. Coinbase set up a structure whereby any project could apply to have their cryptocurrency or token listed on Coinbase. For a long time, there was only a small number of cryptocurrencies listed on Coinbase. This included bitcoin, ether, bitcoin cash, litecoin, and at a later stage ether classic. However, the listings accelerated as 2018 was wrapping up with 0x Project, Basic Attention Token, Decentraland, Civic, Loom Network, and Golem all listed in the final quarter. More listings are looking likely for 2019!

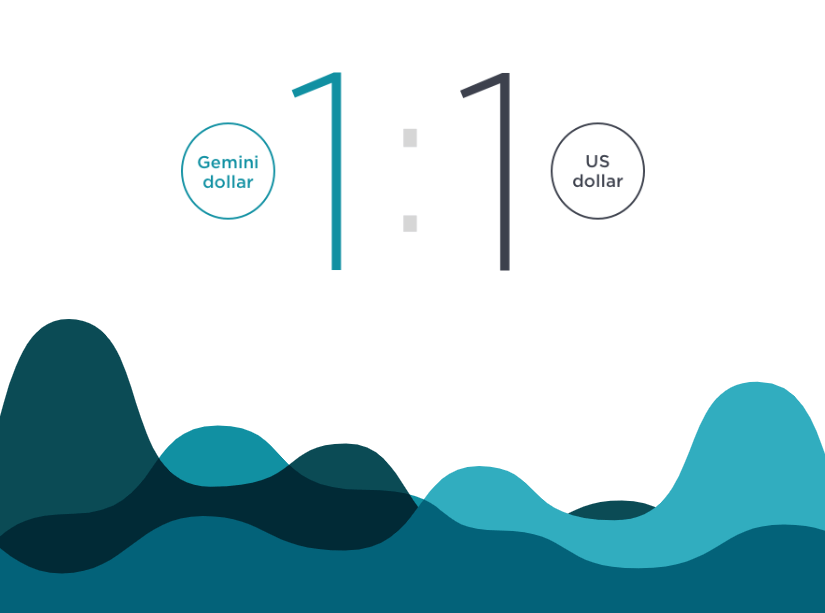

5. Gemini Gearing up for Anything Else?

Gemini also made some shuffles in 2018. They launched their USD-backed stablecoin – the Gemini dollar. The dominant stablecoin remains USD Tether despite increasing amounts of controversy. 2018 was a turbulent year for USD Tether. The company behind the stablecoin – Tether limited – finished their relationship with their auditor early in the year. Tether also failed to hold its value to USD crashing to 0.85 per USD in October. With Gemini setting up the Gemini dollar in an FDIC insured bank that is audited, it will be interesting to see if it can challenge Tether for the number one USD stablecoin spot.

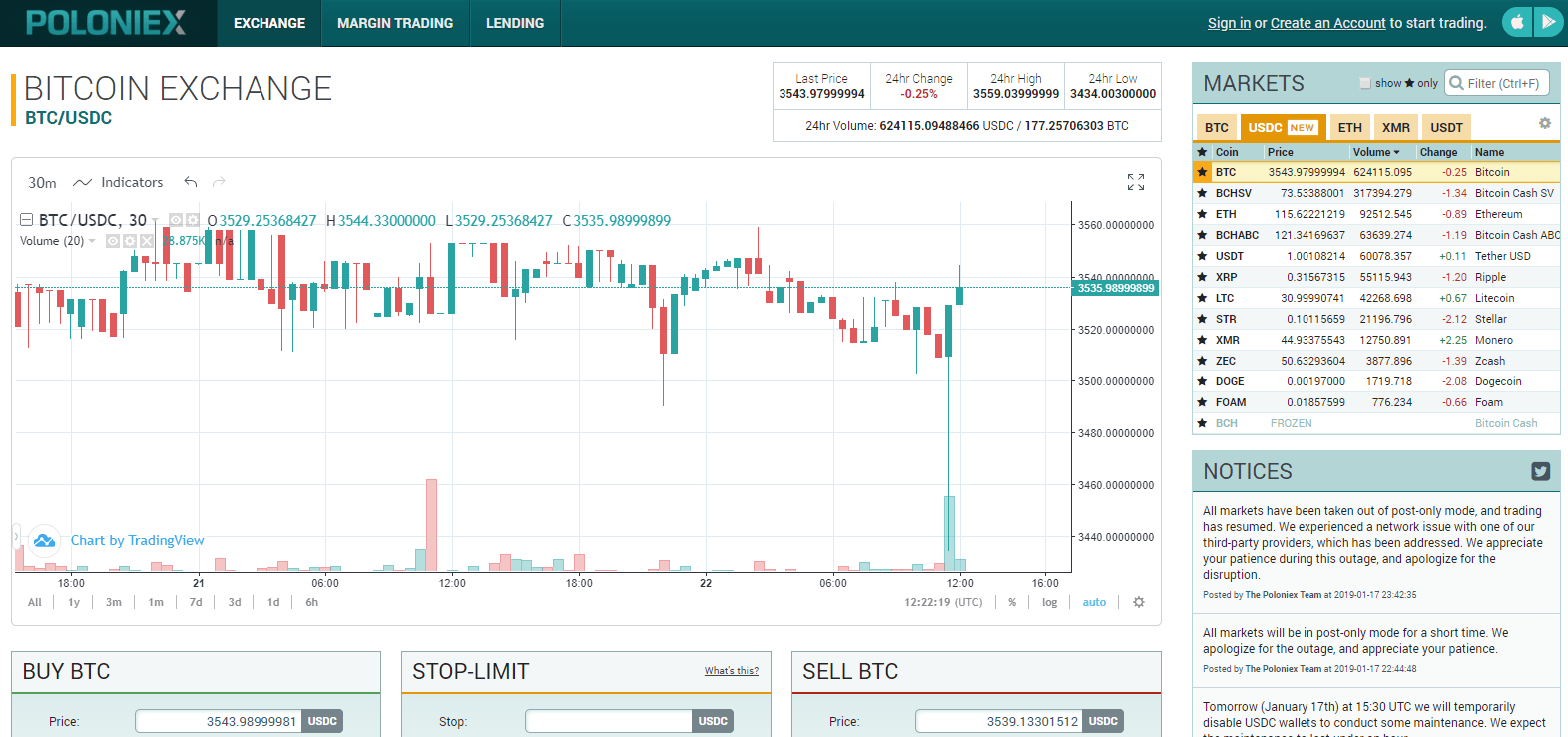

6. What is Poloniex Planning?

Early in 2018, Poloniex was acquired by the Goldman Sachs backed company Circle. There was a lot of talk about what this would mean for Poloniex but not a lot has happened since. It is possible Poloniex was acquired for the sake of just adding an extra company to the balance sheet. However – if cryptocurrencies start being delisted rapidly from Poloniex during the year – something bigger may be in the works. Delisting cryptocurrencies may mean that they are planning on venturing Poloniex into being a fiat-to-crypto exchange.