How Different is Bitcoin from 2017?

Volatility has reentered the price of bitcoin but how different is the network from when the price surged in 2017? We break down the metrics that quantify how strong the bitcoin network actually is.

Quick take;

- The price of bitcoin is starting to increase at a pace similar to what was observed in 2017

- The Bitcoin network today is far more secure than the one in 2017 with more hash rate and a greater distribution of hash rate in the mining market

- Developments built on top of Bitcoin and applications for users have also had a tremendous progression over the past two years

The price of bitcoin has been on the rise as Consensus week comes to a close. The last time we observed prices increasing at such a fast pace was the speculative euphoria of 2017. Many are reminded of 2017 as double-digit increases were recorded in the space of a day during the week.

The price increases of 2017 were both a good time and a bad time for the crypto industry. On the one hand, the price increases gave cryptocurrencies mainstream attention. On the other hand, many poor projects launched during this time that have since failed with countless investors losing money.

A lot has changed since the last wave of bullish movements. The metrics driving the health of the network, commonly called fundamentals, are in a far different state now than they were in 2017.

Technicals versus fundamentals

Fundamentals are metrics that provide information on what the network is actually providing and how strong the network is. Given the early stage of the crypto markets, it is questionable how much fundamental metrics actually play into price.

Fundamentals play an extremely important role in more mature markets such as equities. Over hundreds of years, analysts have developed valuation models for equities based on these fundamentals.

These models value equity based on the fundamentals underlying it. Analysts typically will agree over the model but argue over the input going into the model.

This is the reason that a stock price will adjust when an earnings announcement is not what analysts estimated it would be. The valuation quickly adjusts to reflect different fundamentals than were estimated.

Crypto markets are in a much earlier stage than equities markets and fundamentals play a far less important role in valuation. Analyst Chris Burniske of Placeholder VC has been producing some of the earliest work in developing valuation models for crypto networks that use fundamentals to calculate a price.

However, Burniske has noted that such valuation models remain rudimentary. As it stands, the early stage of the crypto market means it is much more subject to the speculative sentiment of traders and investors.

Technical analysis is the tool of choice among crypto market participants. This form of analysis can be useful for identifying the direction of a trend and gauging the sentiment of investors.

It is also a popular choice among retail investors which comprise the vast majority of the cryptocurrency market. In contrast, equity markets are typically comprised of mostly institutional investors which use far more refined models to guide investment decision making.

However, as the crypto market continues to mature, fundamentals are expected to play an increasingly important role. Burniske foresees analysts converging on accepted valuation models for crypto networks moving forward. While it took hundreds of years to arrive at this point in the equity markets, Burniske believes it will happen orders of magnitude faster in crypto.

The Fundamentals of Bitcoin

Even with the trend-based nature of crypto market prices, fundamentals play an important role in quantifying what crypto networks actually provide. One of the most important fundamental metrics for proof-of-work chains such as Bitcoin is the hash rate deployed on the network.

The hash rate is a measure of how much computing power is deployed on the network by miners competing to append transactions to the blockchain. A greater hash rate makes the network more expensive to attack.

Hash rates cannot be compared between different proof-of-work chains as they typically use their own mining algorithm but it can be useful for comparing the evolution of hash rate over time.

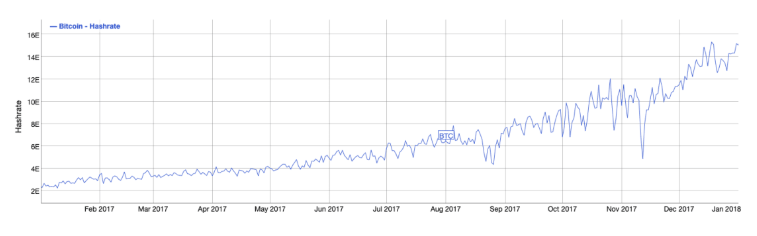

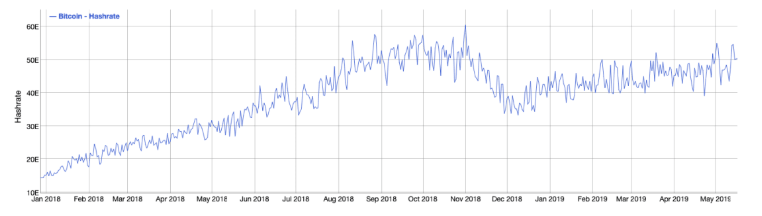

The hash rate in 2017 ranged from 2.4 EH/s to a high of 15.3 EH/s with a gradual increase taking place over the year. The hash rate has more than tripled since then with current figures being around 50 EH/s.

A high of approximately 60 EH/s was recorded in November 2018 but a sharp drop in the prices led to a drop in miner profitability. This resulted in huge amounts of miners coming offline.

However, the hash rate means little if it is overly concentrated in a small number of entities. If an entity owns 51% of the hash rate, they can execute double spend attacks and also carry out deep reorganizations of the blockchain.

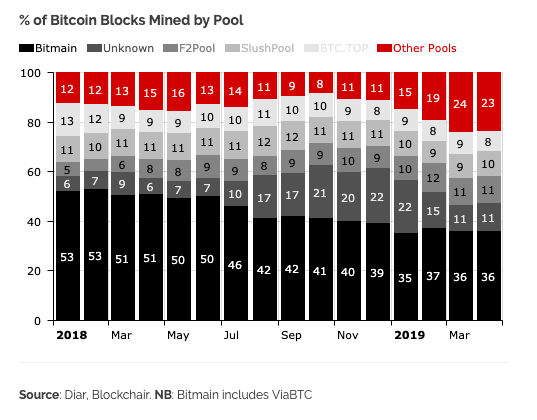

Too much concentration of hash power makes the network vulnerable to a small number of entities executing these attacks. The threat of too much concentration in the bitcoin network is even higher with Bitmain owning AntPool and BTC.com as well as being an investor in ViaBTC.

In 2017, Bitmain controlled approximately 50% of the hash rate. Recent research finds that the control of hash rate is far more diluted now than it was in 2017.

The share of hash rate controlled by smaller mining pools has almost doubled since last year while the share of hash rate controlled by Bitmain-related pools has decreased from ~50% to 36% in April. This demonstrates that the Bitcoin network is not only secured by a greater amount of hash power but it is also benefiting from a greater degree of concentration.

On-Chain Bitcoin Fundamentals

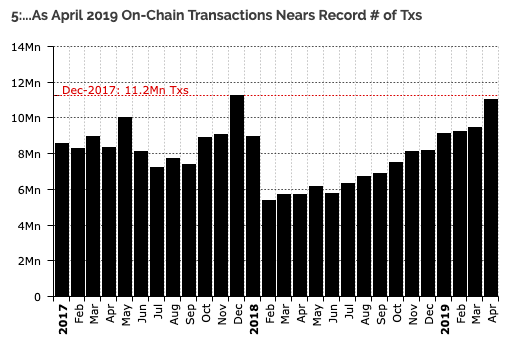

While the hash rate has increased, the number of transactions being recorded on the Bitcoin blockchain has been below record figures. However, the on-chain transactions recorded in April have been returning near peak levels.

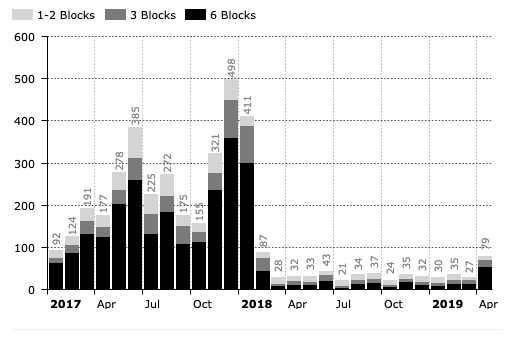

One area which has improved is the fees paid. The above graph demonstrates that the amount of satoshis paid per byte transferred is far below levels observed at the last peak.

Developments

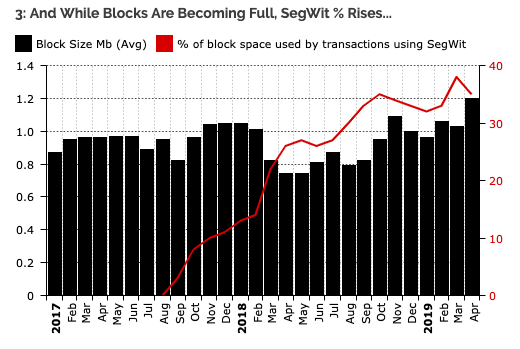

One of the reasons noted for the lower fees observed is the launch and adoption of SegWit. The average block size is currently 1.2 Mb with the current percentage of SegWit enabled blocks mined estimated to be 35%.

SegWit was a controversial development in the bitcoin protocol that was implemented via a soft fork in 2017. The soft fork was not so controversial but what preceded it was.

Prior to the implementation of SegWit, there were years of discussion and debate regarding the implementation of SegWit along with a block size increase via a hard fork. This debate ultimately culminated with the hard fork of Bitcoin Cash in August of 2017 which implemented a block size increase in their chain split.

On the original Bitcoin chain, SegWit has been increasing in adoption levels and the latest Bitcoin Core upgrade is also pushing miners towards updating to support SegWit native addresses known as bech32 addresses. It is believed that Bitcoin Core will default to being SegWit enabled by as early as upgrade 0.19.0. The latest upgrade was 0.18.0.

Second Layer Developments

SegWit is mainly a development targeting the scalability of the Bitcoin blockchain. Second layer solutions have also progressed immensely since 2017.

The Lightning Network is a protocol which facilitates the opening of bidirectional payment channels on top of the Bitcoin network. The protocol enables users to send fees quickly with minimal fees. While not as secure as transferring across the Bitcoin blockchain, the protocol does use the Bitcoin blockchain as a settlement layer.

The Lightning Network was still in an extremely early phase in 2017. It has since received much greater attention with far more developers and teams working on the protocol. Circle Research reports in their Q1 2019 overview that the number of channels opened and value held within these channels both increased 100% in the first quarter of 2019.

The Liquid sidechain is another second layer solution built on top of Bitcoin. The sidechain was launched in October 2018 by Bitcoin development company Blockstream and also enables low fee and fast transactions to take place.

Liquid is essentially a blockchain built on top of the Bitcoin network with different features and capabilities than the Bitcoin network. Similar to the Lightning Network, the Liquid sidechain does not have the same assurances as the Bitcoin blockchain but it is finding a strong use case among companies that need to conduct fast and efficient transfers.

Bitcoin User Applications

Applications that users can use to make use of the Bitcoin protocol were at a far more rudimentary stage in 2017 than they are today. With the growth of the crypto industry, several companies have spawned to make using bitcoin a much easier process. Just over the past weeks, Gemini has launched a product that enables users to spend their bitcoin with major businesses. Microsoft also announced that they will be building an identity management system on top of Bitcoin.

We are also seeing a credit market being built based on bitcoin. BlockFi launched their interest-earning deposit account where account holders can earn interest on bitcoin deposited.

Can Bitcoin Continue to Increase?

It is likely that the price of bitcoin will meet many areas of selling pressure between now and its previous all-time highs. However, a look at the fundamentals indicates that the network is in a significantly stronger position now than it was in 2017. Projects such as Lightning Network which were at a rudimentary phase in 2017 have seen an immense progression. The network itself is also significantly more robust with a greater hash rate supporting it and a greater distribution of this hash rate.