Binance Consider Reorg After $40 Million Hack… Does it Make Sense?

Quick Take:

- Debate and discussion are sparked after Binance consider reorganizing the Bitcoin blockchain to recover funds stolen from a hacker

- A number of analysts break down the incentives behind executing a reorg and the feasibility that one could be successfully pulled off

- The users are noted to play an important role in incentivising miners not to coordinate a reorg

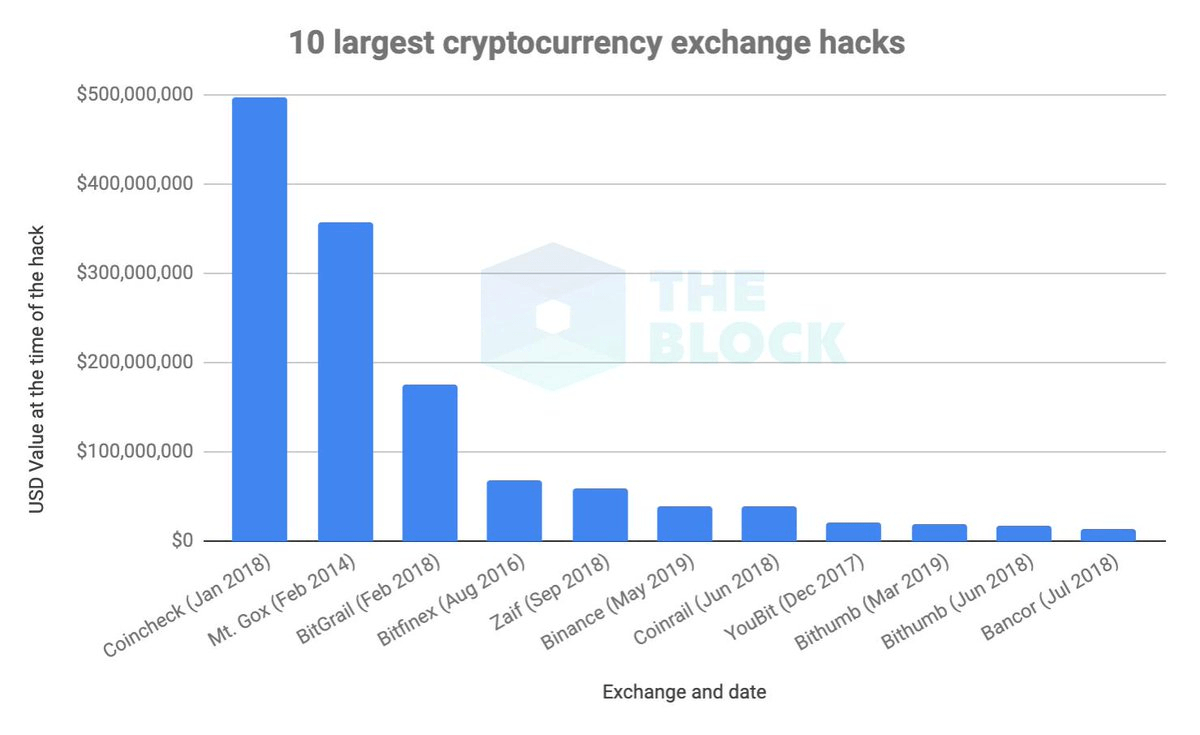

The largest exchange by average daily trading volume, Binance, has been hacked for the equivalent of $40 million. The hack of the exchange is the sixth largest in the history of cryptocurrency exchange hacks with 7,000 bitcoin being stolen.

As Binance contemplated how to deal with the hack, the idea of reorganizing the Bitcoin blockchain was considered by Binance CEO Changpeng Zhao. This idea quickly picked up momentum and sparked intense discussion and debate to take place.

Some immediately claimed that the possibility of a reorg would be impossible in practice. However, the idea was originally proposed by Bitcoin Core contributor Jeremy Ruben giving the idea some weight.

Others such as Bitcoin developer Jimmy Song analysed under what circumstances that a reorg event would theoretically be possible. What took place over the time since the hack was intense discussion regarding how immutable the Bitcoin blockchain really is.

What is a reorg?

A reorganization (reorg) of the blockchain occurs when some miners essentially rollback the blockchain to build a new set of blocks from a certain point. Two chains are essentially simultaneously mined until one of the blockchains is eventually recognized as the one with the most proof-of-work.

Two reorgs of the Bitcoin Cash SV blockchain recently took place whereby a three-block reorg and a six-block reorg took place. Reorgs are disastrous from the point of view of users with the payments made not being reliable.

How it all started?

The idea of a reorg was initially suggested by Bitcoin Core contributor Jeremy Rubin. Rubin tweeted to Changpeng Zhao that he could reveal his private keys and “coordinate a reorg to undo the theft”.

The reorg was proposed when the hack was already 50 blocks deep. A reorg of this magnitude on the Bitcoin blockchain is unthinkable to most.

Zhao later discussed the possibility of a reorg in an ask me anything (AMA) which was hosted. The acknowledgment of a reorg as an approach to dealing with the hack sparked intense discussion and debate.

How would a reorg actually work?

The idea is relatively simple. However, the execution contains so many complexities that it is widely believed to be impossible in practice.

At its most basic level, if the hacked amount is greater than the rewards that miners have received, it would be worthwhile to incentives miners to reorg the chain if pulled off successfully. However… that is a big IF…

The hacked amount was roughly 7,000 bitcoin. Let’s say the transaction which the block was included in happened 100 blocks ago. This means that there have been 100 block confirmations since the theft happened.

This means that miners have earned at least 1250 in revenue since the transaction was confirmed. That’s excluding transaction fees.

The idea is that if Binance can double spend the stolen funds with a large enough transaction fee, miners would be incentivised to rollback the blockchain to the point where the funds were stolen and start building a new chain. This would enable them to mine a new chain where the funds were not stolen and process the transaction with the enormous fees placed by Binance.

It is similar to a 51% attack whereby an attacker takes control of over 51% of the hash rate and can double spend transactions. However, reorgs happen regularly on a small-scale where miners disagree over the chain with the longest proof-of-work. However, these are resolved when miners recognize the chain with the longest proof-of-work.

A deeper reorg is a whole different matter entirely. A deep reorg of the Bitcoin blockchain would bring into question the immutability and level of decentralization of the Bitcoin network.

Considerations of Changpeng Zhao?

Changpeng Zhao consulted a number of professionals on the idea to reorg the chain. These professionals included Jihan Wu, Jeremy Rubin, James Prestwich, and Brandon Curtis.

After consulting these professionals and considering the time pressures of coordinating a deep reorg, Zhao decided not to attempt a reorg and identified a number of pros and cons to attempting to execute a reorg.

| Pros | Cons |

| Revenge the hackers by moving the fees to miners | Possibly damage the credibility of Bitcoin |

| Deter future hacking attempts | May cause a split in the Bitcoin network and community |

| Explore the possibility of how the Bitcoin network would deal with such situations | Hackers demonstrated weak points in the design of the Binance security system |

Zhao later acknowledged that the reorg could not have been pulled off given how deep the transaction of the theft was into the blockchain. Zhao noted the Bitcoin blockchain to be “the most immutable ledger on the planet”.

What do other analysts say?

Ari Paul is one of the analysts that were active in breaking down the reorg considerations. Paul highlighted the role of those who voiced opinions against a reorg on Twitter as an important one.

“By strengthening the social consensus around immutability, we imply a large devaluation in BTC price should such a reorg occur, which incentivizes miners who own ASICS or BTC not to reorg in marginal cases.”

Miners are extremely exposed to the prices of both Bitcoin and their ASIC hardware. The inflexibility of ASIC hardware for mining the bitcoin network is a great feature for lining up the incentives of miners with the long-term health of the network.

Miners who use GPU hardware could make a short-term decision for profit as they can easily sell their hardware or adapt to mine on a different network. ASIC hardware lacks such flexibility and provides a strong incentive for miners to always mine on the longest chain.

Jimmy Song published an analysis in a Medium post after the events analysing the scenarios of executing a reorg assuming the hack was 100 blocks deep into the blockchain. While theoretically possible, executing such a reorg would be extremely complicated in practice.

Even if the miners were coordinated to execute such a reorg, users would have an important role to play. A reorg chain would be a huge inconvenience for major users such as custodians, exchanges, and merchants.

All these entities would be highly incentivised to raise the fees on the original chain to attract hash power back to this chain. Another entity that would be highly incentivised to raise fees on the original chain to attract miners back would be the thief.

Rationally, the thief could put anything less than the amount stolen in efforts to attract miners back to the original chain. In this case, that would be anything less than 7,000 bitcoin.

Users played an important role when miners attempted to force a SegWit 2x upgrade in 2017. Users refused to upgrade their clients and the code implementations failed to go ahead. This ultimately resulted in the creation of the Bitcoin Cash network in 2017.

While this situation is different than a software upgrade, users can similarly have an important role to play. Ari Paul has already that users played an important role in communicating to miners that they value the immutability of the Bitcoin blockchain and a reorg would not fare well. Song then explained users power to incentivise miners back to the original chain in the case that a reorg did go ahead.

Nic Carter also published a blog post on Medium after the events. However, Carter took a drastically different course with his blog post and wrote a satirical piece pushing for a self-regulatory mining body which could execute reorgs any time large entities such as exchanges needed.

What are the alternatives?

Replace by fee (RBF) is a feature in the Bitcoin network that could have been used to prevent the hack from happening if the right systems were in place. RBF would have enabled Binance to replace the hacked transaction with another transaction with a higher fee up until the point that the transaction was confirmed in the blockchain.

The fact that RBF could have been used was also pointed out by Jeremy Rubin. It was later noted by Twitter user @hasufl that Binance could have rationally spent up to 7000 bitcoin on the transaction fees in RBF to prevent the attack from happening.

Could one happen in the future?

The interesting thing about the reorg situation is that the incentives make a lot more sense for a reorg going ahead if the hack is large in size and the reorg is coordinated relatively quickly. The longer it takes for the reorg to be executed, the deeper the hack goes into the blockchain and the more expensive incentivising a reorg becomes.

Ari Paul noted that a reorg coordinated relatively quickly for a hack large in size could make sense.

“This hack was relatively small, but consider Bitfinex’s previous hack of 117k+ BTC, which was 30+ days of block rewards. If Bitfinex could create a smart contract to programmatically incentivize miners to re-org 3 days of the blockchain, the simple economic incentives work.”

What about Binance?

Although this hack is the sixth largest in the history of cryptocurrency exchanges, Binance will easily recover the funds in revenue. It is estimated that it will take Binance 47 days to recover the funds.

The users of Binance will be compensated through the SAFU (“secured asset fund for users”). This is a fund that Binance contributed towards in the event that something like this would happen.