Can Binance launch the first dominant decentralized exchange (DEX)?

Binance quickly rose to dominate the cryptocurrency exchange business. The exchange only launched in July of 2017 despite most other major exchanges launching in 2012 or earlier. Binance completed its ICO in July 2017 raising $15 million to fund the development of its exchange. By January of 2018, it had already progressed to the point where it accounted for the largest amount of trading volume among top cryptocurrency exchanges.

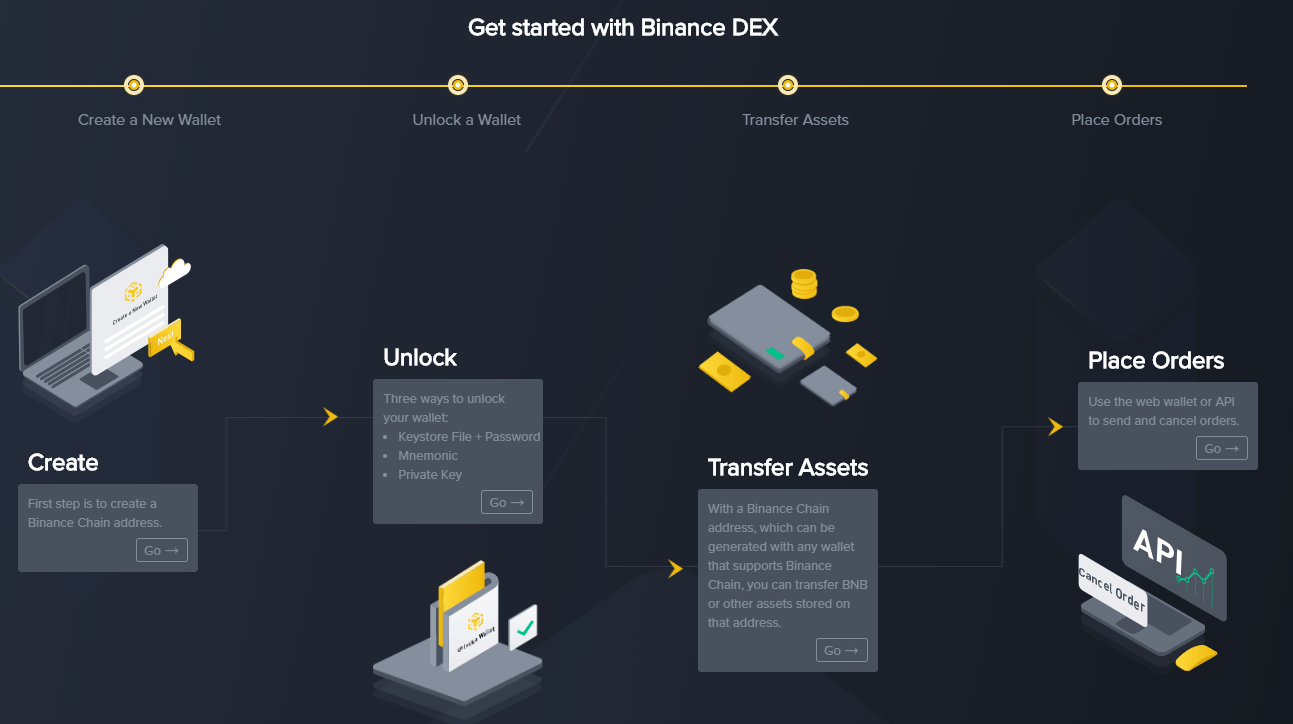

Binance has been expanding into several other areas of business such as launching fiat to cryptocurrency exchanges in a number of jurisdictions. However, one project that Binance seems determined to make a success is the launch of its decentralized exchange which is set to be fully operational sometime in the first half of 2019. So far, no DEX has succeeded in achieving any substantial liquidity or adoption. The vast majority of DEX’s operating now account for less than $1 million in daily trading volume. The average daily volume of Binance throughout 2018 was approximately $1.6 billion. Can the most dominant force in the cryptocurrency exchange business crack the DEX problem and make it a success? We analyse the problems that DEX’s have faced so far and what Binance is proposing that may make them launch the first widely adopted DEX.

What advantages does a DEX bring?

Before presenting the challenges of a DEX, it is worth considering what are the advantages to users. The main advantage lies in the custody of assets. When funds are left on a centralized exchange, the custody is transferred to the exchange. The phrase if you don’t hold your keys, you don’t hold your cryptocurrency is widely circulated for this reason. DEX’s are built on a blockchain meaning that users are not transferring the ownership of their assets to a third party. They have their own address on the blockchain and they have complete control over their assets. Another advantage to a DEX is the idea of decentralization. Many cryptocurrency enthusiasts are opposed to the idea of centralized entities controlling their ability to buy and sell cryptocurrencies. DEX’s don’t rely on any one entity as the DEX is governed and procured by a decentralized network of computers.

What are the challenges that previous exchanges have faced?

The first and biggest challenge that DEX’s have faced has been the chicken and egg problem of liquidity. Liquidity is required to make an exchange attractive to traders but traders are required to generate the liquidity. This has been a significant challenge of all previous DEX’s and every DEX has failed to generate levels of liquidity even close to that of centralized counterparts. Binance actually has a huge benefit in tackling this problem. Binance has already indicated that they will be incentivising traders to transition their liquidity from their centralized exchange to their DEX by offering larger discounts on trading fees.

The second major problem has been the throughput and latency issues associated with DEXs. With a DEX operating on a blockchain, it is subject to the throughput and latency limitations of the blockchain it is built upon. Most major DEXs have been built upon Ethereum which has a 15-second block time. Some of the DEX’s have tackled this by facilitating the order book off-chain but there are still some limitations. Traders still have to wait for the block to be added to confirm their trade has been executed. Furthermore, fees have been charged for cancelling orders making it a highly unattractive option for market makers. Binance invested huge amounts of resources in building an infrastructure to handle huge amounts of volume in their traditional exchange. Their order matching engine can match 1.4 million orders per second. However, none of this matters when it comes to their DEX. Binance has other solutions when it comes to building the DEX in the right way. The DEX will operate on Binance Chain, Binance’s own native blockchain. The Binance Chain will use the Tendermint consensus protocol which is a relatively new technology but will result in 1 second block times. This will be orders of magnitude faster than any DEX currently operating.

Any problems that might pop up with the DEX?

With Tendermint being a new technology and not released into production in any large scale product, there may be some security risks. The Binance Chain will likely not be as secure as larger public blockchains like Ethereum. However, tradeoffs are being made to facilitate the speed and Binance have a good history with security practices so it is unlikely that the DEX will be fully launched unless it is extremely secure.

Despite the one-second block times, the DEX will still likely be unattractive to many market makers and will be completely infeasible for high-frequency traders. There is also the possibility that traders continue to prefer throughput and liquidity over custody of their assets despite Binance incentivising traders to transition to the exchange.

Where does it stand now?

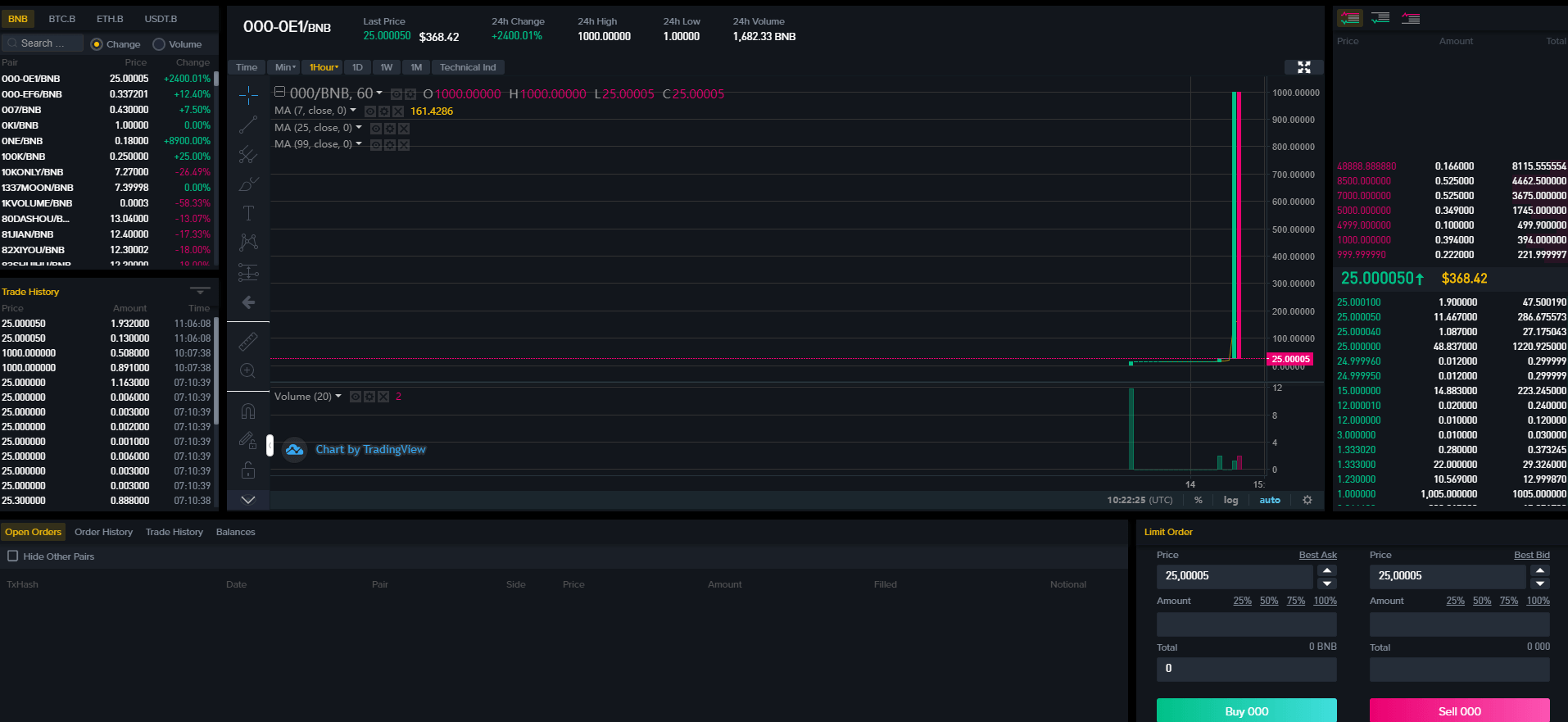

The Binance Chain is currently in testnet phase and traders are able to transfer Binance’s native token, BNB, to the exchange. The main network is aimed to be launched within the first half of 2019. Binance has actually acknowledged that the DEX will be cannibalizing their centralized business model. But they envision it having a positive impact on BNB and that they will profit from this due to the large amounts of BNB they hold. Successfully launching a DEX is one thing. Launching a DEX to rival volumes seen on major centralized exchanges is something which has never been seen. So far, Binance has accomplished everything they have been determined to do. By the end of 2019, we may see the first DEX successfully competing with major exchanges.