The Ultimate Crypto Staking Guide: Everything You Need to Know About Staking Cryptocurrency

Without any doubt, the growing crypto economy houses a wide variety of concepts uniquely conceived to optimize the workings of blockchain and its many infrastructures. One of these concepts that you most likely encounter regularly is crypto staking. The importance of this mechanism to the operations of several blockchains and decentralized applications makes it a top priority for new entrants looking to explore the fundamentals of crypto and blockchain technologies.

As such, we have created a comprehensive cryptocurrency staking guide that discusses everything from the types of staking to the process involved.

What Is Staking?

Blockchain networks interested in establishing a decentralized model of governance must select the appropriate consensus mechanisms. The preferred consensus model ought to highlight the network’s take on security, the accepted degree of decentralization, and the projected size of the ecosystem. When all these factors are put into consideration, it becomes easier to identify the best system for a given crypto operation framework. Apart from the popular Proof of Work-powered mining system, there is a broad range of alternative consensus models.

Speaking of alternative consensus mechanism, staking is widely considered a less resource-intensive option to crypto mining. Instead of requiring miners to commit their computer power to the validation and security needs of the network, staking takes a more power-efficient route. Here, network nodes indicate their interest in becoming validators by locking funds on the blockchain. This gesture underscores the participant’s commitment to ensuring that the network maintains a secure state. Like crypto mining, those who partake in staking opportunities stand a chance of earning rewards and receiving a commission on each transaction they validate.

For what it is worth, we can liken crypto staking to the act of depositing funds in a fixed savings bank account to generate interest. However, the process surrounding staking and its role in blockchain security makes it a lot more advanced. Also, the staked funds are always in the form of the blockchain’s native tokens, and the network can choose to reward validators with the same coin or another unique set of tokens. The more tokens you stake, the higher your chances of becoming a validator.

What Is Proof of Stake?

For those familiar with the intricacies of bitcoin mining, it is common knowledge that miners have to solve difficult puzzles to earn the chance of finding a new block and playing a major role in the network’s transaction validation process. The algorithm that controls the entirety of this process is the Proof of Work (PoW) mechanism. Just as mining on blockchains requires PoW protocol, a special algorithm also governs staking on blockchains. Called Proof of Stake (PoS) consensus mechanism, this protocol picks validators from the pool of individuals or entities that have met the blockchain’s staking requirements.

Also, it provides the necessary policies to ensure that validators keep to their tasks and do not undertake actions that could jeopardize the security or validity of the network. To this end, validators that fail to comply with predefined requirements could lose their staked coins or be exempted from future staking draws on the blockchain network.

What Is the History of Staking?

Proof of stake first came to the limelight in 2012, when Sunny King and Scott Nadal detailed a hybrid consensus model that supports staking in Peercoin‘s paper. This project initially combined PoW and PoS to achieve consensus. The energy-consuming nature of PoW motivated the creation of this alternative model. although this solution seems to have evolved the way decentralized blockchains achieve consensus, PoS does have its peculiar sets of challenges. Over the years, crypto projects have introduced diverse solutions to eliminate these limitations.

Four main pain points could limit the efficiency of PoS:

Distribution: There must be an initial method of distributing coins fairly to users before imposing staking requirements and allocating rewards to nodes that meet the prerequisites of a successful staking attempt.

Monopolization: While nodes with the highest number of staked coins could emerge as validators repeatedly, it is imperative to implement the appropriate system to reduce the propensity for a monopoly.

51% Attacks: Just as PoW blockchains are susceptible to 51% attacks. PoS networks must also introduce viable security fail-safes to minimize the possibility of entities with 51% stake weight. For those who are not sufficiently informed on this security threat, 51% attack occurs when an entity controls more than half of the networks’ hash rate or mining economy. The same applies to staking as an entity that controls over 50% of the total coins staked on the network can attempt to alter the blockchain data.

Nothing at Stake: This challenge arises when two nodes meet the set of conditions governing the creation of new blocks. In this case, two new blocks will be created and signed by both nodes. under normal circumstances, the operations of subsequent validators will orphan one of these soft forks. In a scenario where subsequent validators choose to confirm transactions on both forked chains, the blockchain will become susceptible to double-spending. Validators can afford to validate transactions on multiple chains because the resource required for staking is not as demanding as the power-consuming process of mining cryptocurrency.

How Has Pos Blockchains Approached These Staking Challenges?

In a nutshell, there have been several attempts by PoS blockchains to eliminate the effect of these problems on the validity of their staking-powered consensus protocol.

Distribution: Peercoin, being the first network to incorporate staking, implemented PoW as the initial coin distribution model for its native cryptocurrency. At the early stage of development, mining served as the primary supply for Peercoin and PoS became more prominent once distribution had been achieved. The same applies to Ethereum, which currently relies on PoW for validation and distribution but has an ongoing PoS upgrade planned to oust ETH mining.

Other crypto projects that had PoS as their primary consensus model from the scratch capitalized on token sales via Initial coin offerings and the likes to distribute cryptocurrencies among interested investors.

Monopolization: For Peercoin, an implementation called “Coin Age” was introduced to ensure that wealthy investors do not dominate its staking and transaction validation systems. Here, the protocol determines the dormant period that staked coins. Owners of coins that have remained in a wallet for more than 30 days have the best chance of being picked as the next validators.

51% Attack: The larger the size of the staking economy of a blockchain network, the lower the probability of a 51% attack. This is because it is very expensive to bribe or acquire over 50% of the staking economy. This in itself makes established PoS blockchains a lot harder to successfully attack.

Nothing at Stake: A majority of early iterations of PoS blockchains used checkpoints to ascertain that there are no hard forks. In contrast, Ethereum and newer iterations are disincentivizing the signing of orphaned blocks. Culprits will lose all their stakes, and they are permanently banned from staking.

As a result of the unique solutions introduced by PoS-based blockchains, we have begun to see a surge in staking opportunities. Every PoS blockchain has rules governing the operations of its validators. These rules contain the financial and technical requirements that every validator must meet. With this, the network can set the minimum amount that can be staked and the size of the reward distributed to staking nodes. It is worth mentioning that the size of the stake always almost determines the number of coins allocated as rewards.

What Are the Types of Staking?

The models for crypto staking can be classified under two major groups. The first is decentralized staking while the second takes up a more centralized version.

Decentralized Staking: This approach employs an autonomous and non-custodial system of staking coins and earning passive income. This staking system allows potential validators to have full control over their validator and withdrawal keys. Although a decentralized staking service provider or dstaking service offers customizable validator setup and management tools, it does not have access to withdraw users’ funds or sign transactions on their behalf.

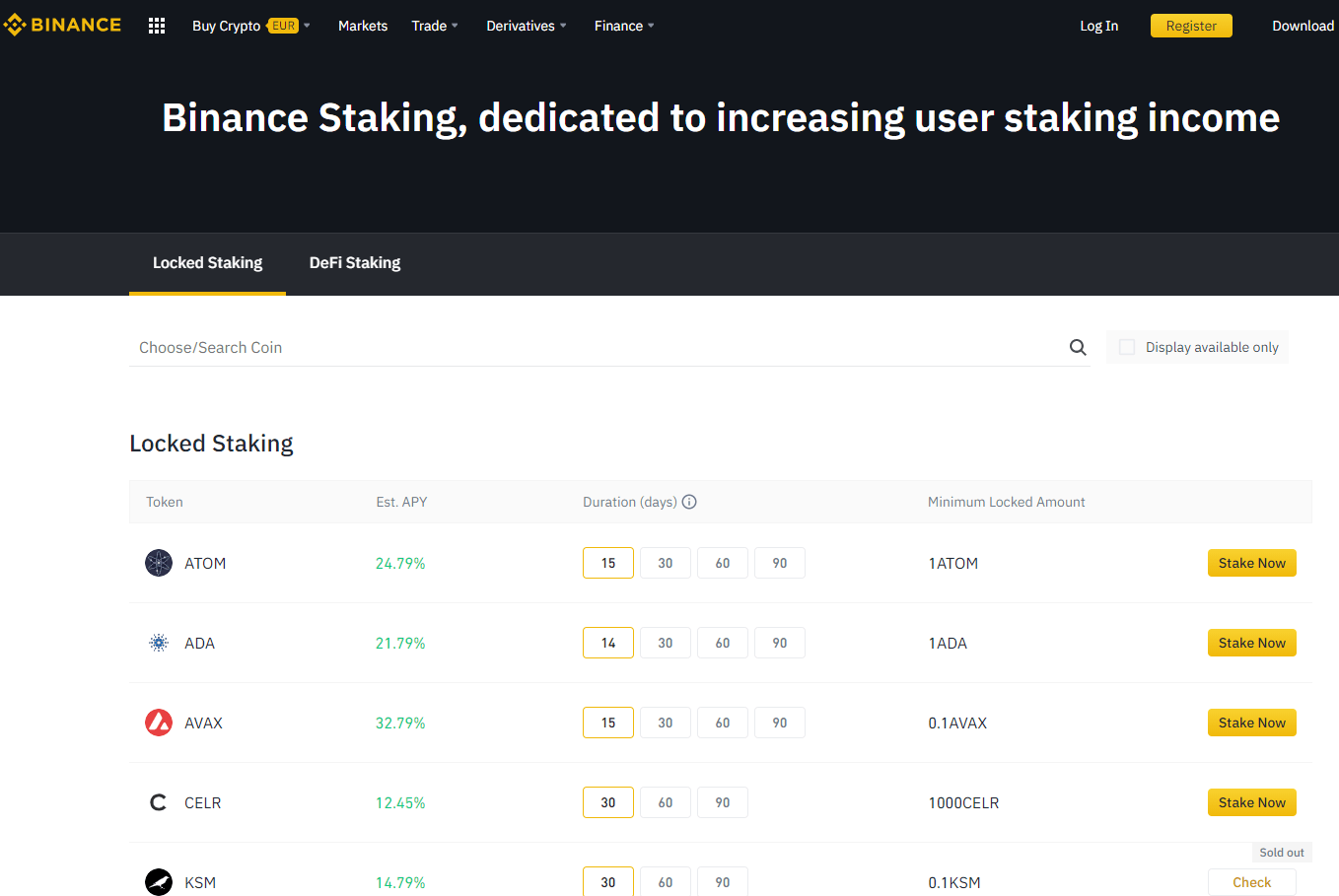

Centralized Staking. Services that embrace a centralized model often maintain custody of the validator keys and withdrawal keys. In essence, investors only have to deposit funds on the platform, and the service provider takes up the responsibility of validating transactions. Since the explosion of crypto staking, we have witnessed more platforms, especially exchanges, offering staking services that do not come with the intricacies involved in self staking.

Decentralized Staking Vs Centralized Staking

Having discussed the fundamentals of both methodologies, it is crucial to highlight their advantages and disadvantages. For one, centralized staking delivers easy onboarding interfaces that have become popular with individuals who are not ready to take on the technical aspect of staking. Depending on the policy of the platform, you can even stake an amount lower than the blockchain’s minimum stake size. However, these benefits come at a cost. the custodial-based design of these crypto staking portals may expose users to risks like slashing penalties or losses as a result of hacks. Also, the service deducts commissions on rewards.

In contrast, dstaking presents users with full autonomy over their operations. Hence, there is less chance of losing funds due to the negligence of the staking service. This type of staking also helps propel engagement on blockchain networks. The democratization of staking activities bodes well for the security of PoS blockchains. The higher the number of nodes incorporating self-staking, the lower the probability of the occurrence of a 51% attack.

What Are the Types of PoS?

Now that you have a basic understanding of the concept of staking and Proof of stake, the next section will help you dissect some of the popular iterations of PoS. Here, we will highlight the factors that make each unique.

Delegated Proof of Stake

Recall that we defined PoS as an algorithm that oversees the process of staking on blockchains, handpicks validators, allocate roles, and distribute rewards accordingly. While this design formed the basis of PoS iterations, the implement alterations set each version apart from the original model. For instance, Delegated Proof of Stake (DPoS) utilizes a voting system for an even more scalable transaction validation process. Here, the number of coins staked determines the voting power of each staking node. And this node can choose to elect witnesses and delegates, which are tasked with the role of managing the network and establishing consensus. Delegates are those elected to oversee the governance of the network, while Witnesses function as validators. Daniel Larimer created this consensus mechanism in 2014.

Like the regular PoS model, the network incentivizes witnesses to maintain the blockchain. In turn, they allocate part of the received rewards to their electors. The voting power or stake size of individual electors determines their share of the earnings. As such, DPoS looks to reduce the number of validating nodes to enhance network performance. With the inputs of a handful of elected delegates, DPoS blockchains can achieve consensus and enable governance parameters almost instantly. So, there is no need for all the nodes of the network to partake in the daily network management tasks.

Although this system has established itself as a viable blockchain consensus model, it sacrifices decentralization for scalability. Since it elects a handful of delegates, the network relies heavily on the inputs of a small percentage of its nodes for its operations. In essence, this diminishes the trustless feature originally envisioned for permissionless blockchains.

However, one could argue that voting on DPoS blockchains is an ongoing process. Therefore, witnesses must keep an acceptable track record to keep their place as validators. It is also worth mentioning that this consensus model comes with a reputation scoring system that helps electors assess the performances of witnesses. Each DPoS-based blockchain can choose the number of witnesses required to run the network and assign tasks to each. In a scenario where a witness fails to find a new block at the allotted time, the network will skip such a validating node and downgrade its reputation score. Hence, this shows that this consensus model has put mechanisms in place to ensure that witnesses maintain the highest standard of operation. Examples of blockchains utilizing this model of staking are EOS, Tron, and Steemit.

Liquid Proof of Staking

Liquid Proof of Stake is similar to DPoS as it provides token holders with voting rights and allows them to vote for delegates. Nonetheless, this model goes a little further to democratize the system. It enables liquid democracy which allows voters to choose delegates and withdraw their votes whenever they feel the operations of the delegate do not represent their interests. Besides, delegates can also transfer the voting rights to other delegates. The fluidity of this mechanism makes it more appealing for small nodes to take part in the consensus process. One more unique thing about Liquid Proof of Stake is that voters do not need to transfer the ownership of their coins to delegates. With this, only the validators run the risk of losing their staked coins in an event of double-spending. One of the prominent blockchains utilizing this system is Tezos.

Bonded Proof of Stake

Bonded Proof of Stake (BPoS) is a bit similar to DPoS. It is optional to vote for delegation and stakes are non-custodial. However, in the case of BPoS, the validators and delegators will forfeit a share of their stakes if found dishonest or inefficient. Hence, delegators must take extra care when voting for validators. Like LPoS, this approach solves some of the limitations of Delegated Proof of stake.

Leased Proof of Stake

This consensus model reinvents the proof of stake mechanism in such a way that nodes can lease their tokens to mining nodes to boost the probability of finding new blocks. This system allows participants that are running full nodes to have a direct impact on the staking economy as they can lock their assets in cold storage and use it as financial backings for mining nodes. Note that the ownership of the tokens in question is not transferred to the masternodes. Hence, no apparent security risks arise from this non-custodial staking system. One of the blockchain networks utilizing this model is Waves.

Masternode Proof of Stake

As its name implies, this staking consensus system favors masternodes that can stake a large number of coins. The minimum stake size for blockchains with masternode-based PoS is usually very high. The ideology behind this approach assumes that nodes that are willing to commit a significant stake size have more to lose than regular nodes. Hence, they have more at stake and will likely ensure the safety of the network. In most cases, this consensus model is paired with other mechanisms like PoW and PoS. A prime example of blockchains that have incorporated the Masternode Proof of Stake system is Dash.

Other Staking Terminologies

Having explored some of the variants of the Proof of Stake consensus mechanism, it is vital to highlight common staking terminologies you may encounter in the crypto sector.

Lockup Period

More often than not, nodes must lock their coins for a set period to stand a chance of partaking in the validation process and earn rewards. Depending on the rules governing staking on your preferred blockchain network, you may not have access to your staked coins until the said lockup period elapses. In contrast, some PoS-based networks allow staking nodes to do as they wish with their staked coins.

Cold Staking

Cold staking is perhaps the safest way to stake coins on blockchain networks and it is mostly associated with non-custodial staking mechanisms. The node has to lock the staked coin in an offline wallet until the lockup period elapses. This approach limits the security risks as cold storage (offline wallets) are not as susceptible to hacks as the online alternatives. However, failure to maintain the set number of coins in the designated offline wallet will result in the loss of staking rewards.

Staking Rewards

As it is with most blockchain operations, Proof of stake blockchains incentivize participation. In other words, the blockchain distributes rewards based on the stake size of each node. Note that staking rewards varies across multiple blockchains. Some crypto networks may choose to reward nodes with the same type of token they staked. Conversely, some may capitalize on the staking process to allocate a completely different type of coin. These rewards commonly include the fees charged on each transaction validated by the staking node.

Notably, certain variations of the Proof of Stake mechanism restrict their reward package to the transaction fees generated from each block. Here, validators and delegators only get to earn transaction fees.

Staking Pools

The crypto industry has always identified ways to encourage participation and democratize opportunities. Recall that the PoS mechanism set minimum requirements for anyone willing to stake their coins. These requirements include the least number of coins acceptable and the technical resources required to meet the demands of being a validator or delegate. Interested nodes that can not meet these requirements can join pools for added staking weight. Hence, staking pools are networks of investors that combine their resources, especially financial strength, to boost their chances of earning staking rewards.

This approach is suitable for individuals that can not meet the minimum stake size for intending validators. They can join staking pools, deposit the number of coins they want to stake, and up the probability of receiving rewards. it is worth noting that the amount contributed or deposited and the share it represents in the total stake of the staking pool determine the percentage of the reward distributed to each participant.

However, as it is with mining pools, there are factors that you must consider before joining a staking pool. For one, take the time to research the fee policy of the pool provider. You may need to request information regarding the membership fees, the withdrawal limits, the lockup period, and the commission deducted from your earnings. Also, you should ascertain the performance of the pool provider. Remember that the actions or inactions of the pool provider may expose you to the risk of losing a fraction of the entirety of your investment.

Proof of Stake VS Proof of Work

The best way to compare and contrast proof of stake and proof of work is to highlight the benefits and downsides of staking-based consensus models. For those who are not so familiar with PoW, it is simply a more capital and energy-intensive method of achieving consensus and finding new blocks. Here, nodes solve puzzles with specialized or generic computing hardware to create new blocks. The network allocates rewards to successful nodes and allows them to receive the transaction fees generated on their new blocks.

What Are the Advantages of Staking?

Like every crypto opportunity, staking has its strengths as well as its downsides. Below are some of its advantages.

It Is Not Resources Intensive

Unlike the PoW mechanism that entails miners to solve difficult puzzles, PoS only expects interest participants to lock or commit a specific sum of coins. There is no need to buy expensive mining gear or pay exorbitant electricity bills. The cost-effectiveness of this method allows more nodes to participate directly.

It Is Eco-Friendly

Experts have raised concerns over the negative impact of mining on the environment. The fact that miners have to consume so much energy to create new blocks often undermines the efficiency of PoW. Hence, it is advantageous to opt for an eco-friendly alternative like PoS.

It Is Scalable

Some variations of PoS do not require the inputs of all the nodes of the network before consensus can be achieved. As such, the process involved in validating transactions is not as cumbersome as PoW-powered mining and governance operations. This modification enables scalable blockchain infrastructures. In other words, this approach boosts the average time it takes to validate transactions on PoS blockchains.

What Are the Disadvantages of Staking?

Some Variants Are Not as Decentralized as Expected of a Permissionless Network

Some of the types of PoS highlighted earlier in this guide entail nodes to vote for representatives and validators. While this is geared at improving the scalability of the network, it puts a dent in the decentralization of the ecosystem. The entirety of the blockchain relies on the judgments of a handful of participants for the smooth running of the system. Although such mechanisms incorporate a voting system, there is no saying how the concentration of power could affect the viability of the network.

The Volatility of Staked Coins Could Affect Profitability

knowing fully well that cryptocurrencies are volatile, there is an inherent risk that comes with locking your coins for a specified duration. The downturn of the price of the coin will automatically cause the value of your stake to fall. Also, this will devalue the rewards. To mitigate this risk, it is imperative to opt for coins that have real-world use cases. We advise that you avoid cryptocurrencies that have no other application other than staking. The versatility of coins almost always determines their long-term viability. In essence, it is more advantageous to revolve your staking activities around viable coins.

Is Staking Profitable?

Various factors could affect the profitability of a crypto staking business. Although this model has already eliminated the overhead cost of electricity and mining gears, other factors can significantly improve or diminish the profitability of staking coins. For one, the block reward of the network always plays a pivotal role when estimating the potential returns on investment. Also, you should take the size of the staking pool into account as well as the highest earnable reward. Do not forget the general rule that states that nodes with a large stake size generate more rewards.

More importantly, you can use specialized tools like Staking Rewards to estimate the earnings that your stake will likely generate. According to Staking Rewards, the staking market cap currently worths $320 billion, with some staking-based blockchains promising over 300% annual reward. At the time of writing, Cardano is the blockchain project with the largest staking economy. A report revealed that the annual reward generated by staking nodes is 11.2%.

What Are the Requirements for Crypto Staking?

Every individual or entity intending to stake cryptocurrency must take the time to understand the rules governing the staking operations of the preferred pool or blockchain. First and foremost, it is crucial to identify the variant of staking supported by the network. Your findings will go a long way to prepare you for the journey ahead. You should check to see whether you have to hold your coins in an online or offline wallet. Besides, some blockchains incorporate specific node setup for delegators, delegates, and validators. Hence, you must ensure that you meet the technical and hardware requirements. Other requirements include:

24/7 Connectivity: A majority of blockchains expect validators to ensure that their nodes are always online. Failure to do this may attract a penalty.

Supported Wallet: Always ascertain that the wallet you intend to use supports crypto staking.

The Minimum Stake Size: More often than not, blockchains and staking pools impose the minimum number of coins that nodes can stake. Ensure that the value of your holdings matches or exceeds these predefined limits.

Lockup Periods: We advise that you verify the lockup period of your chosen blockchain or pool. You must adhere to this rule or run the risks of forfeiting earnings.

Is Staking the Same Thing as Yield Farming?

Without any doubt, there are some similarities between staking and yield farming as they both require investors to hold coins on a platform to generate profits. However, the latter focuses on providing liquidity for DeFi protocols, whereas the former deliver consensus. Yield farmers lock funds on DeFi lending protocols and receive the interest paid on loans as rewards. In contrast, staking nodes lock funds to become eligible to partake in the transaction validation and governance processes of a blockchain. Also, staking generates a more stable passive income as opposed to yield farming which is very much volatile.

What Are the Largest Staking Networks?

Cardano

With a total market capitalization worth $21 billion, Cardano is one of the most established crypto networks. The blockchain supports delegation and staking. Interested investors can delegate their stake via their wallets as the process maintains a non-custodial framework. There is approximately over $13 billion worth of ADA – the network’s native coin – set aside as stake incentives. The network distributes 0.3% of this stash as staking rewards every 5 days. Data shows that the annual reward generated by investors is 4.28%. At the moment, the value of the total volume of ADA staked on Cardano is around $14 billion. This figure represents over 70% of the cryptocurrency’s market cap.

Polkadot

Polkadot and its native token, DOT, have continued to surge in the last couple of months. The market capitalization of the token has already surpassed the $20 billion mark and it is fast becoming one of the go-to staking platforms for investors. With an annual reward of 13.55% up for grabs, staking has become an integral component of the blockchain’s economy. There is over $14 billion worth of assets staked on Polkadot. This platform uses a Nominated Proof of Staking consensus mechanism, which allows each node to nominate up to 16 validators. Nominees who eventually become elected to the validator set share their rewards with nominators. It is worth mentioning that the lower the number of DOTs staked at a given time, the higher the rewards distributed to validators. Also, the protocol supports reward slashing as a mechanism for penalizing defaulting validators and their nominators.

Avalanche

Avalanche has a market cap of $2 billion, while its staking economy is valued at $7 billion. This ecosystem is a combination of blockchains, which allows delegation-based staking. You can earn up to 10.41% annual reward for delegating AVAX – the platform’s native token – or 11.21% for validating transactions. Note that you must lock at least 25 AVAX for 2weeks to become a delegator.

Ethereum 2.0w

It is common knowledge that Ethereum is the second most valuable blockchain in the crypto market and that its ongoing foray into the staking market will shift the dynamics of the entire ecosystem. Following the success of the early phase of the transition from PoW to PoS, Ethereum has gradually emerged as one of the largest staking-based crypto networks. Already, over $4 billion worth of ETH has been locked on the blockchain, even though investors can not withdraw their funds and rewards anytime soon. Staking Rewards estimates that the average annual reward that investors will generate is 9.24%. There is a wide variety of ways investors can stake on Ethereum 2.0. You can run a validator node, use a validator-as-a-service provider, stake via exchanges, or join a staking pool.

Algorand

Algorand utilizes the Pure Proof of Stake consensus mechanism to secure its network and validate transactions. The total value of assets staked currently on Algorand is $3 billion. The network rewards both offline and online users with an annual reward set at 7.30%. For now, Algorand allocates rewards to every node participating in staking according to the proportionality of their stakes. However, in the future, the blockchain may create new rewarding metrics that take into account the role of each investor in network maintenance.

Conclusion

You will agree that staking is fast becoming a vast subject, especially now that more networks are looking to capitalize on the benefits of staking-based blockchain consensus. We are certain that this guide covers the fundamentals of this crypto concept and introduces you to some of its technicalities. You can source for more information on Cryptolinks about the best staking tools and websites.

Thank you for sharing the article.